Abstract

Electric vehicles (i.e., battery and plug-in hybrid electric vehicles) are seen as one promising technology toward a sustainable transport system as they have the potential to reduce CO2 emissions. The forecast of their market penetration depends on various factors including the cost development of key components such as the electric battery. This chapter focuses on the impact of experience curves on the battery costs, and consequently on the electric vehicles’ market penetration, which is simulated by coupling two system dynamics transport models: ASTRA, representing Europe, and TE3, representing key non-European car markets. The results of the TE3 model show that the consideration of global endogenous learning curves has an impact on the battery costs and therefore, the development of the electric vehicle stock (“feedback loop”).

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

1 Introduction

1.1 Motivation

The transport sector has not yet contributed to greenhouse gas mitigation targets but increased its emissions in most countries. As user behavior stayed rather constant during the last decades and a further increase in motorized transport is being observed—mainly in developing countries—technological solutions come into the focus for enabling the transition toward transport sector decarbonization. Hence, electric vehicles (EV) (including battery EV (BEV) and plug-in hybrid EV (PHEV)) in combination with the already ongoing energy transition seem to be a possibility to reverse the increasing trend of producing greenhouse gas emissions even if the number of the global passenger car fleet might double until 2050 (Creutzig et al. 2015).

In the vein of this book chapter this increase in EV registrations has two effects. Due to the increase in battery demand, learning effects (cf. Chapter 3) will lead to decreasing battery prices. This effect reduces the price of stationary storages for the electricity system and the prices for new EV, which in turn accelerates their market penetration and increases the flexibility of electricity consumption. The consideration of global battery demand is necessary for modeling this effect adequately as batteries are produced and traded internationally.

1.2 Related Research and Research Question

Until now, mobile information and communications technology devices such as smart phones and laptops have dominated global battery demand. If the EV market gains momentum, the battery market will experience a tremendous acceleration. Hence, the development of global EV registrations over time is decisive and should be carefully analyzed.

In literature there is already a plenitude of studies which deal with this future market and show the related high uncertainties (Gnann et al. 2018). Also the variety in the underlying methods is manifold (Jochem et al. 2017). Many studies have a shorter time horizon than 2050 (IEA 2018; Tsiropoulos et al. 2018). Most studies focus on one dedicated market (e.g., on Japan in González Palencia et al. 2017 or on China in Liu and Lin 2017) and do therefore neglect the global feedback effect (i.e., each local market of EV is dependent on the price development of batteries, which are mainly resulting from the global EV production). Hence, global scenario analysis is a suitable approach to analyze these uncertainties of future markets. For Europe suitable studies already exist (cf. Chapter 7 or Pasaoglu et al. 2016). However, considering additionally the non-Europe countries and therefore a model coupling in particular is still underrepresented in the literature. Consequently, the research question of this section is on how the EV market develops over time in the main non-European car markets within our given scenario framework. These four countries (US, Japan, India, and China) were chosen as they have over 60% of global car sales in 2016 (OICA 2018) and are expected to have over 30 million EV in the next years as they are members of the EV Initiative and thereby showing public commitments toward the EV deployment (EVI 2016).

The structure of the chapter is the following. Section 5.2 presents a discussion on the development of EV, including the implementation of the experience curve in existing transportation models to foster global learning as well as the defined scenario framework. Section 5.3 outlines the results and discusses limitations and Sect. 5.4 concludes and sums up the chapter insights.

2 Considering Experience Curves in Market Diffusion Modeling and Scenario Definition

2.1 The TE3 Model and Implementation of Experience Curves

The TE3 (Transport, Energy, Economics, Environment) model supports policy-making analysis in the context of oil demand reduction and GHG mitigation from car travel (Gómez Vilchez 2019).Footnote 1 This tool explores market developments of future car powertrain technologies and offers an international perspective by covering six main car markets. The time horizon is limited to the period from 2000 to 2050 and the underlying methodology is mixed, as the model contains elements of econometrics and system dynamics (SD).

The endogenously implementation of experience curves of batteries for EV in the TE3 model is based on SD core concepts, considering feedback loops as well as distinguishing between flow and stock variables (see e.g. Sterman 2000). For the implementation of the experience curve in the TE3 model the following Eq. (5.1) is used.

The parametrization of this Eq. (5.1) is derived from Chapter 4. The battery costs C(X) result from the product of the battery costs in the first year C0 and the overall production of batteries X as well as the learning rate l (15.2%) and is measured in USD/kWh. The cumulated battery capacities include BEV and PHEV batteries with their assumed battery capacities of 30 kWh and 10 kWh per car, respectively. While the historical costs are taken from literature, the overall production of batteries relies on the EV stock of the previous modeling period. This includes results of TE3 for the non-European (i.e. China, India, Japan, and US) as well as of ASTRA for the European markets. In an iterative process, the coupled models add the battery capacities of the EV in countries considered by the other model to their cumulative production; i.e., the TE3 model provides the cumulative battery capacities of the considered non-European markets and ASTRA of the European markets. This may lead—according to the learning curve approach (cf. Eq. 5.1)—to adjusted battery costs, which in turn may influence the EV market penetration of new model runs of the two models. This iterative process represents the so-called “feedback loop” (cf. Chapter 3). In this way, the development of the European market as well as of the four key non-European ones is jointly considered. Through the implementation of the respective experience curves and the described linkage between the two transport models, the global development of the battery costs is modeled endogenously.

2.2 Framework of the Two Analyzed Scenarios for the Main Non-European Car Markets

Many EV specific policies have been launched over the last years. Recently, some countries even announced sales bans for internal combustion engine vehicles (ICEV) (e.g. IEA 2017a; Plötz et al. 2019). As part of the REFLEX modeling framework, one Mod-RES and one High-RES scenario is introduced. In the High-RES scenario it is further distinguished between a centralized and decentralized world (cf. Chapter 2). For the four non-European countries the distinction between a centralized and decentralized world is not considered.

The implementation of the two developed scenarios (Mod-RES and High-RES) to the BEV case is outlined in the following, including assumptions with respect to the applied EV policy and the general development of the respective countries with respect to population and resulting overall passenger car stock. The Mod-RES scenario relates in principle to current policies and the High-RES scenario until 2030 as well. The latter includes a higher investment in infrastructure and lower emission standards and has therefore, a stronger EV increase. Both scenario represent possible outcomes, knowing that until 2050 there is a high uncertainty.

2.2.1 Mod-RES Scenario

The current policy instruments aiming at sustaining EV diffusion in the US, Japan, China, and India resemble each other in main points.

Table 5.1 gives an overview over most of the support programs for EV. Each of these countries gives a tax break or another financial incentive on the purchase price of EV. Japan exempts quite many taxes for owners of an EV (e.g., acquisition tax and tonnage tax). All countries subsidize the charging infrastructure by providing attractive loans or by directly co-financing charging stations. Non-financial incentives are quite common in China and the US: EV users have a clear advantage over others while driving exclusively on specific lanes such as bus lanes or have access to dedicated inner-city areas. In the US, incentives may vary from state to state. California is the state where EV owners receive significant advantages due to the Clean Vehicle Rebate Project and the State’s government has a challenging goal to reach five million EV in 2030 (Clean Vehicle Rebate Project 2019). With the “Energy Independence and Security Act of 2007” the US support the expanding, establishing or equipping manufacturing facilities in the US with direct loans to increase the production of clean renewable fuels (US Congress 2007). The US supported automobile manufacturers with already eight billion USD (Tesla, Ford, and Nissan) out of this loan program whereas 17.7 billion USD are still remaining (US Department of Energy 2019a). China makes clear requirements for all car manufacturers which sell cars in China. This includes fines if they do not produce a certain number of EV (Environmental and Energy Study Institute 2018). Furthermore, they focus on dedicated EV shares in overall sales. In India, the government tries to reduce dependency on oil imports and promote the adoption of alternative fuels through introducing the FAME (Faster Adoption and Manufacturing of Hybrid and EV) initiative. The assumption of a strong EV increase in India until 2030 is not included as the planned values are not fixed values by now. ICEV selling bans are not considered in any of the four key non-European countries in our modeling because it is not clear whether the policy will remain until that period.

The Mod-RES scenario is in principle related to these rather short-term policies like subsidizing charging infrastructure. As it is hard to tell how to extrapolate the policies until 2050 the assumptions were more restrained, e.g., no further purchase subsidies were assumed. In general this scenario shows one possible future development pathway for the different car technologies.

When it comes to the population development of the four considered countries the medium variant scenario of the United Nations is taken until the year 2050 (cf. United Nations, Department of Economic and Social Affairs, Population Division 2017). Accordingly, China’s population increases until 2030 and decreases afterwards. Japan has an overall decreasing trend. India and the US are assumed to steadily increase their population numbers (cf. United Nations, Department of Economic and Social Affairs, Population Division 2017).

To assess the total car stock, car ownership ratios are assumed. China is the country with the strongest increase for this ratio, having in 2018 about 11% of car ownership (i.e., 110 passenger cars per 1,000 inhabitants). It is assumed to be at around 31% (i.e., 310 passenger cars per 1,000 inhabitants) in 2050. While also for India and Japan a positive trend of this ratio is expected, the US car ownership ratio is assumed to be stable. Back in 2015, China had still a car stock of 136 million passenger cars and India about 22.5 million passenger cars (OICA 2018). Hence, both car stocks will increase significantly over the next period.

2.2.2 High-RES Scenario

While population and car stock have the same values as in the Mod-RES scenario, an even stronger increase in the charging infrastructure is assumed for the High-RES scenario as one policy measure. Different studies present various development plans for EV charging infrastructure in a range of eight million of up to 33 million units in 2030 for the whole world (cf. IEA 2017b). In comparison, one further assumption is that in the High-RES scenario ten million EV supply equipment (EVSE), i.e., charging stations, are installed by 2030, leading to about 33 million for 2050 for the four considered countries. According to the German National Platform Future of Mobility this is still a rather unsatisfactory low number because one EVSE outlet for 15 EV (i.e., 10 million EVSE per 150 million EV in 2030) might not provide a seamless operation of EV. Additionally, the average emission standards for new cars amount to 40 g CO2/km in 2050, whereas the values of the Mod-RES scenario are assumed to be 50 g CO2/km in 2050.

3 Results of Key Non-European Countries

3.1 Effects on Cumulative Battery Capacity and Battery Costs

Figure 5.1 presents the development of the cumulated battery capacity (solid lines) and the derived battery costs (dotted lines) for the four key non-European countries and Europe (provided through the ASTRA model, cf. Chapters 6 and 7) in the time span from 2015 to 2050 for the Mod-RES and High-RES scenarios. While initially both scenarios develop very similarly, there is a significant increase of the cumulated battery capacity after the year 2030 in the case of the High-RES scenario.

The development of the battery costs well reflects the learning curve behavior with a significant decrease by about 50% in 2030 and up to 70% in 2050 compared to the year 2020. It can be seen that in both scenarios the shape of the curve is similar and the battery costs differ in 2050 by only 4 USD/kWh. The battery costs of 68 USD/kWh in 2050 represent 18% of the costs in 2015; this is due to the development of cumulated battery capacities, which is driven by EV volumes.

The development of battery costs is analyzed in several studies. The spread of the costs varies from 40 EUR/kWh to 250 EUR/kWh by 2040. Most of the studies depict battery costs between 50 and 100 EUR/kWh in the long-term, in particular if they were conducted after 2015 (cf. Tsiropoulos et al. 2018). Hence, the values of the two considered scenarios in this book chapter (64 USD/kWh and 68 USD/kWh in 2050) are within this range.

Different studies for the development of the EV fleets show prospects ranging from 5 TWh up to 36 TWh for the global cumulated battery capacity in 2040 (Tsiropoulos et al. 2018). In the two scenarios, the cumulative battery capacities including all the sales up to then sum up to 14.6 TWh and 16.5 TWh in 2040, respectively. In the year 2050 values of about 26.7 TWh and 34.3 TWh are reached. It should be kept in mind that the first cumulated GWh was reached in the year 2011 and the first cumulated TWh in 2015.

3.2 Development of the Car Stock for the Four Main Markets in the Mod-RES and High-RES Scenario

The resulting EV car stocks of the European and the four key non-European car markets increase in both scenarios from less than ten million EV to about 450 million EV (cf. Figure 5.2). The results of the Mod-RES scenario show around 80 million PHEV and 367 million BEV in 2050. If we combine the values with Europe, the numbers add up to 536 million EV. The most dynamic countries are China (211 million BEV) and India (109 million BEV). This dynamic is mainly driven by the significant incentives for investing in BEV rather than in PHEV. Consequently, the overall PHEV share is rather low. The highest national shares for PHEV are seen in Japan (17%) and the US (13%) of the overall car stock in 2050. The car sales ratio per year is in each country by at least 35%, except for the US (27%) in 2030. In 2050, each of the countries has sales values reaching from 40% (US) to 63% (China).

In the High-RES scenario the share of the PHEV drops even further to 55 million PHEV and the share of BEV increases to a value of 481 million BEV in 2050. Together with Europe, there are around 710 million EV by 2050. None of the four countries has a two-digit percentage for the PHEV penetration by 2050. The highest share of BEV in 2050 will be in China with around 56% and the lowest one will be in the US with about 32%.

As mentioned above the main difference between the two scenarios is the higher investment in infrastructure in High-RES. Therewith the public charging infrastructure has a density of at least one EVSE outlet for 15 BEV. Apart from that, in particular the strong decrease of the battery costs to less than 100 USD/kWh by 2030 (cf. Figure 5.1) has a major impact on the increased overall penetration of the EV stock.

The EV share of the total car stock until 2050 is shown in Fig. 5.3. Car ownership ratio increases in China, Japan and India while it is quite stable in the US. The growth of the total car stock in the US is a result of the increasing number of inhabitants, which has a change from 320 million people in 2015 to 390 million inhabitants in 2050 forecasted (cf. United Nations, Department of Economic and Social Affairs, Population Division 2017). In contrast, the drivers in China and India are high shares of EV by 2050 (56 and 54%, respectively), particularly in the Mod-RES scenario.

For the High-RES scenario each of the EV shares increases, in particular the one for Japan. The modest development of BEV in the US has mainly two reasons: First, the higher purchase prices of EV compared to other countries (cf. the New Policies Scenario by the World Energy Outlook 2017). Purchase prices of EV will not undercut the one from ICEV in the US before 2025 (cf. IEA 2017a). The lower operating costs do still attract some, but not all customers. Second, not all member states in the US have announced strong EV plans. Therefore, the resulting market share of about 1/3 in 2050 of the total stock seems to be in line with other scenarios in literature.

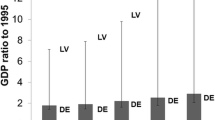

The Mod-RES and High-RES scenarios are within the range of several other studies focusing on the development of EV until 2030 and 2040 (cf. Figure 5.4).

Nevertheless, a “rest of the world” factor would need to be included when comparing the REFLEX scenarios to global studies such as the one of the IEA which includes other countries like Russia, Canada, Thailand, or even continents like South America or Africa that will play a role by 2050 and have a total car stock of over half a billion cars.

3.3 Critical Review and Limitations

Finally, some limitations should be addressed. First, the considered time period until 2050 is very long for such new technologies resulting in a lot of uncertainties. For instance, policy instruments can have a significant impact on market development in particular purchase subsidies, taxes or car bans. In this work sales bans for ICEV were not considered, however, this might have a major effect on the market diffusion of EV or other alternative powertrain technologies. The user behavior, including a change in the customer preference might be another factor, which needs to be reflected. Apart from that, factors influencing the car price, like fuel costs or resources for EV, can have an impact on the car stock as well.

Moreover, both assumed scenario developments for the non-European countries are close to each other and a stronger investment in the charging infrastructure could increase the ramp up of EV even further. Moreover, the effect of the European countries on the global learning and hence the battery costs is in comparison much smaller than the effect of all the non-European countries due to the EV numbers. For the Mod-RES scenario the values are for Europe 85 million EV and for the non-European countries 447 million EV.

A consideration of a “rest of the world” factor would increase the accuracy of the results. Furthermore, the average learning rate (of 15.2%) was chosen for the application. A change in that parameter has a significant impact. If sensitivities of ± 2.9% are considered, the range of the battery costs is between 128 USD/kWh and 40 USD/kWh (lower and higher learning rate, respectively) (cf. Heitel et al. 2020). Moreover, a variation in the experience curve parameters would directly have an impact on the battery cost estimate and hence, on the estimated deployment of the EV stock.

4 Summary and Conclusions

This chapter outlined the development of EV until 2050 in four key non-European car markets (i.e. China, India, Japan, and the US). In both underlying scenarios, a significant increasing trend for the EV car stock can be seen resulting in total numbers of 447 million (Mod-RES) and 536 million (High-RES) EV for the four considered non-European markets in 2050. The PHEV share in the High-RES scenario is lower than in the Mod-RES scenario for all countries and the BEV shares have an increasing trend over time and between scenarios. Not surprisingly, China and India are seen as the main EV markets due to their ambitious policy goals.

The coupling of the two models, ASTRA (for the European market) and TE3 (for the main non-European car markets), in order to consider 34 countries in detail (and therewith more than 90% of current EV sales) allows analyzing the interrelations of global battery costs and the individual market shares endogenously. The battery costs drop from 380 USD/kWh in 2015 to below 100 USD/kWh by 2030 and decrease to values of 68 USD/kWh and 64 USD/kWh in 2050 for the two scenarios, Mod-RES and High-RES, respectively.

For further research, additional countries and policies like sales bans, higher CO2 standards or higher investments for EVSE might be included in the modeling.

Notes

- 1.

A version of TE3 is available at www.te3modelling.eu and further details can be found in Gómez Vilchez (2019).

References

BNEF (2018) Long-term electric vehicle outlook 2018. EVO 2018

Clean Vehicle Rebate Project (2019) Drive clean and save. https://cleanvehiclerebate.org/eng. Accessed on 20 May 2019

Creutzig F, Jochem P, Edelenbosch OY, Mattauch L, van Vuuren DP, McCollum D, Minx J (2015) Transport: a roadblock to climate change mitigation? Science (Policy Forum) 350(6263):911–912. https://doi.org/10.1126/science.aac8033

Environmental and Energy Study Institute (2018) Comparing U.S. and Chinese electric vehicle policies. https://www.eesi.org/articles/view/comparing-u.s.-and-chinese-electric-vehicle-policies. Accessed on 20 May 2019

EVI (2016) Electric Vehicles Initiative (EVI). Clean Energy Ministerial (CEM). International Energy Agency (IEA). http://www.iea.org/topics/transport/subtopics/electricvehiclesinitiative/. Accessed on 10 Oct 2016

Gnann T, Stephens TS, Lin Z, Plötz P, Liu C, Brokated J (2018) What drives the market for plug-in electric vehicles?—a review of international PEV market diffusion models. Renew Sustain Energy Rev 93(June 2017):158–164. https://doi.org/10.1016/j.rser.2018.03.055

Gómez Vilchez JJ (2019) The impact of electric cars on oil demand and greenhouse Gas emissions in key markets. KIT Scientific Publishing, Karlsruhe. https://doi.org/10.5445/ksp/1000091891

González Palencia JC, Otsuka Y, Araki M, Shiga S (2017) Scenario analysis of lightweight and electric-drive vehicle market penetration in the long-term and impact on the light-duty vehicle fleet. Appl Energy 204:1444–1462. https://doi.org/10.1016/j.apenergy.2017.05.054

Heitel S, Seddig K, Gómez Vilchez JJ, Jochem P (2020) Global electric car market deployment considering endogenous battery price development. In: Junginger M and Louwen A (eds) Technological learning in the transition to a low-Carbon energy system: conceptual issues, empirical findings, and use in energy modeling. Academic Press, London, pp 281–305. https://doi.org/10.1016/B978-0-12-818762-3.00015-7

IEA (2017a) World energy outlook 2017. OECD (World Energy Outlook). https://doi.org/10.1787/weo-2017-en

IEA (2017b) Global EV outlook 2017: two million and counting, IEA Publications, pp 1–71. https://doi.org/10.1787/9789264278882-en

IEA (2018) Global EV outlook 2018: towards cross-modal electrification. https://webstore.iea.org/download/direct/1045?filename=globalevoutlook2018.pdf

Jochem P, Gómez Vilchez JJ, Ensslen A, Schäuble J, Fichtner W (2017) Methods for forecasting the market penetration of electric drivetrains in the passenger car market. Transp Rev 1647(May):1–27. https://doi.org/10.1080/01441647.2017.1326538

Liu C, Lin Z (2017) How uncertain is the future of electric vehicle market: Results from Monte Carlo simulations using a nested logit model. Int J Sustain Transp 11(4):237–247. https://doi.org/10.1080/15568318.2016.1248583

National Automotive Board (2019) FAME-India: national mission on electric mobility. https://fame-india.gov.in/newsdetail.aspx?newsid=22. Accessed on 20 May 2019

OICA (2018) Passenger cars vehicles in use 2005–2015. http://www.oica.net/category/vehicles-in-use/. Accessed on 20 May 2019

Pasaoglu G, Harrison G, Jones L, Hill A, Beaudet A, Thiel C (2016) A system dynamics based market agent model simulating future powertrain technology transition: scenarios in the EU light duty vehicle road transport sector. Technol Forecast Soc Chang 104:133–146. https://doi.org/10.1016/j.techfore.2015.11.028

Plötz P, Axsen J, Funke SA, Gnann T (2019) Designing car bans for sustainable transportation. Nat Sustain 2(7):534–536. https://doi.org/10.1038/s41893-019-0328-9

Sterman JD (2000) Systems thinking and modeling for a complex world. Management. https://doi.org/10.1108/13673270210417646

Tsiropoulos I, Tarvydas D, Lebedeva N (2018) Li-ion batteries for mobility and stationary storage applications Scenarios for costs and market growth. https://doi.org/10.2760/87175

United Nations, Department of Economic and Social Affairs, Population Division (2017) World population prospects: the 2017 revision, United Nations world Population prospects. https://population.un.org/wpp/Download/Standard/Population/. Accessed on 15 May 2019

US Congress (2007) Energy independence and security act of 2007. USA. https://www.energy.gov/sites/prod/files/2014/03/f11/hr6.pdf

US Department of Energy (2019a) Advanced technology vehicles manufacturing (Atvm) loan program. https://www.energy.gov/lpo/atvm. Accessed on 20 May 2019

US Department of Energy (2019b) Alternative fuels data center: electricity laws and incentives in federal. https://afdc.energy.gov/fuels/laws/ELEC?state=US. Accessed on 20 May 2019

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2021 The Author(s)

About this chapter

Cite this chapter

Seddig, K., Jochem, P., Fichtner, W. (2021). Electric Vehicle Market Diffusion in Main Non–European Markets. In: Möst, D., Schreiber, S., Herbst, A., Jakob, M., Martino, A., Poganietz, WR. (eds) The Future European Energy System. Springer, Cham. https://doi.org/10.1007/978-3-030-60914-6_5

Download citation

DOI: https://doi.org/10.1007/978-3-030-60914-6_5

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-60913-9

Online ISBN: 978-3-030-60914-6

eBook Packages: Economics and FinanceEconomics and Finance (R0)