Abstract

This chapter was originally prepared in 1984 as California University Department of Agricultural and Resource Economics (CUDARE) Working Paper 321, Giannini Foundation of Agricultural Economics Working. It is posted at the eScholarship Repository, University of California. http://repositories.cdlib.org/areucb/321. It is also a Center for Real Estate and Urban Economics Working Paper, Number 84–76, March 1984.

Peter Berck died before publication of this work was completed.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

1 Background

This chapter was originally prepared in 1984 as California University Department of Agricultural and Resource Economics (CUDARE) Working Paper 321, Giannini Foundation of Agricultural Economics. It is posted at the eScholarship Repository, University of California. http://repositories.cdlib.org/areucb/321. It is also a Center for Real Estate and Urban Economics Working Paper, Number 84–76, March 1984.

This paper originated out of the desire of the commodity futures exchanges to expand their reach outside of the agriculture sector to other sectors of the economy. As a result, we teamed up to apply Berck’s extensive work on futures markets (Berck, 1981; Berck & Cecchetti, 1981) with Rosen’s empirical work on housing and institutional work on the building material inputs to housing production (Rosen, 1978, 1979). Berck extended his previous work to provide a theoretical framework for hedging using a housing start futures contract. Rosen tested the models using empirical data on housing starts and building material companies. The importance of finding a way to hedge the impact of the large and very volatile housing sector using commodity future exchanges has been further validated by the introduction of Government National Mortgage Association (GNMA) futures based on work by Sandor (1975) and housing price future contracts based on work by Shiller (2008).

2 Introduction

Many building materials firms and home builders are highly dependent on the aggregate level of housing production. Currently, there is little that a firm can do to mitigate the impact of fluctuations in housing activity on the firm’s activity, other than diversify out of the housing industry. While careful planning and forecasts can reduce the cost of these fluctuations, most firms in these industries (with the exception of lumber firms) are unable to hedge against unexpected changes in housing starts. The Coffee, Sugar and Cocoa Exchange’s proposed futures contract on housing starts would greatly change this situation. This paper carefully examines in both a theoretical and empirical framework the Coffee, Sugar and Cocoa Exchange’s proposed futures contract based on housing starts.

In a theoretical sense, the use of hedging for a building material supplier or a homebuilder faced with an uncertain quantity of housing starts is similar to the agricultural producer using a price hedge. As in the agricultural model, the variance of income can clearly be reduced by a hedging strategy. The amount of hedging which is undertaken depends on the covariance of the future and the firms’ profits and the variance of the futures. We show that quantity futures indices make sense not only as a risk trading device but also as a cost-efficient method to allow firms to obtain the benefits of diversification. Instead of hedging by diversifying production into unfamiliar product lines, firms can obtain the same benefits through hedging in the futures market.

Our theoretical view that a housing start futures index has important economic benefits is strongly confirmed by our empirical analysis. A key factor influencing the potential usefulness of the housing start future is the extent to which housing start forecasts are accurate. We show that there is a substantial prediction error in housing start forecasts, sometimes as large as 300,000 to 500,000 starts on a seasonally adjusted annual basis.

A second key factor influencing the housing start futures potential efficacy is the relationship between firm profits in the building materials and building sector and housing starts. Using ordinary least squares regressions, we develop earnings equations for 25 publicly traded firms, whose major business was one of wood products, cement, general building materials, or home building. Despite the well-known deficiencies in using reported earnings as a proxy for firm profits, we conclude that housing starts are a highly significant explanatory variable in explaining variations in earnings for firms in these industries. Three aggregate production regressions confirm the close relationship between housing starts and lumber, cement, and gypsum output.

Using our empirical results, we construct a minimum variance hedge for each firm. We show that utilizing an optimal hedge on housing start futures could reduce the variance of a typical building material supply company’s reported earnings by 25% or more. Our simulations on the effect of hedging on the variance of earnings of home builders showed less dramatic results, primarily because of the unreliability of the earnings data. We have no doubt that hedging would be even more valuable to a national home building company than to a national building materials supplier. We also find that a seasonally adjusted quarterly starts futures hedge is somewhat more effective than the annual moving average start index proposed by the Coffee, Sugar and Cocoa Exchange. Finally, a survey of potential users indicates that while, in a theoretical and hypothetical empirical sense, the housing start futures looks desirable, the industry will require a substantial sales and educational effort before making widespread use of the instrument.

3 Theory

Evaluations of hedging strategies are usually carried out in the framework of mean variance analysis. Mean variance analysis is chosen because it is empirically tractable, even with a large number of potential strategies for hedges. The usual arguments, given in various forms by Peck, Rolfo, and Rutledge, and by Berck in recent applications, relate to the case in which a commodity is being stored or grown, and its price is uncertain (Peck, 1975; Rutledge, 1972; Rolfo, 1980; Berck, 1981; Berck & Cecchetti, 1981). In these applications, taking a hedge position can reduce the variance in an agent’s income – possibly at the cost of reducing mean income as well. An earlier work by Freund (1956) considers choosing a portfolio of crops to grow based on the mean and variance of return. Berck (1981) expands the notion of Freund to include choosing a portfolio of crops and futures based on the means and variance of return. In his model, a farmer chooses how much cotton and how much alfalfa to grow; at the same time, he chooses how much cotton to hedge. It differs from the Peck-Rutledge-Rolfe view in that it is the covariance of the future with a portfolio of crops and not the covariance of the future with a single crop that determines the desirability of hedging.

The present problem, that of choosing an optimal hedge for a supplier of building materials (such as lumber) or home builder faced with an uncertain quantity of housing starts, has much in common with these earlier models. As in earlier models, it is the variance of income which results from an activity – in this case, producing lumber or houses and, in the earlier case, growing crops – that is to be reduced by a hedging strategy. If taken from the point of view of a single entrepreneur without the ability to diversify, the appropriate measure of risk is variance. Of course, this is the measure of risk in Peck, Rutledge, and Rolfe. If taken from the point of view of the stockholder who owns a diversified portfolio, the appropriate measure of risk is covariance with the market. This is similar to Berck’s extension of the standard agricultural hedging model. The difference between this and earlier models is that earlier models are concerned with an uncertain price, and the concern here is with an uncertain quantity, which also induces an uncertain price.

Housing starts are a very good predictor of activity in the construction sector. This activity, in turn, is what generates much of the demand for materials, such as lumber, gypsum board, plumbing materials, etc. From the point of view of a material supplier, there are really two periods. In this first period, housing starts and, hence, ultimate sales are very uncertain. To be sure, predictions are available from firms that sell the results of models, such as those by DRI and Chase Econometrics. Although these predictions are valuable, they do not eliminate the uncertainty in what housing starts will be. During this early period, firms make some decisions; perhaps, these are the decisions to hold inventories for later sale or, perhaps, they relate more directly to the production process. Some varieties of lumber, for example, must be cut more than a year before they can be sold. The second period faced by the firm is when the number of housing starts is known. In this time frame, the demand for materials is known quite exactly. Firms make decisions, also, in this time frame; for example, gypsum manufacturers can adjust their output quite rapidly and would do so in that time frame. The result of these decisions is a flow of economic profits. These economic profits vary as a function of housing starts. The variance in these profits can be undesirable to firms for several reasons. First, investors prefer less risky (in the sense of covariance with market) assets, so risk – particularly undiversifiable risk – reduces stock prices.

Second, the variance can be so extreme that the firm may face severe cash flow problems, or even reorganization, when profits are low. Third, the owners of the firms may not be holding a diversified portfolio – large parts of the stock of forest products firms are often held by a single family – so the stockholders themselves prefer a lower variance in earnings. As will be shown below, a futures market in housing starts can reduce this variance.

The remainder of this theory section is organized into four parts. First, we will describe how much hedging should be done as a function of a firm’s profits and their covariance with the proposed contract. Second, we will describe how a materials supplier’s profits will be correlated with the proposed contract. Third, we describe how a builder’s profits are correlated with the market. Finally, we discuss some of the general equilibrium aspects of a futures market.

3.1 Optimal Hedging

This section outlines the theory of a futures market in housing starts. It considers the case in which agents’ preferences are representable by a function of the mean and variance of their incomes and in which the level of investment in the industry that produces materials for use in housing and related industries is fixed. Since the model does not account for investment, it is a short or medium run model. Stoll (1979) and Berck and Cecchetti (1981) provide similar models.

Before proceeding to the model, it is necessary to introduce some notation. Let S be the number of units actually started in the second period of this two-period model. From the point of view of the first period, S is a random variable. In the first period, agents trade a contract that will have the value S at the end of the second period. The value of the contract in the first period is PS and the quantity of contracts traded are FS. They are determined by the supply and demand for the contract. The potential hedger is a supplier of materials for the building industry. His profits pi(S) are dependent on the realized level of housing starts as well as on other factors, which we have suppressed for convenience. The “speculators” are holders of a presumably diversified portfolio, which has the uncertain payout of z in the second period. Both sets of agents are homogeneous, and their preferences are representable by a function linear in mean and variance. The restriction of preferences to those that can be written in terms of mean and variance is common in finance because of the computational ease of using the first two moments. We adopt it without further apology.

The materials manufacturer’s income is composed of his profits, pi(S), and his gains or losses from the futures market, –FS (S – PS). The quantity in parentheses is the value of the contract at the end of the trading period less its value in the first period; it is the gain or loss on an individual futures contract. The number of contracts traded is FS, and – FS are the number sold by the potential hedger. The manufacturer’s utility function is:

where y is income, y = pi(S) − FS(S − PS).

Since utility is ordinal, there need be no constant preceding the term in mean income, and only the constant u is needed.

The manufacturer’s choice problem is to choose his futures position to maximize his utility:

which has first-order condition:

Since (S – PS) is the cost of hedging and FS is the quantity of hedging, this gives a demand curve for hedging. Its intercept depends on the covariance of the future and the industries’ profits; the higher the covariance, the larger the demand for futures. The slope of the demand curve depends upon the variance of the futures. A greater variance makes for a steeper demand curve and, therefore, for less hedging.

The speculator is an owner of a market portfolio, z, who has the opportunity to add one more security, the future, to his portfolio. Like the hedger, his preferences are representable in terms of mean and variance of his income, y:

and

His maximization problem is to:

which has first-order conditions,

Here E[S] – PS is the expected gain from the contract, which is the return to speculation, and FS is the quantity of long contracts held by the speculative sector.

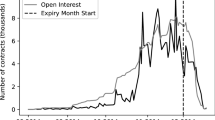

From this, one concludes that there will be some hedging any time the future correlates better with the building industry than it does with the market as a whole. Eliminating E[S] – PS from both of the first-order conditions gives the equilibrium quantity of the futures contracts:

From the above expression, we learn that the open interest decreases as the variance of the value of the futures increases. Similarly, a large difference in the covariance in the future and the market as opposed to the future and industry profits leads to a large open interest. The expected gain on a contract can also be derived from the first-order conditions. It is,

Again, the differences in the covariances are critical in determining how much a hedger will have to pay, in expectation, for hedging.

The above analysis provides a theory of hedging that emphasizes the risk trading function of futures markets, which is the essence of the Keynes-Hicks version of these markets. The markets may, however, be driven and exist for other reasons. For instance, the various participants, while recognizing the risks involved in the market, may hold differing expectations regarding S. There is no reason why hedgers and speculators as classes should differ, but if there is great divergence of opinion within the groups (or among them), then the market will flourish.

The above theory can also be extended to allow for hedging in many futures market instruments. For instance, interest rate futures, lumber, and plywood futures could also be useful to the potential hedger. To find the optimal hedge, one finds the variance covariance matrix of the possible hedging instruments and profits, Q. Letting the possible future be the new vector quantity FS with mean returns X, the hedging problem is:

The first-order conditions are much as before, but a meaningful solution requires quadratic programming. Although this paper will not pursue these sorts of hedges, we will offer a few observations. If one of the hedging instruments correlates very well with profits and is cheap to use, it will be the major, or even only, instrument chosen. If one of the instruments is very highly correlated with a set of the other, then only the cheapest of the two sets will be used. Thus, for the new future to have a good chance of market acceptance, it should be better correlated with the firms’ activities than were the old futures, and it should have a lower expected loss to the hedge position than the old futures did.

3.2 Materials Supplier

The materials suppliers’ profits are correlated with housing starts because the demand for his product is determined by housing starts. The supplier has two fundamentally different times to make his decisions, before and after starts are known.

We capture this two-part decision-making process and the firm’s technology in a conditional cost function. Let K be the input to the production process purchased before housing starts are known, and let M be the ultimate output of materials. The conditional cost function C(M, K) = c(M) ⋅ g(K). Both the functions, g and c, are twice continuously differentiable, where the first derivative of g is negative, its second derivative is positive, and the first derivation of c is positive. The demand facing the firm is assumed to be linear in price, M = f(S) – bP. Here, b is a constant and f is a twice continuously differentiable function with a positive-first derivation. The demand equation asserts that, as the number of housing starts goes up, so does the demand for materials.

In the period after s becomes known, one can find the magnitudes of all of the relevant variables by solving supply equals demand for M, where supply is the inverse marginal cost curve. In symbols, CM = P and M = f(S) − bP. This can be written, also, as M* = f(S) – bCM(M*). Since S is random, so is M.

Profits, pi, are:

which are also random because M* is a function of the random S.

A specific example would be C = a0 + a1 M + a2 M2 so C′ = a1 + 2a2 M.

Straightforward calculation gives,

since,

On making the substitution, one gets

Taking the short run point of view, where K is fixed, one could easily find the optimal hedge if one knew the covariance of pi and fs, as in the previous section.

One can approximate that covariance as

where D is the derivative operator. This gives

Since the size of the minimum variance hedge is just this covariance divided by the variance of the hedge, a large hedge depends upon f, f and g(K) all being large. That is to say, demand f should be larger and it should be responsive to starts (f′ large). Moreover, there should be a larger commitment made before S is known, large K. A later section discusses how K might be chosen.

3.3 The Builder

The theory for the builder is slightly different from that of a materials supplier. The home building industry is composed of two generic classes of builders: custom builders and speculative or for sale builders. The custom builder takes orders from households and primarily builds units which are sold and at least partially paid for prior to the start of construction. The speculative builder on the other hand starts a unit with a hoped-for sale one to two quarters in the future. Thus, this type of builder is betting on macroeconomic conditions one to two quarters in the future, which will influence his ability to sell his housing unit. Thus, his profit at time t is dependent on sales in time t and starts in time t – 2.

Thus, a speculative builder really needs to hedge sales rather than housing starts. Only if current housing starts are highly correlated with current home sales could he utilize the housing start futures index. Fortunately, it appears that empirically housing starts are highly correlated with new home sales (0.881), so a profit maximizing builder could utilize the housing start futures index to hedge against an unexpected change in sales.

Proceeding more formally, supply of new units for period t depends upon their being started in period t – 1. How many units will be started at t – 1, given pure competition? Can the risk in building them be hedged?

Let It–l be the inventory of unsold units at t – 1. With St–1 starts, the additions to occupied dwellings at t are St–l + It − 1 − It. The price would be given by the demand curve.

Here, a are uncertain macro conditions, and It is a function of new housing completions.

From the vantage point of t – 1, a will determine: (1) the sale price Pt and (2) the additions to occupied stock, through the unsold carryout, It. The mean-variance decision maker considering starting a house will evaluate the price Pt and its variance Var Pt, since the mean and variance of his income are linear transformations of these numbers. Both these numbers would be easy to compute, if It were known. Unfortunately, it needs to be computed by dynamic-stochastic programming, and its exact form is beyond the scope of this paper. For our purposes, we simply note that it is a decreasing function of a. To determine the efficacy of hedging, we need to compute the covariance of a builder’s income for houses started in t – 1 with starts in period t. Again, this would require a more complicated decision model than we will present here, but we offer a few observations. If a turns out to be quite low, then the price will be low, income will be low, and carryout will be high. Since carryout will be high and starts in period t directly compete with carryout in period t – 1, starts at t will be low, but the exact correlation is critically mediated by how many houses remain unsold when macro conditions are poor for house sales. We leave the usefulness of such hedges as an empirical question.

4 General Equilibrium

So far, this discussion of theory has assumed that the level of underlying economic investment is fixed. In terms of our model of Sect. 3.2, K was fixed. This section discusses how one might generalize to the case where investment level, K, is determined at the same time as decisions are made about future FS. The theory borrows heavily from Stoll (1979) and Berck and Cecchetti (1981).

Again, take a mean variance point of view. How many futures and how much K should be invested? Let K cost r per unit. The agent’s problem is:

where the expression for pi is the same as in the earlier sections. The first-order conditions for an intercept maximum are:

The first condition, which is new, says that the expected profit less the cost of K is equal to the marginal contribution to risk times the utility cost of risk, u. Since both equations are evaluated at the optimal K and FS, hedging affects the optimal scale of the material industry.

Further generalization would be to allow more activities; let K and FS be vectors. The first-order conditions will be similar, except that they will involve many more covariance terms. When the agent’s choices are expanded to the full market, he ceases to be a material supplier and becomes a wealth holder in the Capital Asset Pricing Market. At that point, he no longer demands any futures, since he already will choose to hold a fully diversified portfolio.

This train of thought leads to a more general view of futures. Futures are used because other methods of diversification are more expensive or inappropriate. First, stock market diversification does not preclude (costly for the stockholders) bankruptcy. Stockholders cannot be made to subscribe additional amounts to the firm when times are bad, even if they would gladly do so. Second, futures diversify risk without diversifying control. And third, one futures market is much less costly than a separate stock offering for each small firm that might use the market.

5 Pricing of the Futures Contract

In this section, we construct the values for the proposed contract at its expiration and one, two, and three quarters prior to its expiration. We have constructed these values on the assumption that the futures market will be unbiased for the value of the contract at expiration. The theory section explains why this might not be so. In a rather famous exchange, Cootner (1960) and Telser (1960) debated the unbiasedness of contracts, with, at best, indecisive results. Hence, our assumption is not at variance with the received literature. The section precedes by the following: (l) choosing a prediction of starts (which we will later unadjust using the X-11 weights), (2) constructing the value of the proposed contract from the predictions and actual starts and finally (3) presenting the value of the contract with some discussion.

5.1 Predicting Starts

Predictions of housing starts for one and two quarters ahead for the period running from the first quarter of 1975 through the second quarter of 1983 were obtained in the following manner. Data were available for the entire sample period for four different series of forecasts; hence, these four were considered as possible components of a forecasting model. Two came from large econometric models: the Data Resources, Inc. (DRI) early forecast and the Chase Econometrics early forecast. The other two were consensus forecasts collected by the American Statistical Association and National Bureau of Economic Research (ASA/NBER), on the one hand, and the Commerce Department’s Bureau of Economic Analysis (BEA), on the other. In each case, the forecasts used were those for one and two quarters after the forecast was issued, which means the forecasts issued for two and three quarters ahead. (Since the models used data from two quarters previously, the forecast issued for one quarter ahead was actually a forecast for the quarter in which the forecast was issued.)

Preliminary analysis indicated that the ASA/NBER forecasts outperformed the other three. Its mean squared error of prediction was the lowest for both forecasts and was a good deal lower than both econometric models for one quarter ahead forecasts and a great deal lower than all three other models for the two quarter ahead forecast, as shown in Table 1.

Regression analysis was used to determine the optimal combination of forecasts to be used. For the one quarter ahead forecast, a linear regression of actual housing starts on the forecasts of the four models yielded significant coefficients only for the ASA/NBER forecast, as shown in Table 2. As the table shows, the hypothesis that the constant term and all forecast coefficients except for the ASA/NBER forecast were equal to zero could not be rejected with any adequate level of confidence; the value of the F-statistic, 0.797, indicates that rejection of the hypothesis would involve a probability of type I error of about 0.55, far too high a value.

The regression results indicate that the ASA/NBER forecast provides all the relevant data for constructing a forecast of housing starts. The necessity of adjustment of the ASA/NBER forecast was explored through a regression of actual housing starts on that forecast. As Table 3 shows, the coefficient of the ASA/NBER forecast was extremely close to one (the ASA/NBER forecast was expressed in terms of millions of starts, while the actual starts were expressed in terms of thousands of starts).

The analysis thus proceeded on the assumption that the ASA/NBER forecast was by itself the best predictor of housing starts one quarter ahead from among the options considered.

A similar analysis was performed for the two quarter ahead forecasts of the four models. In this case, both the DRI and the ASA/NBER forecasts had coefficients that were significantly different from zero (i.e., the value of the t-statistics associated with the coefficient was greater than 1.96). The value of the F-statistic associated with the hypothesis that the constant term and all forecast coefficients except for the ASA/NBER forecast was significant was 2.851, indicating that rejection of the hypothesis would involve a probability of type I error of slightly under 0.05. In this instance, the case for including the ORI forecast was stronger; nonetheless, the statistical evidence indicated that the ASA/NBER forecast would be quite adequate as the sole data for forecasting. Again, a regression of actual starts on the ASA/− NBER forecast showed a coefficient of about one, so that it was concluded that the ASA/NBER unadjusted provided the best forecast of housing starts two quarters ahead.

A key factor influencing the potential usefulness of the housing start future is the extent to which the forecasts described above were accurate. Table 4 shows the forecast errors for the one and two quarter ahead forecasts. These data clearly show that there is a substantial prediction error, sometimes as large as 300,000 to 500,000 starts. This implies that there is substantial room for a futures contract that will allow firms to hedge against these unpredicted movements in housing activity.

6 Constructing the Contract

Given the ASA/NBER starts predictions, it is possible to find the value of the contract. The proposed contract is to have a value equal to the number of starts (in thousands) times 100 on its day of expiration. The number of starts is the number of units actually started in the previous 12 months. For example, the contract expiring in mid-January, 1981, would have a settlement price of $129,890. This price is the number of thousand starts in calendar 1980 times 100. In this section, we examine what these contracts would have traded at over the four quarters prior to their expiration.

First, let us consider the quarter immediately prior to the expiration of the contract. For concreteness, consider an expiring January contract, so that mid-October is the decision time in the quarter immediately prior to contract expiration. By mid-October, the actual starts are already known for the first three quarters of the year. All that is left to predict is the current quarter. Thus, by mid-October, the expected number of annual starts is the actual starts for the first three quarters plus the prediction of the actual, not the seasonally adjusted, starts for the last quarter. Assuming that there is neither backwardation nor contango (and there is no strong theoretical reason to believe either will hold), the value of the contract will be the expected number of starts. The variance in the value of the contract will be the prediction error of actual starts in the fourth quarter, with the predictions made in October.

Two quarters back, the story is much the same, except that only two quarters are history and two quarters will have to be predicted. The variance in the value of the contract is the variance of the sum of the errors made in predicting the two remaining quarters. Similarly, three quarters back leaves three quarters to predict and only one as history and four quarters back leaves all four quarters to predict.

There are two important things to note about the construction of this contract: (1) Since the contract is for realized annual numbers, as the contract gets close to its expiration, it becomes more certain purely because three quarters of what makes up the contract become history. Also, since housing start data are released monthly, more information is available about the actual housing start numbers as we get close to the end of the quarter. Offsetting that increased certainty is that monthly housing starts are often revised. (2) As we find in the potential user survey, most of the industry is used to thinking in terms of seasonally adjusted data. Forecasts are made for and quoted for seasonally adjusted data, but using this contract requires predictions of the actual number of starts.

7 Value of Contract

Table 5 provides the values of the contracts at expiration and in the four quarters prior to expiration. Subtracting the last column in the table from the first gives the return to a long position held for three quarters. For instance, the contract expiring in the third quarter of 1983 would have made $20,000 for the holder of a long position. Most of the contract, however, produced gains far smaller than that. Table 6 gives the returns to the long position held for 270 days.

One final note on these tables: They are constructed with private housing starts, not total starts. This is necessary because only private starts are announced mid-month following the month of the starts.

8 Hedging

This section presents and evaluates our calculations of optimal hedging based on reported earnings of firms and corroborated by models based on sectoral output indices. The subsections are as follows: (1) a discussion of the relations between the sale of building materials and construction, (2) presentation of hedges based on earnings data, (3) corroboration from value indices, and (4) a qualification to our findings from considering basis risk.

9 The Relationship Between Building Materials Output and Construction Output

One way of quantifying the importance of housing construction to various types of building material producers is to construct a simple input-output table. Table 7 shows the dependence of various materials on construction output. The input-output table was constructed for 1979 and excludes sales within a sector (i.e., sales of lumber products to lumber companies). It shows that all construction utilizes 54% of lumber and wood products output, 66% of stone and clay products output (cement, gypsum, and brick), and 81% of heating, plumbing, and fabricated structural metal output. If we could separate residential and nonresidential construction and also break down our materials categories more finely, we would find somewhat different but still important linkages between housing production and building material sales.

10 Earnings

One method of testing the efficacy of the proposed futures market in starts is to test its effects in stabilizing earnings. Earnings are a proxy for firm profits. They are not a perfect proxy because they are subject to being manipulated by the firms’ accountants to make the firm look better. One of the firms in our sample reported in its telephone interview that its reported earnings bore little relation to its economic profits. Sharpe (1964) notes this problem and comments further that the distortion of earnings from economic profits can continue indefinitely. It is not merely a matter of smoothing the quarter-to-quarter variations in earnings, although that alone would cause serious underestimation of the benefits of hedging. Our view is that the amount of hedging one would do to stabilize reported earnings is less than what would be used to stabilize true economic profits, because the incentive is to make the former more stable than the latter.

The steps needed to find the appropriate hedge are:

11 Predicting Earnings

Our method is to use ordinary least squares to predict real earnings as a function of housing starts and seasonal dummies.

We chose a sample of 25 publicly traded firms, whose major business was one of wood products, cement, building materials, or home building. Their earnings were divided by the consumer price index to produce real earnings. We tried regressing real earnings on contemporaneous housing starts and on once and twice lagged housing starts and found that the best fits and highest t values were obtained in the regressions that used twice lagged housing starts and the seasonal dummies. In 19 of the 26 regressions, housing starts were a significant explanatory variable. Only the regressions for the six builders were by and large disappointing in terms of statistical significance and fit – three of the six did not have significant coefficients. The R-squared of these equations averaged close to 0.60 for the cement group and less for the other groups. Since the R-squared is a major part of the prediction error, high R-squared is likely to make hedged strategies seem more profitable. How high these statistics are, thus, is best discussed in terms of how much hedging can reduce variance of earnings.

The limitations of this method, besides those imposed by the imperfections in the earnings data, relate to the imperfections of the regressions as economic models. To the extent that other demand side variables, such as nonresidential construction, and supply side variables, such as wages, are significant and should have been included in the regressions of earnings, the coefficients in the regressions are biased. Hedging strategies based on these coefficients would turn out to be ineffectual, if the omitted variables moved with housing starts during the sample period and moved independently thereafter. We have not included these variables, because of the lack of available forecasts of their magnitude, and can only hope that our error of omission is less than the error we would commit if we forecasted these variables in an ad hoc fashion.

Since there are 25 publicly traded firms in our sample, we will refrain from presenting all of our OLS results. Table 7 gives the coefficients on housing starts and the overall fit of the equations. From these regressions, we conclude that housing starts are a highly significant explanatory variable. The seasonal dummies, though not statistically significant, are necessary in the regressions, because the starts figures are seasonally adjusted and the dummies remove the seasonality. The Durbin-Watson statistics indicate no autocorrelation. Finally, twice lagged starts perform much better than lagged starts, as a purely empirical matter. We believe this just reflects accounting corrections and that the actual lag between starts and earnings is closer to one quarter. Similar results were obtained by running the regressions on predicted rather than actual starts. Since only predicted starts were known to the agents at the time the hedge was constructed, the regressions with predicted starts were used for constructing the optimal hedges (Table 8).

As we showed above in the theory section, the minimum variance hedge is just the covariance of the futures contract and earnings divided by the variance of the futures contract. It reduces the variance of earnings to the previous variance times one minus the correlation coefficient of futures and earnings squared. For a contract on seasonally adjusted quarterly starts, Table 9 shows that 11 of the 19 firms who were not builders would be able to reduce the variance of their reported earnings by 25% or more by pursuing an aggressive hedging strategy. In aggregate, these 19 firms would buy 3697 contracts for housing market futures. Table 10 gives the results for the contract as specified by the exchange on actual starts. This index is slightly less effective than the futures index using seasonally adjusted quarterly starts.

The theory section provided a demand for hedging curve. It showed that the amount of hedging is actually sensitive to the expected loss from a hedged position. The formula for the optimal mean variance hedge is:

12 Aggregate Production Regressions

Aggregate production regressions were run to show the relationship between housing starts and three building materials: lumber, cement, and gypsum. The closer the relationship between the output of these materials and housing starts, the more useful a housing start hedge might be to a producer of these materials.

The first equation relates the real value of lumber output to current and lagged seasonally adjusted housing starts over the period 1975:1 to 1983:2. The R2 of 0.84 and coefficient estimates that are three times their standard errors indicate that the equation is highly statistically significant. It explains a large portion of the fluctuations in real lumber output.

The second equation relates the real value of cement output to current and lagged seasonally adjusted housing starts and the real value of industrial building (a large user of cement slabs). The equation was also run over the 1975:1 to 1983:2 period. The R2 was 0.69, and the coefficient estimates were between 1.4 and 2.2 times their standard error. While the cement equation is somewhat less of a tight fit than the lumber equation, it is clear that residential construction is still a major determinant of cement sales.

The third aggregate equation relates gypsum sales to current seasonally adjusted housing starts, housing starts lagged one and two quarters, and the total real value of nonresidential construction for the period from 1978:3 to 1983:2. The R2 was 0.96, and the coefficient estimates were 2.0 to 4.6 times their standard errors, indicating that the gypsum equation showed the closest relationship to housing activity.

Table 11 shows the aggregate material supply regressions in detail.

13 Basis and Basis Risk

The basis is the difference between a cash and a futures market price. It includes a price difference for timing, e.g., current delivery versus June delivery, and a price difference for transportation, e.g., Iowa delivery versus Chicago delivery. It may also include a grade differential. The logical extension of the notion of basis to quantity futures markets is the futures market quantity less the actual quantity that occurred. In the case of housing starts futures, the basis would be the value of the futures market contract less the number of units started in a particular locality in the preceding 12 months. Thus, the basis for starts has two components, the difference in the number of starts in the past year versus the number of starts predicted for the contract period, a time element, and the difference in the number of starts in a local region versus the number of starts nationally. As the contract nears maturity, the part of the basis relating to timing will disappear. The part relating to regionality may not.

A standard example of basis risk is that of a flour miller: “We make a flour sale requiring 13.50 protein spring wheat as a raw material. The Minneapolis dollar price of that wheat is $2.25. We buy the September at $2.30. It goes down to $2.20, but the dollar price of 13.50 protein wheat stays at $2.55 (which is another way of saying that the premium advanced from $.24 to $.35 over the future). We have lost $.10 on the September future while the price of our raw materials has remained the same. We have no compensating gain. We are out $.10 per bushel” (Atherton Bean, “The Miller and the Commodity Market” in Ann E. Peck, ed., Views from the Trade, [Chicago:Chicago Board of Trade, 1978], p.).

In this example, the miller’s basis is the difference between the price of the grade of wheat he wanted and the grade traded in the futures market turned against him. This is basis risk in the milling industry.

In the housing market, regionality would seem to be the major contributor to basis risk. To make the notion more clear, consider a cement producer who only sells in California. It is units started in California, not units started nationally, that affect his sales. Thus, a low correlation between national starts and California starts would entail a large basis risk for this producer. He could find, for instance, that national housing starts increased, while his sales and California starts decreased. In this case, he would be losing money in both the cash and the futures markets, which is even worse than being unhedged.

14 Regional Basis Risk

To get some notion of how bad this type of basis risk could be, we correlated national and regional housing starts for all states. These correlation coefficients are shown in Table 12 for the 1975–1983 period.

The correlation between seasonally adjusted national starts and seasonally adjusted starts by state varies over a wide range. Nearly 40 states show a correlation coefficient over 0.70, indicating that in most states regional basis risk is not a large factor. However, in a few states, such as Hawaii, Alaska, Texas, and Vermont, national and state starts have a low correlation.

This implies that producers who sell primarily in those states will have difficulty using the national housing start index for hedging. However, for most producers who sell in a local market, the fairly high correlation of state and national starts minimizes regional basis risk. For those producers who sell to a national market, which is the case for most of the publicly traded firms we have examined, regional basis risk is of little or no consequence.

15 Survey of Potential Users of Housing Start Futures as a Hedge

In order to study the potential impact of the proposed housing start futures contract, a survey of potential users of this new contract was performed. Thirty building material supply firms and home builders were surveyed by mail and telephone.

Each of the potential users was provided with the three-page description from the Coffee, Sugar and Cocoa Exchange entitled, “Hedging with Sectoral Output Indices” and the two-page description on contract terms of the futures contract on housing starts. The 30 companies, essentially the same companies for which the hedge models were constructed in Sect. 4, were also provided with a list of five questions. The five questions were as follows: (1) Would your company be likely to use a housing start futures contract to hedge sales and profits? (2) What difficulties would you find in using such a contract? (3) Does your company presently use any futures contract to hedge? (4) What further informational material on the contract would you need before embarking on a hedging program? (5) If you used a hedging program, would you execute it internally or would you seek an outside expert consultant or trader? We will now report the results of the survey by question.

On the first question, concerning likely use of the contract, most potential users were quite conservative. They called it an “interesting concept” and “conceptually very interesting for those in cyclical industries.” However, most companies concluded that they probably would not use it because their company was “too conservative,” “not sophisticated enough,” or it does not “fit our style.” In particular, a number of companies said that they were already well diversified and not that tied to housing. This was the response of diversified material companies and cement companies.

A number of the companies noted that a major problem with the start index was its national nature. Most companies felt they were more closely tied to starts in one region – the “West,” California, or the “Mid-West.” This regional basis risk problem, as we discussed earlier in the paper, was definitely perceived as a major problem for a number of companies which have a regional orientation, such as home builders, cement, and gypsum companies.

Several companies also noted that the start index chosen was especially cumbersome and not intuitive to those thinking in terms of seasonally adjusted monthly start rates. Also, several companies felt that they could forecast dramatic change in housing starts fairly well and so did not see how they could use the futures contract. Of course, as we have pointed out earlier in the paper, there were a number of occasions when the consensus housing start forecast was dramatically wrong.

In response to the question of present use of other futures contracts, about half of the companies use lumber or foreign currency futures. Those companies which presently used such contracts were more inclined to be positive about the housing start futures contract. However, those tied directly to lumber preferred to use the lumber contract directly rather than the housing index.

Most companies felt that they needed substantially more educational and sales effort before they completely understood and could persuade their company to use a housing start futures contract. All but one company said they would use an outside consultant to set up their hedging strategy.

The best way to summarize the survey results is that there is cautious but not enthusiastic interest in the contract. This is probably explained by the fact that the contract is still hypothetical and that most of the companies come from a manufacturing and conservative perspective. Hedging with futures is as of now not part of their typical corporate financial strategy. However, it is our view that the actual appearance of the contract and active sales effort by the Coffee, Sugar and Cocoa Exchange concerning the clear benefits of the contract would stimulate substantial contract volume.

References

Berck, P. (1981). Portfolio theory and the demand for futures: The case of California Cotton. American Journal of Agricultural Economics, 63, 466–474.

Berck, P., & Cecchetti, S. (1981). An equilibrium approach to the theory of futures markets (Working paper no. 175). Department of Agricultural and Resource Economics.

Cootner, P. H. (1960). Returns to speculators: Telser versus Keynes. Journal of Political Economy, 68, 396–404.

Freund, R. J. (1956). The introduction of risk into a programming model. Econometrica, 24, 253–263.

Fried, J. (1970). Forecasting and probability distributions for models of portfolio selection. Journal of Finance, 25, 539–554.

Peck, A. E. (1975). Hedging and income stability: Concepts, implications, and an example. American Journal of Agricultural Economics, 57, 410–419.

Rolfo, J. (1980). Optimal hedging under price and quantity uncertainty: The case of the cocoa producers. Journal of Political Economy, 88, 100–116.

Rosen, K. T. (1978). The implications of demand instability for the behavior of firms: The case of residential construction (with C. Manski). Journal of Urban and Real Estate Economics, 6, 204–226.

Rosen, K. T. (1979). Seasonal cycles in the housing market: Patterns, costs, and policies. MIT Press.

Rutledge, D. J. S. (1972). Hedgers’ demand for futures contracts: A theoretical framework with application to the U.S. soybean complex. Food Research Institute Study, 11, 237–256.

Sandor, R. L. (1975). On the interest rate futures market: An introduction to the development and use of the Chicago board of trade GNMA contract. In Federal Home Loan Bank Board Journal. Federal Home Loan Bank Board.

Sharpe, W. F. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk. Journal of Finance, 19, 425–442.

Shiller, R. J. (2008). Derivatives markets for home prices. Cowles Foundation, Discussion Paper No. 1648.

Stoll, H. (1979). Commodity futures and spot price determination and hedging in capital market equilibrium. Journal of Financial and Quantitative Analysis, Proceedings Issue, 14, 873–894.

Telser, L. G. (1960). Rejoinder. Journal of Political Economy, 68, 405–408.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2023 The Author(s)

About this chapter

Cite this chapter

Berck, P., Rosen, K.T. (2023). Hedging with a Housing Start Futures Contract. In: Zilberman, D., Perloff, J.M., Spindell Berck, C. (eds) Sustainable Resource Development in the 21st Century. Natural Resource Management and Policy, vol 57. Springer, Cham. https://doi.org/10.1007/978-3-031-24823-8_5

Download citation

DOI: https://doi.org/10.1007/978-3-031-24823-8_5

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-24822-1

Online ISBN: 978-3-031-24823-8

eBook Packages: Economics and FinanceEconomics and Finance (R0)