Abstract

The growing use of composites in various industries such as aerospace, automotive and wind turbine has increased environmental concerns regarding their waste disposal methods. Deploying circular economy practices to reuse composites could play a crucial role in the future. In this regard, this chapter addresses the development and implementation of new business models for composites re-use, as fundamental enabler for the industrial exploitation and diffusion of technological and methodological innovations developed in the FiberEUse project. Seven products were chosen as representatives for composites reuse application in four industrial sectors: sanitary, sports equipment, furniture and automotive. Re-use business models are presented describing their value proposition, with particular reference to the provision of advanced product-service bundles, the revenue models (including schemes such as leasing), as well as new supply chain configurations entailing new partnership between producers and recyclers to access post-use composites to re-use. Given the importance of reverse supply networks, the potential reverse logistics pathways for mechanical recycling of Glass Fiber Reinforced Plastic (GFRP), thermal recycling of Carbon Fiber Reinforced Plastic (CFRP) and remanufacturing of CF composites waste in Europe for 2020 and 2050 have been investigated. We concluded that the optimal reverse logistics network needs to be decentralized in more than one country in Europe. Therefore, it is suggested that policy makers address regulation to allow the transportation of waste between European countries to facilitate the development of recycling networks for composites reuse.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

Keywords

- Business model innovation

- Circular business model

- Composites reuse

- Product-service system

- Reverse logistics

- Optimization

- Recycling

1 Introduction

1.1 What Is Circular Business Model Innovation?

Circular business models refer to models that articulate the logic of how organizations create, offer and deliver value to its broad range of stakeholders while, at the same time, minimizing ecological and social costs [1]. It is a conceptual logic for value creation based on utilizing the economic value retained in products after use in the production of new offerings [2]. However, there are diverse views on what circular business models are. For example, business models can focus on utilization of intermediary outputs that have no further use in the creation of activities that are monetized in the form of either cost reductions or revenue streams [3]. Business models could also focus on the use of ‘presources’ over the use of resources in the process of creating, delivering and capturing value [4] or they can focus on market value of sustainable remanufacturing [5]. Inherent in all these definitions is value creation using pre-existing products [6]. Implicit in these definitions of circular business models are business processes that support sustainable manufacturing strategies in the circular economy.

With increasing global population and limited scarce natural resources, the linear economic model whereby raw materials are utilized in the manufacture process and disposed of is unsustainable. There is need to consider circular industrial business models. The linear economic model is giving way to the circular economy model focuses on careful alignment and management of resource flows across the value chain by integrating reverse logistics, design innovation, collaborative ecosystem, and business model innovation [7]. This is an innovative area that is receiving attention as governments push to cut carbon emissions to combat global warming and meet their climate change targets [8]. Circular business promotes sustainability by allowing companies to generate maximum return from given resources and reach zero waste targets. It also contributes to greater customer satisfaction through service innovation that reduces negative impact on the environment [9].

High investment costs and risks, deficiency in take back programs, and lack of awareness of environmental concerns are among factors that stand as barriers to implementation of circular business models [10]. Circular business models represent solutions to move towards zero waste, improving environmental impacts and increasing economic profit [11]. However, issues such as cultural barriers and risk of cannibalization could serve as barriers to the implementation of circular business models [12].

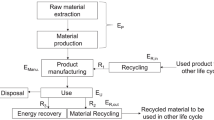

There is increasing demand for sustainable manufacturing that takes responsibility in conserving natural resources and limiting negative impact on the environment. This has given rise to the evolution of the circular economy that investigates how raw materials can be managed in a sustainable and ethical manner. Circular economy could help in reducing harmful emissions to the environment on the one hand, while at the same time reduce utilization of energy. As suggested in Fig. 1, sustainable manufacturing strategies that add value in the circular economy in the life cycle of the product include recycling, recondition and repair, reuse and remanufacture. At every point in the life cycle of a product, virgin raw materials energy and resources are being utilized while emissions and waste are released into the land, sea and air [13].

Remanufacturing concept and significance [13]

Underpinning the circular economy are circular business models that take cognizance of the contextual environment in which the sustainable manufacturing is taking place. Life Cycle Analysis could be useful if comparing and contrasting the advantages of different circular business models. It could be argued that the type of business model may be indicated by the type of sustainable manufacturing activity undertaken. However, this opens up debates on how and when to apply specific circular business models (i.e. for remanufacturing instead than recycling).

1.2 Circular Business Model Trends

Business model for sustainability deals with creating competitive advantage through superior customer value that contributes to a sustainable development for companies and society [14]. This is distinguished from Business Models for Circularity (BMCs) that explicitly link business models to the product life cycle [15].

In the literature various business model strategies are suggested. Firstly, those that provide performance (through the capability of satisfying user needs without needing to own products), secondly, those that extend product value (exploiting residual value of products from manufacturers, customers and back to manufacturers), thirdly, those that focus on delivering long life of products supported by design for durability and repair, fourthly, those that encourage sufficiency, such as those that actively reduce end user consumption through principle such as upgradability and service, fifthly, those that extend resource value, such as exploiting residual value of recourses through collection of “wasted materials” and turning them into new forms of value and sixthly industrial symbiosis that utilize residual outputs from one process and a resource for another process. However, they may not fit into neatly separate strategies [1].

With the emergence of Circular Business Model Innovation (CBMI), there is need for development of tools that support these processes. There is need for standardization of terminology in what is meant by circular business models [16]. From the literature it could range from different sustainable remanufacturing strategies to the business activities that underpin sustainable manufacturing. For example, conceptualizing sustainable business models into 5 categories including, Coordinating circular value chains through data, Circular product design, Use, Reuse, Share and repair, Collection and reverse logistics, Sorting and pre-processing [17]. These could be argued to be concepts that underpin sustainable business models and not business models in their selves.

The need to better conceptualize circular business models demonstrates the variety in definitions and operationalization of circular business processes [6, 18]. An ambitious attempt to categories circular business models delineates them into those that exploit resource supplies, resource recovery, product service systems and open innovations [10]. While product service systems are often highlighted as a potential enabler for new circular business models, not all business models based on product service systems have superior impact on the environment and efficient use of resources [19].

In contrast, circular business models may be conceptualized into those grounded on pay per use concepts (where products are rented or leased instead of owned), product life extension (such as reuse, repair, reset) and resource value extensions (such as recycling materials) [20]. There is a risk of mixing up the sustainable manufacturing strategies that contribute to the circular economy from the business models that underpin these strategies [4]. This buttresses the need for research that provides clear standardization of terminology and nomenclature in the circular business model landscape.

1.3 State of the Art of Current Research

Business Model Canvas (BMC) can be used for circular business models as a conceptual framework. It is suggested that there is an urgent need for research in business models that take cognizance of issues such as customer relationships, key partners, value proposition, costs and revenue into consideration [21]. These will include research on how risk of cannibalization are managed and how policy makers can be enablers of circular business models. There is need for research that investigates how policy influences the operationalization of circular business models in creating value for customers [22]. Research is needed on how circular business models inform circular economy as well as the development of sustainability theories that inform current challenges to circular business models [14]. There is also need for research that tests the hypothesis of effectiveness of different circular business models which could include business to business and business to customer which evaluates reverse logistics and viability of operationalization of different sustainability strategies [18].

1.4 Need for Circular Business Models for the Case of Composites Re-use

Composite materials made of glass and carbon fibers are extensively used in various industries such as aerospace, automotive and sport equipment, due to their durability and superior mechanical properties, light weight and high corrosion resistance [23]. By 2020, the yearly production of Carbon Fiber (CF) composites is expected to be more than 140,000 tons [24]. Also, the market of glass fiber reinforced plastic (GFRP) is huge and is expected to rise at a Compound Annual Growth Rate (CAGR) of 6.4% from 2017 to 2022 [25]. As a consequence of such rising demand, the waste management of composites is crucial. However, at the moment the common waste treatment of composites is landfilling [26]. On the other hand, there are serious environmental concerns on landfill disposal of composites, which have raised serious concerns among policy makers [27]. For instance, EU legislation is making the composites landfilling unviable in most EU countries [28].

As the future recycling of composites will be at the top in the agenda of many countries, manufacturers in several sectors shift towards implementing a circular economy business model, which encourages the use of recycled composites. This way, the new businesses will be more economical and contribute to environmental legislations [26].

FiberEUse project aims at diversion of waste from landfill through recycling and reuse of composites and development of innovative circular business models. In the following sections the circular business models of composites reuse in the sanitary, ski equipment, furniture and automotive industries are presented.

2 Rational of Business Model Research Approach

As the purpose of this study is to develop innovative circular business models based on composites reuse, the state of the art of business model innovation in the context of circular economy was firstly investigated to derive insights for the development of novel value propositions, innovative value network architectures and revenue models. Both academia and industry sources have been considered. In particular, 29 publications on composites waste management and business model have been taken in to account. The search keywords were chosen as following: business model innovation, circular business model, composites reuse, product-service system.

The proposal of innovative circular business models referred to the specific cases of products chosen from sectors where composites are key-materials, such as the sanitary, sports, furniture and automotive industry.

To develop a novel business model, it is significant to study the current market conditions, envisaged trends and customers’ needs [29]. Focus group research methodology was selected to derive such market insights. Two focus groups were organized involving automotive industry experts from Spain and Germany, sanitary sector experts from Italy, ski industry experts from Austria, and furniture industry experts from Italy. The combined insights from these workshops as well as literature review supported the formulation of realistic novel business models. Graphical representation of the methods used is presented in Fig. 2.

3 New Circular Business Models for Composites Reuse

In this paragraph, a new business models for each selected industry is proposed.

3.1 New Sustainable Business Models for Products in Sanitary and Sport Equipment

Sanitary and sports equipment are among the industries that can benefit from using recycled composites. Composites are an appropriate alternative to metals and are widely used in industrial and sports equipment sectors [30]. As some examples of using GF composites in sanitary products, we can mention shower trays and bathtubs. Ski is an example of sports product using massively GF composite materials.

Sanitary products. The global demand for sanitary products is increasing. As an example, the market of shower trays is expected to grow by 4.9% from 2018 to 2025 [31].

The new business model for shower tray and bathtub is focused on offering a product made of recycled composites via mechanical recycling (Table 1). The model suggests a manufacturer offers a product which is built using scraps generated from the production process, that are usually lost. In this new paradigm, a manufacturer could replace at least 40% of virgin GFRP with post-industrial GFRP waste (the percentage is calculated based on average performance/sustainability considerations). In case in-house produced scraps are not sufficient to produce new products, manufacturers can use external waste materials to meet the minimum level of scraps they need to reach such a percentage (main available scrap source is the construction industry). The intrinsic benefit of using in-house or external scraps implies securing the value chain for raw material (cost saving) as well as assuring the quality of secondary materials (non-mixed fractions of waste) are met.

From the value proposition point of view, the new business model aims at offering products that have lower environmental impact, while keeping the price and performance at the same level of products made out of virgin material. Thus, this is mainly the case of a product-oriented type of business model. However, the offering of greener products provides also the opportunity to provide a set of services that increase the value for customers and that can also decrease eventual customers’ acceptance barriers. In particular, in order to address concerns about products performance, maintenance packages and enhanced performance guarantee, which include product substitution in case of failures, can be offered in bundle with the product (with no or limited cost increase). Another type of possible advanced service consists in the product upgrade after a certain use period, coupled with an efficient take-back system. This service might be particularly interesting for segments such as hotel, Spa, sport club, etc., which may plan in this way renovation periods in the frame of long-term supply and service contracts.

Regarding the revenue stream, the selling price of products such as shower tray and bath tub made out of recycled material need to be set at least the same as that of products realized with virgin material. Customers may be reluctant to spend more money for a partly recycled product, especially until when a generally-diffused consumers’ green culture will not be established. With respect to cost structure, the increase in cost due to the recycling process will be compensated by the use of the in-house scraps.

Since the value proposition emphasizes green product, it is crucial to properly communicate in order to let customers know the green value embedded in the products. Eco-marketing strategy could be deployed to highlight the company’s effort in decreasing its ecological footprint through more sustainable production.

Key-assets of manufacturers to implement this business model are on the one hand the mastery of the mechanical recycling process and, on the other, the establishment of a green brand image. Scrap collection, mechanical recycling and customized after sale services such as offering maintenance and repair packages are the key activities of manufacturer to create and deliver value.

From the value architecture point of view, if the internal waste to build a recycled product is not enough, it is necessary that manufacturers establish new partnerships with waste management companies or with other composites manufacturers willing to sell their GFRP production scraps.

Ski. By having 43% of the global ski market, Europe holds the largest market share of this industry. America and Asia, with 34% and 20% of the market respectively, are the other largest markets for the ski industry [32]. Major customer of ski industry are ski rental companies.

Regarding the ski’s End-of-Life (EoL), a systematic take back system to collect the product does not exist. Moreover, since ski is made out of different types of materials, disassembly is a very challenging task. As a consequence, currently, the product at its EoL goes to landfill or incineration after removal of aluminum.

The new business model of ski is based on offering a greener product via replacement of 10% of virgin GFRP (via mechanical recycling) with in-house scraps from the production process. Such a limited percentage of recycled material is due to the need to guarantee extreme mechanical performance to the products.

The business model proposed for skis is the same as sanitary products (Table 1). The manufacturer sells a greener product with similar price and performance, while offering additional value-added service to ski renting companies. The service includes enhanced warranty to customers during extended periods. In this way, the customer uncertainty regarding the recycled product’s performance will be reduced.

In terms of cost structure, the product’s cost is lower than the original one.

The key assets of manufacturer are the mechanical recycling technologies and green brand image.

From a value architecture point of view, there will be less need to recur to external scraps supplier with respect to the sanitary case, since the target percentage GFRP post-industrial waste is lower and compatible with internal production scraps of ski-making companies.

3.2 Leasing of Composite-Made Components in Furniture Industry

Green public procurement (GPP) is one of the promising tools in moving towards a more resource efficient economy [33]. GPP brings environmental factors into the core of decisions that are related to purchasing public goods and services [34]. The expenditures of public organizations that use GPP for goods and services account nearly the 14% of the EU’s Gross Domestic Products (GDP). Such a large demand for green products acts as a catalyst on green innovations and largely contributes to circular production and sustainable consumption [35].

One of the areas that GPP can widely be used is in the office furniture industry. Currently, there is a serious environmental concern regarding the inefficient life cycle management of office furniture. These concerns are mainly related to the high volume of waste at the end of products life cycle [36]. In Europe, around 1.2 million tons of office furniture are discarded every year [33]. Therefore, new business models that suggest reusing the furniture materials instead of disposing them can generate significant environmental and economic gains in comparison to conventional business models. In order to show how recycled materials can be used in this sector, we consider the case of office desks built from recycled composites. Desks are composed of two main parts: a table top made of GFRP and metal pillars. The two parts can be easily disassembled and re-assembled, for example for on-site substitution and renewal of table top or for re-use in other products.

In the new business model, we consider a business partnership between a furniture supplier and a GFRP-made tabletops supplier (Table 2). The furniture producer offers an eco-friendly office desk, with similar performance and aesthetic features compared to those products made out of virgin material. He is responsible for installation of desks at customers’ site and take-back service. The tabletop supplier is specialized in the production of green GFRP materials by include a certain percentage of end-of-life composites in the production of parts through mechanical recycling technologies integrated in its plant. In the case of tabletops, about the 50% of virgin GFRP can be replaced by recycled composites.

The proposed case falls under the category of a usage/access oriented business model where the product ownership remains with the furniture producer and customer pays for using the product rather than owning it [37]. In other words, this business model is based on leasing the product instead of selling it. In reference to circular economy concept, leasing would guarantee a constant return flow of old office desks from customers to furniture producer. After recollecting the used products, the furniture producer disassembles the desks and send their tabletops to the manufacturer. This way the dismantled tabletops will be recycled and re-enter the production cycle.

A long-term partnership between tabletop manufacturer and furniture producer is crucial for the successful implementation of the new circular business model. Part manufacturer’s capacity in recycling materials, enables the furniture producer to offer a lease concept centered on “green products” and that incorporates continuous renovation services to the customers. On the other hand, the leasing model guarantees the tabletop manufacturer to have a constant and planned return flow of parts to be recycled.

In the new financial scheme, the furniture producer offers a 4–7 years lease contract to public organizations and by the time that lease expiries, the furniture producer would take back the old product and provide customers with new green office desks. In addition, the furniture producer can offer regular maintenance checks and ergonomic desk adjustments to address customers’ concerns on product performance.

From an economic point of view, the furniture producer will experience postponed incomes, which affect the revenue model. As a result, furniture producer need to precisely reflect this into the leasing fee proposed to customers. Therefore, adoption of advanced marketing and financial approaches are crucial for the economic sustainability of this business models. Overall, the increase in the expenses need to be compensated by the cost saving associated with reuse of materials and by market increase due to the new attractive value proposition.

After 4–7 years that the lease expires, most of the metal pillars might still be in good conditions. These metal parts can easily be integrated into the manufacturing of new office desks and the manufacturer can decrease its related production costs. Therefore, although composites reuse is the main area of focus in this business model, reusing the metal pillars of the office desks can be another attractive opportunity to consider for efficiency and sustainability, as well as to strengthen the “green image”.

Using recycled composites in the manufacturing process complies with regulations related to environmental protection. For instance, Italy has introduced an environmental legislation that requires a mandatory GPP requirement for all the Italian public offices. [38]. Therefore, business risks associated with the novelty of circular model can be mitigated through company’s green marketing strategies. Eco-labeling, as part of the green marketing strategy (company’s interface with customers) can be applied to highlight the use of recycled composites in the product. This would help customers to be aware of the green aspect of the product and accept the new business model as an added value. From a customer perspective, green element embedded in a product can be a key driver towards accepting the new business model.

From a value chain network building blocks perspective, new partnership with logistics companies for collection of old office desks might be considered, in case the furniture supplier does not manage logistics internally. Finally, it is important to consider building a strong partnership with government and public bodies. Such a partnership will contribute to the evolution of legislation/directives that entail incentives to increase the sustainability of GPP practices.

3.3 Greener Structural Components in Automotive Industry

Automotive industry is going through a radical transformation. There are signs which indicate that new technology and circular business models will be the leading trends of the future [39]. The use of lightweight parts made of composite materials in vehicles is another leading trend. One of the major drivers to use lightweight material stems from the fact that heavyweight components used in Internal Combustion Engine (ICE) cars are one of the sources of pollution. Therefore, the lightweight and remarkable fatigue behavior of composite materials are the reasons, which the automotive industry is moving towards using more composites [40]. Such a trend will be even more marked in the future due to the transition towards electric vehicles, in which the significant weight of battery pack requires reduction of weight of other components.

In the automotive industry, GF composites and carbon fiber reinforced polymer (CFRP) are used in the structural components of cars [41]. Regarding the EoL waste of CFRP, the common scenario is landfilling or incineration [42]. In order to address the EoL waste problem of composites, three case studies of car components made out of recycled composites reclaimed from thermal recycling are discussed in this section.

The first vehicle structural component is cowl top, which is built from 20 to 30% rGF. The manufacturer uses the rGF derived from EoL of wind turbine blades reclaimed from thermal recycling. Wind turbines have a lifecycle around 20–25 years. Therefore, the removal and dismantling of wind turbines in near future will lead to a substantial amount of composites waste [43]. The second vehicle structural component is clutch pedal that is built from 20 to 40% thermally recycled CF (rCF). Finally, the third vehicle component is a front-end carrier that is built from 15 to 25% rCF thermally recovered from the production waste of the aeronautic sector. CFRP is widely used in the aeronautic industry [41].

In the new business model of cowl top, a tier 1 manufacturer provides eco-friendly products with lower price, while keeping the aesthetic values and performance at the same level of those products made out of virgin material.

Regarding the clutch pedal and front end carrier, the tier 1 manufacturer offers green products with the enhanced performance, while the product’s price and aesthetic value will be similar to the original products. Products’ technical performances are improved since the new product is lighter, thanks to the low density of the rCF.

The new business models are characterized as product-oriented (Table 3). The revenue is generated through selling greener performing products. In order to address possible concerns about the performance of parts manufactured with post-consumer material, extended guarantee will be offered with direct substitution of eventual defective products as a product-oriented service. The targeted customers are Original Equipment Manufacturers (OEMs), in particular those with a high environmental profile. The evolution of regulation in the automotive sector will favor the diffusion of this business model, since OEMs will be forced to increase the rate of recycled materials in automotive parts. Regarding the cost structure, the product cost can be either lower or higher than the product made out of virgin material. Given the proportion of recycled material used in a product and the price of rCF, the product final cost may vary.

The key asset of the tier 1 manufacturer includes long term contracts with suppliers of rCF/rGF and logistics providers. Through such contracts, the manufacturer is assured of a steady supply of a certain volume of materials with specific quality requirements. Green brand image is another key resource of manufacturer.

From a technical point of view, the manufacturing process is the same as the one from virgin composites (GF/CF). Therefore, key activities of the manufacturer include keeping the production cycle time equivalent to the original product and making sure that the reliability and quality of the recycled materials fulfill the technological specification of the final products.

From the value chain architecture point of view, new partnerships with recyclers and logistics providers need to be established. Another key partner includes government and public bodies. Such a partnership allows government to update legislation/ directives and offer new incentives that promotes the circular economy and EoL waste management based on the new business models.

3.4 Selling of Remanufactured Components in Automotive from EoL Carbon Fiber Reinforced Plastic

Composite materials are an appropriate alternative to metals [30] due to their strength, lightweight and long life cycle [40]. In comparison to metal the deterioration of composites is quite slow. Therefore, at the EoL of a car, technical performance of CF composite structural components is close to new ones. This means that a great proportion of composite components can be reused in several car generations. Based on this consideration, a new business model is proposed, where the manufacturer adopts lightweight CFRP car platform for an electric vehicle, that can be re-used at the end of life, as an alternative to a steel one. The platform will be made using both virgin and recycled composites, mainly drawn from the automotive industry.

In this novel business model, the tier 1 manufacturer offers a greener product with the same quality and reliability, while the technical performance and aesthetic values are enhanced and the product life cycle is extended through product reuse in several car generations. In other words, the new product has the same stiffness and can tolerate the same fatigue, while it is 40% lighter and has a better design compared to the steel one. In addition, the product life cycle is extended through quick and non-destructive disassembly. After the disassembly, the product will be tested to identify whether it can be reused or not. In case the product cannot be reused, it will be sent to recyclers.

The new business model is a product-oriented business model, with the inclusion of End-Of-Life related services (Table 4). The tier 1 manufacturer establishes long-term contracts with the OEM for the supply of CFRP platform, guaranteeing their re-use in vehicles other than the first one at their end-of-life within a fixed time horizon. Thus, recovered platform can be re-used either in vehicles of new production (in a futuristic scenario), in fleets of vehicles sold to leasing/renting companies, or as spare parts for used or refurbished vehicles. In the contractual relationship, OEM returns to tier 1 manufacturer the platform dismantled from End-Of-Life vehicles. The latter tests them, eventually carries out repair and adaptation operations, and provides back to the OEM platforms to be installed in other vehicles with the same performance guarantee than the initial ones. Supplied platforms can come from his stock of re-usable platforms (after testing and necessary repair/adaptation operations) or can be platforms of new production. Thus, tier 1 manufacturer becomes the responsible of the circular economy of platform for the OEM, guaranteeing performance in-use in multiple use cycles.

A promising market scenario for this business model is the one of vehicles fleets leased to car sharing/renting companies, private or B2B customers. In particular, it is projected that by year 2030, the sharing paradigm will reshape the automotive industry. In Europe, car sharing will stand for almost 35% of road trips [39]. For fleet vehicles that are used by customers occasionally or in the frame of full-service contract limited in time, the main requirement is efficiency-in-use and cost saving, while the non-ownership of the product lowers possible acceptance barriers related to re-used parts. Furthermore, contractually fixed leasing periods with certain return time of parts, allow the exact definition of use cycles time, which is a fundamental variable both for long-term contracting and operations planning.

From the cost structure point of view, in the first diffusion phase of this business model, the first production cost of CFRP platform is significantly higher than the current traditional platform cost (it will decrease when scale economies will be realized through the massive adoption of this concept by OEMs). However, the possible re-use of the part in 4–5 use cycles will more than compensate the increased initial cost and will provide economic advantage in the long term. However, this implies additional risk and postponed revenues.

In terms of key assets, the platform manufacturer should rely on detachable joining technologies enabling the disassembly of the lightweight platform quickly and without any destruction. Other key resources are the non-destructive test and repair technologies. When the platform is dismantled, special technologies are needed to specify if the product can be reused or not. In addition, in case of product’s small damages, the manufacturer repairs the products via innovative repair technologies. The green brand image and the long term contract with recyclers and raw material suppliers are other key resources of the manufacturer. Finally, special agreements need to be established with OEM/fleet management companies/car sharing. Such agreements serve as a key resources, which guarantees a strong take back system to collect a lightweight platform at vehicle’s EoL.

From value chain architecture point of view, it is important to develop a partnership with raw material (CF) supplier, recyclers, logistics providers and fleet management / car sharing companies’ and taxis. Another key partner includes public bodies, so that they can update regulations based on the new business model to increase the circular economy practices in the automotive industry.

4 Reverse Logistics

4.1 Current Status of Logistics for Composite Materials Circular Business Models

It is identified both in the academia and industry that the introduction of reverse logistics is essential to the transition towards a circular economy business model [44]. It is considered one of the main modifications for the companies’ circular economy business models [45]. During the reverse logistics management on a circular business model it is highly important to investigate the potential of each return product and decide regarding the reuse, recycle, remanufacture of the material, component and product itself. In addition, another necessary issue is to understand the sources and the frequencies of the returns, as well as their impending benefits [46]. This includes concerns regarding the returns’ quality and their quantification, especially in the future. In this section, potential reverse logistics pathways for composite materials are presented, along with the quantification of the sources.

It is argued that one of the first issues on the reverse network design in general is the location-allocation problem, hence there is a rising interest on the reverse flows and optimal facilities identification [47]. Extensive collection of papers can be found in the literature that discuss the deterministic optimization of closed loop and reverse supply chains [48] or optimization under uncertainty [49]. In Table 5 a review of reverse logistics circular economy methods is presented, including the optimization method, the objectives and the application sector.

It is evident from Table 5 that in the existing literature there are no studies focusing in the reverse supply chain optimization of reinforced composite parts. This can be explained by the fact that the reverse supply chain for composite parts and materials does not currently exist, apart from some exceptions (e.g. the carbon fiber recycling sector). Models for the automotive reverse supply chain have also been proposed [52], however the focus was not on the reinforced composite parts of the EoL vehicles.

There are few cases that considered reinforced composite products. A study developed an optimization model to identify suitable locations in UK to process the waste from wind blades, however the study focused only on the material flow form the wind farms to the recycling facilities [57]. Another study introduced an optimization model for the design of an aerospace CFRP waste management supply chain in France, including various recycling technologies [58]. However, the reverse supply chain proposed did not include the outbound flow of the recycled fiber to the customers. This gap in the literature has to do with the fact that there is uncertainty and challenges regarding the reinforced composite parts recycling, as well as the end market of the recycled composites.

In the following section, potential, novel reverse logistics pathways for composite materials are proposed.

4.2 Novel Reverse Logistics Pathways for Composite Materials

Proposed Reverse Logistics Pathways. Three promising reverse logistics pathways for composite materials are proposed, and are presented in Fig. 3. These pathways were identified within the FiberEUse project.

The three pathways recommend different treatment for the FRP waste: mechanical and thermal treatment, as well as remanufacturing. For Glass Fiber (GF) material the mechanical treatment option was considered as the most reasonable way forward due to the low value of virgin material and the high volumes of waste available, in combination with the availability of potential end use applications. The wind sector was selected as a representative example of waste supplier of EoL GFRP, due to the fact that wind blades consist more than 82% of GF and it is estimated that by 2050 there will be more than 300,000 tons of waste wind blades in Europe [59]. The Sheet Molding Compound (SMC) and Bulk Molding Compound (BMC) manufacturers are assumed the most promising customers of the recycled material according to the literature [60] and experts, where the shredded fibers are used as fillers in new thermoset polymers. In that respect the reverse supply network has a cross-sectorial approach since the SMC and BMC material is employed in various end applications such as transportation, electronics and building. Furthermore, the SMC/BMC material has an increasing demand with approximately 287,000 tons produced in 2018 and an expected 1–2% annual growth [61].

Regarding the Carbon Fiber material, thermal treatment was assumed, due to the expensive processing required that, according to the literature and experiments, it is not a feasible option for a low value material such as Glass Fibers, and the fact that thermal treatment has the potential to maintain the original fiber properties to a higher extent than mechanical treatment, which enhances the potential for high-value applications and circularity of the rCF. In addition, the production of carbon fibers is energy-intensive [62], which has as a result the high price of the virgin material. Therefore, the possibility of recycling the CFRP waste has both economic and environmental incentives. Two sectors have been assumed to provide material for the thermal treatment, the automotive and aircraft sector, since CFRP material use has great potential in those two sectors due to its lightweight properties [63]. However, the latter sector, has the greatest amount of material with better mechanical properties. In total it is forecasted that from both sectors, there will be more than 130,000 tons of CFRP available in Europe by 2050. A potential pathway, after the rCF are retrieved is to create pellets that can be used for injection molding in the automotive sector. For this reason, the rCF are sent to chemical facilities (compounders) and after to the end customer, the 1st Tier car part manufacturers, where the demand of CFRP in Europe is forecasted for 2050 to be more than 200,000 tons [61].

For the final reverse supply chain pathway, remanufacturing of FRP parts is considered. As mentioned earlier in the business model section, the focus is on an innovative and high value product from the automotive, the reusable CF car frames (platform) from car share companies. Car sharing is an alternative for sustainable transportation and it supports towards a low emission mobility [64]. It is estimated that Europe has currently almost a 60,000 cars fleet [65] and an increase is expected. In addition, the use of the CF platform for the shared cars is promising due to the lightweight properties of the material, it improves the fuel consumption, which is highly important for the car users. Secondly, these cars have a high usage (almost 12,000 miles per year) and they are usually dismissed after three years of service, however, the platform of the car is usually in a good condition and only the engine or the body of the car actually needs replacement. Therefore, the EoL cars are assumed to be sent to a new entity, the remanufacturing facility, where they are dismantled and the car platform is inspected. Some frames are then remanufactured depending on their condition, otherwise they are sent to thermal treating facilities. The remanufactured car frames are returned to the car assembly plants, where they are reused for new car production.

For the first pathway with the mechanical treatment, four logistical scenarios were identified according to the wind sector and waste management experts that are presented in Fig. 4, as already presented in Chap. 3 of this Book.

In all four scenarios the main process, shredding, is performed in a dedicated processing facility, however in scenario 2 a pre-shredding process is performed in the wind farm location. It is challenging to fully shred the wind turbine blades at the wind farm currently, as pre-shredding at the wind farms is controlled by many regulations concerning the prevention of dust formation and in some countries (as Germany) it is almost impossible. Scenarios 1 and 3 are quite alike, with only difference in the final size of the blades at the wind farm. Scenario 1 is similar with the currently adopted procedure, when the blades are cut and transported for landfilling. These two scenarios showcase the trade-offs between the more cost-efficient cutting in the facility and the lower transportation cost of scenario 3, with the more efficient transport density of the blades. In the final scenario, the blade is transported as it is to the facility with exceptional transport, which has a much higher cost compared to the other alternatives.

A sensitivity analysis was performed for the four scenarios against the most influential parameters in order to identify the most interesting ones from a cost and practical perspectives. The four scenarios were investigated for the following variables, which are the most impactful:

-

Number of blades in a decommissioned wind farm: 3, 6, 12, 18, 30 and 40

-

Distance wind farm-plant: 20, 100 and 1000 km

-

Particles final output dimension: 2, 4, 6, 8, 10 mm.

The scenarios that were optimal in greatest percentage of combinations of the above factors are scenarios 1 and 2, as it is depicted in Table 6. Therefore, these two reverse supply networks are considered the most promising.

The first two proposed reverse logistics pathways of Fig. 3 are optimized for Europe and the latter one for the case of United Kingdom, due to data availability. A location-allocation problem was followed with the inputs and outputs of Fig. 5. A cost optimization model was developed, because the focus was to maximize the potential for viability of the proposed reverse supply chains. At the current stage where the cost is one of the key barriers, focusing on configurations that reduce the carbon footprint, while potentially increasing the cost would be less relevant. In addition, the proposed networks that introduce a circular pathway are considered more sustainable than the current end-of-life option, which is the landfilling or the incineration. In future work, the model could be adapted to include environmental objectives as a multi-objective optimization problem.

Some indicative results regarding the optimal configurations and their economics as well as environmental performance are presented in the following section.

Results from Optimal Networks. The model developed for the reverse logistics network cost optimization was employed to find the optimal facility location and material flows for the three previously presented reverse supply chains for composite materials. The optimal networks are presented in Table 7 for the proposed supply networks for both 2020 and 2050.

For the mechanically treated glass fiber it can be observed in Table 7 that the network proposed from the optimization will need to change from 2020 to 2050 for both scenarios. Only the facilities in Germany and Spain remain the same and facilities in UK and Poland are introduced. The optimal reverse supply chains have a decentralized nature and similar locations of the optimal facilities for both scenarios and for 2020 as well as 2050. This can be inferred as an approximate indication of where the facilities should be initially located, whichever treating process is selected and these locations will remain optimal while the system would be expanding over time. It should be noted first that the facilities are located near the SMC/BMC manufactures and second that the largest facility is in Germany, which has the highest supply and demand of material.

For the second reverse logistics pathway (CFRP), it is observed that the proposed network is semi-decentralized, with only two facilities for 2020 since the amount of waste material is quite low and four facilities for 2050. The two proposed networks are quite different, with only similarity the facility in the Netherlands. Generally, in both networks the facilities are located in central Europe.

In the final reverse logistics pathway (reusable CF car platforms), for 2020 both scenarios indicate as optimal a centralized facility near the hot spot of CFRP EoL products, due to the low amount of material. It is observed that both the optimistic and pessimistic scenario propose the same facility location. On the other hand, the optimal network for 2050 differs and becomes very decentralized. This is highlighted on the optimistic scenario, where 8 facilities are proposed, due to the higher amount of CFRP EoL product.

Finally, it can be inferred for the two first reverse supply networks that the optimal supply network structure identified is not centralized and the facilities receive material in most cases from more than one country, as well as they supply material in customers in other countries. Therefore, the optimal networks showcase the need of intercountry transportation of both waste and recycled material.

In Fig. 6 the breakdown of the cost of each process is presented for all the optimal reverse logistics pathways. For the first pathway, it is evident that the transportation cost for scenario 1 is much higher compared to scenario 2. This is due to the fact that in the former case there is no pre-shredding of the blades in situ; therefore, the blades are transported into pieces, which is more costly. The most prominent way to transport one blade in pieces is with two trucks with two containers each. On the other hand, it is inferred that the processing cost in situ for scenario 2, represents almost 50% of the total cost, whereas for scenario 1 it is only 4–6% because in that case the only process required in situ is the cutting of the blades in large pieces.

For the second reverse supply network, it is observed that the compounding cost constitutes the greatest percentage on the total costs. It is evident that in 2050 the pyrolysis cost percentage is decreasing; this is due to the benefits of the economy of scale. So, the material increases and therefore, the processing costs increase proportionally.

For the final reverse logistics pathway, it is evident that the processing constitutes the greatest part of the costs with more than 85%. For both 2020 and 2050 it is observed that the processing cost decreases, when the scenario becomes pessimistic thus the percentage of material that is sent for recycling and is not remanufactured increases. On the other hand, the transportation cost increases, since more material is transported to the recycling facility.

In Fig. 7, the percentage of emissions per stage on the total emissions is displayed. In the first case, the emissions from the shredding process correspond to more than 70% of the total emissions, with highest emissions for scenario 1 due to the highest electricity consumption in the facility. The carbon emissions from transportation are higher on scenario 1 compared to scenario 2 with almost 25% of the total emissions, due to the inefficient blade transportation process, the higher amount of material transported and generally the higher transportation effort involved.

In the second investigated reverse logistics pathway, the carbon emissions from pyrolysis constitute more than 42% of the total emissions, whereas the compounding around 37% for 2020. It is observed that in 2050 the emissions from compounding consist a higher percentage than those of pyrolysis, this is due to the fact that the carbon emissions per kWh per country differ. According to the data, Sweden, Norway, France and Switzerland have a very low carbon emissions coefficient compared to Austria and Netherlands. Finally, in both cases the contribution of the transportation to the emissions is very low.

For the final reverse logistics pathway, it is observed that the greatest contribution derives from the remanufacturing facilities, where mostly electricity is used. This percentage is higher on the optimistic scenario, due to the greater amount of CFRP EoL products that are processed. On the other hand, it is evident that in 2050 optimistic scenario the percentage of the emissions from the transportation is decreased compared to 2020. This decrease derives from the fact that the facilities on these scenarios in 2050 are more decentralized therefore the distances travelled per EoL CFRP product are reduced.

4.3 Logistics Challenges in Closing the Loop of Fiber-Reinforced Composites

A barrier in closing the loop for fiber-reinforced composites is the current lack of some links in the reverse logistics/supply chain, that are needed for the reverse flow of the material to happen. For example, in the mechanically treated GF logistical pathway examined, there is currently no mechanical processing capacity available to undertake this task. Despite the fact that the technology required exists, with modifications of commercially available heavy-duty shredders, there is currently very limited capacity available as there is no market for the end product yet. This is enhanced by the fact that in many countries e.g. Austria landfills currently accept the EoL wind blades in small pieces. In a similar way, pyrolysis capacity for CF currently exists at the scale of the current CF waste production levels, but this will need to be significantly enhanced in the future, since the anticipated amounts of related waste will increase drastically. These supply chain links, essentially the material processors, could be created by a market pull, either as new entities/startups specializing in offering these services, or by existing players in relevant areas that could exploit the new business opportunities arising, for example waste management and recycling companies.

Additional transport obstacles arise when it comes to cross border transportation. At a cross border transport of waste, it has to be ensured if a notification in the origin country as well as in the receiving country is necessary. Shipments of waste on the “Green List” for closing the loop do not require notification. Since fiber-reinforced composites are not included in the “Green List”, notifications are needed. It was also observed that FRP are generally materials with low density, which is not ideal for achieving logistical efficiencies.

Another logistics-related barrier in the emergence of the proposed circular economy pathways relates to the geographical spread of the waste material availability. Glass and carbon fibers are included in products that are used widespread, and in most cases a recycling system would need to recover the EoL material from too many remote locations. This leads to logistical inefficiencies, as (a) the materials involved have low density and do not make efficient use of transportation vehicle capacities and (b) they require complex routing decisions and long transportation distances, as the material is not currently aggregated at more centralized locations. Recycling systems generally benefit from economies of scale at the processing facility level, while the geographical spread of material availability favors more decentralized systems to reduce logistical costs. This is a trade-off between designing centralized and decentralized systems that is difficult to resolve. Ultimately, some of the EoL material that is available in very remote locations leads to much higher costs overall for the system; hence, if systems were not forced to collect the material from everywhere, or if the remote material logistical operations were subsidized in some way, the overall circular economy pathways economics would be much more favorable.

It was also identified that increasing the transported material density significantly reduces the overall system cost. In more detail, the scenarios for the wind blades reverse supply network show that the transportation cost in scenario 1 is much more expensive, especially the inbound due to the inefficient transport of the blade pieces as well as the transportation density difference of the cut and pre-shredded blades. This leads to low utilization of the transportation capacity when transporting large blade pieces. Therefore, this issue would require further research and significant attention, in order to reduce the costs.

Ultimately, a current major barrier in the emergence of the proposed circular economy pathways for fiber-reinforced composite materials is the low cost of the virgin materials, especially in the case of GF. For any circular economy pathway to be successful in practice, a clear prerequisite is to be able to provide the recycled/reused material at a price equal or lower to the virgin material currently used in the specific end processes.

4.4 Managerial and Policy Implications of Novel Reverse Logistics Pathways

The three logistical pathways investigated are quite different from each other; therefore, generic conclusions are difficult to draw. A conclusion valid for both pathways 1 and 2 is that the optimal supply network structure that leads to minimum cost contains a handful of processing facilities at the European level. Hence, the material flows are not country-specific and in many cases the proposed facilities source waste from many countries or may serve end users in a different country. This means that if the aim is to minimize the recycled end product cost, movement of waste and recycled material between countries should be allowed and any existing barriers removed, as very few European countries in isolation would have enough supply and demand to be able to support feasible circular economy pathways. For a successful circular economy approach, especially in the GF case investigated where the feasibility is marginal against the virgin material competitors, a change of perspective from ‘waste’ to ‘valuable raw materials’ should be adopted. For the CF case, the economics are more favorable due to the much higher cost of the competitor virgin CF materials; however, even in this case the supply network proposed indicates large facilities around Europe with a waste material ‘catchment area’ spanning many countries each. Ultimately, standardization of legislation on movement of waste material, when these are for recycling and reusing within a circular economy approach, would be of great importance to facilitate the development of economically viable recycling systems.

Another important lever in the hands of policy makers is the disincentives for alternative waste disposal pathways, such as landfilling or energy recovery. Currently, there is a large variation in policies and costs of disposal of GF and CF, with many European countries having very cheap landfilling, whereas others have already banned the landfilling of these materials. Therefore, if policy makers ensure that the alternative options that divert the material from the circular economy become more expensive, or even cease to exist, they would automatically support the development of such recycling networks for reuse of the FRP.

It is also interesting to note that when one designs a system to process/recycle all the available waste material of one type, this comes at a higher cost compared to a system that only processes the profitable quantities. This of course leaves a question on what would be done with the remaining amounts of FRP waste. It is apparent that some locations will incur a higher cost to provide the waste material for processing, therefore incentives from the policy makers’ perspective should be considered for the reverse supply system to include this more ‘expensive’ waste.

Another key point for consideration of managers and policy makers alike is that the trade-off between larger facilities for ensuring economies of scale, versus the need for more decentralized network with more and smaller facilities to reduce the logistical costs, has no obvious solution. This is apparent from the results of the various pathways and scenarios investigated, where the optimal network structure is different for most of them. Therefore, modelling tools can support a better understanding of these trade-offs and allow investigation of the impact of alternative scenarios, policies or forecasts.

It was also observed that FRP are generally materials with low density, which is not ideal for achieving logistical efficiencies. Despite the fact that there was not one approach identified as best, in most cases increasing the transported material density significantly reduces the overall system cost. Therefore, this issue would require further investigation and significant attention, in order to bring the costs down. Still, one would need to consider the whole network before focusing only on the logistics efficiency in a part of the network, as in our work it has been shown that increasing the transportation efficiency in logistical pathway 1 by pre-shredding at the wind farms ultimately may come at a disproportional cost due to the cost of additional operations in remote locations.

Logistical pathway 3 was quite different in scope than 1 and 2, as it investigated the potential for remanufacturing and reuse of a CF-based automotive part, a novel car frame designed specifically for car sharing applications. Despite the numerous assumptions that had to be made, due to the novelty of this idea, it was identified that even at the country level there would be multiple facilities required in the future, if the demand grows significantly. This shows that the remanufacturing network would be much more decentralized at European level compared to the pathways 1 and 2, and indicated the need for these remanufacturing facilities to be located primarily close to the end users and secondarily close to EoL car availability hotspots. It also shows that transportation costs for reusing whole parts are even more important than in the first two scenarios, ultimately favoring more local reverse supply chain networks.

5 Conclusion

In this chapter, new potential business opportunities of composites reuse were presented. Case studies of products made out of recycled composite materials in the sanitary, sports equipment, furniture and the automotive industry were selected to propose innovative circular business models. The new business models of products made from secondary composites in the sanitary, ski and automotive industries were all focused on selling a greener product together with product-related services. The innovative business model of recycled office desk, in the furniture sector, was based on leasing (non-ownership). Finally, the proposed business model for designing and remanufacturing of lightweight platform built from FRP was based in a customer–supplier long-term supply relationship where the supplier sells greener and more performing products that are periodically taken back and re-supplied at favorable conditions for new production.

In addition, pathways for implementation of reverse logistics, which leads to viable recycling and reuse of composites in Europe, were also proposed. Three possible logistical pathways to reuse composites in Europe were investigated as following: mechanical recycling of GFRP derived from EoL of wind turbine blades; thermal recycling of CFRP derived from aeronautic waste; remanufacturing of CFRP component (reusable CFRP platform) in the automotive industry. The optimal supply network for the first two pathways, which leads to cost reduction, indicates that the waste material flow should be semi-decentralized and that an open multi-country approach should be pursued. The logistics pathway for the latter case suggested that the remanufacturing network needs to be more decentralized in Europe in comparison with the former pathways. In addition, it was defined that even if remanufacturing is carried out in one country, several recycling facilities are required in the future.

Future research is needed at business model level to carefully investigate sustainability and risks, considering the high number of possible business model implementation options and scenarios. Based on techno-economic results, policy research is also needed to elaborate evidence-based policy guidelines to support the diffusion of circular business models in this sector.

References

Hoffman, F., Jokinen, T., Marwede, M.: Circular business models. European Union Development Fund (2017). https://sustainabilityguide.eu/methods/circular-business-models. Last accessed 01 Dec 2020

Linder, M., Williander, M.: Circular business model innovation: inherent uncertainties. Bus. Strateg. Environ. 26, 182–196 (2015)

Roos, G.: Business model innovation to create and capture resource value in future circular material chains. Resources 3, 248–274 (2014)

Den Hollander, M., Bakker, C.: Mind the gap exploiter: Circular business models for product lifetime extension. In: Proceedings of the Electronics Goes Green 2016, pp. 1–8, Berlin, Germany (2016)

Vogtlander, J.G., Scheepens, A.E., Bocken, N.M.P., Peck, D.: Combined analyses of costs, market value and eco-costs in circular business models: eco-efficient value creation in remanufacturing. J. Remanuf. 7(1), 1–17 (2017)

Nußholz, J.: Circular business models: defining a concept and framing an emerging research field. Sustainability 9(10), 1810 (2017)

Goyal, S., Esposito, M., Kapoor, A.: Circular economy business models in developing economies: lessons from India on reduce, recycle, and reuse paradigms. Thunderbird Int. Bus. Rev. 60(5), 729–740 (2018)

Tse, T., Esposito, M., Soufani, K.: How businesses can support a circular economy. Harvard Business Review (2016). https://hbr.org/2016/02/how-businesses-cansupport-a-circular-economy. Last accessed 19 Nov 2020

Upadhyay, A., Akter, S., Adams, L., Kumar, V., Varma, N.: Investigating “circular business models” in the manufacturing and service sectors. J. Manuf. Technol. Manag. 30(3), 590–606 (2019)

Chen, C.W.: Improving circular economy business models: opportunities for business and innovation: a new framework for businesses to create a truly circular economy. Johnson Matthey Technol. Rev. 64(1), 48–58 (2020)

Oghazi, P., Mostaghel, R.: Circular business model challenges and lessons learned—an industrial perspective. Sustainability 10(3), 739 (2018)

RISE—Research Institutes of Sweden, Ict, and Viktoria.: Circular business model innovation: inherent uncertainties. Bus. Strat. Environ. 26(2), 182–196 (2017)

Ijomah, W.L., McMahon, C.A., Hammond, G.P., Newman, S.T.: Development of robust design-for-remanufacturing guidelines to further the aims of sustainable development. Int. J. Prod. Res. 45(18), 4513–4536 (2007)

Fraccascia, L., Giannoccaro, I., Agarwal, A., Hansen, E.G.: Business models for the circular economy: opportunities and challenges. Bus. Strateg. Environ. 28(2), 430–432 (2019)

Hansen, E.G., Große-Dunker, F., Reichwald, R.: Sustainability innovation cube. A framework to evaluate sustainability-oriented innovations. Int. J. Inno. Manage. 13, 683–713 (2009)

Bocken, N., Strupeit, L., Whalen, K., Nußholz, J.: A review and evaluation of circular business model innovation tools. Sustainability 11(8), 2210 (2019)

Shahbazi, K.: 10 circular business model examples, https://www.boardofinnovation.com/blog/circular-business-model-examples. Last accessed 19 Nov 2020

Lewandowski, M.: Designing the business models for circular economy—towards the conceptual framework. Sustainability 8(1) (2016)

Pieroni, M.P.P., McAloone, T.C., Pigosso, D.C.A.: Configuring new business models for circular economy through product–service systems. Sustainability 11(13), 3727 (2019)

Whalen, C.J., Whalen, K.A.: Circular economy business models: a critical examination. J. Econ. Issues 54(3), 628–643 (2020)

Reim, W., Parida, V., Sjödin, D.R.: Circular business models for the bio-economy: a review and new directions for future research. Sustainability 11(9), 2558 (2019)

OECD.: Business models for the circular economy: opportunities and challenges from a policy perspective. OECD Publishing, Paris (2018)

Naqvi, S.R., Prabhakara, H.M., Bramer, E.A., Dierkes, W., Akkerman, R., Brem, G.: A critical review on recycling of end-of-life carbon fibre/glass fibre reinforced composites waste using pyrolysis towards a circular economy. Resour. Conserv. Recycl. 136, 118–129 (2018)

Meng, F., Olivetti, E.A., Zhao, Y., Chang, J.C., Pickering, S.J., McKechnie, J.: Comparing life cycle energy and global warming potential of carbon fiber composite recycling technologies and waste management options. ACS Sustain. Chem. Eng. 6, 9854–9865 (2018)

GFRP Composite Market. https://www.marketsandmarkets.com/Market-Reports/glass-fiber-reinforced-plastic-composites-market-142751329.html#:~:text=%5B160%20Pages%20Report%5D%20The%20global,6.4%25%20from%202017%20to%202022. Last accessed 12 Nov 2020

Rybicka, J., Tiwari, A., Leeke, G.A.: Technology readiness level assessment of composites recycling technologies. J. Clean. Prod. 112(1), 1001–1012 (2016)

Jacob, A.: Composites can be recycled. Reinforced Plastic 55(3), 45–46 (2011)

Pickering, S.J.: Recycling technologies for thermoset composite materials—current status. Compos. A Appl. Sci. Manuf. 37(8), 1206–1215 (2006)

McGrath, R.G.: Business models: a discovery driven approach. Long Range Plan 43(2–3), 247–261 (2010)

Oliveux, G., Dandy, L.O., Leeke, G.A.: Current status of recycling of fibre reinforced polymers: review of technologies, reuse and resulting properties. Prog. Mater Sci. 72, 61–99 (2015)

Global Shower Trays Market. https://www.qyresearch.com/index/detail/1087978/global-shower-trays-market. Last accessed 03 Dec 2020

Hudson, S.: Snow Business a study of international Ski industry, 1st edn. Cassell, London (2000)

Parikka-Alhola, K.: Promoting environmentally sound furniture by green public procurement. Ecol. Econ. 68(1–2), 472–485 (2008)

European Environment Agency.: https://www.eea.europa.eu/help/glossary/eea-glossary/green-procurement. Last accessed 23 March 2021

European Commission, ICLEI and PPA: Buying Green! A Handbook on Green Public Procurement, 3rd ed. Publications Office of the European Union, Luxembourg (2016). https://ec.europa.eu/environment/gpp/pdf/Buying-Green-Handbook-3rd-Edition.pdf

Besch, K.: Product-service systems for office furniture: barriers and opportunities on the European market. J. Clean. Prod. 13, 1083–1094 (2005)

Tukker, A.: Eight types of product–service system: eight ways to sustainability? Experiences from SusProNet. Bus. Strategy Environ. 13, 246–260 (2004)

Forrest, A., Hilton, M., Ballinger, A., Whittaker, D.: Circular economy in the furniture sector. Arditi, S (ed.) European Environmental Bureau (EEB) (2017)

Kuhnert, F., Stürmer, C.: Five trends transforming the automotive industry. https://www.pwc.at/de/publikationen/branchen-und-wirtschaftsstudien/eascy-five-trends-transforming-the-automotive-industry_2018.pdf. Last accessed 16 Jan 2018

Kumar, S., Bharj, R.S.: Emerging composite material use in current electric vehicle: a review. In: International Proceeding of Conference on Composite Materials: Manufacturing, Experimental Techniques, Modeling and Simulation, pp. 27946–27954. Material Today Proceedings, Jalandhar (2018)

Koniuszewska, A.G., Kaczmar, J.W.: Application of polymer based composite materials in transportation. Progr. Rubber, Plastics Recycl. Technol. 32(1), 1–24 (2016)

Hagnell, M.K., Åkermo, M.: The economic and mechanical potential of closed loop material usage and recycling of fiber-reinforced composite materials. J. Clean. Prod. 223, 957–968 (2019)

Larsen, K.: Recycling wind turbine blades. Renew. Energy Focus 9(7), 70–73 (2009)

Werning, J.P., Spinler, S.: Transition to circular economy on firm level: Barrier identification and prioritization along the value chain. J. Clean. Prod. 245, 118609 (2020)

Urbinati, A., Chiaroni, D., Chiesa, V.: Towards a new taxonomy of circular economy business models. J. Clean. Prod. 168, 487–498 (2017)

Özkir, V., Başligil, H.: Modelling product-recovery processes in closed-loop supply-chain network design. Int. J. Prod. Res. 50(8), 2218–2233 (2012)

Difrancesco, R.M., Huchzermeier, A.: Closed-loop supply chains: a guide to theory and practice. Int. J. Logistics Res. Appl. 19(5), 443–464 (2016)

Van Engeland, J., Beliën, J., De Boeck, L., De Jaeger, S.: Literature review: Strategic network optimization models in waste reverse supply chains. Omega 91, 102012 (2020)

Govindan, K., Fattahi, M., Keyvanshokooh, E.: Supply chain network design under uncertainty: a comprehensive review and future research directions. Eur. J. Oper. Res. 263(1), 108–141 (2017)

Achillas, C., Vlachokostas, C., Aidonis, D., Moussiopoulos, N., Iakovou, E., Banias, G.: Optimizing reverse logistics network to support policy-making in the case of electrical and electronic equipment. Waste Manage. 30(12), 2592–2600 (2010)

Barros, A.I., Dekker, R., Scholten, V.: A two-level network for recycling sand: a case study. Eur. J. Oper. Res. 110(2), 199–214 (1998)

Cruz-Rivera, R., Ertel, J.: Reverse logistics network design for the collection of end-of-life vehicles in Mexico. Eur. J. Oper. Res. 196(3), 930–939 (2009)

Jayaraman, V., Guide Jr, V.D.R., Srivastava, R.: A closed-loop logistics model for remanufacturing. J. Oper. Res. Soc. 50(5), 497–508 (1998)

Kim, J., Do Chung, B., Kang, Y., Jeong, B.: Robust optimization model for closed-loop supply chain planning under reverse logistics flow and demand uncertainty. J. Clean. Prod. 196, 1314–1328 (2018)

Krikke, H., Bloemhof-Ruwaard, J., Van Wassenhove, L.N.: Concurrent product and closed-loop supply chain design with an application to refrigerators. Int. J. Prod. Res. 41(16), 3689–3719 (2003)

Listeş, O., Dekker, R: A stochastic approach to a case study for product recovery network design. Eur. J. Operational Res. 160(1), 268–287 (2005)

Sultan, A.A.M., Mativenga, P.T., Lou, E.: Managing supply chain complexity: foresight for wind turbine composite waste. Procedia CIRP 69, 938–943 (2018)

Vo Dong, A., Azzaro-Pantel, C., Boix, M.: A multi-period optimization approach for deployment and optimal design of an aerospace CFRP waste management supply chain. Waste Manage. 95, 201–216 (2019)

Lichtenegger, G., Rentizelas, A., Trivyza, N., Siegl, S.: Offshore and onshore wind turbine blade waste material forecast at a regional level in Europe until 2050. Waste Manage. 106, 120–131 (2020)

Mamanpush, S.H., Li, H., Englund, K., Tabatabaei, A.T.: Recycled wind turbine blades as a feedstock for second generation composites. Waste Manage. 76, 708–714 (2018)

Witten, E., Mathes, V., Sauer, M., Kuhnel, M.: Composites Market Report 2018 (2018)

Song, Y.S., Youn, J.R., Gutowski, T.G.: Life cycle energy analysis of fiber-reinforced composites. Compos. A Appl. Sci. Manuf. 40(8), 1257–1265 (2009)

Li, X., Bai, R., McKechnie, J.: Environmental and financial performance of mechanical recycling of carbon fibre reinforced polymers and comparison with conventional disposal routes. J. Clean. Prod. 127, 451–460 (2016)

Goldman, T., Gorham, R.: Sustainable urban transport: four innovative directions. Technol Society 28(1–2), 261–273 (2006)

Phillips, S.: Car sharing market analysis and growth. https://movmi.net/carsharing-market-growth. Last accessed 15Jan 2020

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2022 The Author(s)

About this chapter

Cite this chapter

Copani, G. et al. (2022). New Business Models and Logistical Considerations for Composites Re-use. In: Colledani, M., Turri, S. (eds) Systemic Circular Economy Solutions for Fiber Reinforced Composites. Digital Innovations in Architecture, Engineering and Construction. Springer, Cham. https://doi.org/10.1007/978-3-031-22352-5_19

Download citation

DOI: https://doi.org/10.1007/978-3-031-22352-5_19

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-22351-8

Online ISBN: 978-3-031-22352-5

eBook Packages: EngineeringEngineering (R0)