Abstract

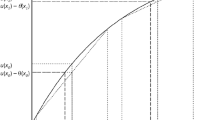

It is shown that, for the Arrow–Pratt measure \(r_u=-u''/u'\) and the third-order measure \(D_u=u'''/u'-3r_u^2,\) an increase in both risk-preference measures, when utility changes from u to v, yields a strict partial ordering by greater downside risk aversion, in that v is then a risk-averse and downside risk-averse transformation of u. More decisively, the result is reversible and, so, a decrease in both measures yields an ordering of utility functions by less downside risk aversion.

Similar content being viewed by others

Notes

Pratt formulates matters a bit differently, but the stated equivalence is nonetheless true, as seen by Eq. (2) below. Pratt has a third well-known equivalence, using the risk premium approach, which is especially well-suited to the second-order risk aversion concept. While efforts have been made to extend this approach to higher-order risk aversion, it appears to us to not be as useful, in this regard, as the other two approaches, at least concerning comparative higher-order risk aversion, the topic of this paper.

With the transformational formulation, classical statements on how a risk-averse person reacts to fair risks can be immediately translated to how a more risk averse person regards changes to which a less risk averse person is indifferent (Diamond and Stiglitz 1974).

Finding \(\varphi\) generally involves inverting u(y) explicitly, which is not always possible, even though one knows it exists, and in any case, can be awkward and unappealing.

Liu and Meyer (2012) emphasize the need for transitivity in the context of third-order risk aversion comparisons.

Reversibility to the less transformation relation doesn’t always follow from the mere fact that a strict measure condition is equivalent to the greater transformation relation, but as seen from (2) below, the equivalence of the second-order less risk averse relation to its measure condition follows, nonetheless, by the very same reasoning as for the second-order greater risk aversion relation.

Were there such a characterization by measures G and H, then \((\varphi ^{-1})''\ge 0\) and \((\varphi )^{-1})'''\le 0\) would be equivalent to \(G_u \le G_v, H_u \ge H_v,\) for all y, and repeating this, because of the transitivity of measures, one would have the transitivity of \((\varphi ^{-1})''\ge 0\) and \((\varphi ^{-1})'''\le 0.\) But, in reality, not even this weak form of the less downside risk averse transformational relation is transitive.

This is because, while S increasing implies \(\varphi '''>0,\) the measure S decreasing does not similarly imply \((\varphi ^{-1})'''<0.\) Thus, S and r, together, provide an example of the claim above that it is not automatic that a measure representation be reversible.

Observe that the refined ordering of utility functions is no longer directly in terms of transformations: it is in terms of measures. The reason we want it to be a refinement of \(\varphi '''>0, \varphi ''<0,\) (and of \((\varphi ^{-1})'''<0, (\varphi ^{-1})''>0\)), is that, in any comparison of two utility functions, it is these relations which correctly reflect the meaning of greater (lesser) downside risk aversion.

Obviously, when you have a comparative result using S and r increasing in going from u to v, you will get the opposite comparative static result in going from v to u, and so, decreasing S and r. However, unlike increases in S and r, which may be associated with increases in downside risk aversion, there is no real justification for associating a result obtained using a decrease in S and r with less downside risk aversion, since \(\psi '''<0, \psi ''>0,\) for \(u=\psi (v),\) is not generally implied.

This does not preclude that there is a reverse comparative static result for the transformational relations—that depends—but it does mean that one has to separately verify it, possibly by some novel argument, and that a reverse result for less downside risk aversion does not just follow from simply reversing measures.

There is no inherent contradiction in this, since while lesser downside risk aversion is not a strict partial order, as usually demanded of a strict relation, it is not cyclic either, thanks to the presence of acyclic r in its definition. It is only cyclic rankings that are in obvious contradiction with comparative statics. There is the additional fact that the results of Peter come with side conditions on base u. A potential comparative static result where the transformation does not permit v to satisfy the same standing assumptions as u doesn’t face the usual discipline requiring that the transformation not have cycles. Beyond this, side conditions can permit the restricted relation to be a partial order, where the relation without such side conditions would not be. We have already seen this, in a slightly different manner, when adding the side condition \(\varphi ''<0\) to \(\varphi '''>0,\) which would otherwise constitute a ranking that is both cyclic at order two and intransitive, but where the pair of conditions, together, constitute a strict partial order, and so merit being called a greater downside risk averse relation.

Regularity assumptions include \(\partial p_i(\mathbf{e} )/\partial e_i>0,\ \partial ^2 p_i(\mathbf{e} )/\partial e_i^2<0,\) and \(\partial p_i(\mathbf{e} )/\partial e_j<0,\ \partial ^2 p_i(\mathbf{e} )/\partial e_i\partial e_j\le 0,\ i\ne j.\) See Liu and Wong (2019), Konrad and Schlesinger (1997), or Treich (2010) for a fuller treatment.

References

Crainich, D., and L. Eeckhoudt. 2008. On the Intensity of Downside Risk Aversion. Journal of Risk and Uncertainty 36: 267–276.

Diamond, P., and J. Stiglitz. 1974. Increases in Risk and in Risk Aversion. Journal of Economic Theory 8: 337–360.

Ehrlich, I., and G. S. Becker. 1972. Market Insurance, Self-Insurance and Self-Protection. Journal of Political Economy 80: 623–648.

Keenan, D., and A. Snow. 2002. Greater Downside Risk Aversion. Journal of Risk and Uncertainty 24: 267–277.

Keenan, D., and A. Snow. 2009. Greater Downside Risk Aversion in the Large. Journal of Economic Theory 144: 1092–1101.

Keenan, D., and A. Snow. 2012. The Schwarzian Derivative as a Ranking of Downside Risk Aversion. Journal of Risk and Uncertainty 44: 149–160.

Keenan, D., and A. Snow. 2016. Strong Increases in Downside Risk Aversion. The Geneva Risk and Insurance Review 41: 149–161.

Keenan, D., and A. Snow. 2018. Direction and Intensity of Risk Preference at the Third Order. Journal of Risk and Insurance 85: 355–378.

Konrad, K., and H. Schlesinger. 1997. Risk Aversion in Rent-Seeking and Rent-Augmenting Games. The Economic Journal 107: 1671–1683.

Liu, L., and J. Meyer. 2012. Decreasing Absolute Risk Aversion, Prudence and Increased Downside Risk Aversion. Journal of Risk and Uncertainty 44: 243–260.

Liu, L., and K. Wong. 2019. Greater (Absolute) Arrow-Pratt Risk Aversion of Higher Orders. Journal of Mathematical Economics 82: 112–124.

Menezes, C., C. Geiss, and J. Tressler. 1980. Increasing Downside Risk. The American Economic Review 70: 921–932.

Peter, R. 2020. Who Should Exert More Effort? Risk Aversion, Downside Risk Aversion and Optimal Prevention. Economic Theory 141: 1259–1281.

Pratt, J. 1964. Risk Aversion in the Small and in the Large. Econometrica 32: 122–136.

Treich, N. 2010. Risk-aversion and Prudence in Rent-Seeking Games. Public Choice 145: 339–349.

Acknowledgement

DCK acknowledges the support of LABEX MME D-II.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

Neither of us received any funding of any sort in the writing of this paper, and so no conflict of any sort is possible.

Rights and permissions

About this article

Cite this article

Keenan, D.C., Snow, A. Reversibly greater downside risk aversion. Geneva Risk Insur Rev 47, 327–338 (2022). https://doi.org/10.1057/s10713-021-00072-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s10713-021-00072-5