Abstract

The main objective of the article is to test the difficulty of changing evolutionary paths, by studying the evolution of the sectoral outcomes of one of the basic regional and industrial policy tools in Greece, the Greek Investment Law (GIL), through a brief analysis the past and present experience of GILs. Based on a unique database of the past four GILS, I will try to comment on the effectiveness of the policies in altering the investment decisions of Greek firms, in the light of the national Smart Specialisation Strategy (3S), particularly focusing on the current law (for which there is some preliminary unpublished data), which incorporates - but is not limited to - the sectoral priorities of the Greek National 3S Strategy, and the degree to which this is visible in the preliminary data. More specifically, I will focus on the extent of visible changes in the sectoral distribution of the recent GILs and whether these seem to converge to the targets of the Greek National Smart Specialization Strategy and whether the lack of convergence can be ascribed to the workings of evolutionary mechanisms and in particular a political and cognitive lock-in.

You have full access to this open access chapter, Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Given the rather limited literature evaluating Smart Specialisation and – perhaps even more so – the entrepreneurial discovery process [1], which should, at least in theory identify the activities (sectors, clusters, ecosystems) to be assisted, through the participation of a wide array of local actors), this paper aims to critically evaluate at least two aspects of Smart Specialisation. The former is the conditionality attached to Smart Specialization requiring policies to comply to the priorities of national or regional 3S. What I will try to show is that adapting ‘traditional’ top-down industrial/regional policy instruments to fit 3S often yields very limited results. The latter (which is inextricably linked to the former) is related to the perceived effectiveness of the entrepreneurial discovery process. In particular, I would like to test the hypothesis that the sectoral priorities of Smart Specialisation strategies identify potential sources of growth, increased profitability and attractiveness to investors. If this is the case, then, these activities should emerge as preferred choices for both incumbent and nascent enterprises and investors even in the absence of specific or mission oriented policies. What I will argue is that in fact evolutionary paths often prove very difficult to change.

Further, I will try to probe into whether we can ascribe the stability of investment decision of Greek firms (and consequently the stable industrial structure of Greece) to the workings of evolutionary mechanisms and in particular a political and cognitive lock-in, or whether this, as Glasmeier [2] warns, would constitute an uncritical use of the concepts.

The paper will be based on the past and current experience of one of the basic regional policy tools in Greece, the Greek Investment Laws (GILs). By studying the evolution of the sectoral outcomes of past and present GILs I will try to comment on the effectiveness of the 3S, particularly focusing on the current law (for which there is some preliminary unpublished data), which incorporates - but is not limited to - the sectoral priorities of the Greek National 3S, and the degree to which this is visible in the preliminary data. More specifically, I will focus on the extent of visible changes in the sectoral distribution of the recent GILs and whether these seem to converge to the targets of the Greek National 3S.

2 Path Dependence and Lock-Ins

The notion of path dependence concerns the influence of past conditions, choices and policies on current outcomes, or as Walker [3] noted, the fact that “… industrial history is literally embodied in the present”. In anticipating the evolutionary turn in Economic Geography Storper and Walker [4] wrote that: “Localized technological change in an industry can be understood, like all industrial development, as an evolutionary path in which each step moves one way from a past that cannot be recovered and that limits future directions’.

The notion of path-dependence was introduced by the economists David [5], who wrote on the economic history of technology and Arthur [6], who was interested on self-reinforcing cumulative economic processes. During the recent years, path-dependence and various other concepts of evolutionary thinking have been elevated into one the dominant concepts of economic geography [7] employed on numerous occasions as the hermeneutic instruments to a wide array of issues related to uneven development, such as the persistence of regional disparities, the lock-in of regions to particular functional specializations [8] and cluster development [9].

Similar notions had been used in economics and economic geography in the past. First and foremost is Myrdal’s [10] attempt to account for uneven development through the cumulative causation concept, which aimed at explaining regional divergence as product of circular processes, or a stream of events directly flowing from a random starting point in the recent or distant path. As Kaldor [11] noted, it is “the cumulative advantages accruing from the growth of industry itself–the development of skill and know-how; the opportunities for easy communication of ideas and experience; the opportunity of ever-increasing differentiation of processes and of specialization in human activities”. The idea that current outcomes are inescapably shaped by past choices is also dominant in the various stages of growth/lifecycle theories [12,13,14,15] which view growth as a sequential process of various stages which eventually lead to a final optimal stage. One of the main differences between stages/lifecycle theories and path dependence [16] is that the former appear to be overly deterministic, prescribing the exact stages that firms, milieus, regions or countries will go through, making the exact definition of stages (and their sequence) the raison d’être in such theories. In contrary, according to Martin and Sunley [17], in more recent approaches of Economic Geography (‘evolutionary’, ‘institutional’ and ‘relational’), in path-dependence there is “an emphasis on the context-specific, locally contingent nature of self-reinforcing economic development, particularly the “quasi-fixity” of geographical patterns of technological change, economic structures and institutional forms across the economic landscape”, implying that path-dependence is not a deterministic mechanism. Finally, concepts pertaining to path dependence have also been widely used by Marxist economic geographers (such as Harvey [18] and Massey [19]), who viewed uneven development as a historical process.

A lock-in is a situation where a number of factors will tend to maintain existing industrial structures, even when they have reached maturity delaying their obsolescence, along with the necessary industrial restructuring. According to the literature [8] there exist three types of lock-ins:

-

functional lock-ins (stemming from close and stable linkages between firms),

-

cognitive lock-ins (a common world view created through social reinforcement, that dictates how to interpret external signals) and

-

political lock-ins (the politico-administrative system that keeps a region on course, even when this course is a dead-end).

Although the writings of Arthur and David are widely considered to be the starting points of the recent interest in lock-ins, there are some considerably older ideas closely resembling the lock-in concept [20]. Olson’s [21] arguments on the negative impact of institutional sclerosis on economic development at the national level seem to fit the articles case study very well. Olson referred to the emergence of interest groups which can stimulate the rent-seeking behaviour of actors. Not only can institutional rigiditiesFootnote 1 hinder economic restructuring at both levels, in a worst-case scenario these rigid institutions at the regional and national level mutually reinforce each other. An even older idea is Checkland’s [33] large and shady upas tree (a metaphor used in his study of shipbuilding in Glasgow until the 1950s) which prevents anything from growing beneath it, even after the tree has died. Similarly, a dominating local industry prevents any other new industry from growing beneath it. When the tree/industry dies there is nothing to replace it, which can severely damage the local ecology/economy.

There are at least two pressing questions around lock-ins: the first is whether lock-ins are inevitable. According to Setterfield [24] a lock-in “is not inevitable either in the present, or at any point in the future” since regions may switch to a new technological regime before the onset of lock-in, while the lock-in threshold is a variable and not a constant, depending on the type of regime and the perceived profitability of the new regime. On the other hand, although at a different scale, Pouder and John [9] claim that a number of forces accounting for the initial success of fast-growing geographic clusters of competing firms eventually lead to their adoption of suboptimal choices.

The second pressing question is whether there is a way out of a lock in. Even though there are reports of regions finding a way out of lock-ins [8], Martin and Sunley [17] claim that “the precise meaning of regional ‘lock-in’ (…) is unclear, and little is known about why it is that some regional economies become locked into development paths that lose dynamism, whilst other regional economies seem able to avoid this danger and in effect are able to ‘reinvent’ themselves through successive new paths or phases of development”. Hassink [25] argues that when it comes to political lock-ins, the notion of a learning region in which the main actors “are strongly, but flexibly, connected with each other and are open both to intraregional and interregional learning processes” may provide a way forward. Supposedly in learning regions policy makers should be involved in processes of identification of past errors, therefore forming policies which could allow for breaking out of lock-ins. However, he claims that due to (1) the fuzziness, (2) the normative character and (3) the fact that learning regions may get squeezed between NISs and GPSs limits their effectiveness in unlocking regional economies from lock-ins. Instead he proposes the notion of the “learning cluster” as capable of playing that role. According to Maskel and Malmberg [26] localised capabilities may decline because of asset erosion, substitution and lock-ins. Hence, firms and regions may have to ‘un-learn’, habits or institutions of the past, a process which is usually faced with considerable resistance from incumbent firms or elites, highlighting the central role of a resolute public intervention [24].

3 Industrial and Regional Policies and Sectoral Rigidities in Greece

During the last 30 years we have witnessed a major upheaval across the international economic landscape, resulting in a rapidly changing international division of labor (IDL). At the heart of this emerging new IDL is the growing industrial production in the developing world, which is reflected in the increasing competitive pressures and the resulting de-industrialization of most developed economies. According to UNCTADstat data, the share of developing countries in the global manufacturing value added increased from 27% in 2000 to 50% in 2014. This change is due to the particularly dynamic growth of specific countries (BRICS and SE Asia) and the significant expansion of global trade through the dramatic growth of global value chains. The rapid upgrading of businesses, sectors, regions and developing countries enables them to overcome significant traditional barriers to entry high value-added activities, sectors and markets, transforming them into the main challenge of the global economy.

In the context of this changing environment, the European Union has set up a broader strategic framework for the next decade, known as Europe 2020, comprised of three complementary priorities: - smart growth based on knowledge and innovation; - sustainable growth to promote more efficient use of resources, a greener and more competitive economy, and inclusive growth, with high employment, social and territorial cohesion. At the same time, according to recent European Competitiveness Reports (European Commission, 2013, 2014), Europe is in dire need of restructuring, as it appears to be losing ground relative to its main competitors, namely the US and SE. Asia. In addition, the recent crisis has had a major impact on the European economy, which seem to be recovering more slowly than its main competitors.

The Greek economy was the biggest victim submitted to more than six years of continuous recession and a consequent restructuring of the Greek production system, which led to a decline in GDP reaching more than 25% and unemployment rates at similar levels. At the same time, during the 2006–2016 period, gross capital investment fell by −64.6%. The extent of the devaluation of invested capital in the productive economy was (and still is) unprecedented and raises questions about the practical possibilities of recovery. Indeed, since 2011 the evolution of the annual net private capital formation has been clearly negative and much lower than other EU countries that experienced a disinvestment problem during the global financial crisis (Italy, Portugal). By the most conservative estimates to meet capital requirements of at least € 70 billion (AMECO/ECFIN, 2016), in order to raise the level of private capital formation to 2010 levels.

In part, this picture was attributed to the weaknesses of the Greek growth model, which relied too heavily on consumption and the abundance of cheap credit, especially from foreign banks after Greece’s entry into the euro. This has led to the country’s over-indebtedness, but also to the decline in the importance of productive investment.

Apart of the challenging external environment, the Greek economy is characterised by a number of endogenous weaknesses which can be summarized as follows [27,28,29]:

-

The problematic structure of the productive sector (e.g. prevalence of micro and small businesses, low export propensity, limited performance in innovation and R&D activities, the strong dualism of Greek businesses and the relative absence of manufacturing and tradeable services).

-

The problematic role of the state. This includes a range of issues such as the low capacity to produce public goods, the inefficient organization of the education system, the complex institutional framework and the frequently changing tax regime. The way in which the state contributes to shaping the country’s vision and strategy for development is also considered ineffective.

-

The problematic form of public-private cooperation (cooperation to generate oligopolistic revenue rather than new production/wealth).

-

The relatively low propensity for entrepreneurship, and

-

low social capital stocks.

3.1 The Greek Smart Specialisation Strategy

It is clear that the Greek economy is in dire need of a competitiveness boost and the approval of the national 3S strategy in August 2015 provided a much-needed framework which is based in three main strategic options intersected by four priority axes (see Table 1).

Further, as a result of a national entrepreneurial discovery process, the following sectors were identified as priority activities in which the country occupies or may develop considerable competitive advantages and by funneling available resources, achieve considerable development outcomes:

(1) Agri-food, (2) Health – pharma, (3) Information and communication technologies, (4) Energy, (5) Environment and sustainable development, (6) Transport, (7) Materials – construction, (8) Tourism - Culture - Creative industries.

Although the underlying logic behind identifying priority sectors is to leverage the strengths of countries and regions in specific activities by diversifying into related activities [30], in reality, the identification of related activities as well as the capacity to measure relatedness remains understudied, at best [1]. To make things more complicated, even if we assume that territories can discover the appropriate (in terms of relatedness, complexity, or any other characteristic) activities to diversify into, the ability of industries, regions or countries to alter evolutionary paths is hindered by a variety of lock-ins [8] which may often cause severely limited rationality in terms of both investment and location decisions.

In the following sections I will study the investment decision of Greek firms assisted by the Investment Laws in an effort to evaluate the capacity of the instruments to guide investment decision and therefore alter the sectors’ evolutionary path. I will comment on the effectiveness of the three previous investment laws, with some emphasis on the current law, which prioritizes the sectors identified in the national 3S.

4 The Greek Investment Laws

The investment law is historically the most significant policy tool with objectives that pertain to regional policies as well as industrial policies [31, 32]. During the last fifty years numerous laws have provided various types of assistance (predominantly direct grants, but also tax reliefs and other types of aid) to firms investing in Greece or abroad with aid intensities that allow for more support to firms investing in least developed regions of the country.

The last three laws were Law 2601/98, Law 3299/05 and Law 3908/2011, while the current law (Law 4399) was enacted in 2016.

4.1 Objectives of the Laws

All four laws explicitly aim at the restructuring of the Greek economy. in particular, the older law aimed at ‘…the restructuring of sectors and branches of production’ with very little information concerning the exact or approximate direction of this restructuring. In turn, the three more recent ones were more specific is setting priorities linked to ‘promoting technological change and innovation’ (L. 3299/05), while L. 3908/2011 was even more explicit, aiming at: a) improving competitiveness, b) technological development c) promoting the Green Economy. Finally, the current law is perhaps the more detailed and at the same time the more ambitious one, aiming at (adopted from the explanatory statement of the law):

“the gradual shift of priorities from the production of low value-added products and low knowledge-intensive products and services to a new direction, which - without ignoring the country’s comparative and competitive advantages (sectoral or horizontal) - will invest in the discovery of new sources of value and competitive advantage. Its main features will be:

-

The effort to re-industrialize the country while shifting to higher value-added marketable services.

-

Increasing the technological content of products and services, as well as innovative processes.

-

Facilitating the entry of new entrepreneurs.

-

Creating tools that allow the development law to be better adapted to the specific characteristics of specific areas and economic activities.

-

Strengthening the extroversion of Greek businesses.”

Furthermore, as was already mentioned, the current law explicitly prioritizes the national 3S sectors.

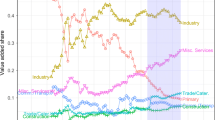

4.2 The Sectoral Distribution of the Laws and a Discussion

Most of the approved projects in all laws are characterized by relatively low technological content and knowledge intensity (Fig. 1). Specifically, 95% of the projects involved investments by enterprises in low tech (29% – e.g. food, tobacco, garments, wood, paper etc.) and medium – low tech manufacturing activities (19%, e.g. petroleum, plastic, non-metallic mineral products, basic metals, repair and installation of machinery, etc.), provision of less knowledge-intensive services (35%, e.g. hotels, transportation, travel agencies, etc.), as well as primary sectors (10%) and energy (1%).

On the contrary, high or medium – high-tech sectors accounted for 4% of total projects. As an indication, of how Greece compares to the rest of Europe, in 2010, EU industry was almost equally divided in terms of technological intensity in two main groups (53% for low-tech/medium-low tech and 47% for high-tech/medium-high tech).

In terms of sectors, the priorities of all four laws were to varying extents clearly not fulfilled, while the current law, which pertains to the national 3S strategy the most does not seem to diverge from the norm, which is an overwhelming majority of projects in the hotel sectors (ranging between 40%–50%). An interesting point here is the fact that the hotel sector is a very mature one, while most projects were concentrated into the core activity of hotels with very little (if any) diversification to related sectors.

An even more convincing characteristic of the current law regarding the difficulty of path switching or upgrading is the relative collapse of the most innovative schemes of the Law and those that could signal an upgrade or a diversification of the Greek economy. For example, the scheme of innovative new enterprises managed to attract very little interest, while the networking scheme turned out to be a total failure, failing to attract a single application!

The situation could be attributed to all kinds of lock-ins. Functional, since (mainly in the insular regions but also progressively in the large urban centers) tourism and the related activities account for the vast majority of economic activity, embedding local and regional productive systems; cognitive, since the sector is widely considered as the country’s “heavy industry” and the optimal activity to capitalize on the country’s comparative advantage. Nevertheless, it is foremost a political lock-in and has consistently been so since the early 1980’s. In fact, the functional and cognitive lock-ins seem to fuel the political one, which is evident, not so much in the existence of a “thick institutional tissue” [25], but mainly in the state’s reluctance to view tourism for what it is, i.e. a relatively low productivity sector absorbing scarce resources which could be better employed in higher value added activities. The exact mechanisms, as well as the relations between the various types of lock-in constitute very interesting issues for future research.

References

Balland, P.A., Boschma, R.A., Crespo, J., Rigby, D.L.: Smart specialization policy in the EU: relatedness, knowledge complexity and regional diversification. SSRN Electron. J. (2017). https://doi.org/10.2139/ssrn.2995986

Glasmeier, A.: Manufacturing Time: Global Competition in the Watch Industry, 1795–2000. Guilford Press, New York (2000)

Walker, R.A.: The geography of production. In: Sheppard, E., Barnes, T.J. (eds.) A Companion to Economic Geography, pp. 113–132. Blackwell, Oxford (2000)

Walker, R., Storper, M.: The Capitalist Imperative: Territory, Technology and Industrial Growth. Blackwell, Oxford (1989)

David, P.A.: Clio and the economics of QWERTY. Am. Econ. Rev. 75, 332–337 (1985)

Arthur, W.B.: Competing technologies, increasing returns, and lock-in by historical events. Econ. J. 99, 116–131 (1989). https://doi.org/10.2307/2234208

Pike, A., Rodriguez-Pose, A., Tomaney, J. (eds.): Handbook of Local and Regional Development. Routledge, London (2010)

Grabher, G.: The weakness of strong ties - the lock-in of regional development in the Ruhr area. In: Grabher, G. (ed.) The Embedded Firm: on the Socioeconomics of Industrial Networks, pp. 255–277. Routledge, London (1993)

Pouder, R., John, C.H.St.: Hot spots and blind spots: geographical clusters of firms and innovation. Acad. Manag. Rev. 21, 1192 (1996). https://doi.org/10.2307/259168

Myrdal, G.: Economic Theory and Under-Developed Regions. G. Duckworth, London (1957)

Kaldor, N.: The case for regional policies. Scott. J. Polit. Econ. 17, 337–348 (1970). https://doi.org/10.1111/j.1467-9485.1970.tb00712.x

Gerschenkron, A.: Economic Backwardness in Historical Perspective: A Book of Essays. Belknap Press of Harvard University Press, Cambridge (1962)

Rostow, W.W.: The Stages of Economic Growth. A Non-Communist Manifesto. Cambridge University Press, Cambridge (1960)

Taaffe, E.J., Morrill, R.L., Gould, P.R.: Transport expansion in underdeveloped countries: a comparative analysis. Geogr. Rev. 53, 503–529 (1963). https://doi.org/10.2307/212383

Vernon, R.: International investment and international trade in the product cycle. Q. J. Econ. 80, 190–207 (1966). https://doi.org/10.2307/1880689

Belussi, F., Sedita, S.R.: Life cycle vs. multiple path dependency in industrial districts. Eur. Plan. Stud. 17, 505–528 (2009). https://doi.org/10.1080/09654310802682065

Martin, R., Sunley, P.: Path dependence and regional economic evolution. J. Econ. Geogr. 6, 395–437 (2006). https://doi.org/10.1093/jeg/lbl012

Harvey, D.: The Limits to Capital. Verso, London, New York (2006)

Massey, D.: Spatial Divisions of Labour. Macmillan Education UK, London (1984)

Hassink, R., Shin, D.-H.: Guest editorial. Environ. Plan. Econ. Space. 37, 571–580 (2005). https://doi.org/10.1068/a36273

Olson, M.: The Rise and Decline of Nations: Economic Growth, Stagflation, and Social Rigidities. Yale University Press, New Haven (1984)

North, D.C.: Institutions, Institutional Change and Economic Performance. Cambridge University Press, Cambridge (1990)

Setterfield, M.: A model of institutional hysteresis. J. Econ. Issues 27, 755–774 (1993)

Setterfield, M.: Notes and comments. Cumulative causation, interrelatedness and the theory of economic growth: a reply to Argyrous and Toner. Camb. J. Econ. 25, 107–112 (2001). https://doi.org/10.1093/cje/25.1.107

Hassink, R.: How to unlock regional economies from path dependency? From learning region to learning cluster. Eur. Plan. Stud. 13, 521–535 (2005). https://doi.org/10.1080/09654310500107134

Maskell, P., Malmberg, A.: Localised learning and industrial competitiveness. Camb. J. Econ. 23, 167–185 (1999)

Iordanoglou, C.H.: State and interest groups: a critique of the conventional wisdom (Kratos kai homades sympherontōn: mia kritikē tēs paradedegmenēs sophias). Polis (in Greek), Athens (2013)

Petrakos, G.: Economic Crisis in Greece. European and Domestic Market and Policy Failures. Région Dév. 39, 9–33 (2014)

Kalogeresis, A., Labrianidis, L.: From spectator to walk-on to actor: an exploratory study of the internationalisation of Greek firms since 1989. Eur. J. Comput. Econ. 7, 121–143 (2010)

Foray, D., Goddard, J., Beldarrain, X.G., Landabaso, M., McCann, P., Morgan, K., Nauwelaers, C., Ortega-Argilés, R.: Guide to research and innovation strategies for smart specialisation (RIS 3). Publications Office of the European Union, Luxembourg (2012)

Papadoulis, A., Petrakos, G., Psycharis, Y.: Policies of investment incentives and regional development: review and initial evaluation. Rev. Econ. Sci. Greek 5, 5–40 (2004)

Petrakos, G., Psycharis, Y.: Regional Development in Greece. Kritiki (in Greek), Athens (2016)

Checkland, S.G.: The Upas Tree: Glasgow 1875–1975?: A Study in Growth and Contraction. University of Glasgow Press (1976)

Acknowledgment

This research is part of the TREnD project (Transition with Resilience for Evolutionary Development), which has received funding from the European Union’s Horizon 2020 research and innovation program under the Marie Skłodowska-Curie grant agreement No. 823952.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2020 The Author(s)

About this paper

Cite this paper

Kalogeresis, A. (2020). Industrial Policies and Evolutionary Paths: A Case Study of the Impact of the Greek Investment Law to Effect Investment Decisions of Greek Firms. In: Bevilacqua, C., Calabrò, F., Della Spina, L. (eds) New Metropolitan Perspectives. NMP 2020. Smart Innovation, Systems and Technologies, vol 177. Springer, Cham. https://doi.org/10.1007/978-3-030-52869-0_7

Download citation

DOI: https://doi.org/10.1007/978-3-030-52869-0_7

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-52868-3

Online ISBN: 978-3-030-52869-0

eBook Packages: Intelligent Technologies and RoboticsIntelligent Technologies and Robotics (R0)