Abstract

To understand the longer-term consequences of natural disasters for global value chains, this paper examines trade in the automobile and electronic sectors after the 2011 earthquake in Japan. Contrary to widespread expectations, we find that the shock did not lead to reshoring, nearshoring, or diversification across non-Japanese suppliers; and trade in intermediate products was disrupted less than trade in final goods. Imports did shift to new suppliers, especially where dependence on Japan was greater. But production relocated to developing countries rather than to other top exporters, and to larger countries. The results, showing relative inertia in intermediate goods and the dominance of economic fundamentals (cost and scale) in determining sourcing decisions, may help us understand supply chain adjustment after other natural disasters, like the COVID-19 pandemic.

Similar content being viewed by others

1 Introduction

Natural disasters impact human lives both directly and through their long-lasting economic consequences. With climate change, the frequency of disasters is expected to increase, and their likelihood will significantly influence economic decisions. One aspect is the risk associated with the interconnected nature of global production and trade. The reliance on foreign inputs can lead to a disruption of production when source countries experience a negative shock. Firms may respond to such a shock by reconsidering the balance between efficiency and resilience in production, leading to long term changes in the structure of global value chains (GVCs) through reshoring, nearshoring and diversification.Footnote 1 The nature of the long-term impact of natural disasters on global value chains and their organization is an empirical question on which there is so far limited evidence.

To understand how firms behave when faced with new risks, we examine the 2011 earthquake in Japan. The earthquake off the Pacific coast of Tōhoku was the most powerful ever recorded in Japan. It triggered a tsunami that swept the Japanese mainland, causing devastation of physical infrastructure and approximately 16,000 deaths. The earthquake also severely disrupted supply chains. For example, a shortage of over 100 parts left Toyota’s North American operations operating at 30 percent capacity for several weeks (Canis 2011). Boehm et al. (2019) show that Japanese multinationals in the United States lost access to intermediate inputs and experienced severe reductions in production as a result. In the short run, the effects were highly disruptive because there were few substitutes for Japanese suppliers. For Japanese firms operating in the US, the elasticity of substitution across material inputs was estimated to be only 0.2 in the short run.

Most of the existing literature on natural disasters focuses on how GVCs transmit shocks, domestically (Carvalho et al. 2016) or internationally (Boehm et al. 2019).Footnote 2 In this paper, we study instead the longer-term impact of the 2011 earthquake in Japan on trade patterns. We focus on the automobile and electronics industries, for which Japan is a key supplier, especially of parts and components. According to the World Development Report (World Bank 2020), these are also the two largest GVC sectors globally. For instance, as the shock severely affected production of Japanese automotive equipment, it had cascading effects on global auto producers such as Honda, Opel, Nissan, and General Motors which froze production lines in several factories worldwide (Automotive News 2011). In electronics, the problems were similar, as many specialized inputs such as connectors, microphones, and sensors were produced in Japan and had few or no substitutes (World Bank 2020).

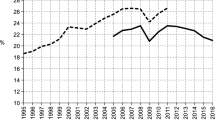

To motivate the analysis, we identify certain patterns in the data. We examine imports of auto and electronics in the 15 largest auto producing countries as of 2010 and in the 15 largest exporters of final electronics products to gauge the longer term effect of the earthquake on suppliers.Footnote 3 The left panel of Fig. 1 shows the average shares of products imported from Japan for importers where Japan is not a prominent supplier (less than 15 percent of total imports of that product by the country). The right panel focuses on importers largely dependent on Japanese suppliers (more than 15 percent of total imports in a product line). The figure shows that reliance on Japan dropped sharply following the 2011 earthquake for the countries most dependent on Japan. The drop was more than 10 percentage points for the auto industry, while in the case of electronics the earthquake appeared to accelerate pre-existing declining trends. This is prima facie evidence that large shocks do lead to a partial reconfiguration of supply chains: while less exposed importers return to near pre-crisis operations after the shock, it is the more dependent producers that tend to change production structures.Footnote 4

Source: 6-digit HS 1988/92 import data from United Nations Comtrade. Notes: The figures plot Japan’s average market share for auto and electronics for country-products in which Japan had an average market share below 15 percent (left panel “Low Share”) and in country-products in which Japan had an average market share greater than 15 percent (right panel “High Share”) calculated over the 2004-2010 period. The sample for auto is restricted to the 15 largest auto producers and for electronics to the 15 largest exporters of final electronics; in both cases Japan is excluded

Country share of imports from Japan in auto and electronics (average).

The analysis relies on a simple identification strategy. We use detailed international trade data for automobile and electronics components and final goods to study whether in the aftermath of the 2011 earthquake, importers more dependent on Japan before the earthquake behaved differently from importers less dependent on Japan. Apart from the change in imports from Japan, we also investigate whether the 2011 earthquake led to a diversification of imports away from Japan and to reshoring or nearshoring of production by more dependent importers.

We find that the earthquake led to a sharp decline in imports from Japan of auto parts and finished vehicles of countries more dependent on Japan before the shock. Electronics shows a similar pattern to the auto industry, but the decline was less pronounced. For both automobiles and electronics, intermediate imports were less affected than final imports. Using a continuous measure of dependence, we find that the decline in imports for both auto and electronics is more severe the higher the importers’ dependence on Japanese suppliers in the period preceding the earthquake. We find, somewhat surprisingly, that while diversification increased overall in the auto industry due to a shift away from Japan, importers more exposed to Japan before the 2011 earthquake did not increase import diversification across non-Japanese suppliers in either automobiles or electronics. There is also no evidence that countries re-shored production. In fact, importers more exposed to Japan before the 2011 earthquake increased total imports, which is consistent with an intensification of offshoring rather than reshoring.

An important question relates to which countries picked up the slack as supply chains reorganized in the aftermath of the 2011 earthquake. We perform a difference-in-differences analysis, comparing shifts in trade patterns of high Japan-dependent products with other products while controlling for importer and product specific time-varying shocks. We find that in the years following the shock, production relocation decisions were largely driven by fundamentals rather than policy. Developing countries, rather than top exporters, were the primary beneficiaries and production tended to relocate in larger countries. There is no evidence that supply chains were increasingly regionalized or that importers sought nearby suppliers, except for final autos where transport costs are especially high.

The rest of the paper is organized as follows. Section 2 provides a simple framework to think of the effects of natural disasters and the reshaping of supply chains. Section 3 studies the impact of the Japanese earthquake on the reconfiguration of supply chains. Section 4 takes a closer look at where production moved after the shock. Section 5 concludes.

2 Natural Disasters and Supply Chain Reconfiguration

To guide the empirical analysis, we propose a simple framework to think of the impact of natural disasters on the reconfiguration of supply chains. To begin with, consider the choice from the perspective of a multinational firm that imports from a subsidiary located in Japan.Footnote 5 A disaster that destroys fixed assets like factories will accelerate the reallocation of production to hubs where average costs are lower. Note that in normal circumstances, a firm would move to another location if the sum of the cost and insurance savings in the new location were larger than the fixed costs of relocation. Specifically, we define the cost of relocation, C = F + S, as the sum of the cost of building a factory, F, and the cost of establishing new relationships in the new production location, S. The benefit of relocation, B = (c + i) q, depends on the scale of production, q (assumed for simplicity to be the same in the two locations), the per-unit cost difference, c, and the per unit insurance premium difference, i, in the new location. For parsimony, we use a static example, in a dynamic setting the cost savings would compound overtime, without changing the qualitative results. A firm would relocate if

Before a natural disaster, small differences in unit costs would not induce a relocation—the sunk costs in the existing location create inertia. The event has two implications for the decision to relocate production. First, if the factory is destroyed as a consequence of the disaster, the cost of building a new factory, F, is no longer relevant because it is truly sunk. It disappears from the inequality because it must now be paid in both the old and new locations. Although the cost of building new relationships, S, must still be incurred in the new location, firms will now be more sensitive to cost differences between the old and new locations than if the factory were intact.Footnote 6 If the same factors that affect production cost also affect cost of building a new factory (for example, exchange rate undervaluation), that will enhance this effect. Second, the natural disaster may affect the differential on the insurance premium between locations. As the old location is riskier, relocating to a new low-risk location becomes more attractive.

Figure 2 provides an illustration of the forces at play. Note that finding new production locations in the aftermath of a natural disaster has larger benefits the higher the dependence on production and hence imports from the exporting country (Japan). To see why, note that the expected costs of exposure to a specific source for imports are related to the relative importance and riskiness of that source. The larger the imports, the greater the disruption caused by a cut off in production in that source. The benefits of relocating production can be seen as the inverse of the expected costs from the disruption associated with a natural disaster. Accordingly, in Fig. 2, BPRE = (c + i) q shows the benefits of switching away from the risky source before the realization of the event as increasing in exposure (i.e., quantity imported from Japan). This benefit must be compared with the costs which depend on the costs of relocating production and the costs of investing in a new relationship, captured by the schedule CPRE = F + S. Before the realization of the natural disaster, country-sectors with exposure higher than q*(PRE) would have switched away from Japan.

A first question that this framework helps to address is whether to continue sourcing from a country that experiences a natural disaster. Following the recent empirical literature on behavioral economics—see Bourdeau-Brien and Kryzanowski (2020) for the US and Cameron and Shah (2015) for Indonesia—we assume that for any given level of dependence, an increase in the perceived riskiness of the source increases the expected loss and, hence, the benefit from switching away from it. The schedule BPOST = (c + iPOST) q depicts the upward shift in benefits due to the upward revision in perceived riskiness, and hence the insurance premium differential, after a shock. These benefits are compared with the costs, now captured by CPOST = S.

The model indicates that (a) an increase in perceived riskiness and the destruction of physical capital lower the threshold at which firms would choose to switch suppliers (from q*(PRE) to q*(POST) in Fig. 2); and (b) importers that are more dependent on the source (i.e., those with imports higher than q*(POST)) are more likely to switch to a different supplier. Note that sectors where the fixed costs of building a factory, F, are relatively higher (e.g., auto) would display more inertia even in presence of larger unit costs differential before a natural disaster. In the figure, the shift in C is greater when the fixed cost is larger. The model thus indicates that these sectors would experience a larger relocation of production after a natural disaster relative to sectors with lower fixed costs (e.g., electronics).

While our analysis has focused on the imports of a multinational firm with a production base in Japan, the analysis of an arms-length importer can be considered a special case. The reduced inertia due to the destruction of a factory is not relevant, and so the impulse to switch sources is primarily due to the increase in the risk premium following the natural disaster—though the cost differential may also rise if factories are not rebuilt. Note, in particular, that the benefits of relocation are again positively related to the extent of import dependence on Japan.

Consider now possible differences between intermediate and final goods. The costs of switching suppliers, S, are likely to be relatively larger for relationship-specific intermediate products relative to final goods due to higher search and customizing costs (Antràs and Chor 2013). Indeed, the data on relationship stickiness in trade (Martin et al. 2021) show that auto and electronics parts are stickier than final autos and electronics, respectively.Footnote 7 In the model, this implies that S is relatively more important than F in the switching costs for intermediate goods as compared with final goods. Thus, the shift down of the C curve will be less pronounced, resulting in more inertia. In other words, relationship-specific investments in intermediates relative to final goods will tend to depress the ability to switch trade partners subsequent to shocks, assuming those relationships remain intact.

3 Impact of the Japanese Earthquake on Supply Chain Reconfiguration

In this section, we study how the 2011 earthquake impacted imports from Japan and whether it led to more diversification or reshoring of production.

3.1 Impact on imports from Japan

As a first exercise, we investigate whether importers less dependent on Japan as a source behaved differently from importers more dependent on Japan in the aftermath of the 2011 earthquake. Specifically, we rely on the following specification:

where \({Y}_{ikt}^{\mathrm{JPN}}\) are country \(i\)’s imports of HS 6-digit product \(k\) from Japan for the 15 largest auto producing countries or the 15 largest exporters of final electronics.Footnote 8,Footnote 9 The analysis focuses on the largest auto producing countries as those are the countries where lead firms located their production facilities. The countries are selected based on 2010 motor vehicle production data from the Organisation Internationale des Constructeurs d'Automobiles (OICA). As there is no comparable production data for electronics, we select the largest exporting countries of final electronics based on the 2004−2010 data.Footnote 10\(I\left(High Share JPN {2011}_{ikt}\right)\) is an indicator variable taking value 1 if the importer is dependent on Japanese suppliers in the period preceding the earthquake (more than \(x\) percent of total imports in a product line between 2004 and 2010, where \(x\) can take value of 15, 10 and 5). The specification also includes \({\alpha }_{ik}\), \({\theta }_{it}\) and \({\sigma }_{kt}\), which are, respectively, the importer-sector, importer-time and sector-time fixed effects. We expect the coefficient of interest, \(\beta \), to be negative if the shock led to a greater drop in reliance on Japan following the 2011 earthquake for the producers most dependent on Japan. This finding would suggest that global value chains reconfigured after the shock.Footnote 11

Table 1 presents the estimates of Eq. (1) for the impact of the 2011 earthquake on imports from Japan. The results show that importers who are more dependent on Japan are more likely to reduce imports. The coefficient in columns 1−3 and 5−7 consider highly dependent imports versus less dependent as defined by the indicated threshold (5, 10, or 15). For example, column 1 shows that importers who relied on Japan for 15 percent or more of the product reduced imports of autos by 56 percent (exp(−.814)=.44), as compared with those that relied on them for 15 percent or less. When the variables for all of the thresholds are included, in columns 4 and 8, results show that the declines in imports for both auto and electronics were stronger for higher thresholds of dependence on Japan.Footnote 12 The estimated negative impact on imports from Japan varies between around 32 percent for electronics and 56 percent for auto—the coefficients for auto are statistically different from those for electronics when using the 15 percent threshold. The stronger effects for the auto industry may reflect that on average this sector faces higher fixed costs of building a factory in this sector relative to electronics. As shown in Section 2, sectors with higher fixed costs would experience larger relocation of production after a natural disaster that destroyed the factory. Alternatively, the industry may be more sensitive to cost savings--a flatter benefits curve or face more elevated insurance costs.

Results in Panels B and C confirm the negative impacts for both intermediates and final products. Results in Panel B for auto parts, columns 1−4, and final vehicles, columns 5−8, show that intermediate auto declined between around 50 and 30 percent, while imports of final auto dropped by around 50 to 70 percent. The impact is stronger for final auto and statistically different from auto parts at the 5 percent threshold. Results in Panel C show a similar pattern for electronics—we observe a stronger, and statistically different, decrease for final electronics than for intermediate products—but the decline is less severe than the drop for the auto industry. As discussed in section 2, the higher search costs associated to finding new suppliers of auto and electronics parts led to lower switching relative to final products, at least for the case of the 2011 Japanese earthquake.

3.2 Impact on Diversification

Economic intuition would suggest that importers exposed to risk may seek to diversify their supplier base. From the model, reduce q in any one location so as to reduce risk. However, the literature on supply chains stresses the importance of firm-to-firm relationships and customized products, suggesting diversification is costly (Antràs 2019). The relative strengths of these two forces in the aftermath of a natural disaster is not obvious. In this subsection, we investigate whether the 2011 earthquake led to a diversification of imports from suppliers other than Japan.Footnote 13 Specifically, we modify Eq. (1) as follows:

where \({\mathrm{HHI}}_{ikt}\) is the Herfindahl–Hirschman Index (HHI), a measure of concentration, for importer i in product k at time t.Footnote 14 The set of fixed effects and the indicator variable are as in Eq. (1). The results from Table 1 showed that importers reduced exposure to Japan in those products where there was high dependence, this regressions tests whether those imports were replaced with less concentrated suppliers. A negative sign on the coefficient of interest, \(\beta \), would indicate that the 2011 earthquake led to a diversification of imports away from Japan in those formerly high dependence products after the shock.

The results in Table 2 suggest that importers more exposed to the 2011 earthquake, those with higher shares of imports sourced from Japan in the pre-shock period, did not increase import diversification as a result of the shock. If anything, the results for electronics suggest an increase in import concentration for the more affected country-products. That is consistent with a post-shock change in risk perceptions that is limited to Japan and does not affect other sources.Footnote 15 Overall, there is no evidence of a systematic increase in diversification following the negative shock which suggests that Japan was replaced by other suppliers that did not have large market shares.

The finding that the shock leads to switching rather than widening sources may be because the required relationship-specific investments discourage firms from diversifying. For instance, many auto parts are customized and need to meet safety standards and other regulatory requirements, making it cost effective to limit the number of key suppliers. A complementary explanation relates to the characteristics of the industries we are analyzing. For example, it could be that all the conditions for producing and exporting vehicles—skills, scale, connectivity, contiguity to large markets—are only available in few countries which may limit the scope for import diversification.

3.3 Impact on Reshoring

Another possibility is that affected producers moved production home in the aftermath of the natural disaster. If this were the case, we would expect to see importers dependent on supplies from Japan reduce total imports of the product in subsequent years. To test this hypothesis, we rely on the following specification

where \({Y}_{ikt}^{TOT}\) are total imports of country \(i\) in HS 6-digit product \(k\) at time \(t\). The set of fixed effects and the indicator variable are again as in Eq. (1). A negative sign of the coefficient of interest, \(\beta \), would indicate a fall in imports of high dependence products, consistently with the view that the 2011 earthquake led to a reshoring of production.

The results for the impact of the shock on total imports are reported in Table 3. There is no evidence that in the aftermath of the shock countries with high dependence on Japan re-shored those activities. The results are robust to the use of different thresholds and consistent across industries and intermediate and final products. Results in Panel A, column 5, and Panel C, columns 1−3, suggest that for electronics overall imports increased after the Japan shock which could indicate an intensification of offshoring of some activities instead reshoring for intermediate electronics.

4 To Which Countries Did Importers Switch?

In this section, we study where importers chose to source from in the aftermath of the 2011 earthquake. We perform a difference-in-differences analysis, comparing shifts in trade patterns of high Japan-dependent products with other products, and allow for heterogenous impacts of the shock depending on country characteristics. This method in effect asks what would trade patterns have looked like had the shock not happened, using unaffected products (countries with limited imports in the product from Japan) as a control group.Footnote 16 To investigate for differential impacts we estimate the following equation:

where \({Y}_{ijkt}\) are bilateral imports, Japan excluded, at time t and \(Cha{r}_{(i)j(k)t}\) are a set of relevant country characteristics such as level of income and population size or country-pair characteristics such as geographic distance, whether countries belong to the same region, or share the border. We also control for bilateral-sector, importer-time and exporter-time fixed effects. The indicator variable \(I\left(High Share JPN {2011}_{ikt}\right)\) is equal to 1 for importer i in a product line k if Japan’s share exceeded 10 percent during the 2004−2010 period.Footnote 17 A significant coefficient, \({\beta }_{2}\), would indicate a differential impact on imports along the \(Cha{r}_{(i)j(k)t}\) dimension. For instance, a positive coefficient on the interaction term \(I\left(\mathrm{High}\, \mathrm{Share} \,\mathrm{JPN} \,{2011}_{ikt}\right)*\mathrm{ln}(\mathrm{populatio}{\mathrm{n pre}}_{\mathrm{j}})\) would indicate a stronger increase in imports from countries with larger population size in the pre-earthquake period.

Information on country and country-pair characteristics come from different sources. Bilateral distance in kilometers and an indicator variable that captures if two countries share a border are from the CEPII’s GeoDist database (Mayer and Zignago 2011). Country characteristics related to population and GDP per capita are from the World Bank World Developments Indicators (WDI). Countries’ vulnerability to natural disasters is constructed based on the World Risk Index (Bündnis Entwicklung Hilft 2011) and it is defined equal to one if the index is greater than 63.3 (i.e., very high risk). The real exchange rate is constructed based on data from the Penn World Tables version 9.1 (Feenstra et al. 2015).Footnote 18 We use trade data from WITS to construct an indicator variable equal to one if the exporter was among the top 4 suppliers of importer \(i\) in HS 6-digit product \(k\) in the pre-shock period and to compute exporter’s revealed comparative advantage (RCA) index. Data on Free Trade Areas (FTA) are from Mario Larch’s Regional Trade Agreements Database from Egger and Larch (2008). Finally, we use World Bank’s regional classification to construct an indicator variable equal to one if two countries are located in the same region.Footnote 19 To reduce potential endogeneity concerns, we use averages based on the pre-shock period for all the time varying variables, except for the real exchange rate which is lagged.

Table 4 presents the estimates of Eq. (4) focusing on fundamentals: distance, size and level of development.Footnote 20 The negative and significant effect on GDP per capita indicates that in the years following the shock, developing countries were more likely to be the new sources for imports of auto and electronics.Footnote 21 For instance, results in columns 1 and 2 suggest that an increase in GDP per capita from the level of the median upper-middle income to the median high income country decreases exports by around 10 percent.Footnote 22 Similarly, imports tended to originate from larger countries, especially for auto parts (column 3) and electronics (columns 5 and 6), perhaps to take advantage of economies of scale. The results do not indicate that closer countries benefited from the relocation. For electronics, imports tended to relocate to more distant suppliers reflecting relatively low trade and transport costs.

Table 5 explores the effect of additional country characteristics on exports. There is no evidence that firms shun countries at a higher risk of natural disasters. Production did not relocate to previous top exporters. Contiguity to the export market appears to be a very important determinant of final auto exports (column 4), which may be due to the high transport costs of final autos. For auto parts and electronics, there is however no evidence that supply chains were increasingly regionalized. The presence of a Free Trade Area (FTA) appears to matter for final electronics. As tariffs tend to be higher on final than on intermediate imports, firms might seek to relocate final production in FTA members because of tariff escalation. A depreciating exchange rate in the preceding period may have also served to attract production in electronics and auto parts. While auto production relocated to countries with a revealed comparative advantage in the years preceding the shock, this was not the case for electronics. It is possible that these countries had a latent comparative advantage in electronics, but the presence of fixed costs of building a factory created inertia that prevented production relocation (Section 2). The earthquake, with its physical destruction and the need to rebuild, thus allowed these countries’ comparative advantage to emerge.

5 Conclusion

This paper investigates the long-term consequences of natural disasters on the reconfiguration of global value chains. Focusing on the 2011 earthquake off the Pacific coast of Tōhoku in Japan, the largest ever recorded, we study how the shock affected trade in automobiles and electronics –two sectors that rely heavily on Japanese suppliers.

We find that countries more dependent on Japanese suppliers before the shock experienced larger declines in imports from Japan. But the decrease for intermediate auto and electronics was less pronounced than for final products. We find no evidence that firms re-shored or nearshored production and increased import diversification to mitigate risk. They also did not switch to other top suppliers. Rather firms replaced suppliers from Japan with suppliers from developing countries and larger countries where scale economies could be realized. We also find that in the years following the shock, production relocation decisions were largely driven by fundamentals rather than policy.

While COVID-19 is a natural disaster unlike any other in recent times,Footnote 23 we conclude with a brief discussion of how the evidence on the long-term consequences of the 2011 earthquake may help understand how firms will reset their supply chains after the pandemic. A view shared by many observers is that COVID-19 will lead firms to reassess production risks and drastically reorganize their supply chains, leading to retrenchment of GVCs (e.g.,Javorcik 2020; Kilic and Marin 2020; Lund et al. 2020; UNCTAD 2020). In contrast, others have argued that the same technological and institutional factors that have underpinned the international fragmentation of production in the past decades would make such retrenchment post-COVID-19 unlikely, unless there is a radical change in the policy environment (Antràs 2021; Baldwin 2020).

Our results suggest that the reshaping of GVCs in the post-COVID-19 world may be less pronounced than expected by many observers. Two major differences between the current shock and the one studied here are that COVID-19 is a global shock, as opposed to the idiosyncratic nature of the 2011 earthquake, and that physical capital has not been destroyed. Capital in place coupled with established relationships, which are especially important for intermediate goods, will tend to reduce the extent of reconfiguration as compared to the Japan shock. Some producers dependent on risky suppliers may reassess their location decisions in the aftermath of the pandemic--but this is likely to be gradual, given capital in place. Sectors and stages of production where search frictions are lower may continue or slightly accelerate existing plans to relocate where economic fundamentals are more attractive, creating opportunities for developing countries. But broader trends toward reshoring, nearshoring or diversification are unlikely to result from firms’ decisions to reconsider the balance between efficiency and resilience in light of COVID-19, unless supported by pronounced government intervention.

Notes

An exception is Zhu et al. (2016) which uses Japanese firm-level data from 2010-2013, to show that the earthquake increased manufacturing offshoring from Japan among firms in the prefectures most affected by the disaster.

See Table 6 in the Appendix for the list of countries. While we have data for automobile production by countries, we do not have similar data for electronics and therefore rely on export data.

To provide more formal evidence, we estimate the following dynamic specification \({\text{ln}}\left( {{\text{imports}}_{ikt}^{{\text{JPN}}}} \right) = \sum\nolimits_{p = - 4}^{p = + 7} {{\beta _p}} I\left( {{\text{High Share JPN }}{\mkern 1mu} {{2011}_{ik,t + p}}} \right) + {\alpha _{ik}} + {\theta _{it}} + {\sigma _{kt}} + {\varepsilon _{ikt}}\) where \({Y}_{ikt}^{JPN}\) are country \(i\)’s imports of HS 6-digit product \(k\) from Japan. The coefficients of this specification are reported in Fig. 3 in Annex.

As noted in the introduction, Boehm et al. (2019) found that Japanese multinationals abroad lost access to auto intermediates and experienced severe reductions in production of final goods. The case of arm’s length trade is also considered below.

The inertia created by the existing capital is documented in the empirical literature. Pelli and Tschopp (2017) show for a large panel of countries that shocks to firms’ physical capital caused by natural disasters reduce the opportunity costs for relocation, leading to a reorganization of production relationships and trade patterns in a way that is consistent with cost differentials.

See Fig. 4 in Annex for the distribution of relationship stickiness across industries and types of products.

See Table 6 in Annex for the list of countries in the sample.

We use product level bilateral trade data from WITS (UN Comtrade) reported at the 6-digit level in the HS 1988/92 classification for the period 2004-2018. See Table 7 in Annex for the list HS6 products.

Results are robust to alternative selection methods. See Table 8 in Annex for results for the auto industry based on exports of final auto and selection based on imports of intermediates.

As we use aggregate (i.e. national) trade data, we are unable to distinguish between imports from the areas directly affected by the earthquake and those that are only indirectly affected through firm-to-firm linkages within Japan. From a modeling perspective, firms might be less likely to reorganize their supply chains if they are only indirectly exposed to the shock (their supplier in Japan's supplier was affected) than if their own capital was destroyed. In light of this, a negative coefficient using aggregate trade data would likely represent a lower-bound as it averages out between the firms that have been directly affected and those that have only been indirectly impacted by the earthquake.

For instance, to gauge the impact for country-products with a Japan share above 15 percent, we would need to sum the coefficients of all the dummy variables (i.e., 5 percent, 10 percent, and 15 percent) as these variables are not mutually exclusive. Note that the coefficients in columns 1-3 and 5-7 cannot be directly compared since the control groups are different. In columns 4 and 8 they are additive and relative to less than 5 percent.

We exclude Japan from the calculation because imports from Japan decreased and this could mechanically drive the diversification index. Also, the index allows us to test if importer replaced Japan with several suppliers.

The formula used to calculate the concentration index is equal to the sum of all the import shares, Japan excluded: \(HH{I}_{ikt}={\sum }_{j=1}^{N}{\left({\rm Import}\, {\rm Share}_{jt}\right)}^{2}.\) The index varies between 1, which indicates that there is only one supplier, to 1/N when all suppliers have the same market share.

Table 9 in the Annex reports the results when constructing the HHI which include Japan as well. Regression results mostly confirm the findings presented in Table 2. The main difference is that post shock import sources are less concentrated for the auto industry when using the 15 percent threshold, which is consistent with a switching away from Japan.

The results above on imports from Japan, diversification, and total imports are significant using the difference-in-differences approach as well.

Results are robust to the use of alternative thresholds (i.e., 15 and 5 percent).

We follow Rodrik (2008) and define the log of the real effective rate as \({\text{ln}}\left( {{\text{RE}}{{\text{R}}_{it}}} \right) = {\text{ln}}({\text{XRA}}{{\text{T}}_{it}}/{\text{PP}}{{\text{P}}_{it}}).\) Data on exchange rates and power parity conversion factors (PPP) come from the Penn World Tables.

We modify World Bank’s regional classification and classify Mexico as part of North America.

To address the problem of zero trade flows, we implement several robustness tests that are commonly used in the trade literature. First, we transform the dependent variable by taking the log of imports plus $1; second, we transform the dependent variable by taking the log of imports plus the minimum flow observed in the data; finally, we use an inverse hyperbolic sine transformation. Results, available upon requests, are robust to these extensions.

Table 10 in Annex presents the results on the impact of the earthquake on Japan’s share of imports from developing countries. The results show that Japan also imported relatively more from developing countries following the earthquake.

In 2010, the median GDP per capita for upper-middle income economies was USD 5,789 versus USD 33,700 for high income countries.

See Espitia et al. (2021) for an analysis of the trade impact of COVID-19 during the first six months of the pandemic.

References

Antràs, P., 2019. Conceptual Aspects of Global Value Chains (No. w26539). National Bureau of Economic Research, Cambridge, MA. Doi: https://doi.org/10.3386/w26539

Antràs, P., 2021. De-Globalisation? Global Value Chains in the Post-COVID-19 Age. 2021 ECB Forum: "Central Banks in a Shifting World" Conference Proceedings.

Antràs, Pol and Davin Chor. 2013. Organizing the Global Value Chain. Econometrica 81(6): 2127–2204.

Automotive News, 2011. Opel, Renault production hit by shortage of Japanese parts.

Baldwin, R., 2020. Thinking Ahead on COVID-19 and GVCs. World Bank Lecture, 22 April 2020. Available at: https://www.worldbank.org/en/news/video/2020/04/22/trade-and-global-value-chains-in-the-age-of-covid-19

Boehm, C.E., A. Flaaen and N. Pandalai-Nayar. 2019. Input Linkages and the Transmission of Shocks: Firm-Level Evidence from the 2011 Tōhoku Earthquake. The Review of Economics and Statistics 101: 60–75.

Bündnis Entwicklung Hilft. 2011. World Risk Report 2011. Berlin: Bündnis Entwicklung Hilft.

Canis, B., 2011. The Motor Vehicle Supply Chain: Effects of the Japanese Earthquake and Tsunami. Congressional Research Service.

Carvalho, V.M., Nirei, M., Saito, Y.U., Tahbaz-Salehi, A., 2016. Supply Chain Disruptions: Evidence from the Great East Japan Earthquake (No. ron287), Discussion papers, Discussion papers. Policy Research Institute, Ministry of Finance Japan.

Constantinescu, C., A. Mattoo, M. Ruta, 2020. The Global Trade Slowdown: Cyclical or Structural?, The World Bank Economic Review, Volume 34, Issue 1, February 2020, Pages 121–142, https://doi.org/10.1093/wber/lhx027

Egger, P. and M. Larch. 2008. Interdependent preferential trade agreement memberships: An empirical analysis. Journal of International Economics 76: 384–399. https://doi.org/10.1016/j.jinteco.2008.08.003.

Espitia, A., Ruta, M., Rocha, N., Winkler, D.E., Mattoo, A., 2021. Pandemic Trade : Covid-19, Remote Work and Global Value Chains (No. 9508), Policy Research Working Paper Series, Policy Research Working Paper Series. The World Bank.

Feenstra, R.C., R. Inklaar and M.P. Timmer. 2015. The Next Generation of the Penn World Table. American Economic Review 105: 3150–3182. https://doi.org/10.1257/aer.20130954.

Javorcik, B., 2020. Global supply chains will not be the same in the post-COVID-19 world, in: COVID-19 and Trade Policy: Why Turning Inward Won’t Work. CEPR Press.

Kilic, K. , Marin, D., 2020. How COVID-19 is transforming the world economy. VoxEU, 20 May 2020.

Lund, S., Manyika, J., Woetzel, J., Barriball, E., Krishnan, M., Alicke, K., Birshan, M., George, K., Smit, S., Swan, D., 2020. Risk, resilience, and rebalancing in global value chains. McKinsey Global Institute.

Mayer, T., Zignago, S., 2011. Notes on CEPII’s Distances Measures: The GeoDist Database (SSRN Scholarly Paper No. ID 1994531). Social Science Research Network, Rochester, NY. Doi: https://doi.org/10.2139/ssrn.1994531

Martin J., I. Mejean, M. Parenti, 2021. Relationship Stickiness, International Trade, and Economic Uncertainty, Working Papers ECARES 2021-03, ULB -- Universite Libre de Bruxelles.

Pelli, M., J. Tschopp, 2017. Comparative advantage, capital destruction, and hurricanes, Journal of International Economics, Elsevier, vol. 108(C), pages 315-337.

Rodrik, D. 2008. The real exchange rate and economic growth. Brookings Papers on Economic Activity 2008: 365–412.

UNCTAD (2020), World Investment Report 2020: International Production Beyond the Pandemic, New York and Geneva: United Nations.

World Bank, 2020. World Development Report 2020: Trading for Development in the Age of Global Value Chains, World Development Report. The World Bank. Doi: https://doi.org/10.1596/978-1-4648-1457-0

Zhu L, K Ito, and E Tomiura, 2016. Global Sourcing in the Wake of Disaster: Evidence from the Great East Japan Earthquake. RIETI Working Papers 2016.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Annex A: Additional figures and tables

Annex A: Additional figures and tables

See Figs.

Dynamic effects. Note: This figure plots the coefficients \({\upbeta }_{\mathrm{p}}\) from the following regression: \(\mathrm{ln}\left({\mathrm{imports}}_{\mathrm{ikt}}^{\mathrm{JPN}}\right)=\sum_{\mathrm{p}=-4}^{\mathrm{p}=+7}{\upbeta }_{\mathrm{p}}\mathrm{ I}\left(\mathrm{High Share JPN }{2011}_{\mathrm{ik},\mathrm{t}+\mathrm{p}}\right)+{\mathrm{\alpha }}_{\mathrm{ik}}+{\uptheta }_{\mathrm{it}}+{\upsigma }_{\mathrm{kt}}+{\upvarepsilon }_{\mathrm{ikt}}\). Robust standard errors clustered at the importer-product level are in parentheses. Error bars show 90% confidence intervals. The specification includes importer-year, importer-product, and product-year fixed effects. The samples include the top 15 auto producers or top 15 exporters of final electronics other than Japan

3,

Source: Martin et al. (2021).

Relationship stickiness.