Abstract

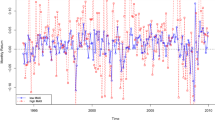

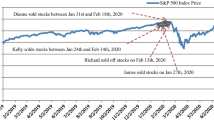

To evaluate the performance of the prospects X and Y, financial professionals are interested in testing the equality of their Sharpe ratios (SRs), the ratios of the excess expected returns to their standard deviations. Bai et al. (Statistics and Probability Letters 81, 1078–1085, 2011d) have developed the mean-variance-ratio (MVR) statistic to test the equality of their MVRs, the ratios of the excess expected returns to its variances. They have also provided theoretical reasoning to use MVR and proved that their proposed statistic is uniformly most powerful unbiased. Rejecting the null hypothesis infers that X will have either smaller variance or larger excess mean return or both leading to the conclusion that X is the better investment. In this paper, we illustrate the superiority of the MVR test over the traditional SR test by applying both tests to analyze the performance of the S&P 500 index and the NASDAQ 100 index after the bursting of the Internet bubble in the 2000s. Our findings show that while the traditional SR test concludes the two indices being analyzed to be indistinguishable in their performance, the MVR test statistic shows that the NASDAQ 100 index underperformed the S&P 500 index, which is the real situation after the bursting of the Internet bubble in the 2000s. This shows the superiority of the MVR test statistic in revealing short-term performance and, in turn, enables investors to make better decisions in their investments.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Agarwal, V., & Naik, N. Y. (2004). Risk and portfolios decisions involving hedge funds. Review of Financial Studies, 17, 63–98.

Bai, Z. D., Liu, H. X., & Wong, W. K. (2009a). Enhancement of the applicability of Markowitz’s portfolio optimization by utilizing random matrix theory. Mathematical Finance, 19, 639–667.

Bai, Z. D., Liu, H. X., & Wong, W. K. (2009b). On the markowitz mean-variance analysis of self-financing portfolios. Risk and Decision Analysis, 1, 35–42.

Bai, Z. D., Wong, W. K., & Zhang, B. Z. (2010). Multivariate linear and non-linear causality tests. Mathematics and Computers in Simulation, 81, 5–17.

Bai, Z. D., Li, H., Liu, H. X., & Wong, W. K. (2011a). Test statistics for prospect and markowitz stochastic dominances with applications. Econometrics Journal, 14, 278–303.

Bai, Z. D., Li, H., Wong, W. K., & Zhang, B. Z. (2011b). Multivariate causality tests with simulation and application. Statistics and Probability Letters, 81, 1063–1071.

Bai, Z. D., Liu, H. X., & Wong, W. K. (2011c). Asymptotic properties of eigenmatrices of a large sample covariance matrix. Annals of Applied Probability, 21, 1994–2015.

Bai, Z. D., Wang, K. Y., & Wong, W. K. (2011d). Mean-variance ratio test, a complement to coefficient of variation test and Sharpe ratio test. Statistics and Probability Letters, 81, 1078–1085.

Bai, Z. D., Hui, Y. C., Wong, W. K., & Zitikis, R. (2012). Evaluating prospect performance: Making a case for a non-asymptotic UMPU test. Journal of Financial Econometrics, 10(4), 703–732.

Baker, M., & Stein, J. C. (2004). Market liquidity as a sentiment indicator. Journal of Financial Markets, 7, 271–300.

Broll, U., Wahl, J. E., & Wong, W. K. (2006). Elasticity of risk aversion and international trade. Economics Letters, 91, 126–130.

Broll, U., Egozcue, M., Wong, W. K., & Zitikis, R. (2010). Prospect theory, indifference curves, and hedging risks. Applied Mathematics Research Express, 2010, 142–153.

Cadsby, C. B. (1986). Performance hypothesis testing with the Sharpe and Treynor measures: A comment. Journal of Finance, 41, 1175–1176.

Chan, C. Y., de Peretti, C., Qiao, Z., & Wong, W. K. (2012). Empirical test of the efficiency of UK covered warrants market: Stochastic dominance and likelihood ratio test approach. Journal of Empirical Finance, 19, 162–174.

Chen, S. X. (2008). Nonparametric estimation of expected shortfall. Journal of Financial Econometrics, 6, 87–107.

Egozcue, M., & Wong, W. K. (2010). Gains from diversification on convex combinations: A majorization and stochastic dominance approach. European Journal of Operational Research, 200, 893–900.

Egozcue, M., Fuentes García, L., Wong, W. K., & Zitikis, R. (2011). Do investors like to diversify? A study of Markowitz preferences. European Journal of Operational Research, 215, 188–193.

Eling, M., & Schuhmacher, F. (2007). Does the choice of performance measure influence the evaluation of hedge funds? Journal of Banking and Finance, 31, 2632–2647.

Fong, W. M., Wong, W. K., & Lean, H. H. (2005). International momentum strategies: A stochastic dominance approach. Journal of Financial Markets, 8, 89–109.

Fong, W. M., Lean, H. H., & Wong, W. K. (2008). Stochastic dominance and behavior towards risk: The market for internet stocks. Journal of Economic Behavior and Organization, 68, 194–208.

Gasbarro, D., Wong, W. K., & Zumwalt, J. K. (2007). Stochastic dominance analysis of iShares. European Journal of Finance, 13, 89–101.

Gregoriou, G. N., & Gueyie, J. P. (2003). Risk-adjusted performance of funds of hedge funds using a modified Sharpe ratio. Journal of Wealth Management, 6, 77–83.

Hanoch, G., & Levy, H. (1969). The efficiency analysis of choices involving risk. Review of Economic Studies, 36, 335–346.

Jobson, J. D., & Korkie, B. (1981). Performance hypothesis testing with the Sharpe and Treynor measures. Journal of Finance, 36, 889–908.

Lam, K., Liu, T., & Wong, W. K. (2010). A pseudo-Bayesian model in financial decision making with implications to market volatility, under- and overreaction. European Journal of Operational Research, 203, 166–175.

Lam, K., Liu, T., & Wong, W. K. (2012). A new pseudo Bayesian model with implications to financial anomalies and investors’ behaviors. Journal of Behavioral Finance, 13(2), 93–107.

Lean, H. H., Phoon, K. F., & Wong, W. K. (2012). Stochastic dominance analysis of CTA funds. Review of Quantitative Finance and Accounting, doi:10.1007/s11156-012-0284-1.

Leung, P. L., & Wong, W. K. (2008). On testing the equality of the multiple Sharpe ratios, with application on the evaluation of iShares. Journal of Risk, 10, 1–16.

Li, C. K., & Wong, W. K. (1999). Extension of stochastic dominance theory to random variables. RAIRO Recherche Opérationnelle, 33, 509–524.

Lintner, J. (1965). The valuation of risky assets and the selection of risky investment in stock portfolios and capital budgets. Review of Economics and Statistics, 47, 13–37.

Lo, A. (2002). The statistics of Sharpe ratios. Financial Analysis Journal, 58, 36–52.

Ma, C., & Wong, W. K. (2010). Stochastic dominance and risk measure: A decision-theoretic foundation for VaR and C-VaR. European Journal of Operational Research, 207, 927–935.

Markowitz, H. M. (1952). Portfolio selection. Journal of Finance, 7, 77–91.

Matsumura, E. M., Tsui, K. W., & Wong, W. K. (1990). An extended multinomial-Dirichlet model for error bounds for dollar-unit sampling. Contemporary Accounting Research, 6, 485–500.

Memmel, C. (2003). Performance hypothesis testing with the Sharpe ratio. Finance Letters, 1, 21–23.

Ofek, E., & Richardson, M. (2003). A survey of market efficiency in the internet sector. Journal of Finance, 58, 1113–1138.

Perkins, A. B., & Perkins, M. C. (1999). The internet bubble: Inside the overvalued world of high-tech stocks. New York: Harper Business.

Schultz, P., & Zaman, M. (2001). Do the individuals closest to internet firms believe they are overvalued? Journal of Financial Economics, 59, 347–381.

Sharpe, W. F. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk. Journal of Finance, 19, 425–442.

Sharpe, W. F. (1966). Mutual funds performance. Journal of Business, 39, 119–138.

Sortino, F. A., & van der Meer, R. (1991). Downside risk. Journal of Portfolio Management, 17, 27–31.

Sriboonchitta, S., Wong, W. K., Dhompongsa, D., & Nguyen, H. T. (2009). Stochastic dominance and applications to finance, risk and economics. Boca Raton: Chapman and Hall/CRC.

Statman, M. (2002). Lottery players/stock traders. Journal of Financial Planning, 14–21.

Tobin, J. (1958). Liquidity preference as behavior towards risk. Review of Economic Studies, 25, 65–86.

Wong, W. K. (2006). Stochastic dominance theory for location-scale family. Journal of Applied Mathematics and Decision Sciences, 2006, 1–10.

Wong, W. K. (2007). Stochastic dominance and mean-variance measures of profit and loss for business planning and investment. European Journal of Operational Research, 182, 829–843.

Wong, W. K., & Bian, G. (2000). Robust Bayesian inference in asset pricing estimation. Journal of Applied Mathematics & Decision Sciences, 4, 65–82.

Wong, W. K., & Chan, R. (2004). The estimation of the cost of capital and its reliability. Quantitative Finance, 4, 365–372.

Wong, W. K., & Chan, R. (2008). Markowitz and prospect stochastic dominances. Annals of Finance, 4, 105–129.

Wong, W. K., & Li, C. K. (1999). A note on convex stochastic dominance theory. Economics Letters, 62, 293–300.

Wong, W. K., & Ma, C. (2008). Preferences over location-scale family. Economic Theory, 37, 119–146.

Wong, W. K., & Miller, R. B. (1990). Analysis of ARIMA-noise models with repeated time series. Journal of Business and Economic Statistics, 8, 243–250.

Wong, W. K., Chew, B. K., & Sikorski, D. (2001). Can P/E ratio and bond yield be used to beat stock markets? Multinational Finance Journal, 5, 59–86.

Wong, W. K., Manzur, M., & Chew, B. K. (2003). How rewarding is technical analysis? Evidence from Singapore stock market. Applied Financial Economics, 13, 543–551.

Wong, W. K., Thompson, H. E., Wei, S., & Chow, Y. F. (2006). Do winners perform better than losers? A stochastic dominance approach. Advances in Quantitative Analysis of Finance and Accounting, 4, 219–254.

Wong, W. K., Phoon, K. F., & Lean, H. H. (2008). Stochastic dominance analysis of Asian hedge funds. Pacific-Basin Finance Journal, 16, 204–223.

Wong, W. K., Wright, J. A., Yam, S. C. P., & Yung, S. P. (2012). A mixed Sharpe ratio. Risk and Decision Analysis, 3(1–2), 37–65.

Acknowledgment

We would like to thank the editor C.-F. Lee for his substantive comments that have significantly improved this manuscript. The third author would also like to thank Professors Robert B. Miller and Howard E. Thompson for their continuous guidance and encouragement. The research is partially supported by grants from North East Normal University, National University of Singapore, Hong Kong Baptist University and the Research Grants Council of Hong Kong. The first author thanks the financial support from NSF China grant 11171057, Program for Changjiang Scholars and Innovative Research Team in University, and the Fundamental Research Funds for the Central Universities and NUS grant R-155-000-141-112.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2015 Springer Science+Business Media New York

About this entry

Cite this entry

Bai, Z.D., Hui, Y.C., Wong, WK. (2015). Internet Bubble Examination with Mean-Variance Ratio. In: Lee, CF., Lee, J. (eds) Handbook of Financial Econometrics and Statistics. Springer, New York, NY. https://doi.org/10.1007/978-1-4614-7750-1_53

Download citation

DOI: https://doi.org/10.1007/978-1-4614-7750-1_53

Published:

Publisher Name: Springer, New York, NY

Print ISBN: 978-1-4614-7749-5

Online ISBN: 978-1-4614-7750-1

eBook Packages: Business and Economics