Abstract

This chapter investigates Chinese wind power development and concludes that innovation cannot be pushed by the efforts of many, and that when the state clarifies directions and objectives, these can be achieved but with severe and unexpected side effects. Two topics are explored: wind curtailment and low technological development, both examples of unproductive entrepreneurship induced by government policies. The goal of wind power capacity expansion leads to construction (i.e., generation capacity) but little electricity. Examples of failures include low grid connectivity with, some years averaging 15% of generation capacity broken or unconnected to the grid. A key lesson for Europe is that forced innovation often amounts to little and that the old saying holds up: “no plan survives contact with reality.”

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

Keywords

1 . Introduction

There is an increasing interest in a global transition to green energy, and in several countries, policies promoting a transition are in effect (Nuñez-Jimenez et al., 2020). While China has become the largest installer of wind power in the world over the last two decades, the quality of the installed capacity has been lackluster (Dong et al., 2018; Zhu et al., 2019; IRENA, 2021). The installed wind capacity in China exceeds the United States by a factor of two (IRENA, 2018). Despite twice the installed capacity in 2016, China has produced less power.

How can more capacity produce less power? The short answer is that incentives matter, and that the Chinese wind power system has induced unproductive entrepreneurship. When studying the last decade’s development, it is easy to find examples of failure like low grid connectivity, with some years averaging 15% of generation capacity broken or unconnected to the grid (Zeng et al., 2015; Karltorp et al., 2017). Technological innovation has been marginal compared to Chinese industrial activity. Chinese firms have had few patents granted internationally, both in absolute terms and relative to the number of applications (Li, 2012; Lam et al., 2017). Exports are small due to quality issues, even though domestic production capacity far exceeds demand (Xingang et al., 2012; Sun et al., 2015; Zhang et al., 2017).

Mazzucato (2015) addressed Chinese green development, stating that green transformation leaders exist where the state plays an active role. To an extent, she is right about China, which has constructed a lot of wind power. However, quality has been low and little new technology has been internationally patented. Green development has been ineffective, and it would not be a surprise to discover the environment had suffered due to mass industrial activity, especially considering the alternative cost of malinvestment. Government action has actually stifled technological development rather than promoting it. As shown by McAfee (2019) and Grafström and Sandström (2020), the trend in Western economies is to extract much more from less. Economic development is not driven by more resources; resource-use actually decreases while economies have expanded. Chinese wind power has economized resources badly; resource-waste has been the result.

This chapter explores the recent history of Chinese wind power expansion, focusing on development since 2000. A literature review explores two main topics: wind curtailment and technological development, both examples of unproductive entrepreneurship induced by China’s central government. During the highly likely global transition to green energy, it is important to understand what not to do.

It is important to emphasize that China is not the only country that has produced bad results when implementing industrial policies to promote renewable energy. In the early 1980s, wind power policies in the United States had similarly negative outcomes, but on a smaller scale (Keller & Negoita, 2013; Wiser & Millstein, 2020). The German Energiewende and the Spanish solar bubble also have received criticism (Del Río & Mir-Artigues, 2012; Nuñez-Jimenez et al., 2020).

This chapter, however, focuses on China because it is the largest producer of wind power. It is important to remember that drawing lessons from the Chinese example is perilous because what is true in China is not necessarily true for Western countries. Investment in wind power does not represent direct investment from the Chinese state, but rather from China’s Central State-Owned Enterprises (CSOEs). One might assume some autonomy for the CSOEs but they answer to the state, in some capacity, at the end (Zhu et al., 2019). Wind power policy must be understood within the broader context of a highly regulated system in which prices are politically or administratively influenced, if not determined.

A cartoon in the Soviet satirical journal Krokodil in 1952 displays the downside of heavy state intervention in the economic system. A worker and a bureaucrat stand beneath a massive 2000-kilo nail. The worker asks about the need for such a big nail and the bureaucrat answers, “the month’s plan fulfilled” (Nove, 1986, p. 94). The lesson is that incentives matter. When studying the Chinese wind power development of the last decade, it appears the production was, due to state goals, just as quantity oriented as the useless 2000-kilo nail in Krokodil. State goals distorted entrepreneurship toward suboptimal solutions, low-energy production, and plentiful resource waste.

2 The Context: China’s Historical Wind Power Development

Global installed wind capacity in 2020 reached 744 gigawatts, up from 597 gigawatts in 2018 (WWEA, 2019, 2020). Globally, 93 gigawatts were installed compared to 52.5 gigawatts in 2018. China’s accumulated wind power capacity in 2020 was 290 gigawatts, which then produces energy when operational (WWEA, 2020).

China’s early wind power development was gradual. In the 1970s, wind power development was limited to geographically remote, small, off-grid projects (Liu et al., 2002; Xu et al., 2010). In 1985, four grid-connected wind power plants were constructed using 55 kW Vestas turbines from Denmark (Zhengming et al., 2006). In 1994, The Ministry of Electric Power ordered a 100-fold increase in installed wind power capacity, from about 10 megawatts to 1000 megawatts for the year 2000. The plan was not fulfilled because only 350 megawatts were constructed. A remedy to the production failure was the Renewable Energy Law of 2006, which forced utilities to purchase (or produce) wind power (Gosens & Lu, 2013). The central government established a price guarantee that exceeded 15% of construction costs, which incentivized the construction of unprofitable plants (Lema & Ruby, 2007). Firms made unprofitable bids on construction sites paid by cash flow, from things like coal, to sustain wind projects.

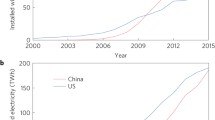

In 2004, China’s accumulated installed wind capacity reached 769 megawatts, the world’s tenth-highest (Zhang et al., 2013). During China’s Eleventh Five-Year Plan period (2006–2010), challenging goals were set. The installed capacity was doubled for 5 years in a row (Sun et al., 2015). In 2012, China bypassed U.S. installed capacity (see Fig. 1). The installed capacity of a power system represents the maximum capacity that can be produced under good conditions. A plant with 1 MW of installed capacity can, under ideal conditions, produce a maximum of 1 MW at any one time. Measures of electricity generation describe the amount of electricity that is produced during a specific period, normally measured in megawatt-hours.

Installed capacity (MW) in wind power by country from 2000 to 2016. Source: IRENA (2018), Renewable Energy Statistics 2018, The International Renewable Energy Agency, Abu Dhabi

Although a large generation capacity was constructed in China, the output did not materialize at an equal rate. For example, electricity generation in the United States was initially significantly higher than China (see Fig. 2). Lu et al. (2016) found that differences in wind resources did not explain the U.S.-China difference in wind power output. Wind quality and resources explain a small part (−17.9% in 2012), but the main issues were related to turbine quality, curtailment, and connection to the grid.

Electricity generation (GWh) from wind power by country from 2000–2017. Source: IRENA (2018), Renewable Energy Statistics 2018, The International Renewable Energy Agency, Abu Dhabi

During the Eleventh Five-Year Plan (2006–2010), the domestic wind industry was prioritized (Feng et al., 2015). The production goal set in the plan generated supply problems. Overcapacity sent prices down in 2011: 30 gigawatts could be manufactured but annual demand was 18 gigawatts (Li, 2012; Zhang et al., 2015).

The Eleventh Five-Year Plan’s stipulations regarding foreign technology allowed in wind power drove foreign firms from China. The Chinese Power Purchase agreements stipulated that in wind turbines, 50% of content (and later 70%) should be local. The shift was significant: in 2000, almost 95% of installed Chinese turbines were imported and in 2005, around 70%. After the plan took effect, the proportion of foreign components dropped. In 2008, only 28% of turbine components were sourced abroad and by the end of 2013, it was less than 6% (Junfeng et al., 2010; Zhang et al., 2015).

3 Two Cases: Powerplants Without Output, and Low Technological Development

3.1 Technological Development: Patents at Home but Not Abroad

Patent data is a popular variable in technological innovation research and the variable is often used to compare countries’ innovation activities. Although patents are a popular measure, they also suffer the curse, “What gets measured gets managed” (a summary of Ridgway, 1956). In China, an emphasis on patens as an output measure affected promotions and evaluations (Li, 2012). China’s surge of patents up until 2006 can be attributed to governmental programs targeted at patent creation (Li, 2012). Patents were an evaluation criterion that could make or break a career for both researchers and public servants (Gosens & Lu, 2013, 2014). The Chinese legal system created several “junk” patents, because the separation of real innovations from false innovations was insufficiently executed (Lam et al., 2017).

Chinese inventors received numerous domestic wind power patents, but few international patents. As seen in Fig. 3, when considering only one patent office—in many cases the inventor’s home office—China has a high share of global patents.

China’s relative share of top countries’ patent activity was highest in 2006. However, if a control for quality is applied, in this case looking at patents approved in at least four patent offices, then China is less visible, as seen in Fig. 4.

Chinese patents did not hit the mark internationally, even though Chinese firms tried to apply for them (Lam et al., 2017). Patent applications by Chinese firms to the European Patent Office were few (between 1980 and 2014). Envision made 38 applications and XEMC made 19, while only two and six patents, respectively, were granted them. Sinovel made 21 applications and all but one was either subsequently withdrawn or rejected. The normal rejection rate at the European Patent Office is around 50%, hence Chinese firms received a significantly higher rejection rate (Grafström, 2017). Of the top ten Chinese firms, seven obtained no patents and five recorded no applications with the European Patent Office. Results were similar at the United States Patent and Trademark Office.

In 2009, the Chinese government began to raise standards by modifying its patent law to demand absolute global novelty instead of “relative novelty” (SIPO, 2009). Tables 1 and 2 show the number of patent applications in the top inventive countries.

3.2 Wind Curtailment: When a Power Plant Is Not Working or Unconnected

China had vast wind power curtailment and consequently low utilization rates over the last two decades (Sun et al., 2015; Zhu et al., 2019). Wind curtailment happens when the power grid disrupts the power connection of installed capacity (due to issues regarding safety, technology, grid access management, etc.). Since 2010, when installed capacity took off, the curtailment rate increased, i.e., power was generated but cut off from the grid, mainly by the State Grid Corporation of China, which decided to interrupt grid connections of installed wind capacity (Dong et al., 2018).

China’s curtailment statistics exceeded the rest of the world’s (Fan et al., 2015; Zeng et al., 2015; Luo et al., 2016). Curtailment between 2010 and 2013 was 3.9, 10, 20.8, and 16.2 TWh, respectively (Luo et al., 2016). Adding the findings in Zhu et al. (2019), the curtailment level was 12.6 TWh in 2014 (8%), 33.9 TWh in 2015 (15%), and 49.7 TWh in 2016 (19%).

As seen in Fig. 5, both the absolute level of curtailment and curtailment as a percentage of total production increased between 2010 and 2016. There have been indications in nonacademic reports that curtailment rates have fallen sharply since 2018, although trustworthy sources are lacking. It is plausible that the curtailment rate has fallen. Curtailments were growing and in the long run should be noticed and remedied. Grid development and connection in some years lagged installed capacity by over 30%, making wind power generation exceed the acceptance of the grid and creating abandonment and grid instability (Zeng et al., 2015; Zhang et al., 2017).

Curtailment levels exceeded those of other countries. For example, Chinese wind turbines produced 1787 full load hours on average in 2007, which was substantially below turbines in the United Kingdom (2628 h), Australia (2500 h), and the United States (2300 h) (Sahu, 2018). On average, Chinese wind power plants were shut down up to 15% of the time, whereas, in Germany, employees are laid off just under 0.5% of the time (Karltorp et al., 2017). If the average of 1787 full load hours in 2007 had remained, there would have been no economic surplus in 2013. An example from Zhu et al. (2019) indicates that to break even in Guazhou county of Gansu, windfarms needed to produce 1800 h, which they did in 2013 (1859 h), but in 2016 the utilization rate had fallen to 992 h.

4 Discussion

The Chinese state’s intentions for wind power may have been good; however, state involvement led entrepreneurial activity astray. The incentives led to what Baumol (1990, 1996) would call unproductive entrepreneurship. Whether entrepreneurship adds value to society or is oriented toward rent-seeking or illegal activity depends on the relative payoffs (Baumol, 1996). Little economic activity in Chinese wind power added value; firms actually suffered losses that could have been avoided. For example, the decision to limit the presence of foreign components in turbines erased valuable international expertise and products left the market.

Most investments in Chinese wind power were made by Central State-Owned Enterprises (CSOEs). This partly explains why investments seem to have disregarded economic logic (Zhu et al., 2019). Because of the need to fulfill political goals, such investments suffer more political intervention than private firms, and performance varies (Fan et al., 2007; Du & Wang, 2013).

State firms must engage in “social” and “strategic” burdens like maintaining regional employment or engaging with sectors that are important to central government planning (Dong & Putterman, 2003). China’s CSOEs neither enjoy the benefit of good investments nor do they endure responsibility for losses, since they have what Chow et al. (2010) call “soft budget constraints”, which are government transfers. When the central government controls economic activities and the decision-making price signals of firms are distorted, the basis of buying raw materials, and from whom, becomes politicized. Hence, the burdens laid on China’s CSOEs make it hard to distinguish between policy-induced losses and business losses (Liao et al., 2009).

China’s CSOEs differ from the private market logic of profit-maximization by following a political logic which, at first glance, is not economically rational (Wang, 2014). A downside of not following profit and price signals is that producers lose their main source of information. Profits indicate value for customers and that scarce resources are used efficiently. When price is absent as a market signal or planners disregard signals, they have to depend on other measures (de Soto, 1992/2010).

Entrepreneurs should be guided by price signals, but market-distorting interventions (such as subsidies, price floors or ceilings, and capacity targets) undercut the ability of entrepreneurs to be active drivers of the economy, relegating them to optimizers of government goals. In an ordinary market economy, it would be illogical to erect a wind power plant without a grid connection. In China, poor localization has been common because of construction goals: When spending somebody else’s money, the cheapest means of goal fulfillment is to buy inferior products for inferior locations. Forced construction created questionable location choices, like the presence of plants in non-populated northern areas at end of the power grid and where the power grid structure was not appropriate for large-scale wind power (Han et al., 2009).

Entrepreneurs are products of the market institutions in which they find themselves. Institutions establish rules to promote behaviors by changing payoffs. Important institutions include (1) well-defined and enforceable private property rights; (2) the rule of law; and (3) a moral code of behavior that legitimizes and acknowledges these traditions (Hayek, 1968/2002). Policies affect outcomes, but good policy under bad institutions can create unintended consequences (Evans, 2016).

A fixed production goal can turn the entrepreneurial process on its head and lead to destructive creation rather than creative destruction. One problem with China’s emphasis on setting quantitative goals is that quality becomes less of a sales point and intense price competition hurts both technological development and the quality of the goods sold (Hayashi et al., 2018). Usually, competition improves quality, but when quantity is optimized and the profit motive is distorted, an equilibrium with low price and low quality can materialize (Xingang et al., 2012; Luo et al., 2016).

A plan needs a goal, for example, an equilibrium state in which demand is satisfied. However, before reaching that rough equilibrium, market changes (individual preferences, the endowments of resources, and available technology) will make the plan obsolete, since even a small relative price change can make another option better (Kirzner, 1982, 1999). Information cannot be assembled beforehand by regulators and planners or an entrepreneurial state administrator. An energy system is a juggernaut that is not easily changed. The planning horizon will be decades-long, because that is how long it takes to initiate the construction of powerplants and to build them. Imagine planning the decade beyond 2007, when neither smartphones nor electric cars would be have been part of the plan. In 2007, both the electric car and what we call smartphones today were largely unheard of.

It is no exaggeration to say the Chinese wind power sector was—and is, it seems from the research literature—deeply regulated by planning and administrative practices. Some policies have been counterproductive, due to several competing and uncoordinated government entities (Lema & Ruby, 2007). Liao (2016) analyzed 72 wind energy policies from 1995 to 2014 and observed over 20 actors who issued policies independently or together. Policy came largely from officials that regulated key economic and administrative issues, but not wind power.

5 Conclusion

This chapter has investigated Chinese wind power development in the twenty-first century. Its main conclusion is that innovation cannot be enforced by mass efforts and that when the state lays out directions and clarifies objectives, these can be achieved but with severe and unexpected side effects. A key lesson for Europe is that while renewable energy has great potential, its development should occur through price mechanisms: emissions like CO2 should become more expensive, thus incentivizing innovation in other energy sources. As observed by Mazzucato (2015), the macro numbers looked good for Chinese wind power, but when investigating the micro-level data, the production aggregates were obviously a mirage. The production numbers presented in this chapter are a stark contrast to Mazzucato’s (2015) notion that China’s strategy of optimal economic development assured a win-win between the environment and profit. Of course, this can exist, but it is not what is revealed in Mazzucato’s example. Just because wind power plants are built does not necessarily mean that electricity will be produced.

China emits a significant portion of the world’s CO2, so efforts to reduce emissions, like wind power construction, are necessary, but large inefficiencies in investments lead to problems. The Chinese wind power sector demonstrates substantial economic activity but less value creation. Political favors from the ruling politicians carry more weight than actual value creation, and market actors have varied project priorities. Wind power investment in China during the period under investigation was sizable; unfortunately, its benefits for consumers were questionable. The real achievement of the projects was to temporarily boost GDP statistics and other indicators decided in state plans. Genuinely sustainable growth, as opposed to debt-laden temporary activity, arises from the production of goods and services that people purchase voluntarily, ultimately facilitated by free competition and entrepreneurship.

Real entrepreneurship, whereby an entrepreneur creates a new business, assumes most of the risk, and enjoys most of the rewards, should be allowed to operate in the Chinese wind energy market. Forced construction, on the other hand, wastes both materials and time. It could be that Chinese investments have knowledge spillovers, but as seen in technological output spillovers, this seems uncertain. Even though domestic patents are plentiful, Chinese firms have received few international patents protecting their inventions. Large monetary benefits act as incentives for patent protection in large markets like Europe and the U.S. One conclusion is that Chinese firms have failed to create any technology worth patenting.

The Chinese wind power sector has been deeply regulated by administrative practices. Planning was likely the underlying institutional reason for the challenges the sector has faced. Government command-and-control targets for installed capacity—or any target for that matter—may deliver to target but, as in all fairy tales, planners should be careful what they wish for: There may be unforeseen and unpleasant consequences. Capacity, as a goal, leads to construction (i.e., generation capacity) but not automatically to energy. China endorsed construction without due consideration of grid connectivity, thus creating economically unprofitable construction.

References

Baumol, W. J. (1990). Entrepreneurship: Productive, unproductive and destructive. Journal of Political Economy, 98(5), 893–921.

Baumol, W. J. (1996). Entrepreneurship: Productive, unproductive, and destructive. Journal of Business Venturing, 11(1), 3–22.

Chow, C. K., Song, F. M., & Wong, K. P. (2010). Investment and the soft budget constraint in China. International Review of Economics & Finance, 19(2), 219–227.

De Soto, J. H. (1992/2010). Socialism, economic calculation and entrepreneurship. Edward Elgar.

Del Río, P., & Mir-Artigues, P. (2012). Support for solar PV deployment in Spain: Some policy lessons. Renewable and Sustainable Energy Reviews, 16(8), 5557–5566.

Dong, X. Y., & Putterman, L. (2003). Soft budget constraints, social burdens, and labor redundancy in China’s state industry. Journal of Comparative Economics, 31(1), 110–133.

Dong, C., Qi, Y., Dong, W., Lu, X., Liu, T., & Qian, S. (2018). Decomposing driving factors for wind curtailment under economic new normal in China. Applied Energy, 217, 178–188.

Du, J., & Wang, Y. (2013). Reforming SOEs under China’s state capitalism. In J. Zhang (Ed.), Unfinished reforms in the Chinese economy (pp. 1–38). World Scientific Publishing.

Evans, A. J. (2016). The unintended consequences of easy money: How access to finance impedes entrepreneurship. The Review of Austrian Economics, 29(3), 233–252.

Fan, J. P., Wong, T. J., & Zhang, T. (2007). Politically connected CEOs, corporate governance, and post-IPO performance of China’s newly partially privatized firms. Journal of Financial Economics, 84(2), 330–357.

Fan, X. C., Wang, W. Q., Shi, R. J., & Li, F. T. (2015). Analysis and countermeasures of wind power curtailment in China. Renewable and Sustainable Energy Reviews, 52, 1429–1436.

Feng, Y., Lin, H., Ho, S. L., Yan, J., Dong, J., Fang, S., & Huang, Y. (2015). Overview of wind power generation in China: Status and development. Renewable and Sustainable Energy Reviews, 50, 847–858.

Gosens, J., & Lu, Y. (2013). From lagging to leading? Technological innovation systems in emerging economies and the case of Chinese wind power. Energy Policy, 60, 234–250.

Gosens, J., & Lu, Y. (2014). Prospects for global market expansion of China’s wind turbine manufacturing industry. Energy Policy, 67, 301–318.

Grafström, J. (2017). Technological change in the renewable energy sector: Essays on knowledge spillovers and convergence (Doctoral dissertation, Luleå University of Technology).

Grafström, J., & Sandström, C. (2020). Mer för mindre?: Tillväxt och hållbarhet i Sverige. Ratio.

Han, J., Mol, A. P., Lu, Y., & Zhang, L. (2009). Onshore wind power development in China: Challenges behind a successful story. Energy Policy, 37(8), 2941–2951.

Hayashi, D., Huenteler, J., & Lewis, J. I. (2018). Gone with the wind: A learning curve analysis of China’s wind power industry. Energy Policy, 120, 38–51.

IRENA. (2018). Renewable energy statistics 2018. The International Renewable Energy Agency.

IRENA. (2021). Renewable capacity statistics 2021. The International Renewable Energy Agency.

Junfeng, L., Pengfei, S., & Hu, G. (2010). China wind power outlook 2010. Global Wind Energy Council.

Karltorp, K., Guo, S., & Sandén, B. A. (2017). Handling financial resource mobilisation in technological innovation systems: The case of Chinese wind power. Journal of Cleaner Production, 142, 3872–3882.

Keller, M. R., & Negoita, M. (2013). Correcting network failures: The evolution of US innovation policy in the wind and advanced battery industries. Competition & Change, 17(4), 319–338.

Kirzner, I. M. (1982). Competition, regulation, and the market process: An “Austrian” perspective. Cato institute policy analysis No. 18.

Kirzner, I. M. (1999). Creativity and/or alertness: A reconsideration of the Schumpeterian entrepreneur. The Review of Austrian Economics, 11(1–2), 5–17.

Lam, L. T., Branstetter, L., & Azevedo, I. M. (2017). China’s wind industry: Leading in deployment, lagging in innovation. Energy Policy, 106, 588–599.

Lema, A., & Ruby, K. (2007). Between fragmented authoritarianism and policy coordination: Creating a Chinese market for wind energy. Energy Policy, 35(7), 3879–3890.

Li, X. (2012). Behind the recent surge of Chinese patenting: An institutional view. Research Policy, 41(1), 236–249.

Liao, Z. (2016). The evolution of wind energy policies in China (1995–2014): An analysis based on policy instruments. Renewable and Sustainable Energy Reviews, 56, 464–472.

Liao, G., Chen, X., Jing, X., & Sun, J. (2009). Policy burdens, firm performance, and management turnover. China Economic Review, 20, 15–28.

Liu, W. Q., Gan, L., & Zhang, X. L. (2002). Cost-competitive incentives for wind energy development in China: Institutional dynamics and policy changes. Energy Policy, 30, 753–765.

Lu, X., McElroy, M. B., Peng, W., Liu, S., Nielsen, C. P., & Wang, H. (2016). Challenges faced by China compared with the US in developing wind power. Nature Energy, 1(6), 1–6.

Luo, G. L., Li, Y. L., Tang, W. J., & Wei, X. (2016). Wind curtailment of China’s wind power operation: Evolution, causes and solutions. Renewable and Sustainable Energy Reviews, 53, 1190–1201.

Mazzucato, M. (2015). The green entrepreneurial state. In I. Scoones, M. Leach, & P. Newell (Eds.), The politics of green transformations (pp. 152–170). Routledge.

McAfee, A. (2019). More from less: The surprising story of how we learned to prosper using fewer resources—And what happens next. Scribner.

Nove, A. (1986). The Soviet economic system. Allen & Unwin.

Nuñez-Jimenez, A., Knoeri, C., Rottmann, F., & Hoffmann, V. H. (2020). The role of responsiveness in deployment policies: A quantitative, cross-country assessment using agent-based modelling. Applied Energy, 275, 115358.

Ridgway, V. F. (1956). Dysfunctional consequences of performance measurements. Administrative Science Quarterly, 1(2), 240–247.

Sahu, B. K. (2018). Wind energy developments and policies in China: A short review. Renewable and Sustainable Energy Reviews, 81, 1393–1405.

SIPO. (2009). Amendment of Patent Law of P. R. China (in Chinese). Retrieved from http://www.sipo.gov.cn/zxft/zlfxg/bjzl/200903/t20090312_444625.html

Sun, S., Liu, F., Xue, S., Zeng, M., & Zeng, F. (2015). Review on wind power development in China: Current situation and improvement strategies to realize future development. Renewable and Sustainable Energy Reviews, 45, 589–599.

von Hayek, F. A. (1968/2002). Competition as a discovery procedure. Quarterly Journal of Austrian Economics, 5(3), 9–23. (translation from German of F.A. Hayek’s “Der Wettbewerb als Entdeckungsverfahren,” a 1968 lecture).

Wang, J. (2014). The political logic of corporate governance in China’s state-owned enterprises. Cornell International Law Journal, 47, 631.

Wiser, R., & Millstein, D. (2020). Evaluating the economic return to public wind energy research and development in the United States. Applied Energy, 261, 114449.

WWEA (World Wind Energy Association). (2019). Wind Power Capacity Worldwide Reaches 597 GW, 50,1 GW added in 2018. Retrieved April 01, 2020, from https://wwindea.org/blog/2019/02/25/wind-power-capacity-worldwide-reaches-600-gw-539-gw-added-in-2018/

WWEA (World Wind Energy Association). (2020). Worldwide Wind Capacity Reaches 744 Gigawatts – An Unprecedented 93 Gigawatts added in 2020. Retrieved June 15, 2020, from https://wwindea.org/worldwide-wind-capacity-reaches-744-gigawatts/

Xingang, Z., Jieyu, W., Xiaomeng, L., & Pingkuo, L. (2012). China’s wind, biomass and solar power generation: What the situation tells us? Renewable and Sustainable Energy Reviews, 16(8), 6173–6182.

Xu, J., He, D., & Zhao, X. (2010). Status and prospects of Chinese wind energy. Energy, 35(11), 4439–4444.

Zeng, M., Duan, J., Wang, L., Zhang, Y., & Xue, S. (2015). Orderly grid connection of renewable energy generation in China: Management mode, existing problems and solutions. Renewable and Sustainable Energy Reviews, 41, 14–28.

Zhang, S., Andrews-Speed, P., & Zhao, X. (2013). Political and institutional analysis of the successes and failures of China’s wind power policy. Energy Policy, 56, 331–340.

Zhang, S., Wang, W., Wang, L., & Zhao, X. (2015). Review of China’s wind power firms’ internationalization: Status quo, determinants, prospects and policy implications. Renewable and Sustainable Energy Reviews, 43, 1333–1342.

Zhang, D., Wang, J., Lin, Y., Si, Y., Huang, C., Yang, J., Huang, B., & Li, W. (2017). Present situation and future prospect of renewable energy in China. Renewable and Sustainable Energy Reviews, 76, 865–871.

Zhengming, Z., Qingyi, W., Xing, Z., Hamrin, J., & Baruch, S. (2006). Renewable energy development in China: The potential and the challenges. Edited and produced by the Centre for Resource Solutions. Retrieved from http://www.efchina.org/documents/China_RE_Report_EN.pdf. European Commission EUR, 22346, 2006-118.

Zhu, M., Qi, Y., Belis, D., Lu, J., & Kerremans, B. (2019). The China wind paradox: The role of state-owned enterprises in wind power investment versus wind curtailment. Energy Policy, 127, 200–212.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2022 The Author(s)

About this chapter

Cite this chapter

Grafström, J. (2022). Less from More: China Built Wind Power, but Gained Little Electricity. In: Wennberg, K., Sandström, C. (eds) Questioning the Entrepreneurial State. International Studies in Entrepreneurship, vol 53. Springer, Cham. https://doi.org/10.1007/978-3-030-94273-1_12

Download citation

DOI: https://doi.org/10.1007/978-3-030-94273-1_12

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-94272-4

Online ISBN: 978-3-030-94273-1

eBook Packages: Business and ManagementBusiness and Management (R0)