Abstract

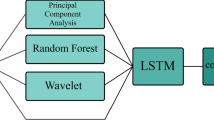

This study comprises a preliminary investigation into the use of Long Short-Term Memory (LSTM) methodology when used in conjunction with Principal Component Analysis (PCA) for producing trading signals for daily returns of the the FTSE100 index. The model is trained on approximately 35 years of daily data and validated on six months of testing data, demonstrating a high degree of risk-adjusted trading efficacy.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Pelikan, M., Goldberg, D.E.: BOA: the Bayesian optimization algorithm. In: Proceedings of the 1st Annual Conference on Genetic and Evolutionary Computation, pp. 525–532 (1999)

de Prado, M.L.: Advances in Financial Machine Learning. Wiley, New York (2018)

Wolpert, D.H.: Stacked generalization. Neural Netw. 5, 241–259 (1992). https://doi.org/10.1016/S0893-6080(05)80023-1

Wold, S., Esbensen, K., Geladi, P.: Principal component analysis. Chemometrics and intelligent laboratory systems. In: Proceedings of the Multivariate Statistical Workshop for Geologists and Geochemists, vol. 2, pp. 37–52 (1987). https://doi.org/10.1016/0169-7439(87)80084-9

Elman, J.L.: Finding structure in time. Cogn. Sci. 14(2), 179–211 (1990)

Pascanu, R., Mikolov, T., Bengio, Y.: On the difficulty of training recurrent neural networks. In: Proceedings of the 30th International Conference on Machine Learning, vol. 28, pp. 1310–1318 (2012)

Hochreiter, S., Schmidhuber, J.: Long short-term memory. Neural Comput. 9(8), 1735–1780 (1997)

Freund, Y., Schapire, R.E.: Experiments with a new boosting algorithm. In: International Conference on Machine Learning, pp. 148–156 (1996)

Jiang, M., Liu, J., Zhang, L., Liu, C.: An improved stacking framework for stock index prediction by leveraging tree-based ensemble models and deep learning algorithms. Phys. A Stat. Mech. Appl. 541. https://doi.org/10.1016/j.physa.2019.122272

Sharpe, W.F.: The Sharpe Ratio. J. Portf. Manag. Fall 21(1), 49–58 (1994). https://doi.org/10.3905/jpm.1994.409501

Smyl, S.: A hybrid method of exponential smoothing and recurrent neural networks for time series forecasting. Int. J. Forecast. 36, 7585 (2020)

Weng, B., et al.: Macroeconomic indicators alone can predict the monthly closing price of major U.S. indices: insights from artificial intelligence, time-series analysis and hybrid models. Appl. Soft Comput. 71, 685–697 (2018). https://doi.org/10.1016/j.asoc.2018.07.024

Pan, S.J., Yang, Q.: A survey on transfer learning. IEEE Trans. Knowl. Data Eng. 22, 1345–1359 (2010). https://doi.org/10.1109/TKDE.2009.191

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Edelman, D., Mannion, D. (2022). Daily Trading of the FTSE Index Using LSTM with Principal Component Analysis. In: Corazza, M., Perna, C., Pizzi, C., Sibillo, M. (eds) Mathematical and Statistical Methods for Actuarial Sciences and Finance. MAF 2022. Springer, Cham. https://doi.org/10.1007/978-3-030-99638-3_37

Download citation

DOI: https://doi.org/10.1007/978-3-030-99638-3_37

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-99637-6

Online ISBN: 978-3-030-99638-3

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)