Abstract

Natural disasters offer a specific case study of the mix of public and private insurance. Indeed, the experience accumulated over the past decades has made it possible to transform poorly-known hazards like flood losses, long considered uninsurable, into risks that can be assessed with some precision. They exemplify, however, the affordability issue associated with risk-based premiums. The French scheme reflects such ideas and offers wide coverage for moderate premiums to all, but is questioned in its principle by climate change: we show that some wealthier areas that were not perceived as ‘at risk’ in the past have now become exposed to submersion risk. This singularly makes some well-off properties the potential main beneficiaries of a scheme that was historically thought to protect the worst-off. Acknowledging that some segmentation may become desirable, we examine several models for flood risk and the disparity in premiums they entail.

Similar content being viewed by others

Notes

Even if premiums asked by insurance companies would be based on several risk-related variables, we only consider here the location of the house or apartment.

The system covers most natural disasters, so geographic diversity increases the chance of facing at least one specific risk in a given area. Nevertheless, in this article, we will not take into account this possible diversification and focus only on the largest in France, flood risk.

In practice, the 5.5% appeared insufficient the next year and was raised to 9%. In 1999, the loading was raised again to its current level of 12%.

Reinsurance is optional. However, since the CatNat premium is fixed by decree, almost all insurers are currently reinsured with the public reinsurer.

For a historical description of the system with a focus on Florida see Michel-Kerjan and Kousky (2010).

Further studies led to a threshold of unaffordability when insurance premiums exceed 1% of income (Long 2018; see also National Research Council 2015). While estimating the threshold of affordability is of interest from the perspective of this paper, the comparison with the U.S. should be handled with care: indeed, the U.S. flood programme is plagued by adverse selection due to low take up. Consequently, recommendations for improving the affordability of the U.S. flood programme may not be directly relevant to the French programme.

The details for several towns are given in Table 8 in the Appendix, and maps are available as supplementary material online at https://github.com/freakonometrics/floods.

The municipality of La Faute-sur-Mer became famous since 29 people died at the end of February 2010 because of the coastal flood caused by windstorm Xynthia.

It started at 5.5%, jumped to 9% in 1985, and then to 12% in 2000.

We will mention here only household insurance, not commercial buildings.

We use here the word town to designate a ‘commune’ or municipality.

E.g. for the département of Eure, in Normandy https://www.data.gouv.fr/fr/datasets/perimetres-des-plans-de-prevention-du-risque-inondationdans-leure.

The fact that \(15{\%}\) of the households are experiencing about \(90{\%}\) of the losses, over 20 years, is actually not unusual in insurance: if we assume that flood risk is uniform and centennial (each household has a 1% yearly chance of claiming a loss), and that all risks are independent, then over 20 years \(18.2{\%}\) of the households claim a loss at least once—if X has a binomial distribution \(\mathcal {B}(n=20,p=1{\%})\) (since we assure independence between years) then \(\mathbb {P}(X=0)=(1-p) ^n=0.99^{20}=81.79{\%}\). So, 100% of the losses are related to \(18.2{\%}\) of the portfolio (and possibly \(18.2{\%}\) is the premium earned).

The Will Rogers phenomenon is obtained when moving an element from one set to another set raises the average values of both sets. It is based on the quote, attributed to comedian Will Rogers, when the Okies left Oklahoma and moved to California, they raised the average intelligence level in both states.

References

Anderson, E.S. 1999. What is the point of equality? Ethics 109 (2): 287–337.

Arneson, R.J. 2011. Luck egalitarianism—a primer. In Responsibility and Distributive Justice, ed. C. Knight, and Z. Stemplowska, 24–50. Oxford: Oxford University Press.

Baker, T., and P. Siegelman. 2013. Behavioral economics and insurance law: The importance of equilibrium analysis. Faculty Scholarship at Penn Law. 655. https://scholarship.law.upenn.edu/faculty_scholarship/655.

Baker, T., and J. Simon. 2002. Embracing Risk. Chicago: University of Chicago Press.

Barry, L. 2020a. Insurance, big data and changing conceptions of fairness. European Journal of Sociology / Archives Européennes de Sociologie 61 (2): 159–184.

Barry, L. 2020b. L’invention du risque catastrophes naturelles. PARI Working Paper No. 18. https://www.chaire-pari.fr/wp-content/uploads/2020/02/Catastrophes-naturelles-invention-dun-risque-WP.pdf.

Beck, U. 1992. Risk Society: Towards a New Modernity. Thousand Oaks, CA: Sage.

Bellah, R.N., R. Madsen, W.M. Sullivan, A. Swidler, and S.M. Tipton. 1996. Habits of the Heart: Individualism and Commitment in American Life: Updated Edition with a New Introduction. California: University of California Press.

Bidan, P., and T. Cohignac. 2017. Le régime francais des catastrophes naturelles: Historique du régime. Variances (11). http://variances.eu/?p=2705.

Born, P.H., and B. Klimaszewski-Blettner. 2013. Should I stay or should I go? the impact of natural disasters and regulation on U.S. property insurers’ supply decisions. Journal of Risk and Insurance 80 (1): 1–36.

Botzen, W.J.W., H. Kunreuther, and E. Michel-Kerjan. 2019. Protecting against disaster risks: Why insurance and prevention may be complements. Journal of Risk and Uncertainty 59: 151–169.

Brown, A. 2005. Luck egalitarianism and democratic equality. Ethical Perspectives 3: 293–340.

Browne, M., and R. Hoyt. 2000. The demand for flood insurance: Empirical evidence. Journal of Risk and Uncertainty 20 (1): 291–306.

Bühlmann, H. 1967. Experience rating and credibility. ASTIN Bulletin 4 (3): 199–207.

Bühlmann, H. 1969. Experience rating and credibility. ASTIN Bulletin 5 (2): 157–165.

Causa, O., N. Woloszk, D. Leite. 2020. Housing, wealth accumulation and wealth distribution: Evidence and stylized facts. LWS Working papers (30).

CCR. 2016. Expert Knowledge of Risks. https://www.ccr.fr/en/-/plaquette-expertise-cat-nat.

CCR. 2020. Bilan des Catastrophes Naturelles, 1982-2019. https://catastrophes-naturelles.ccr.fr/-/bilan-cat-nat-1982-2019.

Charpentier, A. 2008. Insurability of climate risks. The Geneva Papers on Risk & Insurance—Issues and Practice 33 (1): 91–109.

Charpentier, A., and B. Le Maux. 2014. Natural catastrophe insurance: How should the government intervene? Journal of Public Economics 115: 1–17.

Clark, K.M. 2002. The use of computer modeling in estimating and managing future catastrophe losses. The Geneva Papers on Risk & Insurance—Issues and Practice 27 (2): 1–15.

Cohen, G.A. 1989. On the currency of egalitarian justice. Ethics 99 (4): 906–944.

Collier, S. J. 2008. Enacting catastrophe: Preparedness, insurance, budgetary rationalization. Economy and Society 37 (2): 224–250. https://doi.org/10.1080/03085140801933280.

Consorcio de Compensación de Seguros. 2016. An Overview. CSS Publication. https://www.consorseguros.es/web/la-entidad/publicaciones.

Díez-Herrero, A., and L. Lain Huerta, and M. Llorente-Isidro. 2009. A Handbook on Flood Hazard Mapping Methodologies. IGME: Spanish Geological Survey.

Dumas, P., A. Chavarot, and H. Legrand. 2005. Mission d’enquête sur le régime d’indemnisation des victimes de catastrophes naturelles. Ministére des Transports, de l’Equipement, de la Culture et de la Mer. https://www.vie-publique.fr/rapport/27992-mission-denquete-sur-le-regime-dindemnisation-des-victimes-de-catastro

Durkheim, E. 2007. De la Division du Travail Social. Paris: Presses Universitaires de France.

Dworkin, R. 2000. Sovereign Virtue. Cambridge: Harvard University Press.

Enault, L.C., G. Boulay, and M. Coulon. 2019. The big day for geographers? Opportunities and precautions of open dvf datafiles to work on property market. Cybergeo: European Journal of Geography.

Ericson, R., and A. Doyle. 2004. Catastrophe risk, insurance and terrorism. Economy and Society 33 (2): 135–173. https://doi.org/10.1080/03085140410001677102.

Ewald, F. 1986. L’Etat Providence. Paris: Grasset.

Ewald, F. 1993. Two Infinities of Risk, 221–228. Minneapolis, MN: University of Minnesota Press.

Feinstein, A.R., D.M. Sosin, and C.K. Wells. 1985. The Will Rogers phenomenon. New England Journal of Medicine 312 (25): 1604–1608.

Frezal, S., and L. Barry. 2019. Fairness in uncertainty: Some limits and misinterpretations of actuarial fairness. Journal of Business Ethics 167: 127–136 (2020). https://doi.org/10.1007/s10551-019-04171-2.

Grace, M.F., R.W. Klein, and P.R. Kleindorfer. 2004. Homeowner’s insurance with bundled catastrophe coverage. The Journal of Risk and Insurance 71 (3): 351–379.

Haigh, N., and J. Crabb. 2013. Managing the Future Financial Risk of Flooding. Food and Rural Affairs (DEFRA): Department of Environment. https://www.gov.uk/government/publications/managing-the-future-financial-risk-of-flooding.

Hudson, P., W.J.W. Botzen, J. Czajkowski, and H. Kreibich. 2017. Moral hazard in natural disaster insurance markets: Empirical evidence from Germany and the United States. Land Economics 93 (2): 179–208.

Jaffee, D., and T. Russell. 2013. The welfare economics of catastrophe losses and insurance. The Geneva Papers on Risk & Insurance—Issues and Practice 38 (3): 469–494.

Jarzabkowski, P., K. Chalkias, E. Cacciatori, and R. Bednarek. 2018. Between State and Market: Protection Gap Entities and Catastrophic Risk. London: Cass Business School.

Klein, R.W., and S. Wang. 2009. Catastrophe risk financing in the United States and the European Union: A comparative analysis of alternative regulatory approaches. Journal of Risk and Insurance 76 (3): 607–637.

Knight, F.H. 1985. Risk, Uncertainty and Profit. Chicago: University of Chicago Press.

Kousky, C., and H. Kunreuther. 2014. Addressing affordability in the national flood insurance program. Journal of Extreme Events 1: 1–22.

Kulp, S., and B. Strauss. 2019. New elevation data triple estimates of global vulnerability to sea-level rise and coastal flooding. Nature Communications 10: 4844. https://doi.org/10.1038/s41467-019-12808-z.

Le Den, X., Persson, M., Benoist, A., Hudson, P., de Ruiter, M., de Ruig, L., Kuik, O. 2017. Insurance of weather and climate-related disaster risk: inventory and analysis of mechanisms to support damage prevention in the EU. European Union. https://op.europa.eu/en/publication-detail/-/publication/4f366956-a19e-11e7-b92d-01aa75ed71a1/language-en.

Lehtonen, T.-K., and J. Liukko. 2011. The forms and limits of insurance solidarity. Journal of Business Ethics 103 (1): 33–44.

Levoy, F., E. Grask, M. Toulemont, G. Garry. 1997. Plans de prévention des risques littorraux (PPR)-guide méthodologique. https://side.developpement-durable.gouv.fr/ACCIDR/doc/SYRACUSE/116882/plan-de-prevention-aux-risques-littoraux-guide-methodologique.

Long, B. 2018. An Affordability Framework for the National Flood Insurance Program. https://www.fema.gov/sites/default/files/2020-05/Affordability_april_2018.pdf.

MEDDTL 2011. Circulaire du 27/07/11 relative á la prise en compte du risque de submersion marine dans les plans de prévention des risques naturels littoraux. https://aida.ineris.fr/consultation_document/6925.

Meyers, G., and I. Van Hoyweghen. 2018. Enacting actuarial fairness in insurance: From fair discrimination to behaviour-based fairness. Science as Culture 27 (4): 413–438.

Michel-Kerjan, E.O. 2010. Catastrophe economics: The National Flood Insurance Program. Journal of Economic Perspectives 24 (4): 165–86.

Michel-Kerjan, E.O., and C. Kousky. 2010. Come rain or shine: Evidence on flood insurance purchases in florida. Journal of Risk and Insurance 77 (2): 369–397.

Moss, D.A. 2002. When All Else Fails: Government as the Ultimate Risk Manager. Cambridge: Harvard University Press.

Määttänen, N., and M. Terviö. 2014. Income distribution and housing prices: An assignment model approach. Journal of Economic Theory 151: 381–410.

National Research Council. 2015. Affordability of National Flood Insurance Program Premiums: Report 1. Washington, DC: The National Academies Press. https://www.nap.edu/catalog/21709/affordability-of-national-flood-insurance-program-premiums-report-1.

National Research Council. 2017. An Affordability Framework for the National Flood Insurance Program. Washington, DC: The National Academies Press. https://southeastfloridaclimatecompact.org/wp-content/uploads/2020/03/RCAP_An-Affordability-Framework.pdf.

O’Neill, O. 1997. Genetic information and insurance: Some ethical issues. Philosophical Transactions: Biological Sciences 352 (1357): 1087–1093.

O’Malley, P. 2003. Governable catastrophes: A comment on bougen. Economy and Society 32 (2): 275–279.

MEDDTL. 2014. Guide méthodologique: Plan de prévention des risques littoraux. https://www.ecologie.gouv.fr/sites/default/files/Guide%20PPRL%20-%20version%20finale%20mai%202014.pdf.

Quantin, A., and D. Moncoulon. 2012. La modélisation des risques majeurs en réassurance avec garantie de l’État: application au régime français des catastrophes naturelles, in Grislain-Letremy, Celine, Reza Lahidji, and Philippe Mongin, Les Risques Majeurs et l’action Publique. Paris: La documentation française, 175–194.

Rakowski, E. 1991. Equal Justice. Oxford: Oxford University Press.

Schwarze, R., and G.G. Wagner. 2007. The political economy of natural disaster insurance: Lessons from the failure of a proposed compulsory insurance scheme in Germany. European Environment 17 (6): 403–415.

Scott, J.C. 1998. Seeing Like a State: How Certain Schemes to Improve the Human Condition Have Failed. London: Yale University Press.

Smith, V.K., J.C. Carbone, J.C. Pope, D.G. Hallstrom, and M.E. Darden. 2006. Adjusting to natural disasters. Journal of Risk and Uncertainty 33 (1): 37–54.

Stjernø, S. 2005. Solidarity in Europe: The History of an Idea. Cambridge: Cambridge University Press.

Surminski, S., and A.H. Thieken. 2017. Promoting flood risk reduction: The role of insurance in Germany and England. Earth’s Future 5 (10): 979–1001.

Thomas, R. 2017. Why Insurance Works Better with Some Adverse Selection. Cambridge: Cambridge University Press.

Viscusi, W.K. 2006. Natural disaster risks: An introduction. Journal of Risk and Uncertainty 33 (1/2): 5–11.

Acknowledgements

The authors wish to thank the two anonymous referees for numerous and very helpful comments and suggestions, as well as Wouter Botzen, Thierry Cohignac, Pierre François, Arnaud Goussebaille, Burrell Montz and Pierre Picard for discussions and feedback on a previous version of this text. Arthur Charpentier received financial support from NSERC and the AXA Research Fund.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Prices of houses and apartments in towns with PPRL (coastal risk) in Vendée and Loire-Atlantique

Prices of houses and apartments in towns with PPRI (overflow risk) in Var

Premiums with the hierarchical model

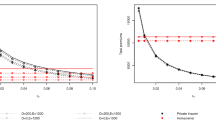

In Tables 6 and 7, we considered some arbitrary values for the pair \((\gamma ,\beta )\), with \(\gamma \in \{0{\%},20{\%},40{\%}\}\) and \(\beta \in \{10{\%},20{\%},50{\%}\}\) (as well as some extreme cases in \(\{0{\%},100{\%}\}\)). In Fig. 8, we have the level curves of premiums as a function of \(\gamma\) and \(\beta\) (or iso-premium curves), where \(\gamma\) is the share of national solidarity and \((1-\gamma )\beta\) is the share of municipality-based solidarity. The key point here is that there is no universal or general pattern. The evolution of the premium \((\beta ,\gamma )\mapsto p_{i:j}(\beta ,\gamma )\) depends on the city i, its relative risk level in its region j and the relative risk level in the country.

Rights and permissions

About this article

Cite this article

Charpentier, A., Barry, L. & James, M.R. Insurance against natural catastrophes: balancing actuarial fairness and social solidarity. Geneva Pap Risk Insur Issues Pract 47, 50–78 (2022). https://doi.org/10.1057/s41288-021-00233-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41288-021-00233-7