Abstract

This chapter describes recent projections for the development of global and European demand for battery storage out to 2050 and analyzes the underlying drivers, drawing primarily on the International Energy Agency’s World Energy Outlook (WEO) 2022. The WEO 2022 projects a dramatic increase in the relevance of battery storage for the energy system. Battery electric vehicles become the dominant technology in the light-duty vehicle segment in all scenarios. In the electricity sector, battery energy storage emerges as one of the key solutions to provide flexibility to a power system that sees sharply rising flexibility needs, driven by the fast-rising share of variable renewables.

The ongoing decline in the cost of battery packs is crucial to this. It enables electric vehicles to compete on cost with their internal combustion engine counterparts in more and more use cases while making stationary battery energy storage a cost-competitive choice for the provision of flexibility and secure capacity.

The projected rise in battery production leads to a strong increase in demand for critical minerals like lithium, cobalt, nickel, graphite, copper, or manganese. Increasing the supply of these critical minerals in lockstep with demand is essential in order for battery costs to continue to decline.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Long-term projections of the development of the global energy system foresee a dramatic increase in the relevance of battery storage for the energy system. This is driven primarily by the proliferation of electric vehicles and a growing demand for electricity storage, connected to rising shares of variable renewables in the electricity supply mix.

At the same time, electric vehicles are projected to continue to make strong inroads in the transport sector, leading to a dramatic increase in battery production geared toward the automotive sector.

Across scenarios, major outlooks published recently foresee a rapid global expansion of variable wind and solar PV-based electricity generation, as well as a rising share of electricity in total final energy consumption (see, e.g., [7, 9, 12, 26,27,28, 30]). The integration of these rising volumes of variable electricity requires key enabling technologies such as battery storage to grow as well.

This chapter provides a detailed look at recent projections for the development of global and European demand for battery storage out to 2050 and analyzes the underlying drivers. It draws primarily on the International Energy Agency (IEA)‘s World Energy Outlook (WEO) 2022 [26], to which the three authors contributed.

The WEO 2022s long-term projections of the development of the global energy system foresee a dramatic increase in the relevance of battery storage for the energy system. As a result of falling costs and supportive policies, electric vehicles become the dominant technology in the light-duty vehicle segment in all scenarios in 2050, contributing to a massive increase in the demand for automotive batteries. In the electricity sector, battery energy storage systems emerge as one of the key solutions to provide flexibility to a power system that sees sharply rising flexibility needs, driven by the fast-rising share of variable renewables in the electricity mix. Batteries are also increasingly tapped to provide firm capacity as traditional generators, such as coal- or gas-fired plants, are retired.

As a result of the growing demand for batteries, the demand for critical minerals used in battery production, such as lithium, cobalt, nickel, graphite, copper, or manganese, is expected to increase substantially as well.

2 Methodology

The projections and findings on the prospects for and drivers of growth of battery energy storage technologies presented below are primarily the results of analyses performed for the IEA WEO 2022 [26] and related IEA publications.

The IEA WEO 2022 explores the potential development of global energy demand and supply until 2050 using a scenario-based approach. It does so through three scenarios. It should be noted that these scenarios do not represent predictions but rather analyze in detail possible versions of how the energy system might develop given different policy targets and assumptions on their implementation ([26], p. 105).

The first two scenarios, the Stated Policies Scenario (STEPS) and the Announced Pledges Scenario (APS), are descriptive. The third scenario, the Net Zero Emissions by 2050 Scenario (NZE Scenario), is prescriptive:

-

STEPS describes the development of the energy system considering only the current policy setting, based on a country- and sector-specific appraisal of policies that are in place or have been announced as of late 2022.

-

APS assumes that all climate commitments, including nationally determined contributions (NDCs) and country-level net zero targets that have been announced as of late 2022, are achieved in full and on time (even though supporting policies may not yet have been put into place), representing a more aggressive emission-reduction pathway than STEPS.

-

The NZE Scenario describes a cost-effective pathway for the global energy system to reach net zero emissions by 2050, maintaining at least a 50% probability of keeping the global temperature rise below 1.5 degrees Celsius until 2050 while achieving universal access to modern energy services (primarily electricity and clean cooking) by 2030 ([15], p. 48, [26], p. 463).

The scenario projections are derived using a bottom-up, partial-optimization model of the global energy system, called the Global Energy and Climate Model (GEC-M), modeling energy demand, transformation, and supply in high detail for 26 regions (11 countries and 15 country groupings). A comprehensive description of the model, the key assumptions, and data sources used can be found in the documentation [21]. Of particular relevance to the representation of battery energy storage in the model are the power and transport sector modules of the GEC-M. The technology-rich power sector module combines an investment model with a high-resolution dispatch model to simulate the evolution of the regional power systems, ensuring that there is sufficient generating capacity to cover peak demand plus a reserve margin, as well as sufficient production to meet the annual demand of all end uses, including grid losses ([21], p. 45). The transport sector module consists of dedicated, regional bottom-up models for aviation, maritime, rail, and road transport. The road transport model projects the evolution of the regional vehicle fleets and their fuel consumption based on, among other things, activity drivers such as historical trends, GDP and population, vehicle scrappage functions, and cost-competitiveness assessments of different drivetrain technologies ([21], p. 32).

3 Development of Demand for Battery Energy Storage

The electricityFootnote 1 and transport sectors are the key users of battery energy storage systems. In both sectors, demand for battery energy storage systems surges in all three scenarios of the IEA WEO 2022. In the electricity sector, batteries play an increasingly important role as behind-the-meter and utility-scale energy storage systems that are easy to scale, site, and contribute to system reliability and flexibility. In the transport sector, the increasing electrification of road transport through plug-in hybrids and, most importantly, battery electric vehicles leads to a massive rise in battery demand.

3.1 Electricity Sector

Energy storage, in particular battery energy storage, is projected to play an increasingly important role in the electricity sector. Storage technologies provide vital system services, ranging from short- to long-term balancing, the provision of operating reserves and ancillary services like voltage control or black start capability, to the management of congestion in the electricity grid. Currently, pumped storage hydro is the most widely deployed storage technology, accounting for 90% of total storage capacity ([22], p. 64), and there is significant additional potential in certain regions. Other emerging options include compressed air and gravity storage for the short-term and hydrogen as an option for long-term storage (IEA, [24]). An overview of several established and emerging storage technologies, as well as their typical capacities and applications, is provided in Fig. 3.1. It shows that, depending on the volume of the battery, battery energy storage systems can dispatch on timescales ranging from seconds to days, over a broad range of capacities. In contrast to other technologies with more specific use cases, batteries are able to provide a broad range of services to the electricity system. Accordingly, battery energy storage systems are the fastest growing storage technology today, and their deployment is projected to increase rapidly in all three scenarios.

Storage technologies and potential power system applications based on discharge times. Note: T and D deferral = transmission and distribution investment deferral. (Source: IEA [22], p. 64)

Battery storage systems can be distinguished between two classes: utility-scale battery energy storage systems and behind-the-meter battery energy storage systems. Utility-scale battery energy storage systems are directly connected to the distribution or transmission systems. They typically offer much higher capacities and greater storage volumes than behind-the-meter systems. They are relatively compact and highly modular, which allows for scalable battery storage systems to be deployed rapidly in almost any location, an advantage compared to traditional large-scale electricity storage solutions such as pumped hydro. In addition to energy storage, which allows operators to engage in energy arbitrage, helping balance the power system and more cost-effectively match demand and supply, they provide important flexibility services to the system. They can be tapped to provide operating reserves and important ancillary services such as frequency control or helping with the restoration of grid operations after a blackout. Due to their scalability and modularity, they are also promising solutions for the provision of localized flexibility in distribution or transmission systems, helping to address bottlenecks and reducing the need for costly investments into new transmission and distribution infrastructure [5, 24]. Furthermore, there are more and more cases of batteries being colocated with variable renewables in order to “firm up” the latter’s electricity production, for example, in Germany or India, where pairing renewables with storage is rewarded through dedicated support mechanisms. Also, where eligible, batteries are increasingly tapped to provide firm capacity in capacity markets ([25], p. 55).

Behind-the-meter battery energy storage systems are connected to the distribution grid behind the utility meter of an individual electricity consumer, typically a household or a small business. Behind-the-meter battery energy storage systems are usually paired with a distributed energy resource, in most cases rooftop solar PV. Behind-the-meter batteries enable consumers to lower electricity bills by maximizing the consumption of self-generated electricity and enabling them to engage in energy arbitrage, i.e., shifting consumption from high to low price periods. The overall magnitude of savings is highly dependent on the level and structure of electricity tariffs and the remuneration consumers receive for feeding electricity into the grid. Variable or time-of-use electricity and feed-in tariffs offer greater potentials for savings using behind-the-meter battery energy storage systems than fixed rates. Another common motivation for the installation of behind-the-meter battery energy storage systems is to improve resilience against interruptions in the power supply from the grid, where behind-the-meter battery storage systems coupled with a distributed energy resource increasingly compete with traditional solutions such as diesel generators [6].

Across all scenarios in the WEO 2022, utility-scale systems account for the majority of battery storage deployment, though the development of both utility-scale and behind-the-meter storage are heavily dependent on the prevailing regulations. In many jurisdictions, net meteringFootnote 2 regulations that underpin the growth of rooftop solar ([14], p. 36) are holding back investments into behind-the-meter electricity storage. Stronger growth in behind-the-meter systems can be expected should regulation change in ways that encourage self-consumption, such as time-of-use tariffs, and introduce a time-dependent, market-based remuneration for electricity fed into the grid by small-scale generators. However, that growth would not necessarily come on top of the projected growth of utility-scale systems, since (aggregated) behind-the-meter storage can, with the right regulation and the appropriate control technology, provide some of the flexibility to the system that would otherwise be provided by utility-scale batteries.

3.1.1 Development of Stationary Battery Energy Storage

In recent years, the pace of installations of battery storage systems has picked up significantly. In 2021 alone, more than 9 GW were installed globally, a nearly 90% increase on 2020. At the end of the year 2022, total global installed stationary battery storage capacity stood at more than 27 GW ([26], p. 311). The speed of the increase has been substantial: just 10 years ago, the global installed battery energy storage was less than 1 GW in total.

Moving forward, battery storage capacity is projected to grow massively in all three scenarios (see Fig. 3.2). In the STEPS, installed global, grid-connected battery storage capacity increases tenfold until 2030, rising from 27 GW in 2021 to 270 GW. Deployments accelerate further after 2030, with the global installed capacity reaching nearly 1300 GW in 2050. Accounting for all announced pledges and policies leads battery storage capacity to grow to 425 GW in 2030 and close to 2300 GW in 2050, a near doubling compared to the STEPS. The pace of deployments is even faster in the NZE Scenario, where installed capacity reaches about 780 GW in 2030 and nearly 3900 GW by 2050, as the electricity sector is the first to be fully decarbonized, by 2035 in advanced economies and by 2040 in emerging market and developing economies.

Global installed stationary battery energy storage capacity by scenario, 2020–2050. (Source: IEA) [26]

In the European Union, total installed battery storage capacity rises from nearly 5 GW today to 14 GW in 2030 and almost 120 GW in 2050 in the STEPS, which achieves the agreed objectives, including reaching 32% of renewable energy by 2030, and fulfills all the National Energy and Climate Plans and major policies as of late 2022. In the APS, which reflects discussions on higher ambitions for renewable energy, including the goal to reach a 40% share in gross energy consumption by 2030 within the Fit for 55 package [11] and the G7 commitment to achieve predominantly decarbonized electricity by 2035 [8], battery storage capacity increases to 50 GW by 2030 and more than 200 GW in 2050. In the NZE Scenario, which requires similar emissions reductions by 2030 and 2035, higher energy efficiency and a more responsive demand side require slightly less battery capacity deployments, with installed capacity reaching 180 GW in 2050 [26].

3.2 Transport Sector

Despite the massive growth projected in all scenarios of the WEO 2022, stationary battery energy storage capacity in the electricity sector is—depending on the scenario—only equivalent to 7–10% of the combined storage capacity of electric vehicle batteries. This makes the transport sector the by far biggest user of batteries.

3.2.1 Deployment of Battery Electric Vehicles

In the sector, the vast majority of batteries are used in electric and plug-in hybrid electric vehicles.

Electric vehicles are projected to make up increasing shares of newly registered vehicles across all types of road vehicles (passenger/commercial light-duty vehicles, medium and heavy-duty vehicles, buses and two−/three-wheelers) in all three scenarios.

In 2021, demand for automotive lithium-ion batteries was 340 GWh per year, doubling from 2020 ([26], p. 167), with global electric vehicle sales reaching a record-breaking 6.6 million ([20], p. 4), bringing the global electric vehicle fleet (excluding two−/three-wheelers) to 18 million ([20], p. 99). Nearly 9% of all new passenger vehicles sold were fully electric. China led the world in sales, followed by Europe and the USA [23].

In the STEPS, which considers only policies already in force as of late 2022, the global electric vehicle fleet (excluding two−/three-wheelers) grows to 200 million vehicles by 2030, representing over 20% of all road vehicle sales ([20], p. 99). In the APS, which assumes that all existing targets are met in full and on time, electric vehicle adoption is more rapid, with their share in total sales growing to over 35% in 2030 and total stock reaching 270 million vehicles in the same year ([20], p. 99). In the NZE Scenario, electric vehicle uptake proceeds even faster, and globally, 60% of all new vehicles sold in 2030 are fully electric, with the number of electric vehicles growing to 350 million ([20], p. 99).

The bulk of the growth comes from the light-duty vehicle segment, most notably passenger electric vehicles. In 2021, electric light-duty vehicles accounted for 95% of the global electric vehicle fleet (excluding two−/three-wheelers), and they continue to maintain this share through 2030 in the STEPS. Electric light-duty vehicle sales grow more rapidly in the APS, reaching a share of 35% of total light-duty vehicle sales by 2030. In the NZE Scenario, more than 60% of all light-duty vehicles sold in the same year are electric ([20], pp. 99–100). The rapid expansion of electric vehicle sales is projected to continue after 2030. In the APS, electric vehicles reach a two-thirds share in total new light-duty vehicle sales by 2040. Slow turnover in the vehicle stock means, however, that even in this scenario, the share of electric vehicles in the global light-duty vehicle fleet will exceed two-thirds only by 2050 ([26], p. 275).

Electrification is projected to proceed more slowly in the medium and heavy-duty vehicle segment. While electric trucks are well suited for roles like urban delivery, with relatively short driving distances and the possibility of overnight charging, larger batteries and a high-power charging infrastructure are required to enable long-distance electric trucking. In the STEPS, electric trucks reach a sales share of under 10% in 2030, while in the APS and NZE Scenario, they account for 10% and 25% of sales, respectively ([20], pp. 100–101).

Electric buses are the second most common type of electric vehicle in use today (excluding two−/three-wheelers). Their share in the bus stock is projected to increase to 11% by 2030 in the STEPS, 15% in the APS, and 25% in the NZE Scenario ([20], p. 100).

Although excluded from the total number of electric vehicles presented above, electric two−/three-wheelers are the most common type of electric vehicle today and are projected to remain so through 2030. In many regions, they are already cost-competitive with internal combustion engine two−/three-wheelers on a total cost of ownership basis and projected to see strong growth in Asia in particular. Electric two−/three-wheelers account for over 25% of the stock in 2030 in the STEPS, up from around 6% in 2021. In the APS, 35% of the total stock is electric, while in the NZE Scenario, that share is even higher ([20], p. 101).

The electrification of road transport is proceeding at different speeds across the world. In terms of the distribution of sales, advanced economies and China act as trailblazers, with battery electric vehicles accounting for more than 50% of the cars sold by 2030 in China, the European Union and the USA ([26], p. 274). In Europe, supportive policies ensure that it remains one of the key electric vehicle markets: in the STEPS, light-duty electric vehicles account for 35% of all light-duty vehicle sales in 2030. In the APS, assuming additional policy pledges are implemented, this share rises to over 50%. The 2030 sales shares are 50% for buses and 7% for trucks in 2030 in the STEPS and 55% for buses and 20% for trucks in the APS ([20], p. 104).

The impact on the demand for automotive batteries is substantial. In the NZE Scenario, which sees the strongest growth of electric vehicles to 2030, demand grows 16-fold, from 340 GWh per year in 2021 to more than 5500 GWh per year in 2030 ([26], p. 167).

4 Drivers of Demand for Battery Energy Storage

As shown above, demand for batteries is projected to increase substantially until 2050 in all scenarios both in the transport and in the electricity sector.Footnote 3

In the transport sector, this is driven by the rising adoption of electric vehicles, which, thanks to falling costs and supportive government policies, are becoming an increasingly attractive choice compared to conventional internal combustion engine vehicles. and supportive government policies.

In the electricity sector, the adoption of batteries is driven mainly by the rising demand for flexibility, adequacy, and energy balancing that accompanies the rise in the share of variable renewables in decarbonizing power systems.

Rising demand for batteries in both sectors can create a virtuous cycle of falling costs through technological improvements, learning, and improved economies of scale, which in turn accelerates deployment, although raw materials costs are likely to play an increasingly significant role ([25], p. 55).

4.1 Electricity Sector

In the electricity sector, clean energy transitions change the nature of power systems. Maintaining capacity adequacy—the ability to match demand and supply at all times with a high degree of reliability—is central to energy security, calling for contributions without adding to overall emissions. Rising flexibility needs, linked primarily to the fast-rising share of variable renewables in the electricity mix, bolster the value of dispatchable technologies, particularly low emissions options. Growing demand for solutions that provide power system flexibility and capacity adequacy is the main driver underpinning the rapid increase in battery energy storage capacity projected in the WEO 2022, as falling costs for battery storage improve their economics compared with competing sources of flexibility and adequacy.

4.1.1 Rising Electricity System Flexibility Needs

Electricity system flexibility needs are projected to increase significantly compared to today in all scenarios modeled for the WEO 2022. Rising flexibility requirements follow from the increase in variable wind and solar PV-based electricity generation in markets around the world. Furthermore, the electrification of additional end uses, such as electric heating, electric vehicles, or certain industrial processes, raises peak demand, as well as the hourly, daily, and seasonal variability of electricity demand ([26], p. 307).

At the same time, the retirement of a large part of the existing fleet of conventional coal- and gas-fired power plants will increase the demand for alternative sources of flexibility and firm capacity ([23], pp. 308). Battery energy storage systems play an increasingly important role in the provision of system flexibility (the ability of the system to respond to fluctuations in supply and demand) and capacity adequacy (maintaining available electricity supply to meet demand in all hours of the year). Additionally, battery energy storage is projected to become increasingly relevant as a component in renewables-based off-grid electricity supplies, supplanting fossil fuel-based generators.

Battery energy storage systems are highly responsive and able to charge or discharge quickly. The energy-to-power ratios of stationary battery energy storage systems, typically ranging from below 1 to 8 hours of storage at full capacity ([26], p. 312), make them well suited to providing flexibility over timescales measured from minutes and hours to a few days [24]. The change in net load from one hour to the next is thus a helpful indicator for flexibility needs that can be usefully served by batteries.

The rising contribution by variable wind and PV increases the variability of the net load.Footnote 4 In the STEPS, the share in the global electricity mix of wind and solar PV together doubles from 10% in 2021 to 20% in 2030 and rises above 40% until 2050. In the APS, it increases to 30% by 2030 and reaches nearly 60% in 2050. In the NZE Scenario, it increases to nearly 70% by 2050. As a result, global flexibility needsFootnote 5 triple until 2050 in the STEPS, rise more than 3.5-fold in the APS, and quadruple in the NZE Scenario. However, there is significant regional variation: systems which today have relatively small shares of wind and solar PV see a much stronger relative increase in flexibility demand. In India, for example, flexibility requirements rise sixfold until 2050 in the APS, whereas in the European Union—where the combined share of wind and solar PV in the electricity mix was already 18% in 2021—they double over the same time period ([26], pp. 214, 299).

The relationship between the rising share of variable renewables in the electricity mix (and thus increasing flexibility demand in the electricity system) and the increase of stationary battery energy storage capacity (as a share of total dispatchable capacity) is illustrated in Fig. 3.3. It shows that across the four regions displayed, battery capacity rises in tandem with the share of variable renewables in the electricity mix. There are, however, differences between regions and scenarios. In the APS, battery storage capacity rises faster relative to the share of renewables in the system than in the STEPS, since renewables are deployed faster and alternative sources of flexibility, such as coal-fired power plants, retired earlier. Regional differences are also the result of the relative share of solar PV and wind in the respective electricity system, as solar in particular is increasingly paired with batteries. Battery deployment thus tends to be larger in places with high proportions of solar PV compared to wind power, like the USA or India, than in regions where wind power predominates, like China or the European Union ([26], p. 312).

Share of batteries in total dispatchable capacity and share of variable renewables in total electricity generation for the European Union, China, India, and the USA, 2021–2050. (Source: IEA [26], p. 311)

4.1.2 Contribution to System Adequacy

In addition to providing flexibility, battery energy storage systems also play an increasingly important role in meeting the adequacy needs of the electricity system. In the APS, for example, battery storage is the primary replacement, in terms of system adequacy, for coal, which is mostly phased out globally until 2050. Battery energy storage accounts for nearly 45% of the replacement capacity, followed by dispatchable renewables, most notably hydropower (15%); solar PV and wind (slightly below 15%); nuclear, fossil fuels with carbon capture utilization and storage (CCUS), hydrogen, and ammonia (7–8% each); and new natural gas-fired capacity (4%) ([19], p. 82).

However, the speed of the shift to batteries as a system adequacy resource varies. Advanced economies, which see the rapid phasing down of their remaining coal fleets in the 2030s, see a surge in investments into battery energy storage systems for system adequacy at around the same time, with emerging market and developing economies following suit in the 2040s, coinciding with a major drop in coal capacity there ([19], p. 82).

4.1.3 Falling Costs

Innovations in battery chemistry, learning effects, and economies of scale are another key driver of rising deployment, since they continue to drive down the cost of battery packs and components that comprise the balance of system of utility-scale battery energy storage systems, making them increasingly cost-competitive with alternative flexibility options. Spillover effects from the electric vehicle industry play an important role in decreasing the cost of battery packs available for stationary applications ([26], p. 311). “Second-life” electric vehicle batteries are projected to play an increasingly important role, providing an option to cheaply expand stationary battery energy storage [24].

Due to increasing economies of scale and continuous innovation along the supply chain, costs for lithium-ion batteries have already declined by nearly 90% between 2010 and 2021 ([26], p. 167). The average installed cost of battery energy storage systems designed to provide maximum power output over a 4-hour period is projected to decline further, from a global average of around USD 285/kWh in 2021 to USD 185/kWh in the STEPS and APS and USD 180/kWh in the NZE Scenario by 2030. Until 2050, costs are projected to drop to around USD 135/kWh in all scenarios ([26], p. 473), with costs in the STEPS slightly above this value and costs in the APS and NZE Scenario slightly below. This makes renewables, in particular solar PV, combined with utility-scale battery energy storage one of the most cost-competitive solutions to provide dispatchable capacity in many markets in 2050, with the levelized cost of electricity falling below that of new combined-cycle gas turbines ([26], p. 406).

It should be noted, however, that as innovation and learning make batteries cheaper and cheaper to produce, the relative contribution of mineral resource prices to the cost of battery packs increases. In 2022, sharp increases in the prices of key minerals like lithium, cobalt, nickel, graphite, copper, or manganese contributed to a 7% increase in the average price of lithium-ion battery packs, despite an ongoing shift to lower cost chemistries that require lower volumes of certain critical minerals [4]. The projected future cost declines presented above are thus contingent on prices of important minerals returning closer to their historical averages.

4.1.4 Policy Frameworks and Regulation

However, while batteries are certain to continue to grow, to get on track for the high levels of deployment seen in the APS and the NZE Scenario, the two more ambitious scenarios of the World Energy Outlook 2022, policies and regulatory frameworks need to evolve.

In the electricity sector, governments should consider energy storage, alongside other flexibility options such as demand response, power plant retrofits, or smart grids, as part of their long-term strategic plans, aligned with wind and solar PV capacity as well as grid capacity expansion plans. Business cases for grid-scale storage can be complex and may not be viable under legacy market and regulatory conditions. In liberalized electricity markets, measures to increase incentives for the deployment of flexibility that is able to rapidly respond to fluctuations in supply and demand could help improve the business case for grid-scale storage. These include decreasing the settlement period and bringing market gate closure closer to real time, as well as updating market rules and specifications to make it easier for storage to provide ancillary services. The business case for storage improves greatly with value stacking, i.e., allowing it to maximize revenue by bidding into different markets. Regulatory frameworks should continue to be updated to level the playing field for different flexibility options, which would help to build a stronger economic case for energy storage in many markets. Transmission and distribution investment deferral (using storage to improve the utilization of, and manage bottlenecks in, the power grid), for example, is another potential high-value application for storage, since it can reduce the need for costly grid upgrades. To capture the greatest benefit, storage should be considered, along with other non-wire alternatives, in the transmission and distribution planning process. A key issue is ownership: in many markets, storage is considered a generation asset, and system operators (transmission as well as distribution) are not allowed to own storage assets. One solution is to allow them to procure storage services from third parties. However, regulatory frameworks need to be updated carefully to minimize the risk of storage assets receiving regulated payments and undercutting the competitive power market [24].

Behind-the-meter battery energy storage is facing challenges on its own. In many jurisdictions, legacy electricity tariff structures do not reward the deployment of behind-the-meter battery storage, which continues to fall behind grid-scale battery energy storage in the projections of the World Energy Outlook 2022. Regulatory changes, such as changes to tariff structures that reward shifting consumption with the help of batteries, could greatly enhance the prospects for behind-the-meter battery energy storage.

4.2 Transport Sector

In the transport sector, a combination of falling electric vehicle costs, government subsidies and support for the development of a charging infrastructure, as well as standards favoring electric and other zero emission vehicles is projected to lead to a massive increase in the global electric vehicle fleet.

4.2.1 Improving Economics of Electric Vehicles

Falling costs, most importantly for the battery packs, driven by ongoing innovation and improving economies of scale, ensure that electric vehicles become the cost-effective choice for most types of road transport after 2030 in all scenarios, especially in the light-duty vehicle segment. In many emerging market and developing economies, electric two−/three-wheelers are, depending on use, already cheaper than internal combustion engine alternatives on a total cost of ownership basis, and this is projected to become the case for most models by 2025 ([17], p. 76; [18], p. 122). The rising attractiveness of electric vehicles to consumers is reflected in the model range. In 2021, around 450 different models of electric vehicles were available on the market, 5 times more than in 2015 ([20], p. 4).

4.2.2 Subsidies and Infrastructure Build-Out

Countries are increasingly looking to boost the uptake of electric vehicles to address concerns around CO2 emissions and local air pollution. Building on the improving competitiveness of electric vehicles, governments across the world are seeking to accelerate the adoption of electric vehicles through subsidies. Direct per vehicle subsidies like cash bonuses or tax rebates lower the cost of electric vehicles, making them more attractive compared to internal combustion engine vehicles.

Other ways to subsidize electric vehicles include exemptions from tolls and charges, as well as the provision of free or subsidized public charging. Increasing investments in charging infrastructure is necessary to make electric vehicle use more practical and alleviate the problem of range anxiety among current and future electric vehicle users, as well as to make electric long-distance trucking more practical ([23], pp. 275). Furthermore, initial public investments in charging infrastructure are essential to overcome the “chicken-and-egg problem” of providing enough chargers to make electric vehicles more attractive and practical to use while at the same time sustaining an infrastructure that is unlikely to be profitable initially due to the low number of users.

Total expenditures by governments in support of electric vehicles almost doubled in 2021. Some countries, including in the European Union, India, and Japan, have introduced or expanded subsidies, while some markets, such as China, Korea, and the UK, have used the opportunity provided by falling electric vehicle costs to reduce per vehicle subsidies, recognizing the narrowing cost gap between electric and conventional internal combustion engine-powered vehicles ([20], p. 59).

4.2.3 Standards and Targets

Standards and targets are projected to play a major role accelerating the adoption of electric vehicles. As of mid-2022, 36 countries and several US states have committed to ending sales of internal combustion engine-powered cars and, in some cases, light trucks, by a certain year ([26], p. 273). With the “Fit for 55” package, the European Union has pledged to ensure that all new cars and vans registered in the block will have to be zero emission by 2035. In an intermediate step, new vehicles will have to comply with CO2 standards that will require emissions drop by 55% until 2030 for cars and 50% for vans (from a limit of 95 g/km for cars and 147 g/km for vans in 2021) [10]. Globally, 25% of the present light-duty vehicle market is covered by pledges or targets to bring the share of zero emission vehicles to 100% by 2035 ([20], p. 57) (Table 3.1).

Major automakers are responding by turning increasingly to electric vehicles—not only to respond to regulation but also to maintain or capture market share and retain or gain a competitive edge [20]. A general overview of the electrification plans of different automakers is provided in the IEA Global Electric Vehicle Outlook 2022 ([20], p. 32).

While electric vehicle sales are projected to continue to grow strongly in all scenarios, a slow turnover in the vehicle stock means that the process of electrifying significant portions of the global vehicle fleet will take time and not be completed until after 2050 in the STEPS and APS. The NZE Scenario therefore assumes an end of new internal combustion engine vehicle sales globally by no later than 2035. This will require significant efforts to step up electric vehicle and battery production ([26], p. 276).

5 Resource Demand for Batteries

Clean energy technologies, including batteries, require far larger volumes of critical minerals than fossil fuel-based technologies. Copper is a key component of most technologies that produce or consume electricity; silver and silicon are needed for solar PV; rare earth elements are an important component of most wind turbine motors and electric motors, while lithium, nickel, cobalt, manganese, and graphite are crucial minerals for the production of lithium-ion batteries ([16], p. 5), the dominant battery chemistry for electric vehicles and utility-scale energy storage applications, both today and under the projections of the World Energy Outlook 2022 ([26], p. 217).

The energy sector is becoming a substantial consumer of critical minerals as the accelerating transition to a clean energy system is expected to significantly raise demand. For the majority of minerals, the energy industry only made up a minor portion of total demand until the middle of the 2010s.

The energy sector’s share is projected to increase significantly over the next two decades: electric vehicles and stationary battery energy storage systems have already outclassed consumer electronics as the largest consumer of lithium and are projected to overtake stainless steel production as the largest consumer of nickel by 2040 ([16], p. 5).

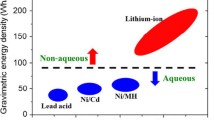

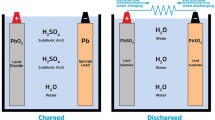

Lithium-ion batteries have emerged as the dominant battery technology in both electric vehicles and stationary battery energy storage applications. They are far more energy dense than competing solutions such as lead acid or nickel cadmium batteries. The production of lithium-ion batteries is mineral-intensive. A battery pack is made up of modules which are composed of individual cells. Cells account for around 70–85% of the weight of the total weight of a battery pack. They contain several minerals, mainly lithium, nickel, cobalt, and manganese (in the cathode), graphite (in the anode), copper (in the current collector), as well aluminum, steel, and microelectronics (for other components of the modules and pack) ([16], p. 90).

5.1 Dominant Lithium-Ion Battery Chemistries

Lithium-ion batteries are often categorized and commonly referred to by the chemistry of their cathodes. The choice of chemistry determines a battery’s energy density and longevity, which varies significantly between chemistries, and is a key determining factor for the type and amount of minerals required. The most commonly used cathode chemistries for lithium-ion batteries are lithium cobalt oxide (LCO), lithium manganese oxide (LMO), lithium iron phosphate (LFP), lithium nickel cobalt aluminum oxide (NCA), and lithium nickel manganese cobalt oxide (NMC) ([16, 32], p. 90; [29]).

Of the types mentioned above, LCO batteries have the greatest energy density and a relatively high specific energy (150–190 Wh/kg). The primary choice for consumer electronics is a mature technology, with the disadvantage, however, of a comparably short life cycle (500–1000 full cycles). This, coupled with an inherent thermal instability, means they are generally not employed in electric vehicles or as stationary electricity storage solutions ([16], p. 90).

The LMO battery has a high specific power, a longer life cycle (1000–1500 cycles), and much better thermal stability than LCO. Being cobalt-free is often considered as a key advantage of this chemistry. However, it has a notably lower energy density, in the range of 100–140 Wh/kg. Presently, it finds use in the production of electric bikes and some commercial vehicles ([16], p. 90).

LFP batteries offer high thermal stability and a longer life cycle (more than 2000 full cycles) ([16], pp. 90). Its lower energy density and specific energy (90–140 Wh/kg) mean that the technology has been thus far favored for large-scale stationary energy storage applications and heavy-duty vehicles, where the size and weight of a battery are secondary considerations over safety and durability, rather than passenger electric vehicles or behind-the-meter home storage systems [24]. Nevertheless, owing to several social, geopolitical, and resource constraint concerns, LFP batteries, which do not require nickel, manganese, or cobalt, are today witnessing a massive resurgence in R&D spending to improve their energy density and make them suitable for passenger EVs. These efforts were spearheaded by automakers in China, where in the past year, both domestic and international OEMs like Tesla Motors and Volkswagen have focused on producing LFP-based entry-level EV models.

The NCA battery has the highest specific energy range (200–250 Wh/kg) in the current class of technologies as well as high specific power, combined with a lifetime of 1000 to 1500 full cycles. NCA is the technology preferred by manufacturers like Tesla and has immense potential for use in power systems in backup and load shifting applications. However, they are more expensive than other chemistries ([16], p. 91).

NMC batteries have longer life cycle (1000–2000 cycles) compared to NCA, but a lower energy density (140–200 Wh/kg). They have dominated the BEV and PHEV markets since its commercialization in the early 2000s. While NCA batteries have higher specific energy to their name, NMC batteries possess longer lifetimes, which makes them the favored choice for PHEVs. Manufacturers producing both BEVs and PHEVs, such as General Motors, are known to use NMC variants of lithium-ion batteries ([16], p. 91).

Advancement in lithium-ion battery technology involves more than just the challenge of improving energy density, durability, safety, and cost. It also includes the effort to do so while minimizing the environmental, social, and political costs of acquiring their constituent materials. Owing to price spikes and concerns over ethical mining practices in the 2010s, EV producers have been working to reduce the amount of cobalt in batteries over the past several years—this implies, in many cases, an increase in the quantity of nickel. NCA batteries transitioned to NCA+, a nickel-rich variant of NCA, and NMC 111 batteries have moved increasingly toward NMC 532, NMC 622, and NMC 811 and could move to even more nickel-rich chemistries. This trend of moving away from cobalt could therefore have major implications for the requirement for nickel, which also has a highly concentrated supply chain today ([16], p. 91).

Anodes must complement cathode chemistries. Anode materials are selected for their charge collection capability. Graphite is currently the dominant choice for the anode in most lithium-ion batteries, although certain manufacturers also use lithium titanate instead of graphite. Efforts to replace some or most atoms of carbon in the graphite anode with silicon atoms are underway (e.g., Tesla, Porsche) and are expected to drastically improve the energy density of the cells. However, silicon anodes swell during charging, causing its surface to crack and performance to drop. Another alternative to the graphite anode is pure lithium metal, which also has far greater charge collection capability than graphite. But this anode cannot be used with liquid electrolyte batteries due to undesirable chemical interactions between the electrolyte and the metal anode, which drastically reduces the lifetime of the cell. The use of a lithium metal anode may increase significantly with the advent of all-solid state batteries (ASSBs) ([16], p. 92).

The future technology mix will have a significant impact on the amount of specific mineral resources required for the production of batteries. As shown in Fig. 3.4, different battery chemistries require different minerals in varying quantities. Different assumptions about the evolution of the technology mix can thus have a substantial effect on the amounts of certain minerals consumed for battery production.

Nickel manganese cobalt oxide (NMC) batteries, for instance, usually require roughly eight times more cobalt but only half as much nickel than nickel cobalt aluminum oxide (NCA) batteries. While nickel, cobalt, and manganese are needed for lithium iron phosphate (LFP) batteries, approximately 50% more copper is required compared to NMC batteries ([16], p. 88).

Further uncertainty is introduced by the potential for disruptive leaps in battery technology. As we reach the physical limits of density and life cycle improvements with current technology and materials, notable cost reductions can only be achieved by the disruption of the current technology—for example, in the form of ASSBs with lithium anodes or through the increased used of silicon in graphite anodes for existing liquid electrolyte chemistries, or through all together new chemistries such as sodium-ion batteries. Therefore, a continued cost decline at the pace observed during the past decade cannot be taken for granted without a further acceleration in technology innovation, and this will be accompanied by changes in mineral demand projections.

5.2 Mineral Resource Requirements for the Production of Batteries

While mineral resource requirements for battery production were not quantified for the STEPS, APS, or the NZE Scenario presented in the WEO 2022, the IEA published detailed minerals demand projections in a preceding report. They are based on the IEA Sustainable Development Scenario (SDS) which describes a global pathway for the energy system that achieves the goal of the Paris Agreement, in addition to meeting the United Nations’ Sustainable Development Goals.

In the SDS, the transport sector sees battery demand from EVs grow by nearly 40 times between 2020 (160 GWh) and 2040 (6200 GWh). The base case chemistry assumptions project a shift away from cobalt-rich chemistries. This is achieved in both NCA batteries and NMC variants, where the ratio of nickel and manganese is increased in the transition from NMC 111 to NMC 532, NMC 622, and ultimately NMC 811 ([16], p. 97). While most heavy trucks are reliant on LFP batteries in the medium term, the base case also sees growth in the market share of LFP for cars due to its increasing use in China. The base case also sees ASSBs becoming commercially available by around 2030 and requiring another 5 years for manufacturing capacity to build up. Even in 2040, ASSBs remain more expensive than liquid electrolyte lithium-ion batteries and are therefore limited to premium vehicles and advanced economies. In the longer term, heavy trucks operating long haul are likely to use ASSBs as soon as they become available because of the great benefits of energy density improvement in these applications. They would enable increased payload, greater operating range, and shorter charging times ([16], p. 96).

For the anode, natural graphite is expected to continue to account for the majority of market share. Even as artificial graphite starts to replace natural graphite for reasons of improved purity and hence energy density, a small number of manufacturers choose lithium titanate (LTO) instead of graphite for heavier vehicles due to its fast-charging advantages. The dominance of graphite declines very slightly over the years to make way for nanocomposite graphite doped with silicon and for lithium metal that emerges with the advent of ASSBs ([16], p. 96).

Overall annual demand for minerals under the base case chemistry assumptions grows by 30 times between 2020 and 2040, from 400 kt to 11,800 kt. Nickel demand grows by 41 times to 3300 kt, while cobalt increases by only 21 times, as cathode chemistries shift away from NMC 111 toward lower-cobalt chemistries (NMC 622 and NMC 811). Lithium demand grows by 43 times, while copper grows 28 times. Graphite demand grows 25 times from 140 kt in 2020 to over 3500 kt in 2040. Silicon registers the largest relative growth, up over 460 times, as graphite anodes doped with silicon grow from a 1% share in 2020 to 15% in 2040 ([16], p. 97).

In the electricity sector, battery storage grows by 11 times between 2020 (37 GWh) and 2040 (420 GWh). In the base case chemistry assumptions, safe and cheap LFP batteries for utility-scale storage are expected to dominate the overall battery storage market. The remaining demand is covered by the more expensive, but energy dense, NMC 111 and NMC 532 used predominantly for home energy storage. The NMC variants transition toward NMC 622 and NMC 811 in a similar way to the market for EV batteries, albeit with a delay owing to the time needed for transfer of technology and sufficient reduction in prices. Vanadium flow batteries (VFBs) first become commercially suitable in 2030 with a small share, growing modestly to capture a wider market for storage applications in large renewables projects.

Overall demand for minerals in the base case grows by 33 times between 2020 and 2040, from 26 kt to nearly 850 kt. Overall mineral demand outpaces battery demand growth, as the market share for LFP batteries is displaced by more mineral-intensive NMC chemistries. The largest relative growth is seen in nickel, which grows more than 140 times from 0.4 kt in 2020 to 57 kt in 2040. Cobalt demand increases by 70 times while manganese demand increases by 58 times.

The base case projections are founded on a set of assumptions, which, when altered due to reasons of technology advancements, could result in scenarios that produce very different results.

The base case for electric vehicle batteries, for example, assumes an ongoing shift away from cobalt toward nickel-rich cathode chemistries. Growing concerns around nickel supplies, for example, due to price spikes triggered by delays to and cost overruns at planned nickel mining projects, could conceivably slow the shift toward nickel-rich chemistries. The impact on minerals volumes could be substantial: compared to the base case, a delayed shift could result in a nearly 50% higher demand for cobalt and manganese for electric vehicle batteries by 2040. Similarly, a much more rapid shift toward ASSBs could result in higher lithium demand than in the base case but would also reduce the demand for graphite and silicon ([16], p. 99).

The base case for energy storage systems is built on the assumption that utility-scale storage forms a major proportion of the demand, wherein cost (and not space) is the primary concern for the technology selection. However, several alternative scenarios could change the base case projections. For instance, more rapid adoption of wall-mounted home energy storage would make size and thus energy density a prime concern, thereby pushing up the market share of NMC batteries such as those already used by the Tesla Powerwall. Conversely, if the technology for flow batteries, which have the advantage of virtually unlimited energy capacity and very long lifetimes, reaches a stage of widespread commercialization earlier than expected, then utility-scale storage technology could shift away from LFP batteries toward VFBs ([16], p. 105).

The mineral demand projections presented in this section show that the proliferation of batteries in the electricity and transport sectors will lead to a significant increase in the demand for various critical minerals essential for battery production. Scaling up the production of these minerals in a sustainable manner is critical to achieving the deployment rates and cost reductions projected in the scenarios presented above. Today already, raw material prices account for 50–70% of total battery costs. A doubling of lithium or nickel prices, for example, would lead to 6% increase in battery costs ([16], p. 107). It is important to note that in addition to primary production (mining), battery recycling has the potential to be a significant source of secondary supply of the critical minerals needed for future battery demand. IEA analysis suggests that the recycling and reuse of batteries from electric vehicles and stationary storage could reduce primary mineral supply requirements by more than 10% by 2040 ([16], p. 187). Targeted policies, including minimum recycled content requirements, tradable recycling credits, and virgin material taxes, all have potential to incentivize recycling and drive growth of secondary supplies. International coordination will be crucial because of the global nature of the battery and critical minerals markets [24].

6 Conclusion

Long-term projections of the development of the global energy system foresee a dramatic increase in the relevance of battery storage for the energy system. This is driven primarily by the proliferation of electric vehicles and a growing demand for electricity storage, connected to rising share of variable renewables in the electricity supply mix.

The IEA WEO 2022 projects electric vehicles to become the dominant technology in the light-duty vehicle segment in all scenarios in 2050, contributing to a massive increase in the demand for batteries. In the electricity sector, battery energy storage systems emerge as one of the key solutions to provide flexibility to a power system that sees sharply rising flexibility needs, driven by the fast-rising share of variable renewables in the electricity mix. Batteries are also increasingly tapped to provide firm capacity as traditional generators, such as coal- or gas-fired plants, are retired.

The ongoing decline in the cost of battery packs is crucial to this. It enables electric vehicles to compete on cost with their internal combustion engine counterparts in more and more use cases. Policies and targets play an important role as well. Zero emission vehicle sales targets, such as the European Union’s commitment to 100% zero emission vehicles in sales by 2035, provide guidance to carmakers, many of whom are responding by expanding the model range and setting their own fleetwide electrification targets. Direct and indirect electric vehicle subsidies, as well as investments into charging infrastructure, are boosting the competitiveness of electric vehicles and their practicality of use.

On the stationary battery energy storage side, falling costs, driven mainly by the battery pack, which benefits from spillover effects from the EV industry, but also ongoing learning and economies of scale on the rest of the balance of system, are increasingly making battery energy storage a cost-competitive choice for the provision of flexibility and secure capacity.

The projected rise in battery production leads to a strong increase in demand for critical minerals like lithium, cobalt, nickel, graphite, copper, or manganese. Increasing the supply of these critical minerals in lockstep with demand is essential in order for battery costs to continue to decline.

Notes

- 1.

In the context of this chapter, we define “electricity sector” as encompassing the production and all stationary end uses of electricity.

- 2.

Net metering is a billing mechanism that allows consumers to credit self-generated against consumed electricity irrespective of when that electricity was generated.

- 3.

It should be noted that the faster scale-up projected for the APS and NZE Scenario (compared to the STEPS) will require policy and regulatory frameworks to evolve in a manner that reflects the contribution that battery energy storage systems are able to make to the system.

- 4.

The net load is the load that remains after deducting the production of wind and solar PV from electricity demand.

- 5.

In the WEO 2022, flexibility needs are measured by the hour-to-hour ramping requirements after removing hourly wind and solar PV production from hourly electricity demand, divided by the average hourly demand for the year ([26], p. 308).

References

Argonne National Laboratory (2020a) BatPaC Model Software. Available at: https://www.anl.gov/cse/batpac-model-software. Accessed 6 Feb 2023

Argonne National Laboratory (2020b) GREET model. Available at: https://greet.es.anl.gov/. Accessed 6 Feb 2023

Ballinger B et al (2019) The vulnerability of electric vehicle deployment to critical mineral supply. Appl Energy 255:113844. https://doi.org/10.1016/J.APENERGY.2019.113844

Bloomberg NEF (2022) Lithium-ion battery pack prices rise for first time to an average of $151/kWh. Available at: https://about.bnef.com/blog/lithium-ion-battery-pack-prices-rise-for-first-time-to-an-average-of-151-kwh/. Accessed 1 Feb 2023

Bowen T, Chernyakhovskiy I, Denholm P (2019) Grid-scale battery storage: frequently asked questions. Available at: https://www.nrel.gov/docs/fy19osti/74426.pdf

Bowen T, Gokhale-Welch C (2021) Behind-the-meter energy storage: frequently asked questions. Available at: https://www.nrel.gov/docs/fy21osti/79393.pdf

BP (2022) BP energy outlook 2022. Available at: https://www.bp.com/en/global/corporate/energy-economics/energy-outlook. Accessed 22 Nov 2022

Bundesregierung (2022) G7 Climate, Energy and Environment Ministers’ Communiqué. Available at: https://www.bundesregierung.de/resource/blob/974430/2044350/84e380088170c69e6b6ad45dbd133ef8/2022-05-27-1-climate-ministers-communique-data.pdf. Accessed 28 Feb 2023

EIA (2021) International Energy Outlook 2021. Available at: https://www.eia.gov/outlooks/ieo/

European Council (2022a) Fit for 55: why the EU is toughening CO2 emission standards for cars and vans – Consilium. Available at: https://www.consilium.europa.eu/en/infographics/fit-for-55-emissions-cars-and-vans/. Accessed: 24 Nov 2022

European Council (2022b) Fit for 55. Available at: https://www.consilium.europa.eu/en/policies/green-deal/fit-for-55-the-eu-plan-for-a-green-transition/#package. Accessed 1 Feb 2023

ExxonMobil (2022) ExxonMobil Outlook for Energy 2022. Available at: https://corporate.exxonmobil.com/energy-and-innovation/outlook-for-energy. Accessed: 22 Nov 2022

Fishman T et al (2018) Implications of emerging vehicle technologies on rare earth supply and demand in the United States. Resources 7(1):9. https://doi.org/10.3390/RESOURCES7010009

IEA (2020) Renewables 2020. Paris. Available at: https://www.iea.org/reports/renewables-2020

IEA (2021a) Net Zero by 2050: A Roadmap for the Global Energy Sector. International Energy Agency, Paris. Available at: https://www.iea.org/reports/net-zero-by-2050

IEA (2021b) The Role of Critical Minerals in Clean Energy Transitions. Paris. https://doi.org/10.1787/f262b91c-en

IEA (2022a) Africa Energy Outlook 2022. Paris. Available at: https://www.iea.org/reports/africa-energy-outlook-2022

IEA (2022b) An Energy Sector Roadmap to Net Zero Emissions in Indonesia. Paris. Available at: https://www.iea.org/reports/an-energy-sector-roadmap-to-net-zero-emissions-in-indonesia

IEA (2022c) Coal in Net Zero Transitions. Paris. Available at: https://www.iea.org/reports/coal-in-net-zero-transitions

IEA (2022d) Global Electric Vehicle Outlook 2022. Paris. Available at: https://www.iea.org/reports/global-ev-outlook-20022

IEA (2022e) Global Energy and Climate Model. Paris. Available at: https://www.iea.org/reports/global-energy-and-climate-model

IEA (2022f) Steering Electricity Markets Towards a Rapid Decarbonisation. OECD Publishing, Paris. https://doi.org/10.1787/d2f0068c-en

IEA (2022g) Tracking clean energy progress: electric vehicles. Paris. Available at: https://www.iea.org/reports/electric-vehicles

IEA (2022h) Tracking clean energy progress: grid-scale storage. Paris. Available at: https://www.iea.org/reports/grid-scale-storage

IEA (2022i) World Energy Investment. Paris. Available at: https://www.iea.org/reports/world-energy-investment-2022

IEA (2022j) World Energy Outlook 2022. Paris doi:https://doi.org/10.1787/3a469970-en

IPCC (2022) Climate change 2022: mitigation of climate change (IPCC AR 6 Working Group III Report). Geneva. Available at: https://www.ipcc.ch/report/ar6/wg3/

IRENA (2022) World Energy Transitions Outlook 2022. Abu Dhabi and Bonn. Available at: https://www.irena.org/publications/2021/Jun/World-Energy-Transitions-Outlook. Accessed: 22 Nov 2022

Liu W, Placke T, Chau KT (2022) Overview of batteries and battery management for electric vehicles. Energy Rep 8:4058–4084. https://doi.org/10.1016/j.egyr.2022.03.016

Shell (2022) Shell scenarios. Available at: https://www.shell.com/energy-and-innovation/the-energy-future/scenarios. Accessed: 22 Nov 2022

Watari T et al (2019) Total material requirement for the global energy transition to 2050: a focus on transport and electricity. Resour Conserv Recycl 148:91–103. https://doi.org/10.1016/J.RESCONREC.2019.05.015

Zubi G et al (2018) The lithium-ion battery: State of the art and future perspectives’. Renew Sust Energ Rev 89(April 2017):292–308. https://doi.org/10.1016/j.rser.2018.03.002

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2024 The Author(s)

About this chapter

Cite this chapter

Schönfisch, M., Dasgupta, A., Wanner, B. (2024). Projected Global Demand for Energy Storage. In: Passerini, S., Barelli, L., Baumann, M., Peters, J., Weil, M. (eds) Emerging Battery Technologies to Boost the Clean Energy Transition. The Materials Research Society Series. Springer, Cham. https://doi.org/10.1007/978-3-031-48359-2_3

Download citation

DOI: https://doi.org/10.1007/978-3-031-48359-2_3

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-48358-5

Online ISBN: 978-3-031-48359-2

eBook Packages: Chemistry and Materials ScienceChemistry and Material Science (R0)