Abstract

Conditions of secular stagnation—low interest rates, below target inflation, and sluggish output growth—characterize much of the global economy. We consider an overlapping generations, open economy model of secular stagnation, and examine the effect of capital flows on the transmission of stagnation. In a world with a low natural rate of interest, greater capital integration transmits recessions across countries as opposed to lower interest rates. In a global secular stagnation, expansionary fiscal policy carries positive spillovers implying gains from coordination, and fiscal policy is self-financing. Expansionary monetary policy, by contrast, is beggar-thy-neighbor with output gains in one country coming at the expense of the other. Similarly, we find that competitiveness policies including structural labor market reforms or neomercantilist trade policies are also beggar-thy-neighbor in a global secular stagnation.

Similar content being viewed by others

Notes

We derive similar results when there is a credit spread function that depends on the level of the capital flow between the two countries. We adopt the quantity restriction here given that the resulting equilibrium conditions are a generalization of the closed economy case considered in Eggertsson and Mehrotra (2014) and provide a slightly simpler exposition.

For a given set of exogenous processes \(\{D_{t},N_{t},Y_{t}\}\) and \( \{D_{t}^{*}, N_{t}^{*},Y_{t}^{*}\}\), an equilibrium in the global economy is now characterized by a collection of stochastic processes \( \{C_{t}^{y},C_{t}^{o},C_{t}^{m},r_{t},B_{t}^{y},A_{t}^{I}\}\) and \( \{C_{t}^{y*},C_{t}^{o*},C_{t}^{m*}, r_{t}^{*},B_{t}^{y*},A_{t}^{I *}\}\) that solve (1), (2), (5), (6) , (7), and (8) for the domestic and the foreign households, respectively, along with asset market-clearing conditions (9) and (10).

This is not a general feature of the model, but is due to the assumption of log preferences and the fact that all income is accrued in middle-aged. Eggertsson and Mehrotra (2014) treat the more general cases that we omit here for simplicity.

The intuition for why debtor countries can run permanent trade deficits is somewhat distinct in our model from Caballero and others (2008) and Maggiori (2013). Those models carry a well-defined risk premium, and debtor country trade deficits reflects compensation for risk (akin to the equity premium). In our case, \(r < g\) implies dynamic inefficiency and the debtor country can borrow since the present value of national income is infinite. We thank Matteo Maggiori for pointing out this distinction.

The rationale for assuming that the reserve accumulation decision is not subject to the international lending constraint is that emerging market economies are, typically, quite closed to private portfolio flows despite considerable official capital flows. Further, some emerging market economies accumulate low interest U.S. Treasuries for non-pecuniary reasons (i.e., insurance against sudden stops, exchange rate manipulation to favor traded sector, etc.).

In equilibrium, we assume that the nominal bonds may be in zero net supply. Hence, these equations are only important for pricing, i.e., the resulting pricing equations for these nominal bonds is what pins down the nominal price level in each country—see Equations (23)–(24). This is convenient because it implies that, in equilibrium, the budget constraint will be identical to the endowment economy so that the previous derivations continue to hold.

One way in which a policy regime of this kind can be implemented is to assume that the central bank follows a Taylor rule where the response coefficient approaches infinity, but the zero bound is respected.

In Eggertsson and Mehrotra (2014), we examine alternative nominal frictions that incorporate forward-looking behavior, like Calvo pricing, but find that it added much complexity with little additional insight. In that environment, the long-run trade-off between inflation and output stems from inefficient price dispersion and misallocation across identical producers.

To generate a secular stagnation, a long-run Phillips curve is needed whereby inflation below target reduces output below its full-employment level. Pricing frictions as in Calvo would also generate this type of Phillips curve, assuming either price or wage rigidities. See Appendix G in Eggertsson and Mehrotra (2014) for discussion.

Our full model exhibits transition dynamics with differences in the response of output and inflation on impact and with a lag. Eggertsson and Mehrotra (2014) feature a quantitative examination of the transition dynamics of our model. Moreover, the determinacy results in this section concern the behavior of the log-linearized dynamic model.

These assumptions are not critical and are in fact relaxed in our numerical examples.

As we have already pointed out in the section Government Debt and the Global Savings Glut, this result also obtains under perfect financial integration but, in that case, it depends on how reserve accumulation is financed.

Another reason for focusing on perfectly integrated capital markets is that the way in which we introduce incompleteness is via fixed quantity constraint. A more general characterization could specify capital flows as a function of the interest rate differential between two countries. In general, the policy implications are likely to depend on the precise specification of capital market imperfections so we have opted here to focus largely on the case of complete integration. We have some discussion of this in Eggertsson and others (2016).

Substantial reserve accumulation in the pre-2008 era may have made the United States more vulnerable to negative demand shocks by increasing the likelihood of hitting the zero lower bound.

Framing the proposition in term of \(K^{*}\) instead of IR, however, involves some complications. We then need to ensure that there remains a positive interest rate differential \(r\ge r^{*}\) at all times. Otherwise, the international lending constraint may no longer be binding or private capital flows can reverse (leading to different special cases depending on parameters).

In an asymmetric stagnation, one country must absorb the entire shortfall in world output. Intuitively, supply exceeds demand and if higher interest rates drive down global demand faster than global supply no equilibria exists. The failure of the AD and AS curves to cross is due to the fact that global supply in an asymmetric stagnation is bounded below by the full-employment level of output in the country not in stagnation. In a symmetric stagnation, there always exists a sufficiently high rate of deflation that drives global output to zero while demand remains bounded away from zero.

Our model does not feature any costs of a higher steady-state level of inflation. With Calvo pricing, deviations of inflation in steady state from zero impose misallocation costs. If these costs are sufficiently large, these misallocation costs must be weighed against the unemployment costs due to downward nominal wage rigidity.

See Eggertsson and Mehrotra (2014) for further discussion on fiscal multipliers under different financing regimes.

At the first best, optimal government spending is then determined by equating the marginal utility of private and public consumption. The planner only wishes to deviate from target in a secular stagnation since higher government expenditures can alleviate the output gap and inflation shortfall.

To obtain exactly the same welfare function in our current setting, we could assume that there is some resource cost of changing prices which does not directly alter the AS equation as these firms are perfectly competitive. It does, however, imply that social welfare can be approximated as above. Note, however, that one would want to assume that all generations receive the same welfare weights.

With imperfect integration, the benefits of government spending are fully realized by the country undertaking the fiscal expansion conditional on the lending constraint remaining binding.

A permanent increase in government debt has the same effects as a helicopter drop at the zero lower bound. A permanent increase in the money supply can eliminate a secular stagnation.

Formal microfoundations could be provided as follows. Imagine that if debt rises above a target level \(B^{\rm safe}\), the household incurs some monitoring cost to prevent default given by \(g\left( B_{t}-B^{\rm safe}\right) .\) Furthermore, as before assume that the perfectly competitive firms pay a resource cost from changing prices. Then a second-order approximation of a representative utility (weighting all generations the same) can generate a loss function of this form.

This mechanism is also at work in the quantitative lifecycle model of Favilukis and others (2015) who consider the effect of the global savings glut on U.S. house prices and asset prices.

References

Acharya, S. and J. Bengui, 2016, “Liquidity Traps, Capital Flows and Currency Wars,” Mimeo: University of Montreal.

Benigno, G. and P. Benigno, 2006, “Designing Targeting Rules for International Monetary Policy Cooperation,” Journal of Monetary Economics, Vol. 53, No. 3, pp. 473–506.

Benigno, G. and L. Fornaro, 2015, “Stagnation Traps.” Mimeo: London School of Economics.

Bernanke, B. S., 2000, “Japanese Monetary Policy: A Case of Self-Induced Paralysis?,” Japan’s Financial Crisis and Its Parallels to US Experience, pp. 149–166.

Bernanke, B. S., 2005, “The Global Saving Glut and the US Current Account Deficit,” Board of Governors of the Federal Reserve System (US) Speech, Vol. 10.

Bernanke, B. S., 2015, “Why Are Interest Rates so Low, Part 2: Secular Stagnation.” http://www.brookings.edu/blogs/ben-bernanke/posts/2015/03/31-why-interest-rates-low-secular-stagnation.

Bianchi, F. and H. Kung, 2014, “Growth, Slowdowns, and Recoveries,” Technical Report 20725, National Bureau of Economic Research.

Caballero, R. J. and E. Farhi, 2014, “The Safety Trap,” Technical Report 19927, National Bureau of Economic Research.

Caballero, R. J., E. Farhi, and P.-O. Gourinchas, 2008, “An Equilibrium Model of “Global Imbalances” and Low Interest Rates,” American Economic Review, Vol. 98, No. 1, pp. 358–393.

Caballero, R. J., E. Farhi, and P.-O. Gourinchas, 2015, “Global Imbalances and Currency Wars at the ZLB,” Technical Report 21670, National Bureau of Economic Research.

Clarida, R., J. Galı, and M. Gertler, 2002, “A Simple Framework for International Monetary Policy Analysis,” Journal of Monetary Economics, Vol. 49, No. 5, pp. 879–904.

Coeurdacier, N., S. Guibaud, and K. Jin, 2015, “Credit Constraints and Growth in a Global Economy,” American Economic Review, Vol. 105, No. 9, pp. 2838–2881.

Cook, D. and M.B. Devereux, 2013, “Sharing the Burden: Monetary and Fiscal Responses to a World Liquidity Trap,” American Economic Journal: Macroeconomics, Vol. 5, No. 3, pp. 190–228.

DeLong, B. J. and L. H. Summers, 2012, “Fiscal Policy in a Depressed Economy,” Brookings Papers on Economic Activity, Vol. 1, pp. 233–297.

Devereux, M. B. and J. Yetman, 2014, “Capital Controls, Global Liquidity Traps, and the International Policy Trilemma,” Scandinavian Journal of Economics, Vol. 116, No. 1, pp. 158–189.

Dixit, A. and L. Lambertini, 2003, “Interactions of Commitment and Discretion in Monetary and Fiscal Policies,” American Economic Review, Vol. 93, No. 5, pp. 1522–1542.

Eggertsson, G. B., 2001, “Real Government Spending in a Liquidity Trap.” Mimeo: Princeton University.

Eggertsson, G. B. and P. Krugman, 2012, “Debt, Deleveraging, and the Liquidity Trap: A Fisher-Minsky-Koo Approach,” Quarterly Journal of Economics, Vol. 127, No. 3, pp. 1469–1513.

Eggertsson, G. B. and N. R. Mehrotra, 2014, “A Model of Secular Stagnation,” Technical Report 20574, National Bureau of Economic Research.

Eggertsson, G. B., N. R. Mehrotra, and L. H. Summers, 2016, “Secular Stagnation in the Open Economy,” American Economics Review, Papers and Proceedings, Vol. 106, No. 5, pp. 503–507.

Favilukis, J., S. C. Ludvigson, and S. Van Nieuwerburgh, 2015, “The Macroeconomic Effects of Housing Wealth, Housing Finance, and Limited Risk-Sharing in General Equilibrium,” Journal of Political Economy, Forthcoming.

Fujiwara, I., T. Nakajima, N. Sudo, and Y. Teranishi, 2013, “Global Liquidity Trap,” Journal of Monetary Economics, Vol. 60, No. 8, pp. 936–949.

Gertler, M. and A. Trigari, 2009, “Unemployment Fluctuations with Staggered Nash Wage Bargaining,” Journal of Political Economy, Vol. 117, No. 1, pp. 38–86.

Gourinchas, P.-O. and O. Jeanne, 2013, “Capital Flows to Developing Countries: The Allocation Puzzle,” The Review of Economic Studies, Vol. 80, No. 4, pp. 1484–1515.

Guerron-Quintana, P. and R. Jinnai, 2014, “Liquidity, Trends, and the Great Recession.” Mimeo: Federal Reserve Bank of Philadelphia.

Hall, R. E., 2005, “Employment Fluctuations with Equilibrium Wage Stickiness,” American Economic Review, Vol. 95, No. 1, pp. 50–65.

Hansen, A., 1939, “Economic Progress and Declining Population Growth,” American Economic Review, Vol. 29, No. 1, pp. 1–15.

Hausman, J. K. and J. F. Wieland, 2014, “Abenomics: Preliminary Analysis and Outlook,” Brookings Papers on Economic Activity, Vol. 2014, No. 1, pp. 1–63.

Kocherlakota, N., 2013, “Impact of a Land Price Fall when Labor Markets are Incomplete.” Mimeo: Federal Reserve Bank of Minneapolis.

Maggiori, M., 2013, “Financial Intermediation, International Risk Sharing, and Reserve Currencies.” Mimeo: Harvard University.

McKay, A., E. Nakamura and J. Steinsson, 2015, “The Power of Forward Guidance Revisited,” Technical Report 20882, National Bureau of Economic Research.

Samuelson, P. A., 1958, “An Exact Consumption-Loan Model of Interest With or Without the Social Contrivance of Money,” Journal of Political Economy, Vol. 66, No. 6, pp. 467–482.

Schmitt-Grohé, S. and M. Uribe, 2011, “Pegs and Pain,” Technical Report 16847, Cambridge: National Bureau of Economic Research.

Schmitt-Grohé, S. and M. Uribe, 2013, “The Making of Great Contraction with a Liquidity Trap and a Jobless Recovery.” Mimeo: Columbia University.

Summers, L., 2013, “Why Stagnation Might Prove to be the New Normal.” The Financial Times.

Summers, L. H., 2014, “U.S. Economic Prospects: Secular Stagnation, Hysteresis, and the Zero Lower Bound,” Business Economics, Vol. 49, No. 2, pp. 65–73.

Summers, L. H., 2015a, “Demand Side Secular Stagnation,” American Economics Review, Papers and Proceedings, Vol. 105, No. 5, pp. 60–65.

Summers, L. H., 2015b, “Lower Real Rates, Secular Stagnation and the Future of Stabilization Policy,” Central Bank of Chile Annual Conference.

Author information

Authors and Affiliations

Corresponding author

Additional information

*Gauti B. Eggertsson is Professor of Economics at Brown University. Neil Mehrotra is Assistant Professor of Economics at Brown University. Sanjay R. Singh is a PhD candidate in Economics at Brown University. Lawrence H. Summers is President Emeritus and Charles W. Eliot University Professor of Harvard.

This paper was written for the conference “Secular Stagnation, Growth and Real Interest Rates,” organized by the European University Institute and the International Monetary Fund on June 18–19, 2015 for a special issue of the IMF Economics Review. We would like to thank Emmanuel Farhi, Pierre-Olivier Gourinchas, Jean-Paul L’Huillier, Matteo Maggiori, Gregory Thwaites, and Jaume Ventura for helpful discussions and conference and seminar participants at Brown, Cambridge, Duke, the EUI-IMF Conference on Secular Stagnation, Federal Reserve Board, FRB San Francisco, MIT, NBER IFM, NBER Japan Project, Oxford, Stanford, UC Berkeley, and the World Bank for comments. Finally, we thank two anonymous referees and the editor, Pau Rabanal, for several helpful comments.

Appendices

Appendix A: Existence, Uniqueness, and Local Determinacy

Here we provide formal proofs for various propositions presented in the body of the text.

Proposition 2

If the international lending constraint is binding, \(r^n > 0\), \(r^{n *} < 0\), \(\bar{\Pi } = \bar{\Pi }^{*} = 1,\) and \(\gamma ^{*} > 0\), there exists a unique, locally determinate secular stagnation equilibrium in the creditor country with \(i^{*} = 0\), \(\Pi ^{*} < 1\), and \(Y^{*} < Y_f^{*}\).

Proof

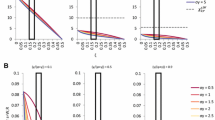

Under the assumptions of the proposition and the monetary policy rule, the zero lower bound is binding for the creditor country and the equilibrium real interest rate in steady state is given by \(r^{*} = \frac{1}{\Pi ^{*}}\). Equilibrium inflation and output in steady state in the creditor country solve the following equations:

where \(\psi ^{*} = \frac{1+\beta }{\beta }\left( 1+g\right) \left( D^{*}+\frac{1+r^n}{1+\beta }K^{*}\right) > 0\). We may define the difference equation \(\Delta \left( \Pi ^{*}\right) \) by taking the difference between (48) and (49) . This function is continuous in \(\Pi ^{*}\) with \(\Delta (\gamma ^{*}) > 0\) and \(\Delta (1) < 0\) . Therefore, there exists a \(\gamma ^{*}< \Pi ^{*} < 1\) such that \(\Delta (\Pi ^{*}) = 0\). Since \(\Pi ^{*} < 1\), it follows that \(Y^{*} < Y_f^{*}\).

To establish uniqueness, we first assume that their exist multiple distinct values of \(\Pi ^{*}\) at which \(\Delta (\Pi ^{*}) = 0\). Graphically, in inflation-output space (output on the x-axis), the AS curve [Equation (49)] lies above the AD curve [Equation (49)] when inflation equals \(\gamma ^{*}\) and the AS curve lies below the AD curve for inflation at unity. Thus, if multiple steady states exist, given that AS is a continuous function, there must exist at least three distinct points at which the AS and AD curve intersect.

At the first intersection point, the slope of AS curve crosses the AD line from above and, therefore, at the second intersection the AS curve crosses the AD curve from below. Since the AD curve is a line, the AS curve is locally convex in output in this region. Similarly, between the second and third intersection, the AS curve is locally concave in output. Thus, as output \(Y^{*}\) increases, the AS curve must first have a positive second derivative followed by a negative second derivative.

We compute the second derivative of inflation with respect output of the AS curve and derive the following expression (we drop the \(*\) for simplicity):

As can be seen, over the region considered, the function \(G\left( Y\right) \) is positive and, therefore, the convexity of the AS curve is determined by the second term. This term may be negative if \(\phi < 1\), but this expression is increasing in Y between 0 and \(Y_f\). Therefore, the second derivative cannot switch signs from positive to negative. Thus, we have derived a contradiction by assuming multiple steady states. Therefore, there must exist a unique intersection point.

As established before, it must be the case that the AS curve has a lower slope than the AD curve at the point of intersection. The slope of the AS curve is

If the slope of the AS curve is less than the slope of the AD curve at the intersection point, then it must be the case that

Linearizing the equilibrium conditions around the secular stagnation steady state, we obtain the following linearized AD and AS equations:

where \(d_{t}^{*}\) is the collateral shocks and various coefficients are given in terms of their steady-state values.

Substituting (55) into (54), we obtain a forward-looking difference equation in \(y_{t}^{*}\). The local determinacy condition requires the coefficient on \(E_{t} y_{t+1}^{*}\) to be less than one. This condition is the same as the slope condition. Therefore, the unique secular stagnation steady state is always locally determinate as required. \(\square \)

Proposition 3

If the international lending constraint at \(K^{*}=0\), \(\bar{\Pi }=1, \) and \(\gamma > 0\), then, if \(r^{n} > 0\), \( i > 0\), \(\frac{\partial r}{\partial IR}<0,\) and \(\frac{\partial Y}{\partial IR}=0\). If \(r^{n} < 0\), \(i=0\), \(\frac{\partial r}{\partial IR}>0,\) and \(\frac{\partial Y}{\partial IR}<0\).

Proof

Given the inflation target, if \(r_{n} > 0\), then the domestic nominal interest rate is \( i = r_{n} > 0\). Since the inflation target is attained, the wage norm does not bind and \(Y = Y_{f}\). The expression for the real rate in steady state is given below:

For small changes in IR, \(Y = Y_{f}\), therefore, \(\frac{\partial Y}{\partial IR}=0\) and, from the previous equation \(\frac{\partial r}{\partial IR}<0\) as required.

Given the inflation target, if \(r_{n} < 0\), then the domestic nominal interest rate is \(i = 0\). As shown in Proposition 2, a unique secular stagnation steady-state exists with \(\Pi < \bar{\Pi }\) and \(Y < Y_{f}\). Observe that \(\frac{d\Pi }{dY} < \left( \frac{1+\beta }{\beta } D\right) ^{-1}\)—the slope of the AS curve is less than the slope of the AD curve evaluated at the secular stagnation steady state.

In the stagnation steady state, output is given implicitly by the following equation where \(\Pi \left( Y\right) \) is output inflation relationship from the AS curve:

In a secular stagnation steady state, the denominator is positive (since the slope of the AS curve is less than the slope of the AD curve at the intersection point), so the \(\frac{\partial Y}{\partial IR}=0\). Since \(\frac{d\Pi }{dY} > 0\), \(\frac{\partial r}{\partial IR}>0\) as required. \(\square \)

Proposition 4

If \(r^{W, Nat} < \bar{\Pi }^{-1}\), there exists a locally determinate secular stagnation equilibrium with \(Y<Y_f\), \(Y^{*}<Y_{f}^{*}\), \(i=i^{*} = 0,\) and \(\Pi < \bar{\Pi }\).

Proof

Under the assumptions of the proposition, monetary policy in both countries cannot track the world natural rate of interest and \(i = i^{*} = 0\). Perfect capital market integration requires equalization of the domestic and foreign real interest rate, hence \(\Pi = \Pi ^{*}\). Steady-state inflation, domestic output, and foreign output jointly satisfy the following equilibrium conditions:

where \(D^{W} = \omega D + \left( 1-\omega \right) D^{*}\) and \(\psi ^{W} = \frac{1+\beta }{\beta }\left( 1+g\right) D^{W}> 0\). We may define the difference equation \(\Delta \left( \Pi \right) \) by taking the difference between (56) and the weighted sum of (57) and (58). Without loss of generality, assume that \(\gamma < \gamma ^{*}\). We assume that output is bounded below by zero—that is, if \(\Pi < \gamma ^{*}\), then \(Y^{*} = 0\). Given this assumption, the function \(\Delta \left( \Pi \right) \) is continuous (but not necessarily differentiable), with \(\Delta \left( \gamma \right) > 0\) and \(\Delta \left( \bar{\Pi }\right) < 0\). Therefore, there exists a global inflation rate \(\Pi _{ss}\) with \(\Pi _{ss} < \bar{\Pi }\) implying that, in steady state, \(Y_{ss} < Y_{f}\) and \(Y_{ss}^{*} < Y_{f}^{*}\).

To establish that this steady state is locally determinate, we observe that, graphically, at \(\Pi = \gamma \) the global AS curve [weighted sum of Equations (57) and (58)]. At \(\Pi = \bar{\Pi }\), the global AD curve lies above the AS curve. Thus, there exists at least one equilibrium in which the AD curve is locally steeper than the AS curve. We first derive the condition for local determinacy. The log-linearized equilibrium conditions for a symmetric stagnation equilibrium are given below:

where \(\phi = \frac{\alpha }{1-\alpha }\) and the other coefficients are defined below:

This linearized system can be expressed as

where \(x_{t} = [\pi _{t},y_{t-1},y_{t-1}^{*}]'\) and the A, B are square matrices with suitably defined coefficients. Local determinacy requires that the matrix \(A^{-1}B\) has exactly one eigenvalue outside the unit circle.

Since the matrix B has a row of zeros, one eigenvalue of the system is zero. The characteristic polynomial that determines the remaining eigenvalues is

Since the characteristic polynomial is positive at \(\lambda = 0\), the condition that ensures local determinacy is that the characteristic polynomial is negative at \(\lambda = 1\). This condition requires

It remains to show that this local determinacy condition is identical to the slope condition that must be satisfied in equilibrium. The slope of the global AS curve and global AD curve is given below:

A steeper slope for the AD curve relative to the AS curve implies

where the last inequality is identical to the determinacy condition derived in Equation (62). \(\square \)

Proposition 5

If \(r^{W,Nat} < \bar{\Pi }^{-1}\), \(D^{W} > \left( 1-\omega \right) Y_{f}^{*}\), \(\gamma > 0\), there exists a unique, locally determinate asymmetric secular stagnation with \(r=r^{*}\), \(Y < Y_{f}\), \(Y^{*} = Y^{*}_{f}\), \(i=0\), and \(\Pi < \bar{\Pi }\).

Proof

Under the assumptions of the proposition and the monetary policy rule, the zero lower bound is binding for the home country and not binding for the foreign country. Nevertheless, real interest rates are equalized across both countries: \(\frac{1}{\Pi } = r = r^{*} = \frac{i^{*}}{\bar{\Pi ^{*}}}\) where \(i^{*} > 0\). Equilibrium inflation and output in the home country solve the following equations:

where \(D^{W} = \omega D + \left( 1-\omega \right) D^{*}\) and \(\psi ^{W} = \frac{1+\beta }{\beta }\left( 1+g\right) D^{W}> 0\). We may define the difference equation \(\Delta \left( \Pi \right) \) by taking the difference between (63) and (64) . This function is continuous in \(\Pi \) with \(\Delta (\gamma ) > 0\) (since \(D^W > \left( 1-\omega \right) Y_f\)) and \(\Delta (\bar{\Pi }) < 0\) since \(r^{W,Nat} < \bar{\Pi }^{-1}\). Therefore, there exists a \(\gamma< \Pi < \bar{\Pi }\) such that \(\Delta (\Pi ) = 0\). Since \(\Pi < \bar{\Pi }\), it follows that \(Y < Y_f\).

Uniqueness of an asymmetric stagnation equilibrium under perfect integration is established identically as in Proposition 2. Graphically, the global AD curve (Equation (63) form a line in domestic inflation-output space. The domestic AS curve [Equation (64)] is identical to Equation (49) and cannot cross the AD curve more than once given that the second derivative cannot switch signs from positive to negative.

It must be the case that the AS curve has a lower slope than the AD curve at the point of intersection. The slope of the AS curve is identical to Equation (53). If the slope of the AS curve is less than the slope of the AD curve at the intersection point, then it must be the case that

The linearization of the global AD curve [Equation (63)] and the domestic AS curve [Equation (64)] around the asymmetric stagnation steady state imply identical expressions to the linearized equilibrium conditions in Proposition 2 where the coefficients are given by

where \(\Pi _{ss}\) and \(Y_{ss}\) are the solution to steady-state equilibrium conditions (63) and (64). Substituting the linearized AS curve into the linearized AD curve as in Proposition 2 provides a forward-looking difference equation in \(y_{t}\). Local determinacy requires the coefficient on \(E_{t} y_{t+1}\) to be less than unity. This condition is identical to slope condition derived above implying that the asymmetric stagnation equilibrium is always locally determinate, as required. \(\square \)

Appendix B: Fiscal Policy Coordination

Non-Cooperative Game

The government in each country unilaterally chooses its own level of government spending G to minimize the deviations of output, inflation, and level of government spending from their own respective target levels. We assume both countries have identical aggregate supply curves—same full-employment level of output, labor share, and degree of wage rigidity. The policy objective and constraints are given below:

where \(D^{W} = \omega D + \left( 1-\omega \right) D^{*}\) and \(\psi ^{W} = \frac{1+\beta }{\beta }\left( 1+g\right) D^{W}\).

By substituting the domestic and foreign aggregate supply curves into the objective function and global aggregate demand curve, we obtain the following Lagrangian:

The first-order conditions are given below:

where \(\lambda \) is the Lagrange multiplier on the global aggregate demand curve. Given that the domestic economy is in secular stagnation: \(Y < Y_{f}\) and \(\Pi < 1\) and \(\frac{dY_{AS}}{d\Pi }> \psi ^{W} > 0\)—and the slope of the AS curve exceeds the slope of the AD curve, the multiplier \(\lambda > 0\) and the fiscal authority in secular stagnation always chooses a level of government spending that exceeds the target. The level of government spending above target is increasing in \(\omega \).

Cooperative Game

We now consider the optimal level of government spending when both countries jointly maximize their welfare. The loss function of the global planner is the weighted sum of each country’s loss function. Given that the aggregate supply curve are identical and if we assume that the target level of government expenditures is the same, we obtain the following loss function subject to a global aggregate demand and global aggregate supply constraints:

where \(D^{W} = \omega D + \left( 1-\omega \right) D^{*}\) and \(\psi ^{W} = \frac{1+\beta }{\beta }\left( 1+g\right) D^{W}\). In the cooperative setup, Y is global output (instead of output of the domestic country only) and G is global government spending. Relative to the non-cooperative setup, the only difference is that the planner chooses G and \(G^{*}\) simultaneously.

The first-order conditions for the optimal level of global government spending are given below:

where the multiplier is the same as in the case of the non-cooperative game. The only difference is that \(\omega \) no longer appears in the second optimality condition.

Proposition 7

Consider two countries in symmetric secular stagnation with identical aggregate supply parameters, loss functions, and target levels of government spending. Then coordinated optimal government spending exceeds uncoordinated government spending. Coordination losses are maximized when \(\omega = \frac{1}{2}\).

Proof

Global government spending under coordination and absent coordination are given below along with the Lagrange multiplier, \(\lambda \):

where \(G_{coop}\) is global government spending under cooperation and \(G_{non-coop}\) is global government spending absent coordination. Since \(\omega \le 1\), \(G_{non-coop} \le G_{coop}\). The term \(\omega ^{2} + \left( 1-\omega \right) ^{2}\) is minimized at \(\omega = \frac{1}{2}\) implying that losses from coordination are maximized when the two countries have the same size. \(\square \)

Corollary

Consider N countries in a symmetric secular stagnation with identical aggregate supply parameter, loss function, and target levels of government spending. Global government spending absent coordination goes to zero as \(N \rightarrow \infty \).

Proof

Since countries are identical, \(\omega = \frac{1}{N}\). The optimality condition for government spending for each country is given by the first-order condition of the non-cooperative game. Therefore, global government spending absent coordination is given by the expression below:

where the second term goes to zero as \(N \rightarrow \infty \). \(\square \)