Abstract

This chapter explores the magnitude of the changes in patterns of material use that will be associated with the increasing deployment of renewable energy and discusses the implications for sustainable development. In particular, this chapter focuses on the increased use of lithium and cobalt, metals which are used extensively in battery technologies, and silver used in solar cells. Consistent with the strong growth in renewable energy and electrification of the transport system required in a 1.5°C scenario, the material requirements also rise dramatically, particularly for cobalt and lithium. Scenarios developed for this study show that increasing recycling rates and material efficiency can significantly reduce primary demand for metals.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

11.1 Introduction

Globally, recent investments in new renewable energy infrastructure have been double the investments in new energy from fossil fuels and nuclear power (REN21 2018). This is strong evidence of the increasing momentum of the energy transition away from fossil fuels. A rapid transition to 100% renewables offers hope for reducing carbon emissions and increasing the chance that global warming will be maintained to below 2.0 °C. However, the transition to 100% renewables also comes with requirements for new patterns of material use to support the renewable energy infrastructure, including wind turbines, solar cells, batteries, and other technologies.

This chapter explores the magnitude of the changes in patterns of material use that will be associated with the increasing deployment of renewable energy, and discusses the implications for sustainable development. In particular, this chapter focuses on the increased use of lithium (used extensively in battery technology), cobalt (again used in batteries, particularly for vehicles), and silver (used in solar cells because it is an excellent conductor of electricity).

The importance of understanding how material use is affected by renewable energy technologies is already established (Ali et al. 2017; Valero et al. 2018). A range of studies have identified different aspects of the challenges associated with the supply of the materials needed for renewable energy. The first aspect is the availability of mineral supplies. For example, Mohr et al. (2012) developed commodity-focused supply projections for lithium, with an emphasis on the origins and locations of available lithium deposits over time, which are contrasted with a simple demand function. Other studies have placed more emphasis on demand scenarios, either for a specific geographic location, such as Germany (Viebahn et al. 2015) or globally (Valero et al. 2018; Watari et al. 2018), and some have explored the role of technology mixes and material substitution in detail (Månberger and Stenqvist 2018).

In addition to issues of resource availability, environmental and social issues have also been explored (Giurco et al. 2014; Florin and Dominish 2017) and the need for improved resource governance has been highlighted (Prior et al. 2013; Ali et al. 2017). This chapter evaluates the total demand to determine which metals may present bottlenecks to the supply of renewable energy technologies. The potential to offset primary demand is explored through a range of scenarios for technology type, material efficiency, and recycling rates. This chapter draws on the results of a larger study funded by Earthworks (see Dominish et al. 2019).

This chapter has five sections. Following this introductory section, the second section outlines the material requirements for key renewable energy infrastructure technologies, namely solar photovoltaics (PV), wind turbines, and batteries. The key assumptions, and the energy and resource scenarios are described in Sect. 11.3, together with a summary of the methodology, which is described in detail in Chap. 3. The requirements for selected materials (lithium, cobalt, and silver) are presented in Sect. 11.4. Following the results, a discussion is presented in Sect. 11.5.

11.2 Overview of Metal Requirements for each Technology

Renewable energy and storage technologies typically have high and diverse metal requirements. Moreover, there are often competing technologies or component technologies, which add to the complexity of material considerations. The key metals used for solar PV, wind power, batteries, and EV are discussed below.

11.2.1 Solar PV

A typical crystalline silicon (c-Si) PV panel, which is currently the dominant technology, with over 95% of the global market, contains about 76% glass (panel surface), 10% polymer (encapsulant and back-sheet foil), 8% aluminium (frame), 5% silicon (solar cells), 1% copper (interconnectors), and less than 0.1% silver (contact lines) and other metals (e.g., tin and lead). Thin film technologies, copper–indium–gallium–(di)selenide (CIGS) and cadmium telluride (CdTe), make up the remainder of the market. These technologies require less material overall than crystalline silicon. For CdTe panels, the composition is 96–97% glass, 3%–4% polymer, and less than 1% semi-conductor materials (CdTe) and other metals (e.g., nickel, zinc, tin). CIGS contain about 88%–89% glass, 7% aluminium, 4% polymer, and less than 1% semi-conductor material (indium, gallium, selenium) and other metals (e.g., copper) (Weckend et al. 2016). Figure 11.1 provides a simplified diagram of the PV supply chain, including key materials and sub-components.

11.2.2 Wind

The major raw materials required for the manufacture of wind turbine components are bulk commodities: iron ore, copper, aluminium, limestone, and carbon. Wind turbines use steel for the towers, nacelle structural components, and the drivetrain, accounting for about 80% of the total weight. Some turbine generator designs use direct-drive magnetics, which contain the rare earth metals neodymium and dysprosium (Fig. 11.2 ). The development of direct-drive permanent magnet generators (PMG) by major producers (e.g., Siemens and General Electric) simplifies the design by eliminating the gearbox, and this is attractive for offshore applications because it reduces maintenance (Zimmermann et al. 2013). It is estimated that about 20% of all installed wind turbines (both onshore and offshore) use rare earth magnets (CEMAC 2017).

11.2.3 Batteries and Electric Vehicles

This study focuses on lithium ion batteries (LIBs), which power almost all electric vehicles (EVs) on the market today and are also an important technology for stationary energy-storage applications. LIBs are made of two electrodes (anode and cathode), current collectors, a separator, electrolyte, a container, and sealing parts. The anode is typically made of graphite, with a copper foil current collector. The cathode is typically a layered transition metal oxide, with an aluminium foil current collector. In between the electrodes is a porous separator and electrolyte. All of these components are typically housed in an aluminium container. LIBs are generally referred to by the material content of the cathode, which accounts for 90% of the material value and about 25% of the total weight (Gratz et al. 2014).

The size and type of the LIB has the greatest impact on the material requirements. Since commercialization in the 1990s, a range of different types (‘chemistries’) have been developed for different applications, named according to the metals in the cathode. The most common LIB types for EV applications are nickel–manganese–cobalt (NMC), lithium–iron phosphate (LFP), nickel–cobalt–aluminium (NCA), and lithium–manganese oxide (LMO) (Vaalma et al. 2018). NMC is the most common battery type for passenger vehicles, and NCA is also common, with a small share for LMO. However, in China, LFP is the dominant chemistry. Electric buses have traditionally used LFP batteries (BNEF 2018) and lead–acid batteries are most commonly used for two-wheel vehicles. However, the application of LIBs in this market sector is growing (Yan et al. 2018).

For energy storage, NMC and NCA are the most commonly used chemistries. A simplified overview of the lithium-ion battery supply chain, including its key metals (for the NMC chemistry) and sub-components, is shown in Fig. 11.3. Rare earth permanent magnets using neodymium and dysprosium are common in most electric vehicle motors. Other motor technologies, or those that replace rare earths with lower-cost materials, are under development and are already used in some vehicles. However, rare earth magnets are expected to remain the standard for the foreseeable future because of their higher performance characteristics (Widmer et al. 2015).

11.3 Scenarios and Key Assumptions

11.3.1 Electricity and Transport Scenarios

The energy scenarios presented here were developed to achieve the climate target in the 2015 Paris Climate Agreement of limiting anthropogenic climate change to a maximum of 1.5 °C above pre-industrial levels. This projection is more ambitious than the IEA’s annual World Energy Outlook (WEO) scenarios, which project that current policies, and therefore the global development of renewable power and electric mobility, will not change. In contrast, many scenarios have been proposed in the academic literature that extend as far as zero emissions, whereas the IEA’s own “Energy Technology Perspectives” (ETP) scenarios include both a 2.0 °C scenario (2DS) and a more ambitious “Beyond 2.0 °C” scenario (B2DS), which aim to achieve the Paris targets. The scenario proposed here includes both a shift to 100% renewable electricity and a shift to renewable electricity and fuels in the transport sector.

In this scenario, solar PV will account for more than one-third of the installed capacity by 2050, with the remainder from wind and other renewables. Lithium-ion batteries will account for approximately 6% of energy storage (which will be dominated by pumped hydro and hydrogen).

In the transport system, we focus on the material requirements for the batteries used in road transport, because other types of transport do not require batteries to power drivetrains or are assumed to rely on other forms of energy (e.g., biofuels for aviation). In 2050, most of the energy for road transport will come from electricity (55%) and hydrogen (22%), and the remainder will be from biofuels and synfuels. In the 1.5 °C Scenario, the batteries required to electrify road transport are specified for electric buses and passenger cars, including battery electric vehicles (BEV), plug-in hybrid electric vehicles (PHEV), and commercial vehicles. Passenger cars will account for 92% of vehicles and 51% of battery capacity, whereas commercial vehicles are projected to account for 48% of battery capacity, although they will make up only 8% of the total fleet of vehicles. This is because the battery sizes for commercial vehicles (assumed to be 250 kWh in 2015 and rising to 600 kWh in 2050) are larger than those for passenger vehicles (5–15 kWh for PHEV and 38–62 kWh for BEV). Buses will account for a small percentage (1%) of both vehicles and batteries. Electric bikes and scooters have been excluded, because although they are currently a growing market in Asia, by 2050, their share of electricity consumption will be negligible compared with the predicted uptake of electric passenger and commercial vehicles. Lead–acid batteries are also the main type of battery for electric bikes and scooters, although lithium-ion may replace these in future.

11.3.2 Resource Scenario Development

Five resource scenarios were developed to estimate the metal demand for 100% renewables, as shown in Table 11.1. The scenarios were developed based on the current market trends and the likelihood of changes in material efficiency or technology. Our aim is to understand how primary demand can be offset through changes in technology or recycling rates.

11.3.3 Technology Assumptions

The total metal demand for renewable energy and battery technology each year is estimated based on the metal intensity of a specific technology and the capacity of each technology introduced in a specific year. This introduced stock will accounts for the new capacity and the replacement of technologies at the end of their lives, based on a lifetime distribution curve for the average lifetime.

The values for metal intensity are given in tonnes/GW (for solar PV) or tonnes/GWh (for batteries) of capacity, and two values are given for each metal to evaluate the impact of improving the material efficiency (for solar PV) and technology shifts (for batteries). To evaluate the impact of recycling, the primary demand is estimated by multiplying the discarded products by the recycling rate. The recycling rate is obtained by multiplying the collection rate by the recovery efficiency of a metal from a specific technology. This recycling rate is also varied to obtain a current rate and a potential rate. The potential recycling rate is technologically possible, but is not currently applicable because it is not economic. The detailed assumptions for batteries and solar PV are explained in detail in the following section.

11.3.4 Batteries

The ‘current materials intensity’ for LIB for EVs and storage (Table 11.2) is estimated based on the assumed market shares of the LIB technologies: NMC (60%), LMO (20%), NCA (15%), and LFP (5%) (Vaalma et al. 2018). The dominant battery technologies in the future are not likely to be the same as those commercialized today. Therefore, for the ‘future technology scenario’, we assume that lithium–sulfur batteries will replace LIB for EVs (Cano et al. 2018). We have modelled a future market (Table 11.3) in which Li–S will achieve a 50% market share for EVs by 2050, with deployment scaling up at a linear rate, assuming the first commercialization in 2030. In this scenario, the technology does not change for storage batteries.

We have assumed a collection efficiency of 100% for all batteries and a recovery rate of 90% for Co and Ni (Georgi-Maschler et al. 2012). A 10% recovery rate is assumed for Li, acknowledging that pyrometallurgical processing routes account for most of the current global capacity, and Li recovery may not be possible by this route (King et al. 2018). For scenarios that assume a ‘potential future recycling’ rate, we have assumed 95% recovery for all metals. This is reasonable given that 100% recovery has been reported in the laboratory (Gratz et al. 2014).Footnote 1 However, some losses during processing seem unavoidable.Footnote 2

11.3.5 Solar PV

For solar PV, we assume that the technology types do not change until 2050, and that they retain their current market shares, so that crystalline silicon will remain the dominant technology. We have modelled the potential to offset demand through increases in material efficiency and increases in recycling.

A high and a low value are given for silver to show the impact of material efficiency on silver demand. The current data on silver intensity are from a survey of the PV industry (ITRPV 2018), and the future material efficiency is based on an assumed minimum amount of silver (Kavlak et al. 2015). The ‘current recycling rate’ scenarios assume a current collection rate of 85% for all panels, consistent with the target of the EU WEEE Directive.Footnote 3 This should be considered an average rate, noting that remote and/or distributed roof-top systems will be more costly to collect and transport than large utility-scale PV. We assume that no recycling is currently occurring for silver from PV, but that 95% recovery may be possible. Therefore, for the ‘potential recycling rate’ scenarios, we assume a 95% recovery efficiency and an 85% collection rate, which will result in an 81% metal recycling rate.

11.3.6 Metal Assumptions

For each scenario, the annual primary demand is compared with the current production (2017 data), and the cumulative demand to 2050 is compared with current reserves. The data presented (Table 11.4) highlight the annual production, total resources, and reserves. ‘Reserves’ are the subset of the total resources that can be economically mined under current conditions. They are dependent on a multitude of factors and can change over time. By contrast, resources are less certain economically and there may be no firm plan to mine them. Over time, new resources can be discovered and as economic conditions change, resources may be upgraded to reserves (for example, where the price for the metal increases, thus making lower-grade or more-challenging ores profitable or where a new technology for extraction allows lower cost processing). In contrast, reserve estimates can also be downgraded over time (as occurred with coal reserve estimates in UK and Germany).

11.4 Results for Lithium, Cobalt, and Silver

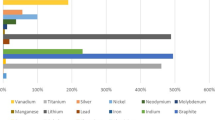

The cumulative demand from renewable energy technologies for cobalt, lithium, and silver by 2050 has been modelled, and is compared to current reserves in Fig. 11.4. The cumulative demand for cobalt from renewable energy and transport exceeds the current reserves in all scenarios, and for lithium, the cumulative demand is exceeded in all scenarios, except the ‘potential recycling scenario’. For silver, the total demand for silver from renewable energy will reach around 50% of current reserves.

The annual demand in 2050 is compared with the current rates of production (based on 2017 data). Both cobalt and lithium have annual demands that far exceed the current rates of production—particularly lithium in the ‘future technology’ scenario. However, the annual demand for silver will remain below current production levels (Fig. 11.5).

The detailed results for each metal are shown in the following section.

11.4.1 Cobalt

The annual demand for cobalt from EVs and storage could exceed the current production rates in around 2023 (in all scenarios). In the ‘future technology’ scenario, shifting to Li–S instead of LIB will reduce the demand for cobalt. However, recycling, rather than shifting technologies, will have the greatest impact on reducing the primary demand in both the current technology and future technology scenarios.

The cumulative total demand to 2050 (with current technology and no recycling) could exceed current reserves by 400%, and exceed current resources by 20%. Even with recycling and a shift to technologies that use less cobalt, the cumulative demand will still exceed reserves. However, in these scenarios, the demand will remain below the resource levels (Figs. 11.6 and 11.7).

11.4.2 Lithium

The annual demand for lithium for EVs and storage could exceed the current production rates by around 2022 (in all scenarios). In the ‘future technology and no recycling’ scenario, a shift to Li–S will increase the demand for lithium, because these batteries have a higher amount of lithium. Increasing recycling from its current low levels (which are assumed to be 10%) will offer the greatest potential to offset the primary demand for lithium.

The cumulative demand for lithium by 2050 will be below the resource levels for all scenarios, but will exceed the reserves unless there is a shift to a high recycling rate. The cumulative demand could be as high as 170% of the current reserves with the current technology, and could be 280% of current reserves with a switch to Li–S batteries (Figs. 11.8 and 11.9).

11.4.3 Silver

The total annual demand for silver could reach more than 40% of the current production rates by 2050, assuming no recycling and that the materials efficiency does not change (Fig. 11.10). The cumulative demand to 2050 could reach around half the current reserves with the current technology, and around one-quarter if the technology improves (Fig. 11.11). The reduction in material intensity in the ‘future technology’ scenario, in which silver use decreases from 20 to 4 tonnes/GW, has the greatest potential to reduce demand.

11.5 Discussion

Within the context of the increasing metal resource requirements for the renewable energy and storage technologies, the rapid increase in the demand for both cobalt and lithium is of greatest concern, and the demand for both metals will exceed the current production rates by 2023 and 2022, respectively. The demand for these metals will increase more rapidly than it does for silver, partly because solar PV is a more established technology and silver use has become very efficient, whereas the electrification of the transport system and the rapid expansion of lithium battery usage has only begun to accelerate in the last few years.

The potential to offset the primary demand differs, depending on the technology. Offsetting demand through secondary sources of cobalt and lithium has the most potential to reduce total primary demand for these metals, as batteries have a comparatively short lifetime of approximately 10 years. The cumulative demand for both metals will exceed current reserves, but with high recycling rates, they can remain below resource levels. However, there is a delay until the period in which recycling will offset demand, because there must be enough batteries in use and reaching the ends of their lives to be collected and recycled. This delay could be further extended by strategies for the reuse of vehicular batteries as stationary storage, which might save costs in the short term and increase the uptake of PV. The efficiency of cobalt use in batteries also significantly reduces demand, and this is already happening as manufacturers shift towards lower-cobalt chemistries (Energy Insights by McKinsey 2018). However, this is also likely to lead to an increase in the demand for lithium.

Increasing the efficiency of material use has the biggest potential utility in offsetting the demand for PV metals, whereas recycling will have a smaller impact on demand. This is attributable to the long life-span of solar PV panels, and their lower potential for recycling. Although not as extreme as the growth of cobalt and lithium, the growth of silver and its demand in 2050 are still considerable. This is important, especially when considering that solar PV currently consumes approximately 9% of end-use silver (The Silver Institute & Thomson Reuters 2018), and although it is possible to create silver-less solar panels, these panels are not expected to be on the market in the near future (ITRPV 2018).

11.5.1 Limitations

This study only focuses on the metal demand for renewable energy and transport. It does not take into account other demands for these metals. It is expected that with the increase in renewable energy, renewable energy technologies will consume a greater share of these metals. In our modelling, the recycled content used in technologies comes only from metals from the same technologies at the end of their lives. However, the demand could potentially be offset by accessing other secondary sources of the metal. At the same time, these technologies are only one end-use within the overall economic demand for these metals. The expansion of renewable energy and storage technologies could have a significant effect on the overall market dynamics, including influencing prices, which may feed back to the efforts to reduce material intensity. These results only focus on cobalt, lithium, and silver because of their importance. However, further analysis is required of other metals that will be important in the renewable energy transition.

Another important limitation is that this analysis does not consider the impact of the demand for a mineral on the mining of that mineral and therefore on the amount of energy required for this mining and processing activity. In particular, as the potential ore grade declines, and polymetallic ore processing and the mining of deeper ore bodies increase, it is possible that this feedback loop could have a more-than-marginal influence on the overall sectoral energy consumption. To examine this is an area accurately will require much more-complex modelling.

11.5.2 Comparison with Other Studies

A large number of studies have examined scenarios for renewable energy and storage technologies that will mitigate climate change. In recent years, there has also been an upsurge in studies of mineral ‘criticality’, which have paralleled the present study in terms of the high penetration of renewable and storage technologies and the potential constraints that certain minerals may impose. This increased interest has been prompted to some extent by China’s rare earth export restrictions of 2009–2011, which reflect the sense that mineral supply chains are still quite insecure. Most of these studies have addressed specific technologies or specific countries or regions, rather than global climate targets. A number of studies have specifically and directly addressed the Paris Agreement targets (ensuring that the temperature rise does not exceed 2.0 °C), although the modelling frameworks have been slightly different. Some of the authors of the present chapter have been involved in these studies (Tokimatsu et al. 2017; Watari et al. 2018).

A range of variables affect the results, including the installed capacity and technology type in the energy scenario; the assumed market demand of technology types (e.g., type of battery or solar panel); and the material intensity assumptions. The projected future demand for lithium is higher than in previous studies, and that for cobalt is similar or higher (Månberger and Stenqvist 2018; Watari et al. 2018; Valero et al. 2018; Watari et al. 2018), as shown in Table 11.5. This is primarily attributable to the ambitious renewable energy scenario used in this study, which includes achieving a 100% renewable transport system by 2050, whereas the other studies have still included a large share of gasoline-powered cars in 2050. This study also includes batteries for stationary energy storage, whereas the other studies have only included batteries for road transport. Moreover, this study assumes a shorter battery life of 10 years, based on current warranties, whereas some scenarios assume a longer life.

The results for silver are in the middle of the range of results given by other studies. Our scenario includes a higher installed capacity of PV in 2050 than the other studies. However, this study also assumes a lower metal intensity than previous studies, because new data have been published based on the current material use by the PV industry (ITRPV 2018).

11.6 Supply Impacts and Challenges

In addition to the material requirements for renewable technologies explored earlier in this chapter, it is important to understand the changes in the available supply, the geopolitical landscape, and the associated social and environmental impacts, which are outlined below.

11.6.1 Geopolitical Landscape

The geopolitical shift underway in the supply of the resources required for the globe’s future energy mix is clearly illustrated in Fig. 11.12. Whereas the value of the lithium industry is much less than the value of the oil industry, this comparison highlights a distinct shift in the energy commodities that society values. Oil’s rate of use is projected to decline somewhat in the decade ahead (Mohr et al. 2015), whereas lithium’s production is expected to grow rapidly (Mohr et al. 2012).

Although it is not a key focus of this particular chapter, the dominance of China in the supply of rare earths has encouraged manufacturing countries to look at diversifying their supply sources, including through the recovery of rare earths from recycled material. A similar situation of heavily concentrated supply occurs for cobalt, where the Democratic Republic of the Congo is the largest supplier, at around 66,000 tonnes per year. The next four largest cobalt-producing countries (China, Canada, Russia, and Australia) only produce 5–7000 tonnes per year each. The supply chain is also concentrated downstream, with around 50% of cobalt smelted and refined in China.

11.6.2 Social and Environmental Impacts

The mining and supply chain for these metals can have adverse social and environmental consequences for workers, local communities, and the environment. These impacts are most significant for the cobalt mined in the Democratic Republic of Congo, where there are human rights violations, child labour, and severe environmental pollution affecting health (Florin and Dominish 2017).

These types of impacts at mine sites and along the supply chain also influence the availability of primary resources. For example, whereas Australia and Chile are large producers of lithium, large deposits remain undeveloped in Bolivia, due in part to local concerns over the social and environmental impacts. The global silver market receives less media attention than the market for lithium, but the world’s second-largest silver mine (Escobal) in Guatemala is currently closed by a constitutional court ruling that the Xinca Indigenous peoples were not adequately consulted before a mine licence was granted (Jamasmie 2018).

The increased use of materials such as lithium, cobalt, and silver has economic implications for the future of battery manufacture. For example, the cost of cobalt has risen dramatically from US$20000/t in 2016 to US$80000 in 2018 (Tchetvertakov 2018). This is prompting manufacturers to look for alternatives, such as nickel, vanadium, and zinc (Tchetvertakov 2018). At the same time, a significant proportion of these price fluctuations are attributable to non-industrial factors, such as investment and speculation in metal markets, which may also require greater regulation to avoid unnecessary restrictions on renewable energy and storage technologies.

11.6.2.1 Recycling Challenges

Whilst recycling can help to offset primary material demand through recycled sources, there is are technological, social and environmental challenges to increasing recycling. The collection systems and infrastructure required to recycle metals from renewable energy technologies are not well established. For example, although silver has an overall recycling rate of 30–50% (Graedel et al. 2011), almost no recycling of silver from PV panels occurs, because most recycling of PV panels focuses on recycling the glass, aluminium, and copper. Most of the processes used to recycle lithium-ion batteries focus on the recovery of cobalt and nickel, because of their higher price, so that lithium is downcycled into less valuable products, such as cement. It should also be noted that the recycling of some key energy materials, such as rare earths in magnets, does not offer significant cost savings or environmental benefits over their extraction from primary resources (McLellan et al. 2013).

The establishment of effective collection networks is important for recycling. Collection networks must be easily understood and must provide easily accessible deposit mechanisms. Recycling can be both informal and formal, and whereas in some cases, informal collection networks offer greater rates of recycling, the social and environmental impacts can be higher. For example, recycling electronic waste on open fires creates hazardous fumes for informal recyclers and has detrimental effects on the environment. There is also a potential tension between reducing material intensity and the ability to effectively separate, recover, and recycle materials. Increasingly, thin layers of material are being utilized because of improved manufacturing processes, which can reduce the costs of products in their first lifetimes. However, as the material content decreases, the value of the secondary production decreases, making it a less attractive option for investment. Again, the use of advanced, complex materials can sometimes make valuable materials difficult to separate from each other, and this again increases the costs and reduces the profits for investors in recovery processes.

To ensure that social and environmental issues will be addressed, several initiatives across supply chains are being developed, including the China-led Responsible Cobalt Initiative, the Cobalt Institute, the Initiative for Responsible Mining Assurance, Solving the Ewaste Problem (StEP), and the R2 standard for sustainable electronics recycling. In the USA, the Dodd-Frank Act has mandated the traceability of the gold, tin, tungsten, and tantalum from the Democratic Republic of Congo. This has arisen from the international concern over the social impacts and implications of sourcing metals from that country, and in particular, to avoid supporting conflict and environmental damage. However, cobalt is not explicitly mentioned in the Dodd-Frank Act.

International resource governance that looks beyond renewable energy and beyond a single commodity focus is increasingly recognised as a missing area in environmental policy (Ali et al. 2017). The transition to renewable energy and the associated requirements for resources to support this transition could be a catalyst for advancing such policies.

11.7 Concluding Remarks

This chapter has given an overview of the material requirements for key renewable energy technologies and the projected demands for lithium, cobalt, and silver. Consistent with the strong growth in renewable energy and the electrification of the transport system required by the 1.5 °C scenario, these material requirements will also increase dramatically, particularly those for cobalt and lithium. The high total demand requirements for these metals emphasize the importance of recycling, alternative chemistries, and transport planning and practices (including city design to encourage active and public transport, as well as car sharing and pooling). The key messages of this chapter are: it is important to design for both renewable energy and resource cycles; and it is important to adopt a systems view that considers the available supply and also social and environmental factors. To support sustainable development goals, both the primary and secondary sources of the resources required to underpin the renewable energy transformation must be stewarded effectively as the supply chains develop.

Notes

- 1.

- 2.

Pers comms Boxall, N.

- 3.

More details available here: http://ec. europa.eu/environment/waste/weee/index_en.htm

References

Ali, S. H., D. Giurco, N. Arndt, E. Nickless, G. Brown, A. Demetriades, R. Durrheim, M. A. Enriquez, J. Kinnaird, A. Littleboy, L. D. Meinert, R. Oberhänsli, J. Salem, R. Schodde, G. Schneider, O. Vidal and N. Yakovleva (2017). “Mineral supply for sustainable development requires resource governance.” Nature 543: 367.

Bloomberg New Energy Finance, 2018., Electric Buses in Cities. Available at: http://www.ourenergypolicy.org/wp-content/uploads/2018/04/1726_BNEF_C40_Electric_buses_in_cities_FINAL_APPROVED_2.original.pdf

Cano, Z.P., Banham, D., Ye, S., Hintennach, A., Lu, J., Fowler, M. and Chen, Z., 2018. Batteries and fuel cells for emerging electric vehicle markets. Nature Energy, 3(4), p.279.

Clean Energy Manufacturing Analysis Center (CEMAC), 2017. Benchmarks of global clean energy manufacturing. Available at: https://www.nrel.gov/docs/fy17osti/65619.pdf

Energy Insights by McKinsey, 2018. Metal mining constraints on the electric mobility horizon. Available at: https://www.mckinseyenergyinsights.com/insights/metal-mining-constraints-on-the-electric-mobility-horizon/

Florin, N., Dominish, E. (2017). Sustainability evaluation of energy storage technologies, Institute for Sustainable Futures for the Australian Council of Learned Academies.

Georgi-Maschler, T., Friedrich, B., Weyhe, R., Heegn, H. and Rutz, M., 2012. Development of a recycling process for Li-ion batteries. Journal of power sources, 207, pp.173–182.

Giurco, D., B. McLellan, D. M. Franks, K. Nansai and T. Prior (2014). “Responsible mineral and energy futures: views at the nexus.” Journal of Cleaner Production 84: 322–338.

Graedel, T.E., Allwood, J., Birat, J.P., Buchert, M., Hagelüken, C., Reck, B.K., Sibley, S.F. and Sonnemann, G. (2011). What do we know about metal recycling rates?. Journal of Industrial Ecology, 15(3), 355–366.

Gratz, E., Sa, Q., Apelian, D. and Wang, Y., 2014. A closed loop process for recycling spent lithium ion batteries. Journal of Power Sources, 262, pp.255–262.

International Technology Roadmap for Photovoltaic (ITRPV), 2018, International Technology Roadmap for Photovoltaic Results 2017, Ninth Edition. Available at: http://www.itrpv.net/Reports/Downloads/

Jamasmie, C. (2018) Guatemala delays ruling on Tahoe’s Escobal mine reopening. Mining.com Accessed 26 September 2018, http://www.mining.com/guatemala-delays-ruling-tahoes-escobal-mine-reopening/

Kavlak, G., McNerney, J., Jaffe, R.L. and Trancik, J.E., 2015. Metal production requirements for rapid photovoltaics deployment. Energy & Environmental Science, 8(6), pp.1651–1659.

King S, Boxall NJ, Bhatt AI (2018) Australian Status and Opportunities for Lithium Battery Recycling. CSIRO, Australia

Månberger, A. and B. Stenqvist (2018). “Global metal flows in the renewable energy transition: Exploring the effects of substitutes, technological mix and development.” Energy Policy 119: 226–241.

McLellan, B. C., G. D. Corder and S. H. Ali (2013). “Sustainability of rare earths—an overview of the state of knowledge.” Minerals 3(3): 304–317.

Mohr, S. H., G. M. Mudd and D. Giurco (2012). “Lithium Resources and Production: Critical Assessment and Global Projections.” Minerals 2(1): 65.

Mohr, S. H., Wang, J., Ellem, G., Ward, J., & Giurco, D. (2015). Projection of world fossil fuels by country. Fuel, 141, 120–135.

Prior, T., P. A. Wäger, A. Stamp, R. Widmer and D. Giurco (2013). “Sustainable governance of scarce metals: The case of lithium.” Science of The Total Environment 461–462: 785–791.

REN21 (2018) Renewables 2018 Global Status Report, REN21 Secretariat, Paris

Tchetvertakov, G. (2018). “Panasonic and Tesla seek to remove cobalt from electric car batteries.” Retrieved 15 September 2018, from https://smallcaps.com.au/panasonic-tesla-remove-cobalt-electric-car-battery/.

The Silver Institute and Thomson Reuters, 2018. World Silver Survey 2018. Available at: https://www.silverinstitute.org/wp-content/uploads/2018/04/WSS-2018.pdf

Tokimatsu, K., H. Wachtmeister, B. McLellan, S. Davidsson, S. Murakami, M. Höök, R. Yasuoka and M. Nishio (2017). “Energy modeling approach to the global energy-mineral nexus: A first look at metal requirements and the 2 °C target.” Applied Energy 207: 494–509.

Vaalma, C., Buchholz, D., Weil, M. and Passerini, S., 2018. A cost and resource analysis of sodium-ion batteries. Nature Reviews Materials, 3, p.18013

Valero, A., A. Valero, G. Calvo and A. Ortego (2018). “Material bottlenecks in the future development of green technologies.” Renewable and Sustainable Energy Reviews 93: 178–200.

Viebahn, P., O. Soukup, S. Samadi, J. Teubler, K. Wiesen and M. Ritthoff (2015). “Assessing the need for critical minerals to shift the German energy system towards a high proportion of renewables.” Renewable and Sustainable Energy Reviews 49: 655–671.

Watari, T., B. McLellan, S. Ogata and T. Tezuka (2018). “Analysis of Potential for Critical Metal Resource Constraints in the International Energy Agency’s Long-Term Low-Carbon Energy Scenarios.” Minerals 8(4): 156.

Weckend, S.;Wade, A.; Heath, G. 2016 End-of-Life Management Solar Photovoltaic Panels; International Renewable Energy Agency and International Energy Agency Photovoltaic Power Systems: Paris, France

Widmer, J.D., Martin, R. and Kimiabeigi, M., 2015. Electric vehicle traction motors without rare earth magnets. Sustainable Materials and Technologies, 3, pp.7–13.

Yan, X., He, J., King, M., Hang, W. and Zhou, B., 2018. Electric bicycle cost calculation models and analysis based on the social perspective in China. Environmental Science and Pollution Research, pp.1–13.

Zimmermann, T., Rehberger, M. and Gößling-Reisemann, S., 2013. Material flows resulting from large scale deployment of wind energy in Germany. Resources, 2(3), pp.303–334.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2019 The Author(s)

About this chapter

Cite this chapter

Giurco, D., Dominish, E., Florin, N., Watari, T., McLellan, B. (2019). Requirements for Minerals and Metals for 100% Renewable Scenarios. In: Teske, S. (eds) Achieving the Paris Climate Agreement Goals. Springer, Cham. https://doi.org/10.1007/978-3-030-05843-2_11

Download citation

DOI: https://doi.org/10.1007/978-3-030-05843-2_11

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-05842-5

Online ISBN: 978-3-030-05843-2

eBook Packages: EnergyEnergy (R0)