Abstract

This paper investigates the relationship between demographics and the current account (CA) employing a polynomial measure that considers the full age distribution. Using a panel of 49 countries over 30 years of data, the polynomial produces economically more intuitive and stable results than previously used demographics measures. We find strong and robust non-linear effects. Specifically, we find that a relatively larger share of young cohorts is correlated with a lower CA, while a larger share of working-age cohorts is correlated with a higher CA. Our results show that disregarding any age group may fail to account for the full demographic effect on the CA over time and across countries. Accounting for the full age distribution thus allows to explain a larger share of observed CA surpluses and deficits.

Similar content being viewed by others

Notes

Studies distinguish between the young and old-age dependency ratio (Chinn and Prasad 2003; Bosworth and Chodorow-Reich 2007; Gruber and Kamin 2007; Chinn and Ito 2008a), the domestic and foreign dependency ratio (Hung and Gamber 2010), or the current and future dependency ratio (Jaumotte and Sodsriwiboon 2010).

Our sample covers 49 countries, among which 24 AEs and 25 EMEs. Sect. 3 describes the sample in more detail.

Indeed, the EBA regression finds a negative and significant relationship for life expectancy of prime savers and CA balances, and a positive and significant coefficient for the interaction. Dao and Jones (2018) argue these results imply that increasing life expectancy has a positive effect on CA balances only for AEs facing unfavorable old-age support ratios. Following their model, they further argue that higher future old-age dependency ratios are associated with less generous pay-as-you-go pension systems.

This assumption can easily be tested using different polynomial degrees in the estimation equation. Section 5 presents the results of these tests.

Runge’s phenomenon describes the oscillation at the edges of an interval that occurs when using polynomial interpolation with high-order polynomials. Runge discovered this problem by looking at the errors that are produced when using polynomial interpolation to approximate certain functions. It shows that increasing the polynomial order does not always improve accuracy, as it may introduce too much noise.

As in the EBA framework, variables are converted into deviations from a weighted sample mean. The controls are defined as in the EBA model with the exception of the fiscal balance and private credit to GDP, which are not cyclically adjusted. Instead, the fiscal balance to GDP is the general government net/lending borrowing using WEO data. Private credit is the private credit by deposit money banks to GDP, or, if missing, domestic credit to the private sector, from the World Bank GFDD.

In a robustness check not shown, we find that our polynomial specification is robust to time and country fixed effects when using the yearly frequency.

We use the medium-variant projections.

References

Alexander, Sidney S. 1952. Effects of a Devaluation on a Trade Balance. IMF Staff Papers 2 (2): 263–278.

Alexander, Sidney S. 1959. Effects of a Devaluation: A Simplified Synthesis of Elasticities and Absorption Approaches. The American Economic Review 49 (1): 22–42.

Almon, Shirley. 1965. The Distributed Lag Between Capital Appropriations and Expenditures. Econometrica 33 (1): 178–196.

Ando, Albert, and Franco Modigliani. 1963. The “Life Cycle” Hypothesis of Saving: Aggregate Implications and Test. The American Economic Review 53 (1):55–84.

Arnott, Robert D., and Denis B. Chaves. 2012. Demographic Changes, Financial Markets, and the Economy. Financial Analysts Journal 68 (1): 23–46.

Attanasio, Orazio P., Sagiri Kitao, and Giovanni L. Violante. 2006. Quantifying the Effects of the Demographic Transition in Developing Economies. The BE Journal of Macroeconomics 6 (1): 1–44.

Auclert, Adrien, Hannes Malmberg, Frederic Martenet, and Matthew Rognlie. 2021. Demographics, Wealth, and Global Imbalances in the Twenty-First Century. NBER Working Paper No. 29161. Cambridge, Massachusetts: National Bureau of Economic Research.

Backus, David, Thomas Cooley, and Espen Henriksen. 2014. Demography and Low-Frequency Capital Flows. Journal of International Economics 92: S94–S102.

Bárány, Zsáfia, Nicolas Coeurdacier, and Stéphane Guibaud. 2018. Capital Flows in an Aging World. CEPR Discussion Paper No. 13180. London: Center for Economic Policy Research.

Bayoumi, Tamim, Joseph E. Gagnon, and Christian Saborowski. 2015. Official Financial Flows, Capital Mobility, and Global Imbalances. Journal of International Money and Finance 52: 146–174.

Behringer, Jan, and Till van Treeck. 2018. Income Distribution and the Current Account. Journal of International Economics 114: 238–254.

Bosworth, Barry, and Gabriel Chodorow-Reich. 2007. Saving and Demographic Change: The Global Dimension. CRR Working Paper No. 2007-2. Boston: Center for Retirement Research.

Brissimis, Sophocles, George Hondroyiannis, Christos Papazoglou, Nicholas Tsaveas, and Melina A. Vasardani. 2012. Current Account Determinants and External Sustainability in Periods of Structural Change. Economic Change and Restructuring 45 (1–2): 71–95.

Brooks, Robin. 2003. Population Aging and Global Capital Flows in a Parallel Universe. IMF Staff Papers 50 (2): 200–221.

Brumm, Johannes, Georgios Georgiadis, Johannes Gräb, and Fabian Trottner. 2019. Global Value Chain Participation and Current Account Imbalances. Journal of International Money and Finance 97: 111–124.

Ca’Zorzi, Michele, Alexander Chudik, and Alistair Dieppe. 2012. Thousands of Models, One Story: Current Account Imbalances in the Global Economy. Journal of International Money and Finance 31 (6): 1319–1338.

Chai, Hua, and Jun Il Kim. 2018. Demographics, Pension Systems and the Saving-Investment Balance. IMF Working Paper No. 18/265. Washington: International Monetary Fund.

Cheung, Calista, Davide Furceri, and Elena Rusticelli. 2010. Structural and Cyclical Factors behind Current-Account Balances. OECD Economics Department Working Paper No. 775. Paris: Organisation for Economic Co-operation and Development.

Chinn, Menzie D., Barry Eichengreen, and Hiro Ito. 2014. A Forensic Analysis of Global Imbalances. Oxford Economic Papers 66 (2): 465–490.

Chinn, Menzie D., and Hiro Ito. 2008. Global Current Account Imbalances: American Fiscal Policy versus East Asian Savings. Review of International Economics 16 (3): 479–498.

Chinn, Menzie D., and Hiro Ito. 2008. A New Measure of Financial Openness. Journal of Comparative Policy Analysis 10 (3): 309–322.

Chinn, Menzie D., and Eswar S. Prasad. 2003. Medium-term Determinants of Current Accounts in Industrial and Developing Countries: An Empirical Exploration. Journal of International Economics 59 (1): 47–76.

Coulibaly, Dramane, Blaise Gnimassoun, and Valérie Mignon. 2020. The Tale of Two International Phenomena: International Migration and Global Imbalances. Journal of Macroeconomics 66: 103241.

Cubeddu, Luis M., Signe Krogstrup, Gustavo Adler, Pau Rabanal, Mai Chi Dao, Swarnali A. Hannan, Luciana Juvenal, Carolina Osorio Buitron, Cyril Rebillard, Daniel Garcia-Macia, Callum Jones, Jair Rodriguez, Kyun Suk Chang, Deepali Gautam, Zijiao Wang, and Nan Li. 2019. The External Balance Assessment Methodology: 2018 Update. IMF Working Paper No. 19/65. Washington: International Monetary Fund.

Dao, Mai Chi, and Callum Jones. 2018. Demographics, Old-Age Transfers and the Current Account. IMF Working Paper No. 18/264. Washington: International Monetary Fund.

Deaton, Angus. 2005. Franco Modigliani and the Life Cycle Theory of Consumption. BNL Quarterly Review 58 (233–234): 91–107.

Eugeni, Sara. 2015. An OLG Model of Global Imbalances. Journal of International Economics 95 (1): 83–97.

Fair, Ray C., and Kathryn M. Dominguez. 1991. Effects of the Changing U.S. Age Distribution on Macroeconomic Equations. The American Economic Review 81 (5): 1276–1294.

Feldstein, Martin. 1976. Social Security and Saving: The Extended Life Cycle Theory. The American Economic Review 66 (2): 77–86.

Ferrero, Andrea. 2010. A Structural Decomposition of the U.S. Trade Balance: Productivity, Demographics and Fiscal Policy. Journal of Monetary Economics 57 (4): 478–490.

Fisher, Irving. 1907. The Rate of Interest: Its Nature, Determination and Relation to Economic Phenomena. New York: Macmillan.

Gagnon, Joseph. 2017. Do Governments Drive Global Trade Imbalances? PIIE Working Paper No. 17–15. Washington: Peterson Institute for International Economics.

Gelman, Andrew, and Guido Imbens. 2019. Why High-Order Polynomials Should Not Be Used in Regression Discontinuity Designs. Journal of Business & Economic Statistics 37 (3): 447–456.

Gerigk, Joschka, Miriam Rinawi, and Adrien Wicht. 2018. Demographics and the Current Account. Aussenwirtschaft 69 (1): 45–76.

Gourinchas, Pierre O., and Hélène Rey. 2005. From World Banker to World Venture Capitalist: U.S. External Adjustment and the Exorbitant Privilege. NBER Working Paper No. 11563. Cambridge, Massachusetts: National Bureau of Economic Research.

Gruber, Joseph W., and Steven B. Kamin. 2007. Explaining the Global Pattern of Current Account Imbalances. Journal of International Money and Finance 26: 500–522.

Gruber, Joseph W., and Steven B. Kamin. 2009. Do Differences in Financial Development Explain the Global Pattern of Current Account Imbalances? Review of International Economics 17 (4): 667–688.

Higgins, Matthew. 1998. Demography, National Savings and International Capital Flows. International Economic Review 39 (2): 343–369.

Higgins, Matthew, and Jeffrey G. Williamson. 1997. Age Structure Dynamics in Asia and Dependence on Foreign Capital. Population and Development Review 23 (2): 261–293.

Hung, Juann H., and Edward N. Gamber. 2010. An Absorption Approach to Modeling the US Current Account. Review of International Economics 18 (2): 332–350.

IMF. 2019. The Revised EBA-Lite Methodology. Policy Paper No. 19/026. Washington: International Monetary Fund.

Jaumotte, Florence, and Piyaporn Sodsriwiboon. 2010. Current Account Imbalances in the Southern Euro Area. IMF Working Paper No. 10/139. Washington: International Monetary Fund.

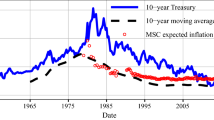

Juselius, Mikael, and E. Takàts. 2015. Can Demography Affect Inflation and Monetary Policy? BIS Working Paper No. 485. Basel: Bank of International Settlements.

Kerdrain, Clovis, Isabell Koske, and Isabelle Wanner. 2010. The Impact of Structural Policies on Saving, Investment and Current Accounts. OECD Economics Department Working Paper No. 815. Paris: Organisation for Economic Co-operation and Development.

Koomen, Miriam, and Laurence Wicht. 2022. Pension Systems and the Current Account: An Empirical Exploration. Journal of International Money and Finance 120: 102520.

Lane, Philip R., and Gian Maria Milesi-Ferretti. 2001. Long-Term Capital Movements. NBER Macroeconomics Annual 16: 73–116.

Lee, Jungjin, Jonathan Ostry, Luca Antonio Ricci, and Gian Maria Milesi-Ferretti. 2008. Exchange Rate Assessments: CGER Methodologies. IMF Occasional Paper No. 261. Washington: International Monetary Fund.

Modigliani, Franco, 1970. The Life Cycle Hypothesis of Saving and Inter-Country Differences in the Saving Ratio. In Induction, Growth and Trade: Essays in Honour of Sir Roy Harrod, ed. by Walter A. Eltis, Maurice F.G. Scott, and James N. Wolfe. Oxford: Clarendon Press.

Modigliani, Franco, and Richard H. Brumberg. 1954. Utility Analysis and the Consumption Function: An Interpretation of Cross-Section Data. In Post-Keynesian Economics, ed. by Kenneth K. Kurihara. New Brunswick: Rutgers University Press.

Modigliani, Franco, and Richard H. Brumberg, 1980. Utility Analysis and the Consumption Function: An Attempt at Integration. In Collected Papers of Franco Modigliani: The Life Cycle Hypothesis of Saving, ed. by Andrew B. Abel. Cambridge Massachusetts: MIT Press.

Moral-Benito, Enrique, and Oliver Roehn. 2016. The Impact of Financial Regulation on Current Account Balances. European Economic Review, 81 (C): 148–166.

Phillips, Steve, Luis Catao, Luca Antonio Ricci, Rudolph Bems, Mitali Das, Julian di Giovanni, D. Filiz Unsal, Marola Castillo, Jungjin Lee, Jair Rodriguez, and Mauricio Vargas. 2013. The External Balance Assessment (EBA) Methodology. IMF Working Paper No. 13/272. Washington: International Monetary Fund.

Runge, Carl. 1901. Über empirische Funktionen und die Interpolation zwischen äquidistanten Ordinaten. Zeitschrift für Mathematik und Physik 46 (20): 224–243.

Smith, R. G., and David E. A. Giles. 1976. The Almon Estimator: Methodology and Users’ Guide. Reserve Bank of New Zealand Discussion Paper E76/3. Wellington: Reserve Bank of New Zealand.

Solow, Robert M. 1956. A Contribution to the Theory of Economic Growth. The Quarterly Journal of Economics 70 (1): 65–94.

Sposi, Michael. 2022. Demographics and the Evolution of Global Imbalances. Journal of Monetary Economics 126: 1–14.

Acknowledgemets

We wish to thank two anonymous referees, Mitali Das, Joschka Gerigk, Gian Maria Milesi-Ferretti, Pinar Yesin, the participants of the Aussenwirtschaft workshop 2018, the NBP-SNB Joint Seminar 2019, and an SNB Brownbag Seminar for very helpful comments on this and earlier versions of this study. We also wish to thank Jeremias Kläui and Adrien Wicht for invaluable research assistance. The views expressed in this paper are strictly the authors’ and do not necessarily reflect those of the Swiss National Bank (SNB). All remaining errors are our own.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.