Abstract

We estimate two SVECM (structural vector error correction) models for the Turkish economy based on imposing short-run and long-run restrictions that account for examining the behavior of the real sphere in the pre-IT policy (before inflation-targeting adoption) and post-IT policy (after inflation-targeting adoption).

Responses reveal that an expansionary interest policy shock leads to a decrease in price level, a fall in output, an appreciation in the exchange rate, and an improvement in the share prices in the very short run for the most of pre-IT period.

Central Bank of the Republic of Turkey (CBT) stabilizes output fluctuations in the short run while maintaining a very medium-run inflation target since January 2006. One of the most important results of this study is that the impact of a monetary policy shock on the real sphere is insignificant during the post-IT policy.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Akyurek, C., & Kutan, M. A. (2008). Inflation targeting, policy rates and exchange rate volatility: Evidence from Turkey. Comparative Economic Studies, 50, 460–493.

Ball, L., & Sheridan, N. (2005). Does inflation targeting matter? In B. Bernanke & M. Woodford (Eds.), The inflation-targeting debate. Chicago: University of Chicago Press.

Bhuiyan, R. (2012). Inflationary expectations and monetary policy: Evidence from Bangladesh. Empirical Economics, Online First™, 26 April 2012.

Breitung, J., Bruggemann, R., & Lutkepohl, H. (2004). Structural vector autoregressive modelling and impulse responses. In H. Lutkepohl & M. Kratzig (Eds.), Applied Time Series Econometrics.

Cecchetti, S. (1995). Distinguishing theories of monetary transmission mechanism. Economic Review of Federal Reserve of Saint-Louis Review, 77 May-June, 83–97.

Clements, B. J., Kontolemis, G. Z., & Levy, J. V. (2001). Monetary policy under EMU: Differences in the transmission mechanisms? IMF Working paper, 01/102.

DeBondt, G. (2000). Credit channels and consumption in Europe: Empirical evidence. BIS Working paper, 69.

Ehrmann, M. (1998). Will EMU generate asymmetry? Comparing monetary policy transmissions across European countries. European University Institute, Working paper ECO 98/28.

Fair, R. C. (2007). Evaluating inflation targeting using a macroeconometric model. Economics: The Open-Access, Open-Assessment E-Journal, 1.

Hachicha, A., & Chaabane, A. (2007). Monetary policy transmission mechanism in Tunisia. Euro-Mediterranean Economics and Finance Review, 1, 104–26.

Hall, P. (1992). The bootstrap and Edgeworth expansion. New York: Springer.

IMF, (2005). Does inflation targeting work in emerging markets? In World economic outlook (Chapter 4, pp. 161–178).

Ivrendi, M., & Guloglu, B. (2010). Monetary shocks, exchange rates and trade balances: Evidence from inflation targeting countries. Economic Modelling, 27(5), 1144–1155.

Johansen, S. (1988). Statistical analysis of cointegrating vectors. Journal of Economics and Dynamic Control, 12, 231–254.

Johansen, S. (1995). Likelihood-based inference in cointegrated vector autoregressive models. Oxford: Oxford University Press.

Kakes, J. I., & Sturm, J. E. (2002). Monetary policy and bank lending: Evidence from German banking groups. Journal of Banking and Finance, 26, 2077–2092.

King, R., Plosser, C., Stock, J., & Watson, M. (1991). Stochastic trends and economic fluctuations. The American Economic Review, 81(4), 819–840.

Lucke, B. (2010). Identification and overidentification in SVECMs. Economics Letters, 108(3), 318–321.

Lütkepohl, H. (1993). Introduction to multiple time series analysis. Berlin: Springer.

Lutkepohl, H. (2005). Structural vector autoregressive analysis for cointegrated variables. EUI Working paper ECO.

Lütkepohl, H., Benkwitz, A., & Wolters, J. (1998). A money demand system for German M3. Empirical Economics, 23, 382–384.

Lütkepohl, H., Benkwitz, A., & Wolters, J. (2001). Comparison of bootstrap confidence intervals for impulse responses of German monetary systems. Macroeconomic Dynamics, 5, 81–100.

Mishkin, F. S. (2001). The transmission mechanism and the role of asset prices in monetary policy. NBER Working paper 8617, December.

Nadenichek, J. (2006). The J-curve effect: An examination using a structural vector error correction model. International Journal of Applied Economics, 3(2), 34–47.

Pfaff, B. (2008). VAR, SVAR and SVEC models: Implementation within R package vars. Journal of Statistical Software, 27(4). http://www.jstatsoft.org/

Ramaswamy, R., & Sloek, T. (1998). The real effects of monetary policy in the European Union: What are the differences? IMF Staff Papers, 45, 347–395.

Rogoff, K., & Reinhart, C. M. (2010). Growth in a time of debt. NBER Working paper 15795.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendices

Appendix 1: Joint Forecast Error Covariance Matrix, Pre-IT, and Post-IT Forecasting Results

The forecast errors have zero mean and, hence, the forecasts are unbiased. The joint forecast error covariance matrix for all forecasts up to horizon h is

where y T + 1/T = y T + j for j ≤ 0.

Assuming normally distributed disturbances, these results can be used for setting up forecast intervals for any linear combination of these forecasts.

See Tables 59.1 and 59.2, Figs. 59.1 and 59.2.

Appendix 2: Pre-IT and Post-IT Cointegration Tests

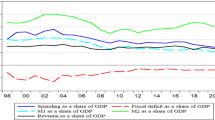

Appendix 3: Pre-IT Macro Variables Responses

See Fig. 59.3.

Appendix 4: Post-IT Macro Variables Responses

See Fig. 59.4.

Appendix 5: Impulse Responses and Confidence Intervals

Rights and permissions

Copyright information

© 2015 Springer Science+Business Media New York

About this entry

Cite this entry

Hachicha, A., Lee, CF. (2015). Pre-IT Policy, Post-IT Policy, and the Real Sphere in Turkey. In: Lee, CF., Lee, J. (eds) Handbook of Financial Econometrics and Statistics. Springer, New York, NY. https://doi.org/10.1007/978-1-4614-7750-1_59

Download citation

DOI: https://doi.org/10.1007/978-1-4614-7750-1_59

Published:

Publisher Name: Springer, New York, NY

Print ISBN: 978-1-4614-7749-5

Online ISBN: 978-1-4614-7750-1

eBook Packages: Business and Economics