Abstract

This work constitutes a theoretically-informed empirical analysis of the spatial characteristics of the short-term rentals’ market and explores their linkage with shifts in the wider housing market within the context of a south-eastern EU metropolis. The same research objective has been pursued for a variety of international paradigms; however, to the best of our knowledge, there has not been a thorough and systematic study for Athens and its neighborhoods. With a theoretical framework that draws insight from the political-economic views of Critical Geography, this work departs from an assessment of Airbnb listings, and proceeds inquiring the expansion of the phenomenon with respect to the rates of long-term rent levels in the neighborhoods of Central Athens, utilizing relevant data. The geographical framework covers the City of Athens as a whole, an area undergoing profound transformations in recent years, stemming from diverse factors that render the city one of the most dynamic destinations of urban tourism and speculative land investment. The analysis reveals a prominent expansion of the short-term rental phenomenon across the urban fabric, especially taking ground in hitherto underexploited areas. This expansion is multifactorial, asynchronous and exhibits signs of positive relation with the long-term rentals shifts; Airbnb not only affects already gentrifying neighborhoods, but contributes to a housing market disruption in non-dynamic residential areas.

You have full access to this open access chapter, Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

The expansion of short-term rental (STR) markets in recent years is a reality that definitely affects living conditions, especially in urban areas. This fact can be attributed to a number of characteristics of STRs, like their ability to take advantage of local landmarks (more than hotels do) because of their capacity to expand in already built-up areas, without the need of specific permits or being subject to land use zoning [6]. This is exceptionally important in the context of urban tourism, a rapidly growing part of the tourism industry, affecting mainly lower-end hotels and those not targeting affluent business travelers [7]. The increasing number of STR listings has generated controversies on several issues of regulation, housing markets and various other spatio-temporal effects [17]. Thus, it calls for urgent research attention based on, among other things, the perspective of humanistic data mining.

Within the STR market, AirbnbFootnote 1, an online peer-to-peer (P2P) accommodation platform, holds a prominent share. Airbnb is a global phenomenon; since its emergence in 2007, it has managed to expand to 81 thousand cities across 191 countries, currently counting more than 6 million listings. While linkages between the spatial characteristics of the platform’s listings and shifts in the housing market have been studied for a variety of cities, like New York [15], Boston [8] or even Barcelona [14], there has not been, to the best of our knowledge, a thorough study for a south-eastern EU metropolis, like Athens and its neighborhoods.

The main aim of the current research is to tentatively discuss the consolidation of Airbnb in the city of Athens and associate it with several socio-economic aspects in specific city areas. The expansion of STRs is viewed as an outcome of several processes, needs and antinomies; i.e through the lens of transnational capital flows into the housing market of a dynamic city. Departing from an analysis of STRs listings (number, density) within the context of the biggest Greek city, we proceed by relating their expansion with an increase in long-term rental (LTR) prices. Specifically, it is highlighted how STRs might put pressure on other forms of housing, causing rents and property values to rise, as residences become “cash cows” [8] and reinforce gentrification [11].

2 The Spatialities of Short-Term Rentals

At the global scale, the Airbnb “community” sprawls in a heterogeneous fashion [9], being mainly used in macro-peripheries where tourism is already a prominent industry, boasts dynamic development overall and the population is “technologically savvy” [7]. The majority of entries regard entire house renting, indicating that the commercial use of Airbnb is pervasive, rendering the platform a rental marketplace rather than a true sharing economy mediator. This reality is further characterized by the heavy involvement of business operators whose presence is obscured by the use of “front men”. In 2017, it was found that almost \(70\%\) of all listings globally referred to entire apartments/houses [9], while in 2016 almost half of the lodgings researched in 5 global cities referred to traditional holiday businesses [5]. Additionally, Airbnb functions often as a mechanism that allows middle and upper-class homeowners to consolidate their position in expensive housing markets, in addition to being a channel of extra income for the urbanities of lower classes, who experience an exacerbated vulnerability amid conditions of low affordable housing stock and high tourist demand [5].

One of the earliest arguments in favor of Airbnb was that it would disperse the supply of tourism-oriented accommodation, relieving areas receiving heavy visitor flows. Nevertheless, an analysis for Barcelona [13] concluded that Airbnb functions as a force concentrating supply rather than decentralizing it. On top of that, the way listings unravel follows a pattern that derives from a specific sociocultural profile regarding both hosts and guests [13].

Apart from Barcelona, STR listings in Europe show significant concentrations in Paris, London, and Rome. Athens also exhibits high concentrations relative to its population, even though it is not among the European cities with the largest number of Airbnb entries. In the US, most Airbnb activity is located in five specific cities: New York, Los Angeles, San Francisco, Miami and Boston [10].

Specifically, New York holds a prominent position in the relevant literature, boasting an exceptionally consolidated activity of the STR market. At the same time, it shows concrete signs of ongoing dynamism and expansion (followed by San Francisco, Miami, Oakland and Oahu [7]) but it also exhibits falling rates of profitability in relation to LTRs. Listings are again mainly located in downtown areas, even though lately they tend to expand to hitherto under-exploited, residential areas [4], resonating with the recent situation in Barcelona as well [6]. In poorer areas, Airbnb seems to be reaffirming its original purpose as a niche sharing economy, with private rooms - which stand for a more casual use of the platform - holding a disproportionate presence [4].

3 The Impact on Long-Term Rentals

The second issue relevant to our research, is the effect of Airbnb – and the STR phenomenon in general – on housing availability and affordability, specifically on LTR levels. There are arguments postulating against such a linkage, as in many cases the P2P accommodation market is very small in comparison to that of LTRs; the reliance of landlords upon long-term tenants, and the falling rates of STRs [4] could be strong factors towards this direction. Another issue keeping short-term and LTRs’ markets afar is the extensive use of housing units that would have remained out of circulation had they not been Airbnb entries; this is particularly the case with spare rooms, that could not be rented out to regular tenants [3]. In some cases, this connection could even be reversed, with STRs causing rents’ decrease, due to the overuse of commons by more people and the negative externalities the higher densities in uses and human flows the rise of P2P accommodation brings [15]. However, there are clear indications linking the STR phenomenon with rents’ inflation [13]; the mobilization of tourism-oriented companies, which in many cases spread their investments across multiple geographical localities and pour a large number of listings into the P2P accommodation market, the stagnation of rent levels even amid recessive pressures that would normally cause shrinkage, or more importantly, the multiple cases where cities experience stark rates of rising rents, such as in San Francisco - which, ironically, is the home city of the Airbnb company itself. Most conducted studies conclude that a link between rising rents and STRs expansion is intuitively relevant and “straightforward” [15].

More specifically, one of the first works that theorized in a systematic way upon the aforementioned connection, identified two mechanisms that distort the housing market and limit the supply of affordable housing [11]. The first refers to the “simple conversion” of houses previously rented out long-term into Airbnb entries year-round. This mechanism generates a relatively insignificant rise in rents citywide, that mainly affects already gentrifying and affluent neighborhoods, as well as downtown areas where the rental market is tighter. However, the impact of the second mechanism is argued to be more severe, and it refers to cases where landlords decide to turn whole buildings into Airbnb listings [16]. In these instances of “hotelization”, the supply of housing is significantly shrunk, spurring displacement and gentrification.

Today, it is widely believed that the link between STRs and rent-inflation is tangible and severely affects contemporary cities [11, 18]. Empirically, existing research has managed to correlate a specific level of rents inflation to the expansion of STR markets in New York [15], Boston [8] and Barcelona [14].

4 The Case of Athens, Greece

4.1 Data

Airbnb does not, so far, provide any data on the spread of its platform on the various cities it operates. Therefore, in order to examine its influence, external sources had to be used, like Inside AirbnbFootnote 2, a website providing both relevant data dumps and tools for downloading the desired information directly from Airbnb. More specifically, Inside Airbnb collects and publishes data dumps of the listings that appear on the P2P platform for various cities and on various dates (recently, it has been collecting data on an almost monthly basis). Each dump consists of a number of files that provide insight on different aspects of the phenomenon; describing in detail the collected listings, designating when each listing is available for rental on the platform and finally containing the reviews it has received so far.

List of Athens’ neighborhoods (numbering is according to Table 1)

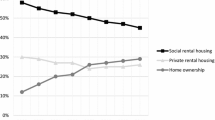

LTR prices, on the other hand, are provided by RE/MAX [1], a private agency conducting surveys on the real estate market in Greece. RE/MAX releases data on LTRs and mean prices per neighborhood, which are conducted on an annual basis and regard the whole domestic market. It should be noted that the spatial boundaries of the neighborhoods in RE/MAX reports are different from the ones Airbnb uses. Figure 1 shows Athens’ neighborhoods as designated in the Airbnb platform. In order to achieve a controlled comparison between the data on short and long-term rentals, the neighborhoods from the private firm have been adapted to the Airbnb neighborhood format (as shown in Fig. 4).

In order to more thoroughly interpret the temporal as well as the spatial effect of STRs on LTRs within the City of Athens, two data dumps that have been obtained in the same month three years apart, were scrutinized (July 17th, 2015 and July 16th, 2018). The analysis mainly focused on the available listings. Initially, the number of listings per neighborhood have been examined, along with their relative change between 2015 and 2018 (Table 1). Then, the density (number of listings per \(km^2\) - Fig. 2) and its change throughout the study period have been calculated (Fig. 3). Additionally, the location quotient (LQ), a metric originating from the area of economic development has been computed for all neighborhoods. LQ is related to density and is used to determine the concentration of a characteristic in a particular area with respect to a wider area. In this case, it was defined as the ratio of a neighborhood’s density to the overall density of the City of Athens (Table 1).

Apart from the expansion of STRs in terms of magnitude and density, the interrelation between short and long-term rentals has been explored. Specifically, the above results have been compared with the changes in rent prices per neighborhood (Fig. 4), while at the same time it has been accounted for what they might mean for the wider area of Athens. It should also be noted that the followed analyis scheme, based on the spatial comparison of absolute numbers and densities for Airbnb listings, albeit a preliminary one, in accordance with relevant research [11, 18].

4.2 Discussion

The most obvious observation of our analysis is that Airbnb listings are increasing in skyrocketing rates, following the general trend of the “sharing economy”. In the field of daily economic life in Athens, such an increase has come as an outlet for many landlords seeking to increase their earnings, avoid the risks of long-term tenancy (damages, unpaid bills etc.) or even allowing for segments of homeowners to continue living in rapidly appreciating housing markets [12]. Our analysis reveals that these astonishing expansion tendencies in the STR market are geographically uneven. The overall increase in the number of listings between 2015 and 2018 is above \(300\%\) (Table 1), whereas in specific neighborhoods the increments are much sharper. The results are deemed as expected, with central areas presenting the highest numbers, densities of listings and concentration of activity (LQs); apart from Koukaki-Makrygianni, a neighborhood among the most noteworthy in terms of Airbnb activity at a global scale, listings are concentrated in the areas of the Emporiko Trigono-Plaka, Thiseio, Kerameikos and Mouseio-Exarcheia-Neapoli.

Airbnb follows a multifactorial pattern of expansion; some areas appear exceptionally lucrative to visitors due to their vicinity to important landmarks, others for their central location, being at a walking distance from most entertainment and cultural spots and some for their convenient position within public transport networks. Koukaki-Makrygianni and Thiseio reflect the first case, exhibiting the biggest densities and concentrations (LQs) during the research period, as most of the apartments listed offer a direct view on the Acropolis, with the neighborhood being in close distance to the Museums of Acropolis and of Modern Art. Emporiko Trigono-Plaka embodies the second case; a visitor choosing a place there is within the most vibrant part of the city. On the other hand, neighborhoods like Pangrati represent a convenient option, being close to the subway and boasting its own local mix of restaurants and bars, due to gentrifying processes in the recent years.

Airbnb’s expansion is also asynchronous; traditionally dynamic areas in the STRs market, such as Emporiko Trigono-Plaka mentioned above, show stagnation signs, with steady rates of density and concentration. The market appears to be expanding outwards, as [14] noted for Barcelona as well, with underexploited central and western zones presenting noteworthy changes. The areas around Agios konstandinos-Plateia Vathis and Plateia Attikis show off their dynamism, experiencing sharp increases in STR volume, even if they do not constitute the safest parts of Athens.

In general, online P2P accommodation platforms have unlocked an array of cheaper choices in comparison to the price range in the regular hospitality industry for tourists and visitors alike, accommodating a more authentic experience that simulates a local way of living. Tourism boom in many geographical contexts can be directly attributed to the emergence of such platforms [14], because, apart from more affordable choices, they offer an unmatched convenience of booking a room or a house and directly check a wider spectrum of prices and choices. Such choices can be divided into two categories: the cheap and the vibrant, “real-feel” neighborhoods. Plateia Attikis is a peripheral, not expensive neighborhood, with a notably high concentration of Airbnb activity, and the \(542\%\) increase in platform entries within the last 3 years is surely eye-catching. The area even though is one of the cheapest options, is close to public transit networks (Attikis Station). Exarcheia, on the other hand, is a neighborhood that attracts an alternative crowd of urban dwellers and the same has started being the case with tourists from abroad. Besides a diverse and vibrant downtown neighborhood, Exarcheia will be part of a forthcoming subway line, drawing the attention of international capital from China, Russia and Israel, which is invested in “ghost hotels” [16]. Such investments can be seen as a logical market response within a context of rampant expanse, with investors and homeowners exploring their options even in areas that, albeit central, had not shown signs of increased activity until recently. Such areas represent a promise of higher yields; leaving the operation of unsafe, informal hotels - hidden as mere listings - aside, the above designate a moving away of Airbnb from the “casual entrepreneurship” of its first years and a formalization of its activities, as the very recent acquisition of HotelTonight by Airbnb has shown.

Lastly, the platform’s expansion has been found to be relevant with significant rent hikes, turning housing in Athens less affordable. This is particularly evident in the areas mentioned above for their high Airbnb listings’ densities and LQs: Koukaki-Makrygianni, Pangrati and Mouseio-Exarcheia-Neapoli. There - and especially in the first two - the increments are almost \(50\%\) within a 3-year span (Fig. 4). More specifically, it has been observed in the data that the said hike in LTR prices is highly correlated to the increased Airbnb activity over the studied period, as measured by three distinct correlation coefficients; the Pearson’s r (0.76), the Spearman’s \(\rho \) (0.74) and the Kendall’s \(\tau \) (0.67).

Overall, the rental market in Athens shows worrying signs of inflation. This reality is attributed to two main reasons; the available housing stock for renting has significantly shrunk and the LTRs receive heavy pressure from the STRs, as the conversion of rented apartments to Airbnb listings constitute an attractive choice for landlords. Furthermore, Airbnb in particular, has been identified in numerous reports and surveys as a crucial factor of reversing the negative climate of the whole Greek real estate market after 2017. At that point, the rental market stopped shrinking and started exhibiting signs of expansion, which are expected to intensify [1, 2]. However, we should not attribute such rent increases solely to the negative externalities of the STRs market. We must identify, for the context of Athens, and the “positive cycle” as well [8]; the necessary renovations done to the existing housing stock, in order to be more attractive for the Airbnb users and the emerging array of local businesses that are positively affected by the increased pedestrian traffic (grocery stores, cafes - mainly those offering breakfast - services directed to urban tourists - such as luggage storage places) lead to an overall upgrading of the economic base and physical environment of these areas and to higher rents.

5 Conclusions

In this work, a preliminary study of the effect of STRs and more specifically those originating from the Airbnb P2P online platform, has been attempted. The increase in the number of listings within the City of Athens and its neighborhoods has been evaluated both quantitatively and qualitatively over a period spanning three years, during which the capital of Greece showed signs of reverting recession and growth, with respect to the real estate market. Emphasis has been placed on the spatial characteristics of the STR phenomenon, in terms of neighborhood density and LQ, with the findings being on a par with similar research studying the dynamics of the city. Additionally, an initial evaluation of the linkages between the spatial characteristics of Airbnb listings and shifts in the housing market has been affirmed, with the observed LTR hikes exhibiting a highly positive correlation with Airbnb expansion, as measured by three distinct correlation coefficients.

The obtained results are very informative and call for a more in-depth analysis of STR development in other dimensions as well. One such direction worth exploring is the fluctuation in STR prices in a temporal (e.g. time of the year) as well as a spatial context. The aforementioned analysis, could be further enhanced through the inclusion of more parameters (like house size, facilities, etc) that would most likely lead to the discovery of very interesting underlying characteristics.

Notes

References

Panhellenic survey for property rentals in 2018 (in Greek). Technical report, RE/MAX, September 2018. https://www.remax.gr/news/485

Antonakakis, I., Liapikos, I.: Property market annual report 2017 Greece. Technical report, MRICS, March 2018. https://gr.eurobankpropertyservices.net/-/media/eps/reports/annual-real-estate-report_2017.pdf

Barron, K., Kung, E., Proserpio, D.: The sharing economy and housing affordability: evidence from airbnb. In: Proceedings of the 2018 ACM Conference on Economics and Computation, EC 2018, p. 5. ACM, New York (2018). https://doi.org/10.1145/3219166.3219180

Coles, P.A., Egesdal, M., Ellen, I., Li, X., Sundararajan, A.: Airbnb usage across New York City neighborhoods: geographic patterns and regulatory implications. SSRN Electron. J. (2017). https://doi.org/10.2139/ssrn.3048397

Crommelin, L., Troy, L., Martin, C., Pettit, C.: Is airbnb a sharing economy superstar? Evidence from five global cities. Urban Policy Res. 36(4), 429–444 (2018). https://doi.org/10.1080/08111146.2018.1460722

Gutiérrez, J., García-Palomares, J.C., Romanillos, G., Salas-Olmedo, M.H.: The eruption of airbnb in tourist cities: comparing spatial patterns of hotels and peer-to-peer accommodation in Barcelona. Tourism Manag. 62, 278–291 (2017). https://doi.org/10.1016/j.tourman.2017.05.003. http://www.sciencedirect.com/science/article/pii/S0261517717301036

Heo, C.Y., Blengini, I.: A macroeconomic perspective on airbnb’s global presence. Int. J. Hospitality Manag. 78, 47–49 (2019). https://doi.org/10.1016/j.ijhm.2018.11.013. http://www.sciencedirect.com/science/article/pii/S0278431918304882

Horn, K., Merante, M.: Is home sharing driving up rents? Evidence from airbnb in Boston. J. Hous. Econ. 38, 14–24 (2017). https://doi.org/10.1016/j.jhe.2017.08.002. http://www.sciencedirect.com/science/article/pii/S1051137717300876

Ke, Q.: Sharing means renting? An entire-marketplace analysis of airbnb. In: Proceedings of the 2017 ACM on Web Science Conference, WebSci 2017, pp. 131–139. ACM, New York (2017). https://doi.org/10.1145/3091478.3091504

Lane, J., Woodworth, R.M.: The sharing economy checks. In: An Analysis of Airbnb in the United States. Technical report, CBRE Hotels’ Americas Research (2016)

Lee, D.: How airbnb short-term rentals exacerbate Los Angeles’s affordable housing crisis: analysis and policy recommendations. Harv. L. Pol’y Rev. 10, 229 (2016)

Rousanoglou, N.: Foreign investor invation in downtown Athens. Kathimerini Newspaper, September 2018. (in Greek). http://www.kathimerini.gr/986258/article/oikonomia/real-estate/eisvolh-ependytwn-sto-kentro-ths-a8hnas

Sans, A.A., Quaglieri, A.: Unravelling airbnb: urban perspectives from Barcelona. In: Reinventing the Local in Tourism: Producing, Consuming and Negotiating Place, vol. 73, p. 209. Channel View Publications (2016)

Segú, M.: Do short-term rent platforms affect rents? Evidence from airbnb in Barcelona. MPRA Paper 84369, University Library of Munich, Germany, February 2018. https://ideas.repec.org/p/pra/mprapa/84369.html

Sheppard, S., Udell, A.: Do airbnb properties affect house prices? Department of economics working papers 2016-03, Department of Economics, Williams College (2016). https://EconPapers.repec.org/RePEc:wil:wileco:2016-03

Sideris, S.: Mapping the dominance of airbnb in Athens: the world’s most popular short-term rental platform and how it is affecting our neighborhoods explained visually, August 2018. https://medium.com/athenslivegr/mapping-the-dominance-of-airbnb-in-athens-4cb9e0657e80

Slee, T.: What’s Yours Is Mine: Against the Sharing Economy. OR Books, New York City (2015). http://www.jstor.org/stable/j.ctt1bkm65n

Wachsmuth, D., Chaney, D., Kerrigan, D., Shillolo, A., Basalaev-Binder, R.: The high cost of short-term rentals in New York City. Technical report, Urban Politics and Governance Research Group, School of Urban Planning, McGill University (2018)

Acknowledgments

This research work has been supported by the General Secretariat for Research and Technology (GSRT) of the Ministry of Education of the Hellenic Republic, under T1EDK-03470.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2019 IFIP International Federation for Information Processing

About this paper

Cite this paper

Gourzis, K., Alexandridis, G., Gialis, S., Caridakis, G. (2019). Studying the Spatialities of Short-Term Rentals’ Sprawl in the Urban Fabric: The Case of Airbnb in Athens, Greece. In: MacIntyre, J., Maglogiannis, I., Iliadis, L., Pimenidis, E. (eds) Artificial Intelligence Applications and Innovations. AIAI 2019. IFIP Advances in Information and Communication Technology, vol 560. Springer, Cham. https://doi.org/10.1007/978-3-030-19909-8_17

Download citation

DOI: https://doi.org/10.1007/978-3-030-19909-8_17

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-19908-1

Online ISBN: 978-3-030-19909-8

eBook Packages: Computer ScienceComputer Science (R0)