Abstract

Despite the fast-rising popularity of whey protein sports supplements over recent years, there has been little research to investigate the driving forces behind the consumer choices. Using a consumer dataset collected in Ireland, we applied the ordered Heckman two-stage method to examine the evolving consumer trend and to determine the key factors that affect consumers’ choices. The study found that demographic variables, such as gender and income, do not significantly influence the decision on whether or not to consume whey, but exercise type is highly influential. The desire for power and strength is a stable key consumption driver, with endurance and flexibility becoming more important in the expansion of this industry. The study also found that whey is under-consumed by older age groups and under-promoted based on country of origin affiliation. Findings of the study provide further insights to relevant literature and have direct implications to the sports supplement industry as well as the dairy ingredient industry.

Similar content being viewed by others

Introduction

Few sports supplements have experienced whey protein’s sustained and notable rise in recent years (Euromonitor 2016). Whey protein represented a global market value of approximately USD 7.7 billion in 2016, and its market value is forecasted to reach around USD 9 billion by 2021, corresponding to an average annual growth of 4% (3A Business Consulting 2017). The global sports supplement market has expanded rapidly due to many factors, including increased consumer health consciousness, technical advances in the food industry, predictions for an aging population, and increased health costs (Hasler 1996; Mirasol 1999; Challener 2000). In addition, the expected increase in dairy production following the abolition of the EU milk quota regime, and governments’ promotion of value-added dairy products, will further push the growing market of whey protein-based sports supplements (e.g., Department of Agriculture, Food, and the Marine (DAFM) 2011).

From the supply side, the major producers of whey products and ingredients are the EU-28 countries and the USA. In recent years, strong growth of high-end protein products (i.e., products with higher protein concentrate like WPC80 and WPI) has been observed, resulting from the fast growth in the main nutritional application sectors, such as sports supplements, infant formula, clinical nutrition, and functional foods. Leading dairy and cheese companies, such as Lactalis, Friesland Campina, and Glanbia, play important roles in whey and lactose markets.Footnote 1 Although the two largest dairy companies, Nestlé and Danone, rarely produce whey and lactose ingredients themselves, they are the major end users of whey and lactose in their products. From the demand side, the major markets have expanded from the EU and US markets to Asia and beyond. In terms of market size, Asia has surpassed North America and is predicted to have the most growth potential over the next 5 years (3A Business Consulting 2017).

From the consumer profiles’ prospectus, the whey protein sports supplement market has transformed enormously over the years. Historically, consumers of sports nutrition products have been bodybuilders and athletes (Froiland et al. 2004). With increased consumer health consciousness and rapid expansion of the dietary supplement industry, the market has seen growing interest in the use of whey protein supplements by recreational users (Agriculture and Agri-Food, Canada [AAFC] 2010). Studies have also shown that the calcium and mineral mix provided by dairy products can accelerate weight and fat loss during energy restriction, suggesting that whey protein might facilitate consumers in achieving a favorable body weight and composition (Ha and Zemel 2003).

Previous research on consumer perception and behaviors toward whey protein products can be found for whey protein-added snack, yogurt, and meal replacement products. Lee et al. (2002) investigated four formulations of whey-protein-isolate (WPI) coatings used for chocolate-covered almonds and found that water-based WPI-lipid coatings had higher consumer acceptance than alcohol-based shellac. In another study done by Childs et al. (2008) on consumer perception of whey and soy protein in meal replacement products, the researchers found that consumers preferred bars to beverages, but there were no significant preferences for protein type, which may result from the lack of knowledge and understanding of the different protein types. They also found that exercisers viewed muscle-building claims as more important, while non-exercisers viewed the heart health, calcium, and vitamin/mineral claims as more important.

There are no up-to-date quantitative studies that explore consumers’ choice behaviors for whey protein-based sports supplements. Although the expansion of the sports supplement market has provided tremendous opportunities for the industry, producers and marketers are facing increasing challenges. First, as a wider variety of products become available in a growing variety of channels, competition is intensified from both inside and outside the sports nutrition market Agriculture and Agri-Food, Canada [AAFC] 2010; Euromonitor 2015). Second, ever-evolving consumer trends have placed more pressure on companies to develop novel products and accelerate the product adaption and innovation process in order to meet consumer needs (Bistrom and Nordstrom 2002; Agriculture and Agri-Food, Canada [AAFC] 2010). Under such a situation, continuous effort in understanding consumer trends is crucial to all the players in the industry.

To facilitate improved understanding on whey protein sports supplement consumption and the evolving consumer trends, we carried out a small-scale consumer survey in Ireland in 2014. Although a small country, Ireland plays a unique role in the world sports nutrition market. From the production side, Glanbia (headquarters in Ireland) became the world’s largest sports nutrition producer in 2003. A number of high-profile acquisitions, including that of Optimum Nutrition and BSN, have given Glanbia a 13% share in a fragmented global sports nutrition market (Food and Drink Business Europe 2011). From the market side, the Irish market for whey protein sports supplements has seen rapid growth in both Irish-owned brands (Optimum Nutrition, Kinetica, BSN, ROS, etc.) and non-Irish brands (USN, PhD, etc.). Compared to the average annual growth of 4% globally, shares of sports nutrition grew by 9% and sports protein powder grew by 12% in current value terms in 2015 in Ireland (Euromonitor 2015). With its leading position in sports nutrition production and its tremendous market growth, Ireland has lent itself to being an appealing case study choice for the evolving trends of this fast-growing industry.

Sports supplements are traditionally used by athletes to enhance training effect and to accelerate body recovery. It is often believed that males are the dominant users of sports supplements (Froiland et al. 2004). The objectives of this research are (1) to identify the determining factors that affect consumers’ choice of whether or not to consume whey protein products, (2) to determine the key factors that affect the amount of whey products consumed by consumers, and (3) to determine the brand awareness and the key factors that affect consumers’ brand choice. Three hypotheses are explored. Hypothesis 1: gender plays an important role in the choice of whey protein consumption. Hypothesis 2: exercise type is a determining factor for the consumption of sports supplements. Hypothesis 3: country of origin label has strong impacts on consumer choices. Findings from the study will have direct implications to improve the effectiveness of product development and other marketing efforts of the industry. The rest of the paper is organized as follows. The “Methodology” section explains the model and methodology applied in the study. The “Data and analysis” section reports the sample details, the analysis process, and the main results. The “Conclusions and implications” section concludes the study and provides industry implications.

Methodology

In a typical consumer study scenario, the people interviewed would be asked if they have consumed a certain product, and if so, how much. For researchers, one problem that often arises is that the consumption quantity is not observable for those who have not consumed the product, so that estimating the consumption quantity based only on the characteristics of consumers of the product would tend to produce biased results (Heckman 1979; Baltagi 2008; Winkelmann 2013). To solve this potential sample selection bias problem, we used Heckman’s two-stage selection model that approaches the sample selection as an omitted variables problem in a two-stage process (Heckman 1979).Footnote 2 In addition, for our survey respondents who have consumed whey protein sports supplements, their consumption levels were indicated by the selection from a list of different intervals. From a data analysis point of view, whey consumption is represented by a series of ordered outcomes rather than a continuous variable. To accommodate this ordered response, we used ordered selection models instead of a standard selection model (Chiburis and Lokshin 2007; De Luca and Perotti 2011).

Combining the above modeling considerations, the main statistical method used herein is Heckman’s ordered probit model taking into account potential selection bias and the nature of ordered data. Following De Luca and Perotti (2011), an ordered response model with sample selection can be represented through the following bivariate threshold-crossing model:

Equation (1) shows the two-stage consumer decision process with each stage decision affected by a list of factors, where \( {Y}_1^{\ast } \) represents the latent variable for the selection process (consume whey or not) and \( {Y}_2^{\ast } \) represent the outcomes of interest (amount consumed, or money spent), respectively; the Xj are exogenous variables (demographics, consumer behaviors, etc.); the βj are vectors of parameters; and the Uj are unknown errors. Equation (2) is the selection equation capturing whether or not a potential consumer i uses whey products, which is modeled as an indicator defined as Y1 = 1 if Y1* > 0, and Y1 = 0 otherwise. Equation (3) is the outcome equation, that is, the quantity of whey protein product consumed by consumer i.

Sample selection bias is such that we only observe Y2 when Y1 = 1; that is, we only observe the quantity consumed by consumers if they decided to consume whey in the first place, with the decision to consume whey being largely based on the utility maximization assumption \( {Y}_1=I\left({Y}_1^{\ast}\ge 0\right) \). Adopting the Heckman selection model, our parametric specification of the model assumes that the errors U1 and U2 follow a bivariate Gaussian (normal) distribution with zero means, unit variances, and correlation coefficient ρ, which allows for the selection effect to operate. Under this assumption on the distribution of the latent regression errors, the log-likelihood function for a random sample of n observations {(Y1i, Y2i, X1i, X2i), i = 1, … , n } is:

where θ = (β1, β2, α, ρ) is the vector of all model parameters (β1 is a vector of the parameters for the selection model, β2 is a vector of the parameters for the outcome model, α is the level of the ordered outcome, and ρ the correlation coefficient for the errors U1 and U2) and the π′s are the conditional probabilities of the possible realizations of Y1 and Y2. A parametric maximum likelihood (ML) estimator of θ maximizes the log-likelihood function specified in Eq. (4) and is consistent and asymptotically efficient under standard regularity conditions (De Luca and Perotti 2011). The statistical software package we used for the estimation is Stata13 (StataCorp 2013).

Data and analysis

A consumer survey on whey protein sports supplements was conducted in Ireland in February and March of 2014. The questionnaires, generated using survey monkey, were posted and collected through an online Facebook community.Footnote 3 The survey was aimed at Irish residents aged 18 years and above with basic knowledge and understanding about whey protein.

The survey collected the respondents’ demographic characteristics, such as gender, age, income, and employment status; whey product consumption and purchase behavior, such as whether or not the respondent consumed whey products in the past 5 years and the amount of product consumed; and information on whether respondents participated in exercises and the types of the exercises. Considering that the main function of whey protein is to improve muscle protein synthesis, promote the growth of muscle, and aid weight-loss, exercise type and frequency are expected to be highly relevant to the consumption and purchase of whey products. A total of 105 valid responses were collected and used in this study.

Statistics of participants’ demographic characteristics, together with exercise and whey consumption behavior, are summarized in Table 1. The percentage of female respondents are somewhat lower than male respondents (46% vs. 54%), likely reflecting the continued gender difference in the consumption of sports supplement products. The majority of the respondents in our sample (77%) engage in more than 3 h of exercise per week, wherein 61% of respondents claim endurance as their main type of exercise compared to 27% of respondents claiming flexibility as their main type of exercise. Among the respondents, new users (started to use whey protein within the past year) account for 40% of all users from the respondents compared to 15% having used whey for more than 5 years. For those who buy whey protein products, more than half are under the age of 25 years and only 24% are aged 36 years or above, which is in line with previous studies showing the popularity of whey sports supplements among younger age groups (Morrison et al. 2004; Bianco et al. 2011).Footnote 4

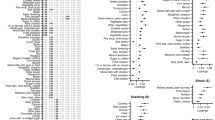

Results from the Heckman ordered probit models are shown in Table 2. The lower part of the table reports parameters for the selection model, that is, factors affecting the decision of whether or not to consume whey protein sports supplements; the upper part of the table includes estimates for the outcome model, that is, factors affecting the amount of whey products consumed given a decision to consume in the first place. Whey consumption amount is captured by both the quantity of whey products consumed (model 1Footnote 5) and the money expenditure on whey products (model 2). In both models, qualitative variables such as gender and exercise type are included as indicator variables, with endurance being used as the base for exercise type. Results in model 1 show that demographic variables such as age, gender, and income do not have a significant influence on the decision on whether or not to consume whey, but exercise type does make a difference: relative to “endurance” type of exercisers, people who engage in “power and strength” types of exercises are more likely to consume whey protein sports supplements. Regarding the quantity purchased, gender and income are not significant in the model results, indicating the lack of statistical evidence to support the gender difference in the decision for whey protein consumption. Conversely, age is negative and significant, showing a negative impact at the 95% confidence level even after controlling for exercise frequency, indicating that among whey consumers, older people tend to consume less whey protein sports supplements. The results in model 2 are consistent with those reported in model 1, where expense replaces quantity of whey sports supplements consumed as the dependent variable.

These findings suggest that income (albeit self-reported) is not a defining factor of whey protein sports supplement consumption, and also challenge the conventional understanding that females are less likely than males to use sports supplements. In addition, perhaps, the most noteworthy finding involves the older age group. Our study shows that older people tend to consume less whey products even after controlling for exercise frequency in the analysis. Scientific research indicates that as people age, they tend to become resistant to the positive effect of protein ingestion, which means that older people need a higher protein dose than younger people post-exercise to achieve desired muscle protein synthesis (Burd et al. 2012). In summary, older people consume less whey protein when they should be consuming more. This apparent divergence offers a potential marketing opportunity for this growing industry.

To further identify the changing consumption trend of whey protein supplements, we took the subsample of the data (in particular, those who consume whey protein products) and divided it into two groups: group 1 includes people who used whey for more than 2 years and group 2 includes those who just started using whey within 2 years at the time of the survey. The statistics show that more than half of the new whey consumers are those who participate in endurance and flexibility types of exercise, indicating a strong market growth potential in this market segment. The statistics also show that more than 80% of the female consumers of whey protein supplements only started to use the product in the last 2 years, indicating a strong growth trend for females in recent years. Reasons behind this trend include the change in perception (that the function of muscle recovery can be achieved without building bulk muscle mass) and product availability (companies are targeting female consumers with specific designs that appeal to females (e.g., pink packaging, smaller size)).Footnote 6

When investigating consumers’ brand preference, we find no significant correlation among age, gender, or exercise type to the choice of Irish brand vs. non-Irish brand. But one noteworthy finding is that while 55% of whey consumers surveyed state that they would prefer Irish brands to non-Irish brands, 41% of consumers within this group were unaware of whether or not the product they bought is an Irish brand product. This current lack of awareness of brand origin among consumers likely reflects the under-promotion of origin-related brand names. On the flip side, using country of origin labeling to further promote whey products may have strong marketing potential.

Conclusions and implications

Previous research on consumer perception and behaviors toward whey protein products are limited to whey protein-added snack, yogurt, and meal replacement products (Lee et al. 2002; Childs et al. 2008). In this study, we investigated the evolving consumer trends for whey protein products as sports supplements using a small-scale consumer survey. We found no evidence that the likelihood for the purchase of whey protein products is affected by gender or income, but the decision is highly correlated with exercise type. This finding is consistent with some of the previous research that concludes that demographic characteristics have less impact on consumer food choice than behavioral variables (Gao et al. 2011; Macharia et al. 2013). Although people who exercise for “power and strength” are more likely to purchase whey protein products, the fast-growing market in recent years is among those who mainly undertake endurance and flexibility exercises. This finding shows that the main driving force behind whey protein consumptions has shifted from elite athletes pursuing higher performance to recreational exercisers looking to improve body and health function, thus providing important updates to our understanding on the market trends compared to previous literature (Froiland et al. 2004).

The increasing popularity of whey protein supplements among women users is evident. This revealed a shift in the gender composition of whey protein consumers from male dominant to gender neutral. In addition, we found that age is an important factor affecting the consumption choices of whey protein: the older age group tends to spend less on whey protein and consume less quantity of whey protein products than the younger age groups even after controlling for exercise frequency, yet according to scientific research, the older age group needs more whey protein for muscle recovery post-exercise due to higher resistance to protein ingestion. In terms of consumers’ brand choice for whey protein products, due to the disconnection of product brands to country of origin information, consumers’ preference for domestic brands is not reflected through their brand choice.

Our findings have several implications for the industry. First, there is a clear opportunity to target recreational and lifestyle users to expand the potential market for whey protein sports supplements. Second, further development of products that target female consumers is a promising direction for the industry. Third, if whey is being under-consumed by the older age group, promoting to this group should not only try to attract new consumers, but also convey to existing users the importance of increasing their whey consumption level based on health grounds. Finally, given the preference for domestic brand by consumers and the lack of brand origin awareness, further promotion of country of origin as a favorable product attribute may lead to potential marketing advantage.

Albeit the interesting findings and consumer trends revealed from this study, as noted above, the data collected in this study have certain limitations in terms of sample size and social media recruitment method. Given the niche market nature of the product studied, recruiting consumers was challenging; thus, the sample size is much smaller than preferred. Even for the targeted group of regular exercisers, only a small percentage consume whey protein products. Another limitation of the study is that we did not include analysis for consumer attitude toward whey protein products. This is partially due to the study design, which focused more on consumption trend than on consumer attitude. Thereby, future research for the whey protein supplement market on a larger scale that includes further analysis on consumer attitude with specific marketing focuses may be beneficial.

Notes

Lactalis is a multinational dairy products corporation headquartered in France. FrieslandCampina is a Dutch dairy cooperative. Glanbia is a global nutrition company headquartered in Ireland.

Compared to another often-used Tobit model in the related literature, Heckman’s model allows different mechanisms for the decision to participate (e.g., buy, consume) and the decisions on the consumption quantity (e.g., how much to buy, how much to consume) (Heckman 1979; Bellemare and Barrett 2006).

There are increasing numbers of research projects being conducted using data collected through online media, given the low cost (compared to face-to-face survey) and vast popularity of social media. For discussions on the validity and justification of using online media for survey recruitment, please refer to Tan et al. (2012) and Samuels and Zucco (2013).

Larger proportion of younger users in the dataset could also partly reflect recruitment using social media.

Two dependent variables that represent whey consumption behaviors which are used in model 1 and model 2 are the average consumer whey protein supplements consumption quantity (kilogram) and the average consumer expense for whey protein supplements (euro) respectively.

When a one-stage ordered probit regression was applied to the subsample of whey protein users using consumption quantity as the dependent variable, we find that the female variable is negative and statistically significant, which implies that female consumers tend to buy smaller quantities compared to their male counterparts.

References

3A Business Consulting (2017) Global market for whey and lactose ingredients, 2017–2021. 3A Business Consulting, Aarhus

Agriculture and Agri-Food, Canada [AAFC] (2010) Overview of the sports nutrition market – food, beverages, and supplements. Agriculture and Agri-Food Canada, Ottawa, Ontario

Baltagi BH (2008) Econometric Analysis of Panel Data. Chichester: Wiley.

Bellemare MF, Barrett CB (2006) An ordered Tobit model of market participation: evidence from Kenya and Ethiopia. Am J Agric Econ 88(2):324–337

Bianco A, Mammina C, Paoli A, Bellafiore M, Battaglia G, Caramazza G, Palma A, Jemni M (2011) Protein supplementation in strength and conditioning adepts: knowledge, dietary behavior and practice in Palermo, Italy. J Int Soc Sports Nutr 8:25 https://doi.org/10.1186/1550-2783-8-25

Bistrom M, Nordstrom K (2002) Identification of key success factors of functional dairy foods product development. Trends Food Sci Technol 13:372–379

Burd NA, Yang Y, Moore DR, Tang JE (2012) Greater stimulation of myofibrillar protein synthesis with ingestion of whey protein isolate v. micellar casein at rest and after resistance exercise in elderly men. Br J Nutr 108(6):958–962

Challener C (2000) Functional foods market offers promise and risk. Chem Mark Report 257:16

Chiburis R, Lokshin M (2007) Maximum likelihood and two-step estimation of an ordered-probit selection model. Stata J 7(2):167–182

Childs JL, Thompson JL, Lillard JS, Berry TK, Drake M (2008) Consumer perception of whey and soy protein in meal replacement products. J Sens Stud 23(3):320–339

De Luca G, Perotti V (2011) Estimation of ordered response models with sample selection. Stata J 11:213–239

Department of Agriculture, Food, and the Marine (DAFM) (2011) Implementation of the Food Harvest 2020 in the Dairy sector (2011). Department of Agriculture, Food, and the Marine, Dublin

Euromonitor (2015) Sports nutrition in Ireland – a category briefing. Euromonitor International, London

Euromonitor (2016) Global trends in protein. Euromonitor International, London

Food and Drink Business Europe (2011) Glanbia acquires US performance nutrition business for $144 million. Dublin: Premier Publishing Ltd.

Froiland K, Wanda K, Hingst J, Kopecky L (2004) Nutritional supplement use among college athletes and their sources of information. Int J Sport Nutr Exerc Metab 14:104–120

Gao Z, House LO, Gmitter FG Jr, Valim MF, Plotto A, Baldwin EA (2011) Consumer preferences for fresh citrus: impacts of demographic and behavioral characteristics. Int Food Agribus Manage Rev 14:23–40

Ha E, Zemel MB (2003) Functional properties of whey, whey components, and essential amino acids: mechanisms underlying health benefits for active people. J Nutr Biochem 14:251–258

Hasler CM (1996) Functional foods: the western perspective. Nutr Rev 54:S6–S10

Heckman J (1979) Sample selection bias as a specification error. Econometrica 47:153–161 Note: Heckman received the Nobel Prize for this paper

Lee SY, Dangaran KL, Guinard JX, Krochta JM (2002) Consumer acceptance of whey-protein-coated as compared with shellac-coated chocolate. J Food Sci 67(7):2764–2769

Macharia J, Collins R, Sun T (2013) Value-based consumer segmentation: the key to sustainable agri-food chains. Br Food J 115:1313–1328

Mirasol F (1999) Sloan outlines nutraceutical trends at DCAT health & nutrition seminar. Chem Mark Report 255:4–5

Morrison LJ, Gizis F, Shorter B (2004) Prevalent use of dietary supplements among people who exercise at a commercial gym. Int J Sport Nutr Exercise Metab 14(4):481–492

Samuels DJ, Zucco C (2013) Using Facebook as a subject recruitment tool for survey-experimental research. SSRN Electron J. https://doi.org/10.2139/ssrn.2101458

StataCorp (2013) Stata Statistical Software: Release 13. StataCorp, College Station, TX

Tan H, Forgasz H, Leder G, McLeod A (2012) Survey recruitment using Facebook: three studies. NETs2012 International Conference on Internet Studies, Bangkok

Winkelmann R (2013) Econometric analysis of count data, 5th edn. Springer, New York

Acknowledgements

The authors would like to thank colleagues who kindly provided their suggestions, in particular, Dr. David Stead for his valuable input. We would also like to thank the two reviewers for their insightful comments and suggestions.

Funding

Not applicable.

Availability of data and materials

The datasets generated during the current study are not publicly available but are available from the corresponding author on reasonable request.

Author information

Authors and Affiliations

Contributions

CK was responsible for the industry review, data collection, and the draft writing. CL was responsible for the data analysis, additional literature review, and paper writing. ZG contributed to the model and was responsible for the data analysis and paper revision. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no competing interests.

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Keogh, C., Li, C. & Gao, Z. Evolving consumer trends for whey protein sports supplements: the Heckman ordered probit estimation. Agric Econ 7, 6 (2019). https://doi.org/10.1186/s40100-019-0125-9

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s40100-019-0125-9