Abstract

Early withdrawals from individual retirement accounts are one of the main problems of pension companies in both developed and emerging countries. The aim of this study is to identify the potential reasons behind decisions to withdraw early from the individual retirement system in Turkey. Using Cox proportional hazards model, we find that there is a significant negative relationship between financial literacy and withdrawal probability. Our results reveal that men and younger individuals are more likely to make an early withdrawal. We also find that individuals who experience liquidity constraints and income shocks tend to withdraw their contracts earlier. Further analysis suggests that the effect of variables remarkably changes among different subgroups. We believe that our findings will assist both pension managers and policymakers to design better retirement plans and to take steps to prevent voluntary withdrawals in the long term.

Similar content being viewed by others

Notes

See Lannoo et al. (2014).

Carrol and Weil (1994).

Attanasio et al. (2000).

Jackson and Nakashima (2015).

See the Individual Pension System Progress Report of Turkey Individual Pension System Progress Report of Turkey (2014) at http://www.egm.org.tr/bes2013gr/bes2013gr_en.pdf.

IRA participants gain the full retirement rights when they are 56 years old and have stayed in the system for at least 10 years. Otherwise they will forego the benefits related with the government match and lower tax rates applied to the amount accumulated.

See U.S. Department of Treasury, Internal Revenue Service (2016).

See Government of Canada (2016) at http://www.esdc.gc.ca/en/reports/pension/changes.page accessed on February, 2016.

Boradbent +et al. (2006).

Butrica et al. (2010).

Engström and Westerberg (2003).

Smith (2006).

In DB plans, the pension is a function of years worked and wages earned and is financed on a pay-as-you-go basis.

The gross domestic savings-to-GDP ratio is 15.8 per cent for Turkey, compared to 29.5 per cent in Hungary, 21.6 per cent in Poland and 19.8 per cent in Argentina as of 2014.

Pension companies have the right to cancel if the customer does not make any contribution for 60 months after the contract date.

Guariglia and Markose (2000).

Munnell et al. (2001).

Smith et al. (2004).

Celiktopuz and Kayam (2013).

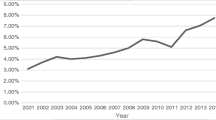

The data were retrieved from the OECD website following the link: data.oecd.org.

Elveren and Hsu (2007).

Elveren (2008).

Financial Services Authority (2006).

Wilmoth and Koso (2002).

Boraas and Rodgers (2003).

Ando and Modigliani (1963).

Mandell (2004).

Hogarth and Hilgert (2002).

Choi et al. (2002).

Madrian and Shea (2001).

Lusardi and Mitchell (2011).

Bayer et al. (2009).

We do not have full access to the information of all individual retirement system participants. Therefore, it is only a small portion of the whole population. Our data vendor Anadolu Hayat Emeklilik provided us the final clustered sample, which consists of more than ten thousands of contracts and contract holders in different spreadsheets. We then combined all the information about the contracts and participants to obtain a single data set, which includes 5972 contracts without any missing data.

Approximately 87 per cent of the individual retirement system participants make monthly payments.

Customers can change the weights of the funds in their portfolio every month.

We have access to the information about the participants’ declared contribution amount for each month.

Is Bankasi (2014).

Cox (1972).

Smith (2001).

References

Ando, A. and Modigliani, F. (1963) ‘The “life-cycle” hypothesis of saving: aggregate implications and tests’, The American Economic Review 53(1): 55–84.

Attanasio, O.P., Picci, L. and Scorcu, A.E. (2000) ‘Saving, growth, and investment: A macroeconomic analysis using a panel of countries’, The Review of Economics and Statistics 82(2): 182–211.

Bayer, P.J., Bernheim, B.D. and Scholz, J.K. (2009) ‘The effects of financial education in the workplace: Evidence from a survey of employers’, Economic Inquiry 47(4): 605–624.

Boraas, S. and Rodgers, W.M. III. (2003) ‘How does gender play a role in the earnings gap? An update’, Monthly Labor Review 126(3): 9–15.

Broadbent, J., Palumbo, M. and Woodman, E. (2006) The Shift from Defined Contribution Pension Plans-Implications for Asset Allocation and Risk Management, paper prepared for a working group on institutional investors, global savings and asset allocation established by the Committee on the Global Financial System.

Butrica, B.A., Zedlewski, S.R. and Issa, P. (2010) Are Early Withdrawals from Retirement Accounts a Problem? The Retirement Policy Program Brief Series No: 27, Washington: The Urban Institute.

Carroll, C.D. and Weil, D.N. (1994) ‘Saving and growth: a reinterpretation’, Carnegie-Rochester Conferences Series on Public Policy 40: 133–192.

Celiktopuz, M., and Kayam, S.S. (2013) ‘Features that influence the exit decision from the private pension system in Turkey’, Journal of Advanced Studies in Finance 2(4): 145–158.

Choi, J.J., Laibson, D., Madrian B.C. and Metrick, A. (2002) Defined Contribution Pensions: Plan Rules, Participant Decisions, and the Path of Least Resistance, NBER Working Paper No. 8655, Cambridge, MA: National Bureau for Economic Research.

Cox, D. R. (1972) ‘Regression models and life tables’, Journal of the Royal Statistical Society 34(2): 187–220.

De Giovanni, D. (2010) ‘Lapse rate modeling: A rational expectation approach’, Scandinavian Actuarial Journal 2010(1): 56–67.

Elveren, A. Y. (2008) ‘Assessing gender inequality in the Turkish Private Pension Scheme’, International Social Security Review 61(2): 39–58.

Elveren, A. Y. and Hsu, S. (2007) Gender Gaps in the Individual Pension System in Turkey, University of Utah, Department of Economics, Working Paper No. 2007–06.

Engström, S. and Westerberg, A. (2003) ‘Which individuals make active investment decisions in the new Swedish pension system?’, Journal of Pension Economics and Finance 2(3): 225–245.

Financial Services Authority (2006) Levels of Financial Capability in the UK: Results of a Baseline Survey, Consumer Research No. 41, London: Financial Services Authority.

Government of Canada (2016) Changes to the Canada Pension Plan, from http://www.esdc.gc.ca/en/reports/pension/changes.page, accessed 2 February 2016.

Guariglia, A. and Markose, S. (2000) ‘Voluntary contributions to personal pension plans: Evidence from the British household panel survey’, Fiscal Studies 21(4): 469–488.

Hogarth, J.M., and Hilgert, M.A. (2002) ‘Financial knowledge, experience and learning preferences: Preliminary results from a new survey on financial literacy’, Consumer Interest Annual 48(1): 1–7.

Is Bankası (2014) . 2010 ve 2012 Verileriyle İllerin Gelişmişlik Düzeyi Araştırması. İktisadi Araştırmalar Bölümü (February).

Jackson, R. and Nakashima, K. (2015). Global Aging and Retirement Security in Emerging Markets: Reassessing the Role of Funded Pensions, Alexandria, VA: Global Aging Institute.

Kim, C. (2005) ‘Modeling surrender and lapse rates with economic variables’, North American Actuarial Journal 9(4): 56–70.

Kolkiewicz, A.W. and Tan, K.S. (2006) ‘Unit-linked life insurance contracts with lapse rates dependent on economic factors’, Annals of Actuarial Science 1(1): 49–78.

Kuo, W., Tsai, C. and Chen, W.K. (2003) ‘An empirical study on the lapse rate: The cointegration approach’, The Journal of Risk and Insurance 70(3): 489–508.

Lannoo, K., Barslund, M., Chmelar, A. and von Werder, M. (2014) Pension Schemes, Doc. IP/A/EMPL/ST/2013-07, Brussels: European Union.

Linton, N.A. (1932) ‘Panics and cash values’, Transactions of the Actuarial Society of America 38: 365–394.

Lusardi, A. and Mitchell, O.S. (2011) Financial Literacy and Planning: Implications for Retirment Wellbeing. NBER Working Paper No.17078, Cambridge, MA: National Bureau for Economic Research.

Madrian, B.C. and Shea, D.F. (2001) ‘The power of suggestion: Inertia in 401(k) participation and saving behavior’, The Quarterly Journal of Economics 116(4): 1149–1187.

Mandell, L. (2004) Financial Literacy: Are We Improving? Results of the 2004 National Jump$tart Survey, Washington: Coalition.

Munnell A. H., Sunden, A. and Taylor, C. (2001) What Determines 401(k) Participation and Contribution? Working Paper No. 2000-12, Chestnut Hill, MA: Center for Retirement Research, Boston College.

Outreville, J.-F. (1990) ‘Whole-life insurance lapse rates and the emergency fund hypothesis’, Insurance: Mathematics and Economics 9(4): 249–255.

Pension Monitoring Centre of Turkey (2014) Individual Pension System Progress Report (May), from http://www.egm.org.tr/bes2013gr/bes2013gr_en.pdf

Renshaw, A.E. and Haberman, S. (1986) ‘Statistical analysis of life assurance lapses’, Journal of the Institute of Actuaries 113(3): 459–497.

Russell, D.T., Fier S.T., Carson J.M. and Dumm R.E. (2013) ‘An empirical analysis of life insurance policy surrender activity’, Journal of Insurance Issues 36(1): 35–57.

Smith, S. (2006) ‘Persistency of pension contributions in the UK: Evidence from the British Household Panel Survey’, Journal of Pension Economics and Finance 5(3): 257–274.

Smith, T. and Smith, B. (2001) ‘Survival analysis and the application of Cox’s proportional hazards modeling using SAS’. In Proceedings of The Twenty-Sixth Annual SAS User’s Group International Conference, Cary, NC: SAS Institute Inc., pp. 244–246.

Smith, K. E., Johnson, R. W. and Muler, L. A. (2004) ‘Deferring income in employer-sponsored retirement plans: The dynamics of participant contributions’, National Tax Journal 57(3): 639–670.

U.S. Department of Treasury, Internal Revenue Service (2016) Distributions from Individual Retirement Arrangements (IRAs), IRS Publication 590-B, from https://www.irs.gov/pub/irs-pdf/p590b.pdf

Wilmoth, J. and Koso, G. (2002) ‘Does marital history matter? Marital status and wealth outcomes among preretirement adults’, Journal of Marriage and Family 64(1): 254–268.

Acknowledgements

We would like to thank Anadolu Hayat Emeklilik Pension Coporation for providing us the data used in this study. The authors are grateful to the editor and two anonymous referees for their comments and suggestions that helped us to improve the paper. Any remaining errors are our own.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Yildiz, Y., Karan, M.B. & Bayrak Salantur, S. An Investigation on Early Voluntary Withdrawals from Individual Retirement Accounts: An Empirical Study on an Emerging Market. Geneva Pap Risk Insur Issues Pract 42, 732–756 (2017). https://doi.org/10.1057/s41288-016-0037-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41288-016-0037-9