Abstract

The Arizona Telemedicine Program and its Health Resources and Services Administration (HRSA)-funded telehealth resource center established a Telemedicine/Telehealth Service Provider Directory (SPD) in 2015. This was established in tandem with a national Service Provider Showcase, a direct-to-hospital (DTH) telemedicine service vendor national meeting which helped launch the SPD. The Service Provider Directory (SPD) was designed to provide healthcare system telemedicine service users critical and convenient information about DTH vendors at a single, reliable, web site. The primary aim of this chapter is to analyze the SPD’s database to help characterize the telemedicine/telehealth DTH service industry. As of 2018, 129 DTH companies were listed in the directory (currently 168 companies). Eighty-four percent of companies listed in the SPD as of 2018 indicated they were medical specialty telemedicine service vendors to healthcare systems; 57% were medical specialty telehealth service vendors to non-healthcare systems, such as prisons; and 25% of companies classified themselves as patient education/engagement service providers. The most common telemedicine services, telepsychiatry and tele-mental health, were offered by 44% and 41% of companies, respectively. Remote patient monitoring and mobile health (mHealth) were available from 30% of companies. Targets for marketing of DTH services were rural hospitals (85%), urban/suburban hospitals (75%), and private physician practices, for 65%. Collectively, the 129 DTH telehealth service companies were marketing 70 teleservices and 8 ancillary services in all 50 states. Only 41% of companies said they use an EHR that is ONC certified.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

Keywords

- Direct-to-consumer (DTC) telehealth

- Direct-to-hospital (DTH) telehealth

- Distance education

- Interstate medical license compact (IMLC)

- mHealth

- Patient monitoring

- Service Provider Directory (SPD)

- Service Provider Summit (SPS)

- Telehealth

- Telemedicine

- Rural telemedicine

- Urban telemedicine

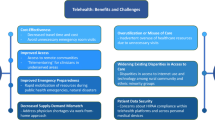

Introduction

The Arizona Telemedicine Program (ATP) was established in 1996, to improve the access to healthcare resources throughout rural Arizona. To do this the ATP designed and implemented:

-

1.

A giant 160 site, 70 community telecommunication network, using asynchronous transfer mode methods on T1 carriers, an application service provider business model adapted from the software industry where it was commonly used in the 1980s.

-

2.

The Arizona Telemedicine Council, to provide a consistent and direct line of communications between the ATP and the Arizona State Legislature.

-

3.

An international award-winning state-of-the-art “e-classroom of the future” at its T-Health Institute in downtown Phoenix, AZ, in which to provide training for the healthcare industry on uses of telemedicine and telehealth in medical and nursing practice [1,2,3,4].

Since the successful rollout of its original broadband telecommunications network, the ATP has expanded its program goals in order to maintain and expand its telecommunication network, support telemedicine research and education, and serve as the headquarters of the Southwest Telehealth Resource Center (SWTRC), a HRSA (Health Resources and Services Administration)-funded telemedicine resource center for its region [5,6,7,8,9,10,11,12,13,14].

In 2014, the Arizona Telemedicine Program created two new, complimentary programs, intended to promote the direct-to-hospital (DTH) telemedicine services industry and provide it with an academic home: (1) an annual national “Service Provider Showcase” (SPS) meeting and (2) the Telemedicine/Telehealth Service Provider Directory (SPD) [15]. The SPS and SPD were run in tandem for 4 years. The SPS was discontinued after 4 years, as planned, and the SPD would continue indefinitely. These two entities were envisioned as having reciprocal relationships and would link the evolving DTH telemedicine service industry with academic medicine and telemedicine research. Each would showcase aspects of the DTH industry and, hopefully, catalyze its growth. This was an ambitious undertaking since the plan was to create both programs, SPS and SPD, without increasing the size of the ATP staff, which consisted of 16 FTE employees at that time.

The SPS was a medical meeting for both the healthcare industry which focused on all aspects of the delivery of specialty care services into hospitals and clinics by outside telemedicine service vendors. The ATP was experienced in creating and managing professional meetings including the prior successful series of four correction telemedicine meetings, held in Arizona a decade before. The new series of SPS meetings and the SPD would be jointly marketed. Marketing of the SPS meetings to exhibitors was coupled with recruiting of telemedicine service provider companies to list their companies in the SPD which was for free. Furthermore, facets of the emerging DTH industry were topics for consideration at plenary lectures, panel discussions, and poster presentations. At the time SPS was created, no other professional conferences in the United States were dedicated exclusively to the DTH industry.

At the same time, rural Arizona hospitals were becoming increasingly interested in partnering with third party specialty telemedicine services from commercial telemedicine service vendors. Awareness of that option was being driven by the dramatic demonstration of successes of the tele-stroke option, a service requiring the diagnosis and treatment of ischemic stroke patients within a “golden hour” in order to prevent progression of the stroke process. That could be accomplished at rural hospitals using tele-stroke service vendors to provide a tele-neurologist to carry out a remote physical examination and a distant tele-neurovascular radiologists to render the CT diagnosis at a distance. Table 17.1 reflects the growth of the SPS industry over the timeframe that SPS meetings were held (2014–2018) (Table 17.1; Figs. 17.1 and 17.2).

Co-chairs of SPS, Dr. Dale Alverson (left) and Dr. Elizabeth Krupinski (middle), interviewing vendor Alan Pitt, chief medical officer of Avizia (right, video screen) during “lighting rounds” at the SPS meeting. They are in the expo hall, broadcasting their string of focused “what’s new?” interviews back to the lecture hall during the SPS’s “lighting rounds.” These proved to be popular, and informative, events and an efficient way to introduce SPS conference attendees in the lecture hall to the 40 exhibitors at SPS 2017. SPS, Telemedicine and Telehealth Service Provider Showcase. (Image reprinted from [16])

2018 Telemedicine and Telehealth Service Provider Summit. Upper left: vendor in the exhibit hall demonstrating a new telemedicine cart. Upper right: former director of the Arizona Department of Health Services posing a question to a panel in the lecture hall. Lower left: panel members Alexis Gilroy, JD, H. Neal Reynolds, MD, and Nathaniel Lackman, JD, discussing a question from the audience. Lower right: poster presentation during a break in the program

As the popularity of the Telemedicine and Telehealth SPS grew, so did the growth of the online Service Provider Directory. Currently 168 companies are listed in the directory and we receive requests to be listed on a weekly basis.

“Advancing Telehealth Partnerships” was the tagline for SPS. Our initial goal was to assist healthcare organization to partner with a vendor service provider. Networking was a key to the partnership; our conference agenda was designed around learning about this new industry. SPS certainly elevated this new industry. Not only did we see cultivation of networking between one healthcare organization and one service provider, but we saw healthcare organizations networking and partnering with multiple service providers. We even saw service providers networking with other service providers to help expand their reach.

The SPD was designed to provide healthcare system telemedicine service users critical information about DTH organizations at a single, reliable, web site.

In 2015, the SPD, a joint venture of the ATP and SWTRC, came online.

The SPD was established with the expressed purpose of providing rural and urban hospitals a resource for identifying and connecting with clinical commercial telemedicine service companies to which they could outsource specialty medicine consultations (Figs. 17.2 and 17.3). By 2018, it was estimated that the SPD represented a significant number of the commercial telemedicine/telehealth companies delivering specialty medical services to healthcare organizations. Some of these companies gradually offered direct-to-consumer (DTC) telemedicine service products but that segment of the telehealth industry was outside of the areas of interest of either the ATP or the SWTRC at the time (Figs. 17.2 and 17.3). Table 17.1 reflects the growth of the DTH telehealth industry over a 4-year period, from 2014 to 2018. Since then, there has been a dramatic increase in the market share of the DTC slice of the telemedicine and telehealth service industry.

Screenshot of the Service Provider Directory home page. Logos: upper left, Service Provider Directory; upper right, Logo for the Service Provider Summit; upper middle, Arizona Telemedicine Program (ATP) and Southwest Telehealth Resource Center (TRC). Bottom: “Search the Directory” with four columns (left to right): “Service In (location),” “Tele-services,” “Customers,” and “Ancillary Services” [13]

Introduction to the Service Provider Directory (SPD)

The SPD was designed to assist users in locating specific specialty medicine services and ancillary healthcare services [17]. In practice, a user could filter and sort through the SPD of companies using lists grossly describing 4 of the 87 variables gathered to characterize each company. The four variables are the state to which the service will be delivered, the specific teleservice being sought, customer base, and ancillary services. After selecting one or more of these variables, a list of companies is generated, all sharing the characteristics the SPD user had selected. From this list, the user can further investigate each company by opening their SPD profile, which shows all 87 variables that make up the directory. An instructional training video on how to use the SPD can be accessed from the SPD home page (Fig. 17.4).

Upper left, “Introduction-Service Provider Directory” video; upper right, word cloud representing the frequency of service offerings across 129 telemedicine service provider companies; lower left, criteria selection in four categories, “Services In” (location of the insourcing hospital or clinic), “Tele-services,” “Customers,” and “Ancillary.” In this example, the user has selected “Arizona,” “Telepsychiatry,” “Rural hospitals,” and “Patient education” as topics of interest. At the time of writing of the chapter (May 28, 2020), this search yields a set of 12 out of 163 companies for further assessment by the SPD user. Each company’s web site can be immediately accessed by clicking on the company’s listing in the SPD. Lower right: closing screen of the video “Overview: Service Provider Directory” video [15, 16, 18].

The primary aim of this chapter is to analyze the SPD’s database to characterize the telemedicine/telemedicine direct-to-hospital service industry (Fig. 17.3). A limitation of the study is that accrual of data included in this survey ended on June 4, 2018, approximately 2 years ago. On the other hand, the study does provide a snapshot of the telemedicine/telehealth service industry as it existed before the recent COVID-19-related DTC telehealth surge in telemedicine, and telehealth clinical activity began to dominate the telemedicine service industry.

Methodology

Criteria for Inclusion of Companies in the Service Provider Directory

Since the primary reason for creating the SPD was to foster connections between telemedicine/telehealth clinical service providers and healthcare organizations in need of specific specialty services, telemedicine service companies are only listed if they meet four criteria. First, they must provide medical or clinical specialty services and/or ancillary services that “touch” the patient. Second, they serve, or be willing to serve, intermediary organizations such as hospitals. Third, they currently provide services in at least one US state. Fourth, they employ or contract with other service providers. Companies may also provide DTC telemedicine and telehealth services, in addition to organizations such as hospitals.

Solicitation of Companies

In late 2014, the ATP/SWTRC began identifying telemedicine/telehealth service provider companies, via email, phone, and in person, to start the directory. Once found, service providers were then solicited to be listed within the directory. Interested companies then used a 32-item SurveyMonkey form, to describe themselves and the services they provide. Until 2018, these efforts actively continued as part of daily business and networking of ATP/SWTRC after attending multiple telemedicine/telehealth conferences.

To maintain the directory, the ATP/SWTRC maintains contact with listed companies. Through this effort, companies can update their directory listing upon request. At least once per year, companies are solicited for updated information. This analysis was of the 129 telemedicine service companies listed in 2018. At the time of the writing of this chapter, in May 2020, there are currently 168 listed companies.

Directory Analysis

This analysis was conducted using 18 selected variables of the 2018 SPD’s underlying database: company name, company type, payment model, targeted customers, teleservices, ancillary services, method of connection, EHR compliance, HIPAA compliance, headquarter address information (5 variables), states serving, provider’s location (states), licenses (states), and planned expansion (states). Variables with complex observations, such as the list of teleservices offered per company, were disaggregated and collectively listed in two columns. For example, the variable “teleservices” listed company names in the first column and their respective services as individual observations in the second column. Variables with simple observations were formatted using the same two-column method. All lists were analyzed using Microsoft Excel’s Pivot Table function and relevant statistical equations.

Geospatial Analysis

Latitude and longitude for headquarters for individual companies were found after aggregating each company’s address information into one variable and running said variable through Geocode, a Google Sheets add-on. Latitude and longitude information were then exported to QGIS, where they were plotted on top of a US state map layer, obtained from www.gadm.org [17]. Major US cities from Esri’s data and maps were then added [19] and used as visual reference points.

For variable geospatial association, companies were joined to the states in which they provided services to, using Microsoft Access’s Simple Query function. The resulting query was made up of three columns: (1) company name, (2) state, and (3) variable. Each observation of these lists was then used as a metric, which we define as a service provision unit (SPU). SPUs can be conceptualized by imagining the following example: if company A offers two services to three states, in total the query would yield a list with six observations or SPUs. The purpose of using SPUs is to count the number of companies offering a service in a specific state. Once determined, SPUs for states’ tele- and ancillary services were then associated with a graduated color scheme and then coupled with their respective geometry on the US state map layer [19].

Telemedicine/Telehealth Market Analysis

Gross Description of Companies

Using a multiple choice-multiple answer question in the SPD company listing form, companies were asked to describe themselves. Eighty-four percent of companies indicated they were medical specialty service providers to healthcare providers; and 57% were medical specialty service providers to non-healthcare systems, such as prisons. Nearly 25% of companies classified themselves as patient education/engagement service providers.

Focusing on the business characteristics of companies, 55% of companies reported using a fee for service payment model, while just over 10% reported using a subscription business model, and 1.5% reported using both.

These data indicated that most of the telemedicine/telehealth companies listed in the SPD supplement specialized services within larger healthcare systems.

Targeted Customers

The two most reported targets for marketing of telemedicine and telehealth services were rural hospitals and urban/suburban hospitals, accounting for more than 85% and 75% of companies listed within the SPD, respectively. The third most stated target market was private physician practices, at 65%. In addition, DTC telemedicine services were reported to be provided by 55% of SPD companies, a surprisingly high percentage in June 2018. This indicated that the DTC industry was already well developed by June 2018.

Considering the gross description of companies (above), this makes sense and supports the idea that most telemedicine/telehealth companies support the provision of specialty services both within larger organizations as well as DTC telehealth.

Teleservices

Of the 70 services surveyed in the directory listing form, the lowest number of services offered by a company was 1, while the maximum was 69. On average, companies were found to provide 9 to 10 telemedicine and /or telehealth services. The most popular services, psychiatry and mental health, were provided by 44% and 41% of companies, respectively. Remote patient monitoring and mobile health (mHealth) were reported to be offered by 30% of companies. Services associated with chronic diseases, such as diabetes, neurology, and cardiology, were reported being offered by 25–27% of companies. Specialties under the general practice umbrella, including pediatrics, primary care, urgent care, integrated care, and internal medicine were reported being provided by 18–26% of companies.

Collectively, these data indicate the presence of a strong association between telemedicine/telehealth and mental health, primary care, and subspecialties of primary care related to chronic diseases.

Ancillary Services

Ancillary services are defined as services that support the provision of telemedicine and telehealth. Using the SPD data entry form, eight ancillary services were surveyed. In total, 58% of SPD companies reported providing ancillary services. The top three ancillary services were patient education, offered by more than 41% of companies; patient engagement, provided by more than 37% of companies; and distance education, offered by more than 25% of companies.

Language Services

Of the 129 companies listed in the SPD in June 2018, 4 companies reported they focused exclusively on language interpretation, which is classified as an ancillary service in SPD. Some language interpretation services were offered by a total of 15% of companies.

Telemedicine Systems Used to Connect to Customers

In aggregate, companies reported using 57 specific telemedicine systems to connect with customers. An average company used only one or two platforms. Of these systems, nearly 19% of companies reported their systems were proprietary, while 17% reported their systems were platform agnostic. Vidyo, Cisco, and Polycom were the top three third-party specific telemedicine systems, used by 16%, 13%, and 10% of the telemedicine service companies, respectively.

It is noteworthy that 72% of companies reported their telemedicine services can be incorporated into an electronic health record, of which 41% were certified by the Office of the National Coordinator (ONC). Nearly all telemedicine service companies (93%) listed in SPD claimed that their patient information system complies with Health Insurance Portability and Accountability Act (HIPAA) and Health Information Technology for Economic and Clinical Health (HITECH) Act.

Comprehensive List of Teleservices and Ancillary Services

Although thousands of telemedicine and telehealth academic articles have been published, none describe a comprehensive list of services. It is for this reason that we utilized the SPD database to derive such a list.

In the SPD listing form, companies are surveyed about which services they offer, using a multiple choice-multiple answer list of 70 teleservices and 8 ancillary services. Open text space was also provided for telemedicine and telehealth service companies to report additional telemedicine and telehealth services they currently provide.

Upon analyzing company details, it was found that all the healthcare services ATP and SWTRC included in the multiple choice-multiple answer question were offered by at least one company. Furthermore, upon review of the “other teleservices” companies stated they offer, no services were found that were not included in the SPD listing.

Tables 17.2 and 17.3 detail the comprehensive lists of teleservices and ancillary services, listed in SPD as of June 2018.

Cross-Referencing Teleservices with the American Board of Medical Specialties

During the analysis of the SPD directory, two questions were posed: first, what specialty would a clinician be classified as if they offered a given service? Second, what specialty boards are associated with the provision of care using tele- and ancillary services?

To better understand the teleservice and ancillary service provision among medical specialties, each service was cross-referenced with the American Board of Medical Specialties [20] or select allied health fields. The number of services were pooled per board and used to create the word cloud seen in Fig. 17.5.

Through this analysis, it was found that providers who belong to general practice specialty boards, internal medicine, gynecology, pediatrics, and family medicine, are the greatest users of telemedicine services.

Geospatial Processing

Headquarter Distribution

After vectorizing companies’ headquarters on a map, a nearest neighbor vector analysis was run. It was found that headquarters were significantly clustered, with a nearest neighbor index of 0.382 and z-score of −13.43. Based on visual inspection, referencing Esri’s city coordinates [17, 19], multiple companies were found to be located around Seattle, San Francisco, Los Angeles, Phoenix, Dallas, Houston, Atlanta, Miami, Jacksonville, DC, and Minneapolis.

This may suggest the location of companies’ headquarters, and their respective service footprint may be determined by population density, indicative of case volume, and/or telemedicine policies.

Teleservices and Ancillary Services

The primary finding of geospatial analysis was that nearly all 70 teleservices and 8 ancillary services were found to be available in all 50 states, provided by at least one company, tele-addiction not being provided by any service provider in Utah, Vermont, or Washington.

Analyzing this further, we used SPUs to determine the presence of tele- and ancillary service pooling. The resulting maps are seen in Figs. 17.6 and 17.7.

Like the clustering of companies’ headquarters, service pooling may be a result of population density, case volume, and/or telemedicine legislative policies. Furthermore, these maps illustrate telemedicine/telehealth service disparities.

States Served, Provider Location, Licenses, and Planned Expansion

Comparing the lists of states which companies provide services to and the lists of states in which providers are located, it was found that 35% of companies offer services in the states where their providers reside. Thirteen percent of companies provide services to less states than where their providers are physically located. And, 53% of companies provide services beyond the states in which their telehealth service providers reside.

Focusing on the list of states in which companies have providers licensed, 43% of companies practice in the same number of states as they are licensed. Thirty-four percent of companies have more state licenses than what they reported practicing in.

By independently comparing the states of planned extension to currently served, service provider locations, and licensed, it was found that 7% of companies plan to expand to states where they hold unused licenses.

Collectively, these data imply an association between medical licensure and the growth of telemedicine/telehealth service provision.

Summary

As an innovative leader in telemedicine, the Arizona Telemedicine Program and Southwest Regional Training Center created the Service Provider Directory (SPD), an online directory used to foster connections between healthcare administrators and commercial telemedicine/telehealth service providers. With its continued curation and sustained expansion, it serves as one of the most comprehensive resources for seeking commercial teleservices. In 2018, the directory was estimated to include approximately 25% of the commercial telemedicine/telehealth service provider companies. It is for this reason we believe that the directory was an accurate representation of the telemedicine/telehealth market, contained enough data to be statistically significant, and used to identify market trends through a standalone analysis. Prior to the aggregation and analysis of these data, basic market trends and statistics were largely only known by service provider companies themselves and the experience of industry leaders.

Findings

According to our analysis of the SPD, an average company was fee for service and indicated targeting 10 customer types on a multiple choice-multiple answer list, the most frequent being medical specialty service provider to healthcare providers and non-healthcare systems. On average, a company offered 9–10 teleservices, with the most frequently provided services being psychiatry, mental health, and remote patient monitoring. Relatedly, an average company also provided 1–2 ancillary services, patient education and patient engagement being the most popular. Companies provided services to an average of 18 states. States with the most service provision units were California, Arizona, and Texas. Service delivery was reported to be done using two connection methods, on average. Nearly all companies reported their services could be integrated into an electronic health record and are HIPAA and HITECH compliant. Only 41% of companies said they use an EHR that is ONC certified.

Tables 17.1 and 17.2 list the 70 teleservices and 8 ancillary services, used to survey companies during the company listing process. These services were used as answers on a multiple choice-multiple answer question, surveying what services each company provides. All found to be provided by at least one company.

When all 70 teleservices were cross-referenced with the specialties and subspecialties of the American Board of Medical Specialties, it was found that more teleservices were related to the boards of pediatrics, internal medicine, and family medicine than any other, as can be seen in Fig. 17.5. This may indicate a significant number of providers that use telemedicine are related to general practice.

The two most significant findings of this chapter are related to the geospatial analysis of the SPD. First is the discovery that nearly all 70 services and all 8 ancillary services were available in all 50 states, the only shortfall being that tele-addiction not being specifically available in Utah, Vermont, or Washington. However, due to addiction medicine being a subspecialty under preventive medicine [6], which is available in all 50 states, we feel confident that the provision of care, under one service or another, is available across the United States.

Second is the creation and application of a methodology that identifies telehealth/telemedicine service disparities. This methodology used service provision units (SPUs), which we defined as a service provided within a specific state by a single company. Using SPUs as a unit of measure, we aggregated all SPUs for every tele- and ancillary service to create Figs. 17.6 and 17.7. The darker green the state, the more teleservices and companies providing those services within the state. Furthermore, these maps can be disaggregated by a selected service to determine the number of companies providing said service per state. In practice, this can be used as a metric within public health or a means for business planning.

Implications of Findings

The implications of the findings described in this chapter can be summarized in three points. First, in 2018, telemedicine/telehealth was transitioning from an independent niche market; second, the directory was an accurate representation of the market; and third, medical licensing was a significant challenge for service providers.

Although the average commercial telemedicine/telehealth company was found to provide 9–10 teleservices and 1–2 ancillary services to 18 states, these statistics do not paint a completely accurate picture of the market. Rather, the market was polarized. For example, only 28% of the companies in the SPD offer ten or more services, while 59% offer five or less, with 25% offering only one. Similarly, 41% of companies do not offer any ancillary services, and 54% of companies provide services to eight or less states. We chose not to exclude companies with larger telemedicine footprints from this analysis, because they accounted for a significant portion of the directory, and we predict companies will continue to grow in this way. Startup companies, capitalizing on niche markets, are getting acquired, partnered, or merged by larger companies. An interesting example of this can be seen when looking back at a 2017 snapshot of the directory, when InTouch, a large company, acquired a smaller company C30 Telemedicine, which provided acute tele-neurology, tele-stroke, distance education, and patient engagement to six states [21]. Since 2018, four of the companies within the SPD have also been involved in acquisitions, InDemand Interpreting being acquired by Stratus, Aligned Telehealth being acquired by American Well, and InSight Telepsychiatry merging with Regroup Telehealth [22,23,24,25]. Considering this collectively we think that the years surrounding 2018 were a transitional period for telemedicine, from independent niche to supply and demand.

As stated on the home page of the SPD, its purpose is to serve as a resource for hospital and healthcare administrators to expand and improve their institution’s healthcare services [15]. With 129 commercial companies listed in 2018, which collectively provide 70 teleservices and 8 ancillary services to all 50 states, we argue it fulfills its objective quite well. The question then arises, “does the SPD only represent the commercial clinical telemedicine/telehealth market, or does it represent the clinical market as a whole?” The main difference between included and excluded clinical provision-based companies is companies that provided services in tandem with larger organizations were listed and companies that operated independently for the sole purpose of DTC telemedicine were not. The most obvious answer to the earlier question is that the clinical commercial market was based on the inclusion-exclusion criteria. However, after reviewing the 21 companies of GoodRx’s Telehealth Marketplace, a directory which connects patients with DTC telehealth service providers, we found their listings are comparable to the larger companies that have historically acquired, partnered, or merged with niche companies [26]. Examples of this include HealthTap acquiring Docphin, MDLive acquiring Breakthrough Behavioral, and Teladoc acquiring both TelaDietitian and MedecinDirect [27,28,29,30]. From these examples and the cross listing of two companies between GoodRx Telehealth and the SPD, which now offer both clinical commercial services (also called “direct-to-hospital” telemedicine and telehealth) and DTC services, despite its exclusion-inclusion criteria, we think the SPD serves as an accurate snapshot of the entire 2018 telemedicine/telehealth “clinical market,” illustrating the transition from clinical commercial (direct-to-hospital) to DTC telemedicine and telehealth as the largest segment of the telemedicine/telehealth industry [31, 32]. Significant growth of DTC telemedicine companies was observed to the extent that it warranted a formal definition within a recent Frequently Asked Question section in a telemedicine/telehealth industry-related congressional report [33, 34].

In a separate 2016 congressional report, it was suggested that one of the greatest policy challenges for the growth of telemedicine/telehealth is medical licensure, the report specifically stating “…state licensure requirements may be inhibiting broader use of telehealth, with as many as 4 out of 5 states requiring out-of-state clinicians providing telehealth services to be medical licensed in the state where the patients reside” [35]. Given that our data indicate 7% of companies planned to expand to states for which their providers already have medical licenses, we agree. Later in the document, the authors state that the Federation of State Medical Boards drafted an interstate licensure compact, which would solve this problem [35]. To date, the Interstate Medical Licensure Compact (IMLC) includes 29 states [36]. As participation in the IMLC expands, we think telemedicine companies’ service footprints will grow, and the telehealth disparities among states, illustrated by a lack of ubiquity in Figs. 17.2 and 17.3, could be mitigated.

Currently, the ATP’s and SWTRC’s SPD is listed at both the Center for Medicare and Medicaid Services (CMS) and the Health and Human Services (HHS) web sites as telehealth and telemedicine resources [37, 38].

Change history

14 June 2021

R.Latifi at al. (eds.), Telemedicine, Telehealth and Telepresence, https://doi.org/10.1007/978-3-030-56917-4

References

McNeill KM, Weinstein RS, Holcomb MJ. Arizona telemedicine program: implementing a statewide health care network. J Am Inform Assoc. 1998;5:441–7.

Krupinski E, Webster P, Dolliver M, Weinstein RS, Lopez AM. Efficiency analysis of a multi-specialty telemedicine service. Telemed J. 1999;5:265–71.

McNeill KM, Barker G, McElroy J. Experience using an ASP model to expand a state-initiated telemedicine program. Comput Ass Radiol Surg. 2001;1230:824–9.

Weinstein RS, Barker G, Beinar S, Holcomb M, Krupinski EA, Lopez AM, Hughes A, McNeely RA. Policy and the origins of the Arizona statewide telemedicine program. In: Whitten P, Cook D, editors. Understanding health communications technologies. San Francisco: Jossey-Bass; 2004. p. 299–309.

Barker GP, Krupinski EA, Schellenberg B, Weinstein RS. Expense comparison of a telemedicine practice versus a traditional clinical practice. Telemed J e-Health. 2004;10:376–80.

Barker GP, Krupinski EA, McNeely RA, Holcomb MJ, Krupinski EA, Lopez AM, Weinstein RS. The Arizona telemedicine program business model. J Telemed Telecare. 2005;11:397–402.

Latifi R, Weinstein RS, Porter JM, Ziemba M, Judkins D, Ridings D, Nassi R, Valenzuela T, Holcomb M, Leyva F. Telemedicine and telepresence for trauma and emergency care management. Scand J Surg. 2007;96:281–9.

Weinstein RS, Lopez AM, Krupinski EA, Beinar SJ, Holcomb M, Barker G. Integrating telemedicine and telehealth: putting it all together. In: Latifi R, editor. Current principles and practices of telemedicine and e-health. Washington, DC: IOS Press; 2008. p. 23–38.

Krupinski EA, Weinstein RS. Telemedicine in an academic center—the Arizona telemedicine program. Telemed e-Health. 2013;19:349–56.

Weinstein RS, Lopez AM, Joseph BA, Erps KA, Holcomb M, Barker GP, Krupinski EA. Telemedicine, telehealth, and mobile health applications that work: opportunities and barriers. Am J Med. 2014;127:183–7.

Weinstein RS, Lopez AM, Barker GP, Krupinski EA, Beinar SJ, Major J, Skinner T, Holcomb MJ, McNeely RA. Arizona telemedicine program interprofessional learning center: facility design and curriculum development. J Interprofessional Care. 2007;21(SI):51–63.

Weinstein RS, McNeely RA, Holcomb MJ, Sotelo MJ, Lopez AM, Erps KA, Martin CJ, Krupinski EA, Graham AR, Barker GP. Technologies in interprofessional education. The interprofessional education distributed “e-Classroom-of-the-future”. J Applied Health. 2010;39(3 pt 2):238–45.

Southwest Telehealth Resource Center. https://southwesttrc.org/. Last accessed 29 May 2020.

“Goals”. The University of Arizona, Arizona Telemedicine Program. 2020. https://telemedicine.arizona.edu/about-us/goals. Last accessed 19 May 2020.

“Service Provider Directory.” The University of Arizona, Arizona Telemedicine Program. 2020. https://telemedicine.arizona.edu/servicedirectory

Alverson DC, Krupinski EA, Erps KA, Rowe NS, Weinstein RS. The Third National Telemedicine & Telehealth Service Provider Showcase Conference: Advancing Telehealth Partnerships. Telemedicine and e-Health. 2019.332-40. https://doi.org/10.1089/tmj.2018.0096.

“Administrative Boundaries (GADM)” https://www.arcgis.com/home/item.html?id=5372763e5f9f4cb29e6a696523cad557. Last accessed 19 May 2020.

“Information: Service Provider Directory” https://swtrc.wistia.com/medias/2n51626yug. Last accessed 29 May 2020.

“ArcMap City” https://desktop.arcgis.com/en/arcmap/10.3/manage-data/editing-fundamentals/exercise-1a-creating-new-points.htm. Last accessed 19 May 2020.

“Specialty and Subspecialty Certificates.” American Board of Medical Specialties. 2020. https://www.abms.org/member-boards/specialty-subspecialty-certificates/

“InTouch Health Acquires C30 Medical Corporation.” InTouchHealth. 2017. https://intouchhealth.com/acquires-c30-medical-corporation/. Last accessed 19 May 2020.

Eddy N. Stratus video buys InDemand interpreting to expand healthcare services. HealthcareITNews. 2019. https://www.healthcareitnews.com/news/stratus-video-buys-indemand-interpreting-expand-healthcare-services. Last accessed 19 May 2020.

Muoio D. American Well acquires Aligned Telehealth to flesh out its behavioral health, telepsychiatry capabilities. mobi health news. 2019.

https://www.mobihealthnews.com/news/north-america/american-well-acquires-aligned-telehealth-flesh-out-its-behavioral-health. Last accessed 19 May 2020.

Muoio D. InSight Telepsychiatry, Regroup Telehealth merge to create US’ largest telepsychiatry provider. mobi health news. 2019. https://www.mobihealthnews.com/news/insight-telepsychiatry-regroup-telehealth-merge-create-us-largest-telepsychiatry-provider. Last accessed 19 May 2020.

“GoodRx/Online Doctors” GoodRx. https://www.goodrx.com/treatment. Last accessed 19 May 2020.

Hall G. Telehealth platform HealthTap buys Docphin to expand online education for doctors. 2016. Silicon Valley Business Journal. https://www.bizjournals.com/sanjose/blog/techflash/2016/07/telehealth-platform-healthtap-buys-docphin-to.html. Last accessed 19 May 2020.

Pai A. MDLive acquires virtual therapy visits provider Breakthrough Behavioral. mobi health news. 2014. https://www.mobihealthnews.com/38116/mdlive-acquires-virtual-therapy-visits-provider-breakthrough-behavioral. Last accessed 19 May 2020.

Muoio D. Scoop: a 2018 acquisition paved the way for Teladoc Health’s new nutrition offering. mobi health news. 2019. https://www.mobihealthnews.com/news/north-america/scoop-2018-acquisition-paved-way-teladoc-healths-new-nutrition-offering. Last accessed 19 May 2020.

Comstock J. Teladoc Health acquires MédecinDirect to secure French foothold. mobi health news. 2019. https://www.mobihealthnews.com/content/teladoc-health-acquires-médecindirect-secure-french-foothold. Last accessed 19 May 2020.

“dr. on demand” Doctor on Demand Professionals. https://www.doctorondemand.com. Last accessed 19 May 2020.

“MDLIVE” MDLIVE Medical Group. https://www.mdlive.com. Last accessed 19 May 2020.

Elliot T, Yopes MC. Direct-to-consumer telemedicine. Curr Allergy Asthma Rep. 2019;19(1) https://doi.org/10.1007/s11882-019-0837-7. Last accessed 19 May 2020.

Elliot VL. Telehealth and telemedicine: frequently asked questions. Congressional Research Service https://fas.org/sgp/crs/misc/R46239.pdf. Last accessed 19 May 2020.

Office of Health Policy, Office of the Assistant Secretary for Planning and Evaluation. August 12, 2016 Report to Congress: E-health and Telemedicine. U.S. Department of Health and Human Services. 2016. https://aspe.hhs.gov/system/files/pdf/206751/TelemedicineE-HealthReport.pdf Last accessed 19 May 2020.

“A Faster Pathway to Physician Licensure.” Interstate Medical Licensure Compact. https://www.imlcc.org/a-faster-pathway-to-physician-licensure/. Last accessed 19 May 2020.

“CMS General Provider Telehealth and Telemedicine Toolkit” https://www.cms.gov/files/document/general-telemedicine-toolkit.pdf

“Telemedicine Service Provider Directory” https://telehealth.hhs.gov/providers/getting-started/

Acknowledgments

SWTRC activity is supported by grants from the Office of Advancement of Telehealth, Federal Office of Rural Health Policy, Health Resources and Services Administration, and Department of Health and Human Services.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2021 The Author(s)

About this chapter

Cite this chapter

Weinstein, R.S. et al. (2021). Survey of the Direct-to-Hospital (DTH) Telemedicine and Telehealth Service Industry (2014–2018). In: Latifi, R., Doarn, C.R., Merrell, R.C. (eds) Telemedicine, Telehealth and Telepresence. Springer, Cham. https://doi.org/10.1007/978-3-030-56917-4_17

Download citation

DOI: https://doi.org/10.1007/978-3-030-56917-4_17

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-56916-7

Online ISBN: 978-3-030-56917-4

eBook Packages: MedicineMedicine (R0)