Abstract

Digital ecosystems and platforms are an important part of the economy. However, specifically the tech-oriented platforms are often considered as “unfair.” In this chapter, we aim to more precisely articulate this feeling of unfairness. We consider fairness in digital ecosystems and platforms as fair if a decision as a result of applying a rule should accommodate all applicable moral distinctions and reasons for all actors involved. However, fairness is not only related to the operations of a digital ecosystem or platform. Fairness of digital ecosystems and platforms requires fair governance also. We consider fair governance as a prerequisite for fair governance, because the concerns of all stakeholders can then be included in the decision process. As a second assumption, we argue that decentralized decision-making contributes to fair governance. If this assumption holds, it is worthwhile to investigate how decentralized governance can be implemented and supported by information technology. We explain how blockchain technology, with consensus reaching at its core, can support such decentralized decision-making.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

1 Introduction

Over the past years, many digital business ecosystems and platforms have emerged. We define a business ecosystem as “a system of economic actors that depend on each other for their survival and well-being” and a platform as “a shared infrastructure of a value network on top of which members of the value network create additional value” (Wieringa and Gordijn 2023). As we consider a platform as a special case of an ecosystem from now on, we use the term “ecosystem” to refer to both in this chapter.

Many new ecosystems are enabled by advances in information and communication technology (ICT) in general and the widespread use of the Internet in particular. Well-known examples of these ecosystems are the GAFA, which means Google, Apple, Facebook, and Amazon, but there are many more. These digital ecosystems are, once they have grown enormously, a substantial source of income for the owner(s) and/or their shareholders.

However, questions can be asked regarding the fairness of these new digital ecosystems. We consider an ecosystem as fair if decision as a result of applying a rule should accommodate all applicable moral distinctions and reasons for all actors involved (see also Sect. 2). The new digital ecosystems and platforms are often in the news because of undesired behavior. There are many examples, such as the Cambridge Analytica scandal (Hinds et al., 2020), the resistance of Amazon against labor unions (Reese and Alimahomed-Wilson, 2022), and the unreasonable high fee Apple charges in its app store for in-app purchases (known as the Spotify case) (Braga, 2021).

The undesired behavior of the emerging big tech digital ecosystems is possible due to (1) centralized governance (one agent takes all decisions) and/or (2) uncontrolled behavior by some agent(s) external to the ecosystem (e.g., shareholders). Many big tech firms have effectively one person taking decisions (the CEO) or are heavily influenced by creating shareholder value. Moreover, because the value propositions of the big tech firms are relatively new, regulation and legislation are often lacking or insufficient. For instance, only very recently, the Digital Services Act (Rutgers & Sauter, 2021) in Europe is active. This act aims to reduce some undesired behavior of the centralized or shareholder-driven ecosystems of the big tech firms.

Having the proper regulation and legislation in place is certainly important to arrive at fairer digital business ecosystems. However, we argue that fairness of executive decision-taking is also needed. One possible way to achieve this is to distribute decision power over a series of agents, in other words, the creation of checks and balances in the ecosystem. Note that distribution of decision-taking is not a guarantee or strict requirement for a fair business ecosystem. There are well-known counter examples. For instance, in the past, the electricity energy ecosystem was quite centralized (only a few power plants in a country which could determine the price). But at the same time, the electricity energy ecosystem has always been subject to strong government regulation, preventing undesired behavior. The other way around, it can be debated whether an extremely distributed ecosystem, such as the Bitcoin, is fair at all. Some argue that the Bitcoin is actually nothing more than a gambling engine, given the substantial fluctuations of the exchange rate of the Bitcoin, and also a pyramid game, in which early adopters of the Bitcoin got extremely rich.

In this chapter, we assume that distribution of executive decision-taking, for example, by means of a voting mechanism, contributes to a fairer ecosystem. The idea is that by involving the relevant stakeholders in the decision process, their interests can be better addressed and dealt with. This does not always result in fairness as other factors may do so too, e.g., strong and fair government regulation. However, if, for example, Amazon had installed a mechanism where all agents in their ecosystem, including their employees, would have a say, likely a number of undesired behaviors would not have happened.

This chapter is structured as follows. Section 2 provides some perspectives on “fairness.” In Sect. 3 we define the notions of digital business ecosystem and platforms. We then argue in Sect. 4 two different ways to achieve fairness in ecosystems and platforms, namely, legislation and penalties and fairness by design. Thereafter, in Sect. 5, we assess whether achieving fairness can be achieved by using blockchain technology, due to its inherently distributed nature. In Sect. 6, we present our conclusions.

2 Fairness

2.1 Unfair Behavior

Digital ecosystems, and specifically the well-known tech firms, may behave unfairly in many ways. They may treat their own personnel badly, e.g., pay them very low wages, offer them bad temporary contracts, see them as one-person companies who they can squeeze out, offer bad labor conditions, have an extreme and pressing performance yield system in place, and deny personnel to join a labor union. Moreover, powerful actors in the ecosystem pay very low prices to their suppliers if they have no option to go elsewhere. The other way around, they may charge their customers an unreasonable high fee compared to the service/product offered, often as a result of an on purposely created monopolistic position. Finally, they may avoid tax and/or pollute substantially. The latter happens at the country/continent level and is unfair to the society of that country/continent.

2.2 Toward a Notion of Fairness

The above discussed behavior raises the question of what fairness actually is. This is not an easy question to answer because the notion of fairness is addressed by a broad range of scientific disciplines and not always in the same way. It is not our intention to give a comprehensive overview of the literature; rather we present a compact overview of how fairness is addressed in various areas.

-

Philosophy: Hooker (2005) defined formal fairness as “interpreting and applying rules consistently, i.e. applying the same rules impartially and equally to each agent.” The notion of formal fairness has problems, because its definition does allow bad rules. For instance, the rule not to admit men to a bar can be impartially and equally applied to each agent but is not necessarily fair. Actually, fairness should be about substantial fairness, which goes beyond the rules as such. A decision as a result of applying a rule should accommodate all applicable moral distinctions and reasons. This raises the question what moral reasons actually are. In Hooker (2005), a number of these reasons are mentioned (also based on the work of Broome (1990)): “(1) reasons deriving from the possibility of benefits or harms, (2) reasons never to kill or torture, and never to order such acts, and (3) reasons deriving from needs, desert, or agreements.”

-

Economics: Following many economic-oriented scientists, Hal Varian considers an allocation of x is fair if and only if it is both equitable and Pareto efficient (Varian 1976). Equity requires that each agent considers his own position at least as good as any other agent. Pareto efficiency refers to maximizing the assignment of x. This happens if the worst-off agent is the one who no one envies, and the best-off agent is the agent who envies no one. The advantage of this point of view is that it is internal, meaning that the observations (position, envying) are made by the agents and not by an external observer, which would require that observations for different agents are comparable. There is also work that studies the allocation of discrete units of x, in the situation that not enough units of x are available for all stakeholders. The approach here is to organize a fair lottery, where each agent has equal chances to win x.

-

AI and computer science: In AI, fairness often refers to bias of algorithms. Essentially, algorithms are supposed to treat everyone the same. For an overview of fairness and bias in AI, see Xivuri and Twinomurinzi (2021). However, machine learning and related technologies sometimes fail and treat people very differently. Fairness in computer science is already quite old. For instance, Wong et al. (2008) define fairness in operating system scheduling as “the ability to distribute CPU bandwidth equally to all tasks based on their priorities.” This corresponds to the work in the field of economics to assign discrete units of x to a number of stakeholders.

The list above is not exhaustive at all but gives an impression how various disciplines view the concept of fairness. Following Hooker (2005), we consider an ecosystem as fair if a decision as a result of applying a rule should accommodate all applicable moral distinctions and reasons for all actors of the ecosystem.

3 Digital Business Ecosystems and Platforms

We define a business ecosystem as “a system of economic actors that depend on each other for their survival and well-being” and a platform as “a shared infrastructure of a value network on top of which members of the value network create additional value” (Wieringa & Gordijn, 2023). A digital business ecosystem is a normal business ecosystem, with the additional requirement that the ecosystem is supported by information technology in its operational and/or managerial processes, and/or the value proposition itself has a strong digital dimension (e.g., Netflix, Spotify, Facebook). Note that, due to the digital transformation wave, currently in the Global North, most business ecosystems are digital ecosystems.

Digital business ecosystems need a business model which we consider as “a description of how value is created, how it is delivered to customers, and how companies capture revenue from this” (Wieringa & Gordijn, 2023). We describe an ecosystem’s business model as a network of actors (enterprises, non-for-profit organizations, and consumers), which we call a value network: “the organizations, companies and people who collaborate and compete to create, deliver, and capture value” (Wieringa & Gordijn, 2023).

We consider platforms as a special kind of ecosystem. They are defined as “a shared infrastructure of a value network on top of which members of the value network create additional value.” Many examples of a platform exist; the Android operating system is a platform that is used by app developers (including Google itself) and end users, and Amazon marketplace is a platform that offers trading functionality of sellers and buyers (and again Amazon itself is a seller on the platform). Many platforms are centralized, meaning that they are dominated by a single party with respect to decision-making. But this is not always the case. For instance, OpenBazaar is an example of a decentralized trading platform. Bitcoin and Ethereum are also positioned as decentralized platforms, although it can be contested they are truly decentralized in terms of governance decision-making.

It is debated if all ecosystems and platforms are fair. Without defining fairness already, intuitively many ecosystems are not so fair. For instance, the Cambridge Analytica scandal (Hinds et al., 2020) exposes unfairness in terms of privacy-related data, Amazon treats employees sometimes unfair (Reese & Alimahomed-Wilson, 2022), and the Apple app store charges its customers (e.g., app developers) an unreasonable high fee, which moreover not directly corresponds to the effort spent by the Apple app store (Braga, 2021). So, the question emerges how we can develop fairer ecosystems. We consider two approaches: (1) by means of legislation and (2) by establishing fair governance. We elaborate further on these two different approaches in Sect. 4.

4 Toward Fairer Ecosystems and Platforms

4.1 Legislation

The fist strategy to achieve more fairness of an ecosystem is by means of legislation, or related to that, (self)-regulation., followed by penalties if someone breaks the rules.

Legislation sets the rules according to which actors in an ecosystem should behave, and if they violate a rule, they have to pay a fine, or they are banned from the market altogether. An example is the EU legislation on reduction, which forces countries to implement rules on the nation level to achieve reduction. Obviously, these rules come with penalties.

Examples of fair legislation are EU competition and contract laws in general and the Digital Services Act and the Digital Markets Act in particular (see Rutgers and Sauter (2021)) for an overview). Both acts are interesting because implicitly they define what the EU considers as fair.

For instance, the Digital Markets Act lists unfair behavior. The act identifies gatekeepers, which are effectively the large platforms. These gatekeepers have to follow rules, for example, to allow business users to access the data that they generate on the platform, to offer companies that advertise on the platform independent tools to see the effects of the advertisement, not to rank services of the platform itself higher than similar services of others, allow users to link to other items outside of the platform, and track users outside of the platform.

According to Rutgers and Sauter (2021), the Digital Services Act is mainly about transparency and accountability. This often relates to the content of the platform, how it is moderated, what the rights of the users are with respect to the content, and how to deal with disputes.

4.2 Fair Governance by Design

Another way to achieve fair ecosystems is to include fairness explicitly during the (re)design of the ecosystem at hand. The idea is that the resulting ecosystem is already fair by design, and moreover that constructs are in place such that the ecosystem remains fair over time.

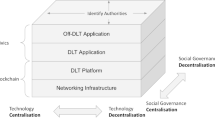

We employ two assumptions with respect to designing fair ecosystems. The first assumption is that fair ecosystems require fair governance. In other words, if fair governance is in place, operations of the ecosystem will be fair too. This is visualized in Fig. 1 as the governance paradigm.

We follow the well-known control paradigm of Blumenthal (see, e.g., Bemelmans (1994) and later de Leeuw (1973)) to arrive at the more specific governance paradigm (see Fig. 1). We distinguish three systems: (1) the governed system (such as the operations of a company) that has to obey to rules set by the governing system (e.g., the management of that same company), (2) the governing system that monitors the governed system, and (3) the meta governing system that controls the governing system (e.g., the government of a country). Systems, such as the governed system, are exposed to rules and are continuously monitored whether they comply with these rules. Obviously, these rules should be fair, e.g., follow appropriate moral distinctions and reasons as, for example, explained by Hooker (2005) and Broome (1990) (see also Sect. 2). Governance is executed by the governing system. This can be a single agent but also a group of agents (e.g., a parliament). The governing system imposes rules on the governed system and checks whether the rules are satisfied. The governance paradigm can be applied recursively, e.g., the environment may govern the governing system itself. As an example, inhabitants who live in a democracy (collectively called the environment) every few years vote for parliament members (the governing system). In turn, the governing system sets rules, legislation consisting of laws for the governed system, e.g., everyone in a particular country.

Our second assumption is less trivial. We take the position that fair governance can be accomplished by decentralized governance systems. The underlying idea is that involving (a representation of) agents, which are well balanced in terms of interests results in a fairer ecosystem than doing so otherwise. A significant part of a governance process is decision-making. In case of decentralized governance, decision-making often happens via a form of voting. In contrast, in centralized governance, only one agent is executing governance processes and can take decisions by him/herself. This only works if the decision-taking authority shows fair behavior, and most of the current digital platforms clearly show that this is not always the case. However, it is not always true that centralized governance is unfair. For instance, the electricity energy industry has a so-called transmission system operator (TSO) who is responsible that at all times, there is a balance between demand and supply of electricity in the network (if this is not the case, the network shuts down, resulting in power outages). The TSO is an example of highly centralized governance; there is only TSO per country, and the TSO controls directly the other parties in the ecosystem, namely, producers and consumers of electricity energy. However, the TSO does not usually behave in an unfair way. This can be contributed to very strong regulation and legislation; there is strict law the TSO should comply with too. This happens in many other fair centralized ecosystems too; they are considered as fair but often are heavily regulated.

In sum, we argue that (1) fairness of ecosystems can be improved by having fair governance and (2) that decentralization of decision power may result in fair governance. Therefore, we need to understand better what fair governance actually is.

4.3 Fair Governance

If we assume that fair governance actually helps to realize fair ecosystems, the question arises what fair governance actually entails. Our interpretation of fair governance is based on Graham et al. (2003), Sheng (2009), and Jairam et al. (2021). To summarize, fair governance requires:

-

1.

Participation. Fair governance requires active involvement in an unconstrained way in the decision-making process of all affected agents.

-

2.

Rule of law. All agents should be treated equally and fairly by the law.

-

3.

Effectiveness and efficiency. Fair governance should perform its tasks without using resources unnecessarily and address the concerns of agents well.

-

4.

Transparency. Information to make decisions should be available to all agents and easy to find.

-

5.

Responsiveness. A fair governance structure should react within a reasonable time frame toward its agents.

-

6.

Consensus-oriented. Fair governance should try to reach (broad) agreement about the decisions taken, e.g., via a voting mechanism.

-

7.

Accountability. Each agent participating in the governance structure is held responsible for its actions.

Returning to Fig. 1, the governance paradigm, it is clear that the understanding of fair governance supposes a governance system consisting of multiple agents, rather than just one, because in the latter case the governance process can easily be corrupted. In addition, these agents need to be treated fairly. In terms of decision-making, a fair governance system requires multiple agents and often the use of some form of voting to make it fair. Many forms of voting exist, such as a majority vote, a delegated vote, a voting system that requires reaching a quorum, etc. Point is that no single agent can take a decision on its own. If the agents are well balanced in terms of interests and decision power, we argue that decentralized decision-making, e.g., using voting can be fair.

Note that the governing system should be governed itself; we also refer to this as meta governance. In the case of most tech platforms, the meta governance is executed by the shareholders, rather than the stakeholders. This often results in profit maximization. In sum, we argue stakeholder value rather than shareholder value. From the meta governance system’s perspective, the governance system is just a governed system, with the special property that it executes governance tasks. Effectively, we just apply the governance paradigm recursively. We argue that the governance system as shown in Fig. 1 can only be fair if the meta governance system is fair too. Consequently, and in line with our earlier argumentation, the meta governance system should consist of multiple, and well-balanced, agents too. In other words, governance systems consisting of one agent only should be avoided at (all) meta levels.

5 Fair Governance Using Blockchain Technology

5.1 Blockchain Technology

Blockchain technology is a fully decentralized solution to support ecosystems with no central or intermediate party. The most well-known example of blockchain technology is Bitcoin (see Nakamoto (2009)) and later Ethereum (see Tikhomirov (2018)). However, there any many implementations of blockchain technology. They differ in scaling possibilities in terms of the number of supported nodes and the number of transactions processed per second. In addition, some blockchain implementations provide support for user-oriented distributed computing, also known as smart contracting.

The idea of blockchain technology is that a table containing data, often called the ledger, is not stored at a central party, such as a bank, but is replicated over participants, called nodes. A node is owned by an agent. For instance, this allows the Bitcoin blockchain to handle payments between two agents directly, without the need to involve a bank to handle the payment. The change in the ledger, normally kept by a bank in a centralized ecosystem, is replicated at all ledgers of the nodes.

Obviously, having the ledger at a (large) number of nodes opens up the possibility to commit a fraud; an agent could change something in his locally stored ledger (e.g., increase the amount of money owned by him) and then claim that his ledger represents the correct situation, in blockchain technology called the world state. To mitigate this, each blockchain has a so-called consensus protocol. There are many different protocols, but they all aim to achieve one agreed and accepted world state. Therefore, changing the ledger locally would not work, because that represents a state for which no consensus was reached.

A blockchain also keeps an immutable ordered history of previous world states (hence the name blockchain). This is useful to have a trace of what happens, which cannot be repudiated by any agent.

Some blockchains such as Ethereum (see Tikhomirov (2018)) also have smart contracts. Since a blockchain has no central agent who can execute custom computations, there is a need to execute computation in a decentralized way, e.g., by the nodes, in a trusted manner. Smart contracts provide that functionality. In terms of governance, they are useful to support and automate the decentralized governance processes, in a decentralized way itself.

Governance of the well-known blockchain platforms (Bitcoin, Ethereum) happens largely off-chain. This means that updates and improvements regarding the Bitcoin or Ethereum protocol, which should be considered as governance activities, are not really supported by the blockchain platform but happen in discussion fora or other informal communication means. The process is explained by Bitcoin Improvement Proposals (BIPs) and Ethereum Improvement Proposals (EIPs), but these processes are only specified on a very high level, and moreover not formalized, e.g., by using smart contracts. Actually, only decision-taking concerning the acceptance of the implementation of a BIP/EIP happens by means of on-chain voting. Tezos (see Allombert et al. (2019)) is one of the blockchain platforms that supports on-chain governance. We consider on-chain governance as a necessity to arrive at fair governance, since it supports governance (from inception of changes until decision-making about specific implementations) in a fully decentralized way. In contrast, off-chain governance as used by Bitcoin and Ethereum is vulnerable to control by just a small group, specifically during the process that leads to a governance decision. In many cases, in-depth knowledge about the protocol is needed to meaningfully comment on changes of that protocol. In practice, there is only a limited group who can do so.

An Important development for decentralized governance are decentralized autonomous organizations (DAOs) (see Wang et al. (2019) for introduction). DAOs have their governance processes, which are fully implemented as a set of contracts. Some well-known services implemented using blockchain technology, such as Uniswap (exchange of cryptos), Compound (crypto lending), Dash (decentralized payment), Metaverse DAO (talent hunting), and Aave (assigning grants), all use DAOs for their governance.

5.2 The Governance Paradigm and Blockchain

In Fig. 1, we introduced the governance paradigm, and the distinction was made between the governance systems, which monitor and control the governed system. Moreover, the governance system itself can be governed by a governance system. As such, the governance paradigm can be recursively applied, to arrive at meta-governance, or even meta-meta-governance. How will this relate to blockchain as a mechanism to implement governance?

First, blockchain is intended for decentralized ecosystems. It makes no sense to apply blockchain to a single agent only, because then a single information will do. In the case of Bitcoin, for example, the governed system is the set of nodes that have reached consensus about the world state (e.g., transactions done). Reaching consensus should be meaningful and require domain knowledge. In blockchain technology, it is possible to achieve consensus about everything, even about nonsense. Consequently, consensus should be based on domain semantics. In Bitcoin, consensus should be reached about avoiding double spending, and if someone possesses the Bitcoins that he wants to transfer, and about the mining/creation of new coins.

The current governance process of Bitcoin, as outlined in BIP 0001, governs the Bitcoin protocol as discussed above, at the governed system level. In Bitcoin, only the final decision to accept a change in the protocol is on chain. So, the governance process is very limited, namely, taking a decision about a BIP using a majority vote. Systems like Tezos and DAOs are far more extensive in the support of governance of the governed system. Smart contracts define the process of governance and hence can be adapted to the required use case.

At the meta-level governance system, systems such as Tezos and DAOs have to define how the governance of Tezos and these DAOs work themselves. Ideally, it would also be possible to change these meta-governance rules, e.g., by a meta-meta-governance system.

5.3 Is Blockchain Fair?

In Sect. 4.3, we introduced fair governance. We now will evaluate how well blockchain technology corresponds to our understanding of fair governance.

-

1.

Participation. By definition, blockchain technology considers the participation of multiple agents. Whether all these agents play a role in the governance process depends on the chosen consensus protocol and/or the way how the smart contracts are defined in DAOs. For instance, Bitcoin uses the proof-of-work (PoW) protocol, which involves all nodes (but not the agents that own a wallet only). But there are many other protocols, e.g., delegated proof-of-stake (PoS), which uses a representative sample of all the agents.

-

2.

Rule of law. Some blockchain implementations treat all agents precisely the same. However, in general it depends on the chosen consensus protocol and/or of the smart contracts that implement the governance process. As an example, since a while, Ethereum uses PoS, where agents with higher stakes have more influence than others.

-

3.

Effectiveness and efficiency. In terms of effectiveness, blockchain systems do precisely as agreed and stated by the smart contracts, provided that the governance is implemented on chain. The efficiency largely depends on the used consensus protocol. PoW (Bitcoin) is known to be very expensive in terms of computing and hence energy consumption. At the other side of the spectrum, practical Byzantine fault tolerance (pBFT) (see, e.g., Aggarwal and Kumar (2021)) is very efficient but unfortunately does not scale in terms of the number of nodes and hence agents.

-

4.

Transparency. Public, non-permissioned, blockchains are fully transparent. Permissioned blockchains are restricted by definition; the agent should be granted access. In addition, it is a matter of design to allow visibility of data to everyone, because certain parts can be encrypted. However, there is no principal reason why a blockchain-supported governance system would not be transparent.

-

5.

Responsiveness. The responsiveness of a blockchain system depends again in the chosen consensus protocol. If a PoW protocol is used, such as in Bitcoin, transactions can be considered final after about 60 min. Other protocols, such as pBFT, are final almost immediately.

-

6.

Consensus-oriented. It goes without saying that consensus is at the very core of every blockchain platform. Currently, there is a broad selection of consensus protocols supported by the various implementations. This is a strong point of blockchain in relation to fair governance.

-

7.

Accountability. Blockchains keep an immutable log of (data) transactions, which can be inspected by everyone. It is not possible to reverse a transaction, or to change it. Consequently, blockchain technology is useful to implement accountability.

6 Conclusions

In this chapter, we argued that blockchain technology can contribute to fairer business ecosystems and platforms. Many of these ecosystems and platforms are centrally led, opening the door to unfair behavior. Unfortunately, such behavior happens often.

One approach to address unfair behavior is to establish dedicated legislation and regulation, with penalties if agents misbehave. The EU Digital Services and Markets Acts are recent examples of such legislation.

An entirely different method is to include fairness in the (re)design process of digital business ecosystems and platforms. The focus should then be on fair governance, as fair governance leads to fair operations. Fair governance can be established by a divide-and-conquer strategy; decision-making and the process leading to decisions should not be in one hand but distributed in a balanced way over a number of agents with different interests.

Blockchain technology, depending on specific choices made, e.g., the consensus protocol, can be instrumental in supporting fair governance in a computational way. It allows for an approach where all agents participate, in an effective, efficient, responsive, and transparent way. Rules of law can be encoded into smart contracts and enforced automatically. Blockchain technology is rich in terms of supported consensus protocols. And finally, since it provides an immutable history, accountability can be easily achieved.

Discussion Questions for Students and Their Teachers

-

1.

Evaluate fairness of blockchain technology with the definition of fairness of economics in mind (an allocation of x is fair if and only if it is both equitable and Pareto efficient).

-

2.

Give some examples of digital platforms that you consider as fair, and motivate why you think these platforms are fair.

-

3.

One way to achieve fairness is by means of legislation. Argue why only legislation is not sufficient to arrive at fair ecosystems.

-

4.

This chapter assumes that fair governance requires decentralized governance. Give at least three examples of ecosystems where this assumption does not hold.

-

5.

Blockchain is a technology to implement decentralized governance. Which other technologies may contribute to decentralized governance?

Learning Resources for Students

-

1.

On fairness from a philosophical point of view, see Hooker (2005) and Broome (1990). These articles provide a good starting point to understand the philosophical thinking about the notion of fairness. The work of Broome is foundational and should be read by anyone working in the field of fairness; the article of Hooker critically builds on top of Broome’s article.

-

2.

On digital ecosystems and platforms, see Wieringa and Gordijn (2023). This book discusses digital ecosystems in detail and analyzes some popular ecosystems critically, e.g., with respect to fairness issues.

-

3.

On fair governance, see Graham et al. (2003), Sheng (2009), and Jairam et al. (2021). The first two articles introduce aspects of fair governance and are also used in this chapter. The last article applies the first two articles on governance of blockchain systems.

References

Aggarwal, S., Kumar, N. (2021). Chapter sixteen - hyperledger working model. In S. Aggarwal, N. Kumar, P. Raj, eds. The blockchain technology for secure and smart applications across industry verticals, Vol. 121 of Advances in computers (pp. 323–343). Elsevier.

Allombert, V., Bourgoin, M., & Tesson, J. (2019). Introduction to the tezos blockchain. In 2019 International conference on high performance computing and simulation (HPCS), IEEE, pp. 1–10.

Bemelmans, T. (1994). Bestuurlijke informatiesystemen en automatisering.

Braga, M. (2021). Spotify vs. Apple: A Titans, PhD thesis, Católica Porto Business School.

Broome, J. (1990). Fairness. Proceedings of the Aristotelian Society, 91, 87–101. http://www.jstor.org/stable/4545128

de Leeuw, A. (1973). Over besturing: een systeemtheoretische beschouwing, TH Eindhoven. Vakgr. organisatiekunde: rapport, Technische Hogeschool Eindhoven. Tekst van de voordracht gehouden in het bedrijfskundig kolloquium op 21 september 1973, Eindhoven.

Graham, J., Plumptre, T., Amos, B., on Governance, I. Canada, P. (2003). Principles for good governance in the 21st century, policy brief. Institute on Governance. https://books.google.com.my/books?id=Bs1CtAEACAAJ

Hinds, J., Williams, E. J., & Joinson, A. N. (2020). “it wouldn’t happen to me”: Privacy concerns and perspectives following the Cambridge analytica scandal. International Journal of Human-Computer Studies, 143, 102498. https://www.sciencedirect.com/science/article/pii/S1071581920301002

Hooker, B. (2005). Fairness. Ethical Theory and Moral Practice, 8(4), 329–352.

Jairam, G., da Silva Torres, I., Kaya, F., Makkes, M. (2021). A decentralized fair governance model for permissionless blockchain systems. In G. Guizzardi, T. P. Sales, C. Griffo, M. Fumagalli (Eds.), CEUR Proceeding of the Workshop of Value Modelling and Business Ontologies, Vol. 2835, CEUR. https://dise-lab.nl/wp-content/uploads/2021/02/Governance_in_blockchain-2.pdf

Nakamoto, S. (2009). Bitcoin: A peer-to-peer electronic cash system. http://www.bitcoin.org/bitcoin.pdf.

Reese, E., & Alimahomed-Wilson, J. (2022). Teamsters confront amazon: An early assessment. New Labor Forum, 31(3), 43–51. https://doi.org/10.1177/10957960221116835

Rutgers, J., & Sauter, W. (2021). Promoting fair private governance in the platform economy: Eu competition and contract law applied to standard terms. Cambridge Yearbook of European Legal Studies, 23, 343–381.

Sheng, Y. (2009). What is good governance. United Nations Economic and Social Commission for Asia and the Pacific.

Tikhomirov, S. (2018). Ethereum: State of knowledge and research perspectives. In A. Imine, J. M. Fernandez, J.-Y. Marion, L. Logrippo, & J. Garcia-Alfaro (Eds.), Foundations and practice of security (pp. 206–221). Springer International Publishing.

Varian, H. R. (1976). Two problems in the theory of fairness. Journal of Public Economics, 5(3), 249–260. https://www.sciencedirect.com/science/article/pii/0047272776900189

Wang, S., Ding, W., Li, J., Yuan, Y., Ouyang, L., & Wang, F.-Y. (2019). Decentralized autonomous organizations: Concept, model, and applications. IEEE Transactions on Computational Social Systems, 6(5), 870–878.

Wieringa, R., & Gordijn, J. (2023). Digital business ecosystems - How to create, capture, and deliver value in business networks. TVE Press.

Wong, C. S., Tan, I., Kumari, R. D., & Fun, W. (2008). Towards achieving fairness in the linux scheduler. Operating Systems Review, 42, 34–43.

Xivuri, K., & Twinomurinzi, H. (2021). A systematic review of fairness in artificial intelligence algorithms. In D. Dennehy, A. Griva, N. Pouloudi, Y. K. Dwivedi, I. Pappas, & M. Mäntymäki (Eds.), Responsible AI and analytics for an ethical and inclusive digitized society (pp. 271–284). Springer International Publishing.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2024 The Author(s)

About this chapter

Cite this chapter

Gordijn, J. (2024). How Blockchain Technology Can Help to Arrive at Fair Ecosystems and Platforms. In: Werthner, H., et al. Introduction to Digital Humanism. Springer, Cham. https://doi.org/10.1007/978-3-031-45304-5_25

Download citation

DOI: https://doi.org/10.1007/978-3-031-45304-5_25

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-45303-8

Online ISBN: 978-3-031-45304-5

eBook Packages: Computer ScienceComputer Science (R0)