Abstract

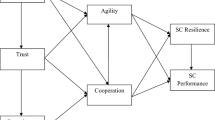

Supply chain finance aims for building trust, commitment to the timely delivery of goods, negotiation about terms of payment, sharing information about customer needs, and supply-related matters. It creates a money-related win-win situation for buyers, suppliers, and financial institutions. This research examines the relationship between trust, relationship commitment, supply chain finance, and supply chain effectiveness for small and medium manufacturing enterprises (MSMEs). Supply chain finance is also essential for MSMEs to maintain business operations smoothly. The target sample was owners of small and medium manufacturing enterprises (MSMEs) in Semarang, Demak, and Kendal city, Indonesia. This research is expected to contribute to identifying supply chain finance adoption and how MSMEs can implement supply chain finance to increase company liquidity in achieving supply chain effectiveness.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Ali, Z., Gongbing, B., Mehreen, A.: Predicting supply chain effectiveness through supply chain finance: evidence from small and medium enterprises. Int. J. Logist. Manag. 30(2), 488–505 (2019). https://doi.org/10.1108/IJLM-05-2018-0118

Basu, P., Nair, S.K.: Supply chain finance enabled early pay: unlocking trapped value in B2B logistics. Int. J. Logist. Syst. Manag. 12, 334–353 (2012)

Burkart, M., Ellingsen, T.: In-kind finance: a theory of trade credit. Am. Econ. Revol. 94(3), 569–590 (2004)

Caniato, F., Gelsomino, L.M., Perego, A., Ronchi, S.: Does finance solve the supply chain financing problem?. Supply Chain Manag. 21(5), 534–549 (2016). https://doi.org/10.1108/SCM-11-2015-0436

Chin, W.W.: The partial Least Square Approach to Structural Equation Model. Publiser, London, Lawrence Elbaum Associates (1998)

Duan, Y., Mu, C., Yang, M., Chin, T.: Study on early warning of strategis risk during the process of firm sustainable innovation based on an optimized genetic bp neural network model: evidence from Chinese manufactures industries. Int. J. Product. Econ. 233, 108293 (2021)

Lamoureux, J.F., Evans, T.A.: Supply chain finance: a new means to support the competitiveness and resilience of global value chains. Available at SSRN 2179944 (2011)

Fugate, B.S., Stank, T.P., Mentzer, J.T.: Linking improved knowledge management to operational and organizational performance. J. Oper. Manag. 27(3), 247–264 (2009)

Gelsomino, L.M., Mangiaracina, R., Perego, A., Tumino, A.: Supply chain finance: a literature review. Int. J. Phys. Distrib. Logist. Manag. 46(4), 1–19 (2016)

Gomm, M.L.: Supply chain finance: applying finance theory to supply chain management to enhance finance in supply chains. Int. J. Log. Res. Appl. 13(2), 133–142 (2010)

Gorodnichenko, Y.: Financial Constraints and Innovation: why poor countries don’t catch up. J. Europe Econ. Assos. 11(5), 1115–1152 (2013)

Hofmann, E.: Supply chain finance: some conceptual insights, Logistik Management Innovation Logistikkonzepte, pp. 203–214. Dtsch. Univ, Wiesbaden (2005)

Jiang, R., Kang, Y., Liu, Y., Liang, Z., Duan, Y., Sun, Y.: A trust transitivity model of small and medium-sized manufacturing enterprises under blockchain-based supply chain finance. Int. J. Product. Econ. 247, 108469 (2022)

Kanwal, A., Rajput, A.: A transaction cost framework in supply chain relationships: a social capital perspective. J. Relat. Mark. 15(1/2), 92–107 (2016)

Nguema, J.N.B.B., Bi, G., Ali, Z., Mehreen, A., Rukundo, C., Ke, Y.: Exploring the factors influencing the adoption of supply chain finance in supply chain effectiveness: evidence from manufacturing firms. J. Bus. Ind. Mark. 36(5), 706–716 (2021). https://doi.org/10.1108/JBIM-01-2020-0047

Paluri, R.A., Mishal, A.: Trust and commitment in supply chain management: a systematic review of literature. Benchmark. Int. J. 27(10), 2831–2862 (2020). https://doi.org/10.1108/BIJ-11-2019-0517

Pfohl, H.-C., Gomm, M.: Supply chain finance: optimizing financial flows in supply chains. Logist. Res. 1(3–4), 149–161 (2009). https://doi.org/10.1007/s12159-009-0020-y

Poppo, L., Zheu, K.Z., Li, J.J.: When can you trust? calculative trust, relational trust, and supplier performance. Strateg. Manag. J. 37(4), 724–741 (2016)

Randall, W.S., Farris, M.T.: Supply chain financing: using cash-to-cash variables to strengthen the supply chain. Int. J. Phys. Distrib. Logist. Manag. 39(8), 669–689 (2009)

Seifert, D., Seifert, D.: Financing the chain. Int. Comerce Revol. 1, 33–34 (2011)

Song, H., Lu, Q., Yu, K., Qian, C.: How do knowledge spillover and access in supply chain network enhance SMEs’ credit quality? Ind. Manag. Data Syst. 119(2), 274–291 (2019). https://doi.org/10.1108/IMDS-01-2018-0049

Vieira, J.G.V., Yoshizaki, H., Ho, L.: The effects of collaboration on logistical performance and transaction costs. Int. J. Bus. Sci. Appl. Manage. 10(1), 1–14 (2015)

Waheed, K.: Measuring trust in supply chain partners relationships. J. Measur. Bus. Excellence 14(3), 53–69 (2010)

Eko, W., Purwanto, E.: The Mediating Role of the Supply Chain Financing on the Relationship between Negotiation, Collaboration and Digitalization with Supply Chain Effectiveness Technologie Report of Kansai University, 63(05) (2021)

Yunus, E.N.: Leveraging supply chain collaboration in pursuing radical innovation. Int. J. Innov. Sci. 10(3), 350–370 (2018). https://doi.org/10.1108/IJIS-05-2017-0039

Zhang, R.: The research on influence facts of supply chain finance operation. In: Proceedings of International Conference on Management Engineering and Management Innovation, Atlantis Press, Changsha, January, pp. 88–92 (2015)

Zimele, A.: The SMME Business Toolkit. New York: SBDA(Pty) Ltd (2009)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Kartikasari, L., Ridho, M.A. (2023). Supply Chain Finance Mediates the Effect of Trust and Commitment on Supply Chain Effectiveness. In: Barolli, L. (eds) Advances in Internet, Data & Web Technologies. EIDWT 2023. Lecture Notes on Data Engineering and Communications Technologies, vol 161. Springer, Cham. https://doi.org/10.1007/978-3-031-26281-4_16

Download citation

DOI: https://doi.org/10.1007/978-3-031-26281-4_16

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-26280-7

Online ISBN: 978-3-031-26281-4

eBook Packages: Intelligent Technologies and RoboticsIntelligent Technologies and Robotics (R0)