Abstract

The chapter examines key geopolitical aspects related to oil and gas in the MENA region. By proposing several key case studies related to the Gulf, Mashreq and Maghreb, the chapter outlines how the entire MENA region has become a major geopolitical hotspot given its key role in the current global energy system. Furthermore, the chapter takes into account several regional and international developments in order to assess the role of natural resources in the growing global energy competition.

You have full access to this open access chapter, Download chapter PDF

Keywords

This Chapter analyses key geopolitical aspects related to oil and gas in the MENA region.

The MENA region has become a major geopolitical hotspot given its key role in the current global energy system. Over the past two decades global oil and gas supply–demand patterns have rapidly changed with the consolidation of new major fossil fuel buyers, especially in Asia, rising climate ambitions in other world’s regions, namely the European Union, and the advent of the US as major hydrocarbon producer and exporter thank to its shale revolution. These developments have changed global players’ energy and economic interests for the MENA region. At the same time, the region has fermented with intra-regional tensions, geopolitical competition, which in some cases have entailed energy consequences.

The Gulf cluster has been characterized by two major crises: one within the Gulf Cooperation Council and the other the clash between Iran and most of the Gulf monarchies. Neither of them has been caused by energy issues. Yet, both of them have entailed profound energy consequences. The GCC crisis erupted in 2017 between some GCC countries (Saudi Arabia, the UAE, Bahrain) and Qatar because of political disagreements on regional affairs and geopolitical competition. Energy was not the cause and energy and energy trade (including Qatar-UAE gas exports) has been preserved. Nonetheless, growing political disagreements have also contributed to Qatar’s withdrawal from OPEC, though this decision was also driven by the Qatari intention to exploit its competitive advantages in natural gas. The other crisis (GCC-Iran) has been a key component of energy geopolitics of the region. The international confrontation against Iran has moreover prevented Iran to fully develop its energy resources and potential, including limiting access to key technologies, such as LNG. Geopolitical confrontations have been visible in the growing tensions around key chokepoints (Hormuz Strait) and major attacks on critical energy infrastructure in Saudi Arabia.

The Mashreq cluster has been at the center of multiple geopolitical developments in the past decade. The Eastern Mediterranean has become a geopolitical hotspot since the discovery of major offshore gas reserves. Thanks to these discoveries, some countries have become (or returned to be) net gas exporters, while geopolitical competition has increasingly soared in the region. Nonetheless, the geopolitical competition is not purely and primarily caused by energy resources. Around the Eastern Mediterranean energy resources, some countries (Israel and Egypt) have expanded and strengthen their bilateral partnerships. Other two countries in the cluster (Syria and Iraq) have experienced major political and security instability. While for the Syrian case, energy resources are not the main motive for geopolitical competition and instability, Iraq’s huge energy resources have in the past been center place of energy conflicts and they remain heavily affected by the ongoing social unrest.

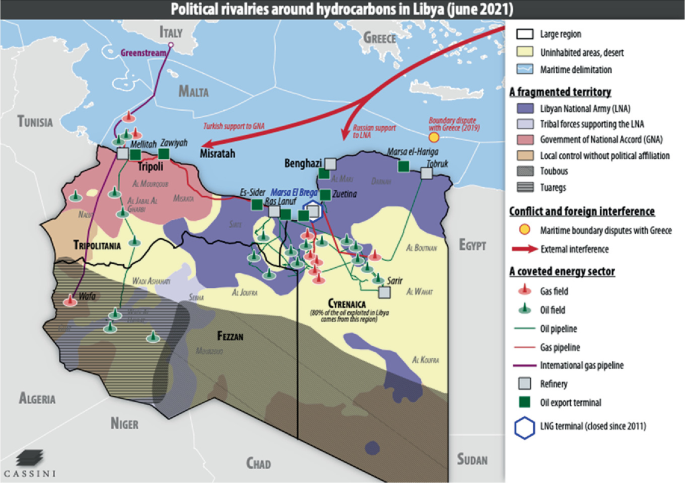

In the Maghreb cluster, there are two main hydrocarbon producers: Algeria and Libya. Algeria has been a key supplier for European energy markets for many decades. The country has recently experienced major political instability especially in 2019, which resulted in the step down of president Bouteflika after 20 years of power. Rising domestic consumption and declining production have caused the erosion of hydrocarbon export volumes. Political disagreements with Morocco caused the end of gas export flows to Spain via Morocco. Italy remains a key buyer for Algeria’s gas volumes and the North African country has gained more relevance in light of Italy’s diversification efforts in response to Russia’s invasion of Ukraine. Libya has been suffering from political and security instability since 2011 when Gaddafi was overthrown. Local militias have been fighting over hydrocarbon reserves and in several occasions the operations have been halted or hindered by militias. Different factions have been fighting over the control of hydrocarbon resources and their revenues. Numerous external players have supported different local militias causing the impossibility to find a peaceful solution for the country. Libya was a key supplier for Europe, but its inability to attract investments and security concerns have left the country’s oil and gas sector underperforming.

The abundance of oil and gas resources and the strategic role of fossil fuels in the present global energy landscape have made the MENA region one of the key hotspots of energy geopolitics for decades. The region attracts numerous geopolitical and geo-economic interests of external actors, primarily the US, European countries, Russia and China. The US has been the most important external player in the Gulf region, whereas the European countries have had stronger relations with the North African countries due to their geographical proximity and historical relations (i.e. the colonial heritage). Over the last decades, other players, such as Russia and China, have increased their energy, economic and political stakes in the region. Moreover, external influence lies on regional dynamics and competition—such as the well-known and ancestral conflict between Sunnis and Shiites.

Over the last decade, the MENA region, just as the world as a whole, has undergone several major transformations in the socioeconomic, political and energy spheres, and so have the international relations of MENA countries among themselves as well as with outside players. This ongoing transformation has been characterized by several turning points: (i) the 2011 ‘Arab Spring’, with the fall of long-ruling leaders, illustrates the weakness of the political structures and social contracts in numerous countries; (ii) the signature of the JCPOA, supported by the then-US President Barack Obama, aims to redesign the regional geopolitical structure engaging with the Islamic Republic of Iran; (iii) the assertive foreign policy pursued by President Trump and the consequent withdrawal from the JCPOA; and lastly (iv) the steady American retrenchment from the region has left a political vacuum that regional and other extra-regional countries are attempting to fill.

Developments in the global oil markets and oil price volatility have contributed to reshaping some political cooperation among MENA oil producing countries and other players (i.e. the US and Russia). In a context of great regional and global transformation, it is inevitable that the balance of power within the region has suffered and will continue to suffer some major shocks.

This Chapter seeks to present and analyze these major changes and shocks for each of the three clusters: Arabian Persian Gulf, Eastern Mediterranean and Western Mediterranean. Old and new conflicts are beginning to meddle with each other. This is the result of the fading supervisor role of the US throughout the region. The reduction of US interests in the region has been caused by numerous factors: the advent of the US shale industry, the reconsideration of its role in the globe, its increasing attention to China’s rise. Whatever the reason, this process has encouraged regional countries to increase their activism to secure their own national interests.

1 The Arabian-Persian Gulf

The geographical cluster of the Arabian-Persian Gulf (hereafter ‘Gulf’) holds a special place in current energy geopolitics. Indeed, it is deeply interlinked with the development of the geopolitics of oil and gas—especially in the second half of the XX century. The vast hydrocarbon resources have positioned the area in the geopolitical energy map of the XX century.

The meeting between US President Roosevelt and Saudi King Abdul Aziz Ibn Saud on the USS Quincy in the Suez Canal on Valentine’s Day 1945 marked the dawn of a new regional architecture in the Gulf region. It also represented the beginning of the longest US relationship with an Arab State, the Kingdom of Saudi Arabia. The Gulf became the strategic heartland of America’s energy security.

The post-WWII structure of the region was then shaken by two episodes: the Islamic Revolution in Iran and the Soviet invasion of Afghanistan in 1979. When the Red Army crossed into Afghanistan, Washington expressed their strong concern for oil security, and US President Jimmy Carter outlined his doctrine (‘Carter Doctrine’), which ensured the full (even military) US protection of the Gulf monarchies. A decade later, this doctrine was implemented by President George H. W. Bush, who decided to intervene to halt Saddam Hussein’s 1990 invasion of Kuwait.

The Doctrine outlined the structure of the regional order: the US provided security for the Gulf states, which were militarily weak, ensuring that oil would flow out of the region, especially through the Strait of Hormuz and other chokepoints, to keep the world supplied. At the same time, the Gulf monarchies were committed to providing oil supplies to the US as well as the global economy. This division of tasks has remained untouched for several decades.

In the last decade, the regional order has experienced new major developments: the decision of US President Barack Obama to engage internationally with Iran—the main US regional enemy since 1979—and the advent of the US shale industry that has enabled the US to become a major oil and gas player. The US decision to engage with Iran resulted in more assertive policies of the Gulf monarchies, which considered the agreement a potential security threat fearing a potential loss of the US security umbrella. The outcome was an intensification of conflicts (i.e. Yemen and Syria) between the two parts.

In 2016, Donald Trump was elected President of the United States. The Trump administration declared Iran a major threat for the regional and international systems. Trump’s foreign policy was based on a strong political support to the Gulf monarchies (and Israel) against Iran. In a sense, this represented the return of US Middle East foreign policy to its post-1979 nature, identifying Iran as a threat while providing security to the Gulf monarchies. To do so, the Trump administration pursued the so-called ‘maximum pressure strategy’ against Tehran, seriously undermining Iran’s oil and gas production and its potential comeback to the global energy markets. In 2021, another potential key turning-point in US foreign policy occurred with the election of Joe Biden. The newly elected President supported the idea of rejoining the JCPOA in stark opposition with the previous administration. Nonetheless, a new international nuclear deal seems quite challenging due to the numerous obstacles put in place by the Trump Administration (e.g. the inclusion of the Islamic Revolutionary Guard Corps (IRGC) in the State Department’s Foreign Terrorist Organization (FTO) list).

Other major economies have enhanced their presence and relevance in the Gulf region. Russia started to increase its political and economic collaboration with the Gulf monarchies, while cooperating with OPEC for the global oil market’s stability. China has steadily strengthened its economic presence while becoming a major energy market for MENA oil and gas exporters.

Given their strategic value, fossil fuels have shaped coalitions as well as conflictual positions in the region, which has experienced two major crises with consequences on the political and economic relations of the cluster and beyond. First, the crisis within the Gulf Cooperation Council (GCC) regarding the role of Qatar. Second, the cleavage between the Gulf monarchies and Iran. In addition to these two crises, the region has seen major setbacks and transformations.

Before diving into these two internal crises in the Gulf (Sects. 5.1.2 and 5.1.3), a short introduction will outline the major evolutions of global oil markets, the role of the MENA region and the recent developments regarding the international actors in the region.

1.1 Global Oil Markets Evolutions and the Major Developments in the Middle East

In 1960, Saudi Arabia, Iran, Iraq, Kuwait and Venezuela founded the Organization of the Petroleum Exporting Countries (OPEC). At that time, the international oil industry was mainly dominated by a few large international Western oil companies, known as the ‘Seven Sisters’.Footnote 1 The creation of OPEC resulted from the interplay of different political, economic and energy relations. From the political standpoint, countries around the world were eager to take control over their destiny and resources as decolonization was unfolding.

Until the early 1970s, OPEC acted as a ‘trade union’ whose main objective was to prevent the income of its member countries from falling (Fattouh and Mahadeva 2013). During this period, OPEC did not succeed in influencing prices, but started to gain market power. In fact, the 1955–1970 period was characterized by declining prices as the Seven Sisters’ aim was to keep out competitors. Simultaneously, global oil demand increased rapidly from 30.8 mb/d in 1965 to 45.3 mb/d in 1970 (BP 2020). OPEC countries met most of this demand increase. This contributed to the shift in market power from IOCs to producing countries.

From the 1970s, OPEC, thanks to the initiative of Libya and Iran, began to reverse the power relationship between oil companies and producing countries, with a consequent increase in oil prices. Saudi Arabia is often considered the de factor leader of the Organization because of its weight in OPEC’s reserves, production and exports as well as the relative stability of its supply. However, in the first years of OPEC, Saudi Arabia did not exercise a leadership role. Its main contribution to OPEC was its ability to ensure a consensus-building approach and distance OPEC from the inter-Arab conflicts (Al-Moneef 2020). Saudi Arabia stepped up its prominence within OPEC decisions in the 1970s by leading Arab oil production cuts until late 1973 thus initiating the oil price rise and leading OPEC to assume the price administration role. Saudi leadership was expressed through the charismatic figure of Ahmed Zaki Yamani, who served as Saudi Minister of Petroleum and Mineral Resources from 1962 to 1986 and key figure of OPEC for 25 years.

The economic recession of the 1980s, combined with the growth in non-OPEC crude oil production prompted by high oil prices, caused a decline in oil demand in the mid-1980s depressing oil prices. Global oil markets turned from a ‘seller’s market’ to a ‘buyer’s market’. In 1982, OPEC introduced a formal quota system, which however did not help reverse the slide in the oil price. Over 1982–1985, Saudi Arabia acted as ‘swing producer’, absorbing the brunt of OPEC’s supply adjustment. The loss of market share and low prices proved to be costly for OPEC countries, and in particular Saudi Arabia. In 1985, Saudi Arabia decided to abandon the defense of the official OPEC price and opted for defending its market share. From this shift, a 15-year period of moderate oil prices was inaugurated, which ended with the second oil price boom over the 2000–2014 period, which was fueled by China’s impressive and long-lasting economic growth. After the economic crisis, where oil prices plummeted, from 2011 to mid-2014, global oil markets were broadly stable with prices included between 100 and 120 US$ per barrel. Demand was recovering from the 2008 financial crisis, whereas supply was growing, especially driven by the US shale oil boom. Geopolitical aspects contributed to shaping the supply side in those years. The political instability in Libya significantly reduced its oil output, while Iranian production dropped by almost a third due to the western embargo on Iranian oil exports since 2012. Moreover, the rise of ISIS in northern Iraq and the Russia-Ukraine crisis have contributed to maintaining oil prices above $100 per barrel because of the fear of potential supply disruptions. However, in 2014 oil prices collapsed, with Brent dropping from $111/barrel in June to $62 in December. The preceding years had witnessed a strongly growing US shale oil output (4 mb/d of output were added between 2010 and 2014) fueled by high prices, and at the same time moderate oil demand growth rates due to these very same high oil prices. The collapse of oil prices in 2014 was determined by the Saudi decision to drive higher-cost competitors (i.e. US shale producers)—which had been eating into the revenues of established producers—out of the market. Pouring additional barrels into the global oil market (and thus ending its strategy of withholding production in order to maintain high prices), Saudi aimed at stopping its fall in the market share due to the ever increasing US shale production. Going forward, with the world engaged in decarbonization, and the power struggle between established OPEC+ producers (which can sit together and collectively try to shape a strategy), and US shale oil producers (which cannot sit at a table with OPEC+ because they are very dispersed), will inevitably lead to an uncoordinated oil market and thus high volatilities.

Falling oil prices in late 2014 and early 2015 (Fig. 5.1), which remained low until early 2022, have seriously challenged the Gulf economies, forcing them to consider how to diversify their economies. Since then, the area has witnessed major developments with rising competition among countries, major regional crises and the growing influence of non-US power.

Notwithstanding this general context, Russia increased its presence in the Middle East. As mentioned before, Moscow actively supported Bashar al-Assad in Syria with the deployment of the Russian army. Moreover, in December 2016 OPEC agreed with a group of non-OPEC countries on a curtailment of crude oil. The two groups’ leaders and the kingmakers of the so-called OPEC+ Footnote 2agreement are Saudi Arabia and Russia. Since the great reliance on hydrocarbon rents of these countries, the decline of oil prices threatened their economic and social stability, following a period of high oil prices. Although prices matter, this union is not just about oil prices. Indeed, the Saudi-Russian cooperation can be explained by several geopolitical elements, beyond the economic rationale.

Russia looked for opportunities to increase its influence in the region beyond its existing partnerships (i.e. Iran and Syria), to avoid getting stuck in the prevailing divisions of the region. Moreover, Moscow aspired to being considered a global power in key geopolitical stages. Its involvement in Syria, Libya, Iraq and its improving ties with Sunni Arab Gulf states, along with Israel, symbolize this ambition. Russia’s Sunni Muslim minority could also have contributed to Russia’s decision to consolidate ties with Sunni Arab Gulf states.

Meanwhile, Saudi Arabia was interested in hedging its foreign policy by establishing a firmer alliance with Russia because of the retreating US influence in the region. In 2017, King Salman became the first ever Saudi monarch to visit Russia, cementing the Saudi-Russian ties. Their relationship is mainly centered on energy issues. The two countries discussed potential partnerships and investments, without, however, attaining any concrete results. This contributed to increasing internal frustration in Russia regarding the OPEC+ agreement. It is also important to note that the two countries disagree on several regional geopolitical issues, notably Syria, Iran, Qatar. And it seems reasonable to believe that oil cooperation will not reduce such disagreements.

China is another player that is advancing its relations with the Middle East area. Energy is one important element of Sino-Gulf relations. Indeed, the relationship can appear as a natural fit. China is a fast-growing energy market, while the Middle East countries hold a significant portion of the world’s oil and natural gas reserves and they are major producers and exporters. Beijing has become the world’s largest oil importer, importing more than 11 million barrels per day in 2018 (BP 2020). The Middle East accounting for more than 40% of China’s oil imports, explains the importance of Sino-Gulf relations. China’s growing energy market is particularly important for Gulf countries, which struggle to secure energy exports. Saudi Arabia competes with Russia to rank the largest source of oil for China. Other Gulf countries export significant quantities as well. For example, Iran managed to continue exporting hydrocarbons to China, which provided vital financial revenues. China is also becoming a major LNG market, becoming one of the largest importers in the world with Japan and South Korea. That is particularly relevant for Qatar, which aims to gain market share through long-term contracts, as seen in the 22-year contract for LNG signed in 2018.

However, China’s influence on the region does not end with energy. Between 2000 and 2017, trade between China and GCC countries has grown from just under $10 billion to nearly $150 billion per year (Fulton 2019). Moreover, China’s foreign direct investment into GCC countries has increased, with over $60 billion invested between 2005 and 2017. Chinese companies have won several major infrastructure construction contracts in the Gulf monarchies, such as the lead venue for the 2022 FIFA World Cup in Qatar, Lusail Stadium, or Saudi Arabia’s Yanbu Refinery as well as the highspeed rail line that connects Jeddah with Mecca and Medina. Sino-Iranian relations have expanded significantly both politically and financially as well as from the energy perspective. The two countries signed a 25-year partnership agreement that envisages ambitious cooperation targets in the investment, economic, political and security fields.

Thanks to their geographical position, the Gulf countries could also contribute to the success of a major Chinese project: the Belt and Road Initiative (BRI). The Arabian Peninsula as well as Iran hold great geostrategic importance, linking South and Central Asia to the MENA region and further to the Mediterranean. Although the newcomers (Russia and China) have increased their stakes in the area, the US is still the dominant power in the Gulf. Washington guarantees security in the region, ensuring that oil chokepoints such as Hormuz remain open.

1.2 GCC Crisis: Political Causes and Energy Implications

The political and energy interests of the three main countries of the Arabian Peninsula (i.e. Saudi Arabia, the UAE and Qatar) have become increasingly conflicting as a result of growing intra-regional tensions. The major outcome of these tensions has been the crisis within the Gulf Cooperation Council (GCC) which started in 2017 and ended in 2021.

The GCC is a regional organization created by Saudi Arabia, the UAE, Qatar, Oman, Kuwait and Bahrain in 1981. These six countries decided to constitute the GCC motivated by the need for an effective collective security institution. Back then, the region had witnessed some major security developments: in 1979 the Islamic Revolution in Iran and in 1980 the beginning of the Iraq-Iran War. Thus, GCC countries were worried about how these developments could threaten their vital security interests.

Since the 2011 Arab Spring, the entire MENA region experienced an intensification of tensions and competition among its key regional players. As a consequence, in June 2017 Saudi Arabia, the UAE, Bahrain—along with Egypt—decided to cut off diplomatic relations with Qatar and imposed a land, sea, and air blockade on the peninsular Emirate, preventing any economic exchange with it.

The key reason for this dramatic decision was Qatar’s alleged support to political Islam and extremism. Moreover, the core competition lies in the substantial differences in foreign and regional policy. For years, Qatar has operated as the main supporter of the Muslim Brotherhood, while Saudi Arabia and the UAE have seen the Muslim Brotherhood as an existential threat to their domestic stability and order. Moreover, the two blocs disagree on their approach towards Iran: Doha is more willing to adopt a cautious approach towards Tehran, whereas other Gulf monarchies look at Iran as a competing regional country and a security threat (see Sect. 5.1.3).

Although Qatar and Saudi Arabia had disagreements before, the GCC crisis came as a surprise for Doha. Saudi leadership was quite cordial to Qatar in the years before the blockade. Nevertheless, higher security concerns and increasing divergence on foreign and regional policies were exacerbated by the more assertive and personalized foreign policy of the new young regional elites, such as Saudi Crown Prince Mohammed bin Salman. He has undertaken to operate more actively and decisively on the regional stage, personalizing Saudi foreign policy.

Another source of higher security and political concerns has been the political vacuum left by the US, the traditional security guarantor. Although the US remain the main security player in the region, Washington has started to reconsider its role in the region’s security architecture, aimed at avoiding additional conflicts and costs as well as repurposing its attention to other world regions (i.e. Asia). All of these elements led to a deterioration of intra-regional relations.

In January 2021, the GCC embargo was officially lifted at the 41st GCC Summit in al-Ula under the lead of Saudi Arabia which aimed to ensure its good will and standing with the new and more Saudi-skeptic administration in the US. Despite the positive development, the key issues that led to the blockade have not been resolved, meaning that renewed tensions could emerge among the countries in the future. Moreover, the crisis has reduced the relevance of GCC for Qatar. For example, the GCC no longer serves its purpose as security provider for Qatar. Indeed, the key security allies for Qatar are the US and Turkey. With Washington, Doha built a protective relationship when it signed the 1992 Defense Pact. The security relation was enhanced when in 2002 Qatar began hosting US forces et al.-Udeid, home to the largest US military base in the Middle East. Yet, during the first phase of the embargo, the US-Qatari relationship was questioned as President Trump expressed his support to the blockade. This political position shifted only after the intervention by then-Secretary of Defense James Mattis and then-Secretary of State Rex Tillerson (Smyth 2020). Over this period, Qatar and US have re-consolidated political relations with two state visits by Qatar’s Emir to the US in 2018 and 2019.

The GCC crisis has pushed Doha toward other countries, making GCC countries less relevant for Qatar’s trade and economy. By contrast, China, India, Iran and Japan are more important partners than the three hostile GCC countries (al-Jabar and Coates Ulrichsen 2020). After three years, the blockade has achieved little or nothing. Qatar has strengthened its relations with Turkey, increasing food imports, upscaling security as well as financial and economic ties. Moreover, Doha has begun using Iranian airspace for its flights and Iranian territorial waters aiming to avoid disruption to its energy exports. Moreover, the blockade decided by three GCC countries (Saudi Arabia, the UAE and Bahrain) did not receive the support of the other GCC members, while obtaining Egypt’s solidarity, showing the limitations of their political decisions and actions.

Given the important role of the GCC countries in the oil and gas markets, at the time of the crisis outbreak, concerns were expressed about its potential spillovers to the energy sphere. However, these countries have managed to limit damages in the energy markets. Firstly, there are no substantial oil or gas exchanges between Qatar and Saudi Arabia or Bahrain. Thus, the political tensions between these countries have had limited impacts on their energy policies. However, Qatar does export gas to the UAE via the Dolphin pipeline.Footnote 3

Despite the deterioration of the political relations between GCC countries, the contending countries preserved a pragmatic approach regarding energy relations. In 2019 Qatar exported 19.5 bcm to the UAE and 2 bcm to Oman. These figures illustrate that the ongoing GCC crisis did not affect existing energy relations. This is also due to the fact that Doha does not want to be seen as an unreliable supplier hence choosing not to shut down its gas flows to the UAE, albeit its great political isolation.

Nonetheless, future gas relations may be hindered by the remaining distrust among countries coupled with a shift in energy strategy. Indeed, the UAE’s state-owned energy company, ADNOC, has recently expressed its intention to reach gas self-sufficiency. This strategy could undermine future gas flows through the Dolphin pipeline. Yet, questions over economics may arise as the pipeline provides cheap gas (still below $2/MMBtu) to the UAE (S&P Global 2019).

Even though Qatar would represent one of the least costly solutions for GCC countries Bahrain, Kuwait and the UAE, thanks to short pipelines or existing LNG facilities, an interconnected gas network in the GCC has been hindered by Saudi concerns over Qatar’s influence in the region. That was the case of the Qatar-Kuwait pipeline project. In the early 2000s, Kuwait and Qatar discussed the construction of a gas pipeline, but in 2006 the project was vetoed by Saudi Arabia forcing Kuwait to turn to LNG imports. On the other hand, Saudi Arabia and the UAE are committed to developing and increasing their domestic gas production, for example from the Jafurah shale development in Saudi Arabia or the Jebel Ali gas field in the UAE, even though production from these formations requires significant investments. In conclusion, Qatar represents the least costly solution for GCC gas ambitions, but political tensions and personalized foreign policy often undermine a political solution and an improvement of intra-GCC (gas) relations.

Although energy has not been an issue of the embargo, it is clear that the enormous role of natural gas for Qatar is a crucial element of inter-regional tensions. Natural gas, and the LNG industry, has allowed Qatar to amass vast financial reserves, which have been used to extend its soft power across the region, and pursue a more autonomous foreign policy vis-à-vis its neighbors, such as Iran. Saudi Arabia and Qatar represent two of the most relevant countries in the global energy system, with two opposite energy sources: Saudi Arabia holds a leading position in global oil markets, whereas Qatar in global gas markets.

As Sect. 3.1.2 explained, Qatar has developed its LNG industry since 1996, rapidly becoming the world’s largest LNG player. In 2019, it exported 107 bcm of LNG, exporting 72 bcm to Asia and 32.2 bcm to Europe. Benefitting from its geographical position between Europe and Asia, Qatar has the possibility to implement a diversified strategy of energy security of demand and supply two major gas markets. However, its leading role in the global LNG market is threatened by the advent of other major LNG exporters, notably Australia, the US and Russia (Fig. 3.12, see Chap. 3 Sect. 3.1.2). These three countries, along with Qatar, are expected to lead the LNG industry in the upcoming years. All of them are increasingly looking to Asia, Qatar’s main gas markets. Higher competition is likely to take place also in the European gas markets as LNG is seen as the main solution to reduce Europe’s dependence on Russian gas in the medium term.

However, Qatar has taken courageous decisions during the embargo years despite low energy prices and an oversupplied market. In 2017, Qatar lifted its self-imposed 2005 moratorium on the expansion of North Field, which will expand its LNG export capacity from 77 million tons per annum (Mtpa) in 2017 to 110 Mtpa in 2026. In 2019, Doha announced a second stage that will ultimately increase output to 126 Mtpa in 2027. The expansion strategy aimed to use Qatar’s numerous competitive advantages to respond to mounting competition from other LNG exporting countries despite low oil and gas prices. The first new volumes from North Field are expected to be available by late 2025. Moreover, Qatar is further consolidating its LNG position through the Golden Pass LNG projectFootnote 4 in Texas in collaboration with ExxonMobil—Qatar Petroleum’s first overseas investment in a liquefaction project. The over 10 billion USD project has a capacity of around 16 Mtpa of LNG and exports are expected to commence in 2024. By 2024/25, Qatar is expected to regain its leading role in the LNG industry. Lastly, in 2018 Qatar decided to integrate its two energy companies (Qatargas and RasGas) in order to improve the efficiency of its energy industry and benefit from its several competitive advantages.

Throughout the years, Qatar has increasingly prioritized its gas industry over oil. This was clear when it withdrew from OPEC in 2018. Qatar was an OPEC member since 1961, and although it is not the first country to leave the organization, it is the first country from the MENA region to take such a decision. For oil markets, the decision has little relevance: in 2017 Doha produced 600 kb/d of crude oil, less than 2% of OPEC’s oil output. It is more a political matter. The small emirate’s decision was driven partially by its desire to free itself from transnational institutions that are under de facto Saudi leadership. Also, Qatar was able to withdraw from OPEC because it earns far more from natural gas and related liquid products than from crude oil. LNG provided 42% of export earnings for the country from 2013 to 2017 (Tsafos 2018). However, the role of gas is far more important than this as Qatar is a major producer and exporter of condensates and natural gas liquids, which can only be recovered by producing natural gas. On international markets, liquids command a much higher net-back price than gas. Moreover, Qatar is also home to the largest Gas-to-Liquids (GTL) plant—known as ‘Pearl GTL plant’—jointly operated by Shell and Qatar Petroleum, which however is only profitable when oil prices are very high.

The leading role in the LNG industry has granted newfound political support since late 2021 when Europe has started to deal with rising energy prices and a growing political crisis, which erupted in 2022 with Russia’s invasion of Ukraine. The US and the European countries have been courting Qatar to supply the European gas markets. Qatar expressed its availability to divert some LNG volumes to Europe if Russia decided to cut its gas supplies as geopolitical tensions were surging. This approach granted Qatar newfound status in the US as well. In early 2022, the Emir of Qatar visited the White House and US President Biden announced that the US would grant Qatar the title of major non-NATO ally. This was also due to its crucial diplomatic role in key regional issues for the US: Afghanistan and Iran. In short, in just a year (2021–22), Qatar has managed to regain centrality in the political debate after the isolation period (GCC Embargo 2017–21).

The Ukraine war and the European Union’s consequent wish to reduce as much as possible and as quickly as possible its gas dependence on Russia, is boosting Qatar’s relevance in global LNG markets and helping to consolidate Doha’s newfound political and strategic status in the West. Qatar holds extensive competitive advantages in the LNG industry as its LNG projects are generally attractive in economic terms, resulting in a lower effective average cost of LNG production compared to other competitors. This is also due to the production of condensate and natural gas liquids in association with natural gas. Moreover, Qatar is in a favorable geographic position between the two major global LNG markets—Asia and Europe—and thus able to play in both markets.

1.3 GCC Versus Iran

The animosity between most of the Gulf monarchies and the Islamic Republic of Iran has been a feature of the regional political competition since 1979. This can be attributed to the historical division between Sunni and Shiite. However, different Sunni countries do not share the same approach regarding relations with Iran. Precisely the different approach towards Iran is one of the main causes of the GCC crisis described in previous Sect. (5.1.2). Doha has adopted a cautious approach towards Tehran, eager to promote economic and cultural links. The Qatari approach is mainly motivated by the need to avoid collision with the country that controls the other half of the North Field (South Pars in Iran), which is the source of Qatari wealth. By contrast, other Gulf monarchies see Iran as a competing regional country and a security threat.

Since the Islamic Revolution in 1979, Tehran has felt isolated in the region due to constant pressure. Indeed, Tehran has attracted the animosity of the US, Gulf monarchies and Israel. Right after the Islamic Revolution, Tehran had to face the eight-year war against Iraq. As a response to these challenges, Tehran built a coalition of Shiite groups across the region as the foundation of its sphere of influence, and used those factions to shape events in the region (Friedman 2019a, b). The Iranian arc of influence covers Iraq, Syria, Lebanon and Yemen. However, though its influence in the region is large, it is far from absolute; it is indeed vulnerable to other powers’ activities.

The US identifies Iran and its sphere of influence as a significant threat to U.S. interests and allies since the foundation of the Islamic Republic of Iran and the overthrowing of the Shah. Washington’s main strategic goal in the region is to counterbalance Iran’s influence and prevent any single power from dominating the region. This strategic opposition was sharpened by the US ‘War on Terror’ and the State of the Union speech given by President George W. Bush in 2002 in which he articulated the existence of an ‘axis of evil’, composed of Iran, Iraq and North Korea.

That speech and the ‘War on Terror’ had a traumatic impact on the region’s politics. Indeed, the US invasion of Iraq in 2003 created space for the empowerment of Shi’a parties supported by Iran, following the dismantlement of the Ba’ath regime of Saddam Hussein. Further pressure and enmity have occurred with the advent of the Trump Administration and its ‘maximum pressure’ strategy. Between these two phases of hostility, President Barack Obama tried to engage positively with Iran through an international agreement and by reducing the burden of economic sanctions on Iran’s economy. With the election of Joe Biden in 2020, the US has recommenced nuclear talks and engagement with Iran with the aim to re-create the international framework on nuclear issues despite the numerous challenges.

Since the 1980s, sanctions have been an essential component of US policy towards Iran. At first, US sanctions were intended to prevent and cease Iran’s support to terrorist groups and to limit its strategic power in the Middle East. Since the mid-2000s, the US and its international allies have imposed sanctions targeting Iran’s nuclear program with the aim to persuade Tehran to agree to limiting it.

Sanctions have targeted several sectors of the Iranian economy, with a special focus on the energy sector given its great potential. Throughout the years, countries, mainly the US and the EU, and international organizations, such as the UN, have issued a complex set of sanctions that forced international companies to leave Iran, limited the international sale of Iranian oil, prevented American and European investments in the Iranian energy sector, excluded Iran from the SWIFT banking network, and effectively forced major European banks and insurance companies to stop dealing with the country.

International sanctions have strongly affected Iran’s gas export potential as they have prevented access to the LNG technology. Indeed, Iran and Qatar, which share the North Field/South Pars field, have experienced opposite results in the LNG, with Qatar becoming the leading player while Iran holding zero LNG capacity. For many years, Iran has considered LNG exports in order to fully exploit its large gas reserves. The Iranian ambition clashed with the reality of international sanctions that stalled LNG projects over the past decades. An example, French’s Total and Royal Dutch Shell had two projects, the 10 Mtpa Pars LNG and 16.2 Mtpa Persian LNG, respectively. However, they had to abandon them as sanctions intensified in the 2000s and early 2010s. International sanctions prevented the development of the two LNG projects under the management of the state-owned oil company NIOC due to the re-imposition of sanctions in 2018.

The sanctions enforced by the US and the EU in 2012 had negative repercussions on Iran’s economy as well as on its oil and gas production. Iran’s oil production declined to 2.7 mb/d in 2013, down from 3.7 mb/d in 2011 and Iranian exports of crude and condensate shrunk from 2.5 to 1.1 mb/d in the same period (Jalilvand 2018a). Iran tried to offset the negative consequences of international sanctions, creating a set of counter policies under the umbrella of the ‘resistance economy’ strategy. Under this economic strategy, companies affiliated to the Islamic Revolutionary Guard Corps (IRGC) sought to fill the gap left behind. However, neither IRGC nor the National Iranian Oil Company (NIOC) managed to counterbalance the loss of cooperation with Western companies. Indeed, Iran was unable to stop the decline of its energy industry under sanctions (Jalilvand 2017).

The Iranian energy industry experienced a spark of hope with the signing of the Joint Comprehensive Plan of Action (JCPOA), known as the ‘Iran nuclear deal’. It was concluded in July 2015 between Iran and the ‘E3 + 3’, composed of the European countries France, Germany and the UK, along with the EU, and the world powers, the USA, China and Russia. The JCPOA was formally implemented on January 16, 2016. It allowed the lifting of several sanctions against Iran in exchange for limitations on, and greater international inspections of, Iran’s nuclear program. Under the deal, European companies were allowed back to Iran, investments in the energy sector were possible again and restrictions on exports were no longer in place. Even though the JCPOA did not completely erase uncertainty and all contentious issues, its implementation attracted the interest of several international oil companies (IOCs) from around the world. Numerous companies began signing several memoranda of understanding (MoUs). Among these companies there were American-Dutch Schlumberger, British-Dutch Shell, Chinese CNPC, French Total, German Wintershall, Italian Saipem, Japanese Inpex, Norwegian DNO, and Russian Gazprom.

In July 2017, Iran reached a first and important milestone by signing a $4.8 billion contract with Total and CNPC, which formed a consortium to develop the eleventh phase of the giant South Pars. The contract was welcomed enthusiastically at first, but it turned out to be the exception rather than the rule; indeed, it did not produce further deals with Western partners.

Total had a long history with Iran’s energy industry, having developed the second and third phases of the South Pars field, and it was the last European company to leave the country in 2010. Additionally, Total affirmed that it could afford the initial investment of $1 billion from the company’s own cash reserves, overcoming a major obstacle to cooperation and investment in the country. Moreover, the decision to cooperate on gas rather than oil was probably motivated by the belief and hope that natural gas projects in Iran might be more acceptable to the US than oil (Jalilvand 2018b). Indeed, natural gas is mostly used for the Iranian domestic market, whereas oil is exported abroad providing hard currency for the Iranian regime. For example, in 2016, the IMF estimated that Iran’s oil exports account for between 50 and 60% of total exports and almost 15% of GDP (Ratner 2018). This is the main reason why Washington imposed sanctions on Iranian oil, aiming at preventing revenues that could finance Iran’s activities in the Middle East.

In March 2018, Iran signed a second contract with a foreign company, Russia’s state-owned Zarubezhneft, marking a potential growth of international cooperation. The Russian company agreed to develop jointly with NIOC and private Iranian company Dana the Aban and West Payedar oil fields, both shared with Iraq. Under the 10-year deal, the Russian company had a stake of 80% (Jalilvand 2018a, b). Moreover, Zarubezhneft would have provided enhanced oil recovery (EOR) technologies that would allow adding 48,000 b/d to Iran’s production from the two fields. The advent of a Russian company was a major news for Iran, representing Iran’s ambition to diversify its international energy portfolio. Indeed, all previous international energy contracts were concluded either with Asian or (West-) European companies.

Meanwhile, the removal of several international sanctions contributed to the increase of domestic output (back to 4.5 mb/d in 2016) and its comeback into the international oil markets. Iran has increased its oil production to 4.5 mb/d in 2016.

The JCPOA was also a major change for US regional policy. It was at the heart of Obama’s vision on the region. Obama decided to engage positively with the moderate and reformist area of the Iranian regime, led by President Hassan Rohani and Foreign Minister Mohammad Javad Zarif. However, the substantial change of the US Middle East policy caused alienation between Washington and its more traditional allies in the region, notably Saudi Arabia, the UAE and Israel. These countries expressed their great anxiety over the risk of the fading US security supervision within the region as well as its engagement with Tehran.

Saudi Arabia is seen as the regional nemesis of Iran. Traditionally, the 1979 Revolution is considered as the watershed moment in the region. This event certainly played a crucial role in shaping the relationship between the two countries. However, in the years before the revolution, both Iran and Saudi Arabia were seen as ‘twin pillars’ of Gulf security following the UK withdrawal from the region. In this security structure, Iran played a key role as a bulwark against the Soviet threat to the region (Mabon and Wastnidge 2020). Both countries had regional ambitions and roles as major oil producers. Nevertheless, as Riyadh began to assert its position as a key oil producer, it was able to undermine Iran’s regional clout thanks to its role in the Arab oil embargo in response to the Yom Kippur War and its rapidly swelling coffers (Idem). Thus, in the lead up to the events of 1979, both states ramped up their military spending to reinforce their regional standing and domestic control. Since the 1979 Islamic Revolution, Saudi Arabia and the US has consolidated their security ties more and more.

Obama’s decision to engage with Iran has shaken the traditional security and political structure of the region. Moreover, under the Obama Administration, the US foreign policy has begun to focus toward other areas, notably Asia (i.e. “pivot to Asia”). Simultaneously, in those years, the US had increased its oil and gas domestic production, resulting in a decrease of reliance to Middle East hydrocarbon imports. These transformations contributed to increasing uncertainty in the region, with Saudi Arabia and the UAE starting to fear that the US security umbrella would be reduced or worse. That led to a more assertive foreign policy undertaken by these regional players and their leadership. In this scenario, in 2015 Saudi Arabia and the UAE waged the Yemen war, seeking to restore the previous Yemeni government to power. The military operations targeted the Houthis group, backed by Tehran, starting another proxy war between Saudi Arabia and Iran.

However, the election of Donald Trump as President of the US in November 2016 marked the turning point of this region’s politics. He has consolidated a strong (personal) relationship with the Saudi and Emirates leadership—particularly with the Saudi Crown Prince Mohammed bin Salman. An odd group of countries has been gathered around Trump’s foreign policy toward Iran. Indeed, the strong animosity against Tehran was welcomed by Saudi Arabia, the UAE and Israel. Israel and the Gulf monarchies have begun a coordinated action against Iranian activities in the region, marking a major development in the region’s politics. The three countries were particularly worried about Iran’s nuclear program, criticizing the signature of the JCPOA. Thus, they found a new ally in Washington with the advent of Donald Trump. Indeed, during the presidential campaign and his presidency, Trump has openly criticized the Iran nuclear deal, condemning Iranian activities in the region against US interests and allies.

In the pursuit of reducing Iran’s sphere of influence in the region, the Trump Administration established the so-called ‘maximum pressure’ strategy, designed by Ambassador John R. Bolton.Footnote 5 Under this strategy, the US has re-imposed sanctions against Iran weakening the international architecture of the JCPOA. On May 8, 2018, the Trump Administration announced the immediate and full withdrawal from the JCPOA, resuming all nuclear-related US sanctions. To further put pressure on Iran, on November 6, 2018 Washington re-imposed all US secondary sanctions, which are applied also to third countries that have economic ties with Iran. The US has increased its pressure on Iran’s energy industry through its unilateral sanctions. The US decided to prevent not only the international sale, but also exports of Iranian oil products and natural gas—unlike before the JCPOA (Jalilvand 2019). At the same time, the US decided to grant temporary sanctions waiversFootnote 6 to eight importers of Iranian oil: China, Greece, India, Italy, Japan, South Korea, Taiwan, and Turkey. In doing so, these countries could continue importing Iranian oil for a period of 180 days.

Despite these concessions, the US decisions prevented Iran’s full return to the international energy landscape. All IOCs left the country in 2018 and Iran’s oil exports fell sharply. Crude oil exports collapsed from an average of 2.5 mb/d in 2017 to just around 1 mb/d in April 2019 (Greenley 2019). In the first half of 2020, Iranian crude and condensate exports averaged just 238,000 b/d, worsening Iran’s economy. Oil and gas revenues brought in just $8.9 billion for the last Iranian calendar year2, compared to $27.8 billion in the year before—the last year before the renewed sanctions took effect.

The unilateral withdrawal from JCPOA reverberated also on transatlantic relations, with a political drift between Washington and its European allies. Indeed, Europeans expressed their commitment to keeping the JCPOA in place, supporting trade and investments with Iran. In August 2018, the EU introduced its Blocking Statute, asking European companies not to follow US sanctions. Yet, all European IOCs left the country and by February 2019 no Iranian oil reached European shores. As a consequence, Iran lost the European market which accounted for 25% of its exports in 2017 (Jalilvand 2019). Asian countries were also affected by US decisions. Most of them are also traditional allies of the US, such as South Korea, Japan and India.

Russia and its energy relations with Iran were affected too. On the one hand, Russia effectively cancelled its investment in Iran made by Zarubezhneft. On the other hand, Russia has benefited to some extent from the US sanctions regime against Iran’s oil and gas sector. The blockade of Iranian oil has left room for other producing countries, including Russia. As the grades of Russia’s oil are similar to Iran’s, Moscow has thereby contributed to replacing Iranian oil globally.

One major consequence of the maximum pressure strategy has been the increase of security concerns among US regional partners. Tehran has responded to increasing pressure with some important activities and operations in the region, which led to an intensification of tensions among regional players. Iranian activities and responses targeted both Saudi and international oil facilities as well as energy infrastructures. Additionally, Iran has decreased its compliance with some of the nuclear commitments of the JCPOA since mid-2019.

Since May 2019, Iran has staged operations in the region, increasing tensions on the global oil market. For example, Tehran targeted ships in port, then tankers in transit and finally it captured a British tanker and crew on the high seas. These activities were undertaken in the world’s most important chokepoint for oil and gas trade: the Strait of Hormuz (Map 5.1).

Persian Gulf and the Strait of Hormuz. Note Location of terminal icons are indicative and not a precise location.

Iran has always used the Strait of Hormuz as a strategic element of its security policy. It has never hesitated to use it as a geopolitical instrument for pressuring the change of US policies. For such reasons, every time tensions in the region rise, concerns about the chance of a closure of the Strait by Iran are expressed globally. Therefore, there is a direct correlation between the threat level perceived by Iran and the actions undertaken by the regime in the Strait. Its actions must be read with this lens.

The Hormuz Strait is a crucial element of the global oil and gas market. In 2018, the daily oil flow through this narrow passage—just 41 km wide at its narrowest point—averaged 21 mb/d, which accounts for about 21% of global petroleum liquids consumption. The top oil supplier through the Hormuz Strait is Saudi Arabia, followed by Iraq. Given the security risks, alternative routes are often considered by Gulf producers. Until 2021, the only operating bypass pipelines are of Saudi Arabia and the UAE: Riyadh has the East–West pipeline and the UAE controls the Habshan-Fujairah pipeline. However, these existing alternative routes are very limited and face some challenges.

The Saudi East–West pipeline carries crude to the Red Sea Yanbu ports, which have crude storage of around 22.5 mn b/d and can export in excess of 5 mn b/d. The pipeline delivered 1.53 mn b/d to refineries in 2018, which would still leave space for more than 3 mn b/d crude for exports—less than half of typical Saudi exports of 7 mn b/d. Saudi Arabia is boosting its Red Sea capacity by expanding the East–West pipeline to 6.5 mn b/d by 2023 in order to further reduce its vulnerability on Hormuz. Saudi vessels headed to Asian markets would need to pass through the Bab al-Mandeb. The Habshan-Fujairah pipeline links the onshore Habshan with the port of Fujairah located outside the Strait of Hormuz. Abu Dhabi typically exports up to 800,000 b/d from Fujairah, while total Emirati exports are typically around 2.4 mb b/d. Thus, the two alternative routes could accommodate an additional 3.5 million barrels per day. However, to put into context, it corresponds to only 17% of current Hormuz oil exports (Schaus 2019). Furthermore, also these routes have been targeted by some attempted attacks, leaving the security concerns unanswered. Indeed, the Bab al-Mandeb is a perilous stretch of water and there have been episodes of attacks to Saudi tankers in July 2018 when transiting the passage.

In July 2021, Iran itself has built and inaugurated its first oil export terminal on the Indian Ocean. The Bandar-e Jask terminal cost $2 billion and is located at the end of the 1,100 km-long Goureh pipeline (with a transmission capacity of 1 mb/d) in the Gulf of Oman (Map 3.2 in Chap. 3 Sect. 3.1). Obviously, the construction of the terminal is not motivated by security concerns over blockade, but it can provide new room for future periodic threats from Iran to block Hormuz. Indeed, until the commissioning of the terminal, Iran would have blocked also its own oil export.

It is clear that a potential closure would have important consequences for importing countries depending on the degree of reliance on oil or gas imports from this area. From this perspective, Asian countries are more reliant on the hydrocarbon trade through Hormuz than Western countries (Fig. 5.2). In 2018, 76% of the crude oil and condensate that moved through the Strait of Hormuz went to Asian markets; with China, India, Japan, South Korea as the largest destinations (accounting for 65% of all Hormuz crude oil and condensate flows in 2018). In terms of volumes, China is the largest importer of oil from the region, but it is not the most reliant country on these flows given the size of its overall oil demand. Japan, South Korea and India are particularly dependent on these exports. The US still imported 1.35 mb/d in 2018 (Schaus 2019).

Source CSIS research and analysis using data from EIA, IEA, PPAC, KEEI, and PAJ; John Schaus and Andrew J. Stanley, “Oil Markets, Oil Attacks, and the Strategic Straits,” CSIS, CSIS Commentary, July 19, 2019, https://www.csis.org/analysis/oil-markets-oil-attacks-and-strategicstraits. Reprinted with permission

Asian Importers rely heavily on Hormuz Export Flows.

Thus, Japan, South Korea and India have an immediate vulnerability to any potential disruption at the Strait. However, an extended disruption would have pricing impacts not limited only to these markets but globally. The Asian economies would feel more economic pressure, while the US could have some benefits as exporter. However, also the US economy would be affected to some extent by higher prices, as the entire world’s economy.

The Strait of Hormuz is critical also for the global LNG trade. Indeed, the Middle East accounted for 26.3% of global LNG exports in 2018, being one of the main supply sources of LNG in the world. Qatar exported 76.8 Mt (24.5% of global LNG exports), while UAE exported 5.5 Mt (1.8% of global LNG exports). These LNG volumes must pass through the Hormuz Strait. Although the maritime natural gas trade through the Hormuz Strait represents a relatively small proportion of global natural gas trade (8.4%), any disruptions to these flows could have severe energy pricing impacts for LNG dependent importers. Of the top 10 importers of Qatari LNG (the main source from Hormuz), eight are Asian countries and two are European, stressing the shift of destination of Qatari LNG throughout the years (Table 5.1). This could potentially change in the future as Europe seeks to import high LNG volumes to reduce its overdependence on Russia’s gas.

However, the world today is very different from the one of 1973. Recent assertive operations along this narrow passage had a smaller impact on oil prices. By contrast, geopolitical risks added a premium to oil prices in the 1970s. Today, climate policies and technological developments are expected to drastically reduce the use of hydrocarbons. Moreover, over the period 2015–2020, both oil and gas markets witnessed an oversupply condition with low prices. Therefore, assertive operations along this narrow passage had less impact than those back in the 1970s. Nevertheless, some countries are concerned about regional tensions in the Hormuz Strait, especially those that rely heavily on oil and gas flowing through the Strait and that could be harmed by potential disruptions. In 2018, 76% of the crude oil and condensate that moved through the Strait of Hormuz went to Asian markets; with China, India, Japan, South Korea as the largest destinations (accounting for 65% of all Hormuz crude oil and condensate flows in 2018). A different scenario would be a closure of the Strait, which currently seems unlikely. A complete blockade of transits through Hormuz would cause major oil and gas price spikes and potential disruptions due to the relevance of exporting countries in this region for the global oil and gas markets.

China has been a major importer of Iranian oil, helping the Iranian regime to collect revenues that are vital for its economy. Following the JCPOA, China’s CNPC entered the Iranian upstream sector through the international consortium with Total for the development of the eleventh block of South Pars. Beijing has also been one of the top importers of Iranian oil. In 2018, Iran exported around 650,000 b/d of oil to China (S&P Global 2020a, b). However, Iranian oil exports to China were severely hit by US sanctions. Indeed, in the second half of 2019, Iranian crude and condensate exports declined to around 225,000 b/d down from around 400,000 b/d in the first half of the year (Idem). Moreover, CNPC left the consortium for the development of the eleventh block of South Pars, following Total’s withdrawal in August 2018, showing the Asian buyers’ sensitivity to US sanctions.

Moreover, China must face a broader and increasing political confrontation with Washington. Since Beijing is one of the most relevant importers of Iranian oil, China will want to avoid Iran’s crude imports getting caught up in the broader US-China relations—mainly in light of the risk to its large energy traders—even as negotiations with the US have once again reached a dead-end (Meidan 2019).

An example is the US Department of State’s announcement on July 22, 2019 concerning its decision to impose sanctions on a Chinese trader, Zhuhai Zhenrong, and its chief executive for knowingly purchasing or acquiring oil from Iran, contrary to US sanctions (Idem). The US decision was driven by the need to pursue its maximum pressure strategy. Meidan (2019) explains that the US decision may be seen as a sign of further escalation in the already fraught relations between the US and China, but in reality the choice of Zhuhai Zhenrong allows both the US and China to maintain opposing diplomatic stances on Iran, without further damaging their increasingly tense bilateral relations. Indeed, Zhuhai Zhenrong has limited exposure to the US market, so the designation is effectively meaningless (Idem). Despite the effects of these sanctions, Beijing will therefore tread carefully with its Iranian imports.

Regional tensions reached a new level on September 14, 2019, shaking the oil markets. On that day, a drone and missile strike hit Saudi Arabia’s Abqaiq and Khurais oil facilities. Iran’s direct (or indirect through its proxy) role in the attacks was a critical development in the region’s politics and in the global energy system. Indeed, Friedman (2019a, b) explained that Iran aims at generating pressure on the US to ease US pressure on the Iranian economy. Tehran identified Saudi Arabia as both vital to the anti-Iran coalition and yet vulnerable to regional tensions. Additionally, Tehran evaluated that Saudi is most vulnerable in oil revenue. So, it supported the attack in order to demonstrate the vulnerability of the Saudi oil industry, while reducing Saudi oil production and inflicting real pain (Idem). Indeed, Abqaiq is the most important oil facility in Saudi Arabia; the plant has a processing capacity of 7 mb/d. Although it was running at 4.5 mb/d at the time of the attack, its capacity accounted for more than 50% of the Kingdom’s output (MEES 2019a, b, c). The Saudi Energy Minister affirmed that the attack curtailed Aramco production by 5.7 mb/d to around 4.1 mb/d, implying that the Khurais facility operated at 1.2 mb/d at that time (Idem). Despite its profound significance, the action had only a limited effect on the global oil market and on oil prices. Also, the US did not respond as strongly as they would have done in the past. This can be mainly motivated by the impressive growth of US domestic oil production, which has reduced Washington’s vulnerability and produced a more assertive foreign policy.

The greater assertiveness of US foreign policy thanks to its oil production was reaffirmed by a remarkable operation. On January 3, 2020, the US killed Iranian Lieutenant General Qassem Soleimani, head of Iran’s Islamic Revolution Guards Corps (IRGC) Qods Force, with an air strike at the Baghdad International Airport. It was an unprecedented event, given the relevance of the target. The air strike produced a sense of uncertainty on the GCC countries and US regional allies, which called for a de-escalation of regional tensions. Indeed, the Sunni countries have begun to fear a military escalation between the US and Iran, especially after Iran demonstrated its capability to target both Saudi and Emirati shipping and assets. This risk persuaded leading GCC players to take a more prudent approach, adopting a relatively conciliatory tone.

With the election of Joe Biden, the US has restarted talks with Iran in Vienna aimed at re-establishing the JCPOA. A potentially renewed JCPOA could contribute to bringing Iranian hydrocarbons back to the international energy markets. Yet, the diplomatic effort faces several challenges. Within the US, Republicans have expressed their opposition to the deal, while in the region the US needs to address Gulf countries’ concerns. Lastly, Western sanctions imposed on Russia following its invasion of Ukraine have driven Russia to abandon its facilitating role in Iran’s nuclear negotiations. Moscow has requested Western governments guarantees that the sanctions related to the Ukraine invasion do not affect and threaten Russia’s relationship with Iran. In doing so, Russia has limited the potential comeback of Iranian oil into the world’s tight market and halted the negotiations.

2 Mashreq

The East Mediterranean cluster, which in this book comprises Egypt, Iraq, Israel, Jordan, Lebanon, Palestine and Syria, has been characterized by rising geopolitical tensions and energy hopes. Over the past decade, energy and power politics have shaped major developments in the area. A growing number of exploration and production activities in the Eastern Mediterranean Sea have brought several oil and gas discoveries offshore Egypt, Israel and Cyprus. Meanwhile, Iraq and Syria have experienced serious social unrest and military conflicts within their borders, which reverberate throughout the entire region.

Cooperation and competition have developed often around energy as it plays an important role in the area. In this cluster, Iraq, Egypt and Syria are traditional hydrocarbon producing countries, while Israel has become a gas producing country only in the last decade. By contrast, Lebanon and Jordan have not found exploitable reserves so far. Old and new regional competition meddles with new energy discoveries and regional energy potential. This section will analyze first two of the traditional hydrocarbon producers in the area: Iraq and Syria. The other major hydrocarbon producer, Egypt, will be analyzed with special emphasis on the East Mediterranean gas saga, which started around 2010.

2.1 Oil and Gas Sector in Conflict Countries: Iraq and Syria

-

Iraq

Within the East Med cluster, Iraq stands out as a major oil player. Iraq holds a great amount of reserves of oil and gas (145 thousand million barrels and 3.5 trillion cubic metres at the beginning of 2020, respectively). Iraq holds the world’s fifth largest proven oil reserves, accounting for around 10% of the global total. Most of its resources are considered as the world’s least expensive and easiest oil to extract. Although these reserves are geographically dispersed throughout the country, the majority is located in the south, concentrated in and around the city of Basra, while 17% are found in the north. According to the IEA (2019), Iraq’s oil fields in the South contain abundant conventional, low-cost onshore oil resources. This area are also includes the “big 4” oil fields of Rumaila, West Qurna, Zubair and Majnoon. The “big 4” fields combined account for 60% of Iraq’s oil production in 2018, and an estimated 70% of the increase in Iraq’s production to 2030 (Idem).

Rumaila and West Qurna are ranked among the top-15 largest oil fields globally based on remaining reserves. By contrast, just under a fifth of Iraq’s production in 2018 came from the North, primarily from the Kirkuk and Bai Hassan fields. The area of Kirkuk is where Iraqi oil was first discovered in 1927, but the area is at the heart of the dispute over land rights and oil revenue sharing between the central government in Baghdad and the Kurdistan Regional Government (KRG) in Erbil, which delayed the development of the region’s resources. It has been further frustrated by the battles against ISIS in the 2014–17 period.

However, Iraq’s oil production and exports have consistently lagged behind the potential of its resources. For example, Iraq’s oil output (1.3 mb/d) did not diverge widely from that of Saudi Arabia (2.2 mb/d) in the mid-1960s; but Iraq had reached only 2 mb/d in 1973 while at the same time Saudi production was close to 8 mb/d (IEA 2012). Additionally, three wars (against Iran from 1980 to 1988 and US-led coalition forces in 1991 and 2003), international sanctions and internal instability have prevented Iraq’s oil output expansion. For example, Iraq had some success in the 1970s, bringing oil towards the strategic goal of creating a 5.5 mb/d production capacity by 1983 formulated at that time. However, this goal was never reached because of the Iran-Iraq war. The war reduced Iraq’s production to 1 mb/d, with exports collapsing from 3 mb/d to 750,000 b/d. A subsequent plan to raise capacity to 6 mb/d by the mid-1990s was once again not realized, because of the First Gulf War in 1991. The US-led Operation Desert Storm inflicted severe damages on Iraqi oil infrastructure. Lastly, Iraq’s oil output suffered another major setback following the US-led invasion in 2003 and the collapse of the former Hussein regime. Indeed, it fell from 2.5 mb/d in the early 2000s to approximately 1.4 mb/d after 2003.

Conflicts and regional politics have also affected Iraqi export growth and potential routes, particularly from the northern region. Indeed, oil produced in the southern regions is exported via sea from the Basra and Khor al-Amaya ports. However, the existing infrastructure does not provide adequate capacity for the potential growth of export volumes. Instead, most of Iraq’s major crude oil pipelines are located in the north (Map 5.2).

Iraq’s oil and natural gas infrastructure.

The Iraq-Iran War altered the Iraqi pipeline map. At the time, Iraqi oil moving eastwards via Syria was blocked due to President Hafez al Assad’s support to Iran during the conflict. Therefore, with no viable export route for Iraqi oil through Syria, Baghdad increased its reliance on Turkey via the Iraq–Turkey pipeline (whose capacity was raised from 750,000 b/d to 1.5 mb/d) (Mehdi 2018). Additionally, Baghdad tried to further diversify its export routes striking a deal with Saudi Arabia to have a pipeline from southern Iraq to the Saudi Yanbu port on the Red Sea. It was commissioned in 1990 but closed and expropriated by Riyadh after the Iraqi invasion of Kuwait (IEA 2019).

Iraq’s oil exports are mainly shipped to Asia, which accounts for over 60% of its total crude oil exports, while Europe is the destination of 25% of Iraq’s crude oil exports. Asia, China, India and South Korea are the key buyers of Iraq’s crude oil, with China and India importing almost 1 mb/d each.

Despite damages due to conflicts and impressive domestic challenges, Iraq has been able to nearly double its oil production over the past decade to 4.7 mb/d, accounting for a fifth of the net increase in global supply. In 2019, Iraq ranked as the fifth-largest source of global oil supply (IEA 2019). The recent growth cemented Iraq’s position as OPEC’s second largest producer, with federal production capacity just under 5 mb/d as in early 2020. Oil production growth has produced an increase also in the export volumes, with southern exports passing from 1.7 m b/d in 2007 to an average of 3.5 m b/d in 2019.

Oil and gas are core pillars of the country’s economy, accounting for almost 60% of the country’s GDP, 99% of export earnings and 90% of government revenues, making the Iraqi economy one of the most oil-dependent in the world (IEA 2019). At the same time, this abundance is also Iraq’s Achilles’ heel due to poor management and its unstable political economy. Following a “pro-cyclical” fiscal policy, the Iraqi economy suffers the volatility of oil prices, especially when oil prices fall under its breakeven fiscal price undermining the government’s expenditures and plans to improve the living standards of its own citizens.

Moreover, the Iraqi energy sector must deal with some challenging features. Iraq’s oil sector has been undergoing a significant upstream growth, while its midstream and downstream have failed to keep pace. Unlike its upstream regional peers, Iraq is the only major producer heavily reliant on refined product imports, reflecting an underdeveloped refining system and a misalignment between the production yield of Iraq’s refining output and its domestics demand (Mehdi 2018).

The hydrocarbon industry is also at the center of a national political debate between the central government in Baghdad and the KRG in Erbil. Baghdad and Erbil have debated strongly over the control of the resources and their revenues. Under the 2005 Iraqi constitution, KRI enjoys considerable administrative autonomy. However, relations between the KRG and the central government are shaken by issues concerning territory, energy and revenue sharing. As already mentioned, Erbil and Baghdad fight over the control of the oil-rich area of Kirkuk. In 2014, the Iraqi military abandoned Kirkuk, as ISIS was emerging and expanding across the area. The Kurdish Peshmerga units fought against ISIS and regained control over the area. From that moment on, the Kirkuk oil has been sold by the KRG rather than the central government. This has inevitably ignited Baghdad’s opposition. In 2022, the Federal Supreme Court ruled Iraqi Kurdistan’s 2007 oil and gas law unconstitutional. The law regulates the Kurdish oil sector and is the basis for foreign companies’ investment in the region.

Oil is essential for the cash flow of both Baghdad and Erbil, but the two entities disagree over oil export revenues. In September 2017, the KRG held a controversial advisory referendum on independence, amplifying political tensions with the national government. As a response, the Iraqi military forces reentered some disputed territories, regaining control of some oil fields in the region. The two entities have extensively discussed revenue sharing and exports of oil and gas produced in the country. In 2018, the central government and the KRG reached an agreement to resume the export of Kirkuk oil to Turkey’s Ceyhan port via the KRG pipeline, which can handle up to 1 mb/d of export flows (IEA 2019). Regarding export routes through KRI, Russia has risen as a potential broker of a deal between Baghdad and Erbil.

Moreover, Iraqi ambitions to increase its oil production in the future cannot be translated into reality unless significant quantities of water are available for field injection. Indeed, many of Iraq’s oil fields have relatively low recovery factors. Therefore, secondary oil recovery is needed to boost recovery factors and maintain or increase production rates. Being essential for secondary oil recovery, water availability and supply are great concerns for the Iraqi oil industry and IOCs in the country. For example, plans were drafted in 2011 to build the Common Seawater Supply Project (CSSP) that would process seawater from the Gulf and transport 5 mb/d of treated seawater to the largest oil fields in the South to be used for injection. IEA (2019) estimated that in total, by 2030, over 8 mb/d water will be required for Iraq’s oil production, up from 5 mb/d used in 2019.

Contrary to its well-developed oil sector, Iraq’s gas sector has been ignored for a long time. Its reserves and production are large, but Baghdad has not been able to use it efficiently and sufficiently. The vast majority of its gas reserves is associated gas, with some significant reserves of non-associated gas. Since Iraq does not have adequate infrastructure in place to allow the production of associated gas and provides few incentives to produce and use it efficiently, Iraq flares a large portion of its gas production, ranking as the world’s second-largest source country of flared gas in the world behind Russia. However, natural gas would be highly beneficial for Iraq’s economy and independence. As of today, Iraq continues to suffer power shortages, which often lead to social unrest like that occurred in Basra in mid-2018.

The great potential of Iraq’s oil and gas industry has attracted several foreign companies and actors. Some IOCs have invested in the promising Iraqi oil upstream sector. The IOC operations in Iraq are governed by the Technical Service Contract (TSC) model. Under the TSCs5, IOCs are reimbursed for their production costs on a quarterly basis and receive a taxable remuneration fee on incremental production, meaning production above pre-contract levels. The big 4 fields (Table 5.2) are operated by ExxonMobil (West Qurna-1), BP (Rumaila), Eni (Zubair) and Lukoil (West Qurna-2).

IOCs have contributed to sustaining and developing Iraq’s oil sector. Also, the natural gas sector has attracted some major international companies. For example, Shell decided to end its oil activity in Iraq but it is the most active IOC in the gas sector through its gas-capture program in Basra, which is jointly operated with the Iraqi government (the Basrah Gas Company) (IEA 2019).

Furthermore, Baghdad’s energy sector is caught up in the competition between Washington and Tehran. Iraq relies heavily on Iran both for electricity and natural gas. As previously mentioned, Iraq flares the vast majority of its gas output and at the same time imports gas from Iran. In 2019, Baghdad received around 7 bcm of gas and 1.57 GW of electricity. Some experts have estimated that Iran, directly and indirectly, met a whooping 28% of Iraq’s peak summer power supply (MEES 2020a). The US seeks to create and support a strong Iraq, capable of tackling Iran’s expansion activities in the region.