Abstract

Western economies are struggling to recover from a decade of Plagued by structural crises, an ongoing pandemic, high unemployment and sluggish growth. As progressively looser monetary and fiscal policies have not helped, both the EU and national governments have increasingly turned towards interventionist industrial policies. Mariana Mazzucato’s The Entrepreneurial State (2011) provided an intellectual justification for these efforts, and consequently gained popularity. The message was clear: in order to get more innovation, entrepreneurship, sustainable development and growth we need more government, not less. In this book, 30 international scholars address the core ideas underpinning the entrepreneurial state. We provide evidence of both historical and recent failures of “green deals” and similar efforts, while also developing novel directions for innovation policy. In many regards, this book is a warning: huge government schemes towards specific, noble outcomes have historically been plagued with failures. In sum, we argue that innovation policy needs to be inverted: instead of being specific and targeted, it needs to be broad and general, focusing on the general conditions for firms to operate. Instead of providing targeted support to certain firms, industries or even technologies, innovation policy needs to constructively deal with barriers to innovation, including the proactive handling of vested interest groups.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

Keywords

Many Western economies have been plagued by prolonged structural crises, persistent unemployment, and the lack of durable economic recovery after the great recession in 2008–2009, the Euro crisis of 2011–2012, as well as the ongoing pandemic and its repercussions.

These crises have resulted in several rapid shifts in economic policy. Low interest rates, quantitative easing, and a myriad of public stimulus packages have followed on top of each other. While available venture capital and new digital startups reach record figures from year to year, public and private debt is mounting, yet productivity growth and job creation have been sluggish. Populist and nationalist agendas have emerged and with them calls for the protection of national interests and industries, as well as well-founded worries of increasing economic inequality and global climate change.

This intellectual and economic milieu has become a fertile ground for the rebirth of top-down industrial policies. Mariana Mazzucato’s book The Entrepreneurial State (2011) has become a best seller that has fueled the renaissance of industrial interventionism. As policymakers around the world were looking for answers and ways to deal with issues such as global climate change, sluggish economic growth, and increasing inequality, Mazzucato’s book was perfectly positioned to go viral. Her follow-up book, Mission Economy (2021), expands on Richard Nelson’s work on innovation missions and moonshots from the 1970s and 1980s to argue that governments should formulate missions by which to spur innovations seeking to solve great societal challenges—from green energy to national security to building resilient health systems.

Mazzucato provided an intriguing and simple argument: the state had been the main agent behind innovation and industrial renewal, and independent entrepreneurs and large companies have merely followed and capitalized upon the efforts of courageous governments over the years. Economic policy, and innovation policy in particular, has therefore been misguided. Innovation and renewal do not happen through independent entrepreneurial endeavors and innovations launched in a free market economy. On the contrary, Mazzucato argues, prosperity instead comes from large government efforts aimed at solving grand challenges faced by humanity.

The aim of this book is to take a serious look at Mazzucato’s ideas. As policymakers were, and are, desperate in their search for solutions, few scholars or politicians have scrutinized or questioned the idea of the entrepreneurial state. Scholars have tended to ignore these ideas since they emerged from a popular science book and not in peer-reviewed academic journals, and arguably they were not subject to much academic debate. On the other hand, policymakers have tended to uncritically accept these ideas as the next big thing, for several potential reasons. After the great recession, the need for fresh ideas and perspectives in public policy was great. Further and perhaps most importantly, by propagating the need for public direction and coordination, especially that governments should be driven by large missions, The Entrepreneurial State and Mission Economy provided public officials with a sense of importance and authority. For these and other reasons, the message was accepted rapidly throughout Europe and elsewhere. Mazzucato has served as an advisor to the European Commission and numerous governments across the world. More cautious policymakers seeking empirical evidence or detailed theoretical rationale for redirecting public investments into large, top-down industrial policy schemes have not been equipped with arguments or evidence to critically examine the story that was advanced.

As a consequence, the ideas of The Entrepreneurial State and Mission Economy have been put into practice and rolled out across Europe over recent years, without much prior analysis. Notwithstanding the increasing number of policy reports and theoretical papers on missions, to date there have been hardly any empirical evaluations or studies of how such missions are designed and executed, or when they work or do not. As foundational innovation scholars Foray, Nelson, and Mowery argued in a special issue on “a new generation of policy instruments to respond to the Grand Challenges,” mission-oriented innovation policies “are not the right models for new programs aimed at the challenges we now face” (2012, p. 1697). They argue that regarding proposals for a new Manhattan or Apollo project focusing on issues such as climate change, such challenges “are all very different than the challenges faced and met by Manhattan and Apollo. These programs were aimed to develop a particular technological capability, and the achievement of their technological objective signaled the end of the program.” Also currently leading innovation economists such as Bloom, Van Reenen, and Williams (2019, p. 179) write that moonshot examples “lack a counterfactual example” and are by design geared toward political decision-making which “may be more likely to favor sectors or firms that engage in lobbying and regulatory capture, rather than the most socially beneficial.” This point is also emphasized in several contributions to this book (see e.g. the chapter “Third-Generation Innovation Policy: System Transformation or Reinforcing Business as Usual?” by Bergkvist et al.). In short, while the idea of aiming high and leveraging large portions of society’s resources to address some fundamental human challenges may sound appealing to many, such ideas have limited scientific credibility.

Currently, ideas emanating from The Entrepreneurial State and Mission Economy are being implemented in large state initiatives in order to accomplish what are currently seen as vital outcomes. The European Union’s Green Deal amounts to investments of around €1000 billion over the next ten years, including €430 billion on hydrogen gas. What do we know—really—about the theoretical logic behind these ideas, and what empirical support is there for the idea that such massive top-down initiatives will bring about the innovative capacity to address global climate change and other missions?

Over the past few years, some scholars have reviewed and discussed different arguments related to The Entrepreneurial State and Mission Economy and have thereby contributed to both scholarly and policy discussions (Aspromourgos, 2018; Brown, 2021; Mingardi, 2015; Pradella, 2017; McCloskey & Mingardi, 2020). However, we are not aware of any systematic effort to scrutinize the raison d’être of The Entrepreneurial State and Mission Economy, their theoretical validity, or empirical support. Hence this book. We address the core ideas behind the entrepreneurial state and related innovation policy agendas, discuss contrasting and complementary perspectives, showcase empirical evidence, and articulate a new, and in our view better founded, direction for innovation policy.

This book is in many ways a warning. Grand schemes toward noble outcomes have a disappointing track record in human political and economic history. Conventional wisdom regarding authorities’ inability to selectively pinpoint certain technologies, sectors, or firms as winners, and the fact that large support structures for specific technologies are bound to distort incentives and result in opportunism, seems to have been forgotten. This book serves as a theoretical and empirical reminder.

1 The Contributions to the Present Volume

While each chapter in the current volume can be read as one distinct piece, there is also an overall idea and logic to the book. Chapters “The Entrepreneurial State and the Platform Economy”, “An Effectual Analysis of Markets and States”, “The Entrepreneurial State: An Ownership Competence Perspective”, “Innovation Without Entrepreneurship: The Pipe Dream of Mission-Oriented Innovation Policy” discuss theoretical perspectives that complement and contrast the theories underpinning the entrepreneurial state. These chapters demonstrate that ideas about top-down innovation policies often fail to consider central aspects of human individual and collective decision-making, idea ownership, and the nature of digitalization. In “The Entrepreneurial State and the Platform Economy”, Sinclair Davidson and Jason Potts (2022) explain how value is created in the platform economy and how Mazzucato’s description of the platform economy essentially misses out on value creation by employing outdated theories of value creation in the network economy. In “An Effectual Analysis of Markets and States”, entrepreneurship scholar Saras Sarasvathy (2022) outlines how theories of entrepreneurial decision-making that incorporate creativity, genuine uncertainty, and docility may be fruitfully leveraged to study markets and market design. In “The Entrepreneurial State: An Ownership Competence Perspective”, organizational economists Samuele Murtinu, Nicolai J. Foss, and Peter G. Klein (2022) discuss how several of the key ideas underpinning The Entrepreneurial State are at odds with notions of economic competence and ownership competence. As government actors lack the owner’s responsibility and incentives, the state is also bound to be less entrepreneurial, as are top-down initiatives governed by public actors.

The first section of the book concludes with Johan P. Larsson’s “Innovation Without Entrepreneurship? The Pipe Dream of Mission-Oriented Innovation Policy” (Larsson 2022), which argues that fundamentally, the state cannot act as an entrepreneur because it faces no real risk, does not address a real market, and cannot be evaluated. Larsson deconstructs the idea of mission-oriented policies and concludes that these policies do not work in practice because of the impossibility of dispersed actors with differing priorities and incentives to, in practice, agree on the mission undertaken or on how it should be accomplished and evaluated.

From these chapters we learn that what may sound good on paper in terms of collective missions and directionality are often—but not always—at odds with the received wisdom of individual action and coordination in open democratic societies.

Chapters “Building Local Innovation Support Systems: Theory and Practice”, “Reducing Higher Education Bureaucracy and Reclaiming the Entrepreneurial University”, “Cultural Ideals in the Entrepreneurship Industry”, “Evaluating Evaluations of Innovation Policy: Exploring Reliability, Methods, and Conflicts of Interest”, “Do Targeted R&D Grants toward SMEs Increase Employment and Demand for High Human Capital Workers?” contain empirical examples of innovation policies in terms of creating entrepreneurial ecosystems, making universities more innovative, and nurturing the innovativeness of new and small enterprises. In “Building Local Innovation Support Systems: Theory and Practice”, Dan Hjalmarsson (2022)—an innovation scholar turned public decision-maker with decades of experience in designing and evaluating innovation policies—applies his ideas to the region of greater Umeå in northern Sweden and discusses what we can learn from decades of policy support to enhance innovation and entrepreneurship in seeking to foster university-industry collaboration. He concludes that successful policymaking is about creating the right incentives, avoiding picking winners, and direct efforts in ways that do not interfere with competition.

In “Reducing Higher Education Bureaucracy and Reclaiming the Entrepreneurial University”, Siri Terjesen (2022) leverages academic research and policy practice from her position as an associate dean to discuss ways in which current top-down policies hamper rather than encourage experimentation and mindful decision-making at higher education institutions, a crucial set of institutions in any innovation paradigm. She argues that bureaucratization and top-down governance stifle innovation both at universities and in corporations. Terjesen describes the worrying trend of increases in bureaucracy and reports on successful anti-bureaucracy policies and practices such as calculating ‘bureaucratic mass’ and the implementation of new technology.

In the chapter “Cultural Ideals in the Entrepreneurship Industry,” Anna Brattström (2022) outlines the increasingly prevalent paradox that although there appears to be much innovative activity in “local ecosystems,” in tangible ways there is little innovative output. Leveraging in-depth data on entrepreneurs, associations, and public sector activities in Skåne, Sweden, she argues that entrepreneurship and “being innovative” has become a cultural ideal that both firms and policymakers sympathize with and enact as a form of social signaling, but with often limited tangible output. In “Evaluating Evaluations of Innovation Policy: Exploring Reliability, Methods and Conflicts of Interest”, Elias Collin, Christian Sandström, and Karl Wennberg (2022) take a closer look at how innovation policies are evaluated and by whom. They conclude that the vast majority of evaluations in Sweden tend to be positive but that these statements are usually not backed by studies of effects. This section concludes with chapter, “Do Targeted R&D Grants Toward SMEs Increase Employment and Demand for High Human Capital Workers?” in which Sven-Olov Daunfeldt, Daniel Halvarsson, Patrik Tingvall, and Alexander McKelvie (2022) report the results of a counterfactual study into the effects of targeted innovation support. Their most significant result is the absence of any statistically significant effects on employees, turnover, or profit. Bearing administrative costs in mind, these findings suggest that the overall impact of such support structures may often be negative for the economy. These chapters showcase how innovation policies are executed in practice, with what impact—both direct and indirect, long term and short term—and how they are commonly evaluated. We learn about practical challenges related to the design, execution, and evaluation of innovation policy in practice.

Chapters “Third-Generation Innovation Policy: System Transformation or Reinforcing Business as Usual?”, “Less from More: China Built Wind Power, but Gained Little Electricity”, “The Failures of the Entrepreneurial State: Subsidies to Renewable Energies in Europe”, “Directionality in Innovation Policy and the Ongoing Failure of Green Deals: Evidence from Biogas, Bio-ethanol, and Fossil-Free Steel” showcase alternative approaches to innovation policy such as transformative policies and missions, focusing specifically on top-down approaches toward more ecologically sustainable economies. Lessons from recent transformative policy programs in the European Union, China, and Swedish regions are discussed. The chapter by John-Erik Bergkvist, Jerker Moodysson, and Christian Sandström (2022), “Third-Generation Innovation Policy: System Transformation or Reinforcing Business as Usual?,” provides a discussion of some ongoing attempts around the Western world to accomplish innovation and renewal through large collaborative schemes. Based on case studies across the European Union, the authors conclude that these collaboration policies are likely to favor established interest groups rather than contribute to industrial transformation.

Chapters “Less from More: China Built Wind Power, but Gained Little Electricity”–“Directionality in Innovation Policy and the Ongoing Failure of Green Deals: Evidence from Biogas, Bio-ethanol, and Fossil-Free Steel” provide empirical evidence that problematize recent green industrial policies. In the chapter, “Less from More: China Built Wind Power, but Little Electricity Came,” Jonas Grafström (2022) reports evidence of failed wind power policies in China. Similarly, Carlo Amenta and Carlo Stagnaro (2022) document that European subsidies to renewable energy have had limited positive effects on the natural environment and done little good for the economy in the chapter, “The Failures of the Entrepreneurial State: Subsidies to Renewable Energies in Europe.” The chapter by Christian Sandström and Carl Alm (2022), “Directionality in Innovation Policy and the Ongoing Failure of Green Deals: Evidence From Biogas, Bio-ethanol, and Fossil-Free Steel,” reports on historical cases of policy failure regarding innovation and sustainable development. Documenting the costly failures of biogas and ethanol efforts in Sweden, the authors identify the underlying mechanisms and apply them to the ongoing development of supposedly fossil-free steel. Sandström and Alm (2022) argue that large pools of “free” public money directed toward specific technologies may distort incentives and make firms immune to risk, which in turn results in reckless investments into specific technologies that may have little potential.

The final section of the book discusses how we can turn the page and move on from ideas such as an entrepreneurial state toward more holistic innovation policy anchored in what we have learned from almost a century of such policies. Chapters “Policy Instruments for High-Growth Enterprises”, “Public-Steering and Private-Performing Sectors: Success and Failures in the Swedish Finance, Telecoms, and City Planning Sectors”, “The Digital Platform Economy and the Entrepreneurial State: A European Dilemma” compare more or less successful innovation policies and describe what we can learn from them about how institutionalized sectors can be transformed. In “Policy Instruments for High-Growth Enterprises”, Alex Coad, Peter Harasztosi, Rozalia Pal, and Mercedes Teruel (2022) provide an in-depth review of decades of knowledge accumulated on high-growth enterprises; their impact in terms of innovation, change, and job creation; and how policy instruments can, or cannot, be used to encourage the emergence and direction of such enterprises. Among other things, they highlight the importance of getting incentives right, and the coordination and consistency of policies over time. This evidence-based approach is perhaps less spectacular than the moonshot policies of the entrepreneurial state, but likely to be more effective in the long term.

In the chapter “Public-Steering and Private-Performing Sectors: Success and Failures in the Swedish Finance, Telecoms, and City Planning Sectors”, Klas A. M. Eriksson and Rasmus Nykvist (2022) discuss showcase three in-depth longitudinal cases of sectoral transformation, documenting the difference in innovation and competitiveness between the sectors that have been liberalized and city planning, which resembles more of a planned economy. In doing so, they also highlight the critical role of vested interest groups in blocking attempts at policy renewal. Relatedly, they highlight that innovation policy needs to deal better with incumbent interest groups. In the chapter “The Digital Platform Economy and the Entrepreneurial State: A European Dilemma,” Zoltan J. Acs (2022) shows how the nature of digital markets causes a dilemma for top-down policies seeking to steer innovation in directional ways. Comparing the state of the rapidly growing digital platforms and their impact in the United States, East Asia, and the European Union, he argues that the absence of competitive European tech firms is a direct function of the ideas and policy recommendations related to The Entrepreneurial State. Literature on innovation systems has emerged and been diffused among policymakers in Europe. American industrial policy tends to put a more direct emphasis on entrepreneurial ventures, and according to Acs, this is the primary reason why Europe is lagging behind.

In the book’s final chapter, “Collaborative Innovation Blocs and Mission-Oriented Innovation Policy: An Ecosystem Perspective,” Niklas Elert and Magnus Henrekson (2022) compare and integrate insights from mission-oriented innovation policy with an older innovation paradigm: that of collaborative innovation blocks. By highlighting how some aspects of “mission interventions” may be beneficial if enacted prudently and with the consideration of the institutional contingencies underpinning innovative activities in various contexts, the chapter discuss how more holistic and resilient innovation policies can be articulated to leverage the strengths of today’s rapidly growing innovation ecosystems.

2 Why Is the Entrepreneurial State so Popular?

The Entrepreneurial State gave policymakers what they needed, when they needed it. With economies struggling to recover and increased demands for sustainability, they were in great need of solutions or at least actions that seemed credible. The book provided a flattering message to politicians and government agencies, highlighting them as heroes and visionaries.

As we have seen in the current volume, it is far from evident that this is the case. As already noted by Lerner (2009) in Boulevard of Broken Dream, history is full of policy failure in the area of innovation and entrepreneurship. Several recent cases of policy failure have been documented in this book. At the same time, efforts in the European Union continue to gain momentum as the EU Green Deal is rolled out across member states.

Another reason why The Entrepreneurial State has been so popular is its compatibility with established interest groups. As observed in several contributions in this book, support structures, platforms for private-public cooperation, and large volumes of technology-specific money usually end up in the hands of established interest groups. Hence, they are not very likely to question these policies but will rather go along with the ride.

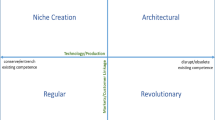

As noted by Potts et al. (2016), innovation policy can be classified either as giving various forms of support or as policies aimed toward removing barriers and removing destructive vested interests. The political economy of these two alternatives looks very different. Giving support does not result in any enemies. The cost of support programs is distributed across the wider collective of taxpayers; potential benefits are concentrated for a few actors. Conversely, policies aimed at dealing with resistance are politically less popular. Dealing with opposition to innovation in the form of incumbent oligopolies, regulations, or institutional obstacles is associated with considerable political costs. While the long-term benefits of doing so may be large, such benefits are less visible and distributed over many actors and over time. We therefore conclude that the entrepreneurial state has become so popular because it seems to cater to established interest groups in society: politicians and government administrations are heralded as entrepreneurial and innovative while big incumbent firms are often sheltered from competition via large collaboration schemes.

3 Innovation Policy, Inverted

As exemplified in several chapters of this book, due to forces of interest groups and political logic, innovation policy tends to become a matter of providing selective support instead of constructively dealing with resistance to innovation. We acknowledge that it is politically difficult to enact policies that deal with powerful interest groups. Yet, there is nevertheless a need to invert innovation policy. Innovation policy should be a matter of removing barriers to growth and renewal instead of handing out targeted support that tends to end up reinforcing vested interests.

Also, it should focus on general conditions for entrepreneurship and innovation rather than specific efforts targeting certain technologies. Targeting certain technologies or setting up large missions relates to an inherent risk of targeting the wrong technology, resulting in distorted competition and lock-in around the wrong solution. As the right technology cannot be known beforehand, markets provide a cumulative and emergent selection mechanism that results in innovation over time.

4 What Should Governments Do?

Innovation is a complex evolutionary process characterized by failures and unpredictable breakthroughs (Aldrich, 1999). Top-down interventions aiming at directionality suffer from the problems of dispersed knowledge emphasized by Hayek (1945). Perhaps the most unanimous conclusion of the broad theoretical and empirical literature on innovation and innovation policy suggests that good institutions, not attempts by bureaucrats to pick winning firms, technologies, and industries, are the key to societally valuable innovations (Aghion et al., 2016; Baumol, 2002; North, 1990). For this reason, the best policies to promote innovation are those that promote productive economic activity more generally: property rights protection, open and contestable markets, a stable monetary system, and legal rules that favor competition and entrepreneurship. Policy should promote an institutional environment in which innovation and entrepreneurship can flourish without trying to anticipate the specific outcomes of those processes—an impossible task in the face of uncertainty, technological change, and a dynamic, knowledge-based economy.

In their recent work synthetizing extant knowledge on central institutional determinants of innovation, Elert et al. (2019) provide a collection of guiding principles for policymaking: neutrality, transparency, moderation, contestability, legality, and justifiability.

Neutrality means not supporting or helping either side in a conflict or disagreement. From this perspective, policymakers should strive toward a level playing field between new incumbent organizations and new entrants—including, importantly, potential entrants (Djankov et al., 2002). With the large financial and network power among large firms, the playing field is all too often tilted against new entrants.

Transparency means that policymakers should operate in such a way that it is easy for others to see what actions are performed and what consequences they will entail. As such, transparency implies openness, communication, and accountability. Ensuring more transparency about the criteria that determine how labor, knowledge, and financial resources are made available or regulated in society reduces the source of institutional uncertainty inherent in innovative endeavors and facilitates innovative actors to focus on the type of uncertainty they seek to engage in—technological, organizational, or market uncertainty (Fleming, 2001; Schumpeter, 1934). As one successful Unicorn Entrepreneur told us when asked in an open panel whether high taxes were a problem, “Well, taxes are like rain. It often rains a lot in this country. That’s ok, as long as we can plan for it. We focus on other things, like hiring the best people wherever in the world we can find them; seeking to produce something new and better for our customers. As long as taxes and regulations are fair and transparent, and apply to everyone, that’s not a problem for us.”

Moderation is commonly defined as the avoidance of excess or extremes or the process of eliminating or lessening extremes (Elert et al., 2019). This means that if regulations or taxes are changed, or subsidies of some sort are deemed necessary, policymakers should be modest in extracting and allocating resources lest such measures become costly to reverse. Uncertainty is all around us and the future is unknowable; thus, altering course in policymaking may also be needed. When this is done, moderate, gradual reforms are usually more wise than large, hard-to-change reforms.

Contestability means that not only markets should be contestable, but also policymaking. When followed, this principle entails that all vested positions, opinions, and truths should be open to challenge and debate (Popper, 1945/2020). If institutions, policies, and markets cease to be contestable, they risk becoming outdated and obsolete in an ever-changing environment. Contestability is thus the cure for societal sclerosis and rigidity.

Legality refers to the idea that de jure and de facto institutions need to coincide, such that legality ensures the rule of law is both upheld and aligned with the institutional framework. This principle is a fundamental precondition in all modern economies and underpins any liberal democratic political order—to the point that it is occasionally taken for granted in much of the European Union. Nevertheless, it is important to realize that formally enacting the appropriate laws does not automatically ensure the legality of institutions that support innovation if policy practice accepts de facto institutions that break with what is formally legalized. When this is done, it is seen as institutional hypocrisy, and it gradually breaks down legitimacy and acceptance of the law.

Justifiability refers to the appropriate balancing of public and private interests that is needed to justify policy interventions beyond a simple laissez-faire attitude. It is not only active policies and institutions that need to be justified but also passive institutions, such as (intellectual) property rights, if they are to be effectively implemented and respected. Common-pool resources like our natural environment need to be taken seriously in institutional governance and policymaking, as do incumbent, new, and potential entrant organizations alike.

When considering commonly heralded institutions theorized to foster socially beneficial innovations like those above, it is clear that the entrepreneurial state violates many of these criteria. Large, top-down innovation schemes and moonshot projects are not compatible with neutrality in terms of a level playing field between entrepreneurs and incumbent firms. They are also less incompatible with moderation as most of the ongoing efforts are large and directed toward certain predefined tasks. When increasingly large swathes of common resources are pooled in very specific missions, these efforts and the institutional backing that they receive become less and less contestable, and how they are evaluated and governed is often not very transparent (Janssen et al., 2021).

It is indeed true, as Mazzucato and others have noted, that successful products and industries often follow military projects, publicly subsidized R&D, and similar programs. It does not follow, however, that governments are better than market participants (entrepreneurs, managers, and those who fund entrepreneurial and innovative projects) at anticipating these successes ex ante. For these reasons we are confident that independent markets actors, not public decision-makers, should be the key actors in innovation policy.

Specific policy interventions may have a sizeable effect on innovation. However, those that turn out to have a significant impact on innovation are usually those that had nothing to do with innovation when they were enacted. For example, migration waves after the collapse of the Soviet Union pushed large numbers of skilled engineers and mathematicians to Israel and the United States, which granted them generous residency and citizenship rights. These migrants made a substantial positive contribution to innovation in those countries. In countries such as the United States or Sweden, tax policies aimed at the deduction of household personal computers or broadband have also been documented to generate innovative entrepreneurship in broader population strata, even if innovation was never a main goal of those policies (Fairlie, 2006; Olsson & Hallberg, 2018). Economists have also argued that broader institutional policies such as housing regulations or access to education may be sizably more important for innovation than any specific intervention (Bell et al., 2019; Bloom et al., 2019).

In short, innovation policy needs to move from a focus on support to a removal of barriers, and toward general improvements rather than specific technologies or missions. While such a recipe is less politically appealing and less tangible than spectacular-sounding moonshot policies, it nevertheless has the best track record. The contributions to this book tell precisely such a story.

5 Lessons from Sweden

Several cases in this book concern the Swedish economy. Despite its small size, Sweden has become somewhat of an entrepreneurial powerhouse over the past two decades, especially within IT and software. The country has become one of Europe’s most dynamic startup hubs, experiencing the largest inflow of venture capital in the EU. Why is this the case? Central to the success of the Swedish technology sector are, first, the large general investments in IT infrastructure and education made back in the mid-1990s. Broadband access throughout the country was highly prioritized, it was possible to deduct taxes on home computing, and educational efforts regarding IT were directed toward the general population, meaning that a new generation of self-taught developers emerged in the early 2000s (Olsson & Hallberg, 2018). Access to free and high-quality university education, as in many European countries, has also been important.

Second, conditions and incentives for starting and running business have been greatly improved. Sweden is still often mistakenly regarded as a semi-socialist economy. Corporate taxation has gone from 50% in 1990 to below 20% today. While taxes on employment remain high, taxes on ownership, capital, and dividends are much lower. The combined effect of high taxes on labor and lower taxes on ownership means that incentives for entrepreneurship have improved greatly (Henrekson & Sanandaji, 2016).

Beyond strong incentives for entrepreneurship and a comparatively efficient and transparent government administration, the country has also undergone a process of privatization and deregulation over the past three decades, effectively opening up markets and making them contestable for entrepreneurial activity. The country was the first to create a fully private and electronic stock exchange in 1992. The postal and shipping market was opened up for competition in 1992, and several welfare sectors such as education and health have also been subject to competition, with many innovative, high-growth companies emerging as a result.

These reforms have led to Sweden rising in international rankings on competitiveness and innovativeness (Karlson, 2018), yet at the same time a strong welfare state provides a cushion and environmental legislation is strict: During the time period 1990–2018, total domestic carbon dioxide emissions in Sweden fell by 27%, driven by a transition to more renewable energy, more efficient utilization of resources, and more growth related to IT and services as opposed to heavy industry (Grafström & Sandström, 2021).

We have also witnessed remarkable improvements with regard to fuel efficiency in Sweden and other countries. Water consumption has been subject to steep declines, both in absolute and relative numbers. Air quality has improved a lot over the past three decades. Out of 26 different air pollutants, 24 have been reduced in absolute figures, with an average decline of 52%. In relation to GDP, the decline is even greater—77%. Lead emissions have seen the greatest decline (97%) (Grafström & Sandström, 2021). In short, Sweden has been on a successful path toward sustainability, which has primarily been focused on regulation, taxes, and legislation.

6 Swedish Failures Are Failures of the Entrepreneurial State

In some sectors, however, Sweden has followed the route of the entrepreneurial state, initiating grand, moonshot projects in order to accomplish great leaps toward sustainability. It is also in these areas that we see the greatest disappointments, as outlined in chapter “Directionality in Innovation Policy and the Ongoing Failure of Green Deals: Evidence from Biogas, Bio-ethanol, and Fossil-Free Steel” (Sandström & Alm, 2022) of this volume: Municipal investments into biogas failed to deliver anything but mounting debt and technology that did not work. Ethanol cars that were heavily subsidized in the early 2000s resulted in a bubble that eventually burst in 2009–2010. Efforts were made to extract ethanol from cellulose in the rural north in order to reindustrialize the region and create sustainability and new jobs. This turned out to be a financial disaster in the years after 2008 (Sandström & Alm, 2022).

What all these policy failures have in common is that ideas related to the entrepreneurial state and the innovation-systems perspective underpinned them. Large sources of public funding at the regional, national, and European levels were combined, making actors immune to risks, resulting in overinvestments in technologies that had little potential.

7 Toward Credible Innovation Policy

Revisiting the guiding principles of Elert et al. (2019)—neutrality, transparency, moderation, contestability, legality, and justifiability—we would argue that the success in recent decades with regard to innovation is related to these guiding principles. Markets have become contestable through open access and competitive reforms, and broad reforms focused on things like skills development and broadband access have resulted in neutrality and moderation.

The findings of this book imply that innovation policy should not be about schemes for public-private collaboration, technology-specific large public investments, or targeted support schemes for specific types of innovators or firms. Instead, innovation policy needs to be inverted. Instead of giving active and specific support to firms or technologies that are deemed to contribute to certain grand challenges, it needs to be passive in focusing on general conditions and incentives, while also actively dealing with interest groups. Instead of being mission and technology oriented—regardless of how important those missions may seem to be—innovation policies seeking to move society in a more equitable, productive, and sustainable way need to focus on the conditions required to create desired outcomes: broad reforms improving the conditions for any person to be able to launch or join new disruptive organizations, whatever their background; ensuring competence through a well-functioning educational system; and dealing constructively with vested interests to make industries more contestable. The protection of common-pool resources and efforts to curb global climate change should be based on environmental legislation and taxation that prohibits or makes it expensive to pollute, but remains technology neutral, since nobody knows from where and through whom the next world-changing or world-saving innovation will come. That is the beauty of innovation.

References

Acs, Z. J. (2022). The digital platform economy and the entrepreneurial state: A European dilemma. In K. Wennberg, & C. Sandström (Eds.), Questioning the entrepreneurial state: Status-quo, pitfalls, and the need for credible innovation policy. Springer.

Aghion, P., Akcigit, U., Deaton, A., & Roulet, A. (2016). Creative destruction and subjective Well-being. American Economic Review, 106(12), 3869–3897.

Aldrich, H. (1999). Organizations evolving. Sage.

Amenta, C., & Stagnaro, C. (2022). The failures of the entrepreneurial state: Subsidies to renewable energies in Europe. In K. Wennberg, & C. Sandström (Eds.), Questioning the entrepreneurial state: Status-quo, pitfalls, and the need for credible innovation policy. Springer.

Aspromourgos, T. (2018). Mazzucato on value and productive activity: A review. History of Economics Review, 70(1), 72–82. https://doi.org/10.1080/10370196.2018.1552482

Baumol, W. J. (2002). The free-market innovation machine: Analyzing the growth miracle of capitalism. Princeton University Press.

Bell, A., Chetty, R., Jaravel, X., Petkova, N., & Van Reenen, J. (2019). Who becomes an inventor in America? The importance of exposure to innovation. The Quarterly Journal of Economics, 134(2), 647–713.

Bergkvist, J.-E., Moodysson, J., & Sandström, C. (2022). 3rd Generation innovation policy: System transformation or reinforcing business as usual?. In K. Wennberg, & C. Sandstrm (Eds.), Questioning the entrepreneurial state: Status-quo, pitfalls, and the need for credible innovation policy. Springer.

Bloom, N., Van Reenen, J., & Williams, H. (2019). A toolkit of policies to promote innovation. Journal of Economic Perspectives, 33(3), 163–184.

Brattström, A. (2022). Cultural ideals in the entrepreneurship industry. In K. Wennberg, & C. Sandström (Eds.), Questioning the entrepreneurial state: Status-quo, pitfalls, and the need for credible innovation policy. Springer.

Brown, R. (2021). Mission-oriented or mission adrift? A critical examination of mission-oriented innovation policies. European Planning Studies, 29(4), 739–761.

Coad, A., Harasztosi, P., Pál, R., & Teurel, M. (2022). Policy instruments for high-growth enterprises. In K. Wennberg, & C. Sandström (Eds.), Questioning the entrepreneurial state: Status-quo, pitfalls, and the need for credible innovation policy. Springer.

Collin, E., Sandström, C., & Wennberg, K. (2022). Evaluating Evaluations of innovation policy: Exploring reliability, methods and conflicts of interest. In K. Wennberg, & C. Sandström (Eds.), Questioning the entrepreneurial state: Status-quo, pitfalls, and the need for credible innovation policy. Springer.

Daunfeldt, S.-O., Halvarsson, D., McKelvie, A., & Tingvall, P. G. (2022). Do targeted R&D grants towards SMEs increase employment and demand for high human capital workers? In K. Wennberg, & C. Sandström (Eds.), Questioning the entrepreneurial state: Status-quo, pitfalls, and the need for credible innovation policy. Springer.

Davidson, S., & Potts, J. (2022). The entrepreneurial state and the platform economy. In K. Wennberg, & C. Sandström (Eds.), Questioning the entrepreneurial state: Status-quo, pitfalls, and the need for credible innovation policy. Springer.

Djankov, S., LaPorta, R., Lopez-de-Silanes, F., & Shleifer, A. (2002). The regulation of entry. Quarterly Journal of Economics, 117(1), 1–37.

Elert, N., Henrekson, M., & Sanders, M. (2019). The entrepreneurial society: A reform strategy for the European Union. Springer Nature.

Elert, N., & Henrekson, M. (2022). Collaborative innovation blocs and mission-oriented innovation policy: An ecosystem perspective. In K. Wennberg, & C. Sandström (Eds.), Questioning the entrepreneurial state: Status-quo, pitfalls, and the need for credible innovation policy. Springer.

Eriksson, K. A. M., & Nykvist, R. (2022). Public-steering and private-performing sectors: Success and failures in Swedish finance, telecom and city planning sectors. In K. Wennberg, & C. Sandström (Eds.), Questioning the entrepreneurial state: Status-quo, pitfalls, and the need for credible innovation policy. Springer.

Fairlie, R. W. (2006). The personal computer and entrepreneurship [article]. Management Science, 52(2), 187–203. http://search.ebscohost.com/login.aspx?direct=true&db=buh&AN=20252352&site=ehost-live

Fleming, L. (2001). Recombinant uncertainty in technological search. Management Science, 47(1), 117–132.

Grafström, J. (2022). Less from more: China built wind power, but gained little electricity. In K. Wennberg, & C. Sandström (Eds.), Questioning the entrepreneurial state: Status-quo, pitfalls, and the need for credible innovation policy. Springer.

Grafström, J., & Sandström, C. (2021). Mer för mindre? Tillväxt och hållbarhet i Sverige. Ratio. Stockholm.

Hayek, F. A. (1945). The use of knowledge in society. American Economic Review, 35(4), 519–530.

Henrekson, M., & Sanandaji, T. (2016). Owner-level taxes and business activity. Foundations and Trends in Entrepreneurship, 12(1), 1–94.

Hjalmarsson, D. (2022). Building local innovation support systems: Theory and practice. In K. Wennberg, & C. Sandström (Eds.), Questioning the entrepreneurial state: Status-quo, pitfalls, and the need for credible innovation policy. Springer.

Janssen, M. J., Torrens, J., Wesseling, J. H., & Wanzenböck, I. (2021). The promises and premises of mission-oriented innovation policy–a reflection and ways forward. Science and Public Policy, 48(3), 438–444.

Karlson, N. (2018). Statecraft and Liberal reform in advanced democracies. Springer International Publishing.

Larsson, J. P. (2022). Innovation without entrepreneurship? The pipe dream of mission-oriented innovation policy. In K. Wennberg, & C. Sandström (Eds.), Questioning the entrepreneurial state: Status-quo, pitfalls, and the need for credible innovation policy. Springer.

Lerner, J. (2009). Boulevard of broken dreams. Princeton University Press.

Mingardi, A. (2015). A critique of Mazzucato’s entrepreneurial state. Cato Journal, 35, 603–625.

McCloskey, D. N., & Mingardi, A. (2020). The myth of the entrepreneurial state. American Institute for Economic Research.

Murtinu, S., Foss, N. J., & Klein, P. G. (2022). The entrepreneurial state: An ownership competence perspective. In K. Wennberg, & C. Sandström (Eds.), Questioning the entrepreneurial state: Status-quo, pitfalls, and the need for credible innovation policy. Springer.

North, D. C. (1990). Institutions, institutional change and economic performance. Cambridge University Press.

Olsson, B., & Hallberg, M. (2018). FinTech in Sweden: Will policymakers’ (in)action nurture or starve its growth? In R. Teigland, S. Siri, A. Larsson, A. Moreno Puertas, & C. Ingram Bogusz (Eds.), The rise and development of FinTech (pp. 66–84). Routledge.

Popper, K. R. (1945/2020). The open society and its enemies. Princeton University Press.

Potts, J, Allen, D.W., and MacDonald, T.J. (2016). Keep your friends close, your enemies closer: The case for inclusive innovation policy. SSRN Working Paper, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2836301

Pradella, L. (2017). The entrepreneurial state by Mariana Mazzucato: A critical engagement. Competition & Change, 21(1), 61–69.

Schumpeter, J. A. (1934). The theory of economic development. Harvard University Press.

Sandström, C., & Alm, C. (2022). Directionality in innovation policy and the ongoing failure of green deals: Evidence from biogas, bio-ethanol and fossil-free steel. In C. Sandström & K. Wennberg (Eds.), Questioning the entrepreneurial state. Springer.

Sarasvathy, S. D. (2022). An effectual analysis of markets and states. In K. Wennberg, & C. Sandström (Eds.), Questioning the entrepreneurial state: Status-quo, pitfalls, and the need for credible innovation policy. Springer.

Terjesen, S. (2022). Reducing higher education bureaucracy and reclaiming the entrepreneurial university. In K. Wennberg, & C. Sandström (Eds.), Questioning the entrepreneurial state: Status-quo, pitfalls, and the need for credible innovation policy. Springer.

Acknowledgments

Our deepest gratitude is directed toward all the researchers who have contributed to this book, and for the anonymous peer reviewers on earlier drafts. Without your efforts and constructive ideas, this book would not have been possible. Special thanks also to the Ratio Institute for fostering a research environment where scholarly work can develop and for administrative support. We are especially indebted to Rickard Björnemalm and Jonathan Grayson for editorial assistance.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2022 The Author(s)

About this chapter

Cite this chapter

Wennberg, K., Sandström, C. (2022). Introduction. In: Wennberg, K., Sandström, C. (eds) Questioning the Entrepreneurial State. International Studies in Entrepreneurship, vol 53. Springer, Cham. https://doi.org/10.1007/978-3-030-94273-1_1

Download citation

DOI: https://doi.org/10.1007/978-3-030-94273-1_1

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-94272-4

Online ISBN: 978-3-030-94273-1

eBook Packages: Business and ManagementBusiness and Management (R0)