Abstract

The traditional model of systematic amortization over its useful life was replaced by the annual application of an impairment test, with the intention of correcting the problems of the lack of relevance and difficulty in estimating said useful life of the previous regulatory framework. The aim of this study is to investigate whether the application of the impairment test between 2005 and 2015 in the main European banks has overcome these problems or whether, on the contrary, its application by managers has been discretionary, opportunistic and arbitrary, presenting, as a result, artificially inflated earnings. Our results obtained show that systematic amortisation has been replaced by opportunistic impairment, which does not reflect the economic conditions underlying the financial activity of the main European banks, which gives rise to less relevant financial information and possible harmful pro-cyclical effects.

Similar content being viewed by others

Notes

“Appendix 1” contains a list of the entities comprising the sample under analysis.

Also, these variables have been studied in previous research.

References

International Accounting Standards Board (IASB). 2015. Post-Implementation Review of IFRS 3 Business Combinations. Report and Feedback Statement. June. Recovered from: https://www.ifrs.org/-/media/project/pir-ifrs-3/published-documents/pir-ifrs-3-report-feedback-statement.pdf. Accessed 25 June 2019.

Financial Accounting Standards Board (FASB). 2016. Topic 350 Intangibles—Goodwill and Other. Simplifying the accounting for goodwill impairment (Proposed Accounting Standards Update). May. Recovered from https://asc.fasb.org/imageRoot/91/82887091.pdf. Accessed 16 June 2019.

Hoogervorst, H. 2018. Are we ready for the next crisis? Speech at the IMF. Washington, D.C. 11 December. Recovered from: https://www.ifrs.org/news-and-events/2018/12/speech-are-we-ready-for-the-next-crisis. Accessed 2 July 2019.

Accounting Principles Board (APB). 1970. Intangible Assets. APB Opinion No. 17. October.

Accounting Standards Board (ASB). 1997. Goodwill and Intangible Assets. Financial Reporting Standard No. 10. December. London.

Accounting Standards Board (ASB). 1998. Impairment of fixed assets and goodwill. Financial Reporting Standard No. 11. July. London.

International Accounting Standards Board (IASB). 2004. Business Combinations. March. International Financial Reporting Standard (IFRS) 3 revised in 2008. Available in: http://eifrs.ifrs.org/eifrs/bnstandards/en/IFRS3.pdf. Accessed 2 May 2019.

Australian Accounting Standards Board (AASB). 2015. AASB 3 Business combinations. AASB Standard 3. August. Recovered from: https://www.aasb.gov.au/admin/file/content105/c9/AASB3_08-15.pdf. Accessed 12 May 2019.

Australian Accounting Standards Board (AASB). 2015. Intangible Assets. AASB Standard 138. October. Recovered from: www.aasb.gov.au/…/AASB138_08-15_COMPoct15_01-18.pdf. Accessed 12 May 2019.

Financial Accounting Standards Board (FASB). 2001. Business Combinations; Statement of Financial Accounting Principles No. 141. June. Revised in 2007.

Financial Accounting Standards Board (FASB) 2001. Goodwill and Other Intangible Assets. Statement Financial Accounting Principles No. 142. June.

Cheng, C.S.A., K.R. Ferris, S. Hsieh, and Y. Su. 2005. The value relevance of earnings and book value under pooling and purchase accounting. Advances in Accounting 21: 25–59.

Giner, B., and F. Pardo. 2007. The value relevance of goodwill and goodwill amortization: A European perspective. Spanish Journal of Finance and Accounting 36 (134): 389–419.

Basel Committee on Banking Supervision (BCBS). 2019. Definition of capital in Basel III - Executive Summary. Recovered from https://www.bis.org/fsi/fsisummaries/defcap_b3.htm. Accessed 29 Feb 2020.

European Financial Reporting Advisory Group (EFRAG). 2016. What do we really know about goodwill and impairment? A quantitative study. Recovered from: https://www.efrag.org/News/Project-251/What-do-we-really-know-about-goodwill-and-impairment–A-quantitative-study. Accessed 19 May 2019.

Canning, J.B. 1929. The economics of accountancy. An initial analysis of accounting theory. New York: Ronald Press.

Gynther, R.S. 1969. Some “conceptualizing” on goodwill. The Accounting Review 44 (2): 247–255.

Wines, G., R. Dagwell, and C. Windsor. 2007. Implications of the IFRS goodwill accounting treatment. Managerial Auditing Journal 22 (9): 862–880.

Carlin, T.M., and N. Finch. 2010. Evidence on IFRS goodwill impairment testing by Australian and New Zealand firms. Managerial Finance 36 (9): 785–798.

Comiskey, E., and C.W. Mulford. 2010. Goodwill, triggering events, and impairment accounting. Managerial Finance 36 (9): 746–767.

Ramanna, K., and R. Watts. 2012. Evidence on the use of unverifiable estimates in required goodwill impairment. Review of Accounting Studies 17 (4): 749–780.

Li, K., and R. Sloan. 2009. Has goodwill accounting gone bad? SSRN Electronic Journal. https://doi.org/10.2139/ssrn.1466271.

Abughazaleb, N.M., O. Al Hares, and C. Roberts. 2011. Accounting discretion in goodwill impairments: UK evidence. Journal of International Financial Management and Accounting 22 (3): 165–204.

Hamberg, M., M. Paananen, and J. Novak. 2011. The adoption of IFRS 3: The effects of managerial discretion and stock market reactions. European Accounting Review 20 (2): 263–288.

Saastamoinen, J., and K. Pajunen. 2012. Auditors’ Perceptions of Goodwill Write-Offs Under IFRS. Recovered from SSRN https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1993014. Accessed 23 July 2019.

Duff and Phelps. 2017. Goodwill Impairment Study. Duff & Phelps. December 2017. Recovered from: https://www.duffandphelps.com/-/media/assets/pdfs/publications/valuation/gwi/2017-eu-goodwill-impairement-study.ashx. Accessed 25 June 2019.

International Accounting Standards Board (IASB). 2013. Impairment of Assets. International Accounting Standard (IAS) 36. Available in: http://eifrs.ifrs.org/eifrs/bnstandards/en/IAS36.pdf. Accessed 26 June 2019.

International Forum of Independent Audit Regulators (IFIAR). 2017. Report of 2016 Survey of Inspection Findings. March. Recovered from: https://www.cpaaustralia.com.au/~/media/corporate/allfiles/document/professional-resources/auditing-assurance/2016-survey-report-ifiar-findings. Accessed 2 July 2019.

Lemeshow, S., and D. Hosmer. 2005. Logistic regression. In Vol. 2 of encyclopedia of biostatistics, ed. P. Armitage and T. Colton, 2870–2880. Chichester: Wiley.

Van Hulzen, P., L. Alfonso, G. Georgakopoulos, and I. Sotiropoulos. 2012. Amortization versus impairment of goodwill and accounting quality. International Journal of Economic Sciences and Applied Research 4 (3): 93–118.

Giner, B., and F. Pardo. 2015. How ethical are managers’ goodwill impairment decisions in Spanish-listed firms? Journal of Business Ethics 132 (1): 21–40.

Glaum, M., W.R. Landsman, and S. Wyrwa. 2015. Determinants of goodwill Impairment: International Evidence. Recovered from: http://ssrn.com/abstract=2608425. Accessed 28 June 2019.

Amel-Zadeh, A, J. Faasse, K. Li, and G. Meeks. 2016. Stewardship and value reference in accounting for the depletion of purchased goodwill. Recovered from SSRN https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2306584. Accessed 28 June 2019.

Hayn, C., and P. Hughes. 2006. Leading indicators of goodwill impairment. Journal of Accounting, Auditing and Finance 21 (3): 223–265.

Fahlqvist, T., and D. Sennerstam. 2014. The value relevance of goodwill impairments on European stock markets. [Unpublished PhD Thesis] University of Gothenburg. Gothenburg.

Laghi, E., M. Mattei, and M. Marcantonio. 2013. Assessing the value relevance of goodwill impairment considering country-specific factors: Evidence from EU listed companies. International Journal of Economics and Finance 5 (7): 32–49.

Li, K., A. Amel-Zadeh, and G. Meeks. 2010. The impairment of purchased goodwill: effects on market value. Recovered from SSRN https://papers.ssrn.com/sol3/papers.cfm?abstract_id=930979. Accessed 25 June 2019.

Qasim, A., A.E. Haddad, and N.M. AbuGhazalech. 2013. Goodwill accounting in the United Kingdom: The effect of international financial reporting standards. Review of Business and Finance Studies 4 (1): 69–71.

Cedergren, M., B. Lev, and P. Zarowin. 2015. SFAS 142, conditional conservatism, and acquisition profitability and risk. New York: New York University, Stern School of Business.

Kravet, T. 2014. Accounting conservatism and managerial risk-taking: Corporate acquisitions. Journal of Accounting and Economics 57 (2): 218–240.

Morricone, S., R. Oriani, and M. Sobrero. 2009. The Value Relevance of Intangible Assets and the Mandatory Adoption of IFRS. Recovered from https://pdfs.semanticscholar.org/7c8f/157b46d1fc8035837a9edc874a1366522e7d.pdf. Accessed 18 June 2019.

Kabir, H, A. Rahman, and L. Su. 2017. The Association between Goodwill Impairment Loss and Goodwill Impairment Test-Related Disclosures in Australia. 8th Financial Markets and Corporate Governance Conference (FMCG) 2017. Recovered from SSRN https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2901397. Accessed 9 July 2019.

Masters-Stout, B., M. Costigan, and L. Lovata. 2008. Goodwill impairments and chief executive officer tenure. Critical Perspectives on Accounting 19 (8): 1370–1383.

Zang, Y. 2008. Discretionary behavior with respect to the adoption of SFAS No. 142 and the behavior of security prices. Review of Accounting and Finance 7 (1): 38–68.

European Financial Reporting Advisory Group (EFRAG) .2017. Goodwill Impairment. Can it be improved? Recovered from https://www.efrag.org/Assets/Download?assetUrl=%2Fsites%2Fwebpublishing%2FSiteAssets%2FGoodwill%2520Impairment%2520Test%2520Can%2520it%2520be%2520improved.pdf&AspxAutoDetectCookieSupport=1. Accessed 11 July 2019.

International Accounting Standards Board (IASB). 2019. Better information about business combinations. Recovered from https://cdn.ifrs.org/-/media/project/goodwill-and-impairment/in-brief-goodwill-and-impairment-factsheet.pdf?la=en. Accessed 12 Jan 2020.

Financial Accounting Standards Board (FASB). 2019. Identifiable Intangible Assets and Subsequent Accounting for Goodwill. Recovered from https://www.fasb.org/jsp/FASB/Document_C/DocumentPage?cid=1176172950529&acceptedDisclaimer=true. Accessed 12 Jan 2020.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This article is the exclusive responsibility of the authors and does not necessarily reflect the opinion of the Universidad de Alcalá or the Banco de España.

Appendices

Appendix 1: List of entities of the analysed sample

Name of entity | Country |

|---|---|

ABN AMRO Group NV | NL |

Alpha Bank AE | EL |

Allied Irish Banks, Pic | IE |

Banca Monte dei Paschi di Siena SpA | IT |

Banco Bilbao Vizcaya Argentaria, SA | ES |

Banco BPI, SA | PT |

Banco de Sabadell, SA | ES |

Banco Popolare Società Cooperativa | IT |

Banco Popular Español SA | ES |

Banco Santander, SA | ES |

Bankinter SA | ES |

Banque et Caisse d’Epargne de l’Etat, Luxembourg | LU |

Barclays Plc | UK |

Bayerische Landesbank | DE |

BNP Paribas SA | FR |

Caixa Geral de Depósitos, SA | PT |

Commerzbank AG | DE |

Cooperatieve Rabobank U.A. | NL |

Credit Agricole SA | FR |

Credit Mutuel Group | FR |

DekaBank Deutsche Girozentrale | DE |

Deutsche Bank AG | DE |

Dexia SA | BE |

DNB ASA | DE |

DZ BANK AG Deutsche Zentral-Genossenschaftsbank, Frankfurt am Main | DE |

Erste Group Bank AG | AT |

Espirito Santo Financial Group SA | PT |

Fundacion Bancaria Caixa d’Estalvis i Pensions de Barcelona, ”la Caixa” | ES |

Governor and Company of the Bank of Ireland | IE |

Groupe BPCE | FR |

HSBC Holdings Plc | UK |

HSH Nordbank AG | DE |

Hypo Real Estate Holding AG | DE |

ING Bank NV | NL |

Intesa Sanpaolo SpA | IT |

Lloyds Banking Group Plc | UK |

Natixis SA | FR |

Nordea Bank AB | FI |

OP Financial Group | PL |

Powszechna Kasa Oszczednosci Bank Polski SA | PL |

Royal Bank of Scotland Group Plc | UK |

Societe Generale SA | FR |

Standard Chartered Plc | UK |

UniCredit SpA | IT |

Unione di Banche Italiane SpA | IT |

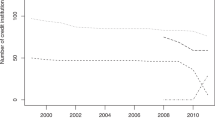

Appendix 2: Behaviour of model variables

Rights and permissions

About this article

Cite this article

Pallarés Sanchidrián, J., Pérez García, J. & Gonzalo-Angulo, J.A. (IR) Relevance of goodwill impairment: the case of European banking (2005–2015). J Bank Regul 22, 24–38 (2021). https://doi.org/10.1057/s41261-020-00126-0

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41261-020-00126-0

Keywords

- Goodwill

- Impairment test

- Value relevance of financial reporting

- Banking sector

- Banking supervision

- Earnings management