Abstract

We examine contemporaneous and dynamic relationship among equity fund flows, market returns, and market risk in China by applying structural vector autoregression (SVAR) and reduced-form VAR models using monthly and quarterly data over the period of 2005–2016. Results from the reduced-form VAR suggest that equity funds can play important role in reducing market risk by actively participating in the equity market. Moreover, adverse market conditions can cause equity funds to refrain from active participation in trading activities. The results from the structural VAR show that market risk and stock returns are contemporaneously related to fund flows, suggesting that concurrent relationships are important in studying the linkages between aggregate equity fund flows and stock market variables. We also discuss the policy implications of findings in the context of recent downturn in the Chinese stock market.

Source V. Stone Financial Products Research Center, http://en.vstone.com.cn/view

Source V. Stone Financial Products Research Center, http://en.vstone.com.cn/view

Similar content being viewed by others

Notes

Mutual funds provide numerous advantages to individual investors who either lack professional expertise or do not have enough time to manage their own portfolios. Some of the advantage of mutual funds include professional management of portfolios, diversification, economies of scale, and liquidity.

Mutual funds influence stock prices in short and long term due to size of their investments. The short-term affects include immediate rise or fall of share prices triggered by sales or purchase of a stock by mutual funds. Trading activities of mutual funds are likely to be followed by other institutional and individual investors resulting in herding patterns. The resultant herding behavior can further move prices up or down. The long-term affects include bullish or bearish trends associated with buy and hold strategy by mutual funds. A buy or sell decision by mutual funds is considered to be based on rigorous or well wetted analysis; therefore such decisions are more likely followed by the individual investors further reinforcing the trend in stock prices.

Also see the study by Narayan et al. (2014) conducted in India.

There are couple of studies on mutual funds in China but their focus is essentially limited to micro aspects i.e., fund performance. See for instance, Chen et al. (2013), Kiymaz (2015), Gang and Qian (2016), Vidal-García et al. (2016), Chen and Chen (2017), Weng and Wang (2017),Yang and Liu (2017), and Choi et al. (2017). The detailed discussion of the mutual fund industry in China and the reason behind studying Chinese market is discussed in “Overview of China’s mutual fund industry” section.

See, for example, Qureshi et al. (2016, 2017a, b). Jank (2012) find that there is contemporaneous relationship between equity fund flows and market returns supporting information response hypothesis, however, with the limitation that the study applies only reduced-form VAR model in the context of USA.

Limitation of reduced VAR model is discussed in “Structural VAR” section.

Statistics on China’ mutual fund industry has been extracted from various sources including V. Stone Financial Products Research Center, http://en.vstone.com.cn/view; China Securities Regulatory Commission (CSRC), http://www.csrc.gov.cn/pub/csrc_en/; The Shanghai Stock Exchange (SSE), http://english.sse.com.cn/; Asset Management Association of China (AMAC), http://www.amac.org.cn/cms/site/preview?ID=23.

For further readings related to Chinese stock market, see Feng and Chan (2016), Li et al. (2016a, b), Cai et al. (2017), and Xue and Zhang (2017). For recent studies on risk modeling in China and other countries from different perspectives, see, among others, Lee and Jeong (2016), Zhang et al. (2016), Liu and Wu (2017), Elenjical et al. (2016), Batten and Vo (2016), Díaz et al. (2017), Jeon et al. (2017), and Moula et al. (2017).

Several other studies such as Fang and You (2014) and Moore and Wang (2014) also apply SVAR in time series context to identify contemporaneous relationships among macroeconomic and stock exchange variables. Moreover, all variables under this study are stationary at level I(0) which is suitable for SVAR application. For co-integration and error correction model, the variables need to be integrated at level one I(1). For details on SVAR, See Sims (1986).

Additionally, we also employ Cholesky identification scheme with similar ordering of variables. However, the results are similar under both identification approaches.

Data on TNA and returns for individual equity fund have been separately extracted from Bloomberg database. There are 818 equity funds for which data are available over the period of 2005–2016. However, majority of the funds were introduced in later years therefore, we have to drop mutual funds for which data are not available. Each mutual fund has been matched for availability of TNA and returns. A mutual fund qualifies for inclusion in the sample if it has data on both TNA and returns. These screening criteria leave us with 768 mutual funds.

Alternatively, stock market capitalization can also be used in denominator of Eq. 6 as in Warther (1995) and Lee et al. (2015) among others. We also calculate equity flows using market capitalization; however, the results from both measures are qualitatively similar. For brevity purpose, we only report results from equity flows obtained through Eq. 6.

We choose 2 lags for reduced-form VAR model based on Akaike Information Criteria (AIC) and Schwarz Bayesian Criteria (SBC).

Different measures of aggregate equity flows i.e., total, expected, and unexpected equity flows, are independently included in the model. Estimation results from daily data are reported in panel A and those from quarterly data in Panel B.

Results from monthly and quarterly data are reported in vertical panels X and Y, respectively. The horizontal panels A, B, and C, respectively, report the results when total, expected, and unexpected equity flows are separately used in structural model.

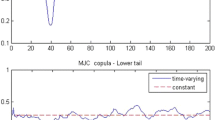

Since our focus is on response of aggregate equity flows to the contemporaneous shocks in market volatility and market returns, we only report relevant responses in the figure.

Following earlier studies i.e., Lee et al. (2015), we only report results of VDC over a period of 12 months due to convergence within this period.

References

Aggarwal, R., and R.P. Rao. 1990. Institutional ownership and distribution of equity returns. Financial Review 25 (2): 211–229.

Batten, J.A., and X.V. Vo. 2016. Bank risk shifting and diversification in an emerging market. Risk Management 18 (4): 217–235.

Bekaert, G., and G. Wu. 2000. Asymmetric volatility and risk in equity markets. Review of Financial Studies 13 (1): 1–42.

Ben-Rephael, A., S. Kandel, and A. Wohl. 2011. The price pressure of aggregate mutual fund flows. Journal of Financial and Quantitative Analysis 46 (02): 585–603.

Ben-Rephael, A., S. Kandel, and A. Wohl. 2012. Measuring investor sentiment with mutual fund flows. Journal of Financial Economics 104 (2): 363–382.

Bernanke, B. S. 1986. Alternative explanations of the money-income correlation. Paper presented at the Carnegie-Rochester conference series on public policy.

Blanchard, O.J., and D. Quah. 1989. The dynamic effects of aggregate demand and supply disturbances. The American Economic Review 79: 655–673.

Brown, K.C., W.V. Harlow, and L.T. Starks. 1996. Of tournaments and temptations: An analysis of managerial incentives in the mutual fund industry. The Journal of Finance 51 (1): 85–110.

Busse, J.A. 1999. Volatility timing in mutual funds: Evidence from daily returns. Review of Financial Studies 12 (5): 1009–1041.

Cai, W., J. Chen, J. Hong, and F. Jiang. 2017. Forecasting chinese stock market volatility with economic variables. Emerging Markets Finance and Trade 53 (3): 521–533.

Cao, C., E.C. Chang, and Y. Wang. 2008. An empirical analysis of the dynamic relationship between mutual fund flow and market return volatility. Journal of Banking & Finance 32 (10): 2111–2123.

Cha, H.-J., and J. Kim. 2010. Stock returns and aggregate mutual fund flows: A system approach. Applied Financial Economics 20 (19): 1493–1498.

Cha, H.-J., and B.-S. Lee. 2001. The market demand curve for common stocks: Evidence from equity mutual fund flows. Journal of Financial and Quantitative Analysis 36: 195–220.

Cha, H., and Kim, J. 2005. Short and long run dynamic relations between security returns and mutual fund flows a system approach. Working paper, Department of Finance, College of Business, University of St. Thomas, St. Paul.

Chen, D., C. Gan, and B. Hu. 2013. An empirical study of mutual funds performance in China. Retrieved from https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2220323.

Chen, H.-H., and L.-H. Chen. 2017. An analysis of the investment concentration of equity mutual funds in China. Emerging Markets Finance and Trade 53 (3): 511–520.

Choi, H.-S., D. Ryu, and S. Seok. 2017. The turn-of-the-year effect in mutual fund flows. Risk Management 19 (2): 131–157.

Coval, J., and E. Stafford. 2007. Asset fire sales (and purchases) in equity markets. Journal of Financial Economics 86 (2): 479–512.

Daigler, R.T., and M.K. Wiley. 1999. The impact of trader type on the futures volatility-volume relation. The Journal of Finance 54 (6): 2297–2316.

Dennis, P.J., and D. Strickland. 2002. Who blinks in volatile markets, individuals or institutions? The Journal of Finance 57 (5): 1923–1949.

Díaz, A., G. García-Donato, and A. Mora-Valencia. 2017. Risk quantification in turmoil markets. Risk Management 19 (3): 202–224.

Edelen, R.M. 1999. Investor flows and the assessed performance of open-end mutual funds. Journal of Financial Economics 53 (3): 439–466.

Edelen, R.M., and J.B. Warner. 2001. Aggregate price effects of institutional trading: A study of mutual fund flow and market returns. Journal of Financial Economics 59 (2): 195–220.

Edwards, F.R., and X. Zhang. 1998. Mutual funds and stock and bond market stability. Berlin: Springer.

Elenjical, T., P. Mwangi, B. Panulo, and C.-S. Huang. 2016. A comparative cross-regime analysis on the performance of GARCH-based value-at-risk models: Evidence from the Johannesburg stock exchange. Risk Management 18 (2–3): 89–110.

Fama, E.F. 1965. The behavior of stock-market prices. The Journal of Business 38 (1): 34–105.

Fang, C.-R., and S.-Y. You. 2014. The impact of oil price shocks on the large emerging countries’ stock prices: Evidence from China, India and Russia. International Review of Economics & Finance 29: 330–338.

Fant, L.F. 1999. Investment behavior of mutual fund shareholders: The evidence from aggregate fund flows. Journal of Financial Markets 2 (4): 391–402.

Feng, X., and K.C. Chan. 2016. Information advantage, short sales, and stock returns: Evidence from short selling reform in China. Economic Modelling 59: 131–142.

Ferreira, M.A., A. Keswani, A.F. Miguel, and S.B. Ramos. 2012. The flow-performance relationship around the world. Journal of Banking & Finance 36 (6): 1759–1780.

Ferson, W.E., and M.S. Kim. 2012. The factor structure of mutual fund flows. International Journal of Portfolio Analysis and Management 1 (2): 112–143.

Fortune, P. 1998. Mutual funds, part II: Fund flows and security returns. New England Economic Review 3–22.

French, K.R., G.W. Schwert, and R.F. Stambaugh. 1987. Expected stock returns and volatility. Journal of Financial Economics 19 (1): 3–29.

Friesen, G.C., and T.R. Sapp. 2007. Mutual fund flows and investor returns: An empirical examination of fund investor timing ability. Journal of Banking & Finance 31 (9): 2796–2816.

Gang, J., and Z. Qian. 2016. Risk-adjusted performance of mutual funds: Evidence from China. Emerging Markets Finance and Trade 52 (9): 2056–2068.

Greene, J.T., C.W. Hodges, and D.A. Rakowski. 2007. Daily mutual fund flows and redemption policies. Journal of Banking & Finance 31 (12): 3822–3842.

Grier, P.C., and P.S. Albin. 1973. Nonrandom price changes in association with trading in large blocks. The Journal of Business 46 (3): 425–433.

Harris, L., and E. Gurel. 1986. Price and volume effects associated with changes in the S&P 500 list: New evidence for the existence of price pressures. The Journal of Finance 41 (4): 815–829.

Jank, S. 2012. Mutual fund flows, expected returns, and the real economy. Journal of Banking & Finance 36 (11): 3060–3070.

Jeon, B.N., L. Zhu, and D. Zheng. 2017. Exchange rate exposure and financial crises: Evidence from emerging Asian markets. Risk Management 19 (1): 53–71.

Jotikasthira, C., C. Lundblad, and T. Ramadorai. 2012. Asset fire sales and purchases and the international transmission of funding shocks. The Journal of Finance 67 (6): 2015–2050.

Kaniel, R., G. Saar, and S. Titman. 2008. Individual investor trading and stock returns. The Journal of Finance 63 (1): 273–310.

Kiymaz, H. 2015. A performance evaluation of Chinese mutual funds. International Journal of Emerging Markets 10 (4): 820–836.

Kopsch, F., H.-S. Song, and M. Wilhelmsson. 2015. Determinants of mutual fund flows. Managerial Finance 41 (1): 10–25.

Lee, B.-S. 1996. Time-series implications of aggregate dividend behavior. Review of Financial Studies 9 (2): 589–618.

Lee, B.S., M. Paek, Y. Ha, and K. Ko. 2015. The dynamics of market volatility, market return, and equity fund flow: International evidence. International Review of Economics & Finance 35: 214–227.

Lee, G., and J. Jeong. 2016. An investigation of global and regional integration of ASEAN economic community stock market: Dynamic risk decomposition approach. Emerging Markets Finance and Trade 52 (9): 2069–2086.

Li, Q., J. Yang, C. Hsiao, and Y.-J. Chang. 2005. The relationship between stock returns and volatility in international stock markets. Journal of Empirical Finance 12 (5): 650–665.

Li, S.Z., H. Wang, and H. Zhao. 2016a. Jump Tail dependence in the Chinese stock market. Emerging Markets Finance and Trade 52 (10): 2379–2396.

Li, S., L. Wei, and Z. Huang. 2016b. Value-at-risk forecasting of Chinese stock index and index future under jumps. Permanent Component, and Asymmetric Information, Emerging Markets Finance and Trade 52 (5): 1072–1091.

Liu, J., and C. Wu. 2017. Dynamic forecasting of financial distress: The hybrid use of incremental bagging and genetic algorithm—Empirical study of Chinese listed corporations. Risk Management 19 (1): 32–52.

Massa, M., W. N. Goetzmann, and K. G. Rouwenhorst. 1999. Behavioral factors in mutual fund flows.

Merton, R.C. 1980. On estimating the expected return on the market: An exploratory investigation. Journal of Financial Economics 8 (4): 323–361.

Moore, T., and P. Wang. 2014. Dynamic linkage between real exchange rates and stock prices: Evidence from developed and emerging Asian markets. International Review of Economics & Finance 29: 1–11.

Moula, F.E., C. Guotai, and M.Z. Abedin. 2017. Credit default prediction modeling: An application of support vector machine. Risk Management 19 (2): 158–187.

Narayan, P.K., S. Narayan, and K. Prabheesh. 2014. Stock returns, mutual fund flows and spillover shocks. Pacific-Basin Finance Journal 29: 146–162.

Oh, N.Y., and J.T. Parwada. 2007. Relations between mutual fund flows and stock market returns in Korea. Journal of International Financial Markets, Institutions and Money 17 (2): 140–151.

Pan, L., and V. Mishra. 2016. Stock market development and economic growth: Empirical evidence from China (No. 16-16). Monash University, Department of Economics.

Qureshi, F., I. Ismail, and S. Gee Chan. 2016. Mutual funds and market performance: New evidence from ASEAN markets. Investment Analysts Journal. https://doi.org/10.1080/10293523.2016.1253137.

Qureshi, F., A. M. Kutan, A. Ghafoor, and S. Qureshi. 2017a. Dynamics of mutual funds and stock markets in Asian developing economies.

Qureshi, F., A.M. Kutan, I. Ismail, and C.S. Gee. 2017b. Mutual funds and stock market volatility: An empirical analysis of Asian emerging markets. Emerging Markets Review 31: 176–192.

Rakowski, D. 2010. Fund flow volatility and performance. Journal of Financial & Quantitative Analysis 45 (1): 223–237.

Rakowski, D., and X. Wang. 2009. The dynamics of short-term mutual fund flows and returns: A time-series and cross-sectional investigation. Journal of Banking & Finance 33 (11): 2102–2109.

Reilly, F.K. 1977. Institutions on trial: Not guilty! The Journal of Portfolio Management 3 (2): 5–10.

Reilly, F.K., and J.M. Wachowicz Jr. 1979. How institutional trading reduces market volatility. The Journal of Portfolio Management 5 (2): 11–17.

Remolona, E., P. Kleiman, and D. Gruenstein. 1997. Market returns and mutual fund flows. Economic Policy Review 3: 33–52.

Sias, R.W. 1996. Volatility and the institutional investor. Financial Analysts Journal 52: 13–20.

Sims, C.A. 1980. Macroeconomics and reality. Econometrica: Journal of the Econometric Society 48: 1–48.

Sims, C.A. 1986. Are forecasting models usable for policy analysis? Quarterly Review(Win) 2: 2–16.

Sirri, E.R., and P. Tufano. 1998. Costly search and mutual fund flows. The Journal of Finance 53 (5): 1589–1622.

Thomas, A., L. Spataro, and N. Mathew. 2014. Pension funds and stock market volatility: An empirical analysis of oecd countries. Journal of Financial Stability 11: 92–103.

Vidal-García, J., M. Vidal, S. Boubaker, and G.S. Uddin. 2016. The short-term persistence of international mutual fund performance. Economic Modelling 52: 926–938.

Warther, V.A. 1995. Aggregate mutual fund flows and security returns. Journal of Financial Economics 39 (2): 209–235.

Weng, Y.-C., and R. Wang. 2017. Do enhanced index funds truly have enhanced performance? Evidence from the Chinese market. Emerging Markets Finance and Trade 53 (4): 819–834.

Xue, W.-J., and L.-W. Zhang. 2017. Stock return autocorrelations and predictability in the chinese stock market—Evidence from threshold quantile autoregressive models. Economic Modelling 60: 391–401.

Yang, L., and W. Liu. 2017. Luck versus skill: Can Chinese funds beat the market? Emerging Markets Finance and Trade 53 (3): 629–643.

Zhang, Y., H. Luan, W. Shao, and Y. Xu. 2016. Managerial risk preference and its influencing factors: Analysis of large state-owned enterprises management personnel in China. Risk Management 18 (2–3): 135–158.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Qureshi, F., Kutan, A.M., Khan, H.H. et al. Equity fund flows, market returns, and market risk: evidence from China. Risk Manag 21, 48–71 (2019). https://doi.org/10.1057/s41283-018-0042-3

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41283-018-0042-3