Abstract.

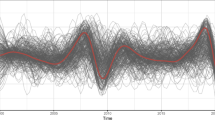

This paper intends to meet recent claims for the attainment of more rigorous statistical methodology within the econophysics literature. To this end, we consider an econometric approach to investigate the outcomes of the log-periodic model of price movements, which has been largely used to forecast financial crashes. In order to accomplish reliable statistical inference for unknown parameters, we incorporate an autoregressive dynamic and a conditional heteroskedasticity structure in the error term of the original model, yielding the log-periodic-AR(1)-GARCH(1,1) model. Both the original and the extended models are fitted to financial indices of U. S. market, namely S&P500 and NASDAQ. Our analysis reveal two main points: (i) the log-periodic-AR(1)-GARCH(1,1) model has residuals with better statistical properties and (ii) the estimation of the parameter concerning the time of the financial crash has been improved.

Similar content being viewed by others

References

D. Sornette, A. Johansen, J.-P. Bouchaud, J. Phys. I France 6, 167 (1996)

D. Sornette, Why Stock Markets Crash: critical events in complex financial systems (Princeton University Press, USA, 2002)

A. Johansen, O. Ledoit, D. Sornette, Int. J. Theor. Appl. Finance 3, 219 (2000)

D. Sornette, A. Johansen, Quantitative Finance 1, 452 (2001)

J. Feigenbaum, Quantitative Finance 1, 346 (2001)

W.-X. Zhou, D. Sornette, Int. J. Mod. Phys. C 13, 137 (2002); Wei-Xing Zhou, D. Sornette, Int. J. Mod. Phys. C 14, 1017 (2003)

M. Gallegatti, S. Keen, T. Lux, P. Ormerod, Physica A 370, 1 (2006)

D. Sornette, A. Johansen, Physica A 245, 411 (1997)

J. Hamilton, Time Series Analysis (Princeton University Press, New Jersey, USA, 1994)

C. Tsallis, D. Stariolo, Physica A 233, 395 (1996)

A.C. Harvey, The Econometric Analysis of Time Series (Philip Allan Publishers Limited, London, 1985)

A. Johansen, O. Ledoit, D. Sornette, J. Risk 1, 5 (1999)

A. Johansen, D. Sornette, Eur. Phys. J. B 17, 319 (2000)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Gazola, L., Fernandes, C., Pizzinga, A. et al. The log-periodic-AR(1)-GARCH(1,1) model for financial crashes. Eur. Phys. J. B 61, 355–362 (2008). https://doi.org/10.1140/epjb/e2008-00085-1

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1140/epjb/e2008-00085-1