Abstract

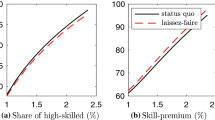

In this article, we study the effect of the Negative Income Tax (NIT) on reducing inequalities. Using a matching model with a continuous distribution of worker skills, we show that a NIT reduces inequalities in favor of less qualified workers by making firms less selective and jobs less complex. However, this technological choice decreases the workers’ average productivity and therefore increases the unemployment rate.

Similar content being viewed by others

References

Acemoglu, D., 1998. Why do new technologies complement skills ? Directed technical change and wage inequality. Quarterly Journal of Economics, 113(4), pp.1055–1090.

Amine, S. and Lages Dos Santos, P., 2010. Technological choices and unemployment benefits in a matching model with heterogenous workers. Journal of Economics, 101(1), pp.1–19.

Amine, S. and Lages Dos Santos, P., 2011. The influence of labour market institutions on job complexity. Research in Economics, 65(3), pp.209–220.

Bargain, O. and Terraz, I., 2003. Evaluation et mise en perspective des effets incitatifs et redistributifs de la Prime pour l’emploi [The incentive and redistributive effects of the employment prime: Assessment and perspective]. Economie et Prévision, 160/161, pp.121–149.

Blundell, R., Duncan, A., McCrae, J., and Meghir, C., 2000. The labour market impact of the working families tax credit. Fiscal Studies, 21(1), pp.65–74.

Cahuc, P., 2002. A quoi sert la Prime pour l’emploi? [What is the purpose of the French PPE?]. Revue Française d’Economie, 16(3), pp.3–61.

Eissa, N. and Liebman, J., 1996. Labor supply response to the earned income tax credit. Quarterly Journal of Economics, 111(2), pp.605–637.

Fugazza, M., Le Minez, S., and Pucci, M., 2004. Une première endogénéisation des comportements d’offre de travail dans le modèle INES: Activité des femmes et prestations sociales [The influence of the prime pour l’emploi on female employment in France: An estimate using the Ines model]. Économie et Prévision, 160-161(4–5), pp.79–102.

Mikol, F. and Remy, V., 2009. L’effet du RSA sur l’équilibre du marché du travail [The effect of RSA on the labor market equilibrium]. Document d’étude, no.148.

Pissarides, C., 2000. Equilibrium unemployment theory. Boston: MIT Press.

Saez, E., 2002. Optimal income transfer programs: Intensive versus extensive labor supply responses. Quarterly Journal of Economics, 117(3), pp.1039–1073.

Strand, J., 2002. Wage bargaining and turnover costs with heterogeneous labour and perfect history screening. European Economic Review, 46(7), pp.1209–1227.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Amine, S., Santos, P.L.D. Technological Choices and Labor Market Participation: Negative Income Tax. Eurasian Econ Rev 3, 98–113 (2013). https://doi.org/10.14208/eer.2013.03.02.001

Published:

Issue Date:

DOI: https://doi.org/10.14208/eer.2013.03.02.001