Abstract.

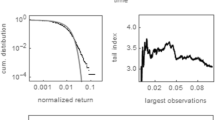

We present an experimental and simulated model of a multi-agent stock market driven by a double auction order matching mechanism. Studying the effect of cumulative information on the performance of traders, we find a non monotonic relationship of net returns of traders as a function of information levels, both in the experiments and in the simulations. Particularly, averagely informed traders perform worse than the non informed and only traders with high levels of information (insiders) are able to beat the market. The simulations and the experiments reproduce many stylized facts of tick-by-tick stock-exchange data, such as fast decay of autocorrelation of returns, volatility clustering and fat-tailed distribution of returns. These results have an important message for everyday life. They can give a possible explanation why, on average, professional fund managers perform worse than the market index.

Similar content being viewed by others

References

A. Cowles, Econometrica 1, 309 (1933)

M. Jensen, Journal of Finance 23, 389 (1968)

B.G. Malkiel, European Financial Management 9, 1 (2003)

B.G. Malkiel, Journal of Economic Perspectives 17, 59 (2003)

S.J. Grossman, J.E. Stiglitz, Ame. Econ. Rev. 70, 393 (1980)

M. Hellwig, Journal of Economic Theory 26, 279 (1982)

S. Figlewski, Journal of Finance 37, 87 (1982)

S. Sunder, Econometrica 60, 667 (1992)

E. Scalas, S. Cincotti, C. Dose, M. Raberto, Fraudulent Agents in an Artificial Financial Market, in Nonlinear Dynamics and Heterogeneous Interacting Agents, edited by T. Lux, S. Reitz, E. Samanidou, Lecture Notes in Economics and Mathematical Systems, 550, 317 (Springer, Berlin, 2005)

M. Kirchler, J. Huber, Journal of Economic Dynamics and Control, forthcoming

J. Huber, Journal of Economic Dynamics and Control, forthcoming

J. Huber, M. Kirchler, M. Sutter, Journal of Economic Behavior and Organization, forthcoming

J.D. Gibbons, Nonparametric Statistical Inference, 2nd edn. (M. Dekker, 1985)

M. Hollander, D.A. Wolfe, Nonpapametric Statistical Methods (Wiley, 1973)

R. Cont, Quantitative Finance 1, 223 (2001)

G.G. Judge, R.C. Hill, W.E. Griffiths, H. Lutkepohl, T.-C. Lee, Introduction to the Theory and Practice of Econometrics (New York, Wiley, 1988)

M. LiCalzi, P. Pellizzari, Quantitative Finance 3, 1 (2003)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Tóth, B., Scalas, E., Huber, J. et al. The value of information in a multi-agent market model. Eur. Phys. J. B 55, 115–120 (2007). https://doi.org/10.1140/epjb/e2007-00046-2

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1140/epjb/e2007-00046-2