Abstract

Bidding in different (single object) auctions, or cross-bidding, and bidding incrementally within one auction, or nibbling, are two phenomena observed in platforms like eBay. This paper tests with numerical methods the validity of a theoretical setting that rationalizes such behavior, while bidders are assumed to observe privately and without error, their valuations from the onset and the objects are imperfect substitutes. Our analysis shows that cross-bidding and nibbling might reduce significantly the variability in the bidder’s surplus.

Financial support from the Spanish Ministerio de Economía y Competitividad (Alvarez: ECO2017-86245-P; Sartarelli: ECO2016-77200-P, ECO2015-65820-P and ECO2013-43119) is gratefully acknowledged.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

Notes

- 1.

The analysis and implications of departures from rationality in decision-making has acquired a markedly cross-disciplinary “flavor” over decades. For example, Tesfatsion (2003), reviews the literature on agent-based modeling which received contributions from scientists and social scientists alike; Camerer et al. (2011) reviews the economics literature which has tried to rationalize a number of puzzling predictions thanks to insights from other disciplines in social science; finally Chernev et al. (2015), reviews research on choice overload in psychology.

- 2.

The departure point of multi-object single bid auction settings is classically represented by Milgrom and Weber (1982). They assume that bidders submit bids for no particular object and they are allowed to bid just once. In short, the choice of an auction and the timing of bidding is absent in the bidder’s decision process. A number of branches in the theoretical literature have been developed thereafter.

- 3.

Our paper is also related to studies on multiple auctions in operational research, whose common objective is maximizing the efficiency of algorithms which, on behalf of bidders, bid in multiple auctions, i.e., proxy bidding. Byde et al. (2002), Anthony and Jennings (2002) develop an algorithm which can bid for multiple units of a good is sold in different types of auctions, e.g., English or Dutch, with different start or end times. In related work Ma and Leung (2007) develop an algorithm to bid in multiple continuous double auctions, which are common in commodities markets and have the peculiarity that bidders and auctioneers can continuously update their bid and ask throughout the trading period. Finally, Chang (2014) creates a proxy measure of heterogeneity in cross-bidding behavior by using statistical methods in entropy analysis and finds that it is positively correlated with revenues.

- 4.

\(\mathbf {1}(\mathscr {A}) = 1\) if event \(\mathscr {A}\) occurs, while \(\mathbf {1}(\mathscr {A}) = 0\) otherwise.

- 5.

Notice that Eq. (1) implicitly assumes \(w_{k^{*}} < v_{n,k^{*}}\). Otherwise the bid would be below the current winning price and thus it would be irrelevant.

- 6.

The term a priori refers to the fact that the condition \(v_{n,k} \ge \beta \), which defines whether bidder n wants to participate in auction k or not, can be checked before the bidding time starts.

- 7.

The code, written in Python 3.6.5, will be made available by the corresponding author upon request.

- 8.

Recall than under the benchmark parameter values, in Table 1, it is \(K=5\), so 0.4 means 2 out of 5 possible coincidences.

- 9.

Of course, not only the valuations but the choice of \(\alpha _H \in \left( \frac{3}{10},\frac{1}{2}\right) \) is essential for the result. A lower value of \(\alpha _H\) would expel A’s rivals from auction 1 in A’s first bid as well, but A’s surplus would also be lower. A higher value of \(\alpha _H\) would not expel B in A’s first bid, which would imply also a lower surplus for A.

- 10.

The raw data can be supplied on request from the corresponding author of this paper.

References

Alvarado Guevara, E. (2019). Efecto sniping y nibling sobre el precio de subastas en ebay. mimeo Universidad Complutense de Madrid.

Alvarez, F., & Sartarelli, M. (2020). Nibbling and sniping in eBay auctions. Documentos de Trabajo del ICAE 2020-04, Universidad Complutense de Madrid.

Ambrus, A., Ishii, Y., & Burns, J. (2013). Gradual bidding in eBay-like auctions. Economic Research Initiatives (ERID) Working Paper 129, Duke University.

Anthony, P., & Jennings, N. R. (2002). Evolving bidding strategies for multiple auctions. In European coordinating committee for artificial intelligence (pp. 178–182). IOS Press.

Anwar, S., McMillan, R., & Zheng, M. (2006). Bidding behavior in competing auctions: Evidence from eBay. European Economic Review, 50(2), 307–322.

Backus, M., Blake, T., Masterov, D. V., & Tadelis, S. (2015). Is sniping a problem for online auction markets? Working Paper 20942, National Bureau of Economic Research.

Backus, M., Podwol, J. U., & Schneider, H. S. (2014). Search costs and equilibrium price dispersion in auction markets. European Economic Review, 71, 173–192.

Byde, A., Preist, C., & Jennings, N. R. (2002). Decision procedures for multiple auctions. In Proceedings of the First International Joint Conference on Autonomous Agents and Multiagent Systems: Part 2 (pp. 613–620). ACM.

Camerer, C. F., Loewenstein, G., & Rabin, M. (2011). Advances in behavioral economics. Princeton University Press.

Chang, S. A. (2014). Multiple overlapping online auction market: Bidder strategic mixture analysis using entropy. Decision Support Systems, 64, 57–66.

Chernev, A., Böckenholt, U., & Goodman, J. (2015). Choice overload: A conceptual review and meta-analysis. Journal of Consumer Psychology, 25(2), 333–358.

Ely, J. C., & Hossain, T. (2009). Sniping and squatting in auction markets. American Economic Journal: Microeconomics, 1(2), 68–94.

Hossain, T. (2008). Learning by bidding. The RAND Journal of Economics, 39(2), 509–529.

Hossain, T., & Morgan, J. (2006). Plus shipping and handling: Revenue (non) equivalence in field experiments on eBay. The B.E. Journal of Economic Analysis & Policy, 5(2).

Ma, H., & Leung, H.-F. (2007). An adaptive attitude bidding strategy for agents in continuous double auctions. Electronic Commerce Research and Applications, 6, 383–398.

Milgrom, P. R., & Weber, R. J. (1982). A theory of auctions and competitive bidding. Econometrica, 1089–1122.

Ockenfels, A., & Roth, A. E. (2006). Late and multiple bidding in second price internet auctions: Theory and evidence concerning different rules for ending an auction. Games and Economic Behavior, 55(2), 297–320.

Rasmusen, E. (2006). Strategic implications of uncertainty over one’s own private value in auctions. The B.E. Journal of Theoretical Economics, 6(1), 1–22.

Roth, A. E., & Ockenfels, A. (2002). Last-minute bidding and the rules for ending second-price auctions: Evidence from eBay and Amazon auctions on the internet. American Economic Review, 92(4), 1093–1103.

Tesfatsion, L. (2003). Agent-based computational economics: Modeling economies as complex adaptive systems. Information Sciences, 149(4), 262–268.

Vadovič, R. (2017). Bidding behavior and price search in internet auctions. International Journal of Industrial Organization, 54, 125–147.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendices

Appendix

Benchmark Values and a Sample from eBay

Alvarado Guevara (2019) analyzes a dataset of two hundred eBay auctions which were randomly selected between March and April 2019. The auctioned items were secondhand mobile phones, which makes the sample relatively homogeneous. For each auction, the whole bidding record was downloaded by the author just after the termination of the auction.Footnote 10 This subsection discusses to what extent the benchmark values used in our paper are in line with statistics computed from that sample.

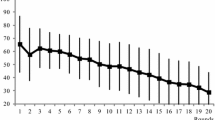

In our model, N is the number of bidders within an auction. Figure 8 plots, for each auction in the sample, the number of bidders against duration, computed as the difference between the opening of the auction and the last bid. While the red line shows that the average number of bidders is 10.84, it is higher for auctions using the eBay standard 7 days closing rule and closer to our benchmark \(N=20\).

In our model, T is the number of times each bidder bids under nibbling (assumed exogenous in our model). Any given bidder in our model does not bid all of the T rounds in the same auction. Thus, the observed sample statistic of bids per bidder within an auction should be taken as a lower bound for T. Table 9 shows some percentiles of the distribution of bids per bidder. Our benchmark value is \(T=5\).

Finally, K is the number of auctions that each bidder considers simultaneously. Clearly, some bidders might bid in auctions within our sample and in bids in other auctions. Thus, the cross-bidding within our sample must be understood as a lower bound of the actual cross-bidding. Only 14% of the bidders of the sample bid in more than one auction (among the auctions in the sample). Among those bidders, the average number of auctions is 2.85, while we have taken \(K=5\) as benchmark value.

We do not try to justify all other benchmark values using sample statistics. The percentage of hard nibblers, \(\alpha \) and \(\beta \) essentially define the strategy space under consideration. To elicit behavioral rules from observed bids constitutes an interesting—and not trivial—question in itself, which we consider beyond the scope of this paper. A similar comment applies to the probability distributions generating valuations.

Second Price Versus Nibbling Payments

Rights and permissions

Copyright information

© 2021 Springer Nature Switzerland AG

About this chapter

Cite this chapter

Alvarez, F., Sartarelli, M. (2021). Cross-Bidding in eBay-like Environments. In: Dawid, H., Arifovic, J. (eds) Dynamic Analysis in Complex Economic Environments. Dynamic Modeling and Econometrics in Economics and Finance, vol 26. Springer, Cham. https://doi.org/10.1007/978-3-030-52970-3_2

Download citation

DOI: https://doi.org/10.1007/978-3-030-52970-3_2

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-52969-7

Online ISBN: 978-3-030-52970-3

eBook Packages: Economics and FinanceEconomics and Finance (R0)