Abstract

In this chapter, I question the extent to which the networks of the flat glass industry facilitated innovation in the past and continue to do so now. So far, students of technology-based industries have focused their attention on a number of high-technology industries including, for example, biotechnology. Since the manufacturing and secondary processing of flat glass require the application of a degree of technological expertise, the flat glass industry is also considered a technology-based industry, though not a high-technology industry in the sense that biotechnology is. This particularity of the industry enables me not only to provide a reasonably complete account of the extent to which the networks of the flat glass industry facilitate innovation, but also to explore whether or not we need a different sort of network thinking for this particular industry—different from the thinking that the students of high-technology industries subscribe to as they study, for example, biotechnology.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

Keywords

To what extent do networks facilitate innovation in technology-based industries? So far, most scholars of this question have focused on just a few high-technology industries. Consider, for example, the work of Powell and his collaborators, Hagedoorn and his collaborators, and Stuart and his collaborators on industries such as computers, semiconductors, pharmaceuticals, and biotechnology.Footnote 1 Their overall conclusion is that collaborations within networks (which are made up of firms as well as institutions such as universities, research institutes, and venture capital) are absolutely necessary components of the virtuous cycles that networks and innovation now constitute in these industries: Networks facilitate innovation, and innovative outputs then attract further collaborative ties (see Powell & Grodal, 2005, p. 67). Simply put, the networks are the locus ofinnovation in these industries: For example, in biotechnology, the most important force behind innovation is reported to be the “structure of its networks” and the “rules governing these networks”—not “money,” not “market power,” not even the “sheer force of novel ideas” (Powell & Grodal, 2005, p. 59; Powell, White, Koput, & Owen-Smith, 2005, p. 1187).

It follows from this conclusion that if one wishes to thoroughly understand the most significant opportunities for innovation in any particular high-technology industry (or, perhaps, in any industry for that matter), one should consider focusing on that industry’s networks. By placing networks at the heart of their study of innovation, the above mentioned researchers make the observations that, first, innovative firms and other institutions are now compelled to be part of networks, and, secondly, that the network’s structure (architecture or topology) and the manner in which they are governed (institutionalized and managed outside governmental rules and regulations, except for antitrust regulations and such) matter a great deal (Powell et al., 2005, p. 1187). Here it is important to point out that as they give prominence to the role that networks play in mobilizing resources for innovation (as scientific and technological knowledge is transferred from university laboratories or R&D departments to industry and from firm to firm, and converted into commercially successful products and processes), they are basically interested in mature and diverse industries with large and complex networks. Consequently, their work, for the most part, is able to accommodate formal network approaches with their particular vocabulary (namely, nodes, lines, and their chartable patterns) and reliance on mathematical modelling.

Now that researchers have all this work at their disposal, it would be interesting to go beyond high-technology industries such as biotechnology, and look into some other technology-basedindustries whose products are developed by the application of some degree of technological expertise (without the entire industries necessarily being labelled as high-technology), and whose networks are typically smaller and less complex than those belonging to biotechnology and similar industries.Footnote 2 In this chapter, I consider one of these industries, namely the flat glass industry, with two purposes in mind—one being the primary purpose of the chapter, and the other a secondary and somewhat provisional one pointing to further research. My primary purpose is to present a reasonably complete picture of the flat glass industry around a research question that concerns the extent to which this industry’s networks facilitated innovation in the past and continue to do so now. My secondary purpose is to explore whether or not a different sort of network thinking is required for this particular industry—different from the thinking that the students of high-technology industries subscribe to as they study, say, biotechnology.

Concerning the primary purpose, I rely on historical accounts such as those of Harris (1975), Barker (1977), and Uusitalo and his collaborators, together with contemporary information available on the Internet as well as in industry publications.Footnote 3 What is common in all these accounts is the observation that the innovative firms in the flat glass industry have not been, as Teece (2016, p. 11) would put it, “islands”—at least not during the last few centuries. I elaborate on this observation here, but then argue that each time period requires a slightly different understanding of the network concept as the flat-glass industry is studied over a long period of time. This is because most innovations in this industry have required technical collaborations between firms, but the contexts in which these have taken place have changed from period to period. For example, in the eighteenth century, technical collaborations occurred between firms located on both sides of the English Channel, and in the nineteenth century between firms on both sides of the Atlantic Ocean. And then, in the twentieth century, thanks to a breakthrough innovation, the flat-glass industry became basically a “one technology, one license, one product” industry dominated by the British flat-glass firm Pilkington. During this period, Pilkington made sure that its licensees all over the world were legally bound to share with it whatever technologies they might develop in the future—thereby changing the role that networks played in this industry with respect to innovations.

Today, there are six firms meeting most of the global demand for flat glass; and as far as the primary processing of flat glass (that is the basic manufacture of flat glass) goes, collaboration within networks still refers to provisional and transitional steps taken by firms in order to enter new markets, open doors for mergers and joint ventures, spread risks, or minimize the costs of research and development. However, when it comes to the secondary processing of flat glass (i.e., the further processing of flat glass by laminating, toughening, coating, or silvering the product), there are signs that collaboration within networks might be starting to get closer to that of high-technology industries—one sign being a newly emerging idea of establishing consortia for major research activities, including a discussion as to who should take a leading role in such efforts. Perhaps, we are entering into a period where exciting scholarly research possibilities will arise from the larger and more complex networks that might emerge from the now maturing industry.

If there really is a possibility of large and complex networks emerging in the world of flat glass (at least with respect to the secondary processing of flat glass), then it is time to consider the sort of network thinking that might be useful concerning the contemporary flat glass industry. Here, we have some choices to make. After all, there is a spectrum of network thinking at our disposal with one end represented by Uusitalo and his collaborators, and the other by Powell and his collaborators. The former group utilizes the network concept basically as, what Marsden (1990, p. 436) calls, a “sensitizing metaphor,” and refrains from developing a formal network approachFootnote 4; whereas at the other end of the spectrum, the latter group utilizes a more formal representation which leads to a particular vocabulary—namely, “nodes,” “lines,” and their chartable “patterns.” Consequently, whereas Uusitalo and his collaborators become interested in distribution of market power and cogency of innovative ideas among firms, Powell and his collaborators let “money,” “market power,” and the “sheer force of novel ideas” take the back seat to “structure of the networks” and the “rules governing these networks” (Powell et al., 2005, p. 1187).

Concerning this chapter’s second purpose (i.e., exploring whether or not a different sort of network thinking is needed for this particular industry), I cautiously consider Coward’s (2018, p. 454) critique of the network thinking that Powell and his collaborators subscribe to—one such criticism being that there is “no natural outside to the network” in this particular network thinking, which Coward (2018, p. 453) calls the “unbounded-ness” problem: “Networks are, in principle, infinitely extensible” in this understanding—something which leads to “fantasies of precision”—as if it is possible to have an accurate understanding of how networks work and what disrupts their workings. There really are opportunities to reflect on Coward’s (2018) concerns here. Consider, for example, the footnote by Powell et al. (2005, p. 1191), in which they inform the reader that they had at one point conducted an analysis on a biotechnology network with “250,000 nodes”—that is, 250,000 firms and institutions such as universities, research institutes, and venture capital that were simultaneously sourcing and receiving knowledge. Before elaborating on this and other issues, in the next section, I will first consider some conceptual challenges arising from the particularities of the flat-glass industry. It should here suffice to point out that the idea is certainly not to contest network thinking in its entirety, but rather to open up a discussion of the many conceptual ways of situating networks within industrial studies.

Some Conceptual Challenges

The flat-glass industry is not perfectly comparable to the high-technology industries from which the research question originated. First of all, the pace of scientific and technological development in high-technology industries such as computers, semiconductors, pharmaceuticals, and biotechnology is now such that single firms no longer have all the necessary skills to keep up with progress and come up with significant innovations (Powell & Grodal, 2005; Teece, 2016). In fact, collaboration within networks in these industries is now more than a provisional and transitional step taken by firms in order to enter new markets, spread risks, or reduce the unnecessary duplication of research costs and efforts. Rather, they are absolutely necessary components that facilitate innovation. Once innovation occurs, innovative outputs attract further collaborative ties (see Powell & Grodal, 2005, p. 67). However, most of what is known about networks’ role in innovation comes from the study of only a few industries.

Obviously, the particularities of the flat-glass industry matter. For example, as mentioned before, the flat-glass industry is not a high-technology industry in the sense that, for example, biotechnology is a high-technology industry. Simply put, innovation in the flat-glass industry is not as cumulative as in some other industries, and innovation’s assets are not as dispersed (locally and globally) as they are elsewhere. On the other hand, in some areas such as “high resolution flat panel displays,” this particular industry is not significantly dissimilar to the above-mentioned industries either (see Stuart, 2000, p. 793). Here, it is vital to remember not only that there are many technology intensive firms in industries that are not regarded as high-technology industries per se, but also that not all firms belonging to high-technology industries are necessarily research-intensive and technologically dynamic (Keeble & Wilkinson, 1999).

Another reason why the flat-glass industry might not be perfectly comparable to the high-technology industries from which my research question originated is that industries such as biotechnology happen to be especially mature and diverse with unusually large and complex networks. Obviously, not all technology-based industries have such large networks. In addition, because history plays a role, it might not be possible to understand what compels contemporary firms to be part of today’s networks without a thorough understanding of what compelled the firms to network with others in the past (including pairing up with only one other firm or institution). All this points to the importance of developing a dynamic understanding of the networks in a variety of technology-based industries—including those with networks not as cohesive and complicated as, say, those belonging to biotechnology.

I must here make a few more conceptual points. First, by giving priority to the networks and the rules governing them in the above-mentioned studies on high-technology I certainly do not mean to deny the role of what Powell et al. (2005, p. 1187) call “the sheer force of novel ideas.” Rather, I mean to emphasize the association between such ideas and the networks. Burt’s (2004) fundamental observation that novel ideas are better expressed, kept, and evaluated as valuable in networked contexts than in isolated contexts can serve as an example: Here, although Burt (2004) hypothesizes that this is the case in all settings, there are good reasons to believe that it is perhaps especially the case in technology-based industries. Just as scientists are supposedly “stimulated to their best ideas by people outside their own discipline,” firms are stimulated to their best innovative performances when they are placed in contact with firms and institutions that are dissimilar to themselves (Burt, 2004, p. 59).

Secondly, I do not deny the importance of money and market power in the above-mentioned studies; rather, I mean to emphasize the association between these factors and the networks. Money and market power are important resources, and “resource rich” firms are more capable of altering their positions by reconfiguring their networks; still, what matters the most is being networked. Simply put, disconnectedness is a “liability” (Powell et al., 2005, pp. 1137–1138). In fact, economists now sometimes wonder whether a firm is “too connected” to fail, just as they once used to wonder whether a firm was “too big” to fail. This focus makes especial sense in high-technology industries, where the fast pace of scientific and technological developments leads to insurmountable disadvantages for isolated firms (including even the most moneyed and powerful ones). Simply put, in such industries, leaving aside the fact that no single firm can master and control all the competencies required for innovation, no single firm can even absorb the available resources (say, the $17 billion grant money offered to biotechnology by the federal government in the United States in the year 2000 only—Powell et al., 2005, p. 1142).

Obviously, it is relatively easy to see how and why the “network” concept comes into play in the context of innovation in high-technology industries: The term “research consortium” has been commonplace in Japan and Europe for a long time, and the Unites States caught up with the idea in the late 1980s after the National Cooperative Research Act of 1984 stipulated that joint R&D ventures between competitive firms “must not be held illegal per se” (Lee & Lee, 1991). At that time, perhaps only “50–100 firms worldwide” had excellent R&D capabilities whose research collaboration with each other, universities, and governments could turn otherwise daunting research projects into possibilities (Teece, 2016, p. 30). The early well-known research collaboration experiences in the United States included the Sematech consortium (founded in 1987), whose network of innovators came from 14 domestic semiconductor manufacturers and the U.S. government. The consortium was created to search for new semiconductor manufacturing processes that would make the United States competitive with Japan—fundamentally because Japan’s dominance was causing concern within the American defense establishment, whose military systems relied heavily on sophisticated electronics (Lee & Lee, 1991).

Today there are a “hundred plus strong technology firms … and hundreds of new enterprises” in almost every technology-based industry worldwide with excellent R&D capabilities that have research collaborations with public institutions and universities in the U.S., Europe, and Asia (Teece, 2016, p. 30). Consequently, today’s well-known research consortia are often multinational in nature—the Human Genome Project (launched in 1990), whose two multinational rival networks published their findings between 2001 and 2006, being an example.

The literature provides some information on the structure and governance of the networks in these well-known examples of research consortia—the most challenging governance issue being that of making sure that the research collaboration is far enough removed from commercialization that firms can cooperate in the laboratory, though still remain able to compete in the marketplace (Lee & Lee, 1991). This issue is connected to the potential antitrust violations that have always been a concern: The National Cooperative Research Act protects “pure research activity” and allows commercial activity only as far as it is “reasonably required” for research (ibid.).

However, there is now a widespread belief that the idea of “pure research activity” is unrealistic. Today, excellent R&D capabilities (both basic and applied research) must go hand in hand with excellent commercial capabilities (which require research into products’ commercialization and marketing)—see Hage and Hollingsworth (2000). Also, what Teece (2016, p. 31) calls “multi-invention contexts” are now the norm—contexts in which individual products and processes “draw on multiple internal and external sources of technology (patented or unpatented).” For example, innovations in laser and computer technology can now be developed much more effectively in collaboration than separately, and further possibilities appear when innovations in optical fiber are also added to the mix (Teece, 2016, p. 31). In fact, in many industries, innovation is now all about combining multiple innovations from different industries—Apple’s iPod being an example (Pitelis & Teece, 2010).

Consequently, today’s networks now comprise multiple forms of research cooperation including, on the one hand, research consortia, industrial parks, and such, and, on the other, what Teece (2016, p. 27) calls “naked licensing.” In between, there are multiple options including joint ventures and strategic alliances—either equity-based or non-equity-based (see Robinson & Stuart, 2007); there are mergers and acquisitions; and there are corporate venture capital investments whose influences on innovation performance have recently received special attention (see, e.g., Phelps, Heidl, & Wadhwa, 2012; Wadhwa & Kotha, 2006; Wadhwa, Phelps, & Kotha, 2016). As a result, empirical research into the manner in which networks influence knowledge creation (and, thus, innovations) often produces conflicting results. For example, Phelps et al. (2012) review article on the subject comprises empirical results from the literature they describe as “conflicting/inconsistent/mixed” at least 35 times. A single empirical study can sometimes include different conclusions about different industries, just as what is found in one region is not always found in another region—see Baptista (2000) and Rowley, Behrens, and Krackhardt (2000) for industry cases, and Beaudy and Breschi (2003) for the regional cases.

Among other factors, the degree to which knowledge sharing is institutionalized as a professional practice in a particular industry makes a significant difference; whether or not a high degree of uncertainty surrounds a particular industry matters; and whether or not the industry’s competitive demands require the exploration of new ideas (rather than the exploitation of what is already known) is a factor. In addition to the industries and regions, the firms themselves also matter—for example, see Stuart (2000) and Robinson and Stuart (2007) for the degree to which network effects can be different for publicly and privately held firms, for well endowed and not so well endowed firms, and for large and technologically sophisticated firms and small and technologically unsophisticated firms (see also Beaudry & Breschi, 2003). Finally, the particular products and processes matter as well: For example, whereas some products require tight links between those doing basic research and those doing product development research (as well as research on manufacturing processes, research on quality control, and research about the commercialization and marketing of products), many products do not need such tight links (Hage & Hollingsworth, 2000).

In summary, the literature’s contributors offer many conjectures concerning the structures and governance rules of high-technology industries that might be studied in an actual, not necessarily high-technology, industry context. For example, one of the many conjectures in stated in the literature is: “Equity joint ventures facilitate knowledge transfer better than other governance modes and lead to increased organizational knowledge creation,” and “can mitigate the unintended leakage of partner knowledge that is unrelated to the partnership” (Phelps et al., 2012, p. 1134).

As mentioned before, the actual industry that is of primary interest here is the flat-glass industry. If one is to investigate the degree to which networks facilitate innovation in the flat-glass industry or consider conjectures around this question (conjectures similar to those mentioned above), one must clearly first develop some basic understanding of the past and present particularities of the flat-glass industry.

The Flat-Glass Industry—A Brief History

I here use term “flat-glass industry” to refer to the manufacturing of the glass found in windows, cars, appliances, electronic devices, solar panels, and so forth. In his book entitled The Substance of Civilization, Sass (1998) writes that flat glass was as technology-based “ten thousand years ago” as it is today. Although this statement is certainly correct on a fundamental level, it requires elaboration: Even though the product might have stayed “forever the same,” the process of manufacturing glass has, of course, changed over history—a history that I will discuss in this section.

Any historic account of glass must include the fact that although “glass was glass,” there were, for a long time, important differences between sheet glass (ordinary window glass), and plate glass (more sophisticated window glass, and, since the 1920s, automobile glass). Sheet glass was expected to have some imperfections (such as little pits, tiny bubbles, and slight distortions), and thus could be manufactured relatively inexpensively. On the other hand, plate glass was expected to be ground and polished for perfection, and thus could only be produced on a large scale at capital-intensive and innovation-heavy plants. Until the 1980s, these two types of glass were manufactured by two different industries. This was not because the plate glass manufacturers did not manufacture any sheet glass, but because they never really excelled in the manufacturing of this relatively inexpensive kind of glass.

Anyone offering an historic account of glass must also pay attention to the degree to which, as early as the eighteenth century, glass manufacturing firms (especially those which manufactured the relatively more expensive plate glass) learned from each other and collaborated. For example, as Harris (1975) discusses in detail, in the eighteenth century, the British Ravenhead learned the technique of casting plate glass from the French Saint-Gobain, whereas Saint-Gobain learned the technique of using coal in glass furnaces from its British competitor. Barker’s (1977) excellent account of the glass industry also contains information as to the manner in which British firms such as Pilkington, Chances, and Hartleys and the French Saint-Gobain continued learning from each other during the nineteenth century—a time period when the competition coming from cheap Belgian glass became significant. Barker (1977) also offers similar information on the beginning of the twentieth century—a time period that he calls the “new age of industrial diplomacy” (p. 197). This period (1900–1914) was the time when glass manufacturers from continental Europe formed “conventions” to determine glass prices—a point whose importance will become clearer later. This time period was also when Saint-Gobain decided to take a stake in the British Chances, and when North American influences were being felt in Britain and Europe.

In the 1920s, there was intense industrial diplomacy between the major plate glass manufacturing firms such as the British Pilkington; the U.S. based firms Pittsburg Plate Glass, Guardian, Libbey-Owens-Ford, and Ford Motor; the French Saint-Gobain; and the Japanese Asahi Glass. While these plate glass manufacturers were producing their plate glass (distortion-free glass not only for architectural uses but also for more sophisticated applications such as automobile glass), the sheet-glass manufacturers such as the German firms Deutsche Libbey-Owens Gesellschaft (Delog) and Deutsche Tafelglas (Detag) were manufacturing ordinary window glass somewhat inexpensively. This was possible because, as mentioned above, ordinary glass was expected to contain occasional flaws and distortions, and this allowed manufacturers to dispense with grinding and polishing the product.

During the 1930s, the plate-glass manufacturers improved the quality of their glass, thanks to an important technical development that had first been commercialized in the late 1920s: the Pittsburgh technique of grinding and polishing. The Pittsburgh technique replaced the Fourcault technique that glass manufacturers had used to grind and polish since the mid-1910s. Meanwhile, sheet-glass manufacturers such as the German Deutsche Tafelglas (Detag) were also steadily producing better and better quality sheet glass. In the 1940s and 1950s, as the quality gap between the expensive plate glass and the inexpensive sheet glass kept narrowing, the sheet-glass industry started to seriously threaten the plate-glass industry. This was because, as mentioned before, although plate glass manufacturers such as Pilkington and Pittsburgh Plate Glass had been excelling in the manufacturing of expensive plate glass, they were not so successful in the production of the cheaper sheet glass (Barker, 1977; Uusitalo & Möller, 2015).

It is worth repeating here how intimate and interconnected the firms within the plate-glass industry (including Pilkington and Pittsburgh Plate Glass) were just before and during this especially competitive period. In the 1940s and 1950s, the plate-glass manufacturers had shares in each other’s companies, and exclusive (or non-exclusive) cross-licensing (or sub-licensing) arrangements with each other. Moreover, they routinely engaged in fidelity agreements and quota arrangements among themselves, which required that there were always some “diplomatic activities” going on between the plate glass manufacturing firms—something which reveals quite a lot about the historic particularities of the industry (Barker, 1977, p. 368). The British firm Pilkington’s “hand in the world of industrial diplomacy” was especially strong (p. 357)—“diplomatic activities” being perhaps a euphemism for cartel-like practices, something to which I will return later.

Then in 1959, just when the competition between plate-glass manufacturers and sheet-glass manufacturers had become especially fierce, Pilkington’s innovation of float glass came to the rescue of the plate-glass industry. This technique was a game changer for two reasons: First, it brought tremendous cost and efficiency improvements to the plate-glass manufacturers; and, secondly, the licensing policy that Pilkington designed and implemented for this new technology turned out to be consequential.

I cannot over-emphasize the first point: The new technique of manufacturingfloat glass (in which sand, soda ash, limestone, dolomite, alumina are all melted, then poured across the surface of a bath of molten tin, and then spread and flattened before being drawn horizontally in a continuous ribbon) was unquestionably superior to any previous technique for two basic reasons. First of all, the float-glass process finally enabled firms to design processes that could operate continuously: that is, 365 days per year, throughout the working life of the float lines (which is between 10 and 15 years). Linking “all the islands of automation into one continuous process” led to significant cost and efficiency-related improvements. In fact, the technique turned glassmaking “into a highly efficient and automated industry”: It reduced the length of the production line by more than half, increased the volume of finished glass by 15–25%, eliminated the use of costly abrasives, lessened waste, and finally diminished labor costs by 80% and energy costs by 50% (Utterback, 1994, pp. 112–113). Secondly, the float technique eliminated the processes of grinding and polishing and produced glass with such an incredible flatness that no amount of grinding and polishing could match it (Pilkington 1969, cited in Utterback, 1994, p. 115). The overall result was a dramatic decline in glass prices (Teece, 2000, p. 225).

Pilkington’s float-glass technique was also a game changer in the industry because of Pilkington’s licensing strategy: With the help of Alastair Pilkington himself (the mechanical engineer who developed the process), the firm decided on a policy of initially licensing the process only to the existing major plate-glass manufacturers. Today’s observers have different interpretations here. Uusitalo and Möller (2015) write that the previous Pittsburgh and Fourcault techniques had been liberally licensed to all firms that could afford it, but that Pilkington chose a different path and left out an entire industry: that of the sheet-glass industry. Here, they point to the fact that, in 1960, the German sheet-glass manufacturer Deutsche Tafelglas (Detag) applied for a license from Pilkington and was refused, and consider this as a sign of Pilkington’s illiberal licensing policy (Uusitalo & Möller, 2015).Footnote 5 Their conclusion is that Pilkington’s decision of which firms would be allowed to acquire the license ended up determining today’s winners and losers (the German and Scandinavian sheet-glass manufacturers were wiped out after their applications for a Pilkington license were rejected), and redrawing the geography of flat-glass manufacturing (through the territorial restrictions that came with the license itself).

Teece’s (2000) interpretation is completely different: Pilkington’s float process replaced only the grinding and polishing stages of the overall glass-production process, and it was for this reason that Pilkington initially restricted the license to those major plate-glass manufacturers that were already skilled at the other stages of production and had the other marketing and distribution capabilities necessary to rapidly commercialize the technique. Furthermore, Teece (2000, p. 228) claims that otherwise “the terms and conditions employed by Pilkington to license the process innovation were generally as liberal or more liberal than those found in agreements for other glass technologies,” such as the Pittsburgh and Fourcault techniques.

In 1962, it was Pittsburg Plate Glass (PPG), Pilkington’s licensor of the Pittsburg technique since 1929, who (after lengthy negotiations over the terms) became the first flat-glass manufacturer to be licensed to use the float process. During the rest of the 1960s and 1970s, the remaining plate manufacturers worldwide acquired the license one by one. Pilkington invested in a number of countries (Canada in 1967 and Mexico in 1968) before becoming a public company in 1970, but especially accelerated its efforts to invest abroad after going public (again Canada in 1970, Australia in 1974, Sweden in 1976, and South Africa in 1977). The U.S. firm Guardian acquired the Pilkington technique in 1971, and in 1976, 21 non-British firms were paying float royalties to Pilkington (Barker, 1977). Thanks to Pilkington’s own investments and those of its licensees, float glass replaced plate glass in a short period of time (Neuman, 1996).Footnote 6 In the 1980s, float glass then also replaced sheet glass, thus allowing the industry to converge into a single industry, classified by a single four-digit code—the Standard Industrial Classification (SIC) code (Uusitalo, 2014a, 2014b). In the process, a number of German, Scandinavian, and Belgian firms (and, in fact, almost the entire German sheet-glass industry) disappeared.

The plate-glass manufacturers who acquired the license agreed to a number of conditions: They would use the technology to construct and operate float-glass plants in a limited number of countries (a territorial restriction), observe Pilkington’s sub-licensing rules, and report and share with Pilkington all future technological improvements that they might develop (Neuman, 1996). Consequently, Pilkington enjoyed an unquestionable power over the industry and, according to an estimate by Teece, Grindley, and Sherry (cited in Teece, 2000), made $5.3 billion (in 1992 prices) from its float innovation. However, as early as the 1980s, there were also a few signs suggesting that Pilkington would not be able to retain its licensing privileges forever. For example, in 1983, following a lawsuit by Pilkington, the U.S. firm Guardian was legally released from the majority of its obligations under its licensing agreements with Pilkington. From then on, Guardian was able to construct float glass plants outside its territory. And then in 1994, when over 90% of flat glass worldwide was being manufactured under the Pilkington license, the U.S. Department of Justice challenged Pilkington and alleged that the firm was continuing to impose restrictions on its licensees even after the expiration of its licenses. Following this lawsuit, a consent decree eliminated all of the limitations Pilkington had imposed on its U.S. licensees: from then on, they were allowed to use the float technology free of charge and sublicense any third party anywhere in the world. The decree also provided, in effect, a similar “safe harbor” for any other American individual or firm who was not a Pilkington float-glass licensee to use any float technology in its possession without any liability to Pilkington (Neuman, 1996).

Intense intra-industry competition followed the decree. The new century’s first decade was a time period in which there was an increase in demand for safety glass, stricter regulations concerning energy efficiency, capacity increases, and declining prices. Herold and Paha (2016) write that it was under these conditions that, between 2004 and 2005, the top four firms in Europe initiated the establishment of a cartel. In fact, the European Commission claimed in 2008 that these cartel practices had started even earlier: namely, between 1998 and 2003, when the firms’ representatives regularly met and decided on the allocation of glass supplies and the division of market shares. That same year, in 2008, the European Commission fined the French Saint-Gobain, the British unit of Japanese Nippon Sheet Glass and Asahi and others a record 1.4 billion euros ($1.77 billion) for price-fixing during 1998–2003 (Kanter, 2008). The French Saint-Gobain was fined the largest amount (896 million euros, i.e., $1.1 billion), because it was a repeat offender when it came to engaging in cartel practices. The firm had been fined twice in the 1980s for cartel pricing in Belgium, Italy, Luxembourg, and the Netherlands. Nippon Sheet Glass’s British unit was fined 370 million euros ($470 million), and Asahi was fined 113.5 million euros ($144 million). Although these high fines indicated that cartel practices were risky, they proved not to be crippling (see Stephan, 2009).

Today’s Flat Glass Industry

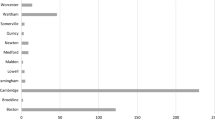

Today, six firms meet most of the global demand for float glass: Namely, NSG (Nippon Sheet Glass, Japan—which acquired Pilkington in 2006), AGC (Asahi Glass Co, Japan), Saint-Gobain (France), Guardian (US), Taiwan Glass (Taiwan), and Şişecam (Turkey). Of these six, NSG, AGC, and Saint-Gobain represent the old guard, whereas Guardian is a relatively newer firm (established in 1932 and acquiring the Pilkington technique in 1971) that has been a powerful actor for some time. Şişecam is a genuine newcomer (established in 1935, acquiring the Pilkington technique in 1977, which has become a regional power in Europe during the last few years). Taiwan Glass is the youngest of all (established in 1964 and acquiring the Pilkington technique in 1974) and, like Şişecam, is more regional than global, with float lines only in China and Taiwan.

These firms are remarkably similar to each other: They all are multi-product/multi-owned brand firms operating geographically separated production facilities in multiple countries. The first four (namely, NSG, AGC, Saint-Gobain, and Guardian) share most of the global demand almost equally, whereas the other two (namely, Şişecam and Taiwan Glass) fulfill regional roles. Among the countries in which these six firms operate float lines, Germany and the BRIC countries (namely Brazil, Russia, India, and China) are at the top of the list, with float lines operated by four or five of these six firms. As mentioned before, each of these six firms reports exactly the same turning point in their respective histories: namely, the year when they acquired the Pilkington license.

There seems to be an overall disappointment in the industry today that, when it comes to the primary processing of glass, the industry has not experienced any innovation that can be considered as consequential as Pilkington’s float-glass process.Footnote 7 In fact, not only have no industry-shattering innovations occurred since the introduction of the Pilkington technique, but even the most incremental innovations have been few and far between. According to Thomsen (2013), this last point makes the industry one with a “slow clock speed,” and, in fact, a “dinosaur.” Obviously, industry insiders are not exactly satisfied with recent innovations—such as Corning’s fusion drawing technique in which the pristine surfaces of the glass are not touched by molten tin—something which results in a remarkably flat and uniformly thick glass that can withstand a high degree of chemical strengthening, providing it with unusual optical clarity, touch sensitivity, and damage resistance, and thus making it even more suitable for use as electronic device display glass.Footnote 8

However, when it comes to glass’s secondary processing (i.e., the further processing of flat glass by, among others, laminating, toughening, coating, or silvering the product), there are more technological developments to be discussed with respect to architectural glass, automotive glass, electronic display glass, and solar glass. For example, in the area of architectural glass, which fills an overwhelming share of the global demand for flat glass, there are possibilities for further innovations with respect to the coating technologyFootnote 9 and the fenestration of flat glass.Footnote 10 The most recent trends seem to be towards increased energy performance (increased stringency, better tuning of the building envelope, and optimal use of daylighting), increased building performance (acoustics optimization and such), and better aesthetics/design (larger glass units, and larger ranges of decorative glass).Footnote 11

In order to be used in the automotive industry, glass needs to be appropriately toughened (thermally or chemically strengthened), laminated, and bent specifically for use in automobile windshields (and perhaps occasionally turned into bullet-proof safety glass). Here, innovation researchers focus on making windshields especially thin in order to make vehicles lighter and more energy efficient, in addition to giving automotive glass scratch resistance and noise-reducing qualities. The trend seems to be going away from the traditional soda-lime-silica windshield glass to high-alumina, high-strength windshield glass. Devices such as televisions, cell phones, laptop computers, tablet computers, and notebook computers require specially manufactured cover glass with a specific thickness, optical clarity, touch sensitivity, and damage resistance. Finally, there is the area of solar photovoltaic and solar thermal power generation that requires glass to be used as plates, front electrodes, and condensing heliostats.

In summary, in the area of the primary processing of its product, the flat-glass industry is not at all similar to well-studied high-technology industries (such as computers, semiconductors, pharmaceuticals, and biotechnology). In addition, collaborations between the industry’s top six firms continue to be along the lines of licensing, joint-ventures, and such, with Saint-Gobain’s recent collaborations with Şişecam being examples. In 2008, the French and Turkish firms agreed to combine forces to first open a flat-glass factory in Egypt in 2010 and then a flat-glass, mirror, and coated-glass manufacturing facility in the Alabuga Special Economic Zone of the Republic of Tatarstan in Russia in 2014. The industry also continues to be characterized by mergers and acquisitions. For example, in 2012, the Turkish firm Şişecam acquired the Romanian GlassCorp (that was formerly known as Geamuri SA), reportedly for the purpose of capacity increases. This acquisition was followed by a 2014 investment of 65 million euros in GlassCorp. In 2013, Şişecam also acquired an over 50% stake in HNG Float Glass Limited in India and acquired Fritz Holding (one of the world’s technology leaders in encapsulated automotive glass), reportedly for the purposes of capacity increases and market access: Fritz had facilities in Germany, Slovakia, and Hungary and manufactured automotive glass for clients such as Mercedes-Benz, BMW, Porsche, Audi, and Lamborghini. Finally, in 2016, Şişecam acquired the Sangalli Vetro Porto Nogaro facility at a price of 84.7 million euros ($91.81 million). During the same year, in 2016, the owner of Pittsburgh Plate Glass (PPG) sold the company to a Mexican manufacturer for $750 million.

However, things might be different when it comes to the product’s secondary processing: Here there are signs that collaboration might now refer to something more than it does in the area of glass’s primary processing. For one thing, the flat glass firms now seem to be aware of the possibility that networks might not only reduce the unnecessary duplication of their research efforts, but also make otherwise daunting research projects possible. For example, Beerkens, Bange, and Durán (2008, p. 368) mention two industry meetings that took place in Switzerland less than a decade ago during which “the first steps to define and organize large scale projects in the glass society with the aim of developing breakthrough technologies in glass products and glass production” were discussed. More recently, an industry insider has stated that the lead firms want “there to be linkages amongst all the people who work in glass research” (a research director at Corning, cited in Corning, 2016). At least there is now talk about who “should take a leading role in defining, initializing, and organizing consortia for major research activities, addressing innovative glass products” (Beerkens et al., 2008, p. 368). A new period is perhaps dawning in which exciting scholarly research possibilities will arise from the newly emerging, large, and complex networks of a now-maturing industry.

Conclusion: Looking at the Flat-Glass Industry from a Network Perspective

To what extent do networks facilitate innovation in technology-based industries? Scholars who have studied a number of high-technology industries such as today’s biotechnology industry answer this question with certainty: Networks facilitate innovation to such an extent that the primary force behind innovation is now the “structure” of these networks and the “rules governing these networks”—not “money,” not “market power,” not even the “sheer force of novel ideas” (Powell & Grodal, 2005, p. 59; Powell et al., 2005, p. 1187). Consequently, they allocate most of their research energy into developing formal network approaches (known for their particular vocabulary of nodes, lines, and their chartable patterns, and for their reliance on mathematical modelling), and conduct analyses of large and complex networks—sometimes large enough to have as many as “250,000 nodes” (see Powell et al., 2005, p. 1191). The conviction is that if researchers thoroughly understand the structure and governance of the networks through which thousands (if not hundreds of thousands) of firms and institutions such as universities, research institutes, and venture capital simultaneously source and receive knowledge from each other, then they can even make predictions about these high-technology industries’ future innovations. This approach has certainly not been without its critics. For example, consider Coward (2018, p. 453), who is concerned, among other things, about the “fantasies of precision” that this sort of thinking might lead to as networks expand and researchers unavoidably abandon more and more of the substantive contents of the nodes whose numbers keep increasing.

Here, with the above mentioned criticism of Coward (2018) in mind, I have looked into the flat-glass industry—an industry in which a number of research intensive and technologically dynamic firms are now reasonably networked, as opposed to being isolated like “islands,” as Teece (2016, p. 11) would put it. However, the flat-glass industry does not make the official lists of high-technology industries; the assets of innovation might not yet be as dispersed (locally and globally) as they are elsewhere; and its networks are not as large and complex as, say, in biotechnology. Consequently, it is understandable that the flat-glass industry has not yet been subject to any formal network approaches in a manner similar to some other technology-based industries.

However, throughout their history (or at least during the last few centuries) the innovative flat-glass firms seem to have been stimulated to their best innovative performances when they established contact with other firms. The accounts of how, say, the British Ravenhead learned the technique of casting plate-glass from the French Saint-Gobain, whereas Saint-Gobain learned the technique of using coal in glass furnaces from its British competitor, can serve as an example. Thus, the observations around the case of the flat-glass industry are mostly in accordance with Burt’s (2004) fundamental observation that novel ideas are better expressed, kept, and considered valuable in networked contexts than in isolated contexts.

On the others hand, it is difficult to go as far as imagining “money,” “market power,” and the “sheer force of novel ideas” taking the back seat to the “structure of its networks” and the “rules governing these networks” in the flat-glass industry, even though this might be the case in biotechnology (see the related claims of Powell et al., 2005, p. 1187; and of Powell & Grodal, 2005, p. 59). The most breakthrough innovation in the flat-glass industry, namely the innovation of the float technique, was fundamentally a “single firm” innovation (the single firm being the British Pilkington) that resulted in the industry turning into a “one technology, one license, one product” industry for decades. After this innovation, Pilkington made sure to legally obligate its licensees worldwide to share with Pilkington whatever technologies they might develop in the future—thereby suggesting the possibility that in this industry, instead of networks facilitating this breakthrough innovation, the innovation itself facilitated the configuration of today’s networks. More specifically, I am here referring to the networks of Pilkington’s licensees who found themselves compelled to share all innovative ideas they might develop in the future with Pilkington. Obviously, the idea behind Pilkington’s licensing policy was making sure that Pilkington would not miss out on any innovation that might appear anywhere in the world.Footnote 12

What is perhaps most interesting here is that Pilkington offered its float-glass licenses only to the existing major plate-glass manufacturers, thereby wiping out the sheet-glass manufacturers in Germany, Scandinavia, and elsewhere, and redrawing the geography of flat-glass manufacturing (through the territorial restrictions that came with the license itself). However, no consensus as yet exists as to the nature and consequences of the manner in which Pilkington governed its innovation. It is here worth mentioning Teece’s (2000, 2016, p. 19) assertion that by settling for “naked licensing,” Pilkington failed to fully benefit from its innovation: It should have created a “true network” around its game-changing innovation in the manner that today’s high-technology firms do: “Pilkington [was] unprepared and unable to implement the technology by itself on a worldwide basis … [Thus] widespread licensing seemed the best alternative” (Teece, 2016, p. 8).

Interestingly, Pilkington’s network-creating policies were also shrouded in controversy: For example, Uusitalo and Möller (2015) observed that the previous Pittsburgh and Fourcault techniques had been liberally licensed to all the firms that could afford it, but that Pilkington chose a different path and excluded an entire industry. On the other hand, Teece (2000, p. 228) claims the opposite: “The terms and conditions employed by Pilkington to license the process innovation were generally as liberal or more liberal than those found in agreements for other glass technologies,” such as the Pittsburgh and Fourcault techniques. This certainly would be a good starting point for a thorough analysis of the flat-glass industry following this breakthrough innovation. More specifically, I suggest further research on the flat-glass industry similar to the somewhat Schumpeterian analysis that Powell and his collaborators conducted on the emergence and growth of the biotechnology industry in the Unites States in the pre-1988 period. I also suggest that future researchers should consider the question of what constitutes a “true network” (Provan & Kenis, p. 231; Teece, 2000, 2016, p. 19).

Obviously, my above suggestions for further work refer to the primary processing of flat glass. There is even more room for further work concerning the secondary processing of the product (i.e., the further processing of flat glass by laminating, toughening, coating, or silvering the product with the purpose of turning glass into more sophisticated products such as high resolution flat panel displays). When it comes to flat glass’s secondary processing, innovation’s assets are now much more dispersed (locally and globally) than they were before. Also, contexts in which individual products and processes draw on multiple internal and external sources of technology are now becoming more and more pervasive in glass’s secondary processing. For example, innovations in laser technology (such as those around ultra-short pulse lasers) and innovations in glass can now be developed much more effectively in collaboration than separately. Similarly, when innovations in optical fiber and glass are brought together, new near-to-eye display technologies become possible. It is now possible to pick up from where Uusitalo and his collaborators left off and study the contemporary manner in which flat-glass firms feel compelled to be part of networks, together with the network structures and rules that seem to be emerging.

Notes

- 1.

Here, I basically refer to a number of publications especially including Owen-Smith and Powell (2004), Powell et al. (2005), Powell, Packalen, and Whittington (2012), Whittington, Owen-Smith, and Powell (2009), Powell and Owen-Smith (2012), Powell and Standholtz (2012), Powell and Padgett (2012), Hagedoorn and Schakenraad (1994), Stuart and Podolny (1996), Stuart (2000), and Robinson and Stuart (2007).

- 2.

I here use the term technology-based as somewhat of a catch-all phrase to refer to all industries whose products are developed by the application of some degree of technological expertise. I am thus not using the terms technology-based and high- technology industries interchangeably—a point that I will elaborate on later.

- 3.

- 4.

For example, consider the extent to which Uusitalo and Möller (2015) use the words “network” (or, in their words, “net”) and “industry” interchangeably. More specifically, by the “two … industrial networks” of the past, they mean “the sheet glass industry and the plate glass industry” (p. 1379).

- 5.

Uusitalo and Möller (2015) believe that the fate of the German Deutsche Tafelglas (Detag) was sealed in 1960 when Detag’s application for a license from Pilkington was refused.

- 6.

See, for example, how Gobain-Pont-a-Mousson’s then newest factory became outdated before it even went into production (Utterback, 1994, p. 121, Footnote 18).

- 7.

Since the publication of the Pilkington license, thousands of licenses related to float glass have been published in the world (Nascimento, 2014). However, unlike the Pilkington license, they have not been breakthrough licenses.

- 8.

Corning based its fusion drawing technique on James Franklin Hyde’s 1932 discovery of a high purity fused silica that only became useful over 80 years after its conception. Corning now uses the fusion drawing technique in the production of its Gorilla Glass (a cover glass used in devices such as tablets, notebook personal computers, and cell phones).

- 9.

The coating technology enhances the performance of architectural glass by turning it into glass with low-emissivity and solar control, glass with scratch resistance qualities, and even self-cleaning glass. There are basically two alternatives: pyrolytic coating (hard coating—used since the 1970s) is produced through chemical vapors deposited onto the glass during the glass production. A newer technique which is called sputtered coating (soft coating—used since the 1980s) is applied off-line independently of the float manufacturing process by depositing layers of thin metallic and oxide coatings onto the surface of precut glass. In sputtered coating, the primary material has for some time been silver: Today single-silver, double-silver, and triple-silver layers are all commercially viable, although there are now concerns about moving towards four-silver layers because it looks as if this might be a point of diminishing returns for firms when the weight and cost of the product are taken into account.

- 10.

The fenestration of flat glass refers to the design and placing of windows in building including double-glazing (insulating). There are a number of alternative double-glazing techniques: warm-edge spacers, gas filled glazing (the gases being argon, krypton, and xenon), aerogel filled glazing, vacuum glazing, and, more recently, glazing via the application of an electric current (electrochromic glass).

- 11.

In the absence of industry shattering innovations, a number of observers believe that what would be best for the industry is a substantial increase in today’s window to wall ratios—preferably 60% glass on the surface of buildings (instead of today’s 40%). Obviously, this is a policy-related issue.

- 12.

It is interesting to note that since the publication of the Pilkington license, no license has been related to a breakthrough innovation, perhaps rendering Pilkington’s expectations a little too optimistic (see Nascimento, 2014).

References

Baptista, R. (2000). Do innovations diffuse faster within geographical clusters? International Journal of Industrial Organization, 18, 515–535. https://doi.org/10.1016/S0167-7187(99)00045-4

Barker, T. C. (1977). The glassmakers: Pilkington: The rise of an international company, 1826–1976. London: Weidenfeld and Nicolson. https://doi.org/10.1017/S002205070008726X

Beaudry, C., & Breschi, S. (2003). Are firms in clusters really more innovative? Economics of Innovation and New Technology, 12, 325–342. https://doi.org/10.1080/10438590290020197

Beerkens, R., Bange, K., & Durán, A. (2008). Glass: The challenge for the 21st century. Boletin de la Sociedad Española de Cerámica y Vidrio, 47, 366–370.

Burt, R. S. (2004). Structural holes and good ideas. American Journal of Sociology, 110, 349–399. https://doi.org/10.1086/421787

Corning. (2016). Inside Corning’s Glass Summit. Retrieved from https://www.corning.com/emea/de/innovation/culture-of-innovation/glass-summit-feature-2016.html

Coward, M. (2018). Against network thinking: A critique of pathological sovereignty. European Journal of International Relations, 24, 440–463. https://doi.org/10.1177/1354066117705704

Hage, J., & Hollingsworth, J. R. (2000). A strategy for the analysis of idea innovation networks and institutions. Organization Studies, 21, 971–1004. https://doi.org/10.1177/0170840600215006

Hagedoorn, J., & Schakenraad, J. (1994). The effect of strategic technology alliances on company performance. Strategic Management Journal, 15, 291–309. https://doi.org/10.1002/smj.4250150404

Harris, J. R. (1975). Saint-Gobain and Ravenhead. In B. M. Ratcliffe (Ed.), Great Britain and her World 1750–1914: Essays in honour of W. O. Henderson (pp. 27–70). Manchester, UK: Manchester University Press.

Herold, D., & Paha, J. (2016). Predicting cartel formation. Retrieved from https://ssrn.com/abstract=2740528. https://doi.org/10.2139/ssrn.2740528

Kanter, J. (2008, November 12). Glass makers are fined $1.7 billion in Europe’s war on price fixing. The New York Times. Retrieved from https://www.nytimes.com/2008/11/13/business/worldbusiness/13glass.html

Keeble, D., & Wilkinson, F. (1999). Collective learning and knowledge development in the evolution of regional clusters of high technology SMEs in Europe. Regional Studies, 33, 295–303. https://doi.org/10.1080/00343409950081167

Lee, M. K., & Lee, M. K. (1991). High technology consortia: A panacea for America’s technological competitiveness problems? High Technology Law Journal, 6, 335–362.

Marsden, P. V. (1990). Network data and measurement. Annual Review of Sociology, 16, 435–463. https://doi.org/10.1146/annurev.so.16.080190.002251

Nascimento, M. L. F. (2014). Brief history of the flat glass patent: Sixty years of the float process. World Patent Information, 38, 50–56. https://doi.org/10.1016/j.wpi.2014.04.006

Neuman, J. N. (1996). Through a glass darkly: The case against Pilkington plc. under the new U.S. Department of Justice international enforcement policy. Northwestern Journal of International Law & Business, 16,284–317.

Owen-Smith, J., & Powell, W. W. (2004). Knowledge networks as channels and conduits: The effect of spillovers in the Boston biotechnology community. Organization Science, 15, 5–21. https://doi.org/10.1287/orsc.1030.0054

Phelps, C., Heidl, R., & Wadhwa, A. (2012). Knowledge, networks, and knowledge networks: A review and research agenda. Journal of Management, 38, 1115–1166. https://doi.org/10.1177/0149206311432640

Pitelis, C. N., & Teece, D. J. (2010). Cross-border market co-creation, dynamic capabilities and the entrepreneurial theory of the multinational enterprise. Industrial and Corporate Change, 19, 1247–1270. https://doi.org/10.1093/icc/dtq030

Powell, W. W., & Grodal, S. (2005). Networks of innovators. In J. Fagerberg, D. C. Mowery, & R. R. Nelson (Eds.), The Oxford handbook of innovation (pp. 56–85). Oxford, UK: Oxford University Press.

Powell, W. W., & Owen-Smith, J. (2012). An open elite: Arbiters, catalysts, or gatekeepers in the dynamics of industry evolution? In J. F. Padgett & W. W. Powell (Eds.), The emergence of organizations and markets (pp. 466–495). Princeton, NJ: Princeton University Press.

Powell, W., Packalen, K., & Whittington, K. (2012). Organizational and institutional genesis: The emergence of high-tech clusters in life sciences. In J. F. Padgett & W. W. Powell (Eds.), The emergence of organizations and markets (pp. 434–465). Princeton, NJ: Princeton University Press.

Powell, W. W., & Padgett, J. F. (2012). Coda: Reflections on the study of multiple networks. In J. F. Padgett & W. W. Powell (Eds.), The emergence of organizations and markets (pp. 566–570). Princeton, NJ: Princeton University Press.

Powell, W. W., & Standholtz, K. (2012). Chance, nécessité, et naïveté: Ingredients to create a new organizational form. In J. F. Padgett & W. W. Powell (Eds.), The emergence of organizations and markets (pp. 379–433). Princeton, NJ: Princeton University Press.

Powell, W. W., White, D. R., Koput, K. W., & Owen-Smith, J. (2005). Networks dynamics and field evolution: The growth of interorganizational collaboration in the life sciences. American Journal of Sociology, 110, 1132–1205. https://doi.org/10.1086/421508

Provan, K. G., & Kenis, P. (2007). Modes of network governance: Structure, management, and effectiveness. Journal of Public Administration Research and Theory, 18, 229–252. https://doi.org/10.1093/jopart/mum015

Robinson, D. T., & Stuart, T. E. (2007). Network effects in the governance of strategic alliances. The Journal of Law, Economics, and Organization, 23(1), 242–273. https://doi.org/10.1093/jleo/ewm010

Rowley, T., Behrens, D., & Krackhardt, D. (2000). Redundant governance structures: An analysis of structural and relational embeddedness in the steel and semiconductor industries. Strategic Management Journal, 21, 369–386. https://doi.org/10.1002/(SICI)1097-0266(200003)21:3<369::AID-SMJ93>3.0.CO;2-M

Sass, S. L. (1998). The substance of civilization: Materials and human history from the stone age to the age of silicon. New York: Arcade.

Stephan, A. (2009). Hear no evil, see no evil: Why antitrust compliance programs may be ineffective at preventing cartels (ESRC CCP Working Paper No. 09-09). https://doi.org/10.2139/ssrn.1432340

Stuart, T. E. (2000). Interorganizational alliances and the performance of firms: A study of growth and innovation rates in a high-technology industry. Strategic Management Journal, 21, 791–811. https://doi.org/10.1002/1097-0266(200008)21:8<791::AID-SMJ121>3.0.CO;2-K

Stuart, T. E., & Podolny, J. M. (1996). Local search and the evolution of technological capabilities. Strategic Management Journal, 17, 21–38. https://doi.org/10.1002/smj.4250171004

Teece, D. J. (2000). Managing intellectual capital: Organizational, strategic, and policy dimensions. Oxford, UK: Oxford University Press. https://doi.org/10.1093/0198295421.001.0001

Teece, D. J. (2016). Profiting from innovation in the digital economy: Standards, complementary assets, and business models in the wireless world (Working Paper Series No. 16). Tusher Center for the Management of Intellectual Capital. Retrieved from https://businessinnovation.berkeley.edu/wp-content/uploads/2014/07/Tusher-Center-Working-Paper-No.-16.pdf

Thomsen, S. (2013). Step change innovation for glass. Keynote Presentation at the Glass Performance Days, Tampere.

Utterback, J. M. (1994). Mastering the dynamics of innovation: How companies can seize opportunities in the face of technological change. Boston, MA: Harvard Business School Press.

Uusitalo, O. (1997). Developments in the flat glass industry in Scandinavia, 1910–1990: The impact of technological change. Scandinavian Economic History Review, 45, 276–295. https://doi.org/10.1080/03585522.1997.10414672

Uusitalo, O. (2014a). Understanding the inter-linkage of innovations: The Finnish float glass and value added industries. Intellectual Economics, 8(2), 92–111. https://doi.org/10.13165/IE-14-8-2-07

Uusitalo, O. (2014b). Float glass innovation in the flat glass industry. Cham: Springer International.

Uusitalo, O., & Mikkola, T. (2010). Revisiting the case of float glass: Understanding the industrial revolution through the design envelope. European Journal of Innovation Management, 13, 24–45. https://doi.org/10.1108/14601061011013212

Uusitalo, O., & Möller, K. (2015). Historical determination of a business network: The case of the flat glass industry. Paper presented at 12th IMP Conference, Karlsruhe.

Wadhwa, A., & Kotha, S. (2006). Knowledge creation through external venturing: Evidence from the telecommunications equipment manufacturing industry. Academy of Management Journal, 49, 819–835. https://doi.org/10.5465/amj.2006.22083132

Wadhwa, A., Phelps, C., & Kotha, S. (2016). Corporate venture capital portfolios and firm innovation. Journal of Business Venturing, 31, 95–112. https://doi.org/10.1016/j.jbusvent.2015.04.006

Whittington, K. B., Owen-Smith, J., & Powell, W. W. (2009). Networks, propinquity, and innovation in knowledge-intensive industries. Administrative Science Quarterly, 54, 90–122. https://doi.org/10.2189/asqu.2009.54.1.90

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2020 The Author(s)

About this chapter

Cite this chapter

Tokatli, N. (2020). Networks as Facilitators of Innovation in Technology-Based Industries: The Case of Flat Glass. In: Glückler, J., Herrigel, G., Handke, M. (eds) Knowledge for Governance. Knowledge and Space, vol 15. Springer, Cham. https://doi.org/10.1007/978-3-030-47150-7_19

Download citation

DOI: https://doi.org/10.1007/978-3-030-47150-7_19

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-47149-1

Online ISBN: 978-3-030-47150-7

eBook Packages: Social SciencesSocial Sciences (R0)