Abstract

Central Asian countries are highly vulnerable to climate change and heavily reliant on fossil fuel resources. All countries need to decarbonise their economies for sustainable growth and to meet their Paris Agreement goals. Within this global challenge, there are significant opportunities for Central Asian countries, such as attracting green investment through the expansion of renewable energy, phasing out fossil fuel subsidies and improving energy efficiency. This chapter presents the results of a study that investigated how carbon pricing instruments are currently used in Central Asia and what the future holds. The study determined that CPI and decarbonisation strategies are now being considered by Central Asian countries at different levels. A SWOT analysis of carbon pricing instrument implementation revealed ways to facilitate the implementation of carbon pricing to decarbonise the regional economy. The study also identified a list of mid- and long-term decarbonisation activities for governments and other stakeholders, and analysed opportunities to strengthen regional cooperation.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

The purpose of this chapter is to provide a regional overview of the carbon pricing trends in Central Asia and to propose strategic recommendations for decarbonisation. Many different trade-offs and adjustments to the energy mix can be made if new decarbonisation initiatives are introduced to the region’s energy systems.

Setting a price on greenhouse gas (GHG) emissions, either directly through a carbon tax or indirectly through an emissions trading system (ETS), is one of the most important policy interventions for reducing GHG emissions. Carbon pricing instruments (CPIs) can stimulate a transition to a low-carbon economy (UNFCCC 2021a), and CPIs are being rolled out around the world as effective policy tools. Since 2012, the overall number of CPIs has nearly doubled (World Bank 2020). Yet despite the progress that has been made to date, approximately 78% of global carbon emissions are not yet priced. Existing carbon pricing schemes have a much lower tariff than the 40–80 dollars per tonne thought to be necessary to meet nationally determined contribution (NDC) goals and the new challenges discussed at the 2021 United Nations Climate Change Conference in Glasgow (COP 26) (World Bank 2021; Nguyen 2019).

Beyond the observation that carbon pricing is being adopted as a policy tool, little is known about key barriers to or issues in implementing market-oriented mechanisms in the Central Asia region (Vakulchuk et al. 2022a). To fill this gap, we carried out a comparative review analysis to investigate adoption tendencies (relating to both current and planned policies) with a view to ascertaining what significant opportunities can be identified for the decarbonisation of the region’s economy.

2 Regional Overview

2.1 Emissions Profile and Fossil Fuel Subsidies

Kazakhstan, Uzbekistan and Turkmenistan have the largest carbon footprints among the Central Asian countries (UNFCCC 2022). In total, the region emitted 710.5 million tonnes of CO2-equivalent (MtCO2e) in 2019, with Kazakhstan accounting for 55.7% (~396 MtCO2e), Uzbekistan 28.9% (~205 MtCO2e), Turkmenistan 12% (~85 MtCO2e), Kyrgyzstan 2.1% (~15 MtCO2e) and Tajikistan 1.3% (~9.5 MtCO2e). The difference between the countries is thus significant (World Bank 2022). It is also worth noting that emissions for the region peaked in the 1990s, before the dissolution of the Soviet Union, and have not reached such levels since.

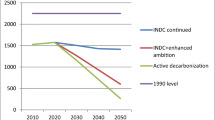

Kazakhstan and Turkmenistan are substantial oil and gas exporters whose per capita emissions grew by almost 70% from 1998 to 2014. This is not reflected in Fig. 1 as it relates emissions to purchasing power parity (PPP) rather than the size of the population. During the same period, Uzbekistan’s per capita emissions fell by 1.6 tonnes. The economies of the lower-emitting countries, Kyrgyzstan and Tajikistan, rely on agriculture which is exposed to climate change. Those countries—Kazakhstan, Uzbekistan and Turkmenistan—with higher economic growth (based on fossil fuel exports) also have higher energy demands, with high levels of fossil fuel consumption in the power sector. This clearly highlights an urgent need to implement new beneficial CPIs for these economies. Tajikistan, on the other hand, utilises hydropower for 98% of the country’s electricity generation (IEA 2020). Yet this is only 5% of its hydropower potential. The other Central Asian countries are also using only a fraction of their current hydropower potential (see below). Hydropower would therefore appear to be key to the decarbonisation of the region’s power generation (Reyer et al. 2015).

Fuel consumption subsidies by selected countries (compiled by authors based on International Energy Agency data) (IEA 2018)

There is also another way to diversify the economies of these countries. The region’s heavy reliance on fossil fuel exports could be replaced with a focus on the export of mineral resources for the green transition. If Central Asia’s production of mineral resources for green technologies expands, the adjustment would help the region’s decarbonisation and strengthen its global position as a critical materials supplier (Vakulchuk and Overland 2021). This is especially true for the major fossil fuel producers.

Kazakhstan, Uzbekistan and Turkmenistan heavily subsidise their domestic consumption of fossil fuels, lowering retail prices of power and transport fuel below the world average and discouraging the expansion of renewable energy (RE) for power generation. Large-scale fossil fuel subsidies are known to undermine the effect of CPIs. Central Asian governments should therefore review their fossil fuel subsidies as carbon pricing methods evolve (IEA 2018) (Fig. 1).

2.2 Climate Commitments and RE Potential

Central Asia has considerable potential for generating electricity from wind, solar and hydropower. Uzbekistan already exploits 40% of its technically feasible hydropower potential, while Kazakhstan and Kyrgyzstan utilise only 13% and 15% respectively and Turkmenistan has only one hydropower station. While hydropower represents 98% of Tajikistan’s domestic power supply, the country is still only using 5% of its hydropower potential.

RE must be secured against intermittency. Greater efficiency and grid stability and greater RE penetration might be achieved by integrating diverse energy sources (e.g. gas, water, wind, solar) into unified power generation systems across countries. The individual Central Asian countries have different strengths and seasonal dynamics in power generation. For instance, Tajikistan and Kyrgyzstan have strong hydropower potential in the summer, while Uzbekistan and southern Kazakhstan have good thermal electricity potential in the winter. Yet electricity provision in Central Asia remains divided. Cross-border electricity exchanges in the region could reduce the need for peak and backup capacity reserves within the respective national systems, while optimising electricity transfer between states will optimise the use of water resources, especially in summer. By fully exploiting and further expanding the area’s integrated power transmission infrastructure, countries could significantly lower their operational costs. Discussions are being conducted at regional and international levels to increase interconnectivity and improve system value. For instance, the CASA-1000 project, connecting nations in Central Asia (Kyrgyzstan and Tajikistan) and South Asia (Afghanistan and Pakistan), will expand power trading prospects within and beyond the Central Asian region (World Bank 2020). The Central Asian countries may thus increasingly be able to identify opportunities to export green electricity.

2.3 Consideration of CPI Adoption

Kazakhstan is the first (and to date the only) Central Asian country to have introduced a CPI. This is in the form of a domestic emissions trading system (ETS) which was launched as a pilot in 2013 (CAREC 2021). All other Central Asian countries are currently considering carbon pricing tools at various institutional levels to cut emissions in accordance with their NDCs, but the governments have not yet made any formal commitments to CPIs (Table 1).

3 Methods

This chapter employs a comparative review analysis of publicly available information from national reports produced by policymakers in each Central Asian country. The authors also conduct a SWOT analysis of the potential for deploying carbon pricing instruments (CPI) in each country. Individual country profiles are presented first, followed by a discussion of the results of the SWOT analysis and a consideration of the potential for collaboration between the countries towards regional decarbonisation. On the basis of the analysis, we develop recommendations for governments and other key stakeholders.

4 Carbon Pricing Considerations in Individual Central Asian Countries

In this section we present the findings of the comparative review, highlighting the key factors that influence the success of decarbonisation efforts, including the adoption and effective implementation of CPIs, in individual Central Asian countries. Following the presentation of the individual country profiles, we consider the findings in a cross-regional perspective.

4.1 Kazakhstan

Kazakhstan is Central Asia’s largest GHG emitter. In 2018, it produced 396 MtCO2e of GHG, close to the 1990 baseline. The ‘Concept of Transition towards a Green Economy—2050’ was adopted in 2013. Renewable sources contributed 3% of electricity generation in 2020 (excluding large hydropower, which accounted for 10%). Kazakhstan proposes to increase the percentage of gas-fired power plants in the overall electricity generation mix to 20% by 2020, 25% by 2030 and 30% by 2050 as a way to gradually reduce the contribution of coal-fired power stations (NCTGE 2013). Gas power with a high ramping rate helps to increase the share of intermittent RE. By 2030, GHG emissions from electricity generation are to be decreased by 15%, and by 40% by 2050 (Yeserkepova et al. 2014). To be in line with the Paris Agreement’s objectives, these targets must be significantly increased. It is critical to increase the share of RE in power generation while decreasing the shares of both natural gas and coal. The government understands its significant carbon footprint and its reliance on coal and is taking steps to enhance the share of renewables in the energy mix, expand its carbon ETS, and increase gasification.

Kazakhstan has announced that it aims to achieve carbon neutrality by 2060 (Vakulchuk et al. 2022b). In one of the scenarios outlined in the Fourth Biennial Report of the Republic of Kazakhstan to the UNFCCC (2019), methane emissions are included under the ETS from 2026 and GHG trading auctions are to be instituted, while the proceeds from auctions and fines will go into a national decarbonisation fund (UNFCC 2019). A carbon tax on unregulated industries has also been considered to fulfil the NDC goals (Wong and Zhang 2022). National plans for the allocation of GHG quotas have been adopted in three phases. In Phase 1, the First National Plan was piloted. Phase 2 (2014–2015) began with the allocation of quotas based on historical emissions. In 2015, independent verification companies started to verify the GHG reports. A process of collection, processing and analysis of GHG emissions data was initiated to assess the benchmarking system for allocating quotas. Kazakhstan has now established facility-level measurement, reporting and verification (MRV) systems as the basis for its domestic ETS (Gulbrandsen et al. 2017).

From 2016 to 2018, Kazakhstan suspended the trading of GHG quotas under the ETS owing to distortions in the system and defects that needed to be eliminated (within the historical method). The government also addressed legal conflicts and gaps in carbon regulation that had been discovered during the previous phases (NIR-KZ UNFCCC 2020; UNFCCC 2019). In 2018, the ETS resumed operations after a two-year suspension, with new distribution methods and trading procedures based on a baseline or benchmarking level. Operators are not obliged to report on emissions of GHGs other than CO2. Emissions of other GHGs account for approximately 17% of the total GHG emissions in Kazakhstan (NIR-KZ UNFCCC 2020).

Phase 3 of the ETS (2018–2020) uses benchmarking and historical quota distribution as the basis for reporting. The National GHG Allocation Plan adopted in January 2018 sets emissions limits for 129 enterprises for the 2018–2020 period, and a 5% emissions reduction target for 2020 (Gulbrandsen et al. 2017).

4.2 Turkmenistan

In their first NDC under the Paris Agreement, submitted in 2016, Turkmenistan explains that the main sources of GHGs in the country are oil and gas enterprises, energy, agriculture and transport industries, as well as housing and communal services. Turkmenistan has the highest energy and carbon intensity per PPP to GDP in the region. Power generation is dominated by natural gas and oil, and significant emissions reductions could be achieved by reducing energy losses in electricity and gas networks and by tackling venting and flaring. The solar and wind potential in the country is very high but underutilised. The development of Turkmenistan during the years following independence was marked by high growth in industrial production and investment in the economy. The country’s rapid economic growth is linked to an increase in the use (and export) of energy products, primarily oil and gas, which has contributed to an increase in GHGs. According to emissions estimates over the 18-year period from 2000 to 2017, Turkmenistan’s GHG emissions more than doubled (Holzhacker and Skakova 2018).

To reduce emissions, Turkmenistan has developed a National Strategy on Climate Change (2019), identifying three main areas for greener economic development, including energy efficiency and conservation, sustainable use of natural gas and petroleum products and increased use of alternative energy sources. In the National Strategy, one of the key proposed actions is studying international experience and preparing a proposal for the development of a green certificate trading system. This complex task provides recognition of the results of a national inventory conducted by local experts and reputable international organisations (MFA 2019).

In 2017, the President of Turkmenistan signed the Decree ‘On Approval of the State Energy Saving Programme for the Period 2018–2024’, according to which a National Inventory System for GHGs should be prepared, along with MRV guidelines to ensure transparency in its implementation.

4.3 Uzbekistan

The World Bank categorises Uzbekistan as one of the world’s most vulnerable countries to climate change (ClimatePolicyDatabase 2021). Uzbekistan emits around 205 MtCO2e annually. About 89.4% of the GHG emissions in Uzbekistan are generated by the energy sector in the western part of the country, where the capital Tashkent is located (UNFCCC 2021b).

A number of policy measures have been adopted that will facilitate Uzbekistan’s transition to low-carbon energy including the National Green Economy Strategy for the period to 2030. This strategy requires an increase in the share of RE in electricity production to at least 25% by 2030. Currently, Uzbekistan is developing legislation in the field of RE, taking into consideration the experience of developed countries and the country’s growing need for energy. The country has also revised building codes and regulations to bring them in line with higher energy efficiency standards. As a result, almost 10 GW will be added to the country’s RE capacity, including 3 GW of wind turbines, 1.9 GW from hydroelectric power plants and 5 GW of solar power (ClimatePolicyDatabase 2021; Uzbekistan’s NDC 2017). The latter excludes the capacity of individual households.

While these developments are encouraging for Uzbekistan’s RE growth, legislative deficiencies prevent the government from adopting a sufficiently ambitious, comprehensive and long-term strategy to decarbonise its energy sector. One of the main goals adopted by Uzbekistan was to reduce specific GHGs per unit of GDP by 10% by 2030. To do so the government plans to expand the introduction of environmental protection measures, strengthen legislation in the field of ecology and introduce the appropriate world standards for equipping newly built enterprises. Beyond the existing 10% reduction target from 2010 levels, more ambitious targets are possible (Uzbekistan’s NDC 2017).

In 2021, Uzbekistan published its Roadmap for a Carbon Neutral Electricity Sector by 2050, which provides a framework for decarbonising the country’s electricity sector. The proposed transition in power generation would require considerable technological and regulatory revisions with strong political support. The roadmap states that Uzbekistan must eliminate legal and institutional preferences for carbon-intensive sources and eventually establish a carbon pricing system to assist in phasing out fossil fuel subsidies in favour of renewables and green economy initiatives. However, without a fully liberalised electricity market where renewables can compete and deliver both cost-related and environmental benefits to consumers, carbon pricing is unfeasible for operators (EBRD 2021).

Converting gas into more valuable products can also result in greater economic benefits, jobs and investment (Uzbekistan’s NDC 2017; EBRD 2021). For instance, Uzbekistan could also use domestic gas supplies and extra RE output in the development of a hydrogen economy. Further areas to explore include the potential to reduce methane emissions from the oil and gas sector and lower nitrous oxide and fluorinated emissions from industrial operations (EBRD 2021).

Uzbekistan has designed MRV systems as part of its Nationally Appropriate Mitigation Actions initiatives, completing an initial evaluation and developing a major road map. CPI in Uzbekistan exists currently only in concept form.

4.4 Kyrgyzstan

Kyrgyzstan recognises its vulnerability to climate change, but also that its planned economic development will lead to a significant increase in GHG emissions if they are unabated. In February 2020, Kyrgyzstan submitted its first NDC under the Paris Agreement. In it, Kyrgyzstan commits to cutting GHGs by 11.49–13.75% below the ‘business-as-usual’ scenario (BAU) by 2030 (Takeuchi 2020). With international cooperation, Kyrgyzstan plans to implement mitigation measures to reduce GHGs by 29–30% below BAU by 2030. The country’s long-term unconditional contribution is to reduce GHGs by 12.67–15.69% below BAU by 2050.

Kyrgyzstan’s seemingly low level of emissions is not actually that low if one takes into account that 90% of the country’s electricity is hydropower (National Statistical Committee of the Kyrgyz Republic 2020). However, climate change is likely to have an impact on the water supply, reducing the potential of hydropower at the same time as electricity demand is expected to grow significantly (Temirbekov 2020).

Considering the country’s emissions profile and Paris Agreement goals, the government is investigating carbon pricing mechanisms. However, there are several barriers, including a lack of conceptual understanding of the benefits of carbon pricing, as well as political will and supportive legal and fiscal frameworks. There is also a lack of capacity, technical understanding, and knowledge of products for CPI implementation. There is also no MRV system, as Kyrgyzstan’s emissions reduction program is in the initial assessment stage.

Owing to these barriers, Kyrgyzstan has yet to consider carbon pricing. There are other potential barriers to the implementation of CPI that include companies perceiving it as restrictive to growth and consumers viewing it as a cost that could lead to poverty. Carbon price increases could thus potentially cause social tension if not handled correctly (Proskuryakova and Ermolenko 2022).

4.5 Tajikistan

In Tajikistan, climate mitigation and adaptation actions are reflected in the National Development Strategy to 2030, adopted in 2019 (UNFCCC 2021a), and in the country’s medium-term development program for 2021–2025. Tajikistan submitted its first NDC under the Paris Agreement in 2017, with the emission reduction targets summarised in Table 2.

Compared to the 1990 baseline, GHG emissions in Tajikistan had decreased by 64.3% by 2014 and amounted to 9.1 MtCO2e. This is largely due to the heavy utilisation and expansion of hydropower, which replaced coal-fired power stations and as of 2020 accounted for 98% of the country’s electricity generation (IEA 2020). Tajikistan’s first Biennial Report was submitted in 2019, the process of preparing the fourth national communication under the UNFCCC is currently underway. Tajikistan’s carbon pricing scheme is in its early stages. However, according to official publications, the country expects to develop an MRV legislative framework by 2025 and a pricing system by 2030 (UNFCCC 2021a). In this regard, the country’s organisational, financial, informational and human capabilities are major barriers. Tajikistan will require international financial support to establish its MRV system and may encounter difficulty with data collection.

5 Discussion

According to the results of the comparative review analysis, there are significant opportunities for decarbonisation and CPI within the Central Asia region. The region’s energy infrastructure needs to be modernised to decrease grid and heat transmission losses while increasing energy generation and distribution efficiency. The countries, especially Kazakhstan, Uzbekistan and Turkmenistan, all have very significant fossil fuel subsidies, distorting the cost of energy and fuels and resulting in increased GHG emissions. Fossil fuel subsidies encourage overconsumption of fossil fuels and discourage the adoption of RE technologies. Retail electricity rates are also below the global average in all Central Asian countries (IEA 2020). Energy and resource efficiency must be improved if the countries want to establish internationally competitive manufacturing and service sectors.

Central Asia has great potential for the deployment of RE, in particular through the integration of regional electricity grids. Increased collaboration and coordination among the Central Asian countries might significantly boost RE penetration at lower costs, while also optimising grid stability. Central Asia’s power system modelling shows significant operating cost savings in the next decade. Discussions are currently ongoing to increase interconnectivity and maximise system value, including as part of the CASA-1000 cross-regional power connectivity project (World Bank 2020; Otarov et al. 2017). In this context, the region may increasingly find opportunities to export green electricity generated by RE. Meanwhile, all Central Asian countries are exchanging commitments under the Paris Agreement and setting up long-term low to net zero emission development strategies, showcasing their long-term planning and forming a potential basis for regional collaboration.

5.1 Decarbonisation Opportunities and CPI: A SWOT Analysis

Despite the growing global trend in the adoption of CPIs to achieve NDCs cost-effectively, Kazakhstan is the first and only Central Asian mover in carbon pricing. Although other Central Asian countries have yet to adopt a CPI, they are highly interested in carbon pricing approaches and in potentially reaping the benefits of regional collaboration.

Our SWOT analysis (Table 3) seeks to identify existing strengths, weaknesses, opportunities and threats that could—or already do—support or undermine the adoption of CPI in Central Asia. The aim is to highlight areas for individual countries and the region as a whole to focus their efforts on, thus increasing the adoption of CPIs throughout the region. The SWOT analysis was based on the findings from the comparative review analysis.

As shown in Table 3, there are still substantial weaknesses and threats to the adoption of CPIs in Central Asia, but there are also considerable strengths and opportunities that might enable their adoption and implementation.

5.2 Recommendations: Actions to Enhance Regional Cooperation on Decarbonisation

On the basis of the comparative review and SWOT analysis, we have developed a set of recommendations for Central Asian governments and key stakeholders to strengthen individual country performance and regional cooperation on decarbonisation and promote the adoption of carbon pricing. We have divided these actions into short-term and longer-term actions.

Short-term actions

-

1.

Central Asian governments should build political will among themselves for the introduction of innovative climate policy tools, including CPI, develop technological regulations for GHG emission inventory to support the implementation of NDCs, national green economy and sustainable development strategies, and green COVID-19 recovery plans.

-

2.

Governments can adopt more ambitious climate commitments in their NDCs, including a willingness and readiness to use new market mechanisms under Article 6 of the Paris Agreement, which allows for the trade of emission reduction units between countries.

-

3.

Governments should support research institutions in examining the implications of phasing out fossil fuel subsidies made by the government in favour of RE and other green economy initiatives.

-

4.

International financial institutions and governments should focus investments on regional cross-border electricity exchange to reduce peak and backup capacity requirements, enable seasonal hydropower trading, reduce required capacity reserves within national systems and promote the growth of RE.

-

5.

The global community must offer for the consideration and potential use of cooperative approaches at the regional and international levels under Article 6 of the Paris Agreement and applicable provisions.

-

6.

Stakeholders must develop and adopt facility-level MRV guidelines for CPI in applicable sectors.

6 Conclusion

According to the results of the comparative review, Kazakhstan, Uzbekistan and Turkmenistan still produce a large amount of GHG emissions. One of the main reasons is their significant subsidies for fossil fuels, which distort the cost of energy and fuel, encourage excessive consumption, and create barriers to the introduction of renewable energy technologies.

This study concludes that all the Central Asian countries can benefit from an economic strategy based on a decarbonisation policy, achieve sustainable growth decoupled from GHG emissions and meet their NDC commitments. Encouraging RE development, reducing fossil fuel subsidies, and increasing energy efficiency and foreign green investment will be the key drivers for decarbonisation in the region.

Central Asian countries can utilise CPIs to stimulate sustainable economic growth and green investment and enable deep decarbonisation in the longer term. Indirect regulatory and institutional support for carbon-intensive sources should be gradually reduced to allow a fair market in the region. Energy subsidies need to be phased out and replaced with cost-reflective tariffs. Regional ETS and phased-out fossil fuel subsidies may thus be considered in the long run to stimulate low-carbon development in the region.

References

CAREC (2021) The UNFCCC activity in the Central Asian region. https://carececo.org/en/main/news/. Accessed 14 Dec 2021

ClimatePolicyDatabase.org (2021) Uzbekistan-policy database. http://climatepolicydatabase.org/index.php/Country:Uzbekistan. Accessed 14 Jan 2022

EBRD (2021) A carbon neutral electricity sector in Uzbekistan. http://minenergy.uz/en/lists/view/131. Accessed 14 Dec 2021

Gulbrandsen LH, Sammut F, Wettestad J (2017) Emissions trading and policy diffusion: complex EU ETS emulation in Kazakhstan. Glob Environ Polit 17(3):115–133. https://doi.org/10.1162/glep_a_00418

Holzhacker H, Skakova D (2018) Turkmenistan diagnostic. Report. EBRD, London. https://www.ebrd.com/documents/policy/country-diagnostic-paper-turkmenistan.pdf. Accessed 14 Dec 2021

IEA (2018) Fossil-fuel consumption subsidies by country, Paris. https://www.iea.org/data-and-statistics/charts/fossil-fuel-consumption-subsidies-by-country-2018. Accessed 14 Dec 2021

IEA (2020) Shaping a secure and sustainable energy future for all. https://www.iea.org/. Accessed 14 Dec 2021

MFA (2019) Adoption of the national strategy of Turkmenistan on climate change. https://www.mfa.gov.tm/index.php/en/news/1615. Accessed 13 Jan 2021

National Statistical Committee of the Kyrgyz Republic (2020) Monitoring of the Sustainable Development Goal indicators in the Kyrgyz Republic. http://www.stat.kg/media/files/0df67c73-a648-4c10-a6b5-c4df2311cac7.pdf. Accessed 14 Dec 2021

Nguyen AT (2019) The relationship between economic growth, energy consumption and carbon dioxide emissions: evidence from central Asia. Eurasian J Bus Econ 12(24):1–15

NIR-KZ UNFCCC (2020) National inventory report of Kazakhstan on the anthropogenic greenhouse gas emissions for 1990–2018. https://unfccc.int/documents/253715. Accessed 14 Dec 2021

NCTGE (2013) National concept for transition to a green economy up to 2050. Approved by Decree of the President of the Republic of Kazakhstan on May 30 2013. N 557. https://strategy2050.kz/en

Otarov, R, Akhmetbekov Y, Zhakiyev N (2017) Determination of optimal CO2 allowance prices for stimulation of investments in CCS, RES and other carbon-clean technologies in Kazakhstan. In: Sustainable energy in Kazakhstan. Routledge, pp 123–133. https://doi.org/10.4324/9781315267302-9

Proskuryakova L, Ermolenko G (2022) Decarbonization prospects in the commonwealth of independent states. Energies 15(6):1987

Reyer CPO, Otto IM, Adams S et al (2015) Climate change impacts in Central Asia and their implications for development. Reg Environ Chang 17(6):1639–50. https://doi.org/10.1007/s10113-015-0893-z

Takeuchi K (2020) Project information document-integrated safeguards data sheet-enhancing resilience in Kyrgyzstan additional financing-P172761

Temirbekov A (2020) Nationally Determined Contributions of the Kyrgyz Republic to the Paris Agreement. http://aarhus.kg/wp-content/uploads/2020/11/3.-Temirbekov-ONUV.pdf

UNFCCC (2017) Third National Communication of the Kyrgyzstan. https://unfccc.int/sites/default/files/resource/NC3_Kyrgyzstan_English_24Jan2017_0.pdf. Accessed 14 Dec 2021

UNFCCC (2019) Fourth biennial report of the republic of Kazakhstan to the un framework convention on climate change. https://unfccc.int/sites/default/files/resource/BR4_en.pdf. Accessed 14 Dec 2021

UNFCCC (2021a) The updated NDC of Tajikistan. https://www4.unfccc.int/sites/ndcstaging/PublishedDocuments/Tajikistan%20First/NDC_TAJIKISTAN_ENG.pdf. Accessed 4 Jan 2021

UNFCCC (2021b) Uzbekistan Biennial update report (BUR). https://unfccc.int/sites/default/files/resource/FBURUZeng.pdf. Accessed 5 Jan 2021

UNFCCC (2022) About carbon pricing, May. https://unfccc.int/about-us/regional-collaboration-centres/the-ci-aca-initiative/about-carbon-pricing. Accessed 14 Dec 2021

Uzbekistan’s NDC (2017) Uzbekistan’s Nationally Determined Contributions. https://www4.unfccc.int/sites/ndcstaging/PublishedDocuments/Uzbekistan%20First/INDC%20Uzbekistan%2018-04-2017_Eng.pdf. Accessed 14 Jan 2021

Vakulchuk R, Overland I (2021) Central Asia is a missing link in analyses of critical materials for the global clean energy transition. One Earth 4(12):1678–1692. https://doi.org/10.1016/j.oneear.2021.11.012

Vakulchuk R, Daloz AS, Overland I, Sagbakken HF, Standal K (2022a) A void in Central Asia research: climate change. Cent Asian Surv 42:1–20. https://doi.org/10.1080/02634937.2022.2059447

Vakulchuk R, Isataeva A, Kolodzinskaia G, Overland I, Sabyrbekov R (2022b) Fossil fuels in Central Asia: trends and energy transition risks. Cent Asia Regi Data Rev 28. https://www.researchgate.net/publication/357866530

Wong JB, Zhang Q (2022) Impact of carbon tax on electricity prices and behaviour. Financ Res Lett 44:102098. https://doi.org/10.1016/j.frl.2021.102098

World Bank (2020) Central Asia electricity trade brings economic growth and fosters regional cooperation 2020. https://www.worldbank.org/en/news/feature/2020/10/20/central-asia-electricity-trade-brings-economic-growth-and-fosters-regional-cooperation. Accessed 14 Dec 2021

World Bank (2021) State and trends of carbon pricing 2020. World Bank, Washington, DC, May. https://doi.org/10.1596/978-1-4648-1586-7

World Bank (2022) National CO2 emissions of CA countries 1992–2016. The World Bank Group. https://data.worldbank.org/indicator/EN.ATM.CO2E.PP.GD?end=2016&locations=KZ-UZ-TM-KG-TJ&start=1992&view=chart. Accessed 14 Dec 2022

Yeserkepova IB, Cherednichenko AV, Baekenova MK, Bultekov NU, Lebed LV, Akhmadieva ZhK, Tsareva EG, Satenova EZh, Ermakhanova EM (2014) First bio-year report of the Republic of Kazakhstan. Report. Zhassyl Damu JSC, Nur-Sultan

Acknowledgements

Co-authors N.Z. and G.A. acknowledge the Ministry of Science and Higher of the Republic of Kazakhstan (Grant No. AP09261258). N.Z. also acknowledges the Scholarship Programme of the Islamic Development Bank (ID 2021-588606).

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2023 The Author(s)

About this chapter

Cite this chapter

Abdi, G., Zhakiyev, N., Toilybayeva, S. (2023). Decarbonisation Opportunities and Emerging Carbon Pricing Instruments in Central Asia. In: Sabyrbekov, R., Overland, I., Vakulchuk, R. (eds) Climate Change in Central Asia. SpringerBriefs in Climate Studies. Springer, Cham. https://doi.org/10.1007/978-3-031-29831-8_5

Download citation

DOI: https://doi.org/10.1007/978-3-031-29831-8_5

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-29830-1

Online ISBN: 978-3-031-29831-8

eBook Packages: Economics and FinanceEconomics and Finance (R0)