Abstract

Given that there is no consensus on the fact that ESG portfolios are characterized by very high returns and very low risks compared to conventional portfolios, this study aims to empirically verify whether the series of returns of an ESG portfolio is less volatile than the returns of a benchmark market portfolio. To verify this hypothesis, we used the Markov-switching GARCH models in order to model the process of the series of daily returns of the ESG portfolio “MSCI USA ESG Select,” as well as those of the market benchmark portfolio daily returns series “S&P 500,” during the period June 01, 2005 to December 31, 2020 as well as that excluding the COVID19 crisis and from June 1, 2005 to October 29, 2019. It can be concluded that the ESG portfolio “MSCI USA ESG Select” is relatively less turbulentcompared to the market benchmark portfolio “S&P 500.”

Similar content being viewed by others

Introduction

During the process of choosing an investment, a company's adherence to environmental, social, and corporate governance (ESG) principles becomes increasingly relevant in the current social and investment climate. Companies that focus on ESG principles have historically outperformed those that do not and experience less risk (Chen and Mussalli 2020; Cheng et al. 2014; Dimson et al. 2015; Harper 2020; Kurtz 2020). However, there is no consensus on the positive relationship between the integration of ESG factors in the investment and its performance (Anson et al. 2020; Brunet 2019; Friede et al. 2015; Giese and Lee 2019). Furthermore, there is an extensive and voluminous literature devoted to ESG investing, and thousands of research studies focused on sustainable investing and ESG highlighting both positive and negative impacts (Anson et al. 2020). Moreover, it is not easy to define a process for building ESG portfolios which, on the one hand, optimally combine profit maximization characteristics and ESG characteristics; and, on the other hand, take into account the specific requirements of investors (Kurtz 2020; Chen and Mussalli 2020). According to Chen and Mussalli (2020), there is an optimal approach to constructing ESG portfolios optimally combining the dual objective of Jensen's Alpha and sustainability outperformance. Their proposed approach is based on three pillars: ESG factors which can also provide Alpha; the consideration of a unique materiality linking ESG and Alpha considerations; and a portfolio construction framework that takes into account the preferences of the ESG assets’ owner.

Considering that ESG is a constantly evolving field, several terms, such as sustainable investing, socially responsible investing, thematic investing, and responsible investing are often used to express the same concept. Indeed, ESG is sometimes used as a synonym for sustainability or corporate social responsibility. However, this usage can be confusing, as ESG factors can be used in many types of valuation. Despite varying definitions, the central concept of corporate social responsibility as a measurable quantity is valid (Orlitzky et al. 2003). On the other hand, the definitions of ESG are different according to the researchers. Chatterji et al. (2015) demonstrate very weak correlations between six different ESG rating systems and note that users of social ratings should be cautious in interpreting their link to actual “corporate social responsibility.” In their analysis of the differences between five scoring systems for the year 2014, Berg et al. (2019) attribute 50% of the variations in the result to measurement error. Therefore, it is logical to use ESG as an adjective “quantitative” rather than as the noun “corporate social responsibility” (Kurtz 2020). Since ESG metrics are used for many different purposes, the results of ESG rating systems are not expected to be highly correlated, nor those of quantitative models. The portfolio manager is, then, called upon to develop the most appropriate frameworks and ratings based on the strategy objectives.

In order to meet the growing craze for ESG portfolios, there is an array of ESG investment solutions. It should be noted that asset owners, who invest in ESG-centric strategies, attribute relatively different importance to ESG and Alpha. Indeed, when we talk about an ESG investment, we often use the following terms: “ESG Alpha” that is to say Alpha factors built with Alpha and ESG considerations; “Standard Alpha” that is, Alpha factors constructed solely on the basis of Alpha considerations; and “Materiality” which establishes the link between ESG considerations and financial returns (Chen and Mussalli 2020). Regarding that the future evolution of a market variable is uncertain, the risk manager is called upon to monitor this uncertainty for a good assessment of the losses to which he is exposed (Hull et al. 2013). In addition to the risk manager, uncertainty about profit prospects and risk assessment also complicates the task of regulatory bodies. Since there is no consensus on the fact that ESG portfolios are characterized by very high returns and very low risks compared to conventional portfolios, we wish to verify empirically whether the series of returns of an ESG portfolio are less volatile than those of a benchmark market portfolio’s returns. Thus, the main purpose behind this article is to identify the econometric model likely to model the process of the series of ESG portfolio daily returns “MSCI (Morgan Stanley Capital International) USA ESG Select,” as well as the series of the “S&P 500” market benchmark portfolio daily returns, in order to predict their short-term trends and volatility. MSCI USA's ESG Select portfolio has been designed to target companies with positive ESG factors. It is designed to overweight companies with a high ESG rating and underweight companies with a low rating. Tobacco and controversial weapons companies, as well as the main producers of alcohol, gambling, firearms, weapons of war, and nuclear power do not qualify for inclusion. Considering that finance has two regimes: state of stability and state of crisis, the Markov-switching “GARCH and EGARCH” models constitute the econometric approach adequate to model the phases of expansion, and those of recession for the case of series of the ESG portfolio “MSCI USA ESG Select” daily returns, and those of the series of the market benchmark portfolio “S&P 500” daily returns, during the period from June 01, 2005 to December 31, 2020 (as well as that excluding the COVID19 crisis and from June 1, 2005 to October 29, 2019). There is, on the one hand, nonlinear models, at the mean level, which include, inter alia, the TAR model (Tsay 1989), the SETAR model (Teräsvirta and Anderson 1992), and the Markov regime change model (Hamilton 1989), and on the other hand, the nonlinear models, at the level of variance, which include, inter alia, the ARCH models (Engle 1982) and its extensions: GARCH (Bollerslev 1986), EGARCH (Nelson 1991), and TGARCH (Zakoian 1994). We have thought of modeling the volatility of the ESG portfolio of our interest by a mixed model between a nonlinear model at the level of the mean and another nonlinear at the level of the variance, i.e., the Markov-switching GARCH model (Adia et al. 2018; Ardia 2008; Cai 1994; Gray 1996; Hamilton and Susmel 1994; Hansen and Lunde 2005; Marcucci 2005). Thus, the objective of this research paves the way to the following questions: is there a change of regimes in the series of an ESG portfolio’s returns? Does the series of ESG portfolio’s returns follow a Markov-switching GARCH process? What is the probability of a transition from a state of stability to a state of crisis for an ESG portfolio? What is the probability of being in crisis (smoothing probability) for an ESG portfolio? How long is a period of high volatility for an ESG portfolio? Is the ESG portfolio less turbulent than a market benchmark portfolio?

In order to present this research, a review of the literature on an ESG investment will be conducted. It will shed light on the main approaches of an ESG investment or portfolio, and the scientific debate on the nature of the relationship between ESG investment and its performance. The methodology adopted will be presented. The ARCH model and its extensions as well as the Markov-switching “GARCH and EGARCH” models are suitable for modeling and forecasting the series of the ESG portfolio’s daily returns “MSCI USA ESG Select” as well as those of the market benchmark portfolio’s daily returns “S&P 500,” during the period 2005–2020 as well as that excluding the crisis of the COVID19 pandemic 2005–2019. At the end of this article, and based on the analysis of results, discussion of the results along with some concluding remarks will be provided.

Conceptual framework of ESG investment

Before presenting the scientific debate on the nature of the relationship between ESG investment and its performance (“The relationship between ESG investment and its performance” section), it is first necessary to take stock of the three main approaches of an ESG investment or portfolio: the exclusion method, the integration investment, and impact investment approaches (“Approaches to ESG investment” section).

Approaches to ESG investment

ESG investing is based on three approaches: the exclusions method, the integrative investing approach, and the impact investing approach. Not all responsible investing products incorporate all three approaches, but most use a combination of them.

Restrictions or exclusions method

Commonly known as “socially responsible investing” (SRI) and considered as the primary form of ESG investment, this investment method excludes investments in companies involved in controversial areas, such as arms, tobacco, gambling, change climate, human rights, adult content, and private prisons. In 1990, the first broad social index was launched in the United States under the name “Domini Social Index,” now called “MSCI KLD 400 Social Index.” The study by Kurtz and DiBartolomeo (2011) analyzes the social index “MSCI KLD 400” through the use of factors from the fundamental risk model of Northfield. That of Trunow and Lindner (2015) studies the “Calvert” social index using an MSCI Barra model. The results of these two studies show, on the one hand that the deviations from the benchmark index are due to common factors, and on the other hand, the existence of a small positive stock selection effect but statistically insignificant (Kurtz 2020). A SRI-based portfolio typically results in a lower Alpha than its counterpart with no list of restrictions. However, these exclusions reduce the maximum return achieved by the manager. Furthermore, they do not distinguish between relatively good or bad ESG companies. Therefore, this exclusion method remains a rudimentary approach to ESG investing that might probably produce less than optimal ESG and Alpha results (Chen and Mussalli 2020; Kurtz 2020).

Integration investment approach

In this approach, ESG factors are integrated into stock selection and portfolio construction. ESG factors can contribute to long-term financial performance, through increasing returns or minimizing risk (Chen and Mussalli 2020; Glosner 2017; Harper 2020). When ESG factors are properly integrated, they allow institutional investors, on the one hand, to better understand the risk and return profile of investments and, on the other hand, to improve the performance of investments (Harper 2020). The advantage of this approach lies in the assessment of ESG issues by Alpha de Jensen. Unlike traditional exclusions, ESG analysis takes into account various social, environmental, and governance issues, and uses rating systems to assess all securities in the investment universe. Currently, asset managers use ESG strategies that completely neglect exclusions. In three years, the proportion of assets under management domiciled in the United States and managed by ESG strategies has risen from less than 10% to almost 60% (Cahan 2019; Kurtz 2020). Chen and Mussalli (2020) consider the construction of ESG portfolios to be better within an integrated framework which, on the one hand, covers the range of ESG needs of asset owners according to the following two dimensions: the importance of ESG performance by report on Alpha and ESG metrics that matter to the asset owner and, on the other hand, is based on three major pillars: Alpha ESG factors, investment materiality measurement, and construction of an integrated ESG portfolio.

Impact investing approach

According to this method, investors must direct their capital to companies that provide solutions to social and environmental problems. One of the main challenges of this approach is the measurability of the results. In this approach, a given portfolio is evaluated according to the ESG and Alpha dimensions. The positive relationship between high corporate social responsibility ratings and the power to make profits for the company illustrates the possibility of Alpha ESG (Investor’s Business Daily 2019; Tsoutsoura 2004; Waddock and Graves 1997). This relationship continues in materiality-based ESG rating systems, which makes it possible to link ESG considerations to Alpha. Environmental, social, and corporate governance (ESG) issues can affect the performance of investment portfolios differently across companies, sectors, regions, asset classes, and over time (Chen and Mussalli 2020). Indeed, environmental issues are important to industrial companies, although they are not as important to professional service companies. On the other hand, employee satisfaction is important for these companies, while it is not as critical for companies whose assets are mainly based on physical capital. Thus, the common approach to identify materiality is to segment companies by industry.

Following their release in 2018, the Sustainability Accounting Standards Board (SASB) standards are widely adopted in the United States and internationally. In September 2019, Bloomberg announced their intention to launch a family of equity indices based on SASB standards (Bloomberg Professional Services 2019). In November 2019, the CFA Institute announced their intention to launch a new ESG standardization initiative (FundFire 2019). In October 2019, Robert Pozen, a speaker from MIT, praised SASB standards but complained about the multitude of acronyms used in the United States, i.e., GRI (Global Reporting Initiative), TCFD (Task Force on Climate- related Financial Disclosures), CDSB (Climate Disclosure Standards Board), and IIRC (International Integrated Reporting Council), which makes it difficult to control them and make decisions, because each of them has somewhat different standards (Kurtz 2020). It is worth noting that, due to the lack of agreement on global standards for responsible investing, there are some investors who do not integrate ESG factors into their investments (Harper 2020). For a potential pair of “investment materiality metrics” (IMM)”and “ Alpha ESG factor” given on an investment universe, the IMM materiality test must take into account its different efficiency in the two investment sub-universes, i.e., the material sub-universe and the intangible sub-universe, and validate the hypothesis that the Alpha ESG factor has significant impacts on the functioning of companies in the material sub-universe and, therefore, on stock returns, relative to the intangible sub-universe (Chen and Mussalli 2020).

Impact investing can take many forms, such as a certificate of deposit from a credit union in a low-income region that can impact through directing capital to a poor population while offering investors a return guaranteed by the federal government, and a municipal bond supporting schools could also offer a win–win outcome through conventional means (Kurtz 2020). Beyond these traditional mechanisms, impact investors have recently made more use of private capital markets to create innovative specialist vehicles (Global Impact Investing Network 2019). Based on a significant number of data on ESG shareholder commitments in 50 countries from 2005 to 2013, Barko et al. (2017) demonstrate the positive effects on the stock prices of the companies concerned and other fundamental indicators, such as return on assets (ROA), return on equity (ROE), gross margin, sales performance, and asset turnover. Consequently, they find that a successful engagement more improves the ESG performance of the companies involved (Kurtz 2020).

The relationship between ESG investment and its performance

With new approaches to integration and impact, investors now have a belief that ESG and Alpha investing are not mutually exclusive. Indeed, breaches of certain ESG criteria can lead to higher business risks and negatively affect financial performance (Chen and Mussalli 2020; Dhaliwal et al. 2011, 2012; Khan et al. 2016; Kotsantonis et al. 2016). As a testament to this, GEO Group stocks underperformed the Dow Jones Equity REIT Total Return Index by more than 50% in 2019, following the litany of allegations of human rights and civil liberty violations (unpaid wages, poor working conditions, and sexual harassment) which had business implications hampering the group's position in government tenders. On the other hand, “Russell 1000” companies that score well on the recently introduced Sustainalytics risk rating have significantly higher operating returns on invested capital (ROIC) than low-rated companies (Kurtz 2020). The superior performance of these companies is the outcome of specific competitive advantages. Indeed, belonging to social indices and having high ESG, sustainalytics scores are both positively correlated with Morningstar's proprietary Moat rating, a judgmental rating that estimates a company's ability to deliver good long-term economic performance (Brilliant and Collins 2014; Hale 2017; Kurtz 2016).

However, the causality between ESG investing and Alpha remains disputed. According to Goldberg (2019), there is no credible answer to the question of whether ESG investing generates Alpha (Orlitzky et al. 2003). Porter et al. (2019) criticize claims that rating systems can improve returns and note that, despite countless studies, there has never been conclusive evidence that socially responsible investing provides “Alpha.” However, they also conclude that taking ESG factors into account, in the context of a particular firm's strategy, could increase investment returns. The literature on ESG investing is voluminous, and thousands of researches on sustainable investing and ESG highlight both positive and negative impacts (Anson et al. 2020). Indeed, the meta-analysis of more than 2000 studies on the advantages and disadvantages of sustainable investing, by Friede et al. (2015), indicates that 48% of studies found a positive impact, 41% found a neutral or inconclusive impact, and 11% recorded a negative impact (Anson et al. 2020). Likewise, Giese and Lee (2019) conclude that there is no consensus on improving risk-adjusted returns by ESG criteria, because of the different ESG methodologies used by researchers and applied over different periods and in different universes of investment (Anson et al. 2020). In addition, in his meta-analysis of 26 research studies on ESG investment, published between 2010 and 2018, Brunet (2019) concludes the absence of this consensus, 10 studies found a positive impact of investment ESG; 10 others found a negative impact; and 6 found a neutral impact (Anson et al. 2020).

In terms of risk, Nofsinger and Varma (2014) show that, depending on the values of beta, market capitalization and book price/price ratio, responsible mutual funds outperform their peers in times of crisis; however, during periods of low volatility, they become underperforming. Kim et al. (2014) find that MSCI ESG stocks that exhibited better ESG performance, during the period 1994–2008, were less risky thanks to better disclosure practices. In addition to these general conceptions of ESG risk, Litterman (2017), the former head of risk at Goldman Sachs, examines climate change risk comprehensively. He notes that, as atmospheric carbon concentrations increase, so does uncertainty about the financial results. Another potential benefit of considering Alpha ESG sources is that companies with a high ESG rating tend to be less exposed to systematic and company-specific risk factors, resulting in lower cost of capital and higher long-term valuation under discounted cash flow (DCF) (Chen and Mussalli 2020). Despite the voluminous literature and thousands of studies on sustainable investing and ESG, there is no consensus on the positive impact of ESG investing on its performance, and the published results highlight, as well, positive than negative impacts (Anson et al. 2020; Brunet 2019; Friede et al. 2015; Giese and Lee 2019).

Methodology of the econometric study

Before presenting the Markov-switching GARCH and Markov-switching EGARCH models likely to take into account the variations of conditional variances (“Markov-switching GARCH models” section), it is first necessary to present the ARCH process and its extensions (“GARCH models” section).

GARCH models

The formula for returns \({r_{t}}\) is

where \(p_{t}\) is the price of the index on day t and \(p_{{t - 1}}\) is the price of the index on day t − 1.

ARCH model

The ARCH(q) model, advanced by Engle (1982) during a study of the variance of inflation in Great Britain, is based on a quadratic parameterization of the conditional variance (Lardic and Mignon 2002). The latter is a linear function of the q past values of the process of the square of innovations of an AR(P) (or regression) model of our variable of interest \(y_{t}\). The ARCH(1) model is then written as follows:

with \(\alpha _{0} > 0\) and \(\alpha _{1} \ge 0\); \(\varepsilon _{t} = \eta _{t} \sqrt {h_{t} }\) (where \(\eta _{t} \sim N\left( {0,-1} \right)\)) as the error term of the following AR(1) model: \(r_{t} = \phi _{1} y_{{t - 1}}\) of our variable of interest; and \(h_{t}\) as the conditional variance.

GARCH model

The GARCH model of Bollerslev (1986) is given by

where \(\alpha _{0} > 0\),\(\sim \alpha_{1} \ge 0{\text{~,}}\) and \(\sim\beta \ge 0\).

EGARCH model

However, the ARCH and GARCH models turn out to be insufficient because of the positivity constraints imposed on their parameters and their formulations which consider that the conditional variance is symmetric (Cao and Tsay 1992; Nelson 1991). These shortcomings were behind the development of the EGARCH (Exponential GARCH) model, the TGARCH (Threshold GARCH) model,e and the QGARCH (Quadratic GARCH) model.

Having been successful in the analysis of the returns of financial assets, the log-linear model EGARCH (1, 1) of Nelson (1991), which relates to the logarithm of the conditional variance and which does not impose the constraints of positivity on the coefficients \(\alpha _{0}\), \(\alpha_{1} ,\sim \alpha_{2} ,\) and \(\beta\), is written as follows:

without conditions or constraints on the parameters.

Markov-switching GARCH models

The pioneering work of Cai (1994) and Hamilton and Susmel (1994) applied Markov-switching ARCH models to financial time series. It is true that they failed to incorporate a lagged value of the conditional variance into the variance equation, but they offer good likelihood calculus compared to the Markov-switching GARCH models. In order to take these last two remarks into consideration, Markov-switching GARCH lower-order models offer a more parsimonious representation than Markov-switching ARCH higher-order models and are characterized by parameters that can change over time as a function of an unobservable discrete variable (Gray 1996; Hansen and Lunde 2005). They have the advantage of adapting quickly to changes in the level of unconditional volatility and, therefore, obtaining better risk predictions (Ardia 2008; Ardiaa et al. 2018; Marcucci 2005).

Hamilton (1989) shows that the first difference of the observed financial series, which are generally non-stationary in level, follows a nonlinear stationary process. By seeking to model the process of a financial series in this way as a Markov-switching process, he determines each of these regimes at date t by an unobservable variable denoted \(S_{t}\). Generated by a Markov process of order 1, where the current regime \(S_{t}\) depends only on the previous regime \(S_{{t - 1}}\), this variable \(S_{t}\) takes on two possible states: the state of stability “1” and that of crisis “2.” It has the following transition probabilities: \({\text{Pr}}\left( {S_{t} = 2/S_{{t - 1}} = 2} \right) = P_{{22}}\) and \({\text{Pr}}\left( {S_{t} = 1/S_{{t - 1}} = 1} \right) = P_{{11}}\).

Its stochastic process is then represented by the matrix of constant transition probabilities:

where \(P_{{ij}} = {\text{Pr}}\left( {S_{t} = j/S_{{t - 1}} = i} \right)\) is the probability of passing from state i to state j and \(\mathop \sum \limits_{{j = 1}}^{2} P_{{ij}} = 1\) for \(i\in\left\{ {1;2} \right\}\); that is to say: \(P_{{12}} = 1 - P_{{11}}\) et \(P_{{21}} = 1 - P_{{22}}\). The transition probabilities will take the following logistic form: \(P_{{11}} = \frac{{\exp \left( {P_{0} } \right)}}{{1 + \exp \left( {P_{0} } \right)}}\) and \(P_{{22}} = \frac{{\exp \left( {q_{0} } \right)}}{{1 + \exp \left( {q_{0} } \right)}}\), where p0 and q0 are initial values chosen arbitrarily.

The unconditional probabilities of the state of stability and that of crisis, which are, respectively, equal to \(\pi _{1} = \frac{{1 - P_{{22}} }}{{2 - P_{{22}} - P_{{11}} }}\) and \(\pi _{2} = \frac{{1 - P_{{11}} }}{{2 - P_{{22}} - P_{{11}} }}\).

The Markov-switching GARCH model in its general form can be written as follows:

where\(f\left( . \right)\) is here the assumed normal conditional distribution function; student or GED; \(\theta _{t}^{{\left( i \right)}}\) is the vector of the parameters in the ith regime which characterizes the distribution (with \(i \in \left\{ {1,~2} \right\}\)); \(p = p_{{11}} ~\); \(p_{{1,t}} = \Pr \left[ {s_{t} = 1|\xi _{{t - 1}} } \right]\) is the ex-ante probability; and \(\xi _{{t - 1}}\) is the information available at time t − 1.

The vector of parameters \(\theta _{t}^{{\left( i \right)}}\) can be decomposed into three components: \(\theta _{t}^{{\left( i \right)}} = \left( {\mu _{t}^{{\left( i \right)}} ,h_{t}^{{\left( i \right)}} ,\upsilon _{t}^{{\left( i \right)}} } \right)\), where \(\mu _{t}^{{\left( i \right)}} \equiv E(r_{t} |\xi _{{t - 1}} )\) is the conditional mean; \(h_{t}^{{\left( i \right)}} \equiv Var(r_{t} |\xi _{{t - 1}} )\) is the conditional variance; and \(\upsilon _{t}^{{\left( i \right)}}\) is the form of the parameter of the conditional distribution (with \(i \in \left\{ {1,~2} \right\}\)).

Accordingly, the Markov-switching GARCH model depends on four elements: the conditional mean, the conditional variance, the regime process, and the conditional distribution.

The conditional mean equation, which is usually modeled by a random walk, can be written as follows:

where \(i \in \left\{ {1,~2} \right\}\) and \(\varepsilon _{t} = \eta _{t} \sqrt {h_{t} }\) and \(\eta _{t}\) follows a process with mean 0 and variance 1.

The conditional variance assumed by a Markov-switching GARCH(1, 1) process is written as follows:

where \(i \in \left\{ {1,~2} \right\}\), \(h_{{t - 1}}\) is the independent state of the past conditional variance.

When the conditional variance follows a Markov-switching EGARCH(1, 1) process, it is written as follows:

where \(i \in \left\{ {1,~2} \right\}\) and \(h_{{t - 1}}\) is the independent state of the past conditional variance.

The probability that the regime at time t is the stability regime (regime 1), knowing the information at time t − 1, is

where \(p = p_{{11}} ~\); \(q = p_{{22}}\); and \(f\left( . \right)\) is the conditional density.

Results of the econometric study

In order to identify the process of both the series of daily returns of the ESG portfolio “MSCI USA ESG Select” and the series of daily returns of the market benchmark portfolio “S&P500,” during the period from June 01, 2005 to December 31, 2020, it is essential to conduct graphical, statistical, and econometric examinations of these series to check their stationarity and the presence of the ARCH effect (“Graphic and statistical study of the series of daily returns of the ESG portfolio “MSCI USA ESG Select” and of the series of daily returns of the market benchmark portfolio “S&P 500” and unit root tests” section). Subsequently, it is important to estimate the “GARCH and EGARCH” with single regime, the Markov-switching “GARCH and EGARCH” models and retain those which, on the basis of the results of Student's t test for the model coefficients and of the Durbin-Watson, Box-Pierce and Ljung-Box tests for the residuals of this model, are statistically and econometrically robust and, therefore, infer the transition probabilities, those unconditional and the anticipated duration conditional on the state of crisis for the two series of our interest (“Results of estimation of the “GARCH and EGARCH” with single-regime and the Markov-switching “GARCH and EGARCH” models” section). It should be noted that we did the same work during the study period from June 1, 2005 to October 29, 2019, without taking into consideration the Covid-19 pandemic period. The tables and figures of the results obtained for this study period 2005–2019 can be found in Appendix. The analysis of these results exists at the end of “Results of estimation of the “GARCH and EGARCH” with single-regime and the Markov-switching “GARCH and EGARCH” models” section.

Graphic and statistical study of the series of daily returns of the ESG portfolio “MSCI USA ESG Select” and of the series of daily returns of the market benchmark portfolio “S&P 500” and unit root tests

Figure 1 below shows the graphical evolution of the series of daily prices and returns of the ESG portfolio “MSCI USA ESG Select” and the market benchmark portfolio “S&P500” from June 01, 2005 to December 31, 2020.

The graphical examination of our interest variables shows that the daily prices of the ESG portfolio “MSCI USA ESG Select” and the market benchmark portfolio “S&P 500” are not stationary I(1) (the curves on the left), whereas the series of daily returns of the same portfolios (the curves on the right) are stationary and so are I(0). Table 1 presents the statistical indicators of the series of daily returns of the ESG portfolio “MSCI USA ESG Select” and the market benchmark portfolio “S&P 500,” during the period from June 01, 2005 to December 31, 2020.

The series of ESG portfolio returns is also characterized by the stylized facts well known and observed in financial time series, such as: the series of daily returns of the market benchmark portfolio “S&P500.” As a result, there is a high probability of occurrence of extreme points, because the distribution of the series of daily returns of the ESG portfolio “MSCI USA ESG Select” is less flattened than the normal distribution: it is a leptokurtic distribution. In fact, its flattening coefficient is high (more than 3). There is also nonlinearity in this series, because its distribution, with an asymmetric coefficient, less than 0, is skewed spread to the left. This asymmetry is reflected in the fact that volatility is lower after a rise than after a fall in returns. In other words, yields react more to a negative shock than to a positive one. It should also be noted that the Jarque Bera test shows that the daily series of returns of the ESG portfolio “MSCI USA ESG Select” does not follow the normal law.

The graphic examination of our interest variables shows that the daily prices of the ESG portfolio “MSCI USA ESG Select” and of the market benchmark portfolio “S&P500” are not stationary I(1) (curves on the left), so that the series of daily returns of the same portfolios (curves on the right) are stationary and are, thus, I(0)(Fig. 1).

In order to make the correct decision on the stationarity of our variables of interest, it is essential to relegate this question to unit root tests, i.e., the Augmented Dickey-Fuller, Phillips-Perron, and KPSS (Kwiatkovski, Phillips, Schmidt and Shin) (Table 2).

These tests converge towards the same result. Indeed, our interest variables, the daily prices of the ESG portfolio “MSCI USA ESG Select,” and the market benchmark portfolio “S&P500” are not stationary (I(1)), whereas the series of their returns are stationary and are, thus, I(0). As a reminder, the series of daily returns of the ESG portfolio “MSCI USA ESG Select” is also characterized by the well-known stylized facts observed in financial time series, such as the series of daily returns of the market benchmark portfolio “S&P500” (Table 1). Therefore, the “GARCH and EGARCH” with single regime and the Markov-switching “GARCH and EGARCH” models are estimated by the maximum likelihood method.

Results of estimation of the “GARCH and EGARCH” with single-regime and the Markov-switching “GARCH and EGARCH” models

The tables below, respectively, present the results of the estimation of the “GARCH and EGARCH” with single-regime models for the ESG portfolio “MSCI USA ESG Select” and for the market benchmark portfolio “S&P500” (Tables 3, 4).

Taking into account the results of the test of the individual significance of the coefficients as well as the information criteria (AIC, BIC, and Log (L)), the GARCH specification, with a conditional distribution GED, turns out to be the most suitable to model the conditional volatility for the ESG portfolio “MSCI USA ESG Select” and the conditional volatility for the market benchmark portfolio “S&P500.” We extended this econometric modeling of volatility by estimating the Markov-switching GARCH models and the Markov-switching EGARCH models for the ESG portfolio “MSCI USA ESG Select” and for the market benchmark portfolio “S&P500” (Tables 5, 6, 7, 8).

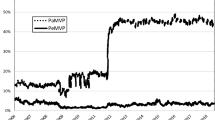

Taking into account, the results of the test of individual significance of the coefficients, the conditional distribution test, and the information criteria (AIC, BIC and Log (L)), the Markov-switching EGARCH models, with a conditional distribution GED, prove to be adequate to model conditional volatility for both the ESG portfolio “MSCI USA ESG Select” and the market benchmark portfolio “S&P500.” The following figure illustrates the graphical representations of the conditional volatilities estimated by the above-mentioned models (the GARCH models and the Markov-switching EGARCH models, both with a conditional distribution GED), from June 01, 2005 to December 31, 2020, for the two series of our interest: RMSCIESG and RS&P500.

From this figure, we can consider that the range (maximum-minimum) is very large for the case of the market benchmark portfolio “S&P500” compared to the case of the ESG portfolio “MSCI USA ESG Select.” This observation illustrates that the ESG portfolio is less volatile than that of the market. The conditional volatilities of the two portfolios of our interest recorded increases during the International Financial Crisis 2007–2009, the Sovereign Debt Crisis in 2011, and the COVID19 pandemic crisis. However, the conditional volatilities for the two portfolios of our interest are very high during the crisis of the COVID19 pandemic in March 2020, compared to other financial shocks (the International Financial Crisis 2007–2009 and the Sovereign Debt Crisis in 2011).

Table 9 gives the values of certain indicators of position and central tendency, and of dispersion of conditional volatilities estimated by the two models used. The results obtained confirm the nature of the evolution of conditional volatility advanced after Fig. 2.

Whether it is for the GARCH models or the Markov-switching EGARCH models, both with a conditional distribution GED, the indicators of central tendency and position (the 1st quartile, the median, the 3rd quartile, the arithmetic mean), the minimum value, the maximum value, and the indicators of dispersion (the standard deviation and the interquartile coefficient) of volatility conditional shows that the ESG portfolio is less volatile than the market one. On the one hand, the extent of conditional volatility for the case of the ESG portfolio is lower than that of conditional volatility for the case of the market portfolio. On the other hand, the indicators of central tendency, i.e., the median and the arithmetic mean, as well as those of dispersion, i.e., the standard deviation and the interquartile coefficient, are higher for the case of the market portfolio if compared to the case of the ESG portfolio.

Table 10 presents the transition probabilities: those unconditional to the state of stability and to the crisis as well as the conditional expected durations to the state of stability and to the crisis for the two series of our interest during the period of study.

In the light of the results of the estimation of the Markov-switching EGARCH model, the state of stability, which has a probability of transition \(P_{{11}} = 0.99\) (i.e., the probability of passing from the state of stability to t−1 to that of stability at t), and that of crisis, which has a probability of transition \(P_{{22}} = 1 - P_{{21}} = 0.99\) (i.e., the probability of passing from the state of crisis at t − 1 to the crisis one in t), are both present for the ESG portfolio “MSCI USA ESG Select” and the market benchmark portfolio “S&P 500.” The probability of passing from the state of stability at t − 1 to that of crisis at t: \(P_{{12}} = 1 - P_{{11}}\) is a little low for the two portfolios, i.e., 0.002 for the ESG portfolio “MSCI USA ESG Select” and 0.0026 for the market benchmark portfolio “S&P 500.” However, the chances for the market portfolio “S&P 500” to go from a state of stability to a state of crisis are slightly greater than those of the ESG portfolio “MSCI USA ESG Select.”

From the value of the unconditional probability in the state of crisis \(\pi _{2}\), we see that the proportion of observations that should be in the state of crisis (\(\pi _{2}\)) is slightly high for the case of the market portfolio “S&P 500”, i.e., 0.3377, compared to the case of the ESG portfolio “MSCI USA ESG Select”, i.e., 0.3333. In other words, for a given sample of the series of ESG portfolio returns, 33.33% of observations should be in the state of crisis, while for a given sample of the series of returns of the ESG portfolio “MSCI USA ESG Select,” 33.77% of observations should be in the state of crisis. On the other hand, the value of the unconditional probability in the state of stability \(\pi _{1}\) indicates that the proportion of observations that should be in the state of stability is slightly high for the case of the ESG portfolio “MSCI USA ESG Select,” i.e., 66.67%, compared to the market portfolio “S&P 500.” with a proportion equal to 66.23%. These latest results are supported by the significant difference that exists between the value of the anticipated duration conditional on the state of stability (\(1/1 - P_{{11}}\)) for the ESG portfolio “MSCI USA ESG Select”, i.e., 500, and that of the market portfolio “S&P 500,” equal to 384.6154. In other words, we can expect a period of low volatility (\(1/1 - P_{{11}}\)) almost equal to 12 months (384.6154 days) for the case of the market portfolio “S&P 500,” against a period of low volatility more than 16 months (500 days) for the ESG portfolio “MSCI USA ESG Select”. For the values of the expected duration at the state of crisis (\(1/1 - P_{{22}}\)) for the two portfolios, there is no significant difference and we can expect a period of high volatility between 6.5 and 8 months for the ESG portfolio “MSCI USA ESG Select” (250/30 ≈ 8 months) and the market portfolio “S&P500” (196.0784/30 ≈ 6.5 months). All in all, we can conclude that the ESG portfolio “MSCI USA ESG Select,” in which daily return series follows a Markov-switching EGARCH process, is less turbulent compared to the market portfolio “S&P500.”

It is worth noting that when the COVID19 crisis is excluded from the study period, the turbulence of the market benchmark portfolio compared to the ESG portfolio “MSCI USA ESG Select” becomes evident. Tables 11 and 12 in the Appendix display the results of the estimation of the Markov-switching “GARCH and EGARCH” models for the ESG portfolio “MSCI USA ESG Select” and for the market benchmark portfolio “S&P500,” during the study period excluding the COVID19 crisis and from June 1, 2005 to October 29, 2019. Taking into account the results of the test of individual significance of the coefficients and the information criteria (AIC, BIC and Log(L)), the Markov-switching GARCH model, with a conditional distribution GED, and the Markov-switching EGARCH model, with a normal conditional distribution, prove to be adequate to model, respectively, the conditional volatility for the ESG portfolio “MSCI USA ESG Select” and the conditional volatility for the market benchmark portfolio “S&P 500.”

Figure 3 in Appendix illustrates the graphical representations of the conditional volatilities estimated by the models indicated above, during the period excluding the COVID19 crisis (2005–2019), for the two series of our interest: RMSCIESG and RS&P500. Based on the results displayed in Figure 3, we can see that the range (maximum–minimum) is very large for the case of the market benchmark portfolio “S&P 500” compared to the case of the ESG portfolio “MSCI USA ESG Select.” This observation demonstrates that the ESG portfolio is less volatile than that of the market. The conditional volatilities of the two portfolios of our interest recorded increases during the international financial crisis 2007–2009 and the sovereign debt crisis in 2011. Table 13 in Appendix gives the values of certain indicators of position and central tendency, and of dispersion of conditional volatilities estimated by the two used models. Likewise, during the study period excluding the COVID19 crisis (2005–2019), the achieved results show that the ESG portfolio is less volatile than the market one. Indeed, the extent of conditional volatility for the case of the ESG portfolio is lower than that of conditional volatility for the case of the market portfolio, and the indicators of central tendency as well as those of dispersion are high for the case of the market portfolio compared to the case of the ESG portfolio.

Table 14 in Appendix shows the transition probabilities, those unconditional to the state of stability, and to that of crisis as well as the conditional expected durations to the state of stability and that of crisis for the two series of our interest during the period of study excluding the COVID19 crisis (2005–2019). In the light of the results of the estimation of the Markov-switching GARCH model, the state of stability, which has a probability of transition \(P_{{11}} = 0.99\), is more present compared to that of crisis, which has a probability of transition \(P_{{22}} = 1 - P_{{21}} = 0.39\) for the case of the ESG portfolio “MSCI USA ESG Select” (Table 14 in Appendix). Whereas, according to the results of the Markov-switching EGARCH model (Table 14 in Appendix), these two probabilities are almost equal for the case of the market portfolio “S&P 500” (i.e. \(P_{11} = 0.99\) and \(P_{22} = 0.98\)). From these two probabilities, we presume, on the one hand, the probability of passing from the state of stability at t − 1 to that of crisis at t: \(P_{{12}} = 1 - P_{{11}}\) which is slightly low for the two portfolios, i.e., 0.008 for the ESG portfolio “MSCI USA ESG Select” and 0.007 for the market portfolio “S&P 500,” and on the other hand, the probability of going from the state of crisis in t − 1 to that of stability in t: \(P_{{21}} = 1 - P_{{22}}\) which is somewhat important for the ESG portfolio “MSCI USA ESG Select,” i.e., 0.6096, but extremely low for the case of the market portfolio “S&P 500,” i.e., 0.0155. In other words, the chances for the ESG portfolio “MSCI USA ESG Select” to go from a state of crisis to that of stability are far greater than those of the market portfolio “S&P 500”. From the value of the unconditional probability in the state of crisis \(\pi _{2}\), we see that the proportion of observations that should be in the state of crisis (\(\pi _{2}\)) is high for the case of the market portfolio “S&P 500,” i.e., 0.3111, compared to the case of the ESG portfolio “MSCI USA ESG Select,” i.e., 0.0131. In other words, for a given sample of the series of ESG portfolio returns, only 1.31% of observations should be in the state of crisis, while for a given sample of the series of the ESG portfolio’s returns “MSCI USA ESG Select,” 31.11% of observations should be in the state of crisis. On the other hand, the value of the unconditional probability in the state of stability \(\pi _{1}\) indicates that the proportion of observations that should be in the state of stability is very high for the case of the ESG portfolio “MSCI USA ESG Select,” i.e., 98.69%, compared to the market benchmark portfolio “S&P 500,” with a proportion equal to 68.89%. These latest results are supported by the significant difference that exists between the value of the anticipated duration conditional on the state of crisis (\(1/1 - P_{{22}}\)) for the ESG portfolio “MSCI USA ESG Select”, i.e., 1.6404, and that of the market portfolio “S&P 500,” equal to 64.5161. In other words, we can expect a period of high volatility (\(1/1 - P_{{22}}\)) of more than 2 months (64.5161 days) for the case of the market portfolio “S&P 500,” against a period of high volatility less than 2 days (1.6404 days) for the ESG portfolio “MSCI USA ESG Select.” For the values of the expected duration at the stable state (\(1/1 - P_{{11}}\)) for the two portfolios, there is no significant difference, and we can expect a period of low volatility equal to 4 months for the ESG portfolio “MSCI USA ESG Select” (123.4568 / 30 ≈ 4 months) and the market portfolio “S&P 500” (142.8571 / 30 ≈ 4 months). In conclusion, we can say that the ESG portfolio “MSCI USA ESG Select,” in which daily return series follows a Markov-switching GARCH process, is less turbulent compared to the market portfolio “S&P 500.”

Discussion

If we take into account the constituents of each portfolio, we can explain this relative resilience to crises of the ESG portfolio “MSCI USA ESG Select” compared to the market benchmark portfolio “S&P 500,” during the two periods of the 2005–2019 study and 2005–2020, by the proportion of companies in the technology sector in each portfolio and that of the energy sector (excluding renewable energy). In fact, nearly 29% of the assets of the ESG portfolio “MSCI USA ESG Select” are devoted to technology, compared to 25% in the market benchmark portfolio “S&P 500.” The performance of the ESG portfolio “MSCI USA ESG Select” is boosted by Apple, the cloud software publisher Salesforce.com and graphics chip designer Nvidia, all of which have skyrocketed recently. It should also be noted that the ESG portfolio “MSCI USA ESG Select” holds less financial stocks than the market benchmark portfolio “S&P 500.” During the period, when the study has been conducted, these financial stocks were, just after energy stocks, among the worst performing. The energy sector has been the most volatile of all market sectors over the past decade, with a standard deviation exceeding 20%, due to rapid changes in oil prices. This sector is under-represented in the ESG portfolio “MSCI USA ESG Select” compared to the market benchmark portfolio “S&P 500.” For example, the ESG portfolio “MSCI USA ESG Select” excludes one of the major oil producers, i.e., Exxon Mobil. Indeed, companies with poor ESG profiles, measured by higher carbon emissions, present a higher extreme risk (Ilhan et al. 2019). However, stocks in the renewable energy sector, such as Sunrun Inc. and SolarEdge Technologies Inc., have recently witnessed strong performances and have largely outperformed technology winners, such as Amazon, Apple, and Facebook. In addition, we can refer to the decrease in the significance of the ESG portfolio performance “MSCI USA ESG Select” compared to the market benchmark portfolio “S&P 500” during the period 2005–2020 (including the COVID19 crisis) compared to the period 2005–2019 (excluding the COVID19 crisis) to the performance of certain large companies excluded from the ESG portfolio “MSCI USA ESG Select,” such as Amazon and Netflix, which emerged stronger during the health crisis. Indeed, during the COVID19 crisis, Alphabet (Google), Amazon, Facebook, Apple, and Microsoft, in other words the Gafam, to which we add the champion of streaming films and series, Netflix, achieved brilliant stock market performances. Amazon is excluded from the ESG portfolio “MSCI USA ESG Select” due to poor working conditions. Due to poor governance measures and lack of reporting, the ESG portfolio “MSCI USA ESG Select” also excludes Berkshire Hathaway and Netflix, which are part of the market benchmark portfolio “S&P 500” and can significantly affect a portfolio's performance.

In the study period 2005–2019 which takes into account the global financial crisis of 2008–2009 and the sovereign debt crisis in 2011, we see that the ESG portfolio “MSCI USA ESG Select” becomes less turbulent than the market benchmark portfolio “S&P 500.” This result coincides with that found by Lins et al. (2017). They found that US non-financial companies with high ESG scores outperformed other companies during the 2008–2009 global financial crisis period (Broadstock et al. 2020). While when we extend the period of the study and we take into account the crisis of the COVID19 pandemic, that is to say the period 2005–2020, the degree of turbulence of the market benchmark portfolio “S&P 500” by compared to the ESG portfolio “MSCI USA ESG Select” becomes a little attenuated compared to the period 2005–2019. This result is supported by that of the research by Broadstock et al. (2020) examining the role of ESG performance during the crisis of the COVID19 pandemic. These authors use a dataset covering China's CSI 300 components. They find modest evidence to suggest that higher ESG companies exhibit lower price volatility during the COVID19 period. In their research on identifying factors affecting the Japanese stock market during the COVID19 pandemic period, Hartzmark and Sussman (2019) conclude that, in terms of ESG engagement, there is no evidence that companies that score highly rated ESGs have higher abnormal returns, but companies with ESG funds outperform those without. Takahashi and Yamada (2020) offer mixed evidence on the relationship between ESG and stock market performance in Japan during COVID19. Although they find that ESG ratings do not influence stock returns, they find evidence of a nonlinear relationship between stock performance and the level of investment in companies by ESG-oriented funds.

However, we can conclude that, in sum, the ESG portfolio “MSCI USA ESG Select” is relatively more resilient to crises compared to the market benchmark portfolio “S&P 500” on the basis of the results obtained during the two periods of the study 2005–2019 and 2005–2020. This conclusion is supported by the results of the study by Broadstock et al. (2020). By breaking down their study sample into high ESG and low ESG companies, these authors find that both sub-samples experience increased business activity, especially among low ESG companies. Indeed, investors engaged in companies with high ESG are more patient and do not sell their shares in order to avoid losses during the crisis period. They find that the high ESG portfolio remains consistently higher than that of the low ESG group, especially in the non-COVID19 period, with a cumulative differential return for the two groups of around 12.83% over the July 2017–December period. 2019 (excluding the COVID19 period), and 9.4% for the entire period (including the COVID19 crisis). These figures indicate that, in sum, an investment strategy based on neutral ESG in the industry allows an investor to obtain significantly higher returns in the Chinese market (Broadstock et al. 2020). Based on 1712 engagements in 573 targeted companies around the world over the period 2005 to 2018, Hoepner et al. (2019) find empirical evidence that engagement on ESG issues reduces downside risk. In their meta-analysis of the results of around 2200 studies on the relationship between ESG criteria and the corporate financial performance (CFP), Fried et al. (2015) conclude that around 90% of studies find a non-negative ESG—CFP relationship, the vast majority of studies report positive results and the positive ESG impact on CFP seems stable over time. Ilhan et al. (2019) show that companies with poor ESG profiles, as measured by higher carbon emissions, are at higher extreme risk. In their comparative study between ESG portfolios and other conventional ones, Jain et al. (2019) conclude that over a period of 5 years, the ESG portfolio “US large-cap ESG index” offers the highest return of all benchmarks on average. They find the ESG portfolio to be a favorable investment option, offering the highest return with a suitable level of risk.

Conclusion

Having grown considerably in recent years, responsible investing uses three approaches, i.e., the exclusion approach, that of integrative investment, and that of impact investing, in order to maximize exposure to factors. Positive ESG while presenting risk and return characteristics similar to those of the market portfolio. In this research, we were interested in the case of the ESG portfolio “MSCI USA ESG Select” which takes into consideration companies with high ESG scores in different sectors. Relative to the parent index, the ESG portfolio “MSCI USA ESG Select” tends to overweight companies with higher ESG ratings and underweight companies with lower ratings. It uses company ratings and research provided by the three products of “MSCI ESG Research,” i.e., “MSCI ESG Ratings,” “MSCI ESG Controversies Score,” and “MSCI ESG Business Involvement Screening Research.” It is subject to quarterly reviews based on ESG scores and also takes into account the events of additions to the parent index, spin-offs, mergers, and acquisitions and changes in the characteristics of the stock.

In this article, we have tried to identify the process of the daily return series of the ESG portfolio “MSCI USA ESG Select” as well as that of the daily return series of the market benchmark portfolio “S&P 500.” The aim is to verify that an ESG portfolio is less turbulent than a market portfolio. We, thus, used the “GARCH and EGARCH” models and the Markov-switching “GARCH and EGARCH” models to model the series of daily returns of the ESG portfolio “MSCI USA ESG Select” and that of the daily returns of the market benchmark portfolio “S&P 500,” during the period from June 01, 2005 to December 31, 2020 as well as that excluding the COVID19 crisis and from June 1, 2005 to October 29, 2019. The graphical examination of our variables of interest and the unit root tests show that the daily prices of the ESG portfolio “MSCI USA ESG Select” and of the market benchmark portfolio “S&P 500” are not stationary I(1), whereas the series daily returns of the same portfolios are stationary and, thus, are I(0). We also found that the series of daily returns of the ESG portfolio “MSCI USA ESG Select” is also characterized by the stylized facts well known and observed in financial time series, such as the series of daily returns of the market benchmark portfolio “S&P 500.” There is then a nonlinearity indicating lower volatility after a rise than after a fall in returns, a high probability of occurrence of extreme points as well as non-normality for the series of daily returns of the ESG portfolio “MSCI USA ESG Select.” Therefore, the Markov-switching “GARCH and EGARCH” models are estimated by the maximum likelihood method. According to the graphical representations as well as the statistical indicators of the conditional volatilities estimated by the models used, during the period from June 01, 2005 to December 31, 2020 as well as that excluding the COVID19 crisis and from June 1, 2005 to October 29, 2019, for the two series of our interest: RMSCIESG and RS&P500, we can see on the one hand that the extent of conditional volatility for the case of the ESG portfolio is lower than that of conditional volatility for the case of the market portfolio, and on the other hand, that the indicators of central tendency, i.e., the median and the arithmetic mean, as well as those of dispersion, i.e., the standard deviation and the interquartile coefficient, are high for the case of the portfolio market compared to the case of the ESG portfolio.

In the light of the results of the Markov-switching “GARCH and EGARCH” models estimated, the values of the transition probabilities, the anticipated duration conditional on the state of stability and the anticipated duration conditional on the state of crisis for the ESG portfolio “MSCI USA ESG Select” and the market benchmark portfolio “S&P500”, during the period 2005–2019 (excluding the crisis of the COVID19 pandemic) and that of 2005–2020 (including the crisis of the COVID19 pandemic), we can conclude that the ESG portfolio “MSCI USA ESG Select” is relatively resilient to crises and less volatile compared to the market benchmark portfolio “S&P 500.” This resilience is more evident during the 2005–2019 study period excluding the COVID19 pandemic crisis compared to the 2005–2020 study period including the COVID19 pandemic crisis.

In conclusion, it is true that there is no consensus on the positive impact of ESG investment on its performance, and the published results highlight both positive and negative impacts (Broadstock et al. 2020; Brunet 2019; Giese and Lee 2019). Nonetheless, the results of our research coincide with those of some research work that supports the positive impact of ESG investment on performance and risk reduction (Anson et al. 2020; Broadstock et al. 2020; Chen and Mussalli 2020; Friede et al. 2015; Hoepner et al. 2019; Ilhan et al. 2019; Jain et al. 2019; Kim et al. 2014; Lins et al. 2017; Litterman 2017), and it can be concluded that the ESG portfolio “MSCI USA ESG Select,” in which series of daily returns follows a Markov-switching EGARCH process, is less turbulent compared to the market benchmark portfolio “S&P 500.”

References

Ardia, D. 2008. Financial Risk Management with Bayesian Estimation of GARCH Models: Theory and Applications. Heidelberg: Springer.

Ardia, D., B. Keven, B. Kris, and C. Leopoldo. 2018. Forecasting Risk with Markov-Switching GARCH Models: A Large-Scale Performance Study. International Journal of Forecasting 34: 733–747.

Anson, M., D. Spalding, K. Kwait, and J. Delano. 2020. The Sustainability Conundrum. The Journal of Portfolio Management 46 (4): 124–137.

Barko, T., M. Cremers, and L. Renneboog. 2017. Shareholder Engagement on Environmental, Social, and Performance. Finance Working Paper n° 509/2017, European Corporate Governance Institute (ECGI).

Berg, F., J. Kölbel, and R. Rigobon. 2019. Aggregate Confusion: The Divergence of ESG Ratings. Research Paper n° 5822–19, MIT Sloan.

Bollerslev, T. 1986. Generalized Autoregressive Conditional Heteroskedasticity. Journal of Econometrics 31: 307–327.

Bloomberg Professional Services. 2019. Bloomberg Launches Equity Benchmarks, Bloomberg, September 17, 2019. https://www.bloomberg.com/company/press/bloomberg-launches-equity-benchmarks/.

Broadstock, D.C., K. Chan, L.T.W. Cheng, and X. Wang. (2020) The Role of ESG Performance During Times of Financial Crisis: Evidence from COVID-19 in China. Finance Research Letters 38: 101716. https://doi.org/10.1016/j.frl.2020.101716.

Brilliant, H., and E. Collins. 2014. Why Moats Matter: The Morningstar Approach to Stock Investing. Hoboken, NJ: Wiley.

Brunet, M. 2019. A Survey of the Academic Literature on ESG/ SRI Performance, Adviser Perspectives, December 10, 2019. In Anson, M., Spalding, D., Kwait, K. and Delano, J. (2020) The Sustainability Conundrum. The Journal of Portfolio Management 46 (4): 124–137.

Box, G.P.E. and G.M. Jenkins. 1978. Time Series Analysis: Forecasting and Control. San Francisco: ed. Revue, Holden Day.

Cahan, R. 2019. Sin, Punished ?. Empirical Research Partners, October 2019.

Cai, J. 1994. A Markov Model of Switching-Regime ARCH. Journal of Business & Economic Statistics 12 (3): 309–316.

Cao, C.Q., and R.S. Tsay. 1992. Nonlinear Time Series Analysis of Stock Volatilities. Journal of Applied Econometrics 7: 165–185.

Chatterji, A., R. Durand, D. Levine, and S. Touboul. 2015. Do Ratings of Firms Converge? Strategic Management Journal 37 (8): 1597–1614.

Chen, M., and G. Mussalli. 2020. An Integrated Approach to Quantitative ESG Investing, Ethical Investing 2020. The Journal of Portfolio Management 46 (3): 65–72.

Cheng, B., I. Ioannou, and G. Serafeim. 2014. Corporate Social Responsibility and Access to Finance. Strategic Management Journal 35 (1): 1–23.

Dhaliwal, D.S., O.Z. Li, A. Tsang, and Y.G. Yang. 2011. Voluntary Nonfinancial Disclosure and the Cost of Equity Capital: The Initiation of Corporate Social Responsibility Reporting. The Accounting Review 86 (1): 59–100.

Dhaliwal, D.S., S. Radhakrishnan, A. Tsang, and Y.G. Yang. 2012. Nonfinancial Disclosure and Analyst Forecast Accuracy: International Evidence on Corporate Social Responsibility Disclosure. The Accounting Review 87 (1): 723–759.

Dimson, E., O. Karakas, and X. Li. 2015. Active Ownership. The Review of Financial Studies 28 (12): 3225–3268.

Engle, R. 1982. Autoregressive Conditional Heteroscedasticity with Estimates of the Variance of United Kingdom inflation. Econometrica 50 (1): 987–1007.

Friede, G., T. Busch, and A. Bassen. 2015. ESG and Financial Performance: Aggregated Evidence from More Than 2000 Empirical Studies. Journal of Sustainable Finance and Investment 5 (4): 210–233.

FundFire. 2019. CFA Institute Seeks Volunteers to Help Create GIPS-Like ESG Standards, November 4, 2019.

Giese, G., and L.E. Lee. 2019. Weighing the Evidence: ESG and Equity Returns, MSCI Research Insight, April 2019. In Anson, M., Spalding, D., Kwait, K. and Delano, J. (2020), The Sustainability Conundrum. The Journal of Portfolio Management 46 (4): 124–137.

Global Impact Investing Network. 2019. 2019 Annual Impact Investor Survey, GIIN, June 19, 2019. https://thegiin.org/research/publication/impinv-survey-2019.

Glosner, S. 2017. ESG Risks and the Cross-Section of Stock Returns. In Chena, M., Mussalli, G. (2020), An Integrated Approach to Quantitative ESG Investing, Ethical Investing 2020. The Journal of Portfolio Management 46 (3): 65–72.

Goldberg, L. 2019. Is There ESG Alpha? A Marketing Question in Research Clothing, Blog post, Aperio Group, May 30, 2019. https://www.aperiogroup.com/blogs/is-thereesg-Alpha-a-marketing-question-in-research-clothing.

Gray, S.F. 1996. Modeling the Conditional Distribution of Interest Rates as a Regime-Switching Process. Journal of Financial Economics 42 (1): 27–62.

Hale, J. 2017. Sustainability and Quality Go Hand in Hand—We Find that Funds with High Sustainability Ratings Tend to Have Higher-quality Holdings, Morningstar, March 16, 2017.

Hamilton, J.D. 1989. A New Approach to the Economic Analysis of Nonstationary Time Series and the Business Cycle. Econometrica 57 (2): 357–384.

Hamilton, J.D., and R. Susmel. 1994. Autoregressive Conditional Heteroskedasticity and Changes in Regime. Journal of Econometrics 64 (1–2): 307–333.

Hansen, P.R., and A. Lunde. 2005. A Forecast Comparison of Volatility Models: Does Anything Beat a GARCH (1,1)? Journal of Applied Econometrics 20 (7): 873–889.

Harper, H. 2020. One Institutional Investor’s Approach to Integrating ESG in the Investment Process. The Journal of Portfolio Management 46 (4): 110–123.

Hartzmark, S.M., and A.B. Sussman. 2019. Do Investors Value Sustainability? A Natural Experiment Examining Ranking and Fund Flows. The Journal of Finance 74 (6): 2789–2837.

Hoepner, A.G.F., I. Oikonomou, Z. Sautner, L.T. Starks, and X. Zhou. 2019. ESG Shareholder Engagement and Downside Risk. Working paper, September 2019, https://ssrn.com/abstract=2874252.

Hull, J., C. Godlewski, and M. Mertil. 2013. Gestion des risques et institutions financières. Londres: 3ème édition Pearson.

Ilhan, E., Sautner, Z. and Vilkov, G. (2019) Carbon tail risk. Working paper, https://ssrn.com/abstract=3204420.

Investor’s Business Daily. 2019. ESG Investing: Now There’s a Better Way To Do It, November 20, 2019.

Jain, M., G.D. Sharma, and M. Srivastava. 2019. Can Sustainable Investment Yield Better Financial Returns: A Comparative Study of ESG Indices and MSCI Indices. Risks 7 (1): 15. https://doi.org/10.3390/risks7010015.

Khan, M., G. Serafeim, and A. Yoon. 2016. Corporate Sustainability: First Evidence on Materiality. The Accounting Review 91: 1697–1724.

Kim, Y., H. Li, and S. Li. 2014. Corporate Social Responsibility and Stock Price Crash Risk. Journal of Banking and Finance 43: 1–13.

Kurtz, L. 2016. Moats and Sustainability, Presentation to CQAsia Conference, November 2016.

Kurtz, L. 2020. Three Pillars of Modern Responsible Investment. ESG Special Issue 2020. The Journal of Investing 29 (2): 21–31.

Kurtz, L., and D. DiBartolomeo. 2011. The Long-Term Performance of a Social Investment Universe. The Journal of Investing 20 (3): 95–102.

Lardic, S., and V. Mignon. 2002. Econométrie des séries temporelles macroéconomiques et financières. Paris: Economica.

Lins, K.V., H. Servaes, and A. Tamayo. 2017. Social Capital, Trust Firm Performance: The Value of Corporate Social Responsibility During the Financial Crisis. The Journal of Finance 72 (4): 1785–1824.

Litterman, R. 2017. Pricing of Climate Risk and the Effect on Portfolio Construction. In 21st Annual Portfolio Management Conference, Uhlenbruch GmbH, June 2017.

Marcucci, J. 2005. Forecasting Stock Market Volatility with Regime Switching GARCH Models. Studies in Nonlinear Dynamics & Econometrics 9 (4): 1558–3708.

Nelson, D.B. 1991. Conditional Heteroskedasticity in Asset Returns: A New Approach. Econometrica 59 (2): 347–370.

Nofsinger, J., and A. Varma. 2014. Socially Responsible Funds and Market Crises. Journal of Banking and Finance 48 (C): 180–193.

Orlitzky, M., F.L. Schmidt, and S.L. Rynes. 2003. Corporate Social and Financial Performance: A Meta-Analysis. Organization Studies 24 (3): 403–441.

Porter, M., G. Serafeim, and M. Kramer. 2019. Where ESG Fails, Institutional Investor, October 16, 2019.

Sustainability Accounting Standards Board. 2018. SASB Codifies First-Ever Industry Specific Sustainability Accounting Standards, SASB, November 7, 2018. https://www.globenewswire.com/news-release/2018/11/07/1646736/0/en/SASB-CodifiesFirst-Ever-Industry-Specific-Sustainability-AccountingStandards.html.

Terasvirta, T., and H.M. Anderson. 1992. Characterizing Nonlinearities in Business Cycles Using Smooth Transition Autoregressive Models. Journal of Applied Econometrics 7: 119–136.

Trunow, N., and J. Lindner. 2015. Perspectives on ESG Integration in Equity Investing: An Opportunity to Enhance Long-term, Risk-adjusted Investment Performance. Calvert Investments.

Tsay, R.S. 1989. Testing and Modelling Threshold Autoregressive Processes. Journal of the American Statistical Association 84: 231–240.

Waddock, S.A., and S.B. Graves. 1997. The Corporate Social Performance-Financial Performance Link. Strategic Management Journal 18 (4): 303–319.

Zakoian, J.M. 1994. Threshold Heteroskedastic Models. Journal of Economic Dynamics and Control 18 (5): 931–955.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Results of the estimation of the Markov-switching “GARCH and EGARCH” models for the ESG portfolio “MSCI USA ESG Select” and the market benchmark portfolio “S&P 500,” during the study period excluding the COVID19 crisis and from June 1, 2005 to October 29, 2019 (Tables 11, 12, 13, 14; Fig. 3).

Rights and permissions

About this article

Cite this article

Ouchen, A. Is the ESG portfolio less turbulent than a market benchmark portfolio?. Risk Manag 24, 1–33 (2022). https://doi.org/10.1057/s41283-021-00077-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41283-021-00077-4