Abstract

This paper explores the distributional effects of monetary policy in the context of a small open economy. Emerging markets are structurally different from developed economies. They are generally associated with greater financial frictions, underdeveloped financial markets, as well as both a high average level of dollarized assets and unequal access to them, among others. Thus, distributional effects of monetary policy in emerging economies require additional specifications. In particular, I show that wealthy households (represented by the top 10% of the income distribution), who are more able to save in foreign currencies, gain in purchasing power of their incomes by hedging against domestic inflation. At the same time, the poor households (represented by the bottom fifty percent of the income distribution) retain a larger share of liquid assets denominated in domestic currency, thus experiencing a greater burden of local currency inflation. I also show that contractionary monetary policy is associated with periods of higher income inequality in emerging markets that is likely to exacerbate the damaging impact of inflation on the bottom groups of the income distribution.

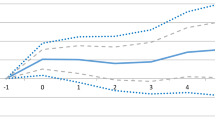

Source: Author’s calculations

Source: Wealth Inequality Data, World Income Inequality Database

Source: Wealth Inequality Data, World Income Inequality Database

Source: Wealth Inequality Data, World Income Inequality Database, BIS

Source: Wealth Inequality Data, World Income Inequality Database, BIS

Source: Wealth Inequality Data, World Income Inequality Database

Source: BIS

Similar content being viewed by others

References

Acosta-Ormaechea, Santiago, and David Coble. 2011. Monetary Transmission in Dollarized and Non-Dollarized Economies: The Cases of Chile, New Zealand, Peru and Uruguay. IMF Working Papers WP/11/87.

Akitoby, Bernardin, and Thomas Stratmann. 2008. Fiscal policy and financial markets. Economic Journal 118: 1971–1985.

Algan, Yann, and Xavier Ragot. 2010. Monetary policy with heterogenous agents and borrowing constraints. Review of Economic Dynamics 13: 295–316.

Areosa, Waldyr, and Marta Areosa. 2016. The inequality channel of monetary transmission. Journal of Macroeconomics 48: 214–230.

Auclert, Adrien . 2017. Monetary Policy and the Redistribution Channel. NBER Working Paper No. 23451.

Bilbiie, Florin. 2008. Limited asset market participation, monetary policy and (inverted) aggregate demand logic. Journal of Economic Theory 140(1): 162–196.

Campbell, John, and Gregory Mankiw. 1989. Consumption, income, and interest rates: Reinterpreting the time series evidence. NBER Macroeconomic Annual 4: 185–216.

Coibion, Olivier, Yuriy Gorodnichenko, Lorenz Kueng, and John Silvia. 2012. Innocent Bystanders? Monetary Policy and Inequality in the US. NBER Working Paper No. 18170.

Colciago, A., A. Samarina, and J. Haan. 2019. Central bank policies and income and wealth inequality: A survey. Journal of Economic Surveys 33(4): 1199–1231.

Doepke, Matthias, and Martin Schneider. 2006. Inflation and the distribution of nominal wealth. Journal of Political Economy 114(6): 1069–1097.

Doepke, Matthias, Martin Schneider, and Veronika Selezneva. 2015. Distributional Effects of Monetary Policy. Working Paper #14.

Drenik, Andres, Gustavo Pereira, and Diego Perez. 2018. Wealth redistribution after exchange rate devaluations. American Economic Association Papers and Proceedings. 108: 552–556.

Easterly, William, and Stanley Fischer. 2001. Inflation and the poor. Journal of Money, Credit, and Banking 32: 160–178.

Epstein, Gerald. 2018. The Political Economy of International Finance in an Age of Inequality: Soft Currencies, Hard Landings. Northampton, MA: Edward Elgar Publishing.

Epstein, Gerald, and Juan Montecino. 2015. Did Quantitative Easing Increase Income Inequality? Institute for New Economic Thinking Working Paper Series No. 28.

Erosa, Andres, and Gustavo Ventura. 2002. On inflation as a regressive consumption tax. Journal of Monetary Economics 49: 761–795.

Fabio, Canova, and Matteo Ciccarelli. 2013. Panel Vector Autoregressive Models: A Survey. Working Paper Series NO 1507, January.

Gali, Jordi, David Lopez-Salido, and Javier Valles. 2004. Rule-of-thumb consumers and the design of interest rate rules. Journal of Money, Credit, and Banking 36(4): 739–763.

Gornemann, Nils, Keith Kuester, and Makoto Nakajima. 2014. Doves for the Rich, Hawks for the Poor? Distributional Consequences of Monetary Policy. Working paper, Federal Reserve Bank of Philadelphia.

Honohan, Patrick. 2007. Dollarization and Exchange Rate Fluctuations. World Bank Policy Research Working Paper No. 4172.

Ize, Alain, and Eduardo Levy-Yeyati. 2003. Financial dollarization. Journal of International Economics 59: 323–347.

Krusell, Per, and Anthony Smith. 2014. The redistributive effects of financial deregulation. Journal of Monetary Economics 68: 867–896.

Levy-Yeyati, E. 2006. Financial dollarization: Evaluating the consequences. Economic Policy 21: 61–118.

Levy-Yeyati, Eduardo. 2019. Exchange rate policies and economic development. In Economic Development.

Meh, Cesaire, and Yaz Terajima. 2011. Inflation, nominal portfolios, and wealth redistribution in Canada. Canadian Journal of Economics 44(4): 1369–1402.

Milanovic, B. 2016. Global Inequality: A New Approach for the Age of Globalization. Cambridge, MA: Harvard University Press.

Min, Hong. 1999. Determinants of Emerging Market Bond Spread: Do Economic Fundamentals Matter? World Bank Policy Research Working Papers.

Monnin, Pierre. 2014. Inflation and Income Inequality in Developed Economies. CEP Working Paper 2014/1.

Mulligan, Casey, and Xavier Sala-i-martin. 2000. Extensive margins and the demand for money at low interest rates. Journal of Political Economy 108(5): 961–991.

Piketty, Thomas. 2014. Capital in the twenty-first century. Cambridge, MA: The Belknap Press of Harvard University Press.

Prasad, Eswar. 2015. Distributional Effects of Monetary Policy in Emerging Market Economies. IZA Discussion Paper No. 9272, August.

Prasad, Eswar, and Boyang Zhang. 2015. Distributional Effects of Monetary Policy in Emerging Market Economies. NBER Working Paper No. 21471.

Reinhart C.M., K.S. Rogoff, and M. Savastano. 2003. Addicted to Dollars. NBER Working Papers Series No. 10015.

Romer, Christina, and David Romer. 1998. Monetary policy and the well-being of the poor. NBER Working Paper No. 6793.

Saez, E.F.A., G. Zucman, L. Chancel, and T. Piketty. 2018. World Inequality Report 2018. Accessed February 7, 2020. wir2018.wid.world.

Sunel, Enel. 2018. Welfare consequences of gradual disinflation in emerging economies. Journal of Money, Credit, and Banking 50: 705–757.

2017. World Income Inequality Database: Version 3.4. UNU-WIDER-UNDP project.

2018. World Inequality Database: Methodology. October 1. Accessed December 7, 2017. https://wid.world/methodology/#library-browse-by-country.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This paper is a revised version of Chapter 1 of my PhD dissertation at University of Massachusetts-Amherst. I thank my advisors Gerald Epstein, Michael Ash, Adam Honig, and Shouvik Chakraborty for their constant guidance and support. I also thank the anonymous referee for the detailed revisions and helpful comments.

Rights and permissions

About this article

Cite this article

Ybrayev, Z. Distributional Consequences of Monetary Policy in Emerging Economies: Dollarization, Domestic Inflation, and Income Divergence. Comp Econ Stud 64, 186–210 (2022). https://doi.org/10.1057/s41294-021-00163-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41294-021-00163-2