Abstract

Transitioning from a linear to a circular economy (CE) is one of the main goals set by the European Union to achieve carbon neutrality by 2050. Portugal is currently revising the national CE action plan, and the construction sector has been identified as one of the key sectors. Barriers and opportunities in the transition to a CE were previously mapped in literature and national or sectorial CE action plans but still need to be identified for the Portuguese construction sector specificities. Over one-thousand stakeholders were interviewed during eleven working sessions to characterize the national construction sector, identifying and clustering barriers and opportunities in this transition. Barriers from the Political and regulatory pillar were critical, and an urgent need to adapt (and simplify) the regulatory framework to promote a circular construction sector was identified. In the Technology pillar, stakeholders acknowledged the need to support people and companies to make the transition. In the market pillar the lack of pilot projects applying CE principles and of a CDW market. Finally, in the Cultural pillar, the need to reskill workers and empower society with CE principles was highlighted. The actions to trigger the transition are a CE-prone framework, digitalization of construction, simplification of procedures, support research, and empowering the whole value chain. All these actions are in line with the just transition mechanism to ensure that “no one is left behind” and point the path towards a carbon–neutral construction sector.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Transitioning from a linear to a circular economy (CE) is one of the main goals set by the EU to tackle climate change and achieve carbon neutrality by 2050. In 2020 the European Commission reviewed its Circular Economy Action Plan (CEAP) [1], following the European Green Deal principles and “making sure no one is left behind” [2]. The new CEAP [1], has four main goals: (i) Reduce pressure on natural resources, (ii) Create sustainable growth and jobs, (iii) achieve the EU’s 2050 climate neutrality target, and (iv) halt biodiversity loss. The Sustainable Development Goals (SDG) set by the United Nations (UN) in 2015 [3] have four aligned goals: (i) Responsible consumption and production (SDG12), (ii) Decent work and economic growth (SDG8), (iii) Climate action (SDG13), and (iv) Life on land (SDG15).

Following the CEAP, most country members have adopted National Circular Economy Action Plans. European and national action plans (also named roadmaps or strategic plans) for a circular economy (CE) identify people’s knowledge and engagement as the key element in the transition from a linear towards a CE. Sectorial plans focusing on the architecture, engineering, and construction (AEC) sector underline the need for workers’ reskilling, creating new professions and courses, and raising general awareness of CE principals as the main actions for the Construction sector transition.

Some barriers hinder this transition such as the current legal framework, lack of investment, and need for skilled labor, among many others. Some opportunities have been identified to overcome these barriers, such as including circularity in the regulatory framework and public procurement (through Green Public Procurement), financing the transition by supporting pilot case studies, and CE training courses, among many other opportunities.

Barriers and opportunities in CE adoption have been identified in the literature and described in current action plans in different EU countries. According to key players in Portugal what are the main barriers and opportunities in the transition to a circular construction sector? The Portuguese Construction sector is mainly composed of micro-, small- and medium-sized enterprises [4], most of which are in a fragile economic position. Moreover, the legal framework is complex and sometimes contradictory, making it difficult to change procedures into a CE. Key stakeholders in the Construction sector and respective value chains were consulted to characterize circularity. This work is based on the results achieved in 11 working sessions, with more than one-thousand actors. It is framed under the funded work to define and publish the Portuguese Action Plan for Circularity in the Construction Sector [5].

1.1 Literature Review

Barriers and opportunities in the transition from a linear to a CE model are presented in literature since 2018. Previous work based on systematic literature reviews and statistical analyses, allowed us to identify, and cluster, the most relevant barriers, and opportunities in the construction sector. One of the first and most cited studies about CE barriers and opportunities was conducted by Kirchherr et al. [5]. It presents the first large-N-study on generic CE barriers in the EU and identifies—with the help of 208 survey respondents and 47 expert interviews—15 main barriers, clustered into four categories: Cultural, Market, Regulatory, and Technological.

Later in 2022, the research published by Wuni [6] employed systematic literature review protocols to search, retrieve, evaluate, and extract relevant metadata from 53 studies. This allowed identifying several barriers, which when analyzed using a Pareto analysis, showed a prioritization of the most relevant barriers (57 barriers), with a similar number of opportunities, and distributed in clusters (11 clusters), directly related to the implementation of CE in the construction sector. At the same time, Oluleye et al. [7] conducted a systematic literature review with a special focus on building construction and demolition waste management. This study considered a PRISMA (Preferred Reporting Items for Systematic Reviews and Meta-analysis Approach) approach that identified 38 relevant papers, identifying 33 barriers, and a similar number of opportunities, divided into 7 clusters and by the actors involved. Focusing on the Australian context, Shooshtarian et al. [8] evaluated stakeholders’ perceptions about CE, identifying the main barriers and opportunities in CE adoption, and focusing on responders’ characterization. Ababio and Lu [9] found 45 barriers and 15 opportunities divided into five clusters: Social and cultural; Political and legislative; Financial and economic; Technological; Framework and theory related. More recently, Murano and Tavares [10] categorized barriers and opportunities by stakeholder level: internal, external, or mixed level. Table 17.1 presents clusters defined in the previously cited papers: [6, 7, 9, 10], and [11] The table shows that the four clusters first defined by Kirchherr [11] are similar to those proposed by the other three authors (in bold).

Table 17.2 presents a top-ten list of barriers and opportunities identified in the literature (unranked) for implementing a CE model in the construction sector with a focus on the European market [12,13,14,15,16,17]. The main barriers are related to the lack of knowledge and awareness of society and all stakeholders along the supply chain, the lack of a CE legal framework, followed by high costs, lack of financial support and technologies, infrastructure, and technical constraints. Identified opportunities are successful pilot projects and businesses applying CE best practices, the empowerment of workers and labor reskilled, investment and financial support, new technologies, and increased data sharing.

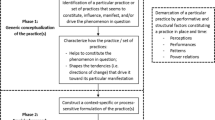

2 Materials and Methods

A five-step approach was developed to build an action plan for circular construction in Portugal: (i) map the regulatory framework; (ii) identify circular economy (CE) action plans in Europe; (iii) characterize the national Construction sector and related impacts; (iv) survey the key stakeholders to identify main barriers and drivers; and (v) plan, writing the action plan, measures, actions, and governance. This paper presents the fourth stage of that approach: a survey of the Portuguese key players in the sector to identify the main barriers and drivers in the transition of the Construction sector to a CE.

2.1 Research Approach

Key actors in the Portuguese Construction sector and construction value chain were consulted during eleven sessions, performed virtually due to pandemic restrictions (from January to March 2022) and using the Concept Board online platform and presential afterward (April to May 2022). The events first had an expository part that framed the subject under discussion, followed by an interactive part during which the various actors could participate in working groups using a methodology combining design thinking principles in a focus group environment. The analytical treatment of the interviews included the transcription of barriers and (after) opportunities, grouping, prioritization (through voting), and results interpretation, this last one including graphical representation and discussion. In addition to statistical data, the information collected from stakeholders’ interviews supported Construction sector characterization. The main obstacles that hinder the transition to circular construction were identified and prioritized, and potential opportunities were pointed out. Table 17.3 presents the list of sessions held during the consultation stage. These sessions are available on YouTube.

2.2 Participants Characterization

The online sessions were public, but the application form allowed to cluster participants in eight categories, following a similar distribution of the actors as defined by the European Commission [18]: Academia & research centers; Contractors & builders; Demolition & CDW management teams; Construction products manufacturers; Government & regulators; Investors, developers & insurance providers; Designers; and Users & owners. Figure 17.1 presents the total number of participants per actor category, showing that Contractors & builders were the highest shares of participants (~30%), followed by Users & owners (~20%) and Government & regulators (~5%).

Figure 17.2 presents the participants’ distribution per actor category in each one of the eleven sessions. From the online sessions, Session 3 (S03) “Construction and demolition waste management: What has changed? What is new?” had the highest number of participants (227), one-third of them being contractors and builders (88), followed by users and owners (47), and government and regulators (34). Both sessions, S02 “How to move from theory to action in the incorporation of recycled materials in the Construction sector” and S04 “Innovation for a more circular construction” had around 130 participants, being the second and third most attended online working sessions. The number of participants in the face-to-face events was high, with 128 participants at the “Construction and demolition waste management: What has changed? What is new?” session held in Oporto (S08) and 137 held in Lisbon (S11). In Lisbon, most of the participants were Contractors & builders (90), while in Oporto they were Government & regulators (32), and contractors & builders (28). Attenders in Leiria were fewer (29) in line with population density and reduced Construction sector activity.

3 Results and Discussion

The results and discussion section presents the main barriers identified by key stakeholders and possible opportunities in the circular economy (CE) within the AEC Portuguese sector and value chain.

3.1 Barriers Identified

The main barriers identified by key stakeholders were distributed along the four pillars following Kirchherr et al. [10]: (i) Political & regulatory; (ii) Technology; (iii) Market; and (iv) Cultural. In the Political & regulatory pillar, stakeholders pointed out the complex and sometimes contradictory legislation as the main barrier, followed by a lack of incentives and sustainable procurement to leverage the transition. In the Technological pillar, it was acknowledged that some building technologies are not fully developed (for disassembly and adaptability, modularity, and offsite manufacturing) and a lack of alternative CE materials or limited knowledge about them. The Market pillar identified the urge to have some pilot projects following CE principles, no market for secondary materials (from CDW), the short life span of building materials and components, and difficulties in maintenance. Finally, the Cultural pillar indicated the lack of qualified professionals and training, acceptance of recycled or reused materials, and the society’s knowledge and awareness about the principles and benefits of circular construction. The main barriers identified by stakeholders are presented in Table 17.4, with the most important highlighted in bold. Barriers in the Political and regulatory pillar are further detailed in [19].

3.2 Opportunities Identified

The stakeholders also identified opportunities to overcome the main challenges presented by the barriers. Most of the opportunities are within the Political & regulatory pillar, including the incentives to support circular business models, simplification of processes, and adaptation of the regulatory framework to CE principles are the main opportunities identified. The Technology pillar has highlighted the support of training and research, and the development of new tools and technologies. In the Market pillar, the funding of circular products, the development of a marketplace with environmental data to support decisions, and public procurement, including environmental criteria. Finally, in the Cultural pillar, stakeholders identified the empowerment of workers and society with CE principles, based on demonstrators’ projects, workshops, and dissemination actions, and reinforcing circular partnerships along the value chain. The main opportunities identified by stakeholders are presented in Table 17.5, with the most important ones highlighted in bold. Opportunities in the Political and regulatory pillar are further detailed in [19]

3.3 Uncertainty and Limitations

The main limitations that may impact the validity, reliability, or robustness of the findings can be due to sampling selection bias as the eleven sessions had an audience composed of professionals with no general public attendees. The sampling was vast (over one thousand people) and presential sessions were held in three different locations trying to overcome the geographical lack of representativeness that may occur: one session in the north region in Oporto, another in the center in Leiria, and finally one in Lisbon. The online events allowed a vaster coverage of the territory, although being held in Portuguese excluded a non-Portuguese-speaking audience. However, as the scope of the study was to listen to the Portuguese key stakeholders is not a limitation but reflects this study’s boundaries.

4 Conclusions

Most of the barriers identified by Portuguese AEC stakeholders during workshops are similar to those stated in the literature, accentuated by the characteristics of the national construction sector: consisting of micro and SMEs, workers shortage, and low productivity. Stakeholders highlighted the need to redefine legislation to include CE principles, conciliate regulation, and simplify procedures. Moreover, the need to reskill labor and raise awareness of CE advantages is clear, as well as, to support enterprises and people in the transition, expressing the difficulties of the national Construction sector. Both barriers and opportunities should be considered by decision-makers, from regulators to business owners or designers, to better support decisions toward a more circular construction sector. To sum up, four opportunities (one per pillar) and underlying mottos are identified:

-

(1)

Redefine and simplify the legal framework: “better” legislation, not “more” legislation.

-

(2)

Digitalization will support the twin transition: digital and green.

-

(3)

Support research: new ways of doing (and living).

-

(4)

Empower workers, companies, and society: no one is left behind!

References

European Commission, Circular Economy Action Plan, European Commission (2020) 28. https://doi.org/10.2775/855540

European Commission: The European Green Deal (2019) https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal_en

United Nations, Sustainable Development Goals (2015)

IMPIC, Relatório do Setor da Construção em Portugal (2020)

Fonseca P, Pedroso M, Tavares V, Laranjeira L (2022) Plano de Ação para a Circularidade na Construção (PACCO)

Wuni I (2022) Mapping the barriers to circular economy adoption in the construction industry: A systematic review Pareto analysis, and mitigation strategy map. Build Environ 223:109453. https://doi.org/10.1016/j.buildenv.2022.109453

Oluleye B, Chan D, Olawumi T (2022) Barriers to circular economy adoption and concomitant implementation strategies in building construction and demolition waste management: a PRISMA and interpretive structural modeling approach. Habitat Int 126:102615. https://doi.org/10.1016/j.habitatint.2022.102615

Shooshtarian S, Hosseini M, Kocaturk T, Arnel T, Garofano T (2022) Circular economy in the Australian AEC industry : investigation of barriers and enablers. Build Res Inform. https://doi.org/10.1080/09613218.2022.2099788

Ababio B, Lu W (2022) Barriers and enablers of circular economy in construction : a multi-system perspective towards the development of a practical framework. Constr Manag Econ 0:1–19. https://doi.org/10.1080/01446193.2022.2135750

Munaro R, Tavares F (2023) A review on barriers, drivers, and stakeholders towards the circular economy: the construction sector perspective. Clean Respon Consump 8:100107. https://doi.org/10.1016/j.clrc.2023.100107

Kirchherr J, Piscicelli L, Bour R, Kostense-Smit E, Muller J, Huibrechtse-Truijens A, Hekkert M (2018) Barriers to the circular economy: evidence from the European Union (EU). Ecol Econ 150:264–272. https://doi.org/10.1016/j.ecolecon.2018.04.028

Bertozzi C (2022) How is the construction sector perceiving and integrating the circular economy paradigm? Insights from the Brussels experience. City, Cult Soc 29:100446. https://doi.org/10.1016/j.ccs.2022.100446

Giorgi S, Lavagna M, Wang K, Osmani M, Liu G, Campioli A (2022) Drivers and barriers towards circular economy in the building sector: stakeholder interviews and analysis of five European countries policies and practices. J Clean Prod 336:130395. https://doi.org/10.1016/j.jclepro.2022.130395

Klein N, Deutz P, Ramos B (2022) A survey of Circular Economy initiatives in Portuguese central public sector organisations: national outlook for implementation. J Environ Manage 314:114982. https://doi.org/10.1016/j.jenvman.2022.114982

Reich H, Vermeyen V, Alaerts L, Acker K (2023) How to measure a circular economy: a holistic method compiling policy monitors. Resour Conserv Recycl 188:106707. https://doi.org/10.1016/j.resconrec.2022.106707

Sáez-de-Guinoa A, Zambrana-Vasquez D, Fernández V, Bartolomé C (2022) Circular economy in the European construction sector: a review of strategies for implementation in building renovation. Energies (Basel) 15:4747. https://doi.org/10.3390/en15134747

Yu Y, Junjan V, Yazan M, Iacob M-E (2022) A systematic literature review on Circular Economy implementation in the construction industry: a policy-making perspective. Resour Conserv Recycl 183:106359. https://doi.org/10.1016/j.resconrec.2022.106359

European Commission, Circular Economy: Principles for buildings design (2020)

Pedroso M, Tavares V (2023) Circular economy supporting policies and regulations: the Portuguese case, in: CircularB 1st Workshop “Creating a Roadmap towards Circularity in the Built Environment,” Skopje—Macedonia

Acknowledgements

The authors gratefully acknowledge the COST Action CircularB for this opportunity. The authors would also like to acknowledge the project “Circular Agreement with the Construction Industry” funded by the Portuguese Environmental Fund and the contribution of the workgroup: AECOPS, AICCOPN, APA, CIP, CPCI, IMPIC, and PTPC. Vanessa Tavares would like to acknowledge the North Regional Operational Programme [NORTE-06-3559-FSE-000176], and Marco Frazão Pedroso the Lisbon Regional Operational Programme [LISBOA-05-3559-FSE-000014].

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2024 The Author(s)

About this chapter

Cite this chapter

Tavares, V., Pedroso, M.F. (2024). Barriers and Opportunities in the Transition to a Circular Construction Sector in Portugal. In: Bragança, L., Cvetkovska, M., Askar, R., Ungureanu, V. (eds) Creating a Roadmap Towards Circularity in the Built Environment. Springer Tracts in Civil Engineering . Springer, Cham. https://doi.org/10.1007/978-3-031-45980-1_17

Download citation

DOI: https://doi.org/10.1007/978-3-031-45980-1_17

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-45979-5

Online ISBN: 978-3-031-45980-1

eBook Packages: EngineeringEngineering (R0)