Abstract

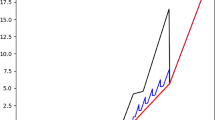

A two-step problem of minimizing average costs of hedging a European call option is studied. The hedging is implemented by buying and selling underlying assets. It is assumed that the durations of asset purchase and sale operations at the market are random and exponentially distributed. The problem is solved by the dynamic programming method. An expression for the expected value of the future loss function at the final step is obtained. A numerical algorithm for finding an optimal strategy at the first step is proposed. An example of using the algorithm is given.

Similar content being viewed by others

References

F. Black and M. Scholes, “The pricing of options and corporate liabilities,” J. Polit. Econ. 81 (3), 637–659 (1973).

M. Y. Zhang, J. Russell, and R. S. Tsay, “A nonlinear autoregressive conditional duration model with applications to financial transaction data,” J. Econometrics 104 (1), 179–207 (2001).

A. Dufour and R. F. Engle, The ACD Model: Predictability of the Time between Consecutive Trades (ISMA Centre, Reading, 2000).

H. Föllmer and A. Schied, Stochastic Finance: An Introduction in Discrete Time (De Gruyter, Berlin, 2004; MTsNMO, Moscow, 2008).

O. V. Zverev and V. M. Khametov, “Minimax hedging of European type options in incomplete markets (discrete time),” Obozrenie Prikl. Promyshl. Mat. 18 (1), 26–54 (2011).

O. V. Zverev and V. M. Khametov, “Quantile hedging of European type options in incomplete friction-free markets. Part 2. Superhedging,” Probl. Upravl., No. 6, 31–44 (2014).

A. I. Kibzun and V. R. Sobol’, “Modernization of the consecutive hedging strategy for an option position,” Trudy Inst. Mat. Mekh. UrO RAN 17 (2), 179–192 (2013).

L. Bachelier, “Theorie de la speculation,” Ann. Sci. École Norm. Sup. 3, 21–86 (1900).

B. M. Miller and A. R. Pankov, Theory of Random Processes in Examples and Problems (Fizmatlit, Moscow, 2002) [in Russian].

D. Bertsekas and S. Sheve, Stochastic Optimal Control: The Discrete-Time Case (Academic, New York, 1978; Nauka, Moscow, 1985).

Author information

Authors and Affiliations

Corresponding author

Additional information

Original Russian Text © A.I. Kibzun, V.R. Sobol’, 2015, published in Trudy Instituta Matematiki i Mekhaniki UrO RAN, 2015, Vol. 21, No. 3.

Rights and permissions

About this article

Cite this article

Kibzun, A.I., Sobol’, V.R. A two-step problem of hedging a European call option under a random duration of transactions. Proc. Steklov Inst. Math. 295 (Suppl 1), 78–88 (2016). https://doi.org/10.1134/S0081543816090091

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1134/S0081543816090091