Abstract

The European Green Deal aims to reduce greenhouse gas emissions by 55% by 2030 and achieve a carbon neutral economy by 2050. The ‘Fit for 55 package’ includes a suite of new regulations and taxes to promote Renewable and Low Carbon Fuels (RLFs) in the maritime transport sector. We use a Vector Autoregressive model (VAR) to forecast the impact of higher marine fuel prices during the transition to RLFs on Ireland’s maritime transport sector and the broader Irish economy. Our analysis finds that higher marine fuel prices are expected to reduce Gross Value Added (GVA) in the maritime transport sector by nearly 8% by 2050, relative to a “no-policy-change” baseline. Our results indicate that fuel price increases will not have a material impact on overall economic activity. The negative impact on real output is projected to range from 0.09% in 2025 to 1.21% in 2050. The projected decline in real exports ranges from 0.17% in 2025 to 2.29% in 2050, while consumer prices will increase from 0.13% in 2025 to 1.72% in 2050.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The European Green Deal aims to reduce greenhouse gas (GHG) emissions by 55% by 2030 and achieve a carbon neutral economy by 2050. To support these efforts, the ‘Fit for 55 package’ is a set of proposals to revise EU laws and introduce initiatives across a range of sectors aimed at ensuring that EU policies are consistent with these climate goals. In the maritime transport sector, the package includes a suite of regulations and taxes to incentivise the use of Renewable and Low Carbon Fuels (RLFs). The use of RLFs will benefit societies by reducing the negative externalities associated with carbon emissions. The cost of RLFs, however, is higher than fossil fuels, and RLF markets and technology are still in the early stages of development. Shipping operators and consumers may, therefore, face higher fuel costs in the transition to RLFs. Given the importance of maritime transport in facilitating trade, maritime transportation cost increases could have broader macroeconomic effects, with pass-through to shipping prices potentially affecting aggregate demand, inflation, employment, trade and output.

As a small open economy and island nation, Ireland is heavily dependent on international trade and is particularly exposed to higher maritime transportation costs. Recent estimates show that maritime transport is responsible for handling 90% of the total volume and 56% of the total value of Irish trade cargoes (Irish Maritime Development Office 2021a; Tsakiridis et al. 2019). Output trends in the Irish maritime transport sector have typically moved with Irish macroeconomic conditions, reflecting the close relationship between the sector and the broader economy. Many studies have found that transportation costs are a significant determinant of trade flows (for example, Anderson and Van Wincoop 2004; Behar and Venables 2011; Bernard et al. 2018; Nanovsky 2019; Beverelli et al. 2010). As fuel costs are a major component of transportation costs, the Fit for 55 package could have a substantial effect on Ireland’s trade flows, maritime transport sector and broader economy.

In this study, we use a Vector Autoregressive model (VAR) to estimate the impact of higher marine fuel costs arising from the Fit for 55 package on Ireland’s maritime transport sector and the broader Irish economy. We first estimate the historical impact of changes in marine fuel prices on output, gross value added (GVA) and employment in the Irish maritime transport sector, as well as on aggregate output, trade, consumption, CPI and employment between 1995 and 2020. We then use our estimates to forecast the impact of higher marine fuel prices from 2025 to 2050.

This study is organised in the following way. Section 2 provides an overview of the Irish maritime transport sector and the links between the sector and the broader Irish economy. Section 3 describes the directives of the Fit for 55 package that will affect maritime fuel costs. Section 4 outlines our empirical approach. Section 5 presents and describes the data used in this study. Section 6 presents our results and projections. Finally, Sect. 7 presents conclusions and discussions.

2 The Irish maritime transport sector

As a small open economy and island nation, maritime transport is crucial for the facilitation of Ireland’s external trade. The Irish maritime transport sector comprises a network of ports and shipping operators that are responsible for the transport of goods to and from the island of Ireland. Historically, strong dependence on maritime transport for trade purposes has led to a strong correlation between the performance of the Irish maritime transport sector and the broader Irish economy (Department of Transport, Tourism and Sport 2013). Irish port throughput has increased by almost one-third since 1998, but growth has been uneven (Department of Transport, Tourism and Sport 2013). Strong growth in the maritime transport sector during the Celtic Tiger was followed by a sharp decline in the years following the 2008 Global Financial Crisis (GFC). Growth resumed from 2010, although pre-crisis peak levels of throughput were not matched until 2018. Recently, significant disruptions to trade stemming from Brexit and especially the Covid-19 pandemic have resulted in a sharp dip in activity (Irish Maritime Transport Development Office 2021b).

Figures 1, 2 and 3 show the estimated value of direct turnover, GVA and employment in Ireland’s maritime transport sector over the past decade. These data cover waterborne transport activities, including both freight and passenger transport, as well as related services, including, inter alia, ship chartering and brokering, equipment leasing, and stevedoring. These activities are captured by NACE industry codes: 50.10, 50.20, 52.22, 52.24, 52.29 and 77.34.

Source: Ireland’s Ocean Economy, a report published by the Socio-Economic Marine Research Unit (SEMRU) at the University of Galway. See Vega et al. (2013, 2015), Vega and Hynes (2017), Tsakiridis et al. (2019), Norton et al. (2022)

Irish maritime transport sector, direct turnover (€ billions) 2010–2021.

In 2021, direct turnover in the sector was around €1.6 billion. That year, the sector generated about €450 million in value added and employed nearly 5000 people. These figures refer to the direct activity of the sector. SEMRU estimates that the indirect activity and employment generated by the sector is roughly of similar size as the direct measures (Vega et al. 2013, 2015; Vega and Hynes 2017; Tsakiridis et al. 2019; Norton et al. 2022). As can be seen in Figs. 1, 2 and 3, activity and employment in the sector started to recover in 2012/13 as the Irish economy and wider European economy began to emerge from the euro area debt crisis. Over the period 2013–2018, turnover, GVA and employment expanded, with average annual growth rates of 8%, 10% and 3.3%, respectively. The softening in activity in 2019 reflected weakness in the dry bulk market due to the unwinding of excess inventories built up during the previous year (Irish Maritime Transport Development Office 2020). The years 2020 and 2021 saw significant constraints in terms of container shortages, lockdown-induced labour supply issues and general disruptions in supply chains as a result of the pandemic (Irish Maritime Transport Development Office 2021a, b).

2.1 Irish trade and port throughput

Ireland’s strong dependence on maritime transportation is evident from Fig. 4, which shows that port throughput has moved closely with trade flows in recent decades. Port throughput increased consistently until the GFC, reflecting strong economic growth and an expansion of trade during the Celtic Tiger. National throughput declined during the GFC and remained relatively static until 2012. Although throughput grew at a solid pace over the last decade, it did not return to pre-crisis peak levels until 2018. A national fodder crisis led to a temporary expansion of throughput in 2017 and 2018, and was followed by a sharp correction (Irish Maritime Transport Development Office 2021a). The Covid-19 pandemic depressed throughput in 2020, and despite the post-Covid recovery, growth is again uncertain due to the global impact of the Russian war in Ukraine.

The majority of Irish port throughput is handled by Ireland’s five largest commercial ports: Dublin, Cork, Shannon Foynes, Rosslare and Waterford (Department of Transport, Tourism and Sport 2013). Cork, Dublin and Shannon Foynes are Ireland's largest ports by throughput volume and collectively handled around 91% of national port throughput between 1998 and 2021. Over this period, Dublin handled the largest share of national tonnage, shipping around 46% of trade cargoes, while Shannon Foynes and Cork shipped around 24% and 21%, respectively. The ports of Rosslare and Waterford are both ports of national significance, and each handled around 3% of national port tonnage over the period 1998–2021.Footnote 1

As shown in Fig. 5, Irish ports handle multiple types of cargo including roll on roll off (RoRo), lift on lift off (LoLo), dry bulk and liquid bulk (Irish Maritime Transport Development Office 2020, 2021a, b). The majority of Ireland’s liquid bulk cargoes are handled by the ports of Cork and Dublin. Shannon Foynes is Ireland's leading dry bulk port and handled around 66% of dry bulk tonnage since 1998. Container cargo is handled by the ports of Dublin, Cork, Rosslare and Waterford. The LoLo market is mainly served by the ports of Dublin, Cork and Waterford, which accounted for respective shares of around 69%, 22% and 9% of national LoLo tonnage since 1998. Dublin handles the vast majority of RoRo traffic and accounted for around 90% of national RoRo tonnage between 1998 and 2021, while Rosslare accounted for 15% since 2010.Footnote 2

In Fig. 6, we show the average gross tonnage shipped to and from Ireland by partner from 1998 to 2021. This chart indicates where goods were shipped to and from and not necessarily final trade partners. These data are important for assessing maritime transport costs as they show important determinants of fuel costs including the typical routes and distances travelled by vessels serving Irish trade. Panel (a) shows these data at national level, indicating that on average 40% of Irish port tonnage was shipped between Ireland and the UK, Ireland's most important shipping partner by a significant margin. The Netherlands was Ireland's second most important shipping partner, accounting for around 13% of the gross tonnage shipped to and from Irish ports, while Belgium accounted for 5%, reflecting the importance of both Rotterdam and Antwerp as hub-and-spoke centres for Irish trade. Other European countries accounted for significant shares too, with Norway, Spain and France accounting for 6%, 5% and 3%, respectively. The remainder, just over 20%, was divided between domestic shipping, which accounted for around 5%, and non-European regions. Countries such as the US, Brazil, Colombia and Guinea were Ireland’s largest non-European shipping partners, although the tonnage shipped to these countries was relatively small compared to European countries.

In panels (b)–(f), we show these data at port level for the ports of Cork, Dublin, Shannon Foynes, Rosslare and Waterford. The UK was the largest shipping partner of both Dublin and Rosslare, accounting for around 62% and 74%, respectively, of the tonnage shipped to and from these ports. The largest continental European shipping partners for Irish ports were Belgium and the Netherlands, again reflecting the importance of the hub-and-spoke system between Ireland and the continent. Non-European regions, located in North America, South America and North Africa accounted for a substantial quantity of the goods shipped to and from the ports of Cork, Shannon Foynes and Waterford. Domestic shipping also accounted for sizeable proportions of the goods shipped to and from the ports of Cork and Waterford.

3 The European Green Deal and the Fit for 55 package

The European Green Deal (2019) aims to transform the EU into a modern, resource-efficient, competitive and carbon neutral economy by 2050 (EC 2019). To support these efforts, the Fit for 55 package sets out a range of initiatives to reduce carbon emissions by 55% by 2030 and achieve a carbon neutral economy by 2050. The Fit for 55 package extends measures to sectors not previously subject to climate regulations. Among these is the maritime transport sector, which is responsible for 3–4% of all EU CO2 emissions (around 144 million tonnes in 2018). To achieve the Fit for 55 targets, it is estimated that the maritime transport sector will need to reduce emissions by around 91–92% relative to 2015 (EC 2021a). The initiatives of the Fit for 55 package which are relevant for the maritime transport sector are outlined in four directives, the Emissions Trading System Directive (ETS), the Energy Taxation Directive (ETD), the FuelEU Directive and the Renewable Energy Directive (RED) (EC 2021e, f, g, h).

The maritime transport fuel mix currently consists, almost exclusively, of liquid fossil fuels. To date, RLFs have failed to penetrate the maritime transport sector due to a number of factors relating to costs, technology and supply issues. The substantial price gap between fossil fuels and RLFs has been a major disincentive for the uptake of RLFs. This challenge has been compounded by legislative shortcomings enforcing RLF usage, and proportionate taxation based on energy intensity. Uncertainty surrounding future regulatory requirements and the maturity of globally utilisable renewable technologies has restricted the uptake of RLFs in the maritime transport sector. There is significant investment risk for first movers given the large capital costs and long average life span of vessels (21 years), creating a potential for stranded assets in the event of new technological breakthroughs which would render early alternative vessels less competitive. Overall, to achieve higher RLF penetration rates in the sector, the directives listed above are designed to create the regulatory certainty and taxation framework necessary to reach the targets set in the Fit for 55 package (EC 2021a).

The FuelEU Directive will bring the most dramatic change to the maritime transport sector. This directive aims to increase demand for RLFs, achieving a penetration rate in the total maritime fuel mix of 6–9% by 2030 and 86–88% by 2050. As outlined in Table 1, three policy options (PO) have been proposed to achieve these targets. The first option would see mandatory RLF shares set by regulation and defined in terms of the share of RLFs in the total maritime fuel mix. This option would see RLF shares increase from 7.4% of the total fuel mix in 2030 to 30% in 2040 and eventually 85.9% in 2050. The second option would set carbon intensity goals for shipping operators, with freedom of choice in terms of fuels and technologies. Policy option three, the favoured option, is a similar approach to option two, with identical targets, but allows transfer and compensation of balances between ships and operators to reward over achievers (EC 2021a).

Increased demand for RLFs should bring forth increased supply and therefore through scale economies lower the price gap between RLFs and fossil fuels, further incentivising the usage of RLFs in the sector (EC 2021a). However, scale economies alone will likely not be enough to sufficiently lower the price gap between RLFs and fossil fuels. Revisions, therefore, to the Emissions Trading System Directive, the Energy Taxation Directive and the Renewable Energy Directive are designed to further disincentive fossil fuel usage through additional taxation, which will help to reduce the price gap between RLFs and fossil fuels.

The EU's Emissions Trading System (ETS) is a cap-and-trade system which limits carbon emissions, requiring the purchase of allowances to cover emissions in excess of the cap. Since 2005, the cap on emissions was lowered by 1.7% per annum to reach a 2020 emissions reduction target of 21% on 2005 levels. The ETS has proven effective in reducing emissions, achieving a 35% reduction between 2005 and 2019, 14% above its 2020 target. To meet the ambitions of the Green Deal, the ETS will be extended to the maritime sector. There are several proposed options for this extension, including integration into the current ETS or the establishment of a separate ETS for the maritime transport sector. All options would result in higher maritime transport costs arising from higher operating costs, and higher capital costs due to the retrofitting of vessels to support renewable fuels. It is estimated that under a separate ETS, ship operators could pay up to €268 per tonne of CO2 emissions, and in the long term all extension policies would lead to a cost increase for operators of 16–20% by 2050 (EC 2021b).

The Energy Taxation Directive (ETD) has a number of shortcomings with respect to taxation. Fuel consumption is currently taxed on the basis of volume rather than energy intensity. Taxation based on volume de facto favours fossil fuels which have a higher energy intensity than RLFs and require a lower volume to travel a set distance, resulting in a higher effective taxation level for RLFs. Another major shortcoming of the current ETD arises from minimum taxation rates, which are based on 2003 inflation levels. This has led to low and inconsistent levels of energy taxation across member states. Revisions to the ETD will address these issues by taxing fuel based on intensity and resetting minimum rates in line with current levels of inflation. The revised ETD will be extended to the maritime transport sector, which will help to lower the price gap between fossil fuels and RLFs, and incentivise the uptake of RLFs in the sector. However, additional taxation will lead to increased fuel costs for ship operators, estimated at 1.2% for transport fuel prices (EC 2021c).

The Renewable Energy Directive has also been revised to reflect the targets of the Green Deal. These revisions increase the target share of renewable energy as part of the overall energy mix from 32% to at least 40% by 2030 (EC 2021d). The revisions also include a framework for the promotion of an integrated energy system across all sectors. Integrated systems will make renewables more flexible, allowing them to penetrate difficult to decarbonise sectors like transport and industry. In the transport sector, the proposal introduces a 13% reduction target for greenhouse gas intensity in transport fuels by 2030, equivalent to an energy-based target of 28%, effectively doubling the 14% target set in 2018 Renewable Energy Directive (EC 2018). Again through fuel cost differentials, the new targets could have a substantial impact on costs in the maritime transport sector.

4 Methodology

International trade flows are influenced by a range of factors, including, inter alia, the business cycle, exchange rates, trade policies, cultural connections and transportation costs. Transportation costs are determined by several factors, including distance, geography, infrastructure, trade facilitation, technology and fuel costs (Anderson and Van Wincoop 2004; Behar and Venables 2011). In this study, we focus on the effect of fuel costs on trade, the maritime transport sector and the broader economy. Maritime transport relies heavily on oil-based fuels, and therefore the cost of fuel in the maritime transport sector is closely correlated with developments in international oil markets. Distance and taxation are also major determinants of maritime fuel costs. Greater distance between producers and consumers means longer transit times and higher fuel consumption and costs. Rising environmental awareness and the subsequent introduction of regulations such as taxes on CO2 and other greenhouse gas emissions have also affected fuel prices and output in sectors that rely heavily on fossil fuels.

Increased fuel and transport costs can negatively impact trade flows and produce spill-over effects on the maritime transport sector and the broader economy, which affect prices, output, consumer spending and employment. Increased transportation costs arising from fuel regulations and taxes raise the cost of exporting and importing final goods, as well as importing intermediate goods and raw materials. Higher costs make firms less competitive relative to firms in countries with less stringent environmental policies, leading to a fall in demand, income and employment. Depending on demand elasticities, firms may pass on higher costs to consumers leading to lower welfare.

Several studies have examined the determinants of transportation costs, as well as the impacts of fuel costs and environmental taxation on economic growth, trade and employment. Hummels (1999) estimated an elasticity coefficient for transport costs with respect to distance of 0.22 for sea transport, while Beverelli et al. (2010) estimated a coefficient elasticity of 0.19–0.36 for container and oil shipping costs, and found that dry bulk shipping is more sensitive to fuel prices changes. Nanovsky (2019) estimated a gravity model which tests the response of global trade to oil price changes, finding that as oil prices increase trade becomes more localised, while it becomes more dispersed as oil prices fall. Abdullah and Morley (2014) tested the impact of environmental taxes on economic growth from 1995 to 2006 using a panel of OECD countries and found that environmental taxes had no significant impact on growth. Using a VAR model, Bernard et al. (2018) found that a shock to gasoline prices significantly affected GDP per capita in British Columbia.

Elgie and McClay (2013) examined the impact of environmental taxation on output growth in British Columbia and found that it had no significant impact on GDP. Others studied the impact of carbon taxes on households and employment. Goulder et al. (2019) examined the effect of carbon taxes on US households. They find that the positive effects of carbon taxes on wages, capital and transfer incomes outweigh the negative effect on the price of household goods and services. Beck et al. (2015) examined the distributional impacts of carbon taxes on households in British Columbia and found a very small impact on household welfare of 0.08%. Yamazaki (2017) and Yip (2018) examined the labour market effects of carbon taxation in British Columbia. Yamazaki (2017) finds that carbon taxation negatively impacted labour income by 0.3–0.9%, while Yip (2018) finds that the carbon tax added 1.2–1.3% to total employment.

We follow the approach of previous studies (Bernard et al. 2018; Kilian and Vigfusson 2011, 2013) by adopting a VAR model to estimate the impact of fuel price changes on output, prices and employment. To capture the impact of fuel price changes over time and control for possible endogeneity we include lags of the dependent, independent and control variables, with the number of lags selected to minimise the BIC statistic. Using real exports as an example, our model examines the response of real exports to lagged changes in marine fuel oil prices:

where \(\Delta {REX}_{t}\) is the change in the log of real exports at time t, \(\Delta {REX}_{t-i}\) are lagged changes in the log of real exports and \(\Delta {FP}_{t-i}\) are lagged changes in the log of real marine fuel oil prices. \({Z}{^ \prime}\gamma\) is a vector of controls to account for possible endogeneity as fuel price changes are likely correlated with other factors which determine Irish trade such as foreign income. We adapt our regressions with respect to our dependent variable in each specification, including control variables which are theoretically appropriate. We estimate regressions for output, GVA and employment for the maritime transport sector, as well as for Irish real GNP, exports of goods, imports of goods, consumer prices (CPI) and employment.

Table 2 lists the control variables used in each specification. GDP is not considered a good measure of Irish economic activity, in part because of distortions relating to the outsized profits of US multinational companies with large operations in Ireland and the effects of the international aircraft leasing sector domiciled in the country (Economic Statistics Review Group 2017). We therefore avoid using Irish GDP as a control variable. Instead, we use controls for economic activity such as real consumption, employment, real trade flows and other influential factors like exchange rates. In our real GNP regression, we control for lagged domestic (GNP) and foreign income to account for lagged growth effects and external demand. For real trade flows, we control for real consumption, foreign income which affects demand for Irish exports, and the Irish real effective exchange rate which is a measure of Irish competitiveness. For CPI, we control for EU inflation to account for pass-through to Irish prices, as well as the UK/Irish nominal exchange rate as a significant share of consumption goods sold in Ireland are imported from the UK. For real consumption, we control for employment and the price level, as both directly determine household consumption levels. In regressions for the maritime transport sector, we control for real total trade, real consumption and the Irish real effective exchange rate. In all regression specifications, we use robust standard errors.

The system of equations above includes an equation in which real marine fuel prices is the dependent variable, as is standard in VAR modelling. We expect Irish trade and output to have little effect on marine fuel prices as these prices are determined internationally. However, using a VAR model as outlined above allows us to estimate impulse response functions, which show the response of our dependent variables to shocks in the error terms, \({\mu }_{it}\) and \({\eta }_{it}\) in the above system of equations.

5 Data

In this section, we present and summarise the data used for our VAR analysis and projections. Our data are quarterly and the sample period for our historical analysis runs from Q1:1995 to Q4:2020. Data on all variables with the exception of marine fuel prices are taken from public databases, including Eurostat, Ireland’s Central Statistics Office (CSO) and FRED. We present all variables in levels below, but as VAR modelling requires data to be stationary, the summary statistics presented in Table 3 refer to quarterly percentage changes.

In Fig. 7, we show the price of heavy sulphur fuel oil at Rotterdam. Heavy sulphur fuel oil was one of the most commonly used marine fuels over the past three decades and serves as a good indicator of overall changes in marine fuel prices. Marine fuel prices increased from the late 1990s, before peaking at €532 per tonne around 2008. In the aftermath of the GFC, marine fuel prices dropped but subsequently recovered from 2010. Since then, prices have fluctuated between €150 and €300 per tonne. The average quarterly marine fuel price change was around 0.92% over the period 1995–2020. However, fuel price changes were fairly volatile, with a standard deviation of 17% (Fig. 8).

Data on output, GVA and employment in the maritime transport sector were collected from the databases of the CSO and Eurostat, and from SEMRU reports on Ireland’s Ocean Economy (Vega et al. 2013, 2015, Vega and Hynes 2017; Tsakiridis et al. 2019; Norton et al. 2022). SEMRU calculates these statistics using data for the NACE four-digit codes: 50.10 (Sea and coastal passenger water transport), 50.20 (Sea and coastal freight water transport), 52.22 (Service activities incidental to water transportation), 52.24 (Cargo handling), 52.29 (Other transportation support activities) and 77.34 (Renting and leasing of water transport equipment). Four-digit level data are available only from 2010, so for the period prior to this year we rely on data for Water Transport (NACE code 50), which typically mirrors overall trends for the sector. To construct a quarterly measure of these variables, we weight the annual figures according to the level of trade in each quarter, and then splice both the Water Transport and SEMRU data together as an index. Our indices for output/turnover, GVA and employment recorded average quarterly changes of 5.80%, 5.62% and 4.71% respectively.

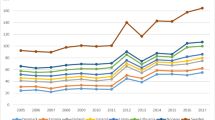

Our macroeconomic variables are presented in Figs. 9 and 10. Figure 9 shows Irish real GNP, real consumption, real exports, real imports, CPI and employment. The trends across all of these variables are similar, with growth in the period before the GFC, declines from 2008, followed by recovery from around 2014. Of these variables, exports and imports were the most volatile, as shown in Table 3. GNP was less volatile than changes in trade, but was more volatile than employment.

In Fig. 10, we present data on our control variables, the Irish real effective exchange rate index, the Irish/UK nominal exchange rate, EU real GDP and EU CPI. The Irish real effective exchange rate is an inflation adjusted weighted average of the value of the Irish pound and later the Euro relative to the currencies of Ireland's trading partners. It is an indicator of Ireland's international competitiveness, with an increase in the index suggesting that Irish goods became less competitive. Irish traded goods became less competitive in the early 2000s, but gradually regained competitiveness as the economy adjusted in the years following the financial crisis. The Irish nominal exchange rate vis-à-vis the UK has been found to be an important determinant of inflation in Ireland. Sterling appreciated in value against the euro shortly after the introduction of the single currency, but weakened significantly during the GFC and has traded in a narrow range since then.

Real EU GDP and CPI are presented in panels (c) and (d) of Fig. 10. These variables follow similar patterns to their Irish counterparts, reflecting the influence of external conditions on the Irish economy. The volatility of EU output, however, was much lower than Irish output, highlighting the problems associated with using Irish output statistics as control variables. Irish CPI was also more volatile than its EU counterpart, although the margin was considerably less than the relative volatility of output.

To forecast the impact of future marine fuel price changes, we calculate the price gap between a fuel mix entirely comprising liquid fossil fuels and the ‘FuelEU’ mandated fuel mix. To calculate this price gap we use the fuel price projections per tonne of oil equivalent (toe) shown in Table 4 and the mandated future RLF usage shares shown in Table 1. Using these figures, we derive a weighted average price per toe of the FuelEU fuel mix and calculate the cost difference between this fuel mix and one solely comprising liquid fossil fuels. The price gap between both fuel mixes is the price shock, which along with our VAR coefficients, we use to forecast the impact of higher marine fuel prices. The prices per toe of both fuel mixes are presented in Fig. 11 and the price gap in Fig. 12, with all data shown in Table 5. In 2025, the price gap will be about 2% and will rise to 6% by 2030, before increasing to 11% by 2035. The price gap will increase to 17% by 2040 and 28% between 2045 and 2050.

6 Results and discussion

The results of our VAR analysis for the maritime transport sector are presented in Table 6. Broadly speaking, these results show that marine fuel price changes had a significant impact on the sector in recent decades. Fuel price increases typically reduced sectoral output and GVA, with a 1% increase typically causing respective declines in output and GVA of 0.20% and 0.28%. However, fluctuations in marine fuel prices appear to have had little effect on employment in the sector. The impact of fuel price changes was typically short-lived, with our lagged coefficients suggesting a significant effect only in the quarter following a price change, which may explain the unresponsiveness of employment.

In Fig. 13 and Table 6, our impulse response functions confirm that the effect of marine fuel price shocks on the maritime transport sector were short-lived, typically dying out after two quarters for output and GVA. We sum the impulse response coefficients, which combined show the long-run impact of marine fuel price shocks, and use these long-run coefficients to forecast the impact of the gradual switch from fossil fuels to RLFs in 2025, 2030, 2035, 2040, 2045 and 2050.

As outlined earlier, the marine fuel price shock resulting from the Fit for 55 measures is expected to range from 2% in 2025 to 28% in 2050 with the price gap increasing substantially from 2035. Table 7 shows the projected impact of these price shocks and suggests that fuel price changes will have a significant effect on output and GVA in the sector, relative to a baseline scenario in which only liquid fossil fuels are used in the fuel mix. The negative impact on output ranges from 0.41% in 2025 to 5.54% in 2050, with the magnitude increasing gradually by about 1% with each successive increase in the RLF share of the maritime fuel mix until 2040. After 2040, considerably higher shares of RLFs will cause a 5.57% decrease in output in 2045 and a 5.54% decrease in 2050. For GVA, the fuel price shock will have a greater negative impact, ranging from 0.58% in 2025 to 7.76% in 2050. Similarly the impact on GVA will initially increase gradually, double between 2030 and 2035, before increasing by around 2% and 3% between 2035–2040 and 2040–2045, respectively.

Our macroeconomic results, presented in Table 8, show that marine fuel price changes had a small but significant impact on real GNP, trade volumes and Irish CPI. Marine fuel price increases caused Irish real GNP to fall, with a 1% increase in fuel prices typically leading to a 0.06% decline in real GNP. Our results suggest that the channel through which fuel price increases affected the economy was through a fall in trade, with growth in trade volumes typically weakening in response to fuel price increases.

The results show that declines in total trade were primarily driven by lower exports following fuel price increases. Perhaps surprisingly, we find that import volumes were largely unaffected by fuel price increases. Although import volumes appear to have been unresponsive, our results provide some evidence that higher fuel costs were passed through to the general price level. Fuel price increases lead to small increases in the consumer price index, with a 1% increase in marine fuel prices leading to lagged increases in the general price level of about 0.04% over 9 months. This suggests that marine fuel price increases were partially passed on to Irish consumers, with consumers generally facing slightly higher prices following marine fuel price increases. We present impulse response functions for all our macroeconomic variables in Fig. 14. These results show that the macroeconomic impact of a fuel price shock was also short-lived. In all cases, except for CPI, the impact of a shock lasted around two quarters, over which real GNP and exports declined.

Our forecasts, outlined in Table 9, indicate that switching to RLFs in the maritime sector will have a modest impact on the Irish economy. The decline in real GNP, relative to baseline, is projected to range from 0.09% in 2025 to 1.21% in 2050, with a very gradual increase in the magnitude of the the decline over the period to 2050. The projected decline in real exports ranges from 0.17% in 2025 to 2.29% in 2050, and grows marginally over the period to 2050. Although insignificant, our projections for imports suggest that fuel price increases are not expected to cause any significant reductions in import volumes. However, as discussed earlier, fuel price shocks are projected to result in a small increase in the CPI ranging from 0.13% in 2025 to 1.72% in 2050, suggesting that higher transportation costs will be passed through to Irish consumers.

7 Conclusions and discussion

In interpreting the findings of this study, it is worth keeping in mind that the results are expressed as deviations from a “no-policy-change” baseline in which only liquid fossil fuels are used in the maritime fuel mix. The Fit for 55 package is projected to increase the price of marine fuel by 28% by 2050 compared with a scenario where the sector continues to rely exclusively on fossil fuels. Our analysis finds that, based on historical relationships, a shock to maritime fuel costs of this magnitude is expected to reduce value added in the maritime transport sector by around 7.5% by 2050.

It is important to note that these results do not mean that the sector is expected to contract from today’s levels of output and value added. Given anticipated growth in global trade, Irish trade and the Irish economy over the medium term, Ireland’s maritime transport sector will undoubtedly expand over coming decades. Moreover, the effects of the shock to the sector stemming from these new EU policies are expected to be spread over many years, given the gradual introduction of these policy changes. These effects will not materialise to any significant degree until after 2035, which should provide the sector with time to adapt to the new policy environment. In addition, it is worth noting that value added in the sector rose 10% annually on average during most of the last decade, in part reflecting recovery from the GFC slump, so the expected loss of value added by 2050 resulting from higher marine fuel prices as a result of the Fit for 55 package is roughly equivalent to just a single year’s growth.

Looking at the broader Irish economy, this study finds that the higher marine fuel prices resulting from the Fit for 55 package is expected to reduce exports by just over 2% by 2050. Based on the results of the VAR analysis, we anticipate no effect on imports. The asymmetry we find in the data between the responsiveness of exports and imports to changes in maritime fuel costs is an anomaly that deserves further investigation. Whatever the source of this asymmetry, the overall impact of the Fit for 55 fuel price increases on Ireland’s trade is expected to be small, with even smaller effects on overall economic activity.

Finally, it is illustrative to compare our results with those from other studies that have considered shocks to trade. In their study of the impact of the Fit for 55 package on Ireland’s aviation sector, De Bruin and Yakut (2021) using a general equilibrium model find that some of the policy proposals could result in a cumulative decrease in aviation value added of between 3% and 14% by 2030. More broadly, Lawless and Morgenroth (2016, 2017) examine the effects on Irish trade of tariff and non-tariff barriers that might arise from Brexit and found that these barriers would reduce Irish exports to Britain by between 5% and 8% and Irish imports from Britain by between 3% and 5%. It is clear that Brexit represented a much larger threat to Irish trade than the increases in maritime fuel costs resulting from the Fit for 55 package.

Data availability

The data presented in Figures 1–3 are published in SEMRU's Ireland's Ocean Economy reports (Vega et al., 2013, 2015; Vega and Hynes, 2017; Tsakiridis et al. 2019, Norton et al. 2022) (available at: https://www.universityofgalway.ie/semru/publications/reports/). The data presented in Figures 4–6, Figures 9, 10 and the NACE sectoral output and employment data for Water Transportation used to derive the indices in Figure 8 are publicly available from the Irish Central Statistics Office (CSO) and Eurostat databases. The fuel price data presented in Figure 7 were sourced from Clarkson Shipping Intelligence. The data presented in Table 1 and Table 4 are published in the FuelEU Impact Assessment Report (EC 2021a) (available at: https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/12312-CO2-emissions-from-shippingencouraging-the-use-of-low-carbon-fuels_en see pp.38-41 for data on policy options and targets, p.38 for the RLF shares used to derive the estimated FuelEU fuel mix cost per toe, and p.125 Table 30 for fuel price projections.

Notes

References

Abdullah, S., and B. Morley. 2014. Environmental taxes and economic growth: Evidence from panel causality tests. Energy Economics 42: 27–33.

Anderson, J.E., and E. Van Wincoop. 2004. Trade costs. Journal of Economic Literature 42 (3): 691–751.

Beck, M., N. Rivers, R. Wigle, and H. Yonezawa. 2015. Carbon tax and revenue recycling: Impacts on households in British Columbia. Resource and Energy Economics 41: 40–69.

Behar, A., and A.J. Venables. 2011. Transport costs and international trade. In A handbook of transport economics, ed. A. de Palma, R. Lindsey, E. Quinet, and R. Vickerman. Cheltenham: Edward Elgar Publishing.

Bernard, J.-T., M. Kichian, and M. Islam. 2018. Effects of BC's carbon tax on GDP. USAEE research paper series, 18–329.

Beverelli, C., H. Benamara, R. Asariotis, and U. Secretariat. 2010. Oil prices and maritime freight rates: An empirical investigation. Technical report, UNCTAD Secretariat.

De Bruin, K., and A.M. Yakut. 2021. The impacts of aviation taxation in Ireland. ESRI Research Series No. 131. Dublin.

Department of Transport, Tourism and Sport. 2013. National ports policy. Dublin, Ireland.

EC. 2018. Proposal for the promotion of the use of energy from renewable sources. Brussels, Belgium.

EC. 2019. The European green deal. 2019. vol. Communicat. Brussels, Belgium.

EC. 2021a. Impact assessment accompanying the proposal for a regulation of the European Parliament and of the Council on the use of renewable and low-carbon fuels in maritime transport. Brussels, Belgium.

EC. 2021b. Impact assessment report accompanying the document Directive of the European Parliament and of the Council amending Directive 2003/87/EC establishing a system for greenhouse gas emission allowance trading within the Union, Decision (EU) 2015/1814 concerning the establishment and operation of a market stability reserve for the Union greenhouse gas emission trading scheme and Regulation (EU) 2015/757. Brussels, Belgium.

EC. 2021c. Impact assessment report accompanying the document proposal for a Council Directive restructuring the Union framework for the taxation of energy products and electricity (recast). Brussels, Belgium.

EC. 2021d. Impact assessment report accompanying the proposal for a Directive of the European Parliament and the Council amending Directive (EU) 2018/2001 of the European Parliament and of the Council, Regulation (EU) 2018/1999 of the European Parliament and of the Council and Directive 98/70/EC of the European Parliament and of the Council as regards the promotion of energy from renewable sources, and repealing Council Directive (EU) 2015/652. Brussels, Belgium.

EC. 2021e. Proposal for a Council Directive restructuring the Union framework for the taxation of energy products and electricity (recast). Brussels, Belgium.

EC. 2021f. Proposal for a Directive of the European Parliament and of the Council amending Directive 2003/87/EC establishing a system for greenhouse gas emission allowance trading within the Union, decision (EU) 2015/1814 concerning the establishment and operation of a market stability reserve for the Union greenhouse gas emission trading scheme and regulation (EU) 2015/757. Brussels, Belgium.

EC. 2021g. Proposal for a Directive of the European Parliament and of the Council amending Directive (EU) 2018/2001 of the European Parliament and of the Council, Regulation (EU) 2018/1999 of the European Parliament and of the Council and Directive 98/70/EC of the European Parliament and of the Council as regards the promotion of energy from renewable sources, and repealing Council Directive (EU) 2015/652. Brussels, Belgium.

EC. 2021h. Proposal for a regulation of the European Parliament and of the Council on the use of renewable and low-carbon fuels in maritime transport and amending Directive 2009/16/ec. Brussels, Belgium.

Economic Statistics Review Group. 2017. Report of the Economic Statistics Review Group. Central Statistics Office, Dublin, Ireland.

Elgie, S., and J. McClay. 2013. BC's carbon tax shift after five years: Results. Report, Sustainable Prosperity, Ottawa, ON, Canada.

Goulder, L.H., M.A. Hafstead, G. Kim, and X. Long. 2019. Impacts of a carbon tax across US household income groups: What are the equity-efficiency trade-offs? Journal of Public Economics 175: 44–64.

Hummels, D.L. 1999. Toward a geography of trade costs. GTAP Working Paper No. 17, 1999.

Irish Maritime Development Office. 2020. Irish Maritime Transport Economist, vol. 17. Dublin: Irish Maritime Development Office.

Irish Maritime Development Office. 2021a. Irish Maritime Transport Economist, vol. 19. Dublin: Irish Maritime Development Office.

Irish Maritime Development Office. 2021b. Irish Maritime Transport Economist, vol. 18. Dublin: Irish Maritime Development Office.

Kilian, L., and R.J. Vigfusson. 2011. Are the responses of the US economy asymmetric in energy price increases and decreases? Quantitative Economics 2 (3): 419–453.

Kilian, L., and R.J. Vigfusson. 2013. Do oil prices help forecast US real GDP? The role of nonlinearities and asymmetries. Journal of Business & Economic Statistics 31 (1): 78–93.

Lawless, M., and E. Morgenroth. 2016. The product and sector level impact of a hard brexit across the EU. ESRI Working Paper No. 550.

Lawless, M., and E. Morgenroth. 2017. Ireland’s international trade and transport connections. ESRI Working Paper No. 573.

Nanovsky, S. 2019. The impact of oil prices on trade. Review of International Economics 27 (1): 431–447.

Norton, D., S. Hynes, M.C. Lanser, J. O’Leary, C. O’Donoghue, and A. Tsakiridis. 2022. Ireland’s Ocean Economy Report 2022. SEMRU. University of Galway and Marine Institute.

Tsakiridis, A., M. Aymelek, D. Norton, R. Burger, J. O’Leary, R. Corless, and S. Hynes. 2019. Ireland’s Ocean Economy, SEMRU Report Series, Ireland's Ocean Economy Report 2019.

Vega, A., and S. Hynes. 2017. Ireland's Ocean Economy Report 2017, Irelands Ocean Economy, SEMRU Report Series.

Vega, A., R. Corless, and S. Hynes. 2013. Ireland’s Ocean Economy, Reference Year 2010, SEMRU Report Series.

Vega, A., S. Hynes, and E. O'Toole. 2015. Ireland’s Ocean Economy, reference year 2012, SEMRU Report Series.

Yamazaki, A. 2017. Jobs and climate policy: Evidence from British Columbia’s revenue neutral carbon tax. Journal of Environmental Economics and Management 83: 197–216.

Yip, C.M. 2018. On the labor consequences of environmental taxes. Journal of Environmental Economics and Management 89: 136–152.

Acknowledgements

This research was carried out with the support of the Marine Institute (Grant-Aid Agreement No. PDOC/19/06/01), funded under the Marine Research Programme by the Irish Government.

Funding

Open Access funding provided by the IReL Consortium.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Ahearne, A., Cassidy, D. The impact of Fit for 55 on Ireland’s maritime transport sector and the macroeconomy. Marit Econ Logist (2023). https://doi.org/10.1057/s41278-023-00267-9

Accepted:

Published:

DOI: https://doi.org/10.1057/s41278-023-00267-9