Abstract.

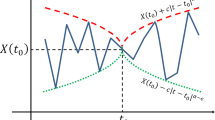

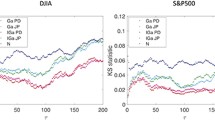

We consider the roughness properties of NYSE (New York Stock Exchange) stock-price fluctuations. The statistical properties of the data are relatively homogeneous within the same day but the large jumps between different days prevent the extension of the analysis to large times. This leads to intrinsic finite size effects which alter the apparent Hurst (H) exponent. We show, by analytical methods, that finite size effects always lead to an enhancement of H. We then consider the effect of fat tails on the analysis of the roughness and show that the finite size effects are strongly enhanced by the fat tails. The non stationarity of the stock price dynamics also enhances the finite size effects which, in principle, can become important even in the asymptotic regime. We then compute the Hurst exponent for a set of stocks of the NYSE and argue that the interpretation of the value of H is highly ambiguous in view of the above results. Finally we propose an alternative determination of the roughness in terms of the fluctuations from moving averages with variable characteristic times. This permits to eliminate most of the previous problems and to characterize the roughness in useful way. In particular this approach corresponds to the automatic elimination of trends at any scale.

Similar content being viewed by others

References

B. Mandelbrot, Fractals and Scaling in Finance (Springer Verlag, New York, 1997)

R.N. Mantegna, H.E. Stanley, An Introduction to Econophysics (CambridgeUniversity Press, Cambridge, 2000)

J.P. Bouchaud, Theory of Financial Risk (Cambridge University Press, Cambridge, 2000)

H.E. Hurst, Transaction of the American Society of Civil Engineers 116, 770 (1951)

M. Couillard, M. Davison, Physica A 348, 404 (2005)

S. Katsev, I. L'Heureux, Computers & Geosciences 29, 1085 (2003)

S.O. Cajueiro, B. Tabak, Physica A 336, 521 (2004)

D. Grech, Z. Mazur, Physica A 336, 133 (2004)

A. Carbone, G. Castelli, H.E. Stanley, Physica A 344, 267 (2004)

T. Di Matteo, T. Aste, M.M. Dacorogna, Journal of Banking and Finance 29, 827 (2005)

A.L. Barabasi, H.E. Stanley, Fractal Concepts in Surface Growth (Cambridge University Press, Cambridge, 1994)

L. Pietronero, Order and Chaos in Nonlinear Physical System, edited by S. Lundqvist, N.H. March, M. Tosi (Plenum Publishing Corporation, New York, 1988), p. 227

C. Castellano, M. Marsili, L. Pietronero, Phys. Rev. Lett. 80, 3527 (1998)

G. Grimmet, D. Stirzaker, Probability and Random Processes (Oxford University Press, Oxford, 2001)

V. Alfi, F. Coccetti, M. Marotta, A. Petri, L. Pietronero, Physica A, in print (2006), e-print arXiv:cond-mat/0601230

J. Asikainen, S. Majaniemi, M. Dub, T. Ala-Nissila, Phys. Rev. E 65, 052104 (2002)

E. Alessio, A. Carbone, G. Castelli, V. Frappietro, Eur. Phys. J. B 27, 197 (2002)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Alfi, V., Coccetti, F., Petri, A. et al. Roughness and finite size effect in the NYSE stock-price fluctuations. Eur. Phys. J. B 55, 135–142 (2007). https://doi.org/10.1140/epjb/e2006-00240-8

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1140/epjb/e2006-00240-8