Abstract

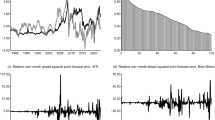

Research on information spill over effects between financial markets remains active in the economic community. A Granger-type model has recently been used to investigate the spillover between London Metal Exchange (LME) and Shanghai Futures Exchange (SHFE), however, possible correlation between the future price and return on different time scales have been ignored. In this paper, wavelet multiresolution decomposition is used to investigate the spill over effects of copper future returns between the two markets. The daily return time series are decomposed on 2n (n=1, ..., 6) frequency bands through wavelet multiresolution analysis. The correlation between the two markets is studied with decomposed data. It is shown that high frequency detail components represent much more energy than low-frequency smooth components. The relation between copper future daily returns in LME and that in SHFE are different on different time scales. The fluctuations of the copper future daily returns in LME have large effect on that in SHFE in 32-day scale, but small effect in high frequency scales. It also has evidence that strong effects exist between LME and SHFE for monthly responses of the copper futures but not for daily responses.

Similar content being viewed by others

References

Bartolozzi, M., Leinweber, D.B., Thomas, A.W., 2006. Scale-free avalanche dynamics in the stock market. Phys. A: Statist. & Theor. Phys., 370(1):132–139. [doi:10.1016/j.physa.2006.04.024]

Chen, J.F., Wang, J.S., 2003. Research on stock price index information measure based on wavelets and fractals theory. Operations Research and Management Science, 12:65–69 (in Chinese).

Deng, K.X., Song, B.R., 2006. Applying wavelet in the analysis of financial data. Application of Statistic and Management, 25:215–219 (in Chinese).

Eun, C., Shim, S., 1989. International transmission of stock market movements. J. Finan. & Quantit. Anal., 24(2):241–256. [doi:10.2307/2330774]

Fang, V., Lee, V.C.S., Yee, C.L., 2005. Volatility Transmission Between Stock and Bond Markets: Evidence from US and Australia. Proc. 6th Int. Conf. of Intelligent Data Engineering and Automated Learning, p. 580–587.

Kim, S.W., Rogers, J.H., 1995. International stock price spillovers and market liberalization: evidence from Korea, Japan and the United States. J. Empirical Finance, 2(2):117–133. [doi:10.1016/0927-5398(94)00013-7]

Li, Y.Z., 2006. A dynamic econometric analysis of the LME copper price and the SHFE copper price. J. Anhui Univ. (Philos. & Soc. Sci.), 30:132–137 (in Chinese).

Ramsey, J.B., Zaslavsky, G., Usikov, D., 1995. An analysis of US stock price behavior using wavelets. Fractals, 3(2):377–389. [doi:10.1142/S0218348X95000291]

Sharkasi, A., Crane, M., Ruskin, H.J., Matos, J.A., 2006. The reaction of stock markets to crashes and events: a comparison study between emerging and mature markets using wavelet transforms. Phys. A: Statist. Mech. & its Appl., 368(2):511–521. [doi:10.1016/j.physa.2005.12.048]

Wang, S.N., Pan, Y.H., 2004. Study on inter-linkage between US and China stock markets. J. Zhejiang Univ. (Eng. Sci.), 38:1431–1435 (in Chinese).

Wu, W.F., Liu, Y., Ye, Z.X., 2006. Empirical analysis on the risk characteristics in the futures copper market between Shanghai and London. Syst. Eng.—Theory Methodol. Appl., 15:256–259.

Xu, M., Zhang, S.Y., 2005. Analysis of financial volatility based on wavelet analysis. Syst. Eng.—Theory & Practice, 2:1–9 (in Chinese).

Zhang, R.F., Li, X.H., Tang, Y., Zhang, S.Y., 2006. Common Volatility Spillover Analysis and Empirical Study on the Financial Market. Proc. 8th Int. Conf. on Industrial Management, p. 445–451.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Wang, Sn., Pan, Yh. & Yang, Jg. Study on spillover effect of copper futures between LME and SHFE using wavelet multiresolution analysis. J. Zhejiang Univ. - Sci. A 8, 1290–1295 (2007). https://doi.org/10.1631/jzus.2007.A1290

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1631/jzus.2007.A1290