Abstract

Using machine learning techniques in financial markets, particularly in stock trading, attracts a lot of attention from both academia and practitioners in recent years. Researchers have studied different supervised and unsupervised learning techniques to either predict stock price movement or make decisions in the market.

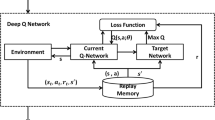

In this paper we study the usage of reinforcement learning techniques in stock trading. We evaluate the approach on real-world stock dataset. We compare the deep reinforcement learning approach with state-of-the-art supervised deep learning prediction in real-world data. Given the nature of the market where the true parameters will never be revealed, we believe that the reinforcement learning has a lot of potential in decision-making for stock trading.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

Notes

- 1.

According to NASDAQ standard, recommendation from analysts can be Strong Buy, Buy, Hold, Underperform or Sell. Reference: https://www.nasdaq.com/quotes/analyst-recommendations.aspx. Accessed on 07-September-2019.

- 2.

- 3.

References

Azhikodan, A.R., Bhat, A.G., Jadhav, M.V.: Stock trading bot using deep reinforcement learning. In: Innovations in Computer Science and Engineering, pp. 41–49. Springer, Singapore (2019)

Bisoi, R., Dash, P.K.: A hybrid evolutionary dynamic neural network for stock market trend analysis and prediction using unscented Kalman filter. Appl. Soft Comput. 19, 41–56 (2014)

Bradley, D.A.: Stock Market Prediction: The Planetary Barometer and how to Use it. Llewellyn Publications, Woodbury (1948)

Chong, E., Han, C., Park, F.C.: Deep learning networks for stock market analysis and prediction: methodology, data representations, and case studies. Expert Syst. Appl. 83, 187–205 (2017)

Dang, Q., Ignat, C.: Computational trust model for repeated trust games. In: Trustcom/BigDataSE/ISPA, pp. 34–41. IEEE (2016)

Deng, Y., Bao, F., Kong, Y., Ren, Z., Dai, Q.: Deep direct reinforcement learning for financial signal representation and trading. IEEE Trans. Neural Netw. Learn. Syst. 28(3), 653–664 (2017)

Elton, E.J., Gruber, M.J., Brown, S.J., Goetzmann, W.N.: Modern Portfolio Theory and Investment Analysis, 9th edn. Wiley, Hoboken (2014)

Florescu, I., Mariani, M.C., Stanley, H.E., Viens, F.G.: Handbook of High-frequency Trading and Modeling in Finance, vol. 9. Wiley, Hoboken (2016)

Föllmer, H., Schied, A.: Stochastic Finance: An Introduction in Discrete Time, 4th edn. Walter de Gruyter, Berlin (2016)

Göçken, M., Özçalici, M., Boru, A., Dosdogru, A.T.: Stock price prediction using hybrid soft computing models incorporating parameter tuning and input variable selection. Neural Comput. Appl. 31(2), 577–592 (2019)

Granger, C.W.J., Morgenstern, O.: Predictability of Stock Market Prices. Heath Lexington Books, Lexington (1970)

van Hasselt, H., Guez, A., Silver, D.: Deep reinforcement learning with double q-learning. In: AAAI, pp. 2094–2100. AAAI Press (2016)

Henrique, B.M., Sobreiro, V.A., Kimura, H.: Literature review: machine learning techniques applied to financial market prediction. Expert Syst. Appl. 124, 226–251 (2019)

Hester, T., Vecerík, M., Pietquin, O., Lanctot, M., Schaul, T., Piot, B., Horgan, D., Quan, J., Sendonaris, A., Osband, I., Dulac-Arnold, G., Agapiou, J., Leibo, J.Z., Gruslys, A.: Deep q-learning from demonstrations. In: AAAI, pp. 3223–3230. AAAI Press (2018)

Hiransha, M., Gopalakrishnan, E.A., Menon, V.K., Soman, K.: NSE stock market prediction using deep-learning models. Procedia Comput. Sci. 132, 1351–1362 (2018)

Ignat, C.L., Dang, Q.V., Shalin, V.L.: The influence of trust score on cooperative behavior. ACM Trans. Internet Technol. (TOIT) 19(4), 46 (2019)

Jacobs, R.A., Jordan, M.I., Nowlan, S.J., Hinton, G.E., et al.: Adaptive mixtures of local experts. Neural Comput. 3(1), 79–87 (1991)

Jangmin, O., Lee, J., Lee, J.W., Zhang, B.T.: Adaptive stock trading with dynamic asset allocation using reinforcement learning. Inf. Sci. 176(15), 2121–2147 (2006)

Jiang, X., Pan, S., Jiang, J., Long, G.: Cross-domain deep learning approach for multiple financial market prediction. In: IJCNN, pp. 1–8. IEEE (2018)

Krizhevsky, A., Sutskever, I., Hinton, G.E.: Imagenet classification with deep convolutional neural networks. In: NIPS, pp. 1106–1114 (2012)

Längkvist, M., Karlsson, L., Loutfi, A.: A review of unsupervised feature learning and deep learning for time-series modeling. Pattern Recogn. Lett. 42, 11–24 (2014)

Lee, J.W.: Stock price prediction using reinforcement learning. In: ISIE 2001. 2001 IEEE International Symposium on Industrial Electronics Proceedings (Cat. No. 01TH8570), vol. 1, pp. 690–695. IEEE (2001)

Lo, A.W., Mamaysky, H., Wang, J.: Foundations of technical analysis: computational algorithms, statistical inference, and empirical implementation. J. Financ. 55(4), 1705–1765 (2000)

Long, W., Lu, Z., Cui, L.: Deep learning-based feature engineering for stock price movement prediction. Knowl. Based Syst. 164, 163–173 (2019)

Malkiel, B.G., Fama, E.F.: Efficient capital markets: a review of theory and empirical work. J. Financ. 25(2), 383–417 (1970)

Menon, V.K., Vasireddy, N.C., Jami, S.A., Pedamallu, V.T.N., Sureshkumar, V., Soman, K.: Bulk price forecasting using spark over NSE data set. In: International Conference on Data Mining and Big Data, pp. 137–146. Springer, Cham (2016)

Mitra, S.K.: How rewarding is technical analysis in the indian stock market? Quant. Financ. 11(2), 287–297 (2011)

Mnih, V., Kavukcuoglu, K., Silver, D., Graves, A., Antonoglou, I., Wierstra, D., Riedmiller, M.A.: Playing Atari with deep reinforcement learning. CoRR abs/1312.5602 (2013)

Nazário, R.T.F., e Silva, J.L., Sobreiro, V.A., Kimura, H.: A literature review of technical analysis on stock markets. Q. Rev. Econ. Financ. 66, 115–126 (2017)

Nison, S.: Japanese Candlestick Charting Techniques: A Contemporary Guide to the Ancient Investment Techniques of the Far East. Penguin, New York (2001)

Park, C.H., Irwin, S.H.: What do we know about the profitability of technical analysis? J. Econ. Surv. 21(4), 786–826 (2007)

Patel, J., Shah, S., Thakkar, P., Kotecha, K.: Predicting stock and stock price index movement using trend deterministic data preparation and machine learning techniques. Expert Syst. Appl. 42(1), 259–268 (2015)

Preis, T., Moat, H.S., Stanley, H.E.: Quantifying trading behavior in financial markets using Google trends. Sci. Rep. 3, 1684 (2013)

Rilling, G., Flandrin, P., Goncalves, P., et al.: On empirical mode decomposition and its algorithms. In: IEEE-EURASIP Workshop on Nonlinear Signal and Image Processing, vol. 3, pp. 8–11. NSIP 2003, Grado (I) (2003)

Schulmeister, S.: Profitability of technical stock trading: has it moved from daily to intraday data? Rev. Financ. Econ. 18(4), 190–201 (2009)

Sewak, M.: Deep Reinforcement Learning - Frontiers of Artificial Intelligence. Springer, Singapore (2019)

Simon, H.A.: A behavioral model of rational choice. Q. J. Econ. 69(1), 99–118 (1955)

Sutton, R.S., Barto, A.G.: Reinforcement Learning: An Introduction. MIT Press, Cambridge (2018)

Thomsett, M.C.: Getting Started in Fundamental Analysis. Wiley, Hoboken (2006)

Wang, J., Leu, J.: Stock market trend prediction using ARIMA-based neural networks. In: ICNN, pp. 2160–2165. IEEE (1996)

Wang, Z., Schaul, T., Hessel, M., van Hasselt, H., Lanctot, M., de Freitas, N.: Dueling network architectures for deep reinforcement learning. In: ICML. JMLR Workshop and Conference Proceedings, vol. 48, pp. 1995–2003. JMLR.org (2016)

Zhai, Y.Z., Hsu, A.L., Halgamuge, S.K.: Combining news and technical indicators in daily stock price trends prediction. In: ISNN (3). Lecture Notes in Computer Science, vol. 4493, pp. 1087–1096. Springer, Heidelberg (2007)

Zhang, G.P.: Time series forecasting using a hybrid ARIMA and neural network model. Neurocomputing 50, 159–175 (2003)

Zhang, X., Li, A., Pan, R.: Stock trend prediction based on a new status box method and adaboost probabilistic support vector machine. Appl. Soft Comput. 49, 385–398 (2016)

Zhou, F., Zhou, H., Yang, Z., Yang, L.: EMD2FNN: a strategy combining empirical mode decomposition and factorization machine based neural network for stock market trend prediction. Expert Syst. Appl. 115, 136–151 (2019)

Acknowledgment

We would like to thank the anonymous reviewer for valuable comments.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 Springer Nature Switzerland AG

About this paper

Cite this paper

Dang, QV. (2020). Reinforcement Learning in Stock Trading. In: Le Thi, H., Le, H., Pham Dinh, T., Nguyen, N. (eds) Advanced Computational Methods for Knowledge Engineering. ICCSAMA 2019. Advances in Intelligent Systems and Computing, vol 1121. Springer, Cham. https://doi.org/10.1007/978-3-030-38364-0_28

Download citation

DOI: https://doi.org/10.1007/978-3-030-38364-0_28

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-38363-3

Online ISBN: 978-3-030-38364-0

eBook Packages: Intelligent Technologies and RoboticsIntelligent Technologies and Robotics (R0)