Abstract

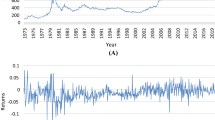

This study presents a novel approach to financial market forecasting based on a synergistic forecasting model, a type of techno-fundamental analysis that combines technical analysis indicators with fundamental variables using the Kalman filter to improve the accuracy of predictions. We used this model to forecast daily market price returns on gold. The obtained results show that our synergistic model can significantly deduct the root-mean-square error (RMSE) of the predictions compared to a sole technical and/or fundamental analysis. Also, 67% of the time, the model significantly and correctly predicted directional changes in prices one day ahead of time, outperforming the benchmark models.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

Notes

- 1.

According to ADF and Phillips-Perron unit root test all of the variables are stationary at level. However, because of the space constraint, results are not presented here. They can be submitted upon request.

References

Bekiros, S. D. (2015). Heuristic learning in intraday trading under uncertainty. Journal of Empirical Finance, 30, 34–49.

Bekiros, S. D., & Georgoutsos, D. A. (2008). Direction-of-change forecasting using a volatility-based recurrent neural network. Journal of Forecasting, 27(5), 407–417.

Cai, C. X., & Zhang, Q. (2014). High-frequency exchange rate forecasting. European Financial Management, 22, 1–22.

Cortes, C., & Vapnik, V. N. (1995). Support-vector networks. Machine Learning, 20(3), 273–297.

Das, D., Kumar, S. B., Tiwari, A. K., Shahbaz, M., & Hasim, H. M. (2018). On the relationship of gold, crude oil, stocks with financial stress: A causality-in-quantiles approach. Finance Research Letters, 27, 169–174.

Ebrahimijam, S., Adaoglu, C., & Gokmenoglu, K. K. (2018). A synergistic forecasting model for high-frequency foreign exchange data. Economic Computation and Economic Cybernetics Studies and Research, 52(1), 293–312.

Engle, R. F. (1982). Autoregressive conditional heteroskedasticity with estimates of the variance of United Kingdom inflation. Econometrica, 50, 987–1007.

Fang, L., Chen, B., Yu, H., & Qian, Y. (2018). The importance of global economic policy uncertainty in predicting gold futures market volatility: A GARCH-MIDAS approach. Journal of Futures Markets, 38(3), 413–422.

Hong, Y., Li, H., Zhao, F., & Haitao, L. (2007). Can the random walk model be beaten in out-of-sample density forecasts? Evidence from intraday foreign exchange rates. Journal of Econometrics, 141, 736–776.

Kalman, R. (1961). A new approach to linear filtering and prediction problems. Journal of Basic Engineering, 82, 35–45.

Khan, M. M. A. (2013). Forecasting of gold prices (Box Jenkins approach). International Journal of Emerging Technology and Advanced Engineering, 3(3), 662–670.

Kristjanpoller, W., & Minutolo, M. C. (2015). Gold price volatility: A forecasting approach using the Artificial Neural Network–GARCH model. Expert Systems with Applications, 42(20), 7245–7251.

Mirza, M. J. (2011). A modified Kalman Filter for non-gaussian measurement noise. In Communication systems and information technology (pp. 401–409). Springer.

Neely, C. J., & Weller, P. A. (2012). Technical analysis in the foreign exchange market. In J. James, I. W. Marsh, & L. Sarno (Eds.), Handbook of exchange rates. Wiley.

Nelson, D. B. (1991). Conditional heteroskedasticity in asset return: A new approach. Econometrica, 59, 347–370.

Parisi, A., Parisi, F., & Díaz, D. (2008). Forecasting gold price changes: Rolling and recursive neural network models. Journal of Multinational Financial Management, 18(5), 477–487.

Potoski, M. (2013). Predicting gold prices. Computer Science CS229. Available at http://cs229.stanford.edu/proj2013/Potoski-PredictingGoldPrices.pdf

Reboredo, J. C., & Uddin, G. S. (2016). Do financial stress and policy uncertainty have an impact on the energy and metals markets? A quantile regression approach. International Review of Economics & Finance, 43, 284–298.

Shafiee, S., & Topal, E. (2010). An overview of global gold market and gold price forecasting. Resources Policy, 35(3), 178–189.

Ul Sami, I., & Junejo, K. N. (2017). Predicting future gold rates using machine learning approach. International Journal of Advanced Computer Science and Applications, 8(12), 92–99.

Welch, G., & Bishop, G. (2001). An introduction to the Kalman filter (TR95-041). UNC-Chapel Hill/ACM, Inc.

Yazdani-Chamzini, A., Yakhchali, S. H., Volungevičienė, D., & Zavadskas, E. K. (2012). Forecasting gold price changes by using adaptive network fuzzy inference system. Journal of Business Economics and Management, 13(5), 994–1010.

Zhang, Y. J., & Wei, Y. M. (2010). The crude oil market and the gold market: Evidence for cointegration, causality and price discovery. Resources Policy, 35(3), 168–177.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendix

Appendix

5.1.1 Flow Chart of the Proposed Synergistic Techno-Fundamental Model

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Gokmenoglu, K.K., Ebrahimijam, S. (2022). A Synergistic Forecasting Model for Techno-Fundamental Analysis of Gold Market Returns. In: Procházka, D. (eds) Regulation of Finance and Accounting. ACFA ACFA 2021 2020. Springer Proceedings in Business and Economics. Springer, Cham. https://doi.org/10.1007/978-3-030-99873-8_5

Download citation

DOI: https://doi.org/10.1007/978-3-030-99873-8_5

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-99872-1

Online ISBN: 978-3-030-99873-8

eBook Packages: Economics and FinanceEconomics and Finance (R0)