Abstract

Much research has been devoted to examination of the financial easing policy of the European Central Bank (ECB). However, this study is one of the first to use a dynamic micro-founded model to investigate empirically the impact of the ECB’s Quantitative Easing (QE) policy on consumption and investment by economic agents in Italy (households, government, firms, and the rest of the world). For this purpose, we constructed a Financial Social Accounting Matrix (FSAM) for the Italian economy for the year 2009 to calibrate a dynamic computable general equilibrium model (DCGE). This model allowed us to evaluate the direct and indirect impact of money flow on the behavior of consumption and investment. The findings of the study confirmed the positive impact of the ECB’s monetary policy on the level of investment and consumption.

Similar content being viewed by others

Introduction

The money I demand is Life,

Your nervous force, your joy, your strife! (Amy LowellFootnote 1).

Money plays a vital role in the function of an economy, because the availability of currency can either perturb or prop up the circular flow of income. Whether access to money is easy or difficult can have far-reaching effects on both investing and consuming by institutional sectors (Mian et al., 2013; Cesarini et al., 2016; Steven et al., 2016). The importance of money supply can be understood in terms of the cataclysmic events of the Great Depression 1929 and the Great Recession of 2007. Although there is still a lively debate regarding the factors that caused these historical events, Friedman and Schwartz (1963a, b) argue that a decrease in the money supply led to the start of the Great Depression, which in turn caused the sharp decline in output prices that tumbled the economy.

Similarly, Bernanke, (1983) made a strong case that a reduction in money supply by banks, along with increased costs of borrowing and lending, contributed to the nation’s economic collapse. As the availability of money decreased, spending on goods and services declined, ultimately prompting firms to cut prices, reduce output, and lay off workers. These actions led to the decline in consumers and business income that caused borrowers to have difficulty repaying loans. A vicious circle was created wherein defaults and bankruptcies soared, banks failed, and the money stock contracted further, so output, prices, and employment continued to decline. A similar cycle was exhibited in the Great Recession of that engulfed the global economies from December 2007 through June 2009, leaving them in a catastrophic state of affairs. The crash of the stock markets was another obvious factor in both the Great Depression and Great Recession.

Research has attempted to understand how money flow in the economy affects the investment and consumption behavior of economic agents. The key lies in the reliance of banking systems and stock markets on the confidence of the various participants in the economy, including depositors and stock traders. There is widespread belief that the expectations of economic agents have a strong link to economic fluctuations (Beaudry and Portier, 2014; Asker et al., 2015; Cheng et al., 2015). When the confidence of individuals, companies, and others is shaken, perhaps because of the failure of a large bank or large commercial firm, they rush to withdraw their deposits out of fear of losing their funds (Bloom, 2014). Similarly, when economic or financial distress arises, the expectations of economic agents sink into uncertainty, which ultimately reduces their willingness to spend on consumer goods and to invest in financial markets (Hansen, Sargent and Tallarini, 1999; Ilut and Schneider, 2014; Hugonnier et al., 2015; Bateman et al., 2015).

Objectives

The financial crisis that began in 2007 significantly hampered the economies of countries around the globe, including many European countries. To this end, the European Central Bank (ECB) acted as a lender of last resort to prop up the faltered economies of Greece, Spain, and Italy, among others. Pursuing a policy of Quantitative Easing (QE), the ECB purchased government bonds in order to provide financial stability to these economies. The intention was that the governments would inject the money collected from selling bonds into their respective economies to restore balance. This expected flow of money into the system would stabilize the financial markets, thereby restoring the confidence of the consumers and investors.

The objective of this paper was to investigate the impact of the ECB’s QE policy on consumption and investment by economic agents in the context of the Great Recession. To this end, we constructed a Financial Social Accounting Matrix (FSAM) for the Italian economy for the year 2009 that represented a suitable database to calibrate the parameters of a dynamic computable general equilibrium (DCGE) model. The model allowed analysis of the direct and indirect effects of the ECB’s money injection policy on the real and financial investments of the economic agents. This study explained how investing and consumption by economic agents is influenced by financial distress and expansion.

The remainder of this paper is structured as follows. Section 2 describes the development of the FSAM and the dynamic general equilibrium model. Section 3 presents the results and the discussion around the policy implications for the Italian economy of the monetary policy. Finally, Section 4 concludes this paper.

Methodology

This study constructed a Financial Social Accounting Matrix “FSAM” for Italy that served as the database for the calibration of all parameters in the dynamic CGE model. The FSAM derives from the incorporation of financial accounts, showing the changes in lending and borrowing by the agents, with the Social Accounting Matrix (SAM), which describe the income circular flow within the economic system for a specific year (Ciaschini and Socci 2006). Then, the dynamic CGE model calibrated on this dataset, allows capturing the different behavior of disaggregated agents operating in the economic system while maintaining coherence with all macroeconomic aggregates, financial and national accounts.

Social accounting matrix and financial accounts

A social account matrix (SAM) presents the economic transactions among the agents related to production processes as well as to primary and secondary income distribution. The flexible structure of a SAM can be modified to include disaggregation of flows according to the aim of the research.

The SAM built for this study included sixty-four commodities and sixty-four activities,Footnote 2 four value-added components (compensation of employees, mixed income, gross operating surplus, and indirect net taxes) and four institutional sectors (households, firms, government, and the rest of the world). Insertion of financial accounts into the SAM requires the inclusion of flows related to capital accounts and financial asset (or liability) accounts (Emini and Fofack 2004) by each Institutional Sector. More specifically, net savings by institutional sector is a balance of incomes and expenditures. Together with net capital transfers (receivables and payables), net savings by institutional sector is used to accrue the non-financial flows (United Nations 2008). The resulting surplus or deficit is the net lending or borrowing, and this figure is the balancing item to move forward from the capital accounts to the financial accounts. In contrast, the financial accounts do not have any balancing item carried forward to other accounts.

The financial accounts depict the changes in lending and borrowing by agents resulting from changes in financial assets and liabilities. Conceptually, the sum of these changes is equal in magnitude to the balancing item of the capital account. The complete set of the financial accounts in SAM helps analyzing the monetary aggregates as well as the long-term financial investments and financial sources (Hubic, 2012). The SAM already incorporates a capital account that presents the gross fixed capital formation (GFCF) of the economic agents. However, this is a unitary account for all economic agents, and therefore it does not reflect the participation of each agent in the GFCF. In addition, the de facto capital account records only the flows of physical capital and the resources received by the agents. The addition of a distinct capital account for each agent keeps the details of different resources held by the individual agents, as well as the details of various physical or financial assets held as counterparts of those resources. Together, the accounts of financial assets and liabilities keep the details of the nature and structure of financial resources and how they are used by economic agents. Table 1 in appendix A presents the basic framework of SAM complemented with financial accounts to make the FSAM.

Table 1 in Appendix A depicts the blocks of economic and financial flows. The financial flows are reported in correspondence to the financial instruments, row 18 and column 18, which are exchanged between institutional sectors. Studying the table by row, we can find the financial flows of assets (row 18, columns 13–16). Working by column, we can read the flows of financial liabilities (column 18, rows 13–16). Institutional sectors incur financial liabilities and acquire assets from other institutional sectors. Since a liability automatically creates a corresponding asset, they must be balanced in aggregate (Greenfiled 1985, Roe 1985).

We considered twelve financial instrumentsFootnote 3 according to the data for financial flows available from the Italian Statistical Department (ISTAT), Eurostat, and published accounts of the Bank of Italy for the year 2009. Table 2 in Appendix A presents the aggregated SAM with economic and financial accounts.

Dynamic computable general equilibrium model (DCGE)

The DCGE model can be used to study the business cycle and assess the dynamic effects of shocks to monetary policy. For instance, DCGE was employed to observe the inertial behavior of inflation and persistence in aggregate quantities (Christiano et al. 2005Footnote 4; Smets and Wouters 2003, 2007). The inclusion of financial mechanisms in general equilibrium models has been recognized in the economic literature because of its ability to include financial frictions in the economy. For instance, Prasad et al. (2004) explored the effects of a large and increasing inflow of private foreign capital on the growth rate of developing countries. Roland (2001) modeled the disaggregated financial transmissions mechanism by type, and suggested several alternative formulations for each of these transmissions, especially for foreign direct investment and flow of reserves.

Goodhart et al. (2004, 2005), who disaggregated net investments by type of investors (banks, firms, and the rest of the world), emphasized the modeling of international financial flows. Maldonado et al. (2007) extended the CGE model for Brazil to treat foreign capital flows as endogenous. They used a function linking it to the expected rate of loss of foreign reserves based on empirical evidence over recent years. Similarly, the studies by Christensen and Dib (2008), De Graeve (2008), Nolan and Thoenissen (2009), and Christiano et al. (2011) employed DGE modeling, and proved that financial frictions improve the performance of a standard New Keynesian model in the context of a frictionless labor market. In comparison, the standard monetary DGE model was augmented by Christiano et al. (2014) to introduce the agency problems associated with financial intermediation in an otherwise standard model of business cycles. They based their model implementation on the work of Bernanke and Mark (1989) and Bernanke et al. (1989).

In this study, we developed a dynamic FCGE model with two main original contributions to the existing literature. First, we developed a multi-sectoral approach. It allowed emphasizing the structural changes in intermediate consumption among the production activities of the economy. In addition, according to the SAM structure, we could examine changes in the institutional sectors’ choices regarding investment and savings in response to fluctuations in the prices of financial instruments (Ciaschini et al. 2011). Second, we developed a recursive dynamic CGE model based on the SAM for the Italian economy that included the financial flows to investigate the impact of the monetary policy on macroeconomic variables.

The dynamic financial CGE model

The dynamic FCGE model developed in this study formalizes the main relationships among the agents over time, based on the data provided by the FSAM for the Italian economy. The model implies that the behavior of agents depends on adaptive expectations (Thurlow 2008). The evolution path is a sequence of single period static equilibria linked to each other by the capital accumulation conditions (Lau et al., 2002). Then, to determine prices and quantities that maximize producers’ profits and consumers’ utility in each period, the model solves the intertemporal optimization problem of the consumer, subject to the constraints of income, technology, and feasibility. The formulation of the model is presented in the Appendix B.

In each period, we considered an open economy with a set of sixty-four commodities, sixty-four activities, fcompensation of employees, mixed income, gross operating surplus, a single account for taxes on production and imports less subsidies, four institutional sectors (firms, households, government, and the rest of the world), and twelve financial instruments.

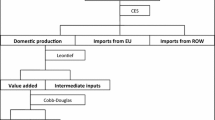

Total output (supply) by commodity derive from the CES aggregation of domestic production and imports following the Armington hypothesis (Armington, 1969).Footnote 5 Domestic production by commodity is derived from the combination of primary factors and intermediate consumption by each activity according to a NESTED production function. Domestic output is the combination of intermediate goods that depends on total output and prices (assuming a Leontief production function), and value added that is affected by total production and primary factors compensations. Assuming a CES production function, value added is generated by combining capital and labor aggregates that are perfectly mobile across activities. Then, the zero-profit condition by commodity in each period is verified when the equilibrium price, obtained by solving the market clearing condition, equals the average cost to produce each unit of output by commodity.

The market clearing condition for all commodities dictates that total output is equal to total demand for domestic and foreign consumption. The final demand for each product comes from activities (intermediate consumption), households (final consumption), government (public expenditure), investment, and the rest of the world (exports). The linear expenditure system (LES) determines the consumption of households and government with a constant fraction of agents’ disposable income allocated to each commodity.

Similarly, the market clearing condition for each primary factor assumes the balance between the total demand by activity (endogenously determined) and the total supply (exogenously determined) derived from the initial endowments resulting from FSAM. The prices of primary factors fluctuate in each period to restore the balance between demand and supply.

The determination of disposable income by institutional sector allows us to find the final demand for consumption and savings. Therefore we can determine the closure of the model in each period, and the terminal closure condition as well. Disposable income can be allocated between final consumption and savings according to the intertemporal well-being function of each institutional sector. All the institutional sectors maximize the present value of their intertemporal utility function, which can be interpreted as the well-being function (Prasad et al. 2004) depending on the final consumption expenditure and gross savings, subject to the lifetime budget constraint. The lifetime budget constraint is the lifetime disposable income that derives from the sum of compensation of primary factors plus net transfers and taxes to or from the other agents occurring in the secondary income distribution phase in each period.

The macroeconomic closures of the model in each period refer to the government balance, the rest of the world balance, and the savings-investment balance. The government balance follows the condition by which gross saving is endogenously determined as the difference between lifetime government disposable income and total expenditures.Footnote 6 The condition for the balance of rest of world states that the real exchange rate can be flexible, while gross saving is fixed in nominal terms.Footnote 7

The condition for the savings-investment balance states that investments are savings driven, so that in each period the gross fixed investment derives from the sum of the institutional sectors’ savings. However, the model closes with the capital accumulation condition stating that the capital stock in period t + 1 is equal to the capital stock in period t, less depreciation, plus gross fixed capital formation in period t.

The equilibrium of financial instruments, also called financial commodities, is obtained as the balance between the total demand for each instrument (At) and the total supply of financial instruments (SLt). In other words, the prices of financial instruments are flexible and adjust to grant the perfect competitiveness of financial markets, where the flows originated by changes in demand for financial instruments generate a similar change in liabilities (supply) of those instruments. Hence, for each agent, the change in the value loaned to the financial fund, and the changes in its liabilities with the financial fund, are compatible with total savings (investment) in each period. Accordingly, the net asset equilibrium of each agent requires that the net change in the balance of borrowing and lending of each agent corresponds to the difference between savings and investment.

The model is solved as a mixed complimentary problem with the GAMS software, the solution of the problem is a vector of prices, quantities, and incomes for which all equations are verified.

Policy implication for the Italian economy

As a regulator of monetary policy, one of the European Central Bank’s main responsibility is to keep the inflation rate low. However, in September 2012, the ECB committed itself to act as a lender of last resort, and decided to buy the bonds of debt-ridden countries. Regardless of the fact that criticism was received from many sources with respect to the proposed policy, the ECB committed to take up the program.

Policy scenario – Results and discussion

In our simulation, we supposed that the Italian Economic system received an increase in money as a consequence of an increase in the demand for bonds by the ECB. The effects of the policy were measured in terms of changes in investment and consumption by the institutional sectors (Figs. 1 and 2), and the quantity and prices of financial commodities with respect to the benchmarks (Figs. 3 and 4).Footnote 8 To estimate these effects, in our simulation we injected 10 billion Euros, which had a quadrupling effect on the FSAM. First, we increased the bonds held by the ECB and this increase was balanced by decreasing the bonds held by Government. On the other side, the amount of currency in government assets was increased and was balanced by decreasing the same amount of currency in the assets of the ECB. The circulation of money from the sale and purchase of bonds affected the whole circular flow of income.

Figure 1 presents the percentage change in the investments of the government, households, and rest of the world from the benchmark. It is obvious from the figure that the investments of the government and households were positive, whereas the investments of the rest of the world were negative. This implies that after the simulation, the investments of government and households increased continuously, whereas the investments of the rest of the world declined. It is important to note that the investments here represented both real and financial investments. Moreover, the figure shows that change in government investments was considerably greater than the change in investments by households. This result was expected because the ECB’s action assumed the government would increase its expenditure after receiving money from the bank’s bond purchases. Therefore, the percentage change in the level of government investments was greater than the change in household investments.

Figure 2 shows the percentage change in consumption by government, households, and the rest of the world. It is obvious from Fig. 2 that consumption by all the institutional sectors showed a positive change, confirming the anticipated increase in the consumption level after simulation. The change in consumption by the rest of the world was greater than the change in consumption by the other two agents. Government had the lowest level change in consumption. It is imperative to note that the change in both investment and consumption by the institutional sectors was very low: the change in investment was between − 0.5% to + 0.2%, whereas the change in consumption was between + 0% to + 0.012%.

These findings may reflect the behavioral characteristics of the investors, a proposal endorsed by Steven et al. (2016) in a study demonstrating that the inclination to invest is positively correlated with capital shocks. Furthermore, they confirmed that capital shocks lead to stochastic volatility in aggregate consumption and investment and the direction of these effects is consistent with business cycles. In this contest, our results may also confirm that in the long run, the positive impact of the expansive monetary policy, generates a more than proportional impact on investment (Henrik and Stephan, 2014). Our results are consistent with numerous previous studies confirming that the investments of economic agents in the long run generates an increasing impact, either negative or positive, in financial markets (Asker et al., 2015; Hugonnier et al., 2015).

Figure 3 depicts the change in output of financial commodities from the benchmark in the years from 2014 to 2020. These findings showed that the injection of money into the economy activated the financial market of Italy, with a few financial commodities undergoing a positive effect while most of the financial commodities evidenced a negative impact. The output of the financial instrument, “Short-term securities, with general government,” increased significantly from the benchmark after the policy simulation, demonstrating an increase in demand from investors for short-term securities with general government backing. The results implied further that short-term investors gained more confidence regarding government securities after the government received money by selling government bonds.

Similarly, the financial instrument in the categories, “Bonds issued by central government” and “Bonds issued by residents,” also demonstrated a positive impact. This finding showed that the QE policy of the ECB impacted not only the money market but also the capital market of Italy. “Money market” here refers to the short-term trading of financial instruments, e.g., short-term securities, whereas “capital market” represents trading of long-term financial instruments, e.g., bonds. Most of the other financial instruments experienced a negative impact, which implies a decline in demand.

Figure 4 illustrates the price changes of financial instruments from the benchmark after the policy simulation. These findings showed that the vast majority of financial commodities evidenced a positive impact on prices, with few exceptions. This result seems inconsistent with the prevailing negative impact on output of financial commodities described by Fig. 3. It is generally accepted that an increase in final demand increases the prices of commodities, and vice versa. In this case, the effect on output of most of the financial instruments was negative, implying less demand for the instruments, but the impact on most financial instrument prices was positive, implying more demand. We suggest that an increase in price is not necessarily a reaction to increased demand. Instead, the price increase could be a reaction to diminished supply. This proposal could be confirmed from the findings of this study.

The results of our study demonstrate that the injection of money into the economy affected and activated the financial market significantly. The current findings are consistent with previous studies on investments in response to positive news (e.g., Bordo and Rockoff 2013; George and Tong, 2013). In this study, the injection of money into the economy served as positive news.

Conclusion

A wide range of literature has been devoted to the discussion on the possibility for the ECB to purchase Government bonds and the impacts of this expansive monetary policy both on economic and financial variables. In this perspective, our study tries to quantify the impact for the Italian economy of the quantitative easing policy performed by ECB using a financial CGE calibrated on the basis of the Financial SAM.

The innovative aspect of the study is related to the characteristics of the database that is able to show the connection between economic and financial flows in a disaggregated contest. Moreover, the model is able to capture the different behavior of agents when the composition, the price and the amount of financial instruments change. In particular, the study simulates the increase in currency supply originated by the purchase of bonds from ECB and investigates the impact of this policy on investments and consumption by commodity and by economic agents.

The findings of our study confirmed the positive impact of the ECB’s monetary policy on the levels of investment and consumption in Italy, although the effect was not very large. This outcome is quite expected, however it can be interpreted only as a preliminary result since it suffers of the limit related to the absence of any hypothesis on investors’ expectations. Moreover, it could be interesting to test the effectiveness of the monetary policy, ruled by ECB, when fiscal policies are introduced in a context characterized by strict guidelines on public deficit and public budget constraint. This aspect could be further explored in future development of this study.

Notes

Sword Blades and Poppy Seed by Amy Lowell, pp. 13, Accessible Publishing Systems PTY, Ltd. CAN 085119953

The classification of commodities and activities is reported in Table 3 in Appendix A.

See Table 4 in Appendix A.

In Christiano et al. (2005), the estimated DCGE model incorporates staggered wage and price contracts and posits an average duration of three quarters and variable capital utilization.

Following this assumption, domestic commodities and imports are imperfect substitutable since they have some elements of differentiation that can be observed by final consumers.

The Government disposable income is calculated as the sum of total tax revenues (tax rates are assumed as fixed) primary factors remuneration and transfers from other Institutional Sectors. Total expenditure is the sum of transfers paid to other Institutional Sectors (exogenous in nominal terms) and government consumption expenditure (exogenous in real terms).

The balance in each period derives from the difference between Rest of world’s revenues and expenditures. Revenues are imports and transfers from domestic Institutional sectors that are endogenously determined and depend on domestic income. Rest of world expenditures are exports and other transfers to domestic Institutional Sectors that are exogenous.

The benchmark trend reflects the initial assumption on exogenous parameters. Therefore, economic variables are: growth in real terms at the rate g and prices growth at (1 + r) rate.

References

Asker J, Farre-Mensa J, Ljungqvist A (2015) Corporate investment and stock market listing: a puzzle. Rev Financ Stud 28(2):342–390

Bateman H, Stevens R, Lai A (2015) Risk information and retirement investment choices mistakes under prospect theory. Journal of Behavioral Finance 16(4):279–296

Beaudry P, Portier F (2014) News-driven business cycles: insights and challenges. J Econ Lit 52(4):993–1074

Bernanke BS, Mark G (1989) Agency costs, net worth, and business fluctuations. Am Econ Rev 79(1):14–31

Bernanke BS, Mark G, Simon G (1989) The financial accelerator in a quantitative business cycle framework. In: Taylor JB, Woodford M (eds) Handbook of monetary economics, Vol. 1C, pp 1341–1393

Bordo MD, Rockoff H (2013) Not just the great contraction: Friedman and Schwartz;s a monetary history of the United States 1867 to 1960. Am Econ Rev 103:61–65

Cesarini D, Lindqvist E, Ostling R, Wallace B (2016) Wealth, health, and child development: evidence from administrative data on Swedish lottery players. Q J Econ 131(2):687–738

Cheng LY, Yan Z, Zhao Y, Gao LM (2015) Investor inattention and under-reaction to repurchase announcements. Journal of Behavioral Finance 16(3):267–277

Christensen I, Dib A (2008) The financial accelerator in an estimated new Keynesian model. Rev Econ Dyn 11:155–178

Christiano LJ, Eichenbaum M, Evans C (2005) Nominal rigidities and the dynamic effects of a shock to monetary policy. J Polit Econ 113:1–45

Christiano LJ, Motto R, Rostagno M (2014) Risk shocks. Am Econ Rev 104:27–65

Christiano LJ, Trabandt M, Walentin K (2011) Introducing financial frictions and unemployment into a small open economy model. J Econ Dyn Control 35:1999–2041

Ciaschini M, Socci C (2006) Income distribution and output change: macro multiplier ap- proach. In: Salvadori N (ed) Economic growth and distribution: on the nature and cause of the wealth of nations

Cronqvist H, and Siegel S (2014) The genetics of investment biases. Journal of Financial Economics. 113:215–234.

De Graeve F (2008) The external finance premium and the macro economy: US post-WWII evidence. J Econ Dyn Control 32:3415–3440

Emini CA, Fofack H (2004) A Financial Social Accounting Matrix for the Integrated Macroeconomic Model for Poverty Analysis : Application to Cameroon with a Fixed-Price Multiplier Analysis. Policy, Research working paper series;no. WPS 3219. World Bank, Washington, DC. © World Bank. https://openknowledge.worldbank.org/handle/10986/14440

Friedman M, Schwartz AJ (1963a) Money and business cycles. Review of Economics and Statistics 45:32–64

Friedman M, Schwartz AJ (1963b) A monetary history of the United States, 1867-1960. National Bureau of Economic Research. Studies in business cycles. Vol. 12. Princeton, Princeton University Press

George JJ, Tong Y (2013) Stock price jumps and cross-sectional return predictability. J Financ Quant Anal 48(5):1519–1544

Goodhart CAE, Sunirand P, Tsomocos D (2004) A model to analyze financial fragility: Applications. J Financ Stab 1:1–35

Goodhart CAE, Sunirand P, Tsomocos D (2005) A model to analyze financial fragility. Economic Theory 27:107–142

Greenfiled, C.C. 1985. A social accounting matrix for Botswana, 1974–75. In Pyatt and J. I. Round (eds)

Hansen LP, Sargent T, Tallarini T (1999) Robust permanent income and pricing. Mimeo.

Hubic A (2012) A A financial social accounting matrix (SAM) for Luxembourg. Working Paper, No.72. The Bank of Luxembourg

Hugonnier J, Malamud S, Morellec E (2015) Capital supply uncertainty, cash holdings, and investment. Rev Financ Stud 28(2):391–445

Ilut CL, Schneider M (2014) Ambiguous business cycles. The American Economic Review 104(8):2368–2399.

Lau MI, Pahlke A, Rutherford TF (2002) Approximating infinite-horizon models in a complementarity format: a primer in dynamic general equilibrium analysis. J Econ Dyn Control 26:577–609

Maldonado WL, Tourinho OAF, Valli M (2007) Endogenous foreign capital flow in a cge model for Brazil: the role of foreign reserves. J Policy Model 29:259–276

Maldonado, W.L., Tourinho, O.A.F., and Valli, M., 2008. Financial capital in a CGE model for Brazil: formulation and implications. Available at: https://www.scribd.com/document/48350369/Financial-Capital-in-CGE-model-for-brazil

Mian A, Rao K, Sufi A (2013) Household balance sheets, consumption, and the economic slump. Q J Econ 128(4):1687–17-26

Nolan C, Thoenissen C (2009) Financial shocks and the US business cycle. J Monet Econ 56:596–604

Prasad, E., Rogoff, K., Wei, S.J., and Kose, MA, 2004. Financial globalization, growth and volatility in developing countries. NBER working paper, n. 10942

Roe, A.R., 1985. The flow of funds as a tool of analysis in developing countries. In G. Pyatt and J. I. Round (eds), pp. 70-83

Roland, H.D., 2001. Capital flows and economy wide modeling. Proceedings of the conference on impacts of trade liberalization agreements on Latin America and the Caribean, Washington, DC

Smets F, Wouters R (2003) An estimated dynamic stochastic general equilibrium model of the euro area. J Eur Econ Assoc 1:1123–1175

Smets F, Wouters R (2007) Shocks and frictions in US business cycles: a bayesian DSGE approach. Am Econ Rev 97:586–606

Steven DB, Burton H, Emilio O (2016) Disagreement, speculation, and aggregate investment. J Financ Econ 119(1):210–225

Thurlow J (2008) A recursive dynamic CGE model and micro-simulation poverty module for South Africa. IFPRI, Washington Available at http://www.tips.org.za/files/2008/Thurlow_J_SA_CGE_and_microsimulation_model_Jan08.pdf

United Nations (2008) System of National Accounts. UNSO, New York

Acknowledgements

The authors are very thankful to the anonymous reviewers for their valuable comments to improve the manuscript.

Funding

Not Applicable

Author information

Authors and Affiliations

Contributions

IA constructed a financial social accounting matrix (FSAM) for Italy to carry out the study. CS integrated and balanced the FSAM and aligned it for calibration. FS calibrated the dynamic computable general equilibrium (DCGE) model on FSAM. QRY interpreted the results obtained from simulation. RP participated in the sequence alignment. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval

Not Applicable

Competing interests

The authors declare that they have no competing interests.

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A

Appendix B

The FCGE model

The current study develops the recursive dynamic CGE model that includes the financial mechanism. The parameters of the model are calibrated on the FSAM and the system of behavioral equations is solved using the GAMS software.

The general formulation of the model can be synthetized as follow.

The intertemporal optimization problem for all consumers can be represented as:

\( \mathit{\max}{\sum}_{t=0}^T{\left(\frac{1}{1+\rho}\right)}^t{U}^l\left[{C}_t^l\right] \) (A1)

\( s.t.{C}_t^l={\xi}_l\left(x\left[{K}_t^j,{L}_t^j,{Mix}_t^j,{M}_t^j,{Ta}^l\right]-{B}_t^j-{I}_t^j-{Exp}_t^j\right) \) (A2)

\( {K}_{t+1}^j=\left(1-\delta \right){K}_t^j+{I}_t^j \) (A3)where t = 1, …, T is the time period, ρ is the individual time-preference parameter, Ul is the utility function by l = 1,...,4 institutional sector, j = 1,...,64 are the commodities, \( {C}_t^l \) is the consumption of each institutional sector in each period, ξ l is the share of consumption by institutional sector (calibrated on the FSAM data). The current model assumes the exogenous nominal interest rate as r = 4% and real growth rate as g = 0.6%. Given the investment on a steady state \( {I}_t^j=\left(\delta +g\right){K}_t^j \), the value of depreciation rate δ is calibrated on the SAM data and is calculated as \( \delta =\frac{\left(g\ast {K}^0-r\ast {I}^0\right)}{I^0-{K}^0} \). The first order conditions deriving from this maximisation problem are:\( {P}_t^j={\sum}_l{\xi}_l\cdot {\left(\frac{1}{1+\rho}\right)}^t\cdot \frac{\delta u\left({C}_t^l\right)}{\delta {C}_t^l} \) (A4)

\( P{k}_t^j=\left(1-\delta \right)P{k}_{t+1}^j+{P}_t^j\cdotp \frac{\delta x\left({K}_t^j,{L}_t^j, Mi{x}_t^j,{M}_t^j,T{a}_t\right)}{\delta {K}_t^j} \) (A5)

\( {P}_t^j=P{K}_{t+1}^j \) (A6)

where \( {P}_t^j \) is the price of output, \( P{k}_t^j \) is the price of capital paid by each sector. Than the corresponding mixed complimentary problem can be formulated as a sequence of conditions on markets, profits and budget constraints.

Market clearing conditions holds for all commodities and primary factors markets. These conditions posit that the value of excess demand is always non positive. Analytically we can write:

\( {X}_t^j\ge {B}_t^j+\sum \limits_l{C}_t^l\left({P}_t^j,{RA}^l\right)+{Exp}_t^j\perp \)

\( {P}_t^j\ge 0,{\mathrm{P}}_t^j\left({X}_t^j-{B}_t^j-{\sum}_l{C}_t^l\left({P}_t^j,{RA}^l\right)-{I}_t^j-{Exp}_t^j\right)=0 \) (A7)

\( {L}_t\ge \sum \limits_j{X}_t^j\frac{\delta x\left({RK}_t,{Pl}_t,{Pm ix}_t,{Pm}_t^j,{Ta}^j\right)}{\delta {Pl}_t}\perp \)

\( {Pl}_t\ge 0,{Pl}_t\left({L}_t-{\sum}_j{X}_t^j\frac{\delta x\left({RK}_t,{Pl}_t,{ Pm ix}_t{Pm}_t^j,{Ta}^j\right)}{\delta {Pl}_t}\right)=0 \) (A8)

\( {Mix}_t\ge \sum \limits_j{X}_t^j\frac{\delta x\left({RK}_t,{Pl}_t,{Pm ix}_t,{Pm}_t^j,{Ta}^j\right)}{\delta { Pm ix}_t}\perp \)

\( { Pm ix}_t\ge 0,{Pm ix}_t\left({Mix}_t-{\sum}_j{X}_t^j\frac{\delta x\left({RK}_t,{Pl}_t,{Pm ix}_t,{Pm}_t^j,{Ta}^j\right)}{\delta { Pm ix}_t}\right)=0 \) (A9)

\( {K}_t\ge \sum \limits_j{X}_t^j\frac{\delta x\left({RK}_t,{Pl}_t,{Pm ix}_t,{Pm}_t^j,{Ta}^j\right)}{\delta {RK}_t}\perp \)

\( {RK}_t\ge 0,{RK}_t\left({K}_t-{\sum}_j{X}_t^j\frac{\delta x\left({RK}_t,{Pl}_t,{Pm ix}_t,{Pm}_t^j,{Ta}^j\right)}{\delta {RK}_t}\right)=0 \) (A10)

\( {M}_t^j\ge {X}_t^j\frac{\delta x\left(R{K}_t,{Pl}_t,P{mix}_t,P{m}_t^j,T{a}^j\right)}{\delta P{m}_t^j}\perp P{m}_t^j\ge 0,P{m}_t^j\left({M}_t-{X}_t^j\frac{\delta x\left(R{K}_t,{Pl}_t,P{mix}_t,P{m}_t^j,T{a}^j\right)}{\delta P{M}_t^j}\right)=0 \) (A11)where the symbol ⊥ represents the complementarity between the inequalities, meaning that at least one of the two inequalities must be satisfied with the equals sign. RAl is the consumers disposable income, RK t is the rental of capital, Pmix t is the mixed income, PL t is the wage paid and \( P{M}_t^j \) is the price of imported goods (exogenous).

The condition on profits posits that total supply in each commodity market is determined by the perfect competitive market condition, that is to say, price equals average total cost (profit are zero). Analytically we have:

K t ≥ 0, K t (PK t − RK t − (1 − δ)PKt + 1) = 0 (A12)

\( {X}_t^j\ge 0,{X}_t^j\left(A{C}^j\left(R{K}_t,P{l}_t, Pmi{x}_t,P{m}_t^j,T{a}_t^j\right)-{P}_t^j\right)=0 \) (A13)

Income balance conditions derive from the budget constraint:

\( {RA}^l={PK}_0{K}_0^l+{\sum}_{t=0}^T\left({Pl}_t{L}_t^l+{Pm ix}_t{Mix}_t^l+{Pm}_t^j{M}_t^{lj}-{Ta}^j\right)-{Pk}_{T+1}{K}_{T+1}^l \) (A14)

The list of parameters calibrated on the FSAM, the exogenous and endogenous variables is displayed in Table 5.

The current study assumes the intermediation fund characterized as a technology that receives resources as deposits (Al), and dispenses them as loans (El), where the index l = 1,..,4 represents the Institutional Sector. We assume a Cob-Douglas technology in borrowing and a CET technology in lending. Mathematically we have:

\( \prod \limits_{l=1}^4{A}_l^{\varphi_l}\ge X\ge B{\left(\sum \limits_{i=1}^4{\beta}_l{E}_l^{\rho}\right)}^{\raisebox{1ex}{$1$}\!\left/ \!\raisebox{-1ex}{$\rho $}\right.} \) (A15)

where φ l , β l , and B are positive constants such that \( \sum \limits_{l=1}^4{\varphi}_l=1 \) and \( \sum \limits_{l=1}^4{\beta}_l=1 \) and ρ > 1 such that σ = (ρ − 1)−1 is the elasticity of transformation in lending. The volume of intermediation of the fund is represented by the variable X. The fund operates competitively, interest rates for the borrowing and lending are represented by r A and r E respectively and the profit is equal to the interest revenue from loans extended less the borrowing costs. Profit maximization is achieved in two steps. First, the problem of borrowing is solved, taking the level of operation of the fund given by:

\( \operatorname{Minimize}\left(\mathrm{A}\right){\sum}_{\mathrm{l}=1}^4{r}_A{A}_l\;\mathrm{Subject}\kern0.17em \mathrm{to}\;{\Pi}_{l=1}^4{A}_l^{\varphi l}\ge X \) (A16)

The first order conditions of minimization problem in (A16) include the existence of a Langrange multiplier λ > 0 and are given by:

r A A i = φ i λX (A17)

The system of equations, comprised of the first order conditions and the production, is solved and the solution gives the fund’s demand for deposits Al and its minimum cost c(X) = λX as a function of r A and X. The fund maximizes its profit in the second stage as follows:

\( \operatorname{Maximize}\ \left({\mathrm{E}}_{\mathrm{i}}\right),\mathrm{X}\;{\sum}_{\mathrm{l}=1}^4{r}_E{E}_l-c(X)\cdot \mathrm{Subject}\kern0.17em \mathrm{to}{\left({\sum}_{\mathrm{l}=1}^4{\beta}_l{E}_l^{\rho}\right)}^{1/\rho}\le X \) (A18)

The optimization problems depicted in (B) and (D) presents the same Lagrange multiplier. The first order conditions of maximization problem are given by:

\( {r}_E=\lambda {\beta}_l\ {\left(\frac{E_l}{X}\right)}^{p-1} \) (A19)

The system of equations, comprised of the first order conditions in (A19) and the restriction in (A16), is solved and the solution gives the optimal level of financial intermediation X* and the optimal level of loans from the fund to each representative agent,\( {E}_i^{\ast } \). The optimal borrowing of the fund from each agent \( {A}_i^{\ast } \) is obtained by substituting back X* into (A17).

The agent’s equilibrium in real and financial market is characterized following the Maldonado et al. (2008). Savings of each agent can be used to purchase real assets or can be transferred to other agents implying the financial funds. Hence, the change in the value, for each agent, lent to the financial fund (ΔAl) and the changes in its liabilities with the financial fund (ΔEl) are subject to compatible with the savings availability and the decision with respect to the level of investment. We can write:

S l + ∆E l = I l + ∆A l (A20)

where

∆A l = A l − Ao l (A21)

∆E l = E l − Eo l (A22)

Here, Ao l and Eo l represent respectively the net positions of each agent in the financial funds in the base year. The total assets and liabilities must be equal as indicated by the following equation:

\( {\sum}_{i=1}^N{E}_i={\sum}_{i=1}^N{A}_i \) (A23)

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Ahmed, I., Socci, C., Severini, F. et al. Forecasting investment and consumption behavior of economic agents through dynamic computable general equilibrium model. Financ Innov 4, 7 (2018). https://doi.org/10.1186/s40854-018-0091-3

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s40854-018-0091-3

Keywords

- European Central Bank

- Quantitative easing

- Monetary policy

- Investment behavior

- Social accounting matrix

- Dynamic CGE analysis