Abstract

Innovation plays a crucial role in China’s energy system transition and revolution. At the 6th meeting of the Central Leading Group for Financial and Economic Affairs in June 2014, General Secretary Xi announced that China would: (i) carry out an energy system revolution to put China’s energy development on the fast track; (ii) reform the energy industry into an effective and competitive market system with a market-oriented pricing mechanism; and (iii) transform the government’s regulation of the energy industry and improve the energy legislation system.

DRC Team Lead of Special Report 4:

Shi Yaodong from the Research Department of Industrial Economy, DRC of the State Council of China.

Shell Team Lead of Special Report 4:

Angus Gillespie, Former Vice President Group CO2, Shell Global Solutions.

Contributors:

Philip Gradwell and Cameron Hepburn from Vivid Economics; Li Weiming, Chen Jianpeng and Zhou Jianqi from DRC of the State Council of China; Liu Xiaoli from the Energy Research Institute, NDRC; and Fan Jingli and Wu Lin from the China University of Mining and Technology.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

Innovation plays a crucial role in China’s energy system transition and revolution. At the 6th meeting of the Central Leading Group for Financial and Economic Affairs in June 2014, General Secretary Xi announced that China would: (i) carry out an energy system revolution to put China’s energy development on the fast track; (ii) reform the energy industry into an effective and competitive market system with a market-oriented pricing mechanism; and (iii) transform the government’s regulation of the energy industry and improve the energy legislation system.

There have been many system constraints on the sustainable development of China’s energy industry for a long time. For example, state monopoly in the oil, gas and power sectors has restricted market competition and kept private capital investment low. Government price control of those three sectors has prevented the market from allocating resources efficiently and distorted the prices of some products. To address these constraints, the government has introduced a series of guidelines and reform roadmaps over the past few years. These include the Opinions of the CPC Central Committee and the State Council on Further Deepening the Reform of the Electric Power System (March 2015), the Opinions of the CPC Central Committee and the State Council on Advancing the Reform of the Pricing Mechanism (October 2015), the Opinions on Deepening the Reform of the Oil and Gas System (May 2017), and the Action Plan for Energy System Revolution (July 2017). These guidelines and roadmaps clearly identify the objectives, pathways and mechanisms for deep energy system reform.

With the introduction of these guidelines, action plans and related support measures,Footnote 1 the reform of China’s energy institutions and system has made positive progress.

Reforming China’s energy system is a formidable task and cannot be achieved overnight. Li Wei, Director of the DRC of China’s State Council and Chinese lead of this DRC-Shell collaborative research project, said in a recent speech that in the context of the global energy revolution, there are still some deeply rooted contradictions and problems for China to address before it can deliver a clean, low-carbon, secure and efficient modern energy system.Footnote 2 In Special report 4, we discuss how China can develop and deepen its energy system revolution and institutional innovations, and we put forward a series of constructive policy proposals.

1 Factors and Trends in Energy System Reform

1.1 Energy Supply and Demand: Global Energy Oversupply and Strong Energy Demand Growth in Asia’s Emerging Economies

Historical experience suggests that it is difficult to implement energy system reform at a time of rapidly growing energy demand, as the priority is to ensure energy supply security and meet demand. In recent years, affected by such factors as slowing world economic growth and industrial restructuring, global energy demand has shown little movement. On the other hand, the shale gas revolution and large-scale investment and development in response to high energy prices have resulted in global energy oversupply and lower energy prices. As China’s economy enters the new normal of slower growth, demand for energy will decline and lead to overcapacity in the country’s energy sectors, including coal, electricity and oil. Thus, it is unlikely that there will be sharp fluctuations in energy demand and large-scale energy supply shortages. To drive energy system reform forward, improvements in energy use efficiency can help strengthen relatively stable internal and external environments.

The annual growth rate in China’s energy demand is forecast to fall below 2% by 2035, from 8% in 2000. This is attributed to China’s slowing economic growth, improved energy efficiency and changing patterns of consumption. China’s energy demand is increasingly less dependent on energy-intensive industries like steel and cement. Instead, future energy demand will be closely linked to economic restructuring—more structural adjustments mean less energy demand, and vice versa. For example, if China’s economic structure shifts closer to that of the USA, energy demand will decrease. As the global economy grows, energy demand will also grow. Almost all new energy supply in 2014–35 will be consumed by rapidly developing economies. According to BP Energy Outlook 2035 (2016), the average annual growth rate in world primary energy demand in 2014–35 will be 1.4% and world total energy demand will increase by 34% in the same period. In the new normal economy, China’s energy demand will grow slowly but sustainably. In 2025–35, China will account for less than 30% of the increase in global energy demand, compared to 60% in the past decade (BP 2016).

The share of oil, natural gas and coal in global energy demand has been stable over the past decade (Fig. 1). In 2016, the share of oil, natural gas and coal production was 38.95%, 28.55% and 32.5% respectively.

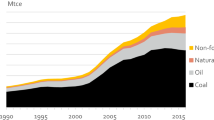

Oil and natural gas production shows slight but steady growth over the past decade, compared to coal, which has declined. As coal-dominated energy producers begin to seek alternative energy sources, the energy system gradually evolves (Fig. 2).

Global primary energy demand did not change significantly in 2006–16 (Fig. 3). Oil had the largest share of global primary energy demand, reaching 33% in 2016. Although many countries are now reducing their consumption of fossil fuels to lower their CO2 emissions, this did not have much impact on energy demand. Renewable energy is expanding and its production landscape is changing. In 2016, demand for renewable energy grew by 12% (including wind, geothermal, solar, biomass, waste-to-energy and biofuels, excluding hydropower). Although this is lower than the average growth rate of 15.7% in 2006–16, it still represents the biggest annual increase ever (a rise of 55 Mtoe, which is more than the decline in coal demand). In the same year, China became the world’s largest renewable energy producer ahead of the USA. Although renewable energy only accounts for 4% of global primary energy demand and the average growth rate of some renewable energy sources, including nuclear and hydro, is only 2.64%, new energy is expected to remain the major driver of the energy revolution and will play a major role in driving economic growth in the future.

Figure 4 shows that growth in energy demand to 2035 comes entirely from emerging economies, with China and India accounting for more than half of the increase. In contrast, oil demand in OECD countries will continue to fall steadily. In terms of oil supply, non-OPEC countries are the main source of increased supply, producing 11 million barrels per day (MMbbl/d) compared to 7 MMbbl/d in OPEC countries. The increase in non-OPEC oil supply comes entirely from the Americas: shale oil from the USA, deep-sea oil from Brazil, and the oil sands of Canada (BP 2016) (Fig. 5).

BP estimates (BP 2016) that the average annual growth rate of global natural gas demand will reach 1.8% in 2014–35, making natural gas the fastest growing fossil energy source. This robust growth is the result of focused supply and environmental policy support. The increase in natural gas demand comes mainly from emerging economies, with about 30% from China and India and more than 20% from the Middle East. Industry and power generation are behind the increase, whereas in OECD countries the increase is primarily from power generation. World shale gas production is rising. In 2014–35, the average annual growth rate of shale gas production is expected to reach 5.6%, and its share of total natural gas production will be almost 25%. In 2014–25, nearly all the increase in shale gas output will be contributed by the USA. By 2035, China is expected to become the largest contributor to increased shale gas production. Global coal demand is forecast to drop sharply to an average annual growth rate of only 0.5% in 2014–35. This is largely due to slowing growth in coal demand and rebalancing of the economy. Even so, China will remain the world’s largest coal market, consuming almost half of global output in 2035. In the same period, India will register the highest growth in coal demand (435 Mtoe) and become the world’s second largest coal consumer ahead of the USA. Although strong growth in coal demand in India and South East Asia can offset lower demand in the USA and the EU, it is unlikely that India and South East Asia will drive the global coal market as China did previously.

Global demand for hydropower and nuclear power will grow steadily at an average rate of 1.8% and 1.9% respectively, due mainly to growing demand for energy in Asia. China’s unprecedented development of hydropower will come to an end, settling at an average annual growth rate of 1.7% in 2014–25. Brazil will have the second highest growth rate (after China) and will replace Canada as the world’s largest hydropower producer. China’s nuclear power demand will grow rapidly, climbing to an average annual growth rate of 11.2%, which is higher than China’s growth rate in hydropower over the past two decades. China’s demand for nuclear power is forecast to double by 2020 and increase ninefold over the current level by 2035.

According to the U.S. Energy Information Administration’s (EIA) World Energy Outlook 2017, global energy consumption will increase by 28% between 2015 and 2040, with more than half of the increase coming from non-OECD countries in Asia, including China and India (Fig. 6). Growth in energy demand from Asia’s emerging economies is the result of their strong economic performance. Rising economic growth and growing energy demand will intensify competition for energy supply. It is therefore important that these countries seize the strategic opportunities of the Belt and Road Initiative to drive international energy cooperation and deepen energy system reform.

1.2 Major Adjustments to the World Energy Landscape: Diversified Energy Supply and Increased Regional Energy Collaboration

After 2005, the share of shale gas in total US natural gas production increased rapidly—from 5.4% (1 trillion cubic feet) in 2006 to 56% (15.2 trillion cubic feet) in 2015.Footnote 3 In 2009, US natural gas production exceeded that of Russia, making it the world’s largest natural gas producer. US shale gas production is forecast to exceed 20 trillion cubic feet by 2040, accounting for more than half of its total natural gas production.Footnote 4 New proven natural gas reserves in the USA continue to increase and are currently estimated to be 2,300 trillion cubic feet. At the present level of consumption, the reserves are sufficient to last for nearly 100 years (Fig. 7).

With its substantially increased oil and gas production, the USA is likely to turn its long-advocated slogan of energy independence into reality. The USA has reduced its dependence on oil imports from 60% in 2005 to 25% in 2016.Footnote 5 The National Intelligence Council predicts that the USA will achieve energy independence by 2030 and become an oil self-sufficient country and a major natural gas exporter. Canada—with proven oil reserves of 172.19 billion barrels in 2015—has 10.1% of the world’s total proven oil reserves, the largest after Venezuela and Saudi Arabia. It also has about 95% of the world’s proven oil sand resources. With abundant conventional and unconventional oil and gas resources, Canada has become a new energy superpower. According to the International Energy Agency (IEA 2017), Canada’s oil production will reach 30–60 MMbbl/d by 2030. The rise of North American energy intensifies the diversification of energy supply.

The US shale gas revolution sparked a shale gas investment boom across the world. In 2011, the USA calculated its domestic shale gas resources and those of 32 other countries. In 2013, it expanded its assessment to include 137 shale formations in 41 countries, including shale oil resources in addition to shale gas. The assessment found that there are highly abundant shale oil and gas resources in the world, corresponding to 10% of the world’s recoverable crude oil reserves and 32% of the world’s recoverable natural gas reserves. Russia has the most abundant shale oil reserves, followed by the USA, China, Argentina and Libya. China has the highest shale gas reserves, with Argentina, Algeria, the USA, Canada, Mexico and Australia also richly endowed.Footnote 6 Currently, Europe and Australia have increased their efforts to explore and exploit shale gas resources, and China is starting large-scale commercial development of its shale gas resources. The IEA forecasts that unconventional natural gas will account for about half of world total natural gas production in 2035, with most produced in China, the USA and Australia. In 2035, China’s shale gas production will stand at 13 billion cubic feet per day (Fig. 8 and Tables 1 and 2).

Distribution of basins with shale oil and gas resources across the world.

The shale gas revolution in the USA has caused a ripple effect in energy and related fields across the world. The impacts of this revolution were first reflected in natural gas prices, which in the USA fell from $10 per million British thermal units (MMBtu) in 2005 to around $3/MMBtu today. In time, as costs rise, the price is expected to increase by about 2.4% per year, reaching $7.8/MMBtu in 2040. Compared with prices in Asia and Europe, the USA will have a clear advantage in prices over the longer term. The IEA estimates that the cost of liquefied natural gas (LNG) exports from the USA (including the cost of liquefaction, transport and gasification) can be held below $10/MMBtu, which is still competitive when compared with the current level of $16/MMBtu and $12/MMBtu in Asia and Europe respectively. As the USA gradually deregulates natural gas exports, its impact on the world’s natural gas market will be increasingly prominent (IEA 2017) (Fig. 9).

As a result of lower natural gas prices, many coal-fired power plants in the USA have switched their fuel from coal to natural gas, resulting in falling coal and electricity prices. This brings a great opportunity to regenerate the manufacturing and chemical industries. Chemical companies that shut down plants in the USA several years ago, due to high natural gas prices, are planning to reopen production facilities and are again using low-price natural gas as a raw material to produce ethylene, synthetic ammonia, chemical fertilisers and diesel fuels.

In short, the large-scale extraction and use of unconventional oil and gas resources make the Americas one of the most important resource exporters after the Middle East, Russia and North Africa. US oil and gas exports will impact energy trade between Europe and Russia for several decades—reducing Europe’s dependence on its neighbour and diversifying its energy import structure. To safeguard energy exports, Russia will strengthen energy cooperation with countries in East and South Asia. The reduction in Europe’s energy dependence on Russia will further consolidate the political, economic and military alliance between Europe and the USA and Canada. Russia’s political and economic cooperation with China, and with emerging economies in Asia, will also grow. China will strengthen its energy cooperation with other countries through the Belt and Road Initiative (BRI). BRI covers two high-quality energy-rich regions: Russia-Central Asia; and the Gulf Region-Western Europe, the former endowed with oil and gas, the latter with advanced energy technologies and widely deployed renewables. Stronger international energy cooperation through BRI will connect Central Asia, North-east Asia, South East Asia, Europe and the Americas, creating regional energy communities to deliver win-win cooperation.

1.3 Protecting the Environment and Combating Climate Change Are Global Concerns

The large-scale development and use of fossil energy severely impacts the air, water and environment. Fossil fuel use emits a large amount of pollutants into the air, including carbon dioxide (CO2), sulphur dioxide (SO2), nitrogen oxides (NOx) and soot. Global SO2 emissions are about 90 million tonnes per year (IEA 2017). They acidify soil and rivers and erode buildings and historical sites. Around 30% of China’s soil surface contains sulphur deposits above the critical level. NOx emissions from fossil energy use impact land, rivers, marine ecosystems and the ozone layer. NOx emissions from urban traffic and thermal power plants are the main source of PM2.5 atmospheric particulate matter. Increasing amounts of particulate matter from thermal power plants, transport and other industrial sectors cause widespread and severe haze, threatening human health. In addition, fossil energy extraction and use consume water resources and cause severe pollution.

According to the International Energy Agency’s World Energy Outlook 2017, 20% of the world’s population live in areas with water shortage. Global water consumption in energy production was 600 billion tonnes, about 15% of total global water consumption. Its impacts include wastewater discharge from coal production and marine and groundwater pollution from oil and gas exploitation. Large-scale development of conventional energy resources can damage vegetation and landforms. Renewables and other types of new energy also impact the environment, such as visual pollution from wind turbines and the disposal of nuclear waste.

Most CO2 emissions from human activities are from burning fossil fuels. As energy consumption grows, CO2 emissions also increase. According to the Fifth Assessment Report (AR5) of the Intergovernmental Panel on Climate Change (IPCC), the concentration of CO2 in the atmosphere reached 392 parts per million (ppm) in 2012, and the global average temperature rise over the last century was 0.74°C. The report suggests that global climate warming has become an indisputable fact, which can be evidenced by the rise in atmospheric and sea temperature, large areas of melting snow and ice, and rising sea levels. According to the data monitored by the US National Oceanic and Atmospheric Administration (Fig. 10), global average CO2 concentration exceeded 400 ppm in July 2017, which is about 40% higher than 100 years ago. Some climate experts believe that the CO2 concentration of 400 ppm represents a critical value that cannot be reversed. When the critical value is exceeded, the global temperature rise will reach 2°C.

Source US National Oceanic and Atmospheric Administration, NOAA (2017) (https://www.esrl.noaa.gov/gmd/ccgg/trends/global.html)

Global monthly mean CO2 concentration.

Global warming has negative impacts on the ecosystem. The combined average temperature over global land and ocean surfaces for April 2016 was 1.10°C above the 20th century average of 13.7°C—the highest temperature departure for April since global records began in 1880. Sixteen of the 17 warmest years on record have occurred since 2000. Global warming does not just make winters warmer and summers hotter, it also causes major environmental crises, such as glacial retreat in the Qinghai-Tibet Plateau and melting ice and snow in the Antarctic and Arctic. Research indicates that if the global average temperature rise exceeds 2°C compared to pre-industrial levels, many species with poor adaptability will die out; if the global average temperature rise exceeds 4°C, grain yields will fall sharply and fishing productivity will be significantly reduced, exposing global food supply to high risk.Footnote 7 Global warming increases the frequency and intensity of extreme weather conditions, and accelerates the melting and shrinking of glaciers, the largest freshwater reserves on Earth, causing sea levels to rise. Millions of people will be threatened by environmental disasters like floods, droughts, typhoons, water scarcity and the submergence of coastal areas, islands and low-lying littoral cities. According to the World Bank, the losses inflicted by extreme weather conditions are increasing—the average annual loss in the 1980s was valued at $5 million. This has risen to $200 billion in the past decade.Footnote 8 Some scientists predict that the average global temperature will rise by at least 3°C by the end of this century, which will result in the extinction of a large number of species (Fig. 11).

From the United Nations Framework Convention on Climate Change (UNFCCC) in 1992 to the Kyoto Protocol in 1997 and the Paris Agreement in 2015, the international community has been increasingly concerned about climate change and made vigorous efforts to reduce greenhouse gas emissions. The Paris Agreement sets ambitious goals for reducing greenhouse gas emissions. It established an approach based on the nationally determined contributions (NDCs) of each signatory country to reduce national emissions and adapt to the effects of climate change; and it reiterates the UNFCCC’s principle of the common but differentiated responsibilities of individual countries. The Paris Agreement represents the first consensus reached by the international community to combat climate change together, and the first proportionate response by the world’s political system to environmental threats. It also brought politicians and academics together, in agreement and on the same side. However, the process is full of twists and turns—the Trump administration announced withdrawal from the Paris Agreement in June 2017 and cancelled the Clean Power Plan introduced by the Obama administration in October 2017, both of which obstruct efforts to combat climate change. The Trump administration is also widely criticised by the international community for its regression and non-action about global climate change. To deliver the goal of emissions reduction, all countries must gradually reduce their use of fossil energy. It is, however, extremely difficult to arrange international negotiations on climate change and align developed and developing countries on climate protection goals, emissions reduction responsibilities and financial investments. As the country with the most advanced industry and the highest cumulative carbon emissions per capita, the USA should accept its responsibilities. Its decision to withdraw from the Paris Agreement is disappointing. Despite the intricate political and economic games behind the negotiations on climate change, the trend of international collaboration on combating climate change cannot be reversed (Fig. 12).

The sense of urgency felt by much of the world about controlling environmental pollution and combating climate change provides operational space for energy system change. Pollution like haze and environmental pollution constraints have made the public aware of the effects of energy consumption on the environment. As a result, the public generally supports energy system reform to control haze and alleviate energy constraints. People are willing to choose cleaner energy consumption and share the cost of environmental protection. As past international experience shows, the public’s recognition of clean development can force the government and business to focus on clean development—the Montreal Protocol on substances that deplete the ozone layer is a case in point (Fig. 13).

The green energy era began at the start of the 21st century. The principal trend in the global energy transition is the shift from fossil fuels to a sustainable, clean and low-carbon energy system. In developed economies, the share of low-carbon energy in the supply system is increasing. In 1974, Japan issued a new energy development plan to raise investment in developing and using solar, geothermal and hydrogen energy and synthetic natural gas, and identified the development of solar energy as a national strategy. In 2004, Japan introduced its strategic vision of developing new energy technologies, including solar and wind, into a pillar industry valued at JPY 3 trillion. This would include reducing oil use from 50% to 40% of its total energy consumption and increasing the share of new energy to 20%. In recent years, European and American countries have adopted a goal-oriented and systematic approach to achieving an energy transition by 2050. For example, as mentioned in the EU Energy Roadmap 2050, the share of renewables in total energy consumption will be more than 55% in 2050. A study by the U.S. Department of Energy said that renewables can meet 80% of power demand by 2050.

Clean energy is becoming a megatrend in global energy development. As the world’s largest energy consumer, China is already targeting an energy revolution. In energy technology, the Action Plan for Innovation in the Energy Technology Revolution (2016–30) and the 13th Five-Year Plan (2016–20) for Energy Technology Innovation have defined 15 innovation pathways for China’s energy technologies in the medium-to-long term. According to the Strategy of Energy Production and Consumption Revolution (2016–30), by 2020, the year before the 100th anniversary of the Chinese Communist Party, China will fundamentally change its model of extensive growth in energy consumption. Total energy consumption will be held within a 5 Btce limit and the share of coal consumption will be decreased. The share of non-fossil energy will be 15%, and energy consumption per unit of GDP will be 15% lower than in 2015. By 2030, the share of non-fossil energy and natural gas in total energy consumption will be around 20% and 15% respectively. Increases in energy demand will be met mainly by clean energy.

1.4 A Sound Legal System Will Secure the Energy Market and Guide the Energy Revolution

Energy in developed economies is based on a relatively mature market system. A sound legal system across the entire energy value chain gives developed economies a head start in energy development. For instance, Japan introduced a series of laws to implement emissions reduction measures and control energy demand growth in all sectors. To lower energy consumption, the USA issued a national energy efficiency policy and regulations and the National Appliance Energy Conservation Act. To reduce emissions, the USA passed the Clean Water Act, the Clean Air Act and the Solid Waste Disposal Act, and others.

Developed economies are at the forefront of new energy legislation. The UK government passed the Climate Change Act 2008 and the Energy Act 2011, which cover green energy options, energy efficiency and low-carbon technologies. The House of Representatives passed the American Clean Energy and Security Act of 2009 (ACES) to drive development of clean energy and energy security in the USA. In Japan in 2011, the House of Councillors and the House of Representatives passed the Act on Special Measures for Renewable Energy to promote new energy technology innovation and reduce dependence on nuclear power. Germany introduced the Renewable Energy Sources Act in 2014, which requires the share of new energy consumption to eventually exceed 50%. Earlier, in March 2009, Germany passed the Renewable Energies Heat Act to increase the share of renewable energy in heat production.

Renewable energy is an irreversible trend. According to the International Renewable Energy Agency, by the beginning of 2016 173 countries had set renewable energy development goals and 146 countries had introduced related support policies. For instance, by 2050 Denmark will be free from fossil fuels and in Germany renewable energy will account for 60% of energy consumption.

China has yet to introduce an energy law to support energy development. In May 2016, the National Energy Administration of China issued the Energy Legislation Plan 2016–20, identifying “five laws and four regulations” as priority projects. These include the Energy Law of the People’s Republic of China and laws on electric power, the coal industry, oil and gas, oil and gas pipelines, nuclear power administration, offshore oil and gas pipelines, national petroleum reserves, and energy supervision and administration. As the energy industry develops, the gap between safeguarding energy security and regulating and managing energy is increasingly apparent. To reform the supervision and administrative system of the energy industry in China, it is important to implement the Energy Law of the PRC.

In recent years, China’s new energy development has accelerated. Installed wind and solar power capacity is at a world-class level. However, there are still some challenges for China to address, including wind and solar curtailment, destructive exploitation of geothermal energy resources, and management and operational mechanisms for new energy development. Solving these problems will largely depend on adjusting relevant policies and laws and regulations, and by drawing on those of other countries.

1.5 The Energy Technology Revolution: IT, Smart Technologies and the Energy Internet

The energy landscape is undergoing major change. This is an age where technological breakthroughs are continually made in energy technologies and the energy system undergoes game-changing evolution. It is the age of systemic change, where the electricity market is increasingly deregulated and existing business and profitability models in the energy industry are shaken. This is the age of the Energy Internet (Internet+), where the Internet and energy are integrated and disruptors spring up to accelerate the game-changing process.

According to Jeremy Rifkin, a renowned American trend expert, the revolutionary combination of communications technologies and energy is breeding the third industrial revolution. Advanced information and communications technologies like the Internet of things (IoT), big data and cloud computing create the Energy Internet by reshaping energy production, transmission, marketing and use. The Energy Internet, with the smart grid as a carrier, is the inevitable result of the extension of Internet development into the energy and other industries. New technologies like cloud computing, IoT, big data and E-commerce connect people with things and enable dispersed components like information and the grid to be consistently managed. In this way, grid production and management can gradually emerge from their decentralised silos into a culture of centralised collaboration, thus improving business, management and innovation. As the integrator of energy and information, the Energy Internet will drive technological and industrial revolution and have a broad and profound impact.

Many governments and businesses are exploring Energy Internet projects. The US FREEDM project is building the Internet of energy: a network of distributed energy resources that intelligently manages power using secure communications and advanced power electronics. The German eTelligence project used Internet technologies to build a real-time electricity balancing and trading system, which manages intermittent, fluctuating levels of energy output using load adjustment to integrate new energy sources with the grid. It also provides a real-life example of how energy allocation can be adjusted using a real-time electricity trading system. And in China, the State Grid Corporation has initiated the concept of the “global energy Internet”, a globally connected smart grid that is designed to allow clean power transmission through ultra-high voltage transmission systems.

There are many other pilot projects that are focused on achieving optimal integration of distributed energy and microgrids. For instance, GCL’s distributed micro-energy grid and ENN’s Ubiquitous Energy Network (UEN) are both examples of a complementary regional multi-energy Internet that works across an extended industry chain. GCL has mainly focused on solar photovoltaic and combined heat and power, although it also operates in natural gas and smart energy; while ENN is mainly focused on fuel gas and the processing of fuel gas for power generation and cooling and heating services.

For traditional power grid businesses, the Energy Internet brings significant challenges. In particular, the deregulation of the distribution network and the openness and sharing that are inherent in the Energy Internet will significantly weaken these companies’ control of the grid. The availability of more competitive products and services will result in high-value customers leaving traditional power grid companies; this can already be seen in the continual customer loss that major grid companies in other countries have suffered after electricity market reform. Traditional power grid enterprises therefore need to: (i) change their mindset to one of active competition, maintain their strength on the demand side of the distribution network, and proactively develop integrated energy services like combined cooling, heat and power; (ii) develop clean energy on the supply side and in alignment with the relevant national policies; and (iii) focus on and incubate promising and competitive industries to rapidly connect the value chain. In short, traditional power grid companies need to transform themselves and become more competitive in the market.

For traditional power generators and other types of energy company, the era of the Energy Internet provides both opportunities and challenges. Power generation companies can gradually move from being behind the scenes to take centre stage and interact directly with customers. They need, however, to diversify their business portfolio. As demand growth for power slows down, power generation companies will need to adjust their business rapidly, because they are no longer competing solely with other power generation businesses, but with companies along the entire power value chain. To stay ahead in the Energy Internet, traditional power generation companies will need to focus on clean and distributed energy, and proactively develop integrated energy services that provide decision support for the demand-response system. In brief, they should be customer-oriented and target the end-user market.

For new energy companies, the Energy Internet will bring substantial financial benefits; many of these companies have already achieved fame and wealth from it. The conservative approach of the traditional energy companies, which often translates into a wait and see strategy, means that they have yet to show up fully as competitors. New energy companies should, therefore, take advantage of this opportunity and capitalise on their strengths by developing benchmark projects and industry standards, in readiness for a future counter-attack by the energy majors. In short, new energy companies should develop a flexible approach in order to proactively guide industry trends.

For power equipment companies, the Energy Internet undoubtedly poses higher demands on those implementing the Made in China 2025 strategy. For these companies, their top priorities are to address the weak integration of energy and the Internet, and to support and drive improvement in power equipment manufacturing. They should also consider collaborating with other companies to jointly develop solutions in the Internet of things and artificial intelligence. In brief, power equipment companies need to modernise and exercise their strengths in intelligent manufacturing.

For Internet and IT companies, big data is an important cornerstone of the Energy Internet. In April 2016, the National Development and Reform Commission (NDRC) issued its Guidelines on Promoting the Development of Internet+ Smart Energy. In these guidelines, the NRDC proposed developing energy big data service applications and outlined the requirements for IT companies and for the integration and secure sharing of big data, business service systems, and industry management and supervision systems. However, Internet and IT companies need to explore how to capture energy big data effectively and integrate it with other big data to maximise data value. In short, Internet and IT companies need to unlock the value of energy data.

1.6 New Energy Development and Storage Technologies: Cheaper and Better Renewable Energy Accelerates the Growth of a Low-Carbon Power System

According to Bloomberg New Energy Finance’s New Energy Outlook 2017, the cost of solar power and onshore wind power will drop by 66% and 47% respectively by 2040, and the operating cost of renewable energy will be lower than that of most fossil fuel power plants by 2030. As the report indicates, the transition of global power systems towards low-carbon energy will be faster than in previous predictions—the total global carbon emissions from power systems will peak in 2026, and by 2040 will be 4% lower than in 2016. One of the report’s authors says: “Thanks to rapidly decreasing solar and wind power costs and the increasingly important role of various battery technologies, including electric vehicle batteries, in balancing power supply and demand, the green power system represents an irreversible trend across the world”. The report also points out that solar and wind power will dominate the future power system. It estimates that by 2040, 72% of total global new investment in power generation will be in renewable energy ($7.4 trillion of the $10.2 trillion total). Solar power investment will be $2.8 trillion and its installed capacity will increase by a factor of 14, and wind power investment will be $3.3 trillion and its installed capacity will rise by a factor of 4. By 2040, wind and solar power will account for 48% of global installed capacity and 34% of global power output, significantly higher than the current levels of 12% and 5% respectively.

Solar energy will pose more challenges for coal-fired power generation. Currently, the levelised cost of energy of solar photovoltaic power is only a quarter of the 2009 level and is expected to fall by a further 66% by 2040, i.e. the solar power that can be purchased with $1 will be 2.3 times that of the current level. In Germany, Australia, the USA, Spain and Italy, the price of solar power is at the same level as coal power.

The cost of offshore wind power is expected to decrease faster than onshore wind power. Thanks to greater experience, intense competition, less risk and the substantial effects of economies of scale in large wind farms, the cost of offshore wind power will fall sharply by 71% by 2040. The cost of onshore wind power will drop by 47%, from a level that has declined by 30% over the past eight years. This is due to lower wind turbine costs, improved efficiency and more streamlined operations and maintenance.

New and flexible energy capacity, such as battery storage, will also facilitate the development of renewable energy. The market for lithium-ion batteries for energy storage systems is projected to grow to at least $239 billion by 2040. As a result, there will be increasingly intense competition between utility-scale battery storage and natural gas-fired power generation. As a report from the International Renewable Energy Agency shows, the cost of battery storage for some applications may fall by up to 66% by 2030. Declining battery prices could also increase the installed capacity of battery storage by a factor of 17, creating new business opportunities.

The increasing use of electric vehicles (EVs) will raise demand for electricity as well as help balance the power grid. By 2040, EVs will consume 13 and 12% of the power output in Europe and the USA respectively. Since EVs can be charged at peak times of renewable energy generation or when the wholesale electricity price is low, the power system will be able to accommodate intermittent energy sources such as solar and wind power better. The development of EVs will drive a reduction of 73% in the cost of lithium-ion batteries by 2030. At the same time, the use of fixed power storage technologies like EV batteries helps decarbonise energy end-use applications.

Household photovoltaic (PV) systems will become increasingly popular. By 2040, the output from rooftop PV systems will account for 24, 20, 15, 12, 5 and 5% of the total power output in Australia, Brazil, Germany, Japan, the USA and India respectively. The development of large renewable energy systems will squeeze the demand for power generated by coal- and natural gas-fired power plants. Even with the increased power demand from EVs, large fossil fuel-fired power plants will be under pressure to maintain their profitability.

1.7 Accelerating Change in Global Energy Governance: From OPEC and the IEA to Win-Win Cooperation

Global energy governance in the second half of the 20th century was epitomised by the ongoing struggle between the Organization of Petroleum Exporting Countries (OPEC), representing the interests of oil producers, and the International Energy Agency (IEA) under the Organization for Economic Co-operation and Development (OECD), which represents the interests of Western oil consumers.

In the 21st century, countries are increasingly concerned about energy security, as a result of which global energy governance has gradually improved. As the most important international energy organisation, the IEA has shifted from its initial goal of “preventing oil supply disruption” to “maintaining and improving system response to oil supply disruptions, promoting reasonable energy policies, strengthening cooperation with non-IEA countries, and industrial and international organisations across the world, operating a permanent international oil market information system, improving the global energy supply and demand structure, driving forward international collaborations on energy technologies through development of alternative energy and improvement of energy utilisation efficiency, and helping integrate environmental and energy policies”. To this end, it has taken a series of measures: strengthening exchange and negotiations with OPEC to promote stability in the international oil market; developing cooperation with Russia and emerging economies such as China and India through the G7 platform; and improving energy efficiency and promoting clean energy to address the huge challenges of global energy development and climate change. In 2012, the IEA put forward six basic principles to build an “efficient energy world”. These include making the economic benefits of energy efficiency more visible, so that regulation can encourage the promotion of energy-efficient technologies.

Global energy governance has developed as the energy industry has evolved. Over 150 years, the energy industry has become a major driver of progress in the world and a core industry in most major countries. However, as the number of participants in the world energy market gradually increases, global energy governance has become ever-more complicated. Despite the current mainstream message of win-win cooperation, the diverse economic and political features of energy make global governance a difficult task in the long term. It will take several decades for the world’s energy consumption to shift from fossil fuels to new energy alternatives, and the global game that currently surrounds fossil energy production, transport and consumption will remain and even intensify while the transition takes place. This can significantly affect international energy cooperation. In particular, the inherent structural conflict between energy producers and consumers makes dialogue and collaboration between them difficult. However, sovereign countries will continue to play a dominant and irreplaceable role in global energy governance, and their input and influence will be essential when it comes to building a new global energy governance system and navigating the energy technology revolution.

1.8 Global Energy Majors Accelerate Their Transformation into Integrated Energy Companies

In recent years, as environmental problems have become increasingly severe, a global consensus has formed around the shift to low-carbon and clean energy. In response to the need for a change in the overall structure of energy consumption, all countries are increasing their policy support for large-scale development of the new energy sector. As a result, the installed capacity of new energy is continuously increasing, the technical costs are rapidly decreasing and the return on investment is steadily improving.

International oil majors, including BP, Shell and Total, began investing in new energy in the 1990s. However, the profits that were available from continuously rising international oil prices after 2009 meant that they reduced their new energy investments or dropped parts of their new energy businesses altogether. After June 2014, the international oil price plunged and then settled at a sustained low price. At the same time, the oil majors recognised the existential role of climate change and the need for oil and gas companies to respond to societal concerns on climate change and play their part in the transition to a lower carbon world.

BP is the international oil giant with the deepest and widest footprint in new energy. the company has identified biofuels as a priority in its new energy business. According to BP, by 2035, the number of vehicles worldwide will grow to 1.8 billion units, double the current level. By then, despite the relatively sufficient availability of oil, the pressure from climate change and carbon emissions will increase, which BP suggests can be mitigated by biofuels. With more than 40 years of experience in hydrogen production and more than 10 years of experience in operating hydrogen refuelling stations, BP has been named the energy partner of the world’s two largest hydrogen demonstration projects in Europe and the USA. BP and the Ministry of Science and Technology of the People’s Republic of China have cooperated successfully on hydrogen energy projects, including China’s first hydrogen refuelling station. Wind power is one of the largest components in BP’s renewable energy business. BP currently operates 14 wind farms in seven states of the USA, with 2,200 MW of capacity.

Turning to Shell, new energy technology now accounts for a fifth of Shell’s annual R&D budget and is expected to become an important growth business. Raízen, a biofuels joint venture between Shell and Cosan, has evolved into the third largest biofuels company in Brazil, producing more than 2 billion litres of bioethanol and more than 20 billion litres of other industrial and transport fuels annually. In hydrogen, Shell plans to build 390 hydrogen retail sites by 2023, including 230 sites using Shell products. Shell has several wind farms in the USA and the Netherlands, with annual wind power output exceeding 500 MW. In 2017, Shell acquired NewMotion, which operates more than 30,000 eV charging stations in western Europe. The acquisition highlights how Shell has strong expectations that this represents the future trend in vehicle energy.

In the context of lower oil prices, Total plans to invest $500 million annually in new energy and expects to increase its share of the new energy market to 15–20% by 2035. Total’s solar energy has been listed among the world’s top three in terms of business size. A leading biofuels producer in Europe, Total began its development of biofuels in 1992, including the first generation of ethyl tert-butyl ether from ethanol and vegetable oil methyl ester. Currently, Total is developing the second generation of biofuels. In 2011, Total paid $1.4 billion for a 66% shareholding in SunPower, the world’s second largest solar panel manufacturer. SunPower made net profits of $246 million in 2014 and became a key pillar of Total’s business performance. In 2016, Total acquired Saft Groupe, a France-based battery manufacturer, for €950 million. This company ranks 15th in the world in fields like nickel-cadmium batteries, high-performance disposable lithium batteries and lithium-ion satellite batteries.

It is clear that these traditional energy titans have had a profound influence on technological progress, especially in new energy, while carrying out their own strategic readjustments.

2 Current Developments in China’s Energy Industry

In 2016, China’s energy supply and demand situation was generally improving. Structural reform of the supply side was under rapid implementation, and there was steady progress in realigning the energy system. However, the traditional sectors—coal, coal-fired power generation, refining and chemicals—were still running at overcapacity, and the development of clean energy was facing major challenges.

2.1 Slight Growth in Energy Demand and Significant Progress in Changing the Energy System

In 2016, China’s total energy demand was 4,360 million tonnes of coal equivalent (Mtce), up 1.4% (60 Mtce) on 2015. This was 2.2% lower than the average annual growth rate during the 12th Five-Year Plan (2011–15) and 5.3% lower than that for the 13th Five-Year Plan (2016–20).

The first reason for this change was a sharp decrease in China’s coal consumption, especially scattered coal. In 2016, China’s total coal consumption was 3,780 Mt, down 4.7% (185 Mt) from 2015. This was the third consecutive decrease since 2014, and it slowed down growth in total energy consumption. Between 2011 and 2015, China’s total energy consumption increased by 7.4%, an annual growth rate of less than 1.5%. This was in sharp contrast to the average annual growth rate of 7.9% between 2000 and 2011. China’s energy consumption per unit of GDP fell by 18.2% between 2011 and 2015, exceeding the goal of the 12th Five-Year Plan (2011–15); it then declined by a further 5% in 2016. This shows that China is supporting economic and social development, while reducing energy consumption and using less resources. Individual sectors tell a similar story: between January and November 2016, coal consumption in the power and steel industries decreased by 0.4% and 0.6% respectively, compared to the same period in 2015; coal consumption in building materials remained at the same level as 2015; coal consumption in chemicals increased by 7.2%; and coal use in other sectors decreased by 10.7%. Coal consumption in power, steel, building materials and chemicals represented 47.9%, 16.3%, 13.8% and 7.2% respectively of total coal use during the same period, up 0.6, 0.1, 0.3 and 0.6% from 2015, while coal consumption in other sectors accounted for 14.9% of the total, down 1.5% from 2015. The reduction in coal consumption in other sectors, especially of scattered coal, was driven mainly by the policies on air pollution control introduced in the previous two years. From 2016, major projects designed to reduce coal consumption, such as modernising coal-fired boilers and substituting waste heat and shallow geothermal energy for coal in household heating, were developed in the Beijing-Tianjin-Hebei region to reduce coal consumption. The scope of this pilot coal reduction and substitution programme was gradually expanded to include the Yangtze River and Pearl River deltas, as well as Liaoning, Shandong and Henan. The scope was also extended from power projects to non-power projects.

The second influential factor was that China’s power consumption grew steadily and the demand for power from service industries and households increased significantly. The National Energy Administration’s data show that China’s total power consumption was 5,920,000 gigawatt-hours (GWh) in 2016, up 5% from 2015 (an increase of 282,500 GWh). Specifically, the growth rate of power consumption by the service industries and urban and rural households was 11.2% and 10.8% respectively, far higher than the growth rate of 2.9% in manufacturing. The service industries and urban and rural households accounted for 56% of the country’s total power consumption.

The third factor was that consumption of oil products kept growing, though there was a clear difference between petrol and diesel. In 2016, as China restructured its economy and modernised consumption patterns, use of oil products continued to rise. According to the Bureau of Economic Operations Adjustment of the National Development Reform Commission (NDRC), China’s total consumption of oil products was 289 Mt in 2016, up 5% on 2015. Specifically, petrol consumption grew by 12.3%, due to the rising number of vehicles on the road. At the same time, macroeconomic trends and industrial restructuring led to a decline in diesel consumption, down 1.2% from 2015, although there was a gradual increase in demand for industrial diesel. Aviation fuel continued its high growth trend, up 10.4% on the preceding year but 7% points lower than previously due to the popularity of high-speed rail. High consumption levels of oil products and significant imports of crude oil meant China’s apparent oil consumption reached 556 Mt in 2016, up 5.5% on the previous year.

The fourth factor was that China’s natural gas consumption picked up, though its share of total energy use remained low. Data from the National Bureau of Statistics (NBS) show that China’s total apparent natural gas consumption reached 208.6 billion cubic metres in 2016, up 8 or 4.6% points on 2015 (an increase of 15.5 billion cubic metres). However, natural gas’s share of primary energy consumption remained at a low 6.3, only 4% higher than in the early 21st century. Driven by a market-oriented natural gas pricing system and new controls on air pollution, natural gas has begun to replace coal projects in many provinces. And on the residential side, a tiered gas pricing mechanism has been launched to encourage the shift to gas. In addition, natural gas consumption in several major sectors has significantly increased. According to the NBS data, the power sector used the most natural gas in 2015; gas consumption in the coal, gas and water production and supply sectors reached 35.27 billion cubic metres, up 30.87% on 2014 (an increase of 8.106 billion cubic metres).

The fifth factor is a significant increase in the use and share of non-fossil energy. In 2016, use of commercial non-fossil energy was around 541 Mtce, accounting for 12.4% of China’s total energy consumption. Adding non-commercial new energy brings the share to 13.3%, a rise of 1.3% on 2015. Initial estimates show that consumption of primary electricity reached about 1,701,000 GWh, up 11.2% (171,000 GWh) on 2015. Non-fossil energy use rose by about 60 Mtce, making it the largest contributor to the increase in consumption.Footnote 9

So, by taking a broad range of measures, China continued to optimise its energy system in 2016. Coal’s share of energy consumption decreased for the third consecutive year, and non-fossil energy was the main source of new energy use. Coal’s share of primary energy consumption was 62%, down 1.7% points on 2015, whereas oil’s share was 18.3%, similar to 2015. The share of natural gas and fossil fuels in primary energy consumption was 6.4% and 13.3% respectively, up 0.5% and 1.25% on 2015. Changes in China’s patterns of energy production and consumption over the past decade have impacted the relationship between supply and demand, driving reform (Fig. 14).

2.2 Sharp Decrease in Energy Production and Significant Rise in Clean Energy Supply

In 2016, China’s total primary energy production was about 3.46 Btce, down 4.2% from 2015. Coal and crude oil production sharply decreased, and natural gas and primary electricity slightly increased.

Coal production declined sharply in 2016, with raw coal production at 3.41 Bt, down 340 Mt (9%) on the previous year. This was consistent with the trend of declining coal consumption over the previous three years. There was a slight increase in the second half of the year, as some high-quality, safe and efficient capacity was released in August and September. The State Council of China announced in its Opinions on Alleviating Overcapacity in the Coal Sector to Secure Sound Development that the approval of new coal mines and mine modernisations to create additional capacity would be stopped from March 2016. For any new coal mines that were genuinely essential, the policy was to reduce outdated capacity and replace it with high-quality capacity. Thanks to the efforts to eliminate overcapacity, excess coal capacity was reduced by 290 Mt, which also helped stabilise the coal price.

There was also a clear drop in crude oil production, though refined crude oil output maintained its growth rate. In 2016, spurred by lower international oil prices, China’s crude oil producers further reduced inefficient production. Data from China’s NBS show that crude oil production was 199 Mt in 2016, down 6.9% on the previous year. This was also the first year since 2010 that crude oil production was less than 300 Mt, with the annual decrease exceeding 10 Mt for the first time. At the same time, regulations around the import and use of crude oil were relaxed. As a result, driven by high demand from the vehicle and aviation sectors, China’s crude oil processing capacity grew rapidly, reaching 541 Mt (up 3.6% on the previous year). In particular, crude oil processing capacity in Shandong, a province with several local oil refining companies, was 101 Mt, which made Shandong the first province to exceed 100 Mt in crude oil processing capacity. In 2016, China’s production of oil products stood at 345 Mt, an increase of 2.4%.

Natural gas production, on the other hand, rose slightly, and shale gas output grew rapidly. Coalbed methane (CBM) production also increased. In 2016, due to slower growth in domestic natural gas demand and a significant increase in natural gas imports, China’s production of conventional natural gas was 136.9 billion cubic metres, up slightly (1.7%) on 2015. Shale gas production maintained strong momentum, with production in 2016 reaching 7 billion cubic metres, up 52.2% on 2015. CBM developed slowly—CBM ground extraction reached 4.5 billion cubic metres, a slight increase of 1.7%, and CBM use was 4.2 billion cubic metres. Production of coal gas was 1.6 billion cubic metres, up 14.3% on the previous year. In 2016, the production and use of coalmine gas were 17.9 billion cubic metres and 8.8 billion cubic metres respectively, an increase of 96 and 148% compared to 2010.

Installed power capacity continued to grow, and non-fossil energy’s share of the power mix increased. According to data from the China Electricity Council, by the end of 2016, China’s installed power capacity reached 1,650 gigawatts (GW). Specifically, installed capacity and output of hydropower were 330 GW (up 3.92% on 2015) and 1,174,800 gigawatt-hours (GWh) (up 5.58% from 2015). The installed capacity and output of nuclear power were 33.64 GW (up 23.83%) and 213,100 GWh (up 24.39%). The installed capacity and output of grid-connected wind power were 147.47 GW (up 12.79%) and 240,900 GWh (up 29.78%). The installed capacity and output of grid-connected solar power were 76.31 GW (up 80.91%) and 66,500 GWh (up 68.51%). The installed capacity of non-fossil energy, including hydro, nuclear, wind and solar power accounted for 36.6% of China’s total installed power generation, while output from non-fossil energy generating units amounted to 29.14% of the total. New installed capacity in 2016 reached 120 GW, including 48.36 GW of thermal power, 19.3 GW of wind power, 34.54 GW of solar power, 11.7 GW of hydropower and 7.2 GW of nuclear power. Non-fossil energy accounted for 60% of China’s total new installed power capacity, the fourth consecutive year it exceeded 50%. This is clear evidence that China is continuing to optimise its power system. In 2016, China’s total power output was 5,990,000 GWh and the share of non-fossil energy was 28.4%, up 1.5% points on 2015. The new power output is equivalent to the 2016 output of two Three Gorges hydropower stations.Footnote 10

The breakdown of China’s primary energy production in 2006–15 is shown in Fig. 15. Raw coal production gradually declined, but is still the main component in energy production. In 2015, raw coal’s share of total primary energy production reached 78.2%, while the share of other energy sources exceeded 10%. Natural gas production increased at an average annual growth rate of 5.27%, reaching 5.3% of total primary energy production in 2015. The average annual growth rate of primary electricity and other energy sources was 6.94%. The share of other energy sources also increased, the result of China’s changing energy system. In the future, the market share of natural gas and renewable energy sources will increase, and their production share could also continue to increase.

China should: (i) develop an energy supply system based on solar, wind, hydro, nuclear and biomass as well as other clean energy sources, complemented by fossil energy such as coal and oil; (ii) encourage energy producers to invest more in clean energy technologies and production, give clean energy priority access to the market, and increase the share of clean energy in the energy supply system; and (iii) implement appropriate taxes and financial policies on fossil fuel energy production and supply, and reduce the development of existing conventional fossil energy resources.

2.3 Energy Efficiency Policies Gradually Take Effect and Controls on Energy Consumption and Energy Intensity Produce Results

Energy efficiency is a key component in building a greener civilisation. Energy efficiency is not just about reducing energy use, but also about improving energy productivity, sharpening industrial competitiveness and creating an efficient and modern energy system. The measures to achieve this include reshaping patterns of production and living, restructuring the economy, optimising the industrial system, increasing the share of clean energy, and making energy use more efficient. Energy efficiency can pave the way for a green and low-carbon society and help realise the centenary goals to mark the founding of the Communist Party of China in 2021 and the People’s Republic of China in 2049. Those two goals are building a moderately prosperous society in all respects by 2021 and transforming China into a modern socialist country that is prosperous, strong, democratic, culturally advanced and harmonious by 2049.

In 2016 the State Council of China issued the Overall Work Plan for Energy Conservation and Emissions Reduction for the 13th Five-Year Plan (2016–20), outlining targets for energy efficiency: by 2020, the energy consumption per unit of GDP should be RMB 10,000, 15% lower than in 2015, and total energy consumption should remain less than 5 Btce. Moreover, the goal of controlling total energy consumption and energy intensity would be delegated to the provinces. As part of the 2016 plan, the National Development and Reform Commission (NDRC) and other authorities were entrusted by the State Council to evaluate provincial government success in delivering the energy efficiency goals of the 12th Five-Year Plan (2011–15). The provinces also had to define their 2016 and 2017 targets for controlling total energy consumption and energy intensity. In 2017, NDRC and its partner authorities assessed the provincial governments’ progress in fulfilling those targets. Twelve ministries and commissions, including the NDRC, the Ministry of Science and Technology, the Ministry of Industry and Information Technology and the Ministry of Finance, jointly issued the Action Plan for National Energy Saving during the 13th Five-Year Plan (2016–20). The plan defined the top 10 energy-saving measures to achieve the targets, including deploying energy-efficient products and promoting energy saving. The introduction of regulations on energy saving—including the Measures for Energy Conservation Supervision, the Measures for the Energy Conservation Review of Fixed-Asset Investment Projects, the Plan for Developing the Energy Saving Standard System and the Measures for the Administration of Energy Efficiency Labels—helped drive energy saving.

With policy support, China began to promote energy efficiency in key sectors. In 2016, the Energy Efficiency Forerunner Programme, designed to make China a leader rather than a follower in energy efficiency, was extended. In the same year, the NDRC and the General Administration of Quality Supervision, Inspection and Quarantine of the People’s Republic of China published the Energy Efficiency Forerunner Product Catalogue for household refrigerators, flat-panel TVs and adjustable-speed air conditioners. The NDRC provided investment support to improve energy efficiency in energy-intensive sectors, promote energy conservation, and improve energy use in urban street lighting, airports, stations and ports. China issued the Measures for the Administration of Energy Conservation in Major Energy-Consuming Enterprises, launched the “100-1,000-10,000” energy conservation programme,Footnote 11 and drove the development of an online energy consumption monitoring system of major energy-consuming enterprises. The Ministry of Housing and Urban-Rural Development made great progress in implementing the green building initiative. The Ministry of Transport promoted the development of a modern, integrated transport system and established a green transport network.

Thanks to the efforts made by these stakeholders, China’s total energy consumption was effectively controlled in 2016, and the energy consumption per unit of GDP reduced by 5% compared to the previous year, thus exceeding the targets for 2016. Overall, China reduced energy consumption by 230 Mtce, equivalent to about 500 Mt of CO2 emissions.

2.4 Fossil Fuel Energy Prices Rebound and the Electricity Price Continues to Decline

In 2016, oversupply in the international market slackened and China’s energy supply reforms were strengthened. As a result, the price of major energy sources rebounded after levelling out, though there was much variation among them.

The price of coal increased slightly in the first half of 2016, rose significantly in the third quarter (Q3), then stabilised at the end of 2016. The price rise in those six months could be seen in the Bohai-Rim Steam-Coal Price Index (BSPI) for 5,500 kilocalories per kg (kcal/kg) thermal coal, which reached RMB 401 per tonne at the end of June, RMB 30/t higher than earlier in the year. Between July and October the price rose quickly, and by the end of October exceeded RMB 600/t, RMB 236/t higher than at the start of the year. At the beginning of Q3, several advanced capacity projects came into operation and dealers released their stockpiles, substantially increasing the amount of coal on the market. Between November and December, the coal price slowly declined, RMB 14/t lower at the end of 2016 than its high point for the year. The coal market then stabilised.

The international oil price rose irregularly after hitting the bottom, and prices of oil products in China increased correspondingly. At the beginning of 2016, Brent and West Texas Intermediate (WTI) prices had plunged to $27.88 per barrel (bbl) and $26.21/bb respectively, the lowest point of the year, after which they gradually picked up. By the end of 2016, Brent and WTI prices had doubled—both exceeding $50/bbl. However, due to an easing in both supply and demand, rebalancing was slower than expected. In addition, the lowering costs and improving efficiency of US shale oil also restricted a rise in oil price. In 2016, of the 25 adjustment cycles for oil products in China, there were five downward adjustments, 10 upward adjustments and 10 non-adjustments. The annual cumulative price rises of petrol and diesel were RMB 1,015/t and RMB 975/t.

The international natural gas price remained at a low level, while that of imported natural gas significantly declined. In 2016, the gas price in international markets dropped—the average annual Port Henry price, UK National Balancing Price (NBP) and Japan Liquefied Natural Gas Import price were 2.49/$ per million British thermal units (Mbtu), $4.64/Mbtu and $6.8/Mbtu respectively, down 5%, 30% and 36% respectively on the previous year, and the price differences between the three indexes narrowed. According to statistics from the General Administration of Customs, China’s average natural gas import price was $305/t in 2016, down 27% on 2015. In particular, the average price of imported pipeline gas and imported LNG were $270/t and $343/t, 31 and 24% lower than in 2015.

The electricity price continued to decline, which helped lower the cost to the real economy. In January 2016, China introduced the coal-electricity price linkage mechanism, and lowered the feed-in tariff for coal-fired generating units and the retail price for general industrial and commercial use by RMB 0.03/kWh, helping businesses to reduce their electricity expenditure by about RMB 22.5 billion. The feed-in tariff for renewable energy decreased: the benchmark feed-in tariff for onshore wind power in Class 1, 2 and 3 resource-rich areas was decreased by RMB 0.03/kWh, and in Class 4 resource-rich areas by RMB 0.01/kWh. The benchmark feed-in tariff for solar photovoltaic power in Class 1 and 2 resource-rich areas was decreased by RMB 0.1/kWh, and in Class 3 resource-rich areas by RMB 0.02/kWh. The pilot reform of power transmission and distribution pricing passed the strict cost supervision and review test, reducing power transmission and distribution prices by 16.3%.

2.5 Imports of Major Energy Sources Grow Rapidly and Oil and Gas Imports Hit a Record High

In the context of lower international energy prices, China’s imports of coal, crude oil and natural gas grew rapidly in 2016, with growth rates exceeding 10%. As a result, China’s dependence on oil and gas imports rapidly increased. Exports of oil products also grew significantly.

The strong rebound in China’s coal price stimulated a significant increase in coal imports. International coal prices, affected by trends in bulk energy commodities like oil, rose only slightly. Meanwhile, lower shipping prices made imported coal more price-competitive in China’s south-east coastal areas. All these factors led to coal imports increasing from May 2016 onwards, with total coal imports in 2016 reaching 256 Mt, up 25.2% from 2015, while coal exports were 8.78 Mt. Net coal imports were 247 Mt, 48 Mt (24.2%) higher than in 2015.

Due to a build-up in oil reserves and changes in the regulations regarding the right to import crude oil, China’s crude oil imports grew sharply to 381 Mt in 2016, equal to that of the USA. This figure was 45 Mt higher than in 2015, reflecting an annual growth rate of 13.6%. Driven by this significant growth, China’s dependence on oil imports hit a record high of 64.4, 3.9% points higher than in 2015.

Despite the limited growth in domestic demand, China’s annual net exports of oil products reached 32.55 Mt, a substantial increase of 11.2 Mt compared to 2015. Exports of oil products accounted for 10.7% of China’s total crude oil processing capacity, and 17.9% of the total net oil product exports of the Asia-Pacific region in 2016, 5.2% points higher than in 2015. China became the third largest exporter of oil products in Asia-Pacific, after Japan and South Korea.

In 2016, due to lower international natural gas prices, rising natural gas demand in China and many new long-term contracts, China’s natural gas imports resumed their high growth, though this came at the cost of lower production at domestic gas fields. Data issued by the National Bureau of Statistics of China show that natural gas imports were about 74.5 billion cubic metres in 2016, an increase of 21.9% on the previous year. LNG imports increased particularly sharply, by 11 billion cubic metres. In addition, China’s dependence on natural gas imports reached 34.2%, up 3.1% points.

2.6 Variations in Energy Company Profitability and Demands that the Petrochemical and Power Sectors Develop Sustainably

In 2016, the diverging price trends of major energy sources caused business performance to vary in the different energy sectors. In particular, coal companies significantly improved their operating performance, while upstream oil and gas companies made losses and midstream oil and gas companies enjoyed steady profits. The profitability of coal-fired power plants declined and non-fossil energy companies registered losses.

In the first half of 2016, a slight rise in the coal price helped to improve the performance of coal companies. Between January and April, the coal mining and coal washing and preparation sector reported total profits of RMB 960 million, down 92% on the same period in 2015. From May onwards, however, coal company profits increased month by month. In 2016, the cumulative profits of the coal mining and coal washing and preparation sector reached RMB 109.09 billion, up 223.6% on 2015. In contrast, the total profits of the mining industry decreased by 27.5% against 2015. Total profits of the coal mining and preparation sector were 60% those of the mining industry, significantly improving the performance of coal companies.

The performance of oil and gas companies varied greatly—oil and gas exploration and development suffered losses but refining and chemicals made huge profits. According to the CNPC Economics & Technology Research Institute, due to lower international oil prices, the profits of China National Petroleum Corporation (CNPC), which has a large share of the upstream oil and gas exploration and production business, decreased sharply by 94.34% in 2016, while China National Offshore Oil Corporation (CNOOC), which is also in the upstream business, suffered a huge loss of RMB 7.735 billion in the first half of 2016. Benefiting from national legislation on oil products, China Petroleum & Chemical Corporation (or Sinopec), which has a higher share of the refining and chemical businesses, reported profit growth of 11.2%. In the context of lower oil prices, the performance of international and Chinese oil companies was weaker. As a result, reducing investments and costs and improving operational efficiency was a common remedy for most oil companies.

In 2016, the profit margins of coal power companies were squeezed significantly due to lower feed-in tariffs, rising coal prices, a sharply decreasing electricity price and lower output. According to statistics from the China Electricity Council, between January and November 2016, the total profits made by the top five Chinese power generation groups amounted to RMB 54.2 billion, down 45% on the same period in 2015. In particular, the profits of coal power businesses dropped by 67.4%. Preliminary estimates show that the reduction in profits in China’s coal power sector resulting from lower feed-in tariffs, rising coal prices and lower output were RMB 110 billion, RMB 7 billion and RMB 7.4 billion respectively.

Due to difficulties connecting renewable energy to the grid, non-fossil energy companies suffered large losses. In 2016, the restrictions on connecting non-fossil energy to the grid became a severe problem—about 150,000 GWh of clean power was not used effectively, equivalent to a reduction in turnover of RMB 60–80 billion. This undoubtedly affected the profitability of non-fossil energy companies. In addition, lower renewable energy subsidies also resulted in higher financial losses for these businesses. Initial estimates show that the gap that renewable energy subsidies failed to cover in 2016 exceeded RMB 60 billion.Footnote 12

2.7 Coalbed Methane Is Developing Well, but Challenges Need to Be Addressed Urgently

On November 24, 2016, the National Energy Administration of China released the 13th Five-Year Plan (2016–20) for Coalbed Methane (CBM) Development and Use. The 3rd Five-Year Plan (1966–70) for the CBM sector is the guideline for China’s exploration and use of CBM during the 13th Five-Year Plan. The 13th Five-Year Plan is the decisive stage in building a moderately prosperous society in all respects and a critical period for adjusting the energy system towards diversified energy supply and clean energy. The CBM sector faces both opportunities and challenges, but the opportunities tend to outweigh the challenges.

On the one hand, the external environment is generally favourable. China has implemented the necessary energy supply structural reforms to: (i) increase the share of non-fossil energy and natural gas in total energy production and demand; (ii) raise the share of natural gas in total primary energy demand to 10%; and (iii) encourage the development of CBM. China has also implemented an innovation strategy and accelerated the local development of critical technologies and equipment. As a result, the technological bottlenecks constraining CBM development are expected to disappear. As China introduces increasingly strict requirements for safety in coal mines, the safe extraction of coalmine gas is a fundamental means to prevent gas explosions. China has made a solemn commitment to the international community to decrease CO2 emissions per unit of GDP by 40–45% by 2020, and that CO2 emissions will peak around 2030. These factors bring a hard-won opportunity for the rapid development of the CBM sector.