Abstract

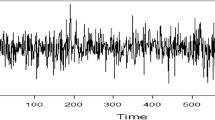

This study examines the nonlinear interdependency among the volatility indexes of gold, oil, and stock markets. The volatility indexes are used as proxies for market sentiment for the period from March 2010 to March 2017. The Markov switching Bayesian vector autoregressive (MS–BVAR) method is applied to measure the interdependency of the lags of these volatility indexes. The empirical results show three unidirectional causal relationships, lag dependencies, and positive impacts of the different market sentiments. There is always a moderate volatility period between every transition from recession to expansion of volatility situations which consistently last for 41 days; high-risk and low-risk periods last for one and three day(s), respectively. The greatest impact is from the first lag of the stock market volatility on the gold market volatility.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Akgül, I., Bildirici, M., & Özdemir, S. (2015). Evaluating the nonlinear linkage between gold prices and stock market index using Markov–switching Bayesian VAR models. Procedia – Social and Behavioral Sciences, 210, 408–415.

Arouri, M. E. H., Jouini, J., & Nguyen, D. K. (2011). Volatility spillovers between oil prices and stock sector returns: Implications for portfolio management. Journal of International Money and Finance, 30(7), 1387–1405.

Baker, M., & Wurgler, J. (2006). Investor sentiment and the cross-section of stock returns. The Journal of Finance, 61(4), 1645–1680.

Baker, M., & Wurgler, J. (2007). Investor sentiment in the stock market. The Journal of Economic Perspectives, 21(2), 129–151.

Barberis, N., Shleifer, A., & Vishny, R. (1998). A model of investor sentiment. Journal of Financial Economics, 49(3), 307–343.

Basher, S. A., & Sadorsky, P. (2016). Hedging emerging market stock prices with oil, gold, VIX, and bonds: A comparison between DCC, ADCC and GO–GARCH. Energy Economics, 54, 235–247.

Broock, W. A., Scheinkman, J. A., Dechert, W. D., & LeBaron, B. (1996). A test for independence based on the correlation dimension. Econometric reviews, 15(3), 197–235.

Brown, G. W., & Cliff, M. T. (2004). Investor sentiment and the near–term stock market. Journal of Empirical Finance, 11(1), 1–27.

Bunnag, T. (2016). Volatility transmission in crude oil, gold, S&P 500 and US Dollar Index Futures using VAR–MGARCH Model. International Journal of Energy Economics and Policy, 6(1), 39–52.

Casarin, R., Sartore, D., & Tronzano, M. (2017). A Bayesian Markov–switching correlation model for contagion analysis on exchange rate markets. Journal of Business & Economic Statistics, 36, 1–14.

Cevik, E. I., & Dibooglu, S. (2013). Persistence and non–linearity in US unemployment: A regime–switching approach. Economic Systems, 37(1), 61–68.

Chang, C., Faff, R. W., & Hwang, C. Y. (2012). Local and global sentiment effects, and the role of legal, information and trading environments. Available at SSRN 1800550.

Creti, A., Joëts, M., & Mignon, V. (2013). On the links between stock and commodity markets’ volatility. Energy Economics, 37, 16–28.

Ehrmann, M., Ellison, M., & Valla, N. (2003). Regime–dependent impulse response functions in a Markov–switching vector auto regression model. Economics Letters, 78(3), 295–299.

Hall, S. G., Psaradakis, Z., & Sola, M. (1999). Detecting periodically collapsing bubbles: A Markov–switching unit root test. Journal of Applied Econometrics, 14, 143–154.

Hamilton, J. D. (1989). A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica: Journal of the Econometric Society, 57, 357–384.

Jammazi, R. (2012). Cross dynamics of oil–stock interactions: A redundant wavelet analysis. Energy, 44(1), 750–777.

Jing–Tung, W. U. (2016). The Markov–switching Granger causality of Asia–Pacific exchange rates. Romanian Journal of Economic Forecasting, 19(3), 94–115.

Krolzig, H. M. (2013). Markov–switching vector autoregressions: Modelling, statistical inference, and application to business cycle analysis (Vol. 454). Springer.

Kumar, D. (2014). Return and volatility transmission between gold and stock sectors: Application of portfolio management and hedging effectiveness. IIMB Management Review, 26(1), 5–16.

Liu, M. L., Ji, Q., & Fan, Y. (2013). How does oil market uncertainty interact with other markets? An empirical analysis of implied volatility index. Energy, 55, 860–868.

Malik, F., & Ewing, B. T. (2009). Volatility transmission between oil prices and equity sector returns. International Review of Financial Analysis, 18(3), 95–100.

Psaradakis, Z., Ravn, M. O., & Sola, M. (2005). Markov switching causality and the money–output relationship. Journal of Applied Econometrics, 20(5), 665–683.

Sims, C. A., & Zha, T. (1998). Bayesian methods for dynamic multivariate models. International Economic Review, 39, 949–968.

Soytas, U., Sari, R., Hammoudeh, S., & Hacihasanoglu, E. (2009). World oil prices, precious metal prices and macroeconomy in Turkey. Energy Policy, 37(12), 5557–5566.

Tsay, R. S. (1989). Testing and modeling threshold autoregressive processes. Journal of the American Statistical Association, 84(405), 231–240.

Walid, C., Chaker, A., Masood, O., & Fry, J. (2011). Stock market volatility and exchange rates in emerging countries: A Markov–state switching approach. Emerging Markets Review, 12(3), 272–292.

Whaley, R. E. (2000). The investor fear gauge. The Journal of Portfolio Management, 26(3), 12–17.

Zhang, Y. J., & Zhang, L. (2015). Interpreting the crude oil price movements: Evidence from the Markov regime switching model. Applied Energy, 143, 96–109.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Ebrahimijam, S., Adaoglu, C., Gokmenoglu, K.K. (2022). Inter-Market Sentiment Analysis Using Markov Switching Bayesian VAR Analysis. In: Procházka, D. (eds) Regulation of Finance and Accounting. ACFA ACFA 2021 2020. Springer Proceedings in Business and Economics. Springer, Cham. https://doi.org/10.1007/978-3-030-99873-8_6

Download citation

DOI: https://doi.org/10.1007/978-3-030-99873-8_6

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-99872-1

Online ISBN: 978-3-030-99873-8

eBook Packages: Economics and FinanceEconomics and Finance (R0)