Abstract

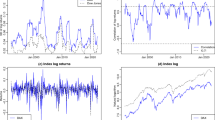

We analyze the realized volatility of stocks traded on the Tokyo Stock Exchange using 5-min high-frequency stock prices. We find that the distributions of stock returns standardized by the realized volatility are consistent with Gaussian distributions which enable us to view the system in superstatistics. Our results suggest that the distributions of the realized volatility are explained with inverse gamma distributions.

Similar content being viewed by others

References

Andersen, T.G., T. Bollerslev (1997) “Heterogeneous information arrivals and return volatility dynamics: uncovering the long-run in high frequency returns,” Journal of Finance 52: 975–1005.

Andersen, T.G., T. Bollerslev (1998) “Answering the Skeptics: Yes, Standard Volatility Models do Provide Accurate Forecasts,” International Economic Review 39: 885–905.

Andersen, T.G., T. Bollerslev, F.X. Diebold and P. Labys (2000) “Exchange Rate Returns Standardized by Realized Volatility are (Nealy) Gaussian,” Multinational Finance Journal 4: 159–179.

Andersen, T.G., T. Bollerslev, F.X. Diebold and P. Labys (2001a) “The distribution of realized exchange rate volatility,” Journal of the American Statistical Association 96: 42–55.

Andersen, T.G., T. Bollerslev, F.X. Diebold and H. Ebens (2001b) “The distribution of realized stock return volatility,” Journal of Financial Economics 61.1: 43–76.

Ausloos, M. and K. Ivanova (2003) “Dynamical model and nonextensive statistical mechanics of a market index on large time windows,” Physical Review E 68: 046122.

Beck, C. and E. G. D. Cohen (2003) “Superstatistics,” Physica A 322: 267–275.

Beck, C. and E. G. D. Cohen (2008) “Recent developments in superstatistics,” arXiv: 0811.4363

Beck, C., E. G. D. Cohen and H. L. Swinney (2005) “From time series to superstatistics,” Physical Review E 72: 056133.

Bollerslev, T. (1986) “Generalized Autoregressive Conditional Heteroskedasticity,” Journal of Econometrics 31: 307–327.

Bouchard, J. P. and M. Potters (2003) Theory of Financial Risk and Derivative Pricing, Cambridge University Press, Cambridge.

Campbell, J. Y., A. W. Lo and A. C. MacKinlay (1997) The Econometrics of Financial Markets, Princeton University Press.

Ding, Z., C. W. J. Granger and R. F. Engle (1993) “A Long memory property of stock market returns and a new model,” Journal of Empirical Finance 1: 83–106.

Engle, R. F. (1982) “Autoregressive conditional heteroskedasticity with estimates of the Variance,” Econometrica 60: 987–1007.

Engle, R. F., and V. Ng (1993) “Measuring and testing the impact of news on volatility,” Journal of Finance 48: 1749–1778

Gerig, A. J. Vicente and M. A. Fuentes (2009) “On the origin of non-gaussian intraday stock Returns,” Physical Review E 80: 065102(R).

Glosten, L. R., R. Jagannathan and D. E. Runkle (1993) “On the relation between the expected value and the volatility of the Nominal Excess on Stocks,” Journal of Finance 48: 1779–1801.

Hansen, P. R. and A. Lunde (2005) “A realized variance for the whole day based on intermittent high-frequency data,” Journal of Financial Econometrics 3: 525–554.

Kozaki, M. and A. H. Sato (2008) “Application of the Beck model to stock markets: Value-at-Risk and portfolio risk assessment,” Physica A 387: 1225–1246.

Nelson, D. B. (1991) “Conditional heteroskedasticity in asset returns: A new approach,” Econometrica 59: 347–370.

Sentana, E. (1995) “Quadratic ARCH models,” Review of Economic Studies 62: 639–661.

Van der Straeten, E. and C. Beck (2009) “Superstatistical fluctuations in time series: applications to share price dynamics and turbulence,” Physical Review E 80: 036108.

Author information

Authors and Affiliations

Corresponding author

About this article

Cite this article

Takaishi, T. Analysis of Realized Volatility in Superstatistics. Evolut Inst Econ Rev 7, 89–99 (2010). https://doi.org/10.14441/eier.7.89

Published:

Issue Date:

DOI: https://doi.org/10.14441/eier.7.89