Abstract

Evidence are dearly needed to understand under which conditions it is relevant for decisions makers to invest in NBS for water-related risk. This chapter presents the methodological framework developed for the economic assessment of NBS for water-related risks and its application to seven case studies. We particularly develop methods for the evaluation of implementation and opportunity costs, the assessment of the reduction of damage costs, and the monetary value of co-benefits. The study confirms that the cost of implementation and maintenance of NBS strategies is lower than the cost of grey solutions for the same level of water risk management, emphasizing the better cost-effectiveness of these solutions. Benefits in terms of avoided damages are however generally not sufficient to cover investment and maintenance costs. Co-benefits represent the largest share of the value generated by NBS strategies. The overall cost-benefit analysis implemented in four cases, is positive in three case studies and negative in one. This confirms the importance to carry out thorough economic assessments for the elaboration of Natural Assurance Schemes.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

Keywords

FormalPara Highlights-

This study combines the integrated cost-benefit analysis of NBS strategies aiming at reducing water risks in four case studies

-

The cost of implementation and maintenance of NBS strategies is lower than the cost of grey solutions for the same level of water risk management, confirming their cost-effectiveness advantage

-

Benefits in terms of avoided damages are however generally not sufficient to cover investment and maintenance costs

-

Co-benefits represent the largest share of the value generated by NBS strategies

-

The cost-benefit analysis of NBS strategies implemented in four case-studies, is positive in three case studies and negative in one

6.1 Introduction

The economic assessment of NBS is a key step in the evaluation of NBS. Indeed, assessing the value of costs and benefits of NBS and being able to compare them to alternative strategies such as business as usual grey solutions is fundamental for decision makers to develop these solutions and eventually turn them into implementable Natural Assurance Schemes, with solid business models and business cases (see Chaps. 8 and 9). However, real case studies are relatively scarce, evidence is therefore needed to understand under which conditions it seems relevant for decisions makers to invest in NBS.

This chapter therefore presents the methodological framework developed for the economic assessment of NBS for water related risks, drought and flood, and its application to NAIAD case studies. Since the reduction of water related risks is the main aim of these NBS, we particularly elaborate on the methodologies that can be used to estimate the reduction of damage costs. Another specificity of NBS, as compared to grey solutions, is their capacity to produce additional environmental and social benefits: the co-benefits. We therefore also present the various methods that can be used for the monetary valuation of co-benefits. We also provide details on the elements that need to be considered for the evaluation of costs. Finally, cost-benefit analyses are implemented to help determining whether projects, such as NBS, improve social welfare from an economic standpoint and should therefore be considered for implementation by decision makers.

This methodological framework has been fully or partially applied to seven case studies of the NAIAD project. We conclude by some lessons learned from the implementation of the methodology as well as some of the key results of the economic assessment.

6.2 Methods

6.2.1 Overall Methodology of the Economic Assessment

The overall aim of the economic assessment methodology is to assess the economic value of alternative actions aiming at managing water risks, through a Cost benefit Analysis (CBA) (European Commission 2014), which provides an evaluation of the economic efficiency of a programme. Depending on the case study, one or several alternatives are compared which incorporate different levels of NBS strategies and traditional grey infrastructure. The methodology is based and detailed in Graveline et al. (2017).

In this study, we mention as NBS strategies, alternative projects that generally include a combination of NBS and grey infrastructures. The principle of CBA is to compare an alternative with-the-project with a counterfactual baseline alternative without-the-project, generally referred to as the Business As Usual alternative (BAU). The CBA performed compares strategies without NBS (considered as the BAU strategy) with one or several strategies including NBS measures.

The CBA requires the estimation of all direct and indirect costs and benefits for the different NBS strategies under study. The following typology of monetary values associated with NBS strategies is considered:

-

Costs of implementation are those that are necessary for the implementation and maintenance of the NBS included in the NBS strategies.

-

Opportunity costs are those that are foregone with the NBS strategies, for instance areas that are taken out of production or land that is used for NBS and that cannot be used for other purposes such as the construction of building. They are the indirect costs of the NBS strategies.

-

Avoided damages are the damages avoided due to the reduction of water risks generated by NBS strategies. Avoided costs are the primary benefit generated by NBS strategies aiming at reducing water risks.

-

Co-benefits are the additional environmental, economic, and social benefits generated by NBS. In the CBA, we will focus on the ones that can be evaluated monetarily although they cover only part of the co-benefits generated by NBS strategies or only a portion of their overall value. The level of co-benefits varies between the different strategies.

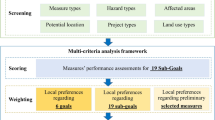

In Fig. 6.1, we present a schematic representation of the CBA method applied to the evaluation of NBS aiming at reducing water risks. Table 6.1 presents the main information of the economic assessment implemented in the different case studies. The cost-benefit analysis was performed fully for the Lez, Brague and Rotterdam case studies and partially for the Medina case.

Description of the cost-benefit analysis approach for the economic valuation of NBS within NAIAD. (Modified from Graveline et al. 2017)

Several indicators can be calculated to carry out a CBA. In this study, we mainly report on the Benefit-Cost Ratio (BCR) that is estimated with the following formula, where CBt is the Co-Benefits in year t, ADt is the Avoided Damage in year t, r is the discount factor, Ct and OCt are implementations Costs and Opportunity Costs in year t and T is the time horizon of the assessment.

In this formula, benefits and costs are discounted with the discount factor r, in order to estimate their present value. This reflects the social view on how future benefits and costs should be valued against present ones: the highest the discount factor the more preference for the present. The European Commission recommends a discount factor ranging from 3 to 5% (European Commission 2014) whereas the Quinet report recommend a value of 2.5% (CGSP 2013). In practice, the discount factor varies in the different case studies, considering the discount factor prevailing in the evaluation of investment projects at the country level.Footnote 1

A BCR superior to 1 means that a project is economically efficient, i.e. that it improves the economic welfare and that it should be eligible for investment by public funds. Decision makers may also compare different alternatives and invest in the alternative that present the highest BCR.

Other partial CBA indicators can be used which we focus on the primary benefit and consider only the direct cost of implementation. Although partial in economic terms, this indicator can be useful for decision makers.

Finally, a cost-effectiveness indicator, which indicates the cost incurred to achieve a given output could also be useful. This indicator in expressed in euro by a physical unit measuring the effectiveness of the measure such as m3 of water retention for flood management. This indicator is compiled only for individual NBS measures and not for NBS strategies (but see Bokhove et al. 2019 for a way to do so at the masterplan scale).

In order to implement the CBA in the case studies, the following stepwise approach has been implemented. This chapter subsequently develops step 4 of this stepwise approach: the economic assessment methods. The details for the implementation of the other steps, especially the engagement with stakeholders, is described in Chap. 19 of this publication.

-

1.

Set scale and time horizon: The spatial scale varies greatly depending on the case study: from a neighbourhood (Rotterdam), to a city catchment (Copenhagen), an aquifer (Medina del Campo) and to a river basin scale (Brague, Lower Danube, Lez and Thames). The time horizon at which the strategies are evaluated defines the number of years for which the benefits and costs are taken into account in the economic analysis. This time horizon varies depending on the type of investment and is usually set at the expected lifetime of the considered investment.

-

2.

Define and describe scenarios and NBS strategies. This step is crucial for the analysis. The identification of scenarios and NBS strategies for water-related risks is undertaken using a participatory process involving the main stakeholders of the considered territory (See Chaps. 5, 7 and 19 for possible methods). Scenarios should be elaborated to determine the prevailing conditions along the time horizon (climate change, land use change) that may affect NBS impact. They are built based on a historical analysis of past trends and the identification of driving forces that may affect the territory under study. NBS strategies are the alternative combinations of NBS measures, developed to address water-related risks, which are compared in the economic analysis. NBS strategies were co-designed with stakeholders based on an assessment of water-related risks and the information available on the impact of NBS on risks and co-benefits. More sophisticated approaches based on System Dynamic Modelling (See Chap. 5) were used to identify strategies responding to territorial challenges.

-

3.

Impact assessment. The impact of NBS strategies needs to be established to subsequently assess the economic effects of these impacts. Given the focus of this study on water risks, a large effort of hydrologic and hydraulic modelling is undertaken to estimate the impact of NBS on water risks (see Chap. 4). Other more simple models are used in order to estimate the physical impact on co-benefits. The impact assessment also requires NBS strategies to be translated into usable inputs for physical modelling. This requires either a simple quantification of some physical variables associated with strategies such as total volume of water retention brought by NBS (for flood control) or in some case GIS modelling for the spatial setting of scenarios and strategies.

-

4.

Assessment of costs and benefits: The details of the methods for the estimation of implementation costs, opportunity costs, avoided damages and co-benefits are presented in the following sections.

-

5.

CBA and sensitivity analysis: Finalization of the CBA by compiling the BCR, according to the formula above, and carry out a sensitivity analysis.

6.2.2 Implementation Costs and Opportunity Costs Assessment

The evaluation of implementation costs was based on the development of guidelines based on the estimation of Life Cycle Costs (LCC) methodology. LCC, also named Total Cost of Ownership (TCO), consider the total cost of acquisition, use/administration, maintenance and disposal of a given item/service (Ellram 1995). The accurate identification of LCC provides the information needed to assess the magnitude of investments for keeping socio-technical system functionality over time. In our case, the expected functionality of NBS is framed in relation to avoiding damages from water-related risks (Denjean et al. 2017).

Therefore, the LCC methodology focused on identifying the generating activities and cost determining factors to maintain the main functionality of NBS, avoiding water-related damages. Cost generating activities can be grouped into five LCC components namely: capital expenditures (CAPEX), operating and minor maintenance expenditures (OPEX), capital maintenance, expenditure on direct support, expenditure on indirect support and cost of capital. Table 6.2 presents the general framework for assessing LCC.

The LCC methodology can be used as a framework to evaluate costs to be integrated in the CBA. In Rotterdam, the three strategies (grey, hybrid and green) were set to meet the same level of flood risk reduction, as requested in the LCC framework. On the other hand, Medina del Campo, Brague, Thames and Lez assessed the LCC components of NBS strategies that emerged from different iterations between technical analysis for meeting policy goals and stakeholder consultations rather than the definition of specific levels of service.

Throughout the case studies, the cost assessment focused on the estimation of LCC components 1 to 3. Rotterdam case study was able to mobilize some directly estimated cost figures as an essential solution of the NBS strategy had been actually implemented in a pilot project. Other costs estimates in Rotterdam and other studies, relied on the transfer of cost parameters from literature, national databases of market prices and expert opinions that allowed the estimates of cost per units of surface (or volume) of individual NBS measures, composing NBS strategies. These costs were then extrapolated to the size of each measure within NBS strategies, to estimate the overall cost associated with NBS strategies. Therefore, the estimation of costs present rather large range of uncertainty depending on the origin of the costs.

NBS implementation usually requires large-scale land use change. Not accounting for opportunity costs arising from land use change would artificially advantage NBS strategies as compared to grey strategies. When NBS are implemented on private land, the cost can be integrated in the capital expenditure related to land purchase, but what about when NBS are mainly implemented on public owned land? The European Commission guidelines on CBA for investment projects (European Commission 2014) mentions that “Many public investment projects use land as a capital asset, which may be state-owned or purchased from the general government budget. Whenever there are alternative options for its use, land should be valued at its opportunity cost […]. This must be done even if land is already owned by the public sector. If it is reasonable to assume that market price captures considerations about land’s utility, desirability and scarcity, then it can generally be considered reflective of the economic value of land.” The question of whether a land may have an alternative use remains largely subject to interpretation when public roads, parking lots or sidewalks are concerned. In the Lez and Rotterdam case, we applied a conservative approach which is to consider land market prices as a proxy of opportunity costs, although alternative possible use of this land is not always clear. In Brague, NBS strategies involve privately owned land use change. In this case, land acquisition costs were included in investments costs while additional opportunity costs were estimated based on profits private land-owners could have obtained from the use of this land (estimated by revenues they could have perceived over this land).

Although the estimation of opportunity costs is fundamental in the CBA framework, the LCC framework normally focuses on making explicit the actual expenses to be assumed by project sponsors for implementing the NBS project. The inclusion of opportunity cost therefore does not appear necessary in this framework. In line with this argument, CBA excluding opportunity costs from overall costs were therefore computed to complete the evaluation.

6.2.3 Assessment of Avoided Damages

6.2.3.1 Overall Approach to the Assessment of Avoided Damage

Brémond et al. (2013) define “damage” as a negative impact of a natural hazard on a socioeconomic system and “cost” as the monetary valuation of such damage. The damages from natural hazards, and their costs, can be classified in tangible -easy to quantify in monetary terms- and intangible – difficult or even impossible to measure, as they comprise non-market values – (Merz et al. 2010; Brémond et al. 2013; Meyer et al. 2013).

The overall approach to the estimation of the avoided damage associated with NBS comprises two main steps: (1) estimation of the relation between water related hazards and damages (catastrophe risk models (CAT) model); and (2) estimation of the impact of NBS strategies on the modification of hazard (droughts or floods) through physical models. The combination of these two steps leads to the estimation of damages under different NBS strategies and without these (Business As Usual, BAU). The difference between damages in the BAU and NBS strategies provides an estimation of the avoided damage (Fig. 6.2), which is expressed in Mean Annual (Avoided) Damage (MA(A)D) and can be integrated in the overall economic evaluation. In the different case studies, this approach was implemented according to the methodological framework as described in Calatrava et al. (2018).

6.2.3.2 Estimating the Relation Between Hazard and Damage Costs: The CAT Model Framework

The CAT model aims to establish the costs of a hazard based on its magnitude (event intensity) and the vulnerability of the elements at risk (Naulin et al. 2016). This involves the following steps (Merz et al. 2010; Foudi et al. 2015).

-

1.

Characterisation of the hazard event;

-

2.

Assessment of the exposure of the assets/elements at risk;

-

3.

Vulnerability analysis to define the damage functions/models.

-

4.

Calculation of the value of the damage cost.

Consequently, the structure of CAT models relies on three units: hazard, vulnerability and damage. This CAT model framework has been applied in all the case studies with methodological differences due to their particularities and to each area’s data availability.

The characterisation of the flood hazard event (Fig. 6.3 hazard unit) in the different case studies has been done by using or adapting hazard models previously developed by project partners. For example, the Lower Danube case study used a hydrological model, to recreate a past event at a large scale. After this, the same parameters were used to simulate the maximum hazard intensity at a smaller scale instead of using a different hydrological model (see Chap. 10).

The assessment of assets exposure (Fig. 6.3 vulnerability unit) consists of the identification, localization and classification of those elements at risk that would be affected by a hazard and the estimation of their value (Merz et al. 2010). It was done by combining the GIS layers of flood maps with the layers of assets/elements at risk to identify those affected by the hazard (Foudi et al. 2015). Elements at risk were then pooled into homogeneous classes of assets (residential, commercial, industrial, agricultural, infrastructures, etc.) for which the assessment is done (Moncoulon et al. 2014). Most case studies used micro-scale approach (i.e. identifying individual elements) using public databases, except for the Rotterdam case study that performed a meso-scale assessment at the neighbourhood level. The typology of elements used depended on the available sources of data (see Chap. 15).

The next step in a CAT model is the vulnerability analysis (Fig. 6.3 damage and avoided damage unit), which consists of establishing a relation between the hazard intensity and the damage caused to each type of element at risk. This implies developing and/or using water stage-damage functions (DF) for each type of element at risk (flood damage models). Damage functions/models for each type of asset can be developed either (i) hypothetically from “what-if analysis” using expert assessment or conceptual/abstract functions (synthetic approach); (ii) empirically, using data on real damage losses from past events; or (iii) a combination of both (Merz et al. 2010; Cammerer et al. 2013).

The empirical approach for developing damage functions (DF) used in both the Lez and Brague case studies relies on the use of insurance data (policies and claims), as in Moncoulon et al. (2014) and Naulin et al. (2016) (see Chaps. 13 and 15). The function is established from direct tangible insured losses for residential homeowners. The damage curves are obtained from historical geolocalised flood claims data for runoff and overflow hazards (Moncoulon et al. 2014). The observed damages are defined by the destruction rate (DR), obtained by dividing the amount of insurance claims by the insured value. The damage curves are established by estimating a relation between DR and the hazard intensity, expressed in cubic meter per second (m3/s) for runoff and in water depth (m) for river flooding. The calibrated flood damage functions are applied to all exposed assets in the property exposure portfolio to estimate the total insured losses. Thus, the simulated costs for each individual element at risk are compared to the real costs of the event. It allows the validation of the DF and the reduction of uncertainties (Cammerer et al. 2013).

If there are no previously estimated DF available for the area of study, or data available to build damage curves, the option is transferring damage functions developed for other areas. However, the transferability of damage functions is limited. An alternative is using synthetic DF developed for larger spatial extents, as long as these are available for similar types of elements at risks, which is the approach proposed in the Medina del Campo case study (see Chap. 11). The French case studies used ad-hoc DF calibrated by CCR on insurance data, but also country-wide DF for public assets (see CGDD 2018), while Medina Demo considered synthetic DF defined at country level. In the Copenhagen case study, they used aggregated insurance data for city of Copenhagen from which a simple unit DF (damage/m2) was derived for the period 2006–2012, including the 2011 cloudburst event. The aggregated value for damage caused by both surface and groundwater flooding was then applied as an estimate for damage as a result of groundwater flooding (see Chap. 17).

Last, the calculation of damage costs for each element at risk is done by combining the outputs of the hazard models (hazard intensity parameters, such as water depth) and the vulnerability assessment (damage functions/models). The total damage for each individual element at risk is obtained by multiplying its asset value by the relative damage (not necessary if absolute damage functions are used). The total damage from a given flood hazard is obtained aggregating the individual damage across all elements at risk of all types. This canonical approach is the one used in the Lez, Brague, Copenhagen and Medina del Campo case studies. In Rotterdam, damage cost estimates were taken from ex-post assessment of previous hazard events.

An alternative approach to CAT models based on DF is using vulnerability indicators to assess at coarser scale (mesh of 250 m/500 m/1 km) the most at-risk areas (Papathoma-Köhle 2016). The method combines detailed geographically-based input layers ranging from physical (e.g. flood depth layer or any other hazard maps) to socio-economic ones (e.g. land use cover) into the raster calculator. The outputs of the GIS-method are validated with information gathered from field surveys and literature review. It allows estimating damage by averaging the water depth in the mesh. The developed damage curves for other case studies are then applied to the water depth. This methodology has been applied in the Lower Danube case study.

6.2.3.3 Estimating the Impact of NBS on Hazards

The assessment of the damage costs avoided through the implementation of NBS strategies requires modelling the change in the physical damages caused by the hazard both with and without the NBS. This involves the different units in the CAT model, as it involves modelling how NBS strategies would change the intensity and location of the hazard (hazard unit) and the level of exposure and vulnerability of elements at risk (vulnerability unit), thus resulting in a change of the estimated damage cost (damage unit). The effect of NBS on physical damages was done using the CAT model in the Thames, Copenhagen and Brague case studies. The Rotterdam case study assumed that the three strategies would result in equivalent hazard reduction, so modelling was not useful for differentiating between strategies, while the Lez and Medina Del Campo encountered computational difficulties for the physical modelling of NBS effects. The Lez case study took justified assumptions about the reduction in physical damages resulting from the proposed NBS instead. In addition to the different NBS strategies considered, several case studies also considered future climate scenarios, and the Brague and Lez scenarios also considered future urbanisation prospects in the area of study.

6.2.3.4 Assessing Avoided Damages

The assessment of the avoided damages for NBS strategies is done by comparing the damage cost estimated under the BAU and the NBS strategies, i.e. by modelling the impact of the hazard under both the NBS and BAU strategies and then estimating the difference in the corresponding damage costs. This can be done either for a specific hazard event or for different events with different return periods. The latter consists in combining the CAT model with the probability of occurrence of different hazard events to obtain damage-probability curves, which relate the damage caused by each potential event with its probability of occurrence, as in Fig. 6.1 (Foudi et al. 2015). The Mean Annual Avoided Damage (MAAD) is calculated from damage-probability curves. The difference between the MAAD for both the BAU and NBS strategies yields the avoided damages resulting from the implementation of the latter. The MAAD was calculated in the Medina, Lez and Brague case studies, while Copenhagen and Rotterdam calculated the avoided damages for specific past hazard events.

6.2.4 Co-benefits Assessment

The IUCN’s definition of NBS stresses on their multiple benefits including addressing societal challenges, providing human well-being and biodiversity benefits (Cohen-Shacham et al. 2016). We group here the multiple benefits of NBS under the concept of co-benefits to stress on additional benefits to the primarily benefit of water-related risk reduction. According to the emerging field of value pluralism approaches (Gómez-Baggethun and Barton 2013; Elmqvist et al. 2015; Jacobs et al. 2016; Costanza et al. 2017), co-benefits can be assessed with several types of indicators: biophysical, socio-cultural and monetary. For the purpose of this Chapter, which focuses on the economic valuation of NBS strategies through a CBA, we present here the methods used by three case studies that conducted a full economic valuation of the co-benefits expected from NBS strategies: the Brague, Lez and Rotterdam case studies. These three evaluations were carried out in two stages, with (1) the identification of co-benefits and (2) the monetary valuation of those co-benefits. As recommended by Nesshöver et al. (2017), a strong involvement of local stakeholders was organised throughout the process in order to integrate their perceptions and knowledge.

Identification of Co-benefits

In the three case studies, the identification of co-benefits strongly relied on the organisation of focus groups or workshops, in which potential benefits of NBS strategies were discussed with local stakeholders. Existing co-benefits classifications and frameworks were used as a basis for discussion:

-

the Millennium Ecosystem Assessment (MA 2005), the Common International Classification of Ecosystem Services (CICES) (Haines-Young and Potschin 2018), and the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES) framework (Díaz et al. 2015) for the identification ecosystem services;

-

the EKLIPSE framework (Raymond et al. 2017) for the identification of challenges areas in urban contexts.

Those frameworks were finally combined in order to embrace a wide range of potential co-benefits and specific local issues. In the Lez case study for instance – a watershed with 50% of natural areas and 30% of agricultural areas- the use ecosystem services classifications was chosen (MEA and IPBES), while in the Rotterdam case study – an urban neighbourhood – the EKLIPSE framework was used as a core framework for co-benefits identification due to its comprehensive coverage of urban issues (see Chaps. 14 and 16).

Co-benefits Valuation

The three case studies used different types of monetary valuation methods described in details by Herivaux et al. (2019):

Direct valuation approaches (market price and cost-based methods) were used in the Rotterdam and Lez case studies, to valuate seven co-benefits, namely climate mitigation through carbon storage, air quality regulation, water cycle regulation, urban regeneration, human health and wellbeing, and aesthetic amenities. These approaches rely on two main steps (Fig. 6.4).

-

Step 1: the quantification of the level of ecosystem services provided by the NBS strategy in non-monetary terms (e.g., annual carbon sequestration expressed in t-eqCO2/year; water availability expressed in m3/year) derived from models, functions or reference values obtained in similar contexts;

-

Step 2: the monetary valuation of the change in the co-benefit level derived from market prices (when market exists), replacement costs (costs required to provide a similar ecosystem service with a human engineered solution) or avoidance costs (costs that would occur if the ecosystem service were lost).

These approaches provide biophysical and monetary indicators for each ecosystem service. However, they do not reflect the total economic value of these ecosystem services, as they only capture direct use values. Results should thus be considered as lower bound estimates.

Stepwise approach for ES valuation when direct valuation approaches are used. (Adapted from Herivaux et al. 2019)

Stated preference approaches, namely the Contingent Valuation Method and the Discrete Choice Experiment (Johnston et al. 2017), were used in the Brague and the Lez case studies. These approaches rely on representative surveys of the population to estimate people’s willingness to pay (how much they would contribute in terms of fee or tax increment) for a hypothetical modification of the environment (here the implementation of NBS strategies). In both cases, the survey gives the opportunity to evaluate the preferences of the population for different NBS strategies, their flood risk perception and the importance the population grants to ecosystem services. They provide socio-cultural and monetary indicators for different NBS strategies and associated bundles of ecosystem services, without seeking to evaluate ecosystem services one by one. Results obtained with such approaches reflect the total economic value (including non-use values) associated with NBS strategies: they cannot be easily added to those obtained with direct valuation methods, as this would lead to double counting.

A benefit transfer approach was also used in the Brague case study to value the co-benefits expected from the NBS strategies. This approach consists in the “application of values and other information from a ‘study’ site where data are collected to a ‘policy’ site with little or no data” (Rosenberger and Stanley 2006).This approach requires relatively sophisticated econometric models to determine variables that have an effect on the overall value of ecosystem services related to NBS. A Meta Regression Analysis (Arfaoui and Gnonlonfin 2019) was performed with 187 monetary estimates from 52 studies evaluating the Willingness to Pay for river restoration measures (restoration of the river stream, restoration of the floodplain, restoration of riparian vegetation, ecosystem-based management practices) and their ecosystem services (food and material provision, local environmental regulation, global climate regulation, habitat quality and species diversity protection, recreational services, aesthetic appreciation). The transfer value function obtained was applied to the Brague case study, considering the characteristics of NBS strategies and the co-benefits that local stakeholders considered as relevant (see Chap. 13).

6.3 Key Results of the Economic Assessment of NBS for Natural Assurance Schemes

We present in Table 6.3 the results of four out of the seven economic assessment, since only these four case studies estimated monetarily at least the costs and the avoided damages brought by NBS strategies.

Some key results can be drawn from the analysis these economic assessment.

In the cases where a grey strategy has been evaluated, the cost of implementation and maintenance of grey solutions is higher than the cost of NBS strategies for the same level of risk management. This confirms previous information mentioning that NBS may be more cost effective solutions as compared to grey solutions as they are less costly. This is particularly highlighted in the Rotterdam and the Brague case, since for the same level of avoided damage, the NBS solutions are 15% and 63% less costly than the grey solutions, respectively.

The cost-effectiveness of individual NBS measures has also been investigated in some case studies. The cost of different measures is compared for the same level of service or a proxy of this level of service: for example for floods the cost/m3 of water retention. This analysis shows a very large heterogeneity of cost-effectiveness of individual NBS measures. For example, in the Lez case study, the cost-effectiveness of green roofs is extremely low because of the large cost of green roofs and their limited water storage capacity (see Chap. 14 for more details). In the Thames case study, a similar assessment reveals a similar heterogeneity with £2.9/m3 of water retention for conservation agriculture, £16.8/m3 of water retention for retention ponds and £61.8/m3 of water retention for leaky dams (see Chap. 12).

In urban areas, taking into account the opportunity costs of NBS can totally change the appreciation of their cost advantage. In Lez and Rotterdam, two urban cases, land price is used as a proxy of opportunity costs, even though NBS are developed on public areas. Although this cost is not actually spent, it provides an estimation of the value associated with the fact that this space cannot be used for other profitable uses. For example, NBS may take space that may not be available for real estate development. Considering that NBS require a large spatial extent as compared to traditional grey strategies, the inclusion of opportunity costs has a strong weight in the overall cost estimation, especially in urban areas where land cost is high.

In cases where flood risk reduction is the main objective of the NBS (Lez, Rotterdam and Brague), benefits in terms of avoided damages are not sufficient to cover capital expenses and operation and maintenance costs. This result needs to be nuanced because our estimations of avoided damage take into account only a share of the damages avoided thanks to protection measures; with a focus on insured damages (public damages are included in the Lez estimation). Indirect damages, such as the macro-economic impact of floods, due to their effect are not considered, although these costs can be highly significant. The assessment also does not consider the potential of protection measures on other non-monetary but essential indicators such as the capacity to reduce the exposition (number of residents in flood prone areas), life protection, injuries or post-traumatic stress. In addition, authorities may have an obligation to deliver a certain level of flood protection, regardless of whether costs are superior to expected avoided damages. The cost-effectiveness advantage of NBS mentioned above therefore remains a key advantage in these contexts. It is to be mentioned that in the case of Medina, which addresses agriculture drought risk, the benefits associated with the change of agriculture crops to reduce drought exposure, in terms of avoided drought damages, overcomes the cost of this change.

Co-benefits represent the largest share of the value generated by NBS strategies. This is the case in all three studies in which co-benefits have been monetarily estimated. This result does not depend on the method used for the estimation of co-benefits, since revealed preference methods have been used in the Lez and Brague case studies, while direct valuation has been used in Rotterdam.

There are no clear-cut conclusions on the overall economic efficiency of NBS in our assessments. Indeed, NBS strategies have a BCR higher than 1 in Lez, Brague and Medina, which means these NBS strategies would be worth the investment, whereas it is <1 in Rotterdam, whatever the strategy. The picture is more positive if we exclude opportunity costs from the economic analysis. Interestingly however, for Brague and Rotterdam, the economic efficiency of NBS strategies is nevertheless much higher than the one for grey strategies. The Benefit Cost ratio should however not be the only criteria considered. For example, the NBS- strategy in the Lez, has the highest Cost-Benefit ratio however the rate of avoided damages on implementation cost is extremely low, since this strategy has very limited effect on flood protection.

6.4 Discussion-Conclusion

This chapter presents a methodological framework for the economic assessment of NBS and its application to seven case studies. Results reveal that NBS aiming at solely reducing water risks cannot be automatically assumed to be economically efficient. It is therefore fundamental to carry out thorough case specific economic valuations of a diversity of strategies, involving NBS, grey and hybrid solutions, in order to identify the most adequate strategy for water risk management and to address territorial challenges. In a context of limited public resources, economic valuation can help identifying the adequate solution to address water risks, the one that maximizes the net benefit for society.

The economic valuation of NBS strategies requires a large effort for the design of strategies. This step requires the participation of stakeholders and preliminary modelling approaches. It is of fundamental importance because the quantification of the physical characteristics (e.g. retention capacity, number of trees) is the basis for the estimation of their costs and benefits.

In our applications, cost estimates mainly rely on the transfer of existing values evaluated in other projects. This reliance on a diversity of sources gives rise to a high level of uncertainty. Costs can indeed vary greatly depending on the exact feature of the NBS and on local contexts. The development of local references for the estimation of costs in all European countries would improve the precision of cost estimation and facilitate greatly cost estimations. The estimation of opportunity costs based on land price, which has been used here, is an upper bound. Some of these areas may indeed not have other profitable use (e.g. sidewalks). The estimation of opportunity costs may indeed need further investigation in the future.

In order to assess the avoided damages as a result of NBS strategies, both simple, straightforward methods and advanced models are necessary to fully estimate the effect of NBS on the intensity and spatial extent of hazards, especially when assessments are carried out at the catchment scale. The evaluation of avoided damages also depends on the availability of data to be able to link the reduction of hazard to a reduction of damages. The detailed estimation of the economic benefits of NBS related to water risk reduction in several case studies is therefore a key contribution of this book. Collaboration with the insurance sector to provide expertise on damage evaluation and data on damages has been instrumental and should be pursued in future studies.

Our methodology also provides a framework for monetary valuation of co-benefits. A diversity of approaches was used to evaluate co-benefits (direct valuation, value transfer, stated preferences approaches) that all require advanced skills in environmental economics. The implementation of this step is key considering the magnitude of co-benefits in NBS benefits and should not be overlooked in the evaluation of NBS. This step can be challenging as it may be difficult for some stakeholders to accept the principle of the monetary valuation of co-benefits. This requires careful explanation to stakeholders that emphasize the limits and the advantages of monetary valuation techniques and their complementarity with other environmental valuation methods. Another challenge is that some methods used in the monetary valuation of co-benefits, such as contingent valuation or choice experiments, require the implementation of surveys with samples of residents. These surveys include the presentation to citizens of alternative water risk management measures and to collect their preference on this matter. This “public consultation” may be considered a delicate issue for certain stakeholders, such as decision makers, that may want to control the way this type of information is revealed to the general public. Using these methods may therefore require lengthy negotiations with stakeholders.

Our economic assessment methodology also has several limits. A large share of these limitations are inherent to every economic analysis with ecological or environmental variables. The multiplicity of models required for the estimation of the different cost and benefits increases their overall uncertainty. On the one hand, it is the relative magnitude of costs and benefits that should be compared rather than the precise values that we have presented. On the other hand, only indicators that could be evaluated monetarily were included in this study. Other indicators such as non-monetary impacts on water risks, co-benefits that could not be or partially be valued monetarily such as social and environmental indicators are important in the decision making process for the development of NBS. The implementation of the economic assessment of NBS should therefore be complemented with the implementation of a Multi-Criteria Decision Analysis (MCDA) such as the one described in Chap. 7. Finally, the cost-benefit analysis only aims at evaluating whether aggregated benefits are higher than aggregated costs. This does not preclude from distributional issues, i.e. the existence of population that benefit from the project and others that lose, for example due to the expropriation of citizens. A project that yields positive economic returns may therefore face the opposition from some stakeholders. These approaches are therefore complementary with approaches focusing on social acceptance and the design of soft measures to facilitate the implementation of NAS such as the one presented in Chap. 5.

Notes

- 1.

We did not include in the evaluation a risk adjusted cash-flow that would account for the risk of not ultimately producing the expected benefits. This step would be necessary for the building of a financeable investment project.

References

Altamirano MA, de Rijke H (2018) Costs of infrastructures: elements of method for their estimation. DELIVERABLE 4.2: EU Horizon 2020 NAIAD Project, Grant Agreement N°730497 Dissemination

Arfaoui N, Gnonlonfin A (2019) The economic value of NBS restoration measures and their benefits in a river basin context: a meta-analysis regression. FAERE Working Paper 09

Bokhove O, Kelmanson MA, Kent T, Piton G, Tacnet JM (2019) Communicating (nature-based) flood-mitigation schemes using flood-excess volume. River Res Appl 35:1402–1414. https://doi.org/10.1002/rra.3507

Brémond P, Grelot F, Agenais A (2013) Review Article: economic evaluation of flood damage to agriculture – Review and analysis of existing methods. Nat Hazards Earth Syst Sci 13:2493–2512. https://doi.org/10.5194/nhess-13-2493-2013

Calatrava J, Graveline N, Moncoulon D, Marchal R (2018) DELIVERABLE 4.3: economic water-related risk damage estimation. EU Horizon 2020 NAIAD project, Grant Agreement N° 730497

Cammerer H, Thieken AH, Lammel J (2013) Adaptability and transferability of flood loss functions in residential areas. Nat Hazards Earth Syst Sci 13:3063–3081. https://doi.org/10.5194/nhess-13-3063-2013

CGDD (2018) Analyse multicritère des projets de prévention des inondations – Guide méthodologique 2018. Commissariat général au développement durable [online]. Available from: https://www.ecologique-solidaire.gouv.fr/sites/default/files/Th%C3%A9ma%20-%20Analyse%20multicrit%C3%A8re%20des%20projets%20de%20pr%C3%A9vention%20des%20inondations%20-%20Guide.pdf

CGSP (2013) Rapport quinet: évaluation socioéconomique des investissements publics

Cohen-Shacham E, Walters G, Janzen C, Maginni S (2016) Nature-based solutions to address global societal challenges. IUCN

Costanza R, de Groot R, Braat L, Kubiszewski I, Fioramonti L, Sutton P, Farber S, Grasso M (2017) Twenty years of ecosystem services: how far have we come and how far do we still need to go? Ecosyst Serv 28:1–16

Denjean B, Denjean B, Altamirano MA, Graveline N, Giordano R, Van der Keur P, Moncoulon D, Weinberg J, Máñez Costa M, Kozinc Z, Mulligan M, Pengal P, Matthews J, van Cauwenbergh N, López Gunn E, Bresch DN, Denjean B (2017) Natural Assurance Scheme: a level playing field framework for Green-Grey infrastructure development. Environ Res 159:24–38. https://doi.org/10.1016/j.envres.2017.07.006

Díaz S, Demissew S, Carabias J, Joly C, Lonsdale M, Ash N, Larigauderie A, Adhikari JR, Arico S, Báldi A, Bartuska A, Baste IA, Bilgin A, Brondizio E, Chan KMA, Figueroa VE, Duraiappah A, Fischer M, Hill R, Koetz T, Leadley P, Lyver P, Mace GM, Martin-Lopez B, Okumura M, Pacheco D, Pascual U, Pérez ES, Reyers B, Roth E, Saito O, Scholes RJ, Sharma N, Tallis H, Thaman R, Watson R, Yahara T, Hamid ZA, Akosim C, Al-Hafedh Y, Allahverdiyev R, Amankwah E, Asah TS, Asfaw Z, Bartus G, Brooks AL, Caillaux J, Dalle G, Darnaedi D, Driver A, Erpul G, Escobar-Eyzaguirre P, Failler P, Fouda AMM, Fu B, Gundimeda H, Hashimoto S, Homer F, Lavorel S, Lichtenstein G, Mala WA, Mandivenyi W, Matczak P, Mbizvo C, Mehrdadi M, Metzger JP, Mikissa JB, Moller H, Mooney HA, Mumby P, Nagendra H, Nesshover C, Oteng-Yeboah AA, Pataki G, Roué M, Rubis J, Schultz M, Smith P, Sumaila R, Takeuchi K, Thomas S, Verma M, Yeo-Chang Y, Zlatanova D (2015) The IPBES Conceptual Framework – connecting nature and people. Curr Opin Environ Sustain 14:1–16

Ellram L (1995) Total cost of ownership: an analysis approach for purchasing. Int J Phys Distrib Logist Manag 25:4–23. https://doi.org/10.1108/09600039510099928

Elmqvist T, Setälä H, Handel SN, van der Ploeg S, Aronson J, Blignaut JN, Gómez-Baggethun E, Nowak DJ, Kronenberg J, de Groot R (2015) Benefits of restoring ecosystem services in urban areas. Curr Opin Environ Sustain 14:101–108

European Commission (2014) Guide to cost-benefit analysis of investment projects, EUROPEAN C

Foudi S, Osés-Eraso N, Tamayo I (2015) Integrated spatial flood risk assessment: The case of Zaragoza. Land Use Policy 42:278–292. https://doi.org/10.1016/j.landusepol.2014.08.002

Gómez-Baggethun E, Barton DN (2013) Classifying and valuing ecosystem services for urban planning. Ecol Econ 86:235–245. https://doi.org/10.1016/j.ecolecon.2012.08.019

Graveline N, Joyce J, Calatrava J, Douai A, Arfaoui N, Moncoulon D, Manez M, Ryke M de, Kozinj Z (2017) General Framework for the Economic assessment of NBS and their insurance value. DELIVERABLE 4.1: EU Horizon 2020 NAIAD Project, Grant Agreement N°730497 Dissemination

Haines-Young R, Potschin MB (2018) Common International Classification of Ecosystem Services (CICES) V5.1 and guidance on the application of the revised structure. Available from www.cices.eu

Herivaux C, Le Coent P, Gnonlonfin A (2019) Natural capital and ecosystem services to valuate co-benefits of NBS in water related risk management. DELIVERABLE 4.4: EU Horizon 2020 NAIAD Project, Grant Agreement N°730497 Dissemination

Jacobs S, Dendoncker N, Martín-lópez B, Nicholas D, Gomez-baggethun E, Boeraeve F, Mcgrath FL, Vierikko K, Geneletti D, Sevecke KJ, Pipart N, Primmer E, Mederly P, Schmidt S, Aragão A, Baral H, Bark RH, Briceno T, Brogna D, Cabral P, De Vreese R, Liquete C, Mueller H, Peh S, Phelan A, Rincón AR, Rogers SH, Turkelboom F, Van Reeth W, Van Zanten BT, Karine H, Washbourne C (2016) A new valuation school: integrating diverse values of nature in resource and land use decisions. Ecosyst Serv 22:213–220. https://doi.org/10.1016/j.ecoser.2016.11.007

Johnston RJ, Boyle KJ, Adamowicz W (Vic), Bennett J, Brouwer R, Cameron TA, Hanemann WM, Hanley N, Ryan M, Scarpa R, Tourangeau R, Vossler CA (2017) Contemporary guidance for stated preference studies. J Assoc Environ Resour Econ 4:319–405. https://doi.org/10.1086/691697

MA (2005) Millenium Ecological Assessment. Millennium ecosystem and human well-being: a framework for assessment

Merz B, Kreibich H, Schwarze R, Thieken A (2010) Review article assessment of economic flood damage. Nat Hazards Earth Syst Sci 10:1697–1724. https://doi.org/10.5194/nhess-10-1697-2010

Meyer V, Becker N, Markantonis V, Schwarze R, Van Den Bergh JCJM, Bouwer LM, Bubeck P, Ciavola P, Genovese E, Green C, Hallegatte S, Kreibich H, Lequeux Q, Logar I, Papyrakis E, Pfurtscheller C, Poussin J, Przyluski V, Thieken AH, Viavattene C (2013) Review article: Assessing the costs of natural hazards-state of the art and knowledge gaps. Nat Hazards Earth Syst Sci 13:1351–1373. https://doi.org/10.5194/nhess-13-1351-2013

Moncoulon D, Labat D, Ardon J, Leblois E, Onfroy T, Poulard C, Aji S, Rémy A, Quantin A (2014) Analysis of the French insurance market exposure to floods: a stochastic model combining river overflow and surface runoff. Nat Hazards Earth Syst Sci 14:2469–2485. https://doi.org/10.5194/nhess-14-2469-2014

Naulin JP, Moncoulon D, Le Roy S, Pedreros R, Idier D, Oliveros C (2016) Estimation of insurance-related losses resulting from coastal flooding in France. Nat Hazards Earth Syst Sci 16:14

Nesshöver C, Assmuth T, Irvine KN, Rusch GM, Waylen KA, Delbaere B, Haase D, Jones-Walters L, Keune H, Kovacs E, Krauze K, Külvik M, Rey F, van Dijk J, Vistad OI, Wilkinson ME, Wittmer H (2017) The science, policy and practice of nature-based solutions: an interdisciplinary perspective. Sci Total Environ 579:1215–1227. https://doi.org/10.1016/J.SCITOTENV.2016.11.106

Papathoma-Köhle M (2016) Vulnerability curves vs. Vulnerability indicators: Application of an indicator-based methodology for debris-flow hazards. Nat Hazards Earth Syst Sci 16:1771–1790. https://doi.org/10.5194/nhess-16-1771-2016

Raymond CM, Frantzeskaki N, Kabisch N, Berry P, Breil M, Razvan M, Geneletti D, Calfapietra C (2017) A framework for assessing and implementing the co-benefits of nature-based solutions in urban areas. Environ Sci Pol 77:15–24. https://doi.org/10.1016/j.envsci.2017.07.008

Rosenberger RS, Stanley TD (2006) Measurement, generalization, and publication: sources of error in benefit transfers and their management. Ecol Econ 60:372–378. https://doi.org/10.1016/J.ECOLECON.2006.03.018

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2023 The Author(s)

About this chapter

Cite this chapter

Le Coent, P. et al. (2023). Economic Assessment of Nature-Based Solutions for Water-Related Risks. In: López-Gunn, E., van der Keur, P., Van Cauwenbergh, N., Le Coent, P., Giordano, R. (eds) Greening Water Risks. Water Security in a New World. Springer, Cham. https://doi.org/10.1007/978-3-031-25308-9_6

Download citation

DOI: https://doi.org/10.1007/978-3-031-25308-9_6

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-25307-2

Online ISBN: 978-3-031-25308-9

eBook Packages: Earth and Environmental ScienceEarth and Environmental Science (R0)