Others have seen what is and asked why. I have seen what could be and asked why not..

–Pablo Picasso.

Abstract

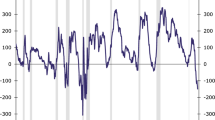

This paper proposes a new framework that identifies a threshold between the fed funds rate and the 10-year Treasury yield and, when the threshold is breached, the risk of a recession in the near future is significant. Our framework predicted several recessions before the yield curve inversion point/monetary cycles’ approaches. In addition, our framework accurately forecasted peaks in the S&P 500 index.

Similar content being viewed by others

Notes

For more details about the effectiveness of the yield curve to predict recession see, Adrian et al. (2010).

Some analysts utilize the spread between the 10-year and 3-month Treasuries as a measure of yield curve. In our view, that spread is overly reliant on market expectations and less reflective of the monetary policy stance.

There are several potential reasons behind the inverted yield curve, and we discussed financial world’s expectations; for more details about the inverted yield curve, see, Adrian et al. (2010).

The yield curve approach missed the 1957–1958 recession completely. The monetary cycle method missed the recession by 2 months according to Adrian and Estella (2009), and was a complete miss, in a real-time analysis, by our reckoning.

The 1973–1975 and 1980 recessions are the only two periods when the Fed raised the fed funds rates during a recession.

In other words, we see this as an example of Goodhart’s Law at work: a correct policy response to an indicator could well superficially suggest that the indicator was in error.

References

Adrian, Tobias and Arturo Estrella. 2009. Monetary tightening cycles and the predictability of economic activity. Federal Reserve Bank of New York Staff Report 397.

Adrian, Tobias, Arturo Estrella, and Hyun-Song Shin. 2010. Monetary cycles, financial cycles, and the business cycle. Federal Reserve Bank of New York Staff Report 421.

Bernanke, Ben S., and Alan S. Blinder. 1992. The federal funds rate and the channels of monetary transmission. American Economic Review 82 (4): 901–921.

Bernard, Henri and Stefan Gerlach. 1996. Does the term structure predict recessions? The international evidence. Working Paper 37, Bank of International Settlements.

Bordo, Michael and Joseph Haubrich. 2004. The yield curve, recessions and the credibility of the monetary regime: long run evidence 1875–1997. National Bureau of Economic Research Working Paper 10431.

Estrella, Arturo, Anthony P. Rodrigues, and Sebastian Schich. 2003. How stable is the predictive power of the yield curve? Evidence from Germany and the United States. Review of Economics and Statistics 85 (3): 629–644.

Silvia, John, Azhar Iqbal and Michael Pugliese. 2016. Recession talks in the spotlight: should we worry? Wells Fargo Economics Group Special Commentary. Report is available upon request from authors.

Silvia, John, Azhar Iqbal, and Sam Bullard. 2016b. A new framework to estimate the near-term path of the fed funds rate. Business Economics 51 (4): 239–247.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Iqbal, A., Bullard, S. & Silvia, J. Are yield-curve/monetary cycles’ approaches enough to predict recessions?. Bus Econ 54, 61–68 (2019). https://doi.org/10.1057/s11369-018-0100-6

Published:

Issue Date:

DOI: https://doi.org/10.1057/s11369-018-0100-6