Abstract

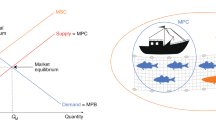

As the prospect of commercial deep seabed mining comes closer to reality, the International Seabed Authority (ISA) has begun to turn its attention to the question of how to achieve equitable sharing of the benefits from such mining as mandated by the UN Convention on the Law of the Sea. One approach to equitable distribution is to develop a methodology for distribution of net financial benefits based on agreed rules or formulae. Under this scenario, ISA would collect the net financial benefits and transfer the monetary proceeds to a pool of qualified beneficiaries. However, there are inherent weaknesses to this approach. We propose, in line with similar suggestions by the Finance Committee of ISA, that an alternative form of distribution could be a Seabed Sustainability Fund, similar to a sovereign wealth fund, administered by ISA. Such a fund would support and enhance knowledge about the deep-sea for the benefit of all humanity. In line with this, it is envisaged that the Fund could also support other global public goods that benefit all of humanity, such as adaptation or mitigation of climate change, advancing scientific knowledge of the ocean and deep-sea ecosystems, and ensuring biodiversity conservation. These are known to be underprovided and underfunded and could also benefit from funding sourced from and returned to all humanity.

The views expressed in this paper are those of the authors alone and do not necessarily reflect the position of the International Seabed Authority or any of its member States.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

Notes

- 1.

General Assembly resolution 2749 (XXV), 17 December 1970.

- 2.

United Nations Convention on the Law of the Sea, 1982: A/CONF.62/122 and Corr. 1–11, ILM 21 (1982) 1261. The Law of the Sea: Compendium of Basic Documents (International Seabed Authority/The Caribbean Law Publishing Company 2001) 1.

- 3.

Agreement relating to the Implementation of Part XI of the United Nations Convention on the Law of the Sea of 10 December 1982, A/RES/48/263, annex. Also reproduced in The Law of the Sea: Compendium of Basic Documents (International Seabed Authority/The Caribbean Law Publishing Company 2001) 206. The Part XI Agreement was provisionally applied from 16 November 1994 (the date of entry into force of the Convention) and entered into force itself on 28 July 1996.

- 4.

The Area is defined in article 1, paragraph 1(1), of UNCLOS as ‘the seabed and the ocean floor and the subsoil thereof, beyond the limits of national jurisdiction.’

- 5.

Development of rules, regulations and procedures on the equitable sharing of financial and other economic benefits derived from activities in the Area pursuant to section 9, paragraph 7 (f), of the annex to the 1994 Agreement, Report of the Finance Committee of the International Seabed Authority, ISBA/26/A/24-ISBA/26/C/39.

- 6.

Ibid. para. 47.

- 7.

1994 Agreement, annex, Sect. 9, para. 7 (f).

- 8.

ISBA/24/FC/4.

- 9.

See ISBA/24/A/6 (Report of the Finance Committee)

- 10.

ISBA/26/A/24-ISBA/26/C/39. The reports presented for the Committee are summarized in Equitable Sharing of Financial and Other Economic Benefits from Deep-Seabed Mining, ISA Technical Study No. 31 (2021).

- 11.

The latest draft is contained in ISBA/25/C/WP.1.

- 12.

Report of the Chair on the outcome of the third meeting of the open-ended working group of the Council in respect of the development and negotiation of the financial terms of a contract under article 13, paragraph 1, of annex III to the United Nations Convention on the Law of the Sea and section 8 of the annex to the Agreement relating to the Implementation of Part XI of the United Nations Convention on the Law of the Sea of 10 December 1982, ISBA/26/C/8.

- 13.

Kirchain, Peacock and Roth, Decision Analysis Framework & Review of Cash Flow Approach Model, 13 February 2020, available at https://isa.org.jm/files/files/documents/dec-analysis_0.pdf

- 14.

Some of these issues are addressed in a separate report prepared for the Finance Committee on future financing of the Authority (Report of the Secretary-General on Future Financing of the International Seabed Authority, ISBA/26/FC/7).

- 15.

See Draft regulations for exploitation of marine mineral in the Area (ISBA/25/C/WP.1) regulation 85. Whilst the draft regulations state that the annual fixed fee shall be determined by the Council, discussions so far have proceeded on the basis that the fee should be not less than the US$1 million originally prescribed in UNCLOS, Annex III, Art. 13, paragraph 3 (which ‘no longer applies’ as a result of the 1994 Agreement).

- 16.

ISA, Study of the Potential Impact of Polymetallic Nodules Production from the Area on the Economies of Developing Land-based Producers of those Metals which are Likely to be Most Seriously Affected (2020) https://www.isa.org.jm/files/documents/impactstudy.pdf

- 17.

Pursuant to the 1994 Agreement, the Legal and Technical Commission shall perform the functions of the Economic Planning Commission until the Council decides otherwise or until the approval of the first plan of work for exploitation. In July 2020, the Commission recommended that the Council should consider the establishment of the Economic Planning Commission before the approval of any plan of work for exploitation. See Report of the Chair of the Legal and Technical Commission on the Work of the Commission at the second part of its twenty-sixth session, ISBA/26/C/12/Add.1, para. 19. At the time of the writing, the Council has not yet met to consider the recommendation of the Commission.

- 18.

General Assembly resolution 2749 (XXV).

- 19.

This includes increased scientific knowledge made available through the Authority as a result of exploration activities, as well as international cooperation in marine science and the results of marine scientific research in the Area carried out pursuant to Articles 143 and 144 of UNCLOS.

- 20.

ISA Technical Study No. 31, Chapter III.

- 21.

Despite the references to ‘benefit of mankind’ in UNCLOS, it is States, not cosmopolitan individuals, that are the primary subjects and have personality under international law. Philosophically, individuals represented by States or States representing individuals can receive greater weight in sharing rule formulae through choice of ethical principles, their balance, and formulae. This issue is covered in more detail in ISA Technical Study No. 31.

- 22.

ISA Technical Study No. 31.

- 23.

Aristotle’s equity principle or proportionality principle states that the goods or services of concern should be divided in proportion to each claimant’s contribution (or claim). See Aristotle, Nicomachean Ethics. Oxford University Press, Oxford (2009). In the case of revenue from deep sea mining, the good is homogeneous, divisible, and measured on a cardinal scale in a common metric (US$), and each individual has an equal claim to share article 140 benefits from deep sea mining in the Area due to the status of mineral resources as the common heritage of mankind. This equal claim is adjusted for progressivity in response to requirements of the Convention to redistribute income on a more equitable basis, so that the distribution is not an exact or even one. Instead, the distribution is an even one with unequal entitlements with claimants weighted by social distribution weights.

- 24.

ISA has also developed a web-based model to enable visualization and comparison of the impact of each of three alternative formulae on any member of ISA under the different scenarios.

- 25.

These measures included the Gini Coefficient, Lorenz curve, Pen’s Parade of Dwarves, Atkinson Inequality Index and Generalized Entropy Measures.

- 26.

For example, the Global Environment Facility (GEF), which claims to be ‘the largest funding mechanism for multi-country collaboration on waters and oceans’ allocated only 11.4% of the $4.4bn pledged under the GEF-7 replenishment to its ‘international waters’ programme. In reality most of that funding is allocated to management of transboundary marine resources rather than deep sea science. See GEF/R.7/22, 2 April 2018, available at https://www.thegef.org/sites/default/files/council-meeting-documents/GEF-7%20Resource%20Allocation%20and%20Targets%20-%20GEF_R.7_22.pdf and https://iwlearn.net/abt_iwlearn/gef-international-waters-focal-area. See also the comments of economist Jeffrey Sachs to the UN Food Systems Pre-Summit, 26 July 2021, https://www.youtube.com/watch?v=WZ1xc491mnU

- 27.

The ISA Endowment Fund for Marine Scientific Research has attracted funding of only $900,000 over 15 years, which severely constrains the effectiveness of the Fund.

- 28.

OECD, Global Outlook on Financing for Sustainable Development 2021 https://www.oecd-ilibrary.org/development/global-outlook-on-financing-for-sustainable-development-2021_6ea613f4-en

- 29.

- 30.

Since it became financially autonomous in 1998, the budget of ISA has increased at an annualized rate of less than 1% and remains below $10m per year. Only 11 new staff posts have been created over the past 22 years, despite a significant increase in the complexity and the range of responsibilities allocated to the secretariat by the member States.

- 31.

IOC-UNESCO, Global Ocean Science Report 2020, https://unesdoc.unesco.org/in/documentViewer.xhtml?v=2.1.196&id=p::usmarcdef_0000375147&file=/in/rest/annotationSVC/DownloadWatermarkedAttachment/attach_import_d52d8a6c-ac51-4ed6-8a97-8736c55545b0%3F_%3D375147eng.pdf&locale=en&multi=true&ark=/ark:/48223/pf0000375147/PDF/375147eng.pdf#1063_20_en_int_GOSR2020_5.indd%3A.68797%3A2753

- 32.

1994 Agreement, annex, Sect. 1, para. 5(i).

- 33.

The ISA Deep Seabed and Ocean Database (DeepData) is a spatial, Internet-based, data management system. It hosts environmental, oceanographic and geological data collected by contractors as well as other relevant environmental and resources related data for the Area. https://www.isa.org.jm/index.php/deepdata

- 34.

Acemoglu and Robinson, Why nations fail, the origins of power, prosperity and poverty, Profile Books Ltd, London (2012).

- 35.

Among the members of the ISA, 27 States are least developed countries (including 10 that are landlocked) and 10 States are both developing and landlocked countries.

- 36.

It is difficult to speculate on the returns that could be generated, but we assume that the Fund would be capable of seeking a balanced long-term high yield on its investment. This implies investing in assets that yield a high long-term return inter alia equity, high yield bonds and real estate. It would thus follow the example of a respectable institution like the United Nations Joint Staff Pension Fund, which realizes a 4.5% annual return net of inflation.

- 37.

This could also help to avoid the need for developing countries to borrow (if they are able to borrow at all) at rates between 5% and 10% higher than those available to the rich countries.

- 38.

1994 Agreement, Annex, Sect. 1 para. 14.

- 39.

ISBA/24/A/10, 27 July 2018.

- 40.

ISBA/25/A/15, 24 July 2019.

- 41.

Report on ISA’s Contribution to the Sustainable Development Goals, 2021 (in press).

- 42.

ISBA/26/A/18, 17 December 2020.

- 43.

ISBA/26/A/17, 17 December 2020.

- 44.

Adrian Glover, Helena Wiklund, Chong Chen and Thomas Dahlgren, Managing a sustainable deep-sea ‘blue economy’ requires knowledge of what actually lives there, elifesciences.org 2018, https://doi.org/10.7554/eLife.41319

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Lodge, M.W., Bourrel-McKinnon, M. (2022). Sharing Financial Benefits from Deep Seabed Mining: The Case for a Seabed Sustainability Fund. In: Sharma, R. (eds) Perspectives on Deep-Sea Mining. Springer, Cham. https://doi.org/10.1007/978-3-030-87982-2_19

Download citation

DOI: https://doi.org/10.1007/978-3-030-87982-2_19

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-87981-5

Online ISBN: 978-3-030-87982-2

eBook Packages: Earth and Environmental ScienceEarth and Environmental Science (R0)