Abstract

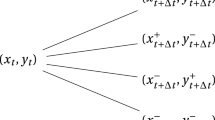

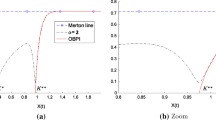

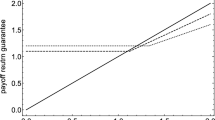

The cost of maturity minimum guarantee of an investment fund is typically deducted upfront or at the beginning of each period, together with other costs such as sales commissions and management fees. This practice gives a significant negative impact on the short term returns of the investment. In this paper, we propose a way to compensate the cost of investment guarantee by continuous withdrawals whenever the fund value stays below or at a predetermined threshold. The corresponding dynamics of fund price follows a (geometric) refracted Brownian motion, where the two drifts are state dependent. We derive integral formulas for the prices of fund and maturity minimum guarantee. Given the cost deduction threshold and the maturity guarantee level, the fair deduction rate can be determined numerically.

Similar content being viewed by others

References

T. Bae and B. Ko, The Korean Journal of Applied Statistics 23(4), 621 (2010).

P. P. Boyle and M. R. Hardy, Insurance: Mathematics and Economics 21, 113 (1997).

M. R. Hardy, North American Actuarial Journal 4, 63 (2000).

M. R. Hardy, Investment Guarantees: Modelling and Risk Management for Equity-Linked Life Insurance (Wiley, New York, 2003).

H. Gerber and E. Shiu, Journal of Computational and Applied Mathematics 186, 4 (2006).

I. Karatzas and S. E. Shreve, Brownian Motion and Stochastic Calculus, 2nd Edition (Springer, New York, 1997).

A. E. Kyprianou and R. L. Loeffen, Annales de l’Institut Henri Poincaré 46(1), 24 (2010).

M. Musiela and M. Rutkowski, Martingale Methods in Financial Modelling, 2nd Edition (Springer-Verlag, Berlin, 2005).

S. E. Shreve, Stochastic Calculus for Finance II: Continuous-Time Models (Springer, New York, 2004).

Author information

Authors and Affiliations

Corresponding author

Additional information

(Submitted by A. I. Volodin)

T. Bae is supported by a startup grant from the University of Regina.

Rights and permissions

About this article

Cite this article

Bae, T., Ko, B. Pricing maturity guarantee under a refracted Brownian motion. Lobachevskii J Math 34, 234–247 (2013). https://doi.org/10.1134/S1995080213030025

Published:

Issue Date:

DOI: https://doi.org/10.1134/S1995080213030025