Abstract

Sharing the burden of adaptation is key for the agricultural sector in developing countries. For the agricultural sector in developing countries, the losses will go from 3% under 1.5 °C scenario to 7% under 2 °C scenario (Masson-Delmotte et al. 2018). This anticipated information on possible climate change-driven challenges possesses a big load in farmers management that might ex-ante stop investing because of the negative consequences of the scenarios presented. This situation could be even worse in subsistence farming system totally dependent on the yields. Crop insurances can be a good way to overcome some of the losses. In this paper, we present weather-based insurance schemes (WII), which are based on weather index objectively determined for the specific agricultural region, and therefore the individual loss assessment, which makes insurances too expensive, is not necessary. We present the results of decisions based on perfect and imperfect weather forecasts and conclude by offering insights in the difference of decision-making if a perfect forecast might be available or not and the consequences for farmers income.

You have full access to this open access chapter, Download conference paper PDF

Similar content being viewed by others

Keywords

Introduction

One of the first things that comes to mind when talking about adaptation is the question of the sharing of the risks we might be facing. As the IPCC Special Report 1.5 Degrees pointed out, the increase of risks between 1.5 °C and 2 °C is quite frightening for several parts of the economy. Agriculture is considered the economic sector most vulnerable to climate change, and in many regions of the developing world, weather- and climate-related risks for the agricultural sector are already jeopardizing parts of the economy dependent on the agricultural outputs (Guimarães Nobre et al. 2019). Since the 1980s, climatic risks have diminished worldwide the yields of main staple food (e.g. maize by 3.8% and wheat 5.5%) (Lobell et al. 2011). The resulting impacts are not only for farmers but also for all the upstream and downstream sectors of those countries.

To share the burden of this risk is key for reaching the Sustainable Development Goals (SDGs), mostly SDG2 related to the reduction of hunger to zero. This goal is crucial for around 700 Million people that are reported to go to bed hungry every day (FAO et al. 2020).

Additional to the SDGs, the Sendai Framework and the Paris Agreement also identify risk-sharing as an important mechanism for facing climate-related risks. Through risk transfer and insurance, risk-sharing turns fundamental to enhance resilience and decrease the economic impacts of climate-related risks.

A crop insurance is one of the possible risks sharing mechanisms that might be implemented to share the burden and be able to adapt to climate-related challenges. Crop insurance is an important adaptation mechanism for agricultural risks because it redistributes the burden of the risk between the farmers and the insurance companies. But, in general, it is often expensive and unaffordable to many farmers, especially in low-income countries. One of the reasons for why crop insurance premiums are so high is the expenditures for loss assessment.

A possible crop insurance mechanism is given by weather-based index insurances. In weather-based index insurance (WII) schemes, the payouts are based on weather index objectively determined for the specific agricultural region, and therefore the individual loss assessment is not necessary. WII are designed not for the individual risk but more for the climate risks that might influence a region’s resilience. Climate services designed for WII are key.

WII paves the way to cheaper and more affordable agricultural insurances (Jørgensen et al. 2020). We suggest that redistributing the risk of agricultural failures through crop WII insurances is an appropriate adaptation strategy that also might support SDG 2 because the implementation of weather-based insurances indicates a high risk-reducing potential, therefore it increases the resilience of farming systems towards risks. Additionally, broad implementation of weather insurance schemes would support not only SDG 2 on zero hunger, but also SDG 10 on reducing inequalities and SDG 13 on climate action (UN 2019).

Weather-Based Index Insurance (WII)

Climate-related extremes as presented in the IPCC 1,5 Special report, can have not only ex-post consequences after, e.g. heavy rains have caused flooding, but also ex-ante consequences because knowing the risk might dissuade from investing in the agricultural sector. In both situations, the losses are high, on the one side because of the damages provoked by flooding and on the other side because of the low productivity due to insufficient investment. Therefore, adaptation instruments should support farming systems in both mentioned situations, by supporting with the sharing of the risk burden and by enabling investments in the agricultural sector.

WII are effective adaptation instruments for ex-ante and ex-post climate risk consequences. They are based on measurable climate variables as precipitation causing, for example, heavy rains or temperature causing heat waves. In WII, losses and payout are determined by the measurement in a particular region. Insurance takers can buy insurances at a relative low cost and this way re-distribute the risk.

WII aggregates the weather information within the vegetation period. This might be a rather simple index, e.g. based on precipitation only, or a more complex construct additionally dependent on, e.g. daily air temperature through thermal units or Growing Degree Days (GDD) which is a measure of heat accumulation that parametrizes the heat affecting the plant (Kovalevsky and Máñez Costa 2021).

One important question when deciding on buying WII is the existence or not of proper weather and climate services that could be used to decide for farmer A, if a WII is worth to buy or not. In many cases, the fact is that not all over the developing world, we will be able to get enough data or access to data that will allow farmers to have the science-based information support. Therefore, our main question to answer was: under which conditions farmers in drought-prone areas will buy a WII and how will this affect their income. With our modelling approach we answer these questions.

Overview of Modelling Approach

We will show that developing comprehensive models of WII schemes is important as adaptation instruments, as WII could have a great impact on making the access to insurances easier for farmers than it is today. As already mentioned, nowadays agricultural insurances are only affordable to rich farmers. This kind of insurance would also support the capability of farmers to have a back-up monetary solution in case of crop failure (ex-post). Additionally, we assume that it would be easier to enhance the resilience of farming systems through WII when WII projects are supported by reliable forecasting tools.

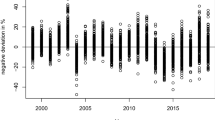

The presented study contributes to theoretical modelling of certain dynamical features of WII project implementation. Specifically, it is focused on modelling the strategies of producers in a drought-prone region regarding the WII policy purchase, and also on simulating the dynamics of aggregate demand for this kind of insurance (see Fig. 14.1). Strategies of individual producers might depend on availability of the weather index forecast and on its quality. The analysis performed suggests that the quality of the forecast would affect the optimal strategy to be selected by an insurance policy buyer under conditions of inevitable uncertainty. Modelling approaches developed can support decisions relevant to design, successful implementation and subsequent scale-up of WII schemes in regions prone to agricultural droughts.

Simulated demand for WII depending on perfect and imperfect forecast for weather index. In case of a perfect forecast (one that can be proven by looking at the previous time period forecasted), there is a steady growth in number of insured farmers. In case of an imperfect forecast, the numbers might be very stable or even decreasing

The analysis of adverse selection is made for a hypothetical scenario where only the policy buyers, but not the insurers, base their decision-making on available weather index forecast. An analogous scenario was considered in a study devoted to rainfall index insurance in the US, together with a more realistic scenario where both the insurers and the insured take into account weather index forecast (Nadolnyak and Vedenov 2013). As shown in Nadolnyak and Vedenov (2013), in the latter case, adverse selection can be precluded by setting insurance premiums on the basis of forecast-conditional calculations. The generalization of the model developed in the present study to account for the decision-making of insurers is left for further research.

Our findings are based on a simple conceptual model for WII. In particular, a simple power law was chosen to parameterize the dependence of crop yield on the weather index. Also, the dynamics of both actual and forecasted weather index was, somewhat arbitrarily, represented by a very simple random process. Bringing more realism to the model, in particular, adopting the crop yield parametrizations from real-world field data, and deriving actual/forecasted weather indices from observations/forecasts of weather and climate variables, is planned for future research. Implementation of this program would make the proposed generic modelling scheme crop- and region-specific, which, as mentioned above, is a necessary prerequisite for successful real-world implementation of WII projects. Another interesting extension of this modelling scheme would be to consider the case where probabilistic forecasts are available to the insurers and the insured, providing not only the expected values of the weather index, but additionally their confidence intervals.

Conclusions and Recommendations

The dynamics of individual producer’s income are shown in Fig. 14.2 (blue line: ‘always insurance’ case; green line: hypothetical perfect forecast case; red line: imperfect forecast case). Producers supported in their decision-making by hypothetical perfect forecasts would benefit from ‘perfectly efficient’ adverse selection. This makes the dynamics of producers’ income under a perfect forecast scenario quite different from the imperfect forecast case (where the forecast quality is low and hence the probability of a wrong decision is high) and from the ‘always insurance’ case (where, by assumption, producers bear expenditures for insurance policies in all years, ‘bad’ and ‘good’).

In a simple WII model discussed in the present paper, the stochastic dynamics of actual weather index were simulated with a stationary random process. However, the climate is changing. In particular, climate model projections suggest that anthropogenic global warming will in future lead to many wet areas getting wetter and to dry regions getting drier. Generally, model projections reveal many drying areas in the low- and mid-latitudes, with a tendency for the subtropical (dry) zones to expand poleward. Consequently, future droughts will have more negative impacts on many economic activities, especially on agriculture, which is, as mentioned at the beginning, the most sensitive sector. By generalizing the proposed modelling scheme to the case of non-stationary random processes, it would be possible to consider weather indices with statistically significant trends that would be important for taking climate change effects into consideration. This would also likely shift the prospects for applications of this modelling scheme to the rapidly developing area of climate services. This modelling also shows the differences in income depending on the decisions made by farmers on buying or not an insurance policy.

References

FAO et al (2020) The State of Food Security and Nutrition in the World (SOFI). Rome, Italy

Jørgensen, Liv S, Termansen M, Pascual U (2020) Natural insurance as condition for market insurance: climate change adaptation in agriculture. Ecol Econs 169:106489. http://www.sciencedirect.com/science/article/pii/S0921800919301612

Kovalevsky DV, Máñez Costa M (2021) Demand behaviour for weather index insurance products in regions prone to agricultural droughts. Discontinuity, Nonlinearity, and Complexity 10(4):765–780. DOI: https://doi.org/10.5890/DNC.2021.12.015 (open access)

Lobell DB, Schlenker W, Costa-Roberts J (2011) Climate trends and global crop production since 1980. Science 333(6042):616–620

Masson-Delmotte V, Zhai P, Pörtner H-O, Roberts D, Skea J, Shukla PR, Pirani A, Moufouma-Okia, Péan C, Pidcock R, Connors S, Matthews JBR, Chen Y, Zhou X, Gomis MI, Lonnoy E, Maycock, Tignor M, Waterfield T (eds) (2018) Global warming of 1.5 °C. An IPCC Special Report on the impacts of global warming of 1.5 °C above pre-industrial levels and related global greenhouse gas emission pathways, in the context of strengthening the global response to the threat of climate change. Geneve

Nadolnyak DA, Vedenov D (2013) Information value of climate forecasts for rainfall index insurance for Pasture, Rangeland, and Forage in the Southeast United States. J Agri Appl Econ 45(1):143638. https://econpapers.repec.org/RePEc:ags:joaaec:143638

Nobre G, Gabriela et al (2019) Financing agricultural drought risk through Ex-Ante cash transfers. Sci Total Environ 653:523–535. http://www.sciencedirect.com/science/article/pii/S0048969718343067

UN (2019) The Sustainable Development Goals Report. New York

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2022 The Author(s)

About this paper

Cite this paper

Máñez Costa, M., Kovalevsky, D.V. (2022). Weather and Climate Services to Support a Risk-Sharing Mechanism for Adaptation of the Agricultural Sector. A Theoretical Example for Drought-Prone Areas. In: Kondrup, C., et al. Climate Adaptation Modelling. Springer Climate. Springer, Cham. https://doi.org/10.1007/978-3-030-86211-4_14

Download citation

DOI: https://doi.org/10.1007/978-3-030-86211-4_14

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-86210-7

Online ISBN: 978-3-030-86211-4

eBook Packages: Earth and Environmental ScienceEarth and Environmental Science (R0)