Abstract

Since the second half of 2021, Italian households have experienced a significant increase in energy prices. Nonetheless the relevance of this issue, information on energy use and how quantity reacts to price increases is still scant and with a very limited level of disaggregation. We propose a novel methodology to estimate the demand and elasticity of electricity, heating and private transport fuels by aligning the microdata of the Italian Household Budget Survey with several external sources. These estimates can be used to assess how energy expenditure weighs on vulnerable households and the effects of a carbon tax. A carbon tax would—as expected—raise significant revenues and curb CO2 emissions but it could also have sizable regressive effects. In order to limit these undesired effects and to increase social consensus, policymakers should devise a set of suitable revenue recycling strategies.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

1 Introduction

Energy is a fundamental requirement for human welfare: households depend on energy services for heating, cooling, cooking, lighting, food conservation and transportation. The demand for these services changes according to consumer preferences, their spending capacity and to exogenous factors (e.g. technology, climate, etc.). In general, we can expect that in the near future energy demand in Italy will change because of climate change (Campagnolo e De Cian 2022) and demographics (Faiella 2011).

Climate change is expected to increase the frequency and the intensity of extreme weather events, such as heatwaves; this, in turn, will put pressure on vulnerable people (e.g. the elderly), requiring sizable investments for adaptation (Carleton et al. 2020) and an increase in energy expenditure to achieve a standard thermal comfort. Indeed, climate change is already affecting energy demand; IEA (2019) estimates that one-fifth of the growth in global energy use in 2018 was due to hotter summers, pushing up demand for cooling and cold snaps leading to higher heating needs, i.e. climate change will likely shift (and maybe increase) energy consumption from space heating to space cooling. The IEA (2018) estimates that energy demand for cooling services will drive future electricity demand, while Randazzo et al. (2020) find that households adapt to hotter spells installing AC systems and spending between 35 and 42% more on electricity. However, AC adoption is unevenly distributed across income levels (Pavanello et al. 2021) therefore potentially unavailable for poorer households. An ageing population can also alter the patterns of energy demand (Bardazzi and Pazienza 2020).

In Italy, where life expectancy is one of the highest in the world, almost one-quarter of the population is aged 65 + ; in 2050 it will be more than one-third (ISTAT 2020). This change can influence energy demand in two opposite directions: elderly people spend more time at home, demanding more energy while using less energy for private transport (Faiella, 2011). This pattern is similar to what is expected in a post-COVID scenario where teleworking becomes more frequent (Hook et al. 2020).

In terms of household budgets, the share of energy purchases is typically higher for less affluent households, private transport being an exception (e.g. Faiella 2011). These households will probably see a larger part of their budgets being eroded because of the energy transition, as it happened during the 2021–22 energy crises (Faiella and Lavecchia, 2022). They have less options when energy prices increase and the climate policies needed to achieve the ambitious target of the European Green Deal (a 55% cut in greenhouse gas emissions by 2030 compared with 1990) will put further pressure on prices (because of the support of low carbon sources or because of carbon pricing).

Understanding how households demand and spend on energy services requires granular information: do they reside in areas subject to extreme weather? Are they living in the countryside or big cities? Which are their household characteristics? What about their dwelling type? And, more importantly, will they cope with a progressive increase in energy prices without compressing other basic needs or eroding their income? These questions are more relevant while analysing the impact of climate policies to deploy to curb GHG emissions. In particular, as global carbon price is the economists’ recommended choice for tackling climate change (Tirole 2017) but, at the same time, also poorly adopted on grounds of equity concerns, it’s fundamental to carefully appraise its distributive impacts and devise compensatory measures (Burke 2020).

In order to try to answer some of these questions, we build a household-level dataset covering the last twenty years to impute the monthly energy demand of Italian households for electricity, heating and private transport. We merge this data with the corresponding prices in order to estimate a set of price elasticities that differs according to households’ characteristics and economic conditions. In particular, we model energy demand through a quasi-panel (Deaton 1985), focusing on conditional demand (i.e. taking the choice of appliances as given; Dubin and McFadden 1984; Rehdanz 2007). We use the model for simulating the introduction of a one-off carbon tax on electricity, heating and transport fuels prices; our strategy allows us to estimate the effect of the tax on expenditure and quantities along the expenditure distribution. In all simulations considered the price increase triggered by the carbon tax is regressive: poorer households suffer a greater drop in energy use and a bigger increase in energy expenditure.

The structure of the chapter is the following. After having presented the literature on estimating energy demand (Sect. 2), we describe households’ energy expenditure in our dataset (Sect. 3). Section 4 introduces the model for estimating the elasticities that are then used in Sect. 5 to assess how different households would react to a one-off introduction of a carbon tax. Section 6 draws the main conclusions and sets the future research agenda.

2 Literature Review

Households’ energy demand—There is a significant amount of research on house-holds’ energy demand, the first work dating back to Houthakker (1951). The number of studies increased considerably in the 1970s, after the “oil shocks” (Dahl 1993), with results far from being conclusive. Labandeira et al. (2017) carry out a meta-analysis for a dozen surveys on energy demand while Espey and Espey (2004) report a meta-analysis of 36 papers, with more than 123 short-run and 96 long-run price elasticities estimates of residential electricity demand.

Surveying the estimates of price and income elasticities for electricity, Taylor (1975) observes that price elasticity is larger in the long run. Dubin and McFadden (1984) propose a discrete choice to model the propensity to purchase home appliances and a linear model to estimate the electricity demand (a sequential discrete–continuous model).

Dahl (1993) reviews the energy demand for different fuels (natural gas, oil, carbon, electricity), showing a great uncertainty in the estimates,Footnote 1 especially for long-run price elasticity. Only residential energy and gasoline demand studies exhibit some consistency.

Rehdanz (2007), focusing on heating oil and natural gas demand for space heating in Germany, finds a larger price elasticity for oil than for natural gas while Schulte and Heindl (2017) find a weaker response for low-income households (and a higher one for top-income ones).

For Italy, Faiella (2011), by analysing the shares of expenditures for energy purchases, finds that the effect of price changes on the shares is negative for heating and positive for private transport. For electricity, the effect is negative for the 1997–2004 period and positive for the 2005–2007 subsample. Bigerna (2012) observes that the price effect on electricity demand depends on the time of the day (due to the tariffs system in place up to 2016, encouraging off-peak use) and on the geographical zones, ranging between −0.03 and −0.10. Bardazzi and Pazienza (2020) observe that, with respect to the age of the head of the household, electricity demand is hump-shaped, reaching a peak when the head of a household is 50 years old, while natural gas demand keeps increasing with age, as the time spent at home increases. They also show that elasticities for electricity and natural gas (at the national level equal to −0.7 and −0.6 respectively) are higher in the Centre and in the Southern regions.

3 Data

According to the National Accounts, in 2019 Italian households’ energy purchases amounted to €77 billion (€37 billion for electricity and heating and €40 billion for liquid fuels for private transport).Footnote 2 In the last 20 years, purchases (in EUR billion) for electricity and heating have decreased by 16% while the expenditure for liquid fuels has dropped by a resounding 37%, taking the corresponding share of total expenditure to roughly 3.5 and 3.8% respectively (from 4.1 and 6.0% in 2000). To understand the drivers of these dynamics (e.g. the demographics, the economic situation and so on), one can analyse the microdata on energy demand. However, only a handful of countries, such as the United States and the United KingdomFootnote 3 collects data on households’ energy demand.

Italy, as many countries, unfortunately, does not. As an alternative, we leverage on the expenditure microdata from the Italian Household Budget Survey (HBS), conducted yearly by Istat.Footnote 4 The HBS collects information from about 23.000 households interviewed in different periods of the survey year. The HBS data collection is very accurateFootnote 5 and it involves a combination of personal and telephone interviews with weekly diaries or logs compiled by households.Footnote 6

We define the energy expenditure of household i at time t as the resources the household earmarks for electricity (EEi,t), heating (EHi,t) and private transportation (ETi,t). Heating includes all heating fuels, such as natural gas (either from a pipeline or tanks), coal, kerosene or wood,Footnote 7 while private transport includes gasoline, diesel and LPG (which is used by almost 9% of cars in Italy). Let Expi,t be the total expenditure. The household-level share of energy expenditure, SEi,t, is:

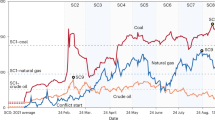

Between 1997 and 2018 the average Italian household spent around 10% of its budget on energy, a roughly constant fraction, with the notable exception of 2012–13, when energy prices peaked (Fig. 1) and the share of energy consumption reached 12%. In 2018, the purchase of fuels for private transport represented half of households’ energy expenditure, followed by heating (30%) and electricity (17%).

In order to evaluate how this share changes with households’ welfare, as there is no data on income in the HBS, we look how the share of energy expenditure is different across the tenth of the expenditure distribution (computing for each i-th household the equivalised expenditure as Exp∗i,t = Expi,t/γi,t where γi,t is the household equivalence coefficient).Footnote 8 In 2018 the share of energy is just below 10% for the average household, for the bottom tenth showed 13 and 7 for the top tenth (Fig. 2).

With respect to the previous decade—when oil prices were record-high and the share of energy was 10.8%—the situation improved almost uniformly, with a reduction of 1 p.p. for all the tenth of the distribution, except for the extremes. The share of electricity decreases steeply across the expenditure distribution, while the share of liquid fuels appears fairly stable; the share of heating stays between the two (Fig. 3).

Following the estimation process described in Appendix A, we are able to analyse energy demand. We estimate energy demand for every year in the sample. For the sake of simplicity, in 2018, an average Italian household consumed 2.500 kWh of electricity, 43 Gj of natural gas and 814 L of fuels for private transportation (see Table 1).

Overall, energy demand decreases over time while it increases with household welfare (Fig. 4, left panel). As a consistency check, we compared the overall energy demand with the Physical energy flow accounts (PEFA) from Eurostat. Results in Table 2 suggest that our estimation process performs fairly well (95% of all energy demand predicted), with a little overestimation for heating and other energy services and a larger underestimation for transport fuels.

Our approach emphasises the different heterogeneity of energy demand across households. As an example, Fig. 5 plots the energy demand for a specific type of household (a couple with 1 child) over time and the equivalent expenditure distribution. We observe that the same type of household but at the two extremes of the distribution exhibits radically different consumption patterns: the poorer household consumes less (as a share of their budget) than the richer one while the electricity demand profile of the richer household is smoother. Moreover, the heating demand for the poorer household increases over time, while it is stable for the richer. Finally, demand for transportation fuels decreases faster for poorer households.

4 Estimating Elasticities

With the energy demanded for each energy use z = E, H, T by each i – th household at time t, we can estimate the price elasticity, \({\epsilon }_{z}\) as:

In an ideal setting, we would observe the quantity demanded and the price for the same household over time. However, the HBS is a cross-sectional survey without a panel component. Following Faiella and Cingano (2015) we adopt a quasi-panel approach (Deaton 1985), which compares the values of population subgroups (so-called strata), and estimates the demand elasticity for each group exploiting the change in time of energy demanded at stratum-level. In this approach, the unit of observation is no longer a single household but a cluster of similar households, aggregated in a stratum according to specific characteristics (constant over time—see Table 3).

In order to define each stratum, we consider the joint information on household typesFootnote 9 and their position in the expenditure distribution (split into fourths). Therefore, we identify 36 subgroups of households for each month of our time series, spanning 22 years (1997 to 2018), roughly 9,500 observations. Our model uses the following log–log specification where the s subscript indicates stratum, t the month and z, as before, the different energy services:

The log of the quantity of energy demanded, \({logQ}_{s,t}^{z}\), depends on:

-

a lagged term, \({logQ}_{s,t-1}^{z}\), which captures the fact that households demand tends to be fairly stable in the short term;

-

the price of energy use (\({logP}_{t}^{z})\)Footnote 10;

-

households’ total expenditure (\({logE}_{s,t}\)), as a proxy of households’ overall welfare;

-

a set of trend (\(t\) and \({t}^{2}\)) and seasonal dummies (w for autumn and winter months and s for summer);

The parameter of interest is \({\beta }_{s}\),, the stratum-level short-run price elasticity, which should be read as the percentage change in energy demand due to a 1% change in the energy price. This setting is a special case of the autoregressive distributed lag (ARDL) model of order 1, also known as partial adjustment model. A special (and convenient) feature of this model is that the long-run elasticity is equal to \(\frac{{\beta }_{s}}{1-{\lambda }_{s}}\) (see Greene 2008 for a discussion). We estimate this model using least square (LS) for the total sample for each stratum. The results for the total sample are summarised in Table 4 and Fig. 6.

According to the LS estimates the demand for heating and electricity is more responsive to price changes: on average, a 1% rise in prices reduces the electricity (heating) demanded by 0.36 (0.40)%. The average LS estimated elasticity for liquid fuels is lower (−0.17) and less precise. The LS price elasticities at the stratum level, which are used to estimate the energy demand, are presented in Tables 5 and 6.

Because we observe price and quantity at equilibrium, there might be an issue of endogeneity (price can be influenced both by supply and demand changes). We therefore also employ an Instrumental Variable (IV) estimator using wholesale pricesFootnote 11 as instruments, under the assumption that they are marginally influenced by households’ demand. This is obvious for international oil markets and it does not seem unreasonable for domestic electricity and gas markets (the share of households’ demand on the total is a fifth for electricity and a quarter for gas). As we have one instrumental variable for each equation, ours is a just identified model.

As a further control we check for a possible non-stationarity of the time series component of our pseudo-panel. We test the residuals of our regressions on the total sample with the Im-Pesaran-Shin test (Im et al. 2003), a specific test for unbalanced panels (not all strata are present in each period considered); the null hypothesis of non-stationarity (H0: each panel has a unit root) is never accepted. IV estimates are comparable with LS except for liquid fuels, for which the instrumented coefficient is almost four times the LS estimate. The results are coherent with a robust version of the Hausman (1978) test developed by Wooldridge (1995), testing for exogeneity: the null is strongly rejected only in the case of fuels for private transportation. We also tested whether our IVs are sufficiently correlated with the endogenous variable, i.e. testing for “weak instruments”. Because the strategy proposed by Stock and Yogo (2010) is unfeasible (it only works under the assumption of i.i.d. errors), we look at the (robust) first stage F-statistic, taking into account the suggestion by Lee et al. (2020) of looking for a value above 104. This is exactly our case: we have values of 851, 2,306 and 12,031 for, respectively, the IVs for electricity, heating and transport fuels. Moreover, as pointed out by Andrews and Stock (2018), in the case with one endogenous variable (k = 1), the robust F-statistics is equal to the F-statistic by Montiel Olea and Pflueger (2013).

In the long run energy demand is more reactive, as expected: all elasticities are greater than 1 and the use of transport fuels is the most responsive to price changes.

Our method allows us to compute stratum-level price and expenditure elasticity, running the model described in Eq. 3 separately for each stratum s. IV and LS estimates are closer when one considers the weighted average of stratum-level LS estimates (third column of Table 4 and last row of Table 5), the price elasticities of the three energy services become more uniform (ranging from −0.45 for transport fuels to −0.29 for electricity).

Table 5, Figures. 7, 8 and 9 report the LS price elasticities (and their standard errors/confidence intervals) for electricity, heating and transport per stratum (Table 6 reports the LS expenditure elasticities per stratum). In each graph, the red horizontal dotted line represents the corresponding price elasticity estimated for the total sample reported in Table 4 while the green vertical lines separate the estimates for each fourth of the equivalent expenditure distribution.Footnote 12

Less affluent households are more reactive to price increases for electricity (Fig. 7), while for heating the demand responsiveness seems more uniform across the expenditure distribution, and more affluent households reduce their consumption more (Fig. 8). For transport fuels, less affluent households again react more, but confidence intervals within the first fourth are pretty large (Fig. 9). Having obtained a reaction function of energy demand to energy prices that differs according to households’ characteristics, we can exploit this information to simulate the introduction of a one-off carbon tax.

5 The Simulation of a Carbon Tax

5.1 The Rationale for a Carbon Tax

There is a significant amount of literature on carbon pricing, especially carbon taxation. A global carbon price is the economists’ recommended choiceFootnote 13 for tackling climate change (Tirole 2017). Indeed, carbon pricing mitigates the mispricing of climate risks and provides an incentive for firms to move away from fossil-fuel technologies and adopt (or develop) carbon-free technologies, fostering innovations (Nordhaus 2021).

In theory, carbon pricing should reflect the social cost of carbon (SCC), i.e. the monetary damage caused by an additional ton of greenhouse gas emittedFootnote 14 or be the price that guides the economy towards the 1.5◦C or 2◦C scenarios (Stern and Stiglitz 2021). Under perfect information, carbon pricing can be implemented either via a carbon tax—the price is set and the amount of emissions consequently adjusts—or an Emissions Trading System (ETS)— the supply of emissions permits is established according to a cap on total emissions and the price of the permits reacts according to their demand.

The effect of carbon pricing on the real economy is not conclusive: some empirical analyses find very small or nil negative effects on economic activity and job creation (Metcalf and Stock 2020); a recent meta-analysis points to firms’ competitive and distributional impacts of carbon pricing are significantly negative (Penasco et al. 2021).

Despite the unanimous support from economists, there is a widespread scepticism towards carbon pricing. Indeed, in the world there are currently 68 carbon pricing initiatives in place (34 ETSs) and covering almost 23% of global GHG emissions (World Bank 2022). By 1 May 2022, 37 countries were running a carbon tax scheme, covering 5.7% of global emissions. In the United States, there are some local schemes, such as the Regional Greenhouse Gas Initiative or the California State cap and trade scheme, but there is no Federal scheme. Moreover, recent proposals to introduce a local carbon tax have been rejected.Footnote 15 As a consequence, the global average carbon price is too low ($2 per ton of CO2 according to the World Bank 2021).

In Europe, 30 countries (all EU-27 member states plus Iceland, Liechtenstein and Norway)Footnote 16 are part of the EU-ETS which covers 45% of all member states GHG emissions. Local carbon pricing initiatives exist in half of the EU member states (Batini et al. 2020), but various attempts to introduce or increase taxes on carbon emissions have faced stiff opposition (as happened in France with the gilets jaunes protests).Footnote 17

A key point for increasing the social acceptance of this instrument is to carefully appraise its distributive impacts (Burke 2020) and devise compensatory measures. A policy of revenue recycling for the resources collected could increase the support for a carbon tax, even if set at $70 per ton of CO2 (Beiser McGrath and Bernauer 2019). In a meta-analysis of 53 empirical studies referring to 39 countries Ohlendorf et al. (2021) find that carbon pricing is likely to have progressive distributional outcomes in lower income countries and for transport sector policies. Kanzig (2021), in a general equilibrium framework, (Kanzig 2021) shows that a carbon tax can be significantly regressive, especially given its indirect effect; indeed, the reduction in wages in the sectors most affected, would account up to 80% of the final impact on vulnerable households. For Italy, Faiella and Cingano (2015) show that a carbon tax could significantly reduce transportation emissions and its revenues could finance the deployment of renewable energy, replacing the existing charges on electricity consumption, thus alleviating the cost burden for less-affluent households.

However, household heterogeneity must be taken into account in the design of the redistribution scheme. van der Ploeg et al. (2022) show a trade-off between efficiency and equity, depending on the way revenues are recycled: a lump-sum transfer is more equitable but less efficient; lower taxes are more efficient but less equitable; a mixed approach, with no more than 60% of the revenues transferred as a lump sum, can result in a more balance between efficiency and equity, spurring enough support for the carbon pricing. In a similar analysis for the United Kingdom, Paoli and van der Ploeg (2021) find that targeted transfers lead to the largest fall in inequality while income tax reduction leads to an increase.

A similar point is made by Eisner et al. (2021) which shows the importance of targeted support based on household size or vulnerability. Studying the effects of carbon tax is also paramount to understand the effects on the financial system. Carattini et al. (2021) model the relationship between macroprudential and environmental policies. In particular, they calibrate an environmental DSGE where the unexpected introduction of a $30.5 carbon tax creates a recession in a setup with financial frictions, leading to a credit crunch that also affects green activities. Faiella et al. (2022) find that a carbon tax could increase the share of financially vulnerable households and firms (and their associated debts).

5.2 A Carbon Tax in Practice

The ambitious EU target of achieving carbon neutrality by mid-century requires a sharp reduction in the carbon content of our activities, and an unprecedented change in the way we transform and use energy. In the decade 2008–2019 EU greenhouse gas (GHG) emissions decreased by 2.1% per year; a 55% cut in emissions by 2030 (compared with 1990) requires this rate to more than double (around 5% per year in the next decade).

Although in Italy emissions are only priced under the ETS system (that covered 43% of domestic fuel combustion’s emissions in 2018), the implicit tax rate on energy (the average amount of taxes per unit of final energy) is among the highest in Europe. In 2018, according to Eurostat data, the tax burden per one ton-of-oil equivalent (42 GJ) was €376 against a European average of €244, the second highest value after Denmark. This corresponds (grossly) to an implicit price of CO2 from energy uses of around €150 per ton (5 times the price of CO2 set on the EU-ETS by the end of 2020).

Nonetheless, the ambitious climate targets shared by Italy under the European Green Deal require a steeper reduction than the one planned in its latest National Energy and Climate Plans (a reduction of 34.6% in the “effort sharing” sectors’ emissions by 2030 compared with 2005). Expanding the perimeter of carbon pricing, extending the coverage of EU-ETS or introducing a carbon tax on energy use, are key policies to achieve these targets. Our dataset and the elasticities previously estimated could help the policymakers to assess to what extent a carbon tax on household final energy use could: (1) reduce energy demand and GHG emissions, (2) increase revenues and (3) impact vulnerable households (proxied by the location in the bottom part of the expenditure distribution).

We simulate the effects of a carbon tax on households’ energy expenditure, focusing on four possible levies (in real euros for 2015): €50, €100, €200 and €800 per ton of CO2. In practice, carbon taxes are set in a specific year and then progressively increased according to predetermined steps. For the sake of simplicity, we assume a one-off introduction on final energy use on top of existing taxes on energy (and costs levied as part of the EU-ETS).

A carbon tax of €50 is the 2021 average of the emissions price on the EU-ETS, close to the value of the French carbon tax in 2018 (€44) and almost double the recently introduced German tax scheme (€30). This value might be not enough to meet the Paris targets: the IMF (2019) suggests a global carbon tax of €62 ($ 75) by 2030 to meet the 2C target while The Carbon Pricing Leadership Coalition (2017) suggests a carbon price level ranging between €35 and €70 ($ 40–80) by 2020. Similar figures are provided by the International Energy Agency (IEA 2020): under the Sustainable Development Scenario, carbon pricing in advanced countries should be around $63 per ton of CO2 in 2025 increasing to $140 in 2040. Other simulations point to higher carbon prices ranging from $20 to $360 in 2030, and from $85 to $1,000 in 2050, depending on the stringency of the target, the smoothness of the transition and the availability of carbon removal technologies (Guivarch and Rogeljb 2017). In order to reach the new EU targets (a cut of 55% in emissions by 2030 and carbon neutrality by 2050), higher levels of carbon pricing are needed: some observersFootnote 18 suggest introducing a carbon tax of up to €200 by 2050 while McKinsey (2020) forecasts that a carbon tax of €100 would only make 80% of the required investments profitable. In the short term, a hypothesis of introducing a carbon tax ranging between €50 and €100 is therefore not unreasonable.

In order to grasp the long-term profile of carbon pricing, one should look at the Social Cost of Carbon (SSC) that results from different climate scenarios. The SCC is the welfare cost of future global climate change impacts that are caused by emitting one extra tonne of CO2 in a given year compared with a reference scenario.

In 2020, the Network for Greening the Financial System (NGFS) released a first set of representative scenarios (NGFS 2020) that describe the possible paths for keeping the temperatures within the Paris targets (1.5◦C–2◦C), depending on the timing of mitigation actions—i.e. if the transition is orderly or disorderly—and on the availability and costs of carbon dioxide removal technologies (CDRs). These scenarios can be compared with a situation where no mitigation is undertaken (Hot house world)Footnote 19 and are designed to provide central banks with basic information to carry out climate-stress test exercises. With an orderly transition, i.e. a situation where there is an early and ambitious strategy to achieve carbon neutrality, the price of carbon reaches $100 by 2020 and $300 by 2050 (all values are expressed in real $ 2010 per ton of CO2). In the event of a disorderly transition, i.e. where climate mitigation is delayed, the carbon price is lower in the first years but it skyrockets thereafter, reaching up to $800–1,200 by 2050. For these reasons, we will discuss the effects of a carbon price of €200 and €800 separately in our simulations, as a way to gauge the difference between an orderly versus a disorderly scenario.

5.3 The Simulation Design

To estimate the impact of each carbon tax on final energy prices, we apply the specific carbon emission factors for each fuel considered. All prices are in euros for the year 2015. For electricity, we use the time series of the carbon emission factors of electricity demand estimated by ISPRA (2019).Footnote 20 For heating, we use the emission factor for natural gas provided by the Italian Ministry for the Environment (Ministero dell’Ambiente 2019), which reports a carbon emission factor of 0.055820 ton CO2 per GJ. As previously mentioned, we assume that the whole of the heating demand is satisfied by natural gas. Finally, for transport fuels, we calculate the emission factors considering the energy content and the specific emission factors of petrol and diesel.Footnote 21

Using 2018 prices as baseline, the introduction of a carbon tax of €50 per ton, is equivalent to add: €0.014 to each kWh of electricity (+6%); €2.8 to each GJ of gas (+12%) and €0.12 to each litre of gasoline or gasoil (+8%). Overall, heating prices increase more, between 12 and 48% under a CT of €50–€200, and almost triple in the event of a carbon tax of €800, followed by transport fuels (8–32% for a CT of €50–€200) and electricity (6–25%) (see Table 7).

Similarly to Faiella and Cingano (2015), our empirical strategy is the following: first, we combine the estimated stratum-elasticities (see Sect. 4) and the price increases described in the previous section to obtain the quantities that would have been demanded in a given year for each household if these different carbon taxes were in place; we use original data for 2018 (the latest year for which HBS microdata are available) as a baseline. For each household i in stratum s, the energy demand for fuel z coherent with the price change \({\tau }_{CT}^{z}\) induced by the introduction of a carbon tax (CT = €50, €100, €200, €800) is given by the following equation:

where \(\widehat{{\epsilon }_{s}^{z}}\sim N\left(0,\widehat{{RMSE}_{s}^{z}}\right)\) and \({\widehat{\beta }}_{s}^{z}\) are the estimated elasticities of energy vector z for each stratum s.

The estimated elasticities \({\widehat{\beta }}_{s}^{z}\) are assigned to each household of the sample according to its stratum. In some strata the estimated parameters explain a fair share of the actual variance while in others the explaining power is lower (see for example Fig. 9). For this reason, in addition to the estimated coefficient, each family belonging to a given stratum is assigned a stochastic component, \({\epsilon }_{s}^{z}\), , with a zero mean and a variability equal to the residual variance of the stratum-level regression (\({RMSE}_{s}^{z}\)) for each fuel z, so that both the mean and the variance of the original distributions are preserved. Then we multiply this counterfactual demand by the new prices and we aggregate across different energy fuels in order to obtain an estimate of the energy expenditure under different levels of carbon taxation \({E}_{is|(\tau =CT)}\), where:

and

Finally, an estimate of the overall expenditure is derived under the assumption that the new level of energy expenditure affects total household expenditure proportionally. Therefore, the total expenditure after the introduction of the carbon tax is equal to the difference between the new energy expenditure and the baseline:

5.4 Simulation Results

The main results of our simulations are reported in Table 7: the baseline values are the original values of 2018. We will first discuss the results of the introduction of a one-off carbon tax of €50 or €100 per ton of CO2, followed by a discussion on the two options related to the level compatible with the NGFS (2020) scenarios (€200 and €800 per ton of CO2). Under a carbon tax of €50 or €100, electricity prices will increase by between 6 and 13%, heating between 12 and 24%, and transport fuels between 8 and 16%. Given that energy expenditure accounts for one-tenth of the households’ total budget, overall inflation would increase by between 0.7 and 1.4%.

The increase in energy prices would decrease the quantity demanded for all energy use (see Fig. 10). Heating demand will decrease more, with a cut of between 5 and 10% of the original demand, followed by transport fuels (between 3 and 5%) and electricity (between 2 and 3%).

Energy expenditure would increase for all energy uses, and particularly for heating (7–13%), followed by transport fuels (5–10%) and electricity (5–9%) (see Fig. 11). Under the hypothesis that the energy share as a percentage of the overall budget remains stable, the total expenditure would increase by 0.5–1%.

Carbon taxation would decrease households’ CO2 emissions by between 4 and 7% (a value similar to van der Ploeg et al. 2021), corresponding to a reduction of 5–9 MtCO2eq, a value in line with that obtained by Metcalf and Stock (2020). A carbon tax of €50 − €100 would raise between €4 and €8 billion, equivalent to 0.2–0.5 p.p. of GDP, which could be used to reduce the impact of the tax on vulnerable households, other taxes (e.g. on labour) or to support the deployment of low-carbon energy sources (as suggested in Faiella and Cingano 2015). As a matter of comparison, between 2012 and Q2-2021 the Italian Government raised €6.7 billion from the ETS auctions or €670 million per year on average (GSE 2021). As for the distributive effects, our simulations suggest that carbon taxation in Italy would be regressive overall. Indeed, total expenditure would increase more for poorer households belonging to the bottom deciles of the expenditure distribution (Fig. 12 and Table 8), under all the levels of carbon pricing.

The effects measured on the expenditure are just a part of the story as poorer households would also further reduce their energy demand across all energy usesFootnote 22 (Fig. 10 and Table 9).

All in all, these results seem to suggest that the implementation of any carbon tax requires a careful design for the compensation measures. Indeed, without any revenue recycling mechanisms, a carbon tax would make vulnerable households worse off, thereby decreasing its social acceptability. To avoid this, the revenues of the carbon taxes might be used to compensate poor households, either via targeted direct payments or using indirect schemes (e.g. increasing the energy efficiency of their dwellings) (Burke 2020).

Finally, we also test the effects of applying a set of carbon taxes consistent with the NGFS (2020) scenarios: €200 for an Orderly transition vis-`a-vis an €800 carbon tax consistent with a Disorderly scenario. Energy prices will increase between 25 and 47% under a €200 CT and more than double under a €800 CT. Energy demand would be cut by 14–38%, while total energy expenditure would increase between 20 and 60%. Emissions would drop significantly, with a cut of 17–48 MtCO2eq, or between 15 and 42% of all household emissions in 2018. The carbon taxes would raise between 0.9 and 2.4 p.p. of GDP and, without any compensating mechanisms, would be highly regressive (Fig. 12).

6 Conclusions

This work explored households’ energy demand and expenditure using survey-based microdata covering all Italian households in the period 1997–2018. The details available in the HBS, with the external information on prices and aggregate quantities used in the exercise, allowed us to analyse three different energy services (electricity, heating and private transport) correlating energy quantities with households’ socio-economic traits.

We present a novel methodology for estimating the price elasticities of these energy services for each stratum of households, which differs according to their characteristics and economic vulnerability.

We then use these estimates to assess the effects of four levels of carbon taxation corresponding to €50, €100, €200 and €800 per ton of CO2.

According to our simulations, the increase in energy prices of a €50-€100 carbon tax would decrease the energy demanded and CO2 emissions (−4/ − 8%) and increase energy expenditure (+5/ + 11%), raising between €4 and €8 billion, which could be used to mitigate the impact on vulnerable households, to reduce other taxes (e.g. on labour) or to support low-carbon energy sources.

In all simulations the price increase triggered by the carbon tax is regressive: poorer households’ expenditure increases more while they also suffer a greater drop in their energy use.

The results of introducing higher taxes (€200 and €800, consistent with NGFS 2020 scenarios), are in line with these general outcomes although considerably bigger.

From a political economy point of view, the successful introduction of a carbon tax requires a commitment to keep the scheme in place; the price should gradually increase over time following a clear path (disclosure) which would reduce uncertainty, helping firms to adjust their investments and achieving an orderly transition.

An important point to explore is to evaluate whether the tax should be levied on final use and if it should be added on top of the existing energy taxation (which in Italy, per unit of energy use, is one of the highest in Europe). As an alternative, it could be imposed on upstream activities, as suggested by The Carbon Pricing Leadership Coalition (2017).

We confirm the literature results showing that the introduction of a carbon tax would be regressive. In order to increase its political acceptability, the effects of the tax should be compensated by transferring the accrued resources to vulnerable households (and firms), for example with lump-sum transfers or by funding low-carbon energy solutions.

Notes

- 1.

Dahl (1993) states that “yet despite our attempts, it appears that demand elasticities are like snowflakes, no two are alike.”.

- 2.

In real terms, euros for 2015.

- 3.

In the United States, for example, the Energy information administration (EIA) collects every five years data on households energy demand, through its Residential Energy Consumption Survey (RECS—latest report in 2015), and on commercial buildings, through its Commercial Buildings Energy Consumption Survey (CBECS—latest report in 2018). In France, the INSEE carries on every year an Annual survey on industrial energy consumption (EACEI) at a very granular level (establishment) for 8.500 establishments. Most of the other western countries, instead, focus on expenditure instead of energy demand. In the UK, since 2008 there has been the Living Costs and Food Survey (LCFS) which replaced the previous Expenditure and Food Survey (EFS), which collects the spending patterns and the cost of living of British households, with 6.000 households surveyed every year. Most of the EU member states carry on Household Budget Survey (HBS) including detailed data on energy expenditure. Eurostat collects data on a harmonised level unfortunately every five years (latest available: 2010). In 2012 the Australian bureau of statistics collected information on household energy expenditure, consumption and behaviours in the Household Energy Consumption Survey (HECS) while some information on energy and water use for firms in the Business Longitudinal Analysis Data Environment (BLADE).

- 4.

In this work, we use the Indagine sui consumi delle famiglie for the years between 1997 and 2013 and the Indagine sulla spesa delle famiglie from 2014 to 2018.

- 5.

The survey reports monthly expenditure for electricity, natural gas, coke, heating oil, district heating, wood…, disaggregated by main and any additional dwelling.

- 6.

Some information on energy expenditure is also available in the EU Survey on Household Income and Living (EU-SILC), but with far fewer details and for a shorter period (IT-SILC started in 2004).

- 7.

Between 1996 and 2018, natural gas accounted for 83.4% of total heating expenditure, followed by district heating (8.6%), wood and coal (4.8%) and kerosene and gasoil (3%).

- 8.

We use the”Carbonaro” scale, which assigns a weight equal to 0.6 for a single person household, 1 for a couple, 1.33 for a household with 3 members, 1.63 with 4 members and up to 2.4 for a household with 7 or more members. This is the scale used by ISTAT for its analysis regarding poverty.

- 9.

In the HBS, households are already classified by ISTAT into 11 types, depending on their size, composition and age (see Table 3). We further collapse this classification into nine groups to have a reasonable number of observations in each cell.

- 10.

Prices are expressed in 2015 values using the consumer price index.

- 11.

For electricity we use the day-ahead price (”Prezzo unico nazionale” or PUN), for heating the natural gas price set at the Virtual Trading Point (”Punto di scambio virtuale” or PSV) and for liquid fuels the Brent dated price (free on board). All prices considered are in euros for 2015. When prices of electricity or gas are not available (before 2004 and 2013 respectively) we use oil prices (in euros for 2015 per MWh).

- 12.

Therefore the strata belonging to the bottom fourth are on the left of each figure, while those belonging to the top fourth quarter are on the right; households’ types are then reported within each fourth in the same order as in Table 3 within quarter and across energy use.

- 13.

More than 3,800 economists, among which 28 Nobel Prize winners in Economics, support a bipartisan proposal for a carbon tax in the United States from the Climate Leadership Council which appeared in The Wall Street Journal, 17 January 2019.

- 14.

There are several methodological issues behind the models used to estimate the SCC, as underlined by Pindyck (2013, 2017) and Hernandez-Cortes and Meng (2020): the choice of the damage function and the discount rate applied, on top of the uncertainty relating to the estimation of climate sensitivity.

- 15.

Voters in the State of Washington rejected two proposals (I-732 and I-1631) in 2016 and 2018.

- 16.

Following Brexit, the United Kingdom set up a UK-ETS which is of the same scope as the EU ETS it replaces.

- 17.

This hostility can be explained, in the US, by the increasing ideological polarization (Anderson et al. 2019) and the lack of adequate communication (for example on compensatory measures). Moreover, recent evidence from France point to a problem of distrust in Government which might lead households not to internalize the positive benefits from carbon tax even after redistribution (Douenne and Fabre 2022).

- 18.

A Climate-Neutral EU by 2050, Shell Climate Change, a blog by David Hone, 5 May 2020.

- 19.

Among the NGFS set of scenarios there is the Too little too late scenario where physical and transition risks are greatest; this scenario has still not been modelled.

- 20.

Between 2010 and 2018, this average carbon emission factor amounted to 332 gCO2 per kWh, 388 gCO2 per kWh in 2010 down to 281 in 2018 as the result of the decarbonization process in the Italian power sector. As a conversion we use 1 kWh = 0.0036 GJ.

- 21.

For 1 GJ: 29.8 L of petrol, 26.1 of gasoil. Specific weights: 0.725 kg/dm3 petrol, 0.825 for gasoil. Carbon emissions: 3.14 kg of CO2 for 1 kg of petrol, 3.17 for gasoil. Carbon emission, 0.067903 tonnes of CO2 per 1 GJ for petrol and 0.068301 for gasoil.

- 22.

One-fourth of all households belonging to the bottom fifth of the distribution owns no vehicles, therefore an increase in transport fuel prices might affect them less.

- 23.

Up to 2016, the variable part increased with consumption, a common, albeit inefficient, scheme (Levinson and Silva 2022). This scheme was abolished by the end of 2016, with a progressive transition towards a volumetric system completed by 1 January 2019.

- 24.

Power load of 3.3 kW and annual consumption of 2,700 kWh as defined by the Italian energy regulator, ARERA.

- 25.

Since 2010, both the variable and the fixed part have included the funding of renewable energy sources which peaked in 2016 at €14.4 billion or 0.9 p.p. of GDP. According to the energy agency in charge of managing the RES incentives, the average household paid €75 to support this policy, i.e. one eighth of the average electricity bill (GSE 2018). These levies have been suspended since Q2-2021.

- 26.

There are other levies which are small in size. Moreover, VAT is applied to the levies as well. Therefore, for the sake of simplicity, we omit these levies and focus on the VAT.

- 27.

92% of domestic customers in Italy had a 3.3 kW power load installed at the end of 2018 (ARERA 2019).

- 28.

As for electricity, we take a weighted average of these prices, using the share of domestic consumption per each band. Moreover, we assume that these prices does not include the fixed component of the gas bill.

- 29.

According to the Survey on households energy use, a one-time sample survey carried out in 2013, the price for wood and pellets in 2013, in energy equivalent terms, was very similar to that of natural gas.

- 30.

The share of heating costs due to natural gas from the pipeline has increased from 54% in 1997 to 70% in 2017.

- 31.

The VAT rate was 19% up to 1 October 1997 then 20% up to 17 September 2011, and then 22% since 1 October 2013).

- 32.

ARERA has been providing fixed costs for six different macro-regions, known as Ambito territoriale. Sardinia, which is not included in the price regulation because it is not on the gas grid, has been assigned to the macro-region of Sicily and Calabria, which is the most expensive.

- 33.

At the end of 2019, according to the Automobile club d’Italia, some 46% of cars used petrol and 44% diesel. There is also a 9% share of dual-fuel vehicles, using petrol with methane (CNG) or LPG.

- 34.

The difference between the highest and lowest price for petrol (self-service) on 31 March 2020, at national level was almost 11%—The price is available every day, for every petrol station, on the website of the Osservatorio Prezzi carburanti of the Italian Ministry of economic development (MISE).

- 35.

In the period 1996-2013 the expenditure for liquid fuels was collected jointly with that for diesel.

References

Anderson STI, Marinescu B, Shor (2019) Can Pigou at the polls stop us melting the poles? NBER Working Paper 26146

Andrews I, Stock JH (2018) Weak instruments and what to do about them. Nber summer lecture 2018, National Bureau of Economic Research

ARERA (2019) Relazione annuale. Autorità di regolazione per energia reti e ambiente, Roma

Bardazzi R, Pazienza MG (2020) When I was your age: generational effects on long-run residential energy consumption in Italy. Energy Res Soc Sci 70:101611

Batini NI, Parry, Wingender P (2020) Climate mitigation policy in Denmark: a prototype for other countries. IMF Working Paper WP/20/235

Beiser McGrath L, Bernauer T (2019) Could revenue recycling make effective carbon taxation politically feasible? Science advances 9(5)

Bigerna S (2012) Electricity demand elasticity in Italy. Atl Econ J 40(4):439–440

Burggraeve KJ, De Mulder, de Walque G (2020)Fighting global warming with carbon pricing: how it works, field experiments and elements for the Belgian economy. Working paper, National Bank of Belgium

Burke J, Fankhauser S, Kazaglis A, Kessler L, Khandelwal N, Bolk J and O’Boyle P (2020). Distributional impacts of a carbon tax in the UK: Report 1; analysis by household type. Technical report, Grantham Research Institute on Climate Change and the Environment

Campagnolo L, De Cian E (2022) Distributional consequences of climate change impacts on residential energy demand across Italian households. Energy Econ 110

Carattini SG, Heutel Melkadze G (2021) Climate policy, financial frictions, and transition risk. NBER Working Paper 28525

Carleton, TA, Jina A, Delgado MT, Greenstone M, Houser T, Hsiang SM, Hultgren A, Kopp RE, McCusker KE, Nath IB, Rising J, Ashw (2020) Valuing the Global Mortality Consequences of Climate Change Accounting for Adaptation Costs and Benefits. NBER Working Papers 27599

Dahl C (1993) A survey of energy demand elasticities in support of the development of the NEMS. University Library of Munich, Germany, Mpra paper

Deaton A (1985) Panel data from time series of cross-sections. J Econ 30(1):109–126

Douenne T, Fabre A (2022) Yellow vests, pessimistic beliefs, and carbon tax aversion. Am Econ J Econ Pol 14(1):81–110

Dubin JA, McFadden D (1984) An econometric analysis of residential electric appliance holdings and consumption. Econometrica 52(2):345–362

Eisner A, Kulmer V, Kortschak D (2021) Distributional effects of carbon pricing when considering household heterogeneity: An EASI application for Austria. Energy Policy 156:112478

Espey JA, Espey, M (2004) Turning on the lights: a meta-analysis of residential electricity demand elasticities. J Agric Appl Econ 36 (1): 1–17. 4

Faiella I (2011) The demand for energy of Italian households. Working Paper 822, Banca d’Italia

Faiella I, Cingano F (2015) La tassazione verde in Italia: l’analisi di una carbon tax sui trasporti. Econ Pubblica 2(2):45–90

Faiella I, Lavecchia L, Mistretta A, Michelangeli V (2022) A climate stress test on the financial vulnerability of Italian households and firms. J Policy Model 2(44):396–417

Faiella I, Lavecchia L (2022) Contenimento dei prezzi dell’energia e spesa delle famiglie. ENERGIA 1(22):36–39

Feldstein M (1972) Equity and efficiency in public sector pricing: The optimal two-part tariff. Quart J Econ 86:175–187

Greene WH (2008) Econometric analysis—sixth edition. Pearson Education

GSE (2018). Rapporto delle attività. Gestore dei servizi energetici, Roma

GSE (2021). Rapporto trimestrale. Aste di quote europee di emissione. Gestore dei servizi energetici, Roma

Guivarch C, Rogeljb J (2017) Carbon price variations in 2 C scenarios explored. Background paper for the high-level commission on carbon prices, Carbon pricing leadership coalition

Hausman J (1978) Specification tests in econometrics. Econometrica 46(6):1251–1271

Hernandez-Cortes D, Meng KC (2020) Do environmental markets cause environmental injustice? evidence from California's carbon market. NBER Working Paper 27205

Hook A, Court V, Sovacool BK, Sorrell S (2020) A systematic review of the energy and climate impacts of teleworking. Environ Res Lett 15(9):093003

Houthakker HS (1951) Some calculations on electricity consumption in Great Britain. J R Stat Soc. Series A 114 (1):359–371

IEA (2018) The future of cooling. International Energy Agency, Paris

IEA (2019) World energy outlook 2019. International Energy Agency, Paris

IEA (2020) World energy outlook 2020. International Energy Agency, Paris

Im KS, Pesaran M, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econ 115(1):53–74

IMF (2019) Fiscal Monitor: How to Mitigate Climate Change. International Monetary Fund, Washington DC

ISPRA (2019) Fattori di emissione per la produzione ed il consumo di energia elettrica in Italia. ISPRA, Roma

ISTAT (2020) Il sistema previdenziale italiano. audizione del direttore del dipartimento per la produzione statistica. Technical report. ISTAT, Roma

Kanzig D (2021) The unequal economic consequences of carbon pricing. Dissertation, London Business School

Labandeira X, Labeaga JM, Lpez-Otero X (2017) A meta-analysis on the price elasticity of energy demand. Energy Policy 102(C): 549–568

Lee DS, McCrary J, Moreira MJ, Porter J (2020) Valid t-ratio inference for IV. Am Econ Rev 112(10):3260–3290

Levinson A, Silva E (2022) The electric Gini: income redistribution through energy prices. Am Econ J Econ Pol 14(10):341–365

McKinsey (2020) Net-zero Europe. Decarbonization pathways and socioeconomic implications. Report, McKinsey

Metcalf GE, Stock JH (2020) The Macroeconomic Impact of Europe's Carbon Taxes. NBER Working Papers 27488

Ministero dell’Ambiente (2019) Tabella parametri standard nazionali. Roma

Montiel Olea JL, Pflueger C (2013) A robust test for weak instruments. Journal of Business and Economic Statistics 31:358–369

NGFS (2020, June) NGFS climate scenarios for central banks and supervisors. Working paper, Network for greening the financial system

Nordhaus W (2021, 01) National and international policies for slowing global warming. Markus Academy speech at the Bendheim Center for Finance, Princeton University, 29 January 2021

Ohlendorf N, Jakob M, Minx JC, Schrder C, Steckel JC (2021) Distributional Impacts of Carbon Pricing: A Meta-Analysis. Environ Resour Econ 78:1–42

Paoli MC, van der Ploeg R (2021) Recycling revenue to improve political feasibility of carbon pricing in the UK, www.voxeu.org

Pavanello F, Cian ED, Marinella D, et al (2021) Air-conditioning and the adaptation cooling deficit in emerging economies. Nat Commun 6460

Penasco C, Anadon L, Verdolini E (2021) Systematic review of the outcomes and trade-offs of ten types of decarbonization policy instruments. Nat Clim Chang 1:1

Pindyck RS (2013) Climate change policy: What do the models tell us? J Econ Lit 51(3):860–872

Pindyck RS (2017) The use and misuse of models for climate policy. Rev Environ Econ Policy 11(1):100–114

Randazzo T, De Cian E, Mistry MN (2020) Air conditioning and electricity expenditure: The role of climate in temperate countries. Econ Model 90(C): 273–287

Rehdanz K (2007) Determinants of residential space heating expenditures in Germany. Energy Econ 29(2):167–182

Schulte I, Heindl P (2017) Price and income elasticities of residential energy demand in Germany. Energy Policy 102:512–528

Stagnaro C, Amenta C, Di Croce G, Lavecchia L (2020) Managing the liberalization of Italy’s retail electricity market: A policy proposal. Energy Policy 137(C)

Stern N, Stiglitz, JE (2021) The social cost of carbon, risk, distribution, market failures: An alternative approach. NBER Working Paper 28472

Stock J, Yogo M (2010). Testing for Weak Instruments in Linear IV Regression. In: Donald W, Andrews K, Stock H (eds) Identification and Inference for Econometric Models, 1 st ed, Cambridge university press, New York, pp 80–108

Taylor LD (1975) The demand for electricity: A survey. Bell J Econ 6(1):74–110

The Carbon Pricing Leadership Coalition (2017). Report of the high-level com-mission on carbon prices. Working paper, World Bank

Tirole J (2017) Economics for the common good. Princeton University Press

van der Ploeg F, Rezai A, Tovar M (2022) Gathering political support for green tax reform. Eur Econ Rev 141

Wooldridge JM (1995) Score diagnostics for linear models estimated by two stage least squares, Oxford: Blackwell, pp 66–87

World Bank (2022) State and trends of carbon pricing 2022. World Bank, Washington DC

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendices

Appendix A: Estimating Households Energy Demand

Modelling Energy Demand

Following Faiella (2011), we define \({Q}_{i,t}^{E}\) as the energy demand of households i for fuel z (where z = 1 with fuels for heating, z = 2 with electricity and z = 3 with gasoline, diesel and other fuels for private transportation). For each i th household this quantity (expressed in energy units, such as joules or ton of oil equivalent) can be represented as a function of other variables (time subscript are omitted for clarity):

where Pz is a vector of prices, Ci a set of characteristics of the i − th household, Bi are consumer preferences and T some exogenous variables relating to climatic conditions. In the short term, energy demand might be rather inelastic, showing a low degree of substitution, while in the medium term, the rise of energy prices (Pz) could push a household to either invest in energy-efficient appliances or switch to different fuels. Energy demand also varies according to individual preferences (Bi). Some consumers are more environmentally aware (for example improving the energy efficiency of their dwelling), while others prefer higher indoor temperatures. In general, more affluent households, with a larger number of appliances and living in bigger dwellings, use more energy.

Climatic conditions (T) also matter and they will become increasingly important in the future because of climate change: the increase in surface temperatures reduces heating demand but increases cooling services. Cooling is expected to become the top driver of global electricity demand in the near future (IEA 2018). This is also true for Italy: according to HBS data, the share of households owning an AC appliance increased from 6% in 1997 to 41% in 2018.

Bearing in mind these determinants, in the following sections, we present our strategy for deriving the energy demand (in energy units) for electricity, heating and liquid fuels for private transport in Italy. Because we have only data on expenditure, we need to merge the HBS dataset with information on the energy prices for the three energy services considered in the analysis.

Estimation of Electricity Demand

In Italy, power retail prices are structured as an efficient two-part scheme (Feldstein 1972): a variable volumetric price, covering the marginal cost of each additional kWh consumed, and a fixed monthly fee, covering the fixed costs such as transmission and distribution.Footnote 23 Poor households (i.e. those with an indicator of the economic condition of the family below a certain threshold) are supported through a discount applied by the local distribution system operator (DSO), known as”bonus elettrico” (electricity bonus). Only one third of the price paid by the average Italian householdFootnote 24 is linked to energy costs; one fourth is for remunerating the transmission, distribution and metering services while the remaining part finances the subsidies to renewable energy sources and other costs (26%, the”oneri generali di sistema” or general system charges)Footnote 25 and taxes 14%. Therefore, taxes and other levies stifle competition by hampering the price signal (Stagnaro et al. 2020). From the HBS, we observe the monthly electricity expenditure of the i-th household at a time (month) t, \({E}_{i,t}^{E}\):

where \({P}_{i,t}^{vE}\) is the variable price in euros per kWh, \({Q}_{i,t}^{E}\) is the quantity of electricity demanded (unknown), \({P}_{i,t}^{fE}\) is a fixed price component and \(1+{T}_{t}\) are taxes. Solving for \({Q}_{i,t}^{E}\), if follows

As previously mentioned, from the HBS we observe \({E}_{i,t}^{E}\), while Tt is the VAT rate, equal to 0.1 in the case of electricity.Footnote 26 Unfortunately, we do not observe either \({P}_{i,t}^{vE}\) or \({P}_{i,t}^{fE}\) and, we will therefore have to estimate them. As for \({P}_{i,t}^{vE}\), the variable price, we use the average, semi-annual, prices released by Eurostat from 2008 onwards assuming that these prices does not include the fixed component of the electricity bill. These data are available for three consumption bands: we take a weighted average of these prices, using the share of domestic consumption per band provided by the Italian energy authority (ARERA), obtaining a unique, semi-annual, average price for electricity. The data between 1996 and 2007 are imputed by regressing the price for the period 2008–2018 on the monthly electricity price index (from ISTAT) and on a set of time dummies (year and semester). The same index is used to derive monthly prices from semi-annual data. The part of the bill that does not change with consumption (\({P}_{i,t}^{fE}\)) includes a fixed instalment and a component depending on the power load,Footnote 27 whose parameters have been updated quarterly by ARERA since 2007. We first estimate the amount paid by a representative Italian house—hold (domestic contract, power load of 3.3 kW); as these pieces of information are only available for each quarter from 2007 onwards, we compute the share of the electricity expenditure due to the fixed component, \({\alpha }_{t}\), in the period 2007–2018. Then, we regress it over total electricity expenditure, prices and a year dummy, to estimate \({\alpha }_{t}\) for the period 1997–2007. This range stood at 8% in 1997 and increased to 27% in 2018, following the 2016 reform of the electricity tariff. We multiply this coefficient by the electricity expenditure in order to obtain an estimate of the fixed price component for each household or,

and then we substitute it back into the formula for \({Q}_{i,t}^{E}\). Finally, we winsorize the extremes and calibrate \({Q}_{i,t}^{E}\) to align our microdata with the annual information on households’ electricity consumption from the National Energy Balance. The calibration increases average households’ consumption by roughly one third.

Estimation of Heating Demand

We consider all heating-related fuel expenditure: natural gas, which is the main fuel used by Italian Households (ISTAT, 2014), district and central heating, wood, coal and kerosene. We thus obtain a comprehensive heating expenditure for household i at month t, \({E}_{i,t}^{H}\). Unfortunately, as for electricity, only semi- annual prices for natural gas, published by Eurostat, are available.Footnote 28 However, prices for natural gas can be considered a reasonably good proxy for other fuels (such as wood and pellets).Footnote 29 Therefore, we model heating demand as a function of natural gas prices.Footnote 30 As for electricity, households heating expenditure is equal to

where \({P}_{i,t}^{vH}\) is the variable price (€ per gigajoule), \({Q}_{i,t}^{H}\) is the quantity of heating demanded (unknown), \({P}_{i,t}^{fH}\) is a fixed price component and \(1+{T}_{t}\) is the VAT rate, which changed three times between 1997 and 2018.Footnote 31 As before, we estimate the share of fixed costs as part of the total expenditure, \({\beta }_{t}\), depending on where the household lives, for the period 2010–2018.Footnote 32 For the period 1996–2009, we regress \({\beta }_{t}\) on total heating expenditure, natural gas prices and the year dummy and then forecast the values. The same index is used to derive monthly prices from semi-annual data. We solve for \({Q}_{i,t}^{H}\) and calibrate the results with the total heating demand from the to align our microdata with the annual information on households’ heating consumption from the National Energy Balance.

Estimation of Private Transport Demand

From the HBS, we observe each households’ expenditure for transport fuels in Italy.Footnote 33 The share of expenditure on private transport is sizable, almost equal to the sum of the share of heating and electricity (Fig. 1). However, this share has its own specificity compared with other energy use; in fact the share of vehicle’ owners is scant in the bottom part of the expenditure distribution. In the bottom tenth, less than two thirds of households own a car while in the top tenth this share is 9 out of 10.

The price of liquid fuels in Italy is fully liberalised, but taxes and levies weigh for more than two thirds of the final price. There is a reasonable level of price competition among the 15.000 petrol stations around the country.Footnote 34 We took the average national monthly price for petrol and diesel, as published by the Italian Ministry of economic development (MISE) to estimate the quantity of fuel demanded. We consider the joint demand for liquid fuels for private transportation,

and a unique price for liquid fuels, as a weighted average (with w as the weight) of petrol and diesel prices,Footnote 35 using their respective share of total expenditure as weights. Finally, we calibrate the results with the total demand for liquid fuels published yearly by the business association of oil and gas companies (Unione Energie per la Mobilità).

Estimation of Total Energy Demand

We are then able to derive the monthly energy demand at the household level for the entire period considered (1997–2018) and we compare our estimates with the official data from the Physical Energy Flow Accounts (PEFA) from Eurostat. For 2018, our estimates for heating and electricity mimic the aggregate data pretty closely, while transport demand is slightly underestimated (our data are about 14% lower compared with transport demand in the official statistics). Overall, our micro data covers the 95% of the official household energy demand in 2018 as measured by the PEFA. Knowing the energy demand at the micro level allows us to analyse the pattern of energy demand according to household characteristics (age of the head, household size, location, and so on,). Considering a measure of their welfare (proxied with their position in distribution of the equivalent expenditure) we find, not surprisingly, that energy demand (and energy expenditure) increases with households welfare (Fig. 4). On average, households at the top of the expenditure distribution use more than twice the amount of energy demanded by poorer households (less than 5 GJ per month). In terms of fuel, the demand for electricity is pretty much uniform across the expenditure distribution, while heating and transport fuels demand is higher for more affluent households. Over the years, energy demand and expenditure has decreased across all fifths. After having merged our data with energy prices and having derived energy demand, we can proceed and estimate the elasticity of energy demand for each energy service.

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2023 The Author(s)

About this chapter

Cite this chapter

Faiella, I., Lavecchia, L. (2023). Households’ Energy Demand and Carbon Taxation in Italy. In: Bardazzi, R., Pazienza, M.G. (eds) Vulnerable Households in the Energy Transition. Studies in Energy, Resource and Environmental Economics. Springer, Cham. https://doi.org/10.1007/978-3-031-35684-1_8

Download citation

DOI: https://doi.org/10.1007/978-3-031-35684-1_8

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-35683-4

Online ISBN: 978-3-031-35684-1

eBook Packages: Economics and FinanceEconomics and Finance (R0)